Chainalysis helps us visualize the flow of funds and the risk easily and quickly. This has greatly shortened our time on investigations and improved the efficiency of our compliance team.”

– Compliance Analyst, Bitget

Challenge

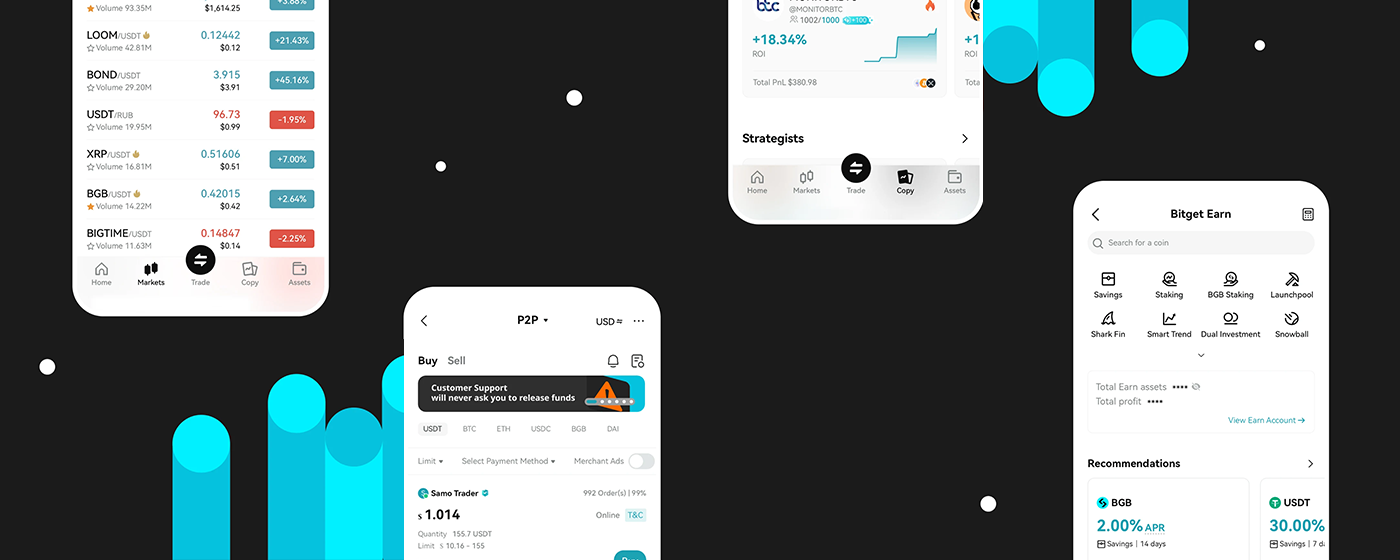

As a fast-growing global cryptocurrency exchange, Bitget faced the challenge of maturing its compliance practices to foster user trust and expand market share. Operating across nearly 200 countries with a daily trading volume of $50 billion, the platform needed to stay ahead of evolving regulations and combat the risk of illicit activity. Bitget’s goal was to build a global brand known for trust, reliability, and security by implementing a comprehensive compliance program and allocating resources to technology, personnel, and training.

Solution

To achieve its compliance goals, Bitget partnered with Chainalysis, leveraging its market-leading risk solutions to optimize risk management and enhance the security of its platform. Using real-time transaction monitoring and pre-screening, the compliance team proactively blocked withdrawals to illicit addresses and conducted in-depth investigations of suspicious transactions.

Bitget also utilized Chainalysis’ clustering functionality and curated OSINT to streamline decision-making processes, enabling faster and more accurate investigations. By integrating Chainalysis APIs, Bitget automated risk assessments for incoming transfers, significantly improving operational efficiency and enabling autonomous compliance decision-making. The partnership also included extensive training and certification opportunities through Chainalysis Academy, empowering the team with the knowledge and tools to ensure comprehensive compliance coverage.