The scalability of blockchains has historically been a significant challenge when designing and building decentralized applications (dApps) to support growing user bases. For instance, how can networks increase transaction throughput without reducing decentralization? What is an appropriate balance between scalability and security? These questions have sparked the exploration of innovative solutions within the Ethereum network, such as layer 2 (L2) protocols, which operate on top of the Ethereum mainnet.

A popular type of L2 protocol is a rollup, which bundles together or “rolls up” and processes transaction data off-chain before uploading them to Ethereum to reduce the network’s computational burden. Among these, zero-knowledge rollups and optimistic rollups have gained prominence. By comparing the goals and architectures of both rollups, we can better understand their potential to shape the future of blockchain scalability and security.

In this blog, we’ll explore the following topics:

-

- What are zero-knowledge rollups?

- How do zero-knowledge rollups work?

- Benefits of zero-knowledge rollups

- Challenges and limitations of zero-knowledge rollups

- What are optimistic rollups?

- How do optimistic rollups work?

- Benefits of optimistic rollups

- Challenges and limitations of optimistic rollups

- Zero-knowledge rollup vs. optimistic rollup activity

Zero-knowledge rollups

What are zero-knowledge rollups?

Zero-knowledge rollups, or zk-rollups, are L2 scaling solutions for blockchain networks that employ zero-knowledge proofs (zk-proofs/ZKPs) to process transactions more efficiently. Instead of storing transaction data directly on the Ethereum mainnet, zk-rollups bundle this data off-chain and generate a cryptographic proof of validity, which is then posted to the mainnet for verification. This proof of validity ensures that no invalid transactions are processed by the rollup, thus diminishing computational demands on the mainnet.

How do zero-knowledge rollups work?

When executing a transaction in a zk-rollup, the following steps typically occur:

- A user decides to sign a transaction and submit it to the zk-rollup for processing.

- This transaction is included in the rollup’s next batch of transactions and aggregated off-chain.

- A zero-knowledge proof that verifies all of the transactions on the rollup is posted to the Ethereum mainnet, along with the bundled transactions, in the form of calldata.

- The proof is permanently stored and searchable in Ethereum’s history.

Benefits of zero-knowledge rollups

A primary benefit of zero-knowledge rollups is improving Ethereum’s scalability and efficiency. Given that zk-rollups bundle transactions off-chain instead of on-chain, they help increase transaction throughput and decrease congestion, allowing more users to participate in the ecosystem. In some cases, reduced congestion may lead to lower gas fees.

Challenges and limitations of zero-knowledge rollups

Zk-rollups require complex cryptography, which can be expensive and difficult to implement. Deployment and regular maintenance of zk-rollups also require developers to have specialized blockchain expertise.

Optimistic rollups

What are optimistic rollups?

Optimistic rollups are L2 scaling solutions for blockchain networks that bundle and execute transactions off-chain, in a manner similar to zk-rollups. These rollups are considered “optimistic” because, unlike zk-rollups, they do not provide direct proofs of transaction validity, but rather assume all transactions are valid unless proven otherwise.

If users notice that a bundle includes invalid transactions, they can submit a fraud proof, stating that the transactions are corrupt. Users have a specific time window to prove that the results of a transaction are indeed incorrect and, if successful, the rollup must reverse the transaction and re-execute without the invalid transactions. The Layer 1 blockchain typically levies a penalty to dissuade rollups from bundling such invalid transactions.

How do optimistic rollups work?

When executing a transaction on an optimistic rollup, the following steps typically occur:

- A user decides to sign a transaction and submit it to the optimistic rollup’s operating system for processing.

- This transaction is included in the rollup’s next batch of transactions and aggregated off-chain.

- Transactions are posted on the Ethereum mainnet in the form of calldata.

- If a user proves that a transaction is incorrect, the rollup reverses the transaction. The user who originally submitted the transaction may then re-submit.

- If valid, the data are permanently stored in Ethereum’s history.

Benefits of optimistic rollups

Similar to zk-rollups, optimistic rollups aim to improve Ethereum’s scalability by increasing transaction throughput and reducing congestion. Optimistic rollups can be more efficient than zk-rollups, as no validity proofs are required, and fraud proofs are only needed in the case of fraud.

Challenges and limitations of optimistic rollups

Users of optimistic rollups may face long withdrawal periods for their funds due to the fraud-proving scheme which requires users to wait a certain amount of time to ensure that others do not submit fraud proofs.

