The cryptocurrency industry has entered a new phase of maturity, driven by increasing global adoption, sustained innovation, and deeper integration into legacy financial systems.

This year, bitcoin (BTC) recorded new all-time high prices in March and December, reflecting unprecedented demand. At the same time, decentralized finance (DeFi) is continuing to solidify its role in the global economy of the world, with inflows across the world approaching new heights. Additionally, a resurgence of engagement from traditional finance (TradFi), with capital influx into areas like stablecoins and crypto exchange-traded product (ETP) markets, suggests that crypto is quietly delivering on its promise to rewire the financial infrastructure of the world.

This is more than just another market cycle, but a defining moment for cryptocurrency. More than ever, organizations are not just adapting to the new landscape, but also participating in its development and shaping its future.

Market snapshot: Not your standard-issue bull-run

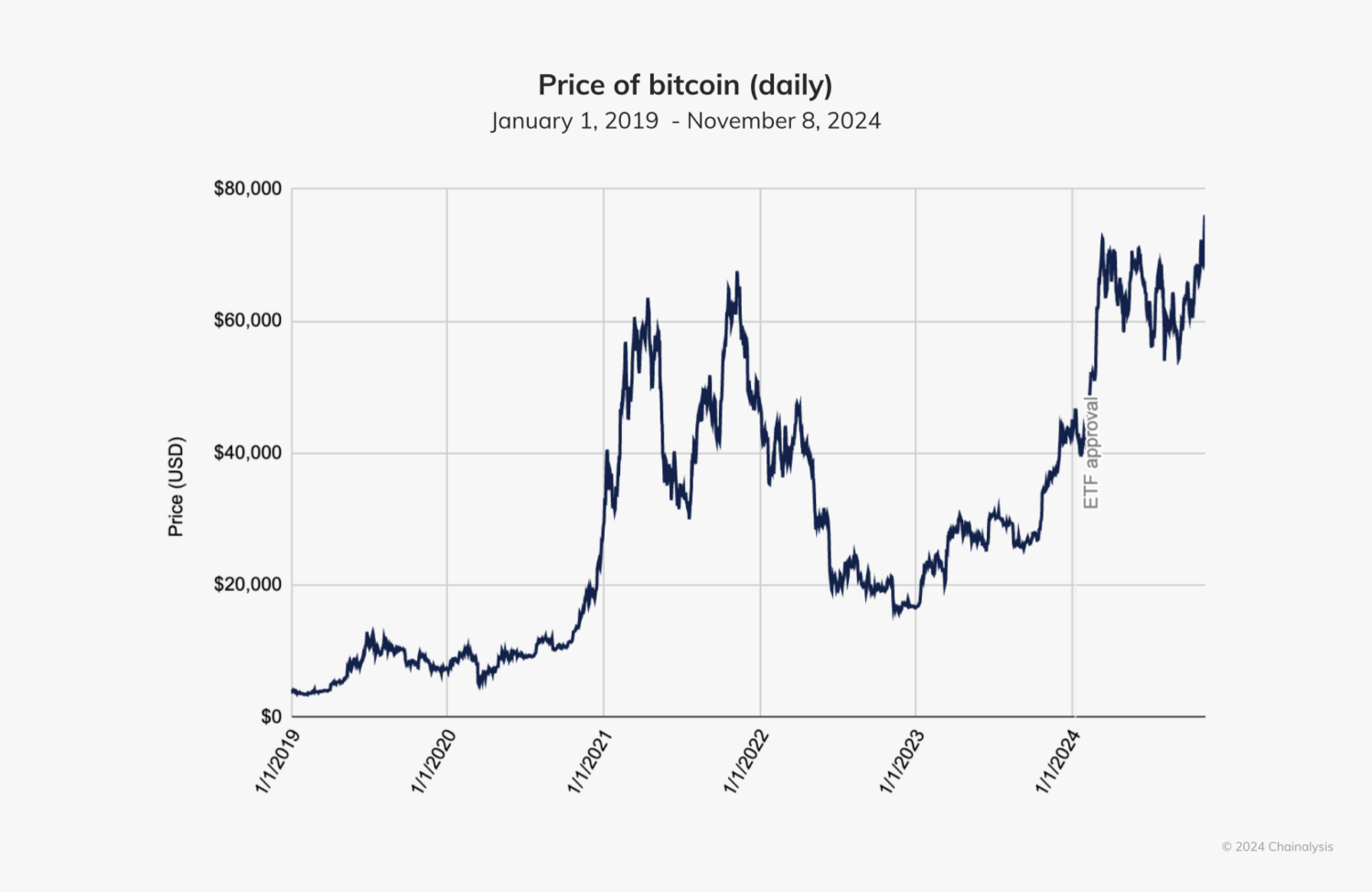

In late 2023, BTC began its upward ascent, marking the beginning of an impressive rally.

