VASP Risking

Fast, accurate, and actionable assessments to know your VASP

Gain comprehensive insights and ensure compliance with continuous monitoring of virtual asset service providers (VASPs).

Understand crypto exposure

Identify and assess the risk of VASPs you and your customers are interacting with.

Allocate resources efficiently

Allocate full due diligence at the right moments with clear, actionable insights.

Partner with confidence

Select and maintain the right crypto partners with knowledge of their exposure to illicit activity.

Maintain compliance

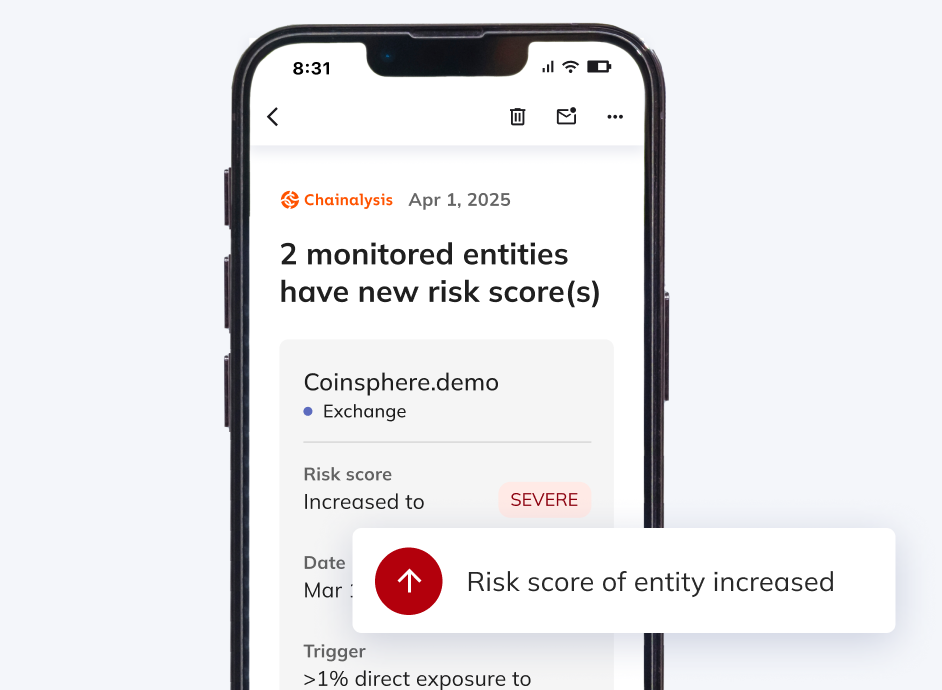

React quickly by automatically knowing when risk has changed for VASPs in your watchlist.

Comprehensive and actionable insights

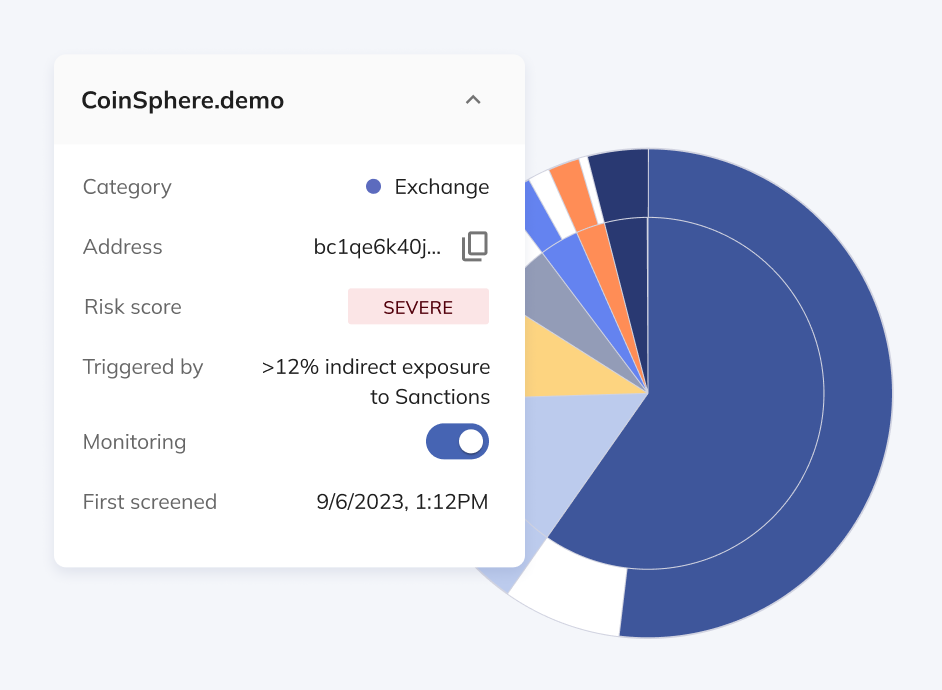

Get a holistic VASP overview

Assess a VASP with a comprehensive risk profile. Understand all aspects of a VASPs’ on- and off- chain activity from historical trends to exposure to counterparties.