Zero-knowledge rollup vs. optimistic rollup activity

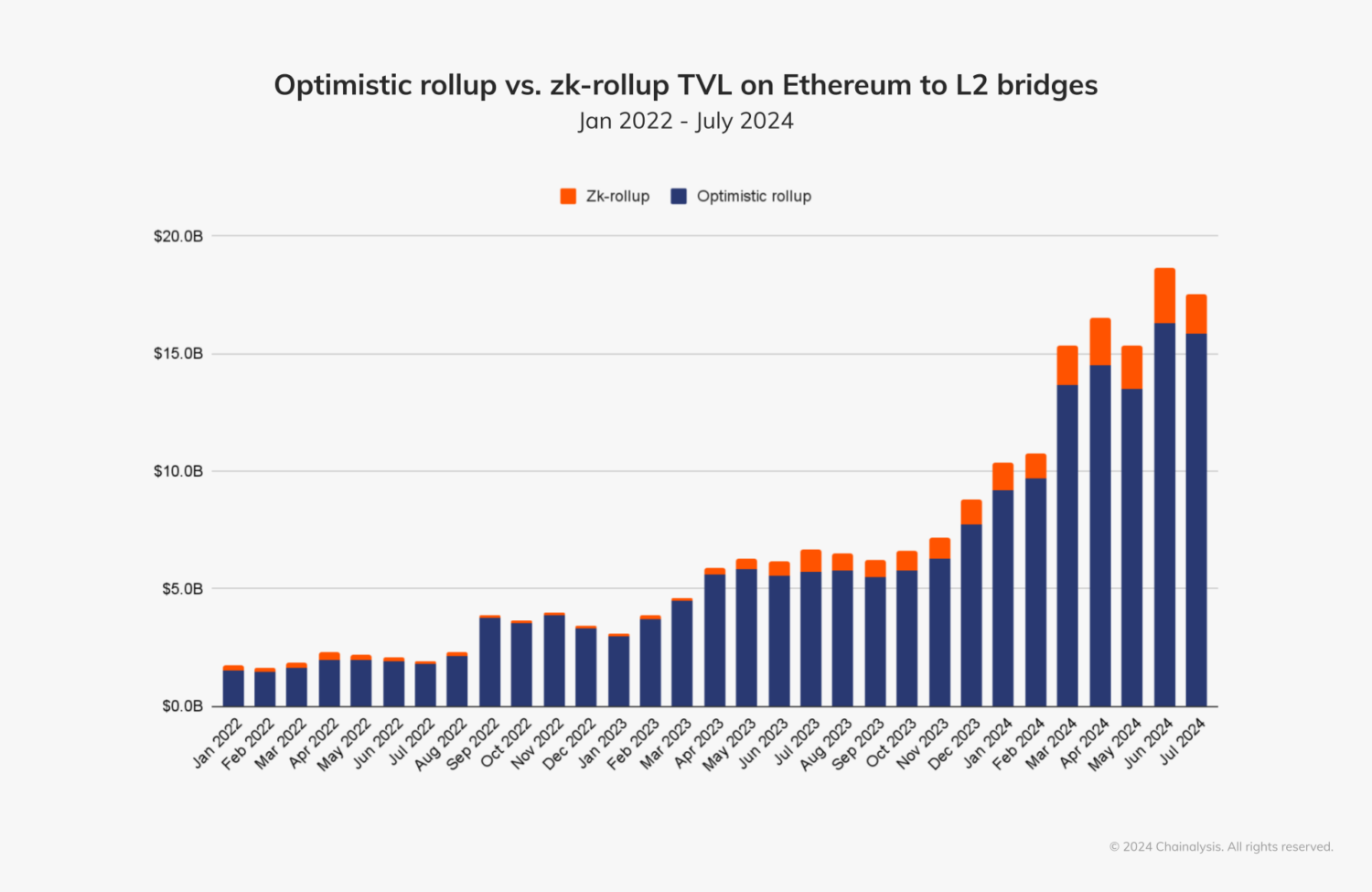

To compare the scale of activity of zk-rollups and optimistic rollups, we looked at the total value locked (TVL) on bridge contracts between Ethereum and L2s for both rollup types. In the below chart, we see that this activity was consistently higher for optimistic rollups than zk-rollups between January 2022 and July 2024. During this time period, the TVL bridged between optimistic rollups and Ethereum was approximately $186.4 billion, whereas it was only $20.8 billion for zk-rollups. Note that the stark difference in TVL is likely due to the fact that it is currently faster and easier to develop optimistic rollups, and they are more compatible with Ethereum.