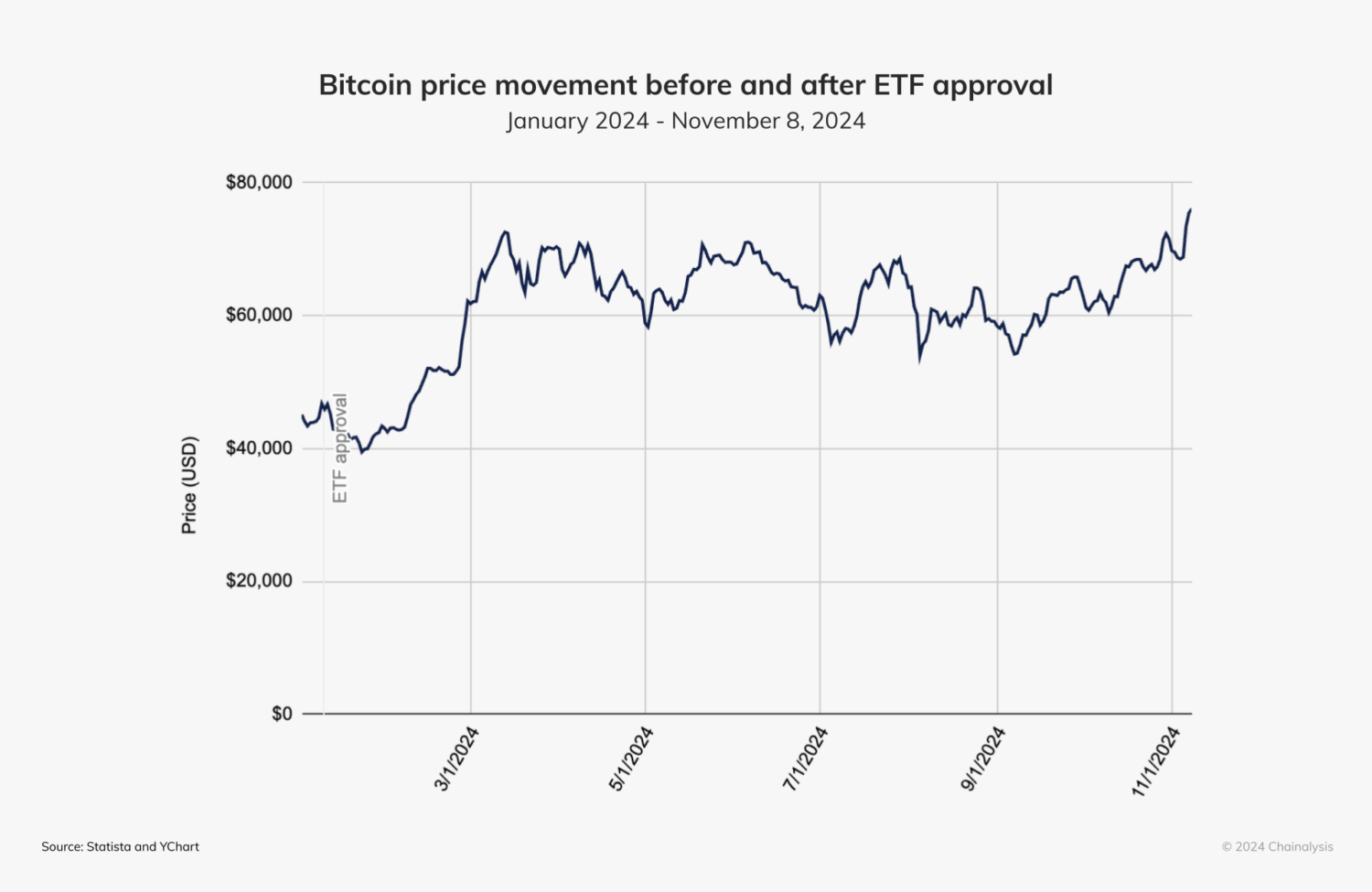

On March 5, 2024, BTC surpassed its previous all-time high, climbing above $73,000, and again in December 2024, exceeding $100,000.