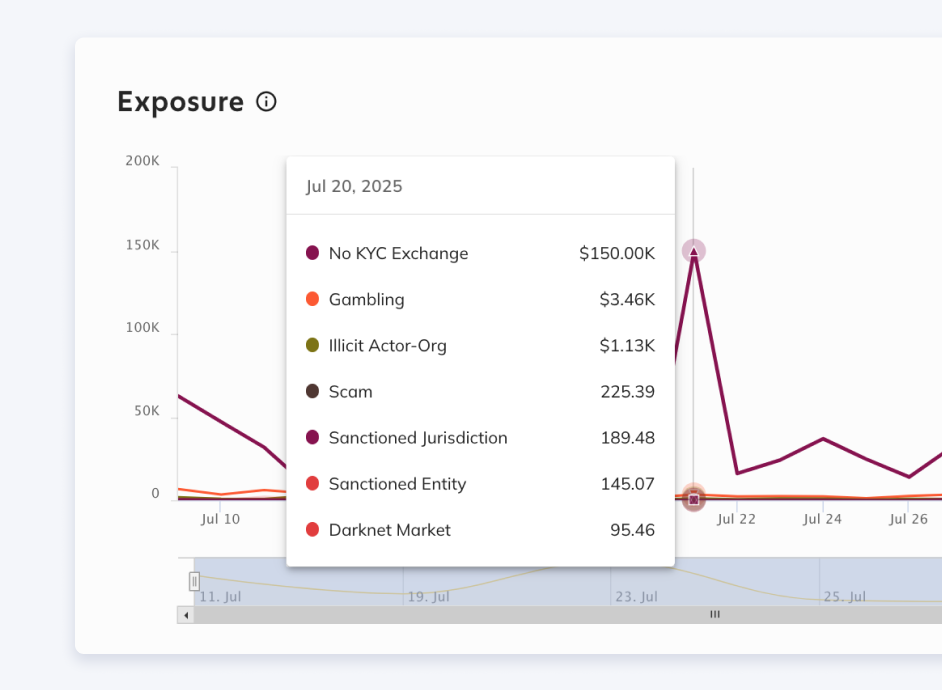

Unlock deeper insights

Advanced filters help to achieve precise exposure analysis with asset-level detail, localization of exposure, and identification of critical risk sources—enabling confident decisions for any risk scenario.

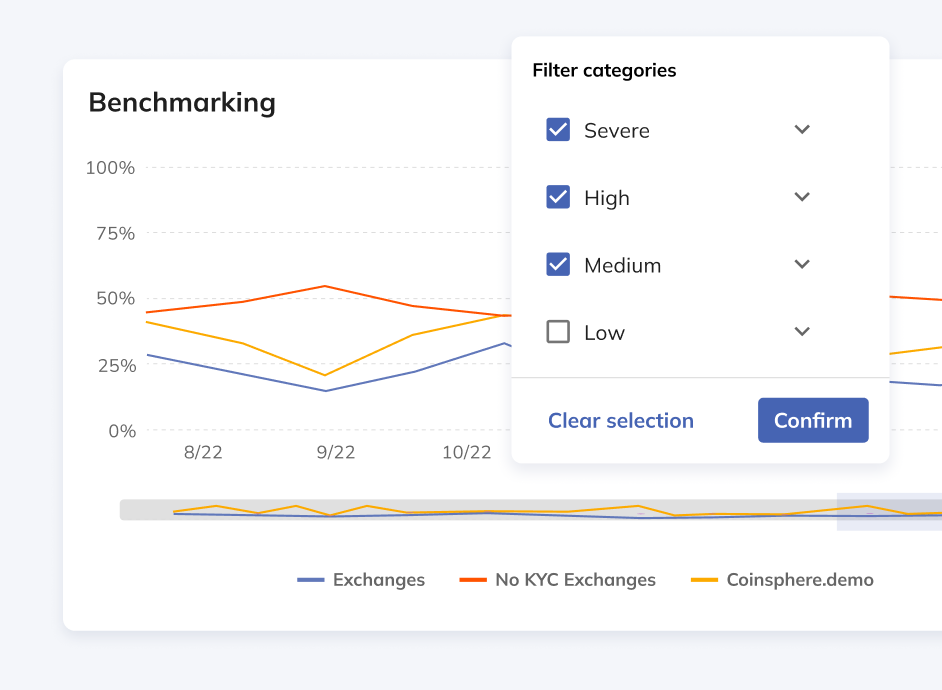

Benchmark against category indices

Compare a VASP against the broader category to understand if activity is consistent with other services like it. Customize the comparison to quickly narrow down on key areas of focus.