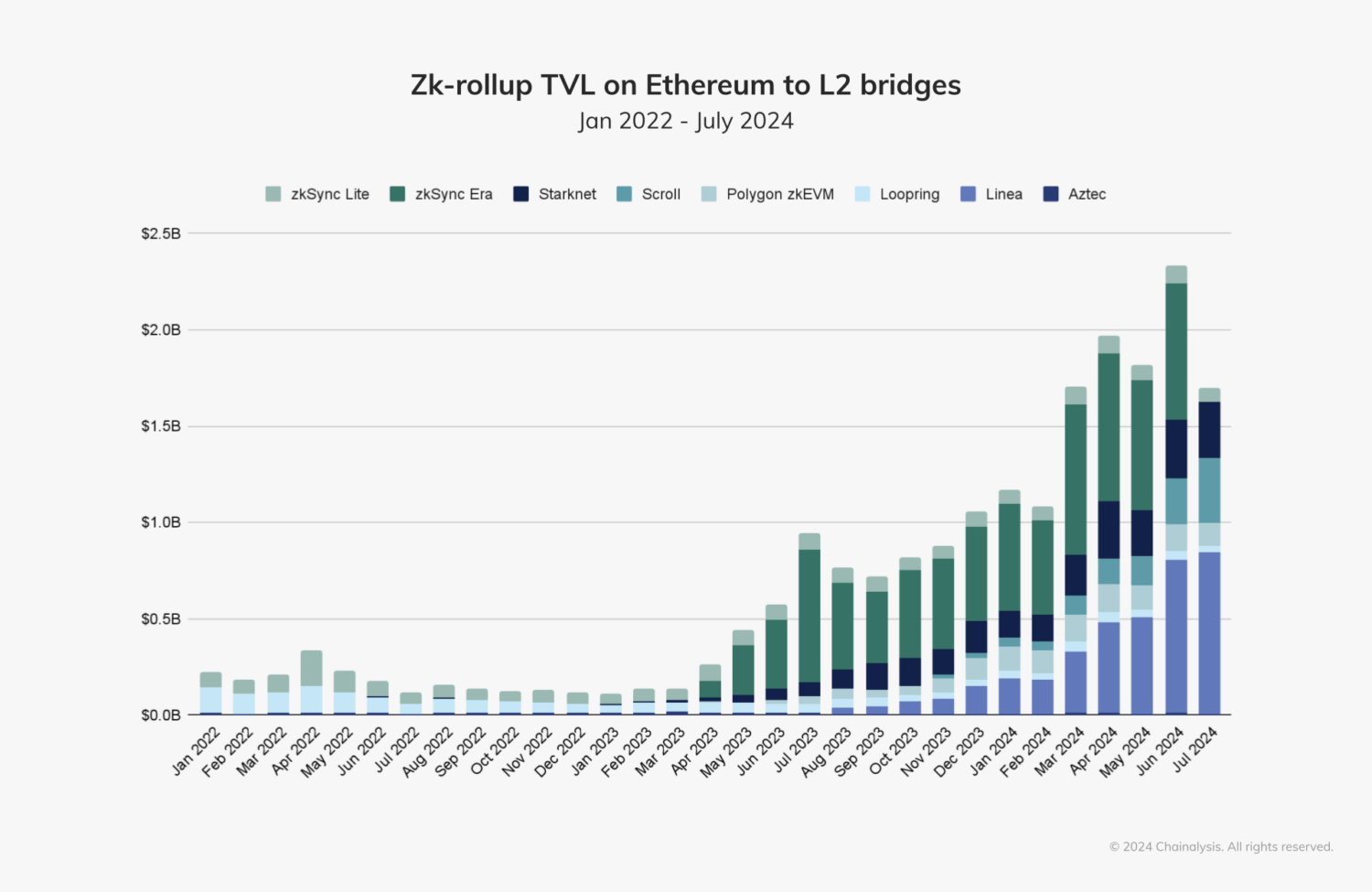

We further broke down this activity to examine specific protocols in each rollup category. For zk-rollups, zkSync Lite and Loopring bridged the most TVL between 2022 and early 2023. After that, zkSync Era, Linea, Starknet, and Scroll experienced uptrends in bridged TVL.