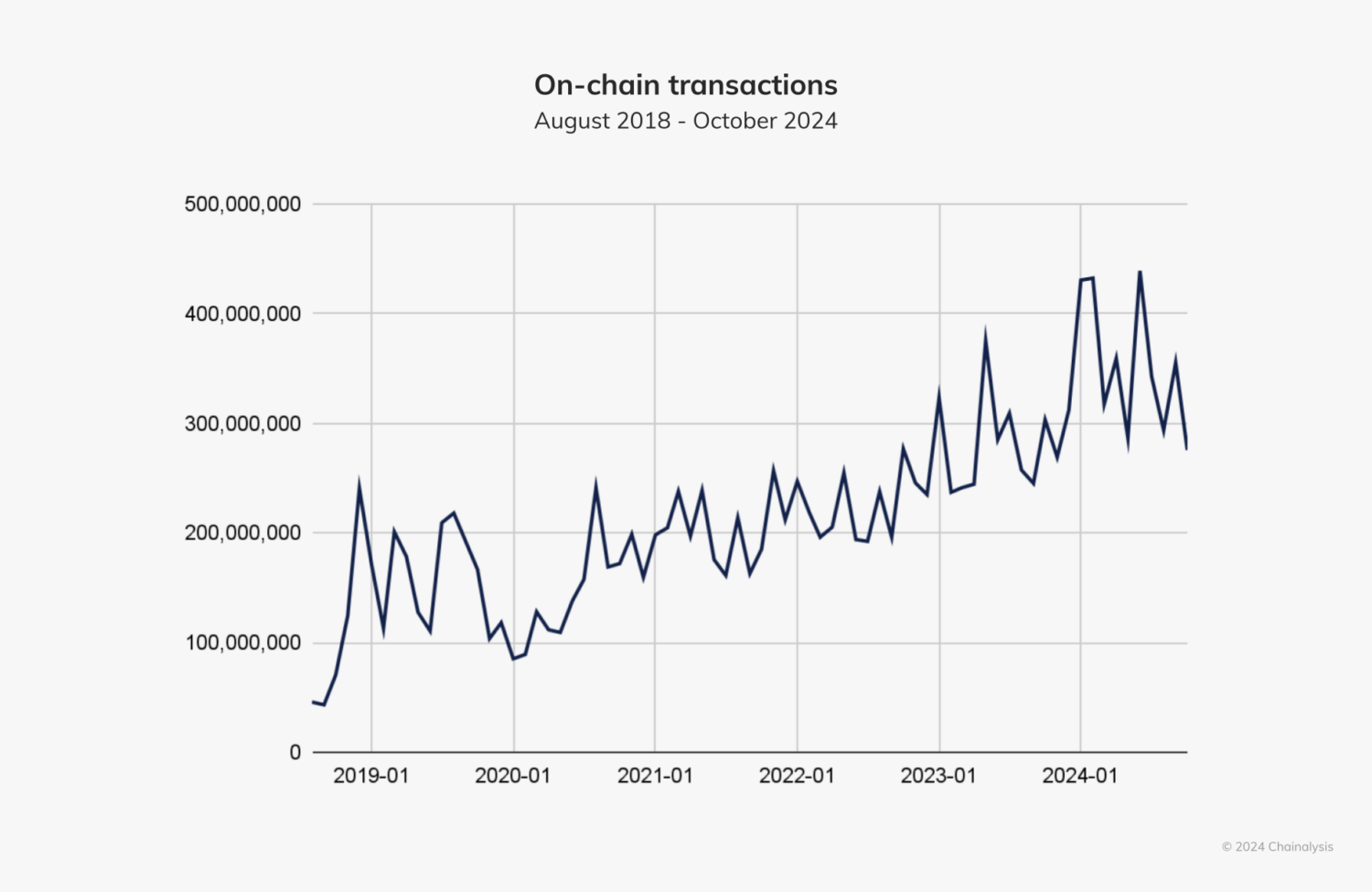

Additionally, transfer activity across all digital assets has eclipsed previous highs seen in late 2020 and 2021, indicating that this market cycle has been significantly more active than the last bull run.

