We appreciate how user friendly and seamless it is to use Chainalysis via their intuitive visualisation of transactions on the blockchain, especially when investigating indirect risky exposure.”

Challenge: Reduce exposure to illicit on-chain activity

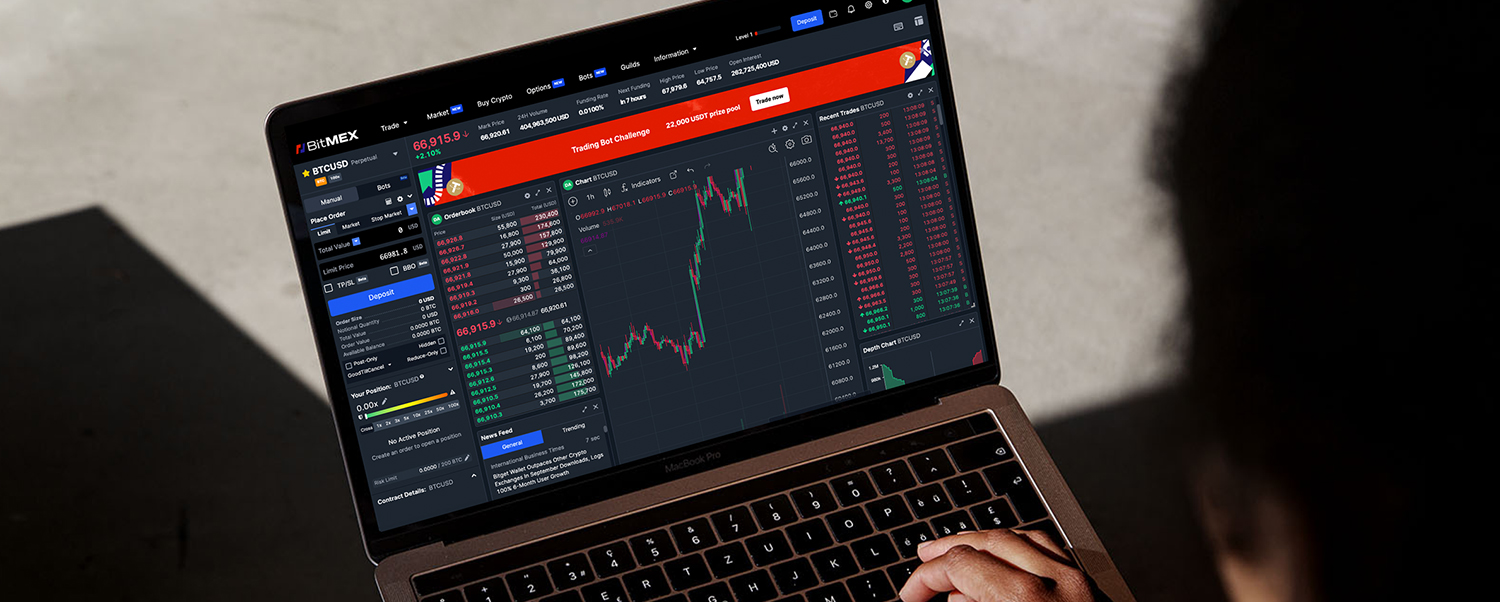

BitMEX is a P2P crypto trading platform that has been serving institutional and professional traders since 2014. Much like others in the industry during the early days of crypto, the company faced significant challenges in managing its on-chain Anti-Money Laundering (AML) risk exposure, and needed to reduce its exposure to illicit activity.

Solution: Real-time transaction monitoring with advanced blockchain analysis capabilities

To address its challenges, BitMEX implemented a robust compliance program with the support of its board and senior management. The comprehensive program covered a full range of AML and regulatory compliance standards across both traditional finance and Web3, including AML risk assessments, risk-based Know Your Customer (KYC) processes, sanctions compliance, anti-bribery and corruption practices, transaction monitoring, market surveillance, Travel Rule compliance, cooperation with law enforcement, Suspicious Transaction Reporting (STR) and regulatory reporting, training, and independent audits.

BitMEX also carefully selected vendors and partners that were industry leaders, and chose Chainalysis to support its compliance program. Using Chainalysis’ Crypto Compliance and Crypto Investigations solutions, BitMEX was able to assess its on-chain risk exposure comprehensively. These solutions provided real-time transaction monitoring, pre-screening, and blocking of direct withdrawals to wallets associated with illicit entities. The capabilities also enabled BitMEX to conduct deeper due diligence on suspicious activities and trace the source of funds in complex investigations.

The BitMEX compliance team especially values Chainalysis’ risk categories and its highly configurable alert parameters, which are constantly evolving to keep pace with fast-changing trends in AML and crypto regulation.

“We appreciate how user friendly and seamless it is to use Chainalysis via their intuitive visualisation of transactions on the blockchain, especially when investigating indirect risky exposure,” says Dias Malayev, Head of Investigations at BitMEX. “Moreover, their support team is world-class when it comes to answering our queries and listening and implementing our feedback.”

Results: 88% reduction in AML risk exposure

Implementing Chainalysis has led to significant improvements in BitMEX’s risk profile. Most notably, BitMEX successfully reduced its on-chain risk exposure from 1.7% in 2019 to 0.2% in 2024. This 88% reduction marks the lowest risk exposure to illicit activity in the platform’s history. This also means that BitMEX is 35% below the global level in terms of risk exposure, as the total share of 2024 illicit activity is 0.304%.

BitMEX also credits Chainalysis’ industry research reports with helping its compliance team stay knowledgeable about threats. In turn, BitMEX educates its customers about the risks of transacting with illicit services, helping the company maintain a low-risk profile and prevent future risky transactions.

Enhancing its compliance and safety has reinforced BitMEX’s leadership in the crypto industry. In fact, the company was able to trace and thwart a multi-million dollar Ponzi scheme, leading to the arrest of the masterminds behind the scam via Interpol Red Notices, demonstrating the effectiveness of Chainalysis solutions in real-world applications.

BitMEX’s success is a testament to the effectiveness of a comprehensive compliance program supported by advanced blockchain analysis tools. The partnership with Chainalysis played a pivotal role in achieving these results, showcasing the importance of industry-leading solutions in managing and mitigating risks in the rapidly evolving crypto landscape.