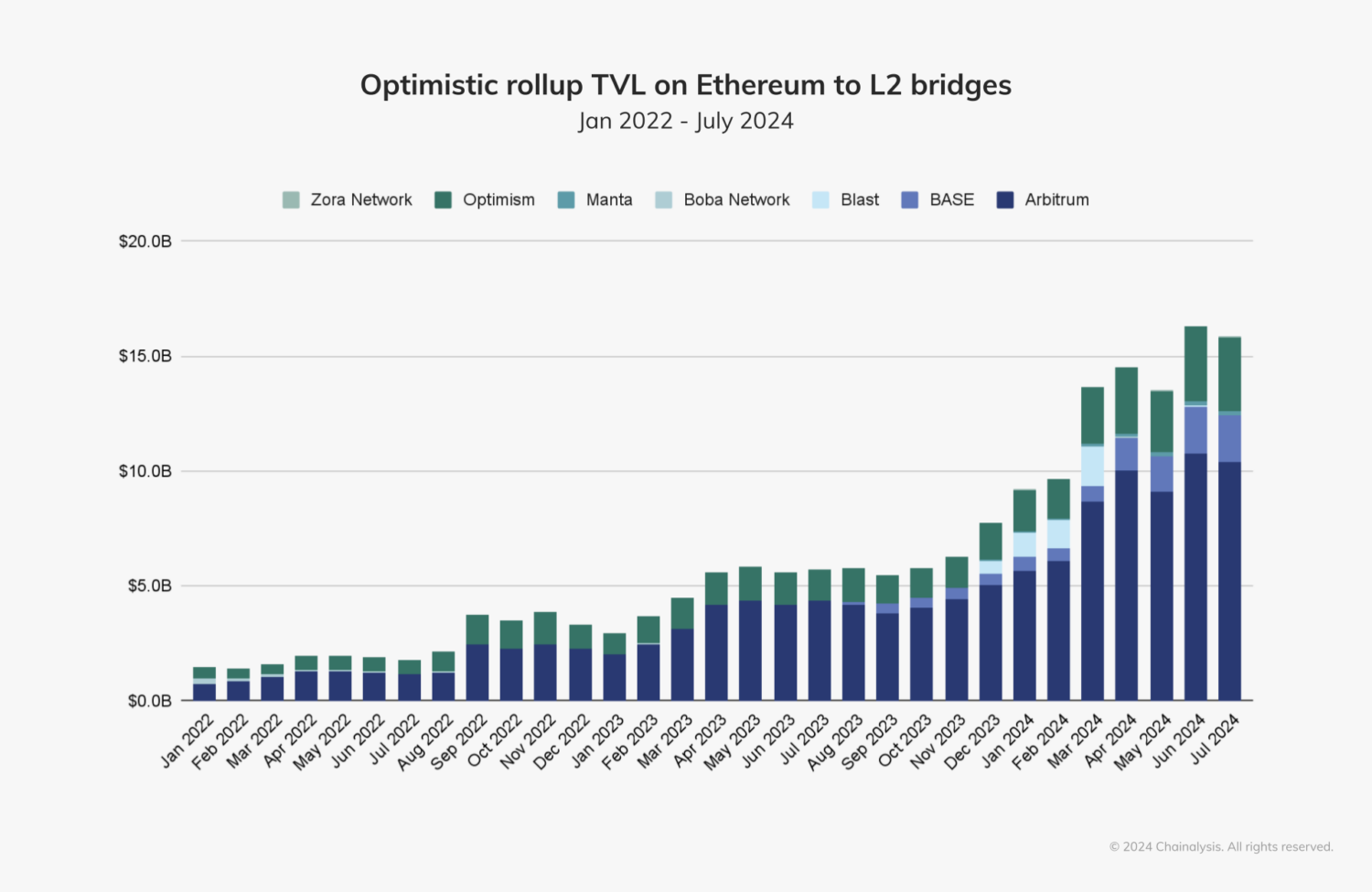

For optimistic rollups, the pattern has been more consistent. Arbitrum and Optimism accounted for the highest amounts of bridged TVL during the time period studied, with several months of high activity on BASE.

Chainalysis’ rollup coverage

Chainalysis has industry-leading coverage of EVMs and rollups, including complete and dynamic token support with the ability to easily onboard new tokens deployed to a network. For transactions executed in both zero-knowledge rollups and optimistic rollups, we have the ability to trace transactions as we can do on Ethereum.

This website contains links to third-party sites that are not under the control of Chainalysis, Inc. or its affiliates (collectively “Chainalysis”). Access to such information does not imply association with, endorsement of, approval of, or recommendation by Chainalysis of the site or its operators, and Chainalysis is not responsible for the products, services, or other content hosted therein.

This material is for informational purposes only, and is not intended to provide legal, tax, financial, or investment advice. Recipients should consult their own advisors before making these types of decisions. Chainalysis has no responsibility or liability for any decision made or any other acts or omissions in connection with Recipient’s use of this material.

Chainalysis does not guarantee or warrant the accuracy, completeness, timeliness, suitability or validity of the information in this report and will not be responsible for any claim attributable to errors, omissions, or other inaccuracies of any part of such material.