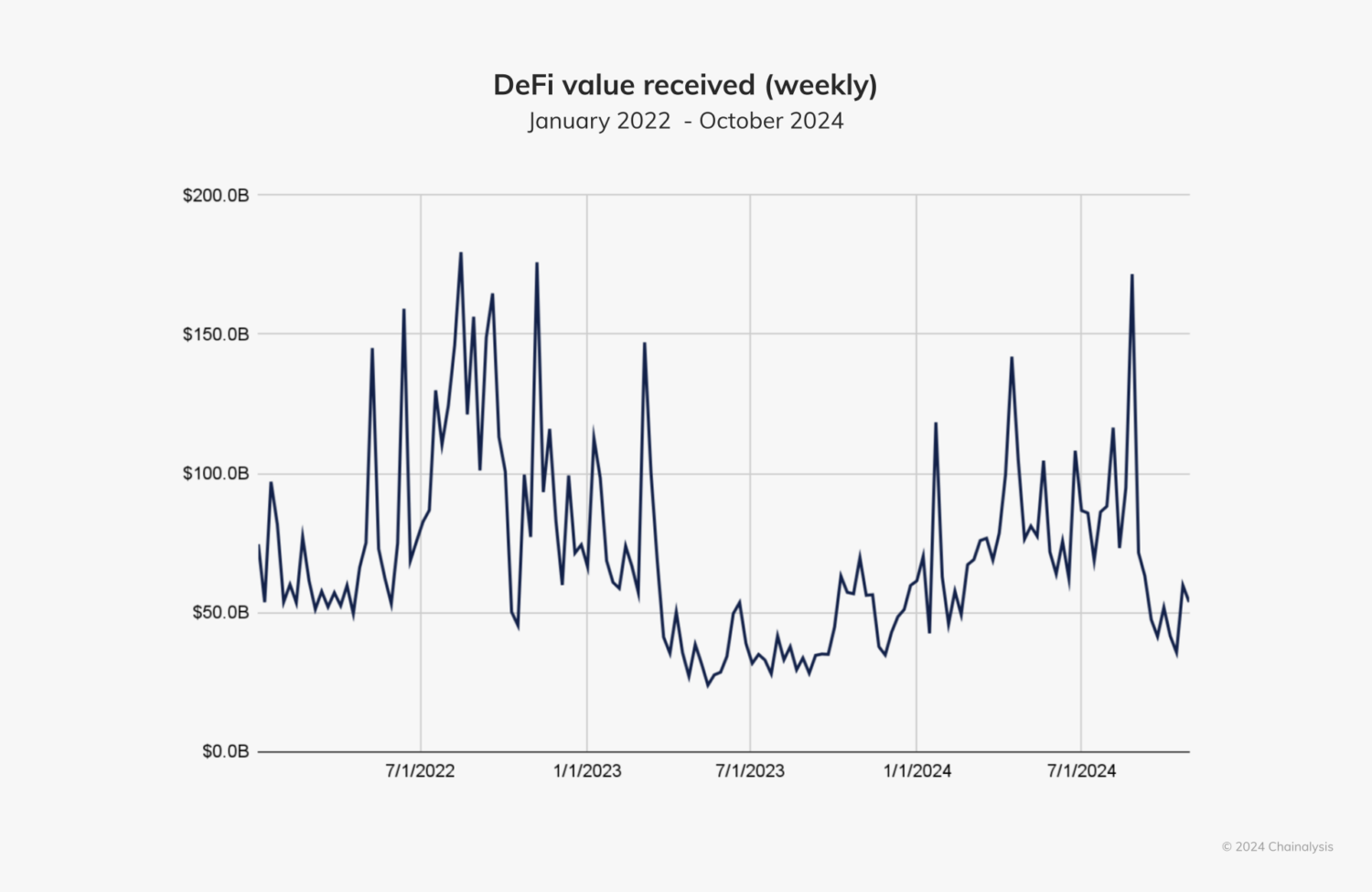

Beginning in late 2023 and early 2024, DeFi began to show signs of a resurgence along with the broader market, reaching previous record highs of activity, as we see below.

Current asset prices and DeFi activity aren’t the only indicators of market adaptability and resilience — the global adoption of stablecoins, explosive interest from TradFi, and the rise of services for new use cases like tokenization, as we’ll explore below, all point to broader acceptance and integration of crypto into the global economy.

Global utility powers the rise of stablecoins

Stablecoins, typically pegged 1:1 to the U.S. dollar or other fiat currencies, afford the efficiency, security, and transparency of cryptocurrency without exposure to the volatility we see in other crypto markets.