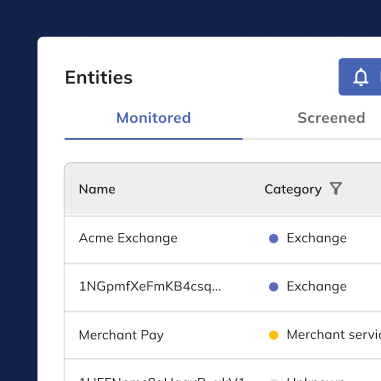

Streamline your workflow and focus resources

Eliminate the manual effort of periodic screening with continuous monitoring. Receive automatic notifications when a VASP’s risk score changes, making it easier to know when to investigate further.

Tailor settings for strategic risk management

With control over risk settings from exposure thresholds to category severity, you can customize the implementation of your compliance program and be alerted to activities most important to your region and compliance policy.

Conduct enhanced due diligence

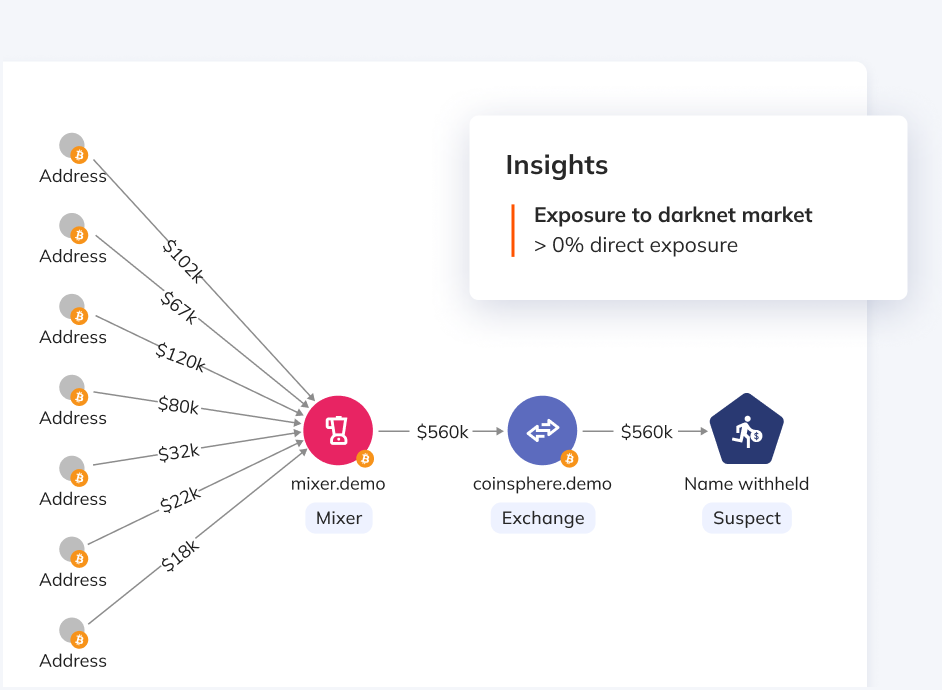

When needed, conduct enhanced due diligence on a VASP with Reactor, providing industry-leading ability to trace funds from source and destination of funds, analyze crypto activity, map crypto relationships to identify key questions and insights

Purpose-built capabilities for effective screening

Risk score

Get a single score that informs the risk level for a VASP.

Off-chain data

View a comprehensive profile that includes off-chain data including license, legal names, jurisdiction, and more.

Exposure

Understand a VASP’s counterparties and a breakdown of exposure to various activity.

Time-based views

Narrow analysis of a VASP to key time periods, to fully assess activity.

Exposure thresholds

Tailor risk assessments to your organization’s specific policies by defining and adjusting exposure thresholds with ease.

Historical records

Maintain records of previous screenings to understand how risk has changed over time.

Category views

Narrow to specific categories of exposure to understand trends in activity.

Asset selection

Enabling targeted compliance and efficient due diligence for VASP Risking

Link traditional financial transactions to VASPs

Assess crypto exposure and potentially illicit activity within your client’s fiat transactions by evaluating inflow and outflow wires to crypto businesses.

Chainalysis provides leading risk management

Superior data

Chainalysis ingests data intelligence at scale, uses hundreds of clustering heuristics, and verifies accuracy using the most rigorous standards in the industry.

Greater control and speed

Chainalysis provides greater tools for customizing risk settings and managing alerts in bulk, enabling you to tailor your risk posture and prioritize focus more effectively.

Leverage a community

Collaborate with a dedicated community of thousands of crypto investigators and compliance professionals.

Align with regulators

Regulators around the world use Chainalysis and collaborate with private sector companies.

WEBINAR

Know Your VASP: Comprehensive Risk Assessments for Informed Decision-Making

Mitigate risk. Ensure compliance. Strengthen trust.

VASP Risking empowers you with the insights and tools needed to assess exposure, enhance security, and make confident decisions that protect your platform and build trust with regulators and partners.