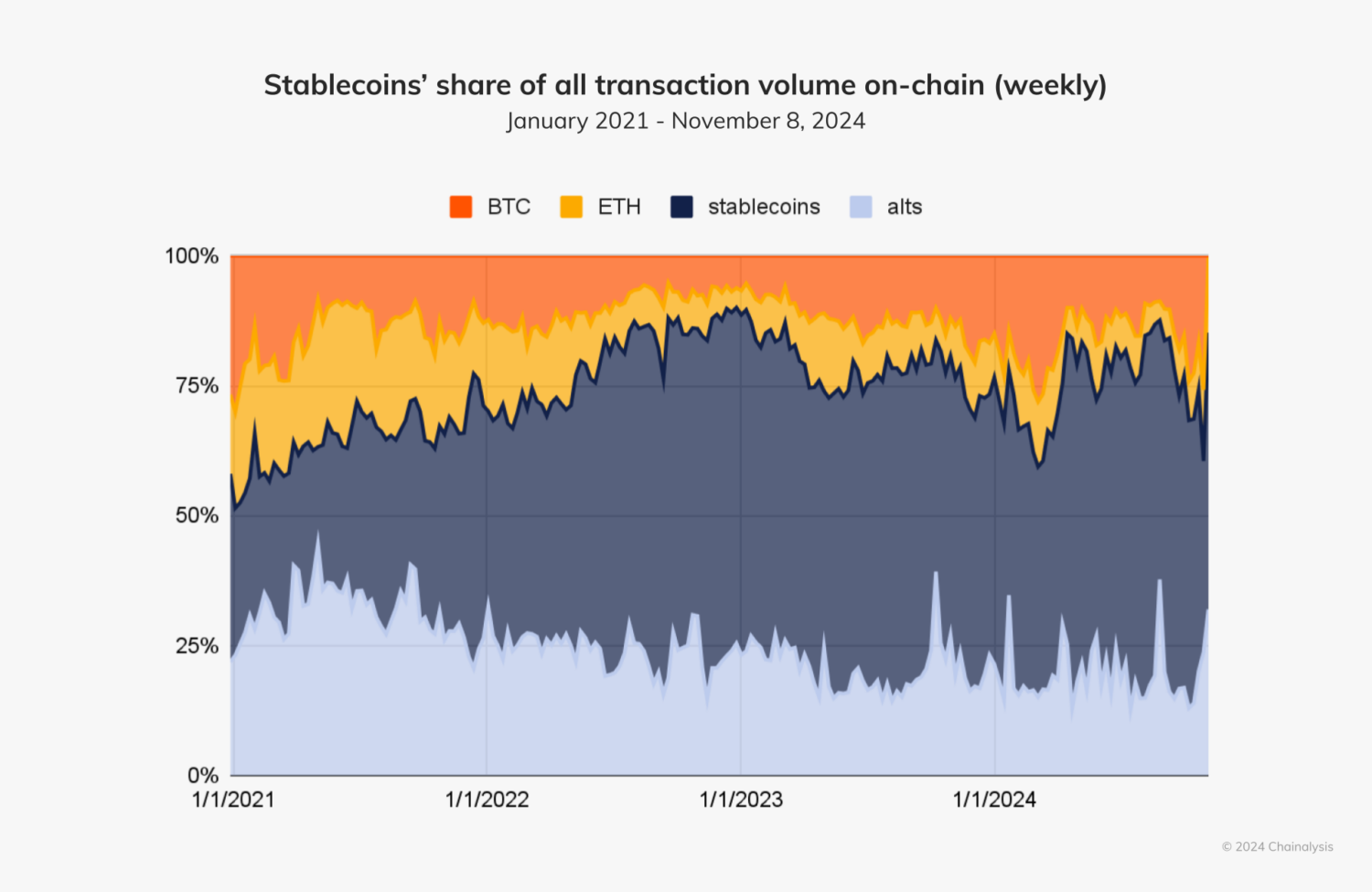

While major cryptocurrencies like BTC and ether (ETH) tend to dominate the headlines and offer gains that stablecoins lack, stablecoins have surpassed all other types of cryptocurrencies in adoption, representing over half — and up to 75% — of all transaction volume on-chain in recent months.

By giving anyone in the world with an internet connection access to the stability of the U.S. dollar, stablecoins are a crucial solution for residents of countries facing currency volatility, both for preserving savings and facilitating commerce. As we’ve discussed previously in our annual Geography of Cryptocurrency Report, industry experts in these countries tell us that residents frequently turn to stablecoins like Tether (USDT) to preserve their savings when the local currency loses value.

The growing prominence of stablecoins in overall transaction activity shows the high levels of utility this asset class has achieved with crypto users.

Bitcoin and Ether ETPs mark historic crypto-TradFi convergence

TradFi delivered its most decisive validation of crypto ever in 2024, with institutional interest bolstered by the introduction of spot BTC exchange-traded products (ETPs) in U.S. markets. Exchange-traded funds (ETFs) — the most popular form of ETP — have captured strong interest from both retail and institutional investors.

The broader market has seen rallies likely driven by the introduction of crypto ETFs, as these funds provide a regulated, mainstream investment vehicle to gain exposure to cryptocurrencies, often appealing to those who may otherwise be hesitant to directly navigate the complexity and security concerns of traditional crypto trading platforms.

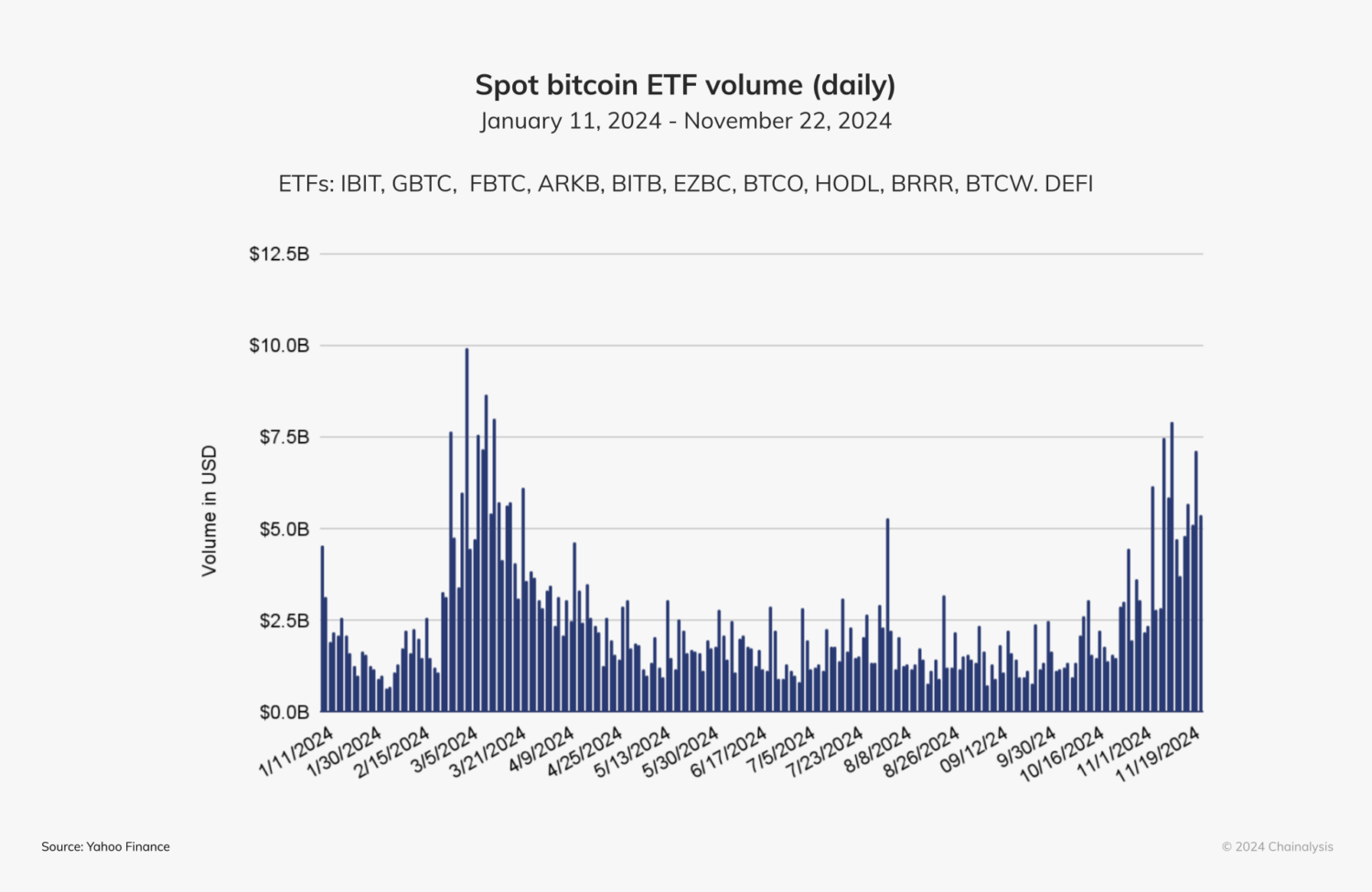

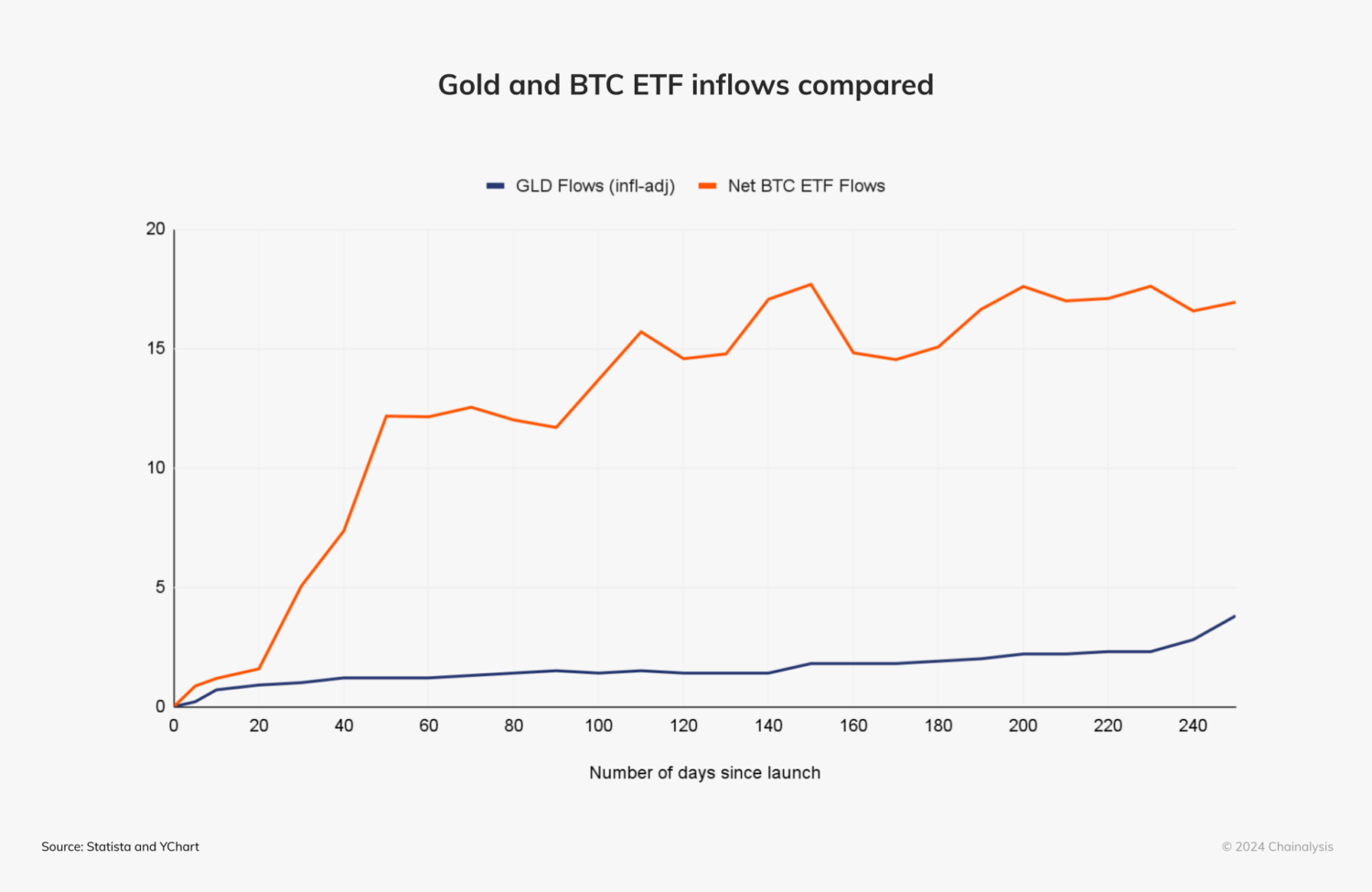

Daily bitcoin ETF volumes have surged, approaching nearly $10 billion in daily volume in March. BTC ETF flows are also outpacing that of the first net gold ETF (inflation-adjusted) from its 2005 launch, as we see below, making it the fastest growing ETF of all time.

The price of BTC began an upward ascent soon after news of the Bitcoin ETF approval broke on January 10, 2024 and trading commenced soon after.

By facilitating easier access to cryptocurrencies through conventional trading platforms, ETPs can unlock new sources of demand for the underlying assets, which appears to have been a big driver of BTC’s recent upwards price action.

Though the exact impact of the U.S. Bitcoin ETP launch is hard to pinpoint, it is widely acknowledged that it has boosted market optimism and expanded institutional BTC exposure. This surge in demand reflects ETPs’ unique appeal to both retail and institutional investors, offering a regulated, familiar way to access BTC without the complexities of managing private wallets.

Tokenization: Real-world assets (RWAs) are growing

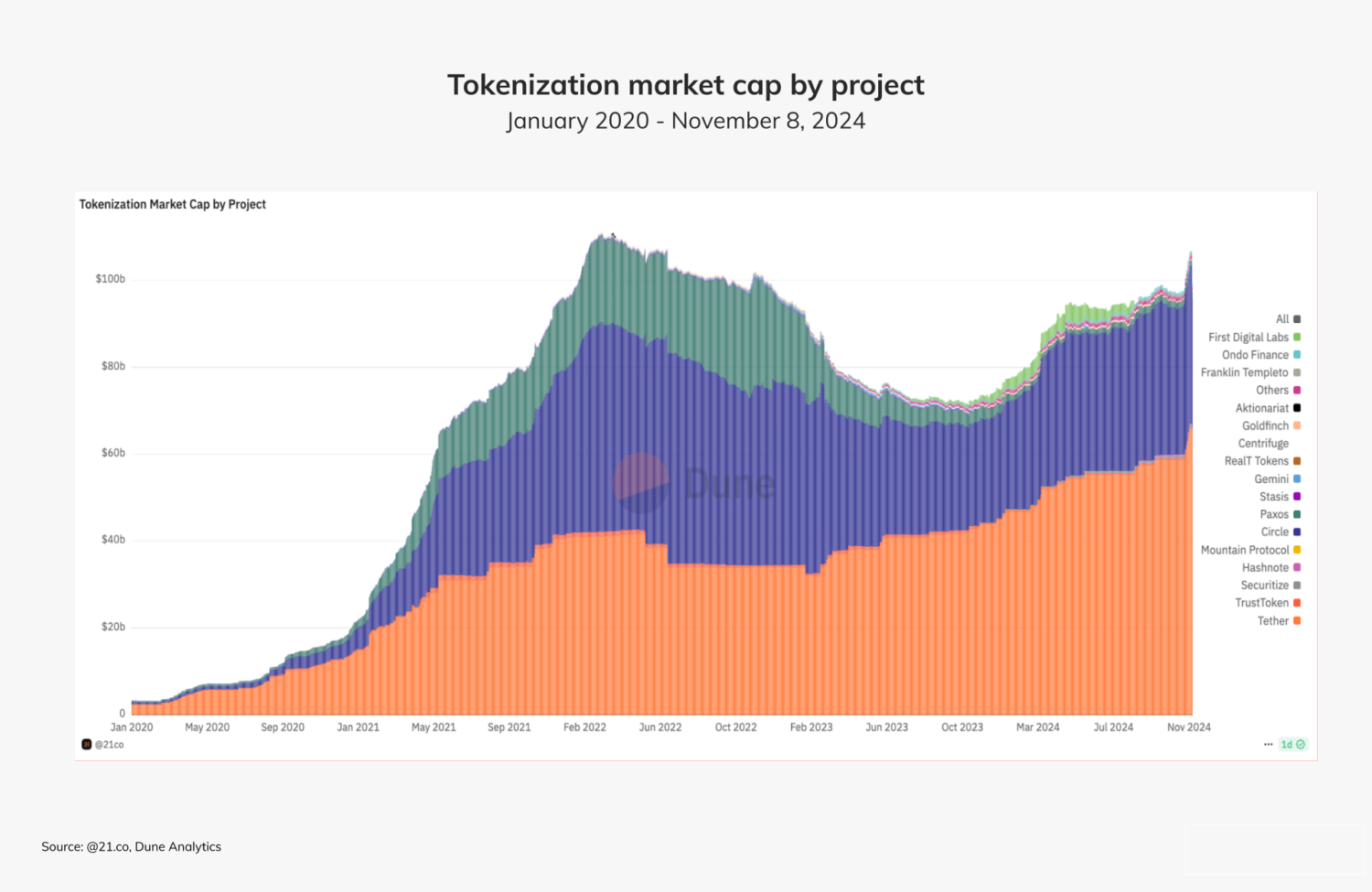

The excitement surrounding real-word assets (RWAs) moving on-chain through mass tokenization is quietly changing the landscape of asset management and investment, with major TradFi players like Franklin Templeton staking their claim in the market. Goldman Sachs is reportedly planning on rolling out a crypto trading platform focused on tokenization in the next 12-18 months.

Real-world assets (RWAs) refers to any asset — tangible or intangible — that derives value outside of the blockchain. Through tokenization, rights to these assets ranging from real estate and art to intellectual property rights are represented as tokens on the blockchain. This process not only streamlines the process of selling and trading these assets, but also enhances their accessibility to a broader audience, creating a more efficient and liquid market. RWAs also promise to enhance the transparency of investment markets, since all transactions are recorded on-chain.

Currently, most RWA projects are focused on tokenizing relatively simple and stable financial instruments, like U.S. treasury bills, with lending platforms powered by tokenized RWAs such as Goldfinch and Ondo Finance representing a large portion of the RWA market. According to data compiled by asset management firm 21.co, the market capitalization of tokenization projects has collectively exceeded $100 billion.

While still in its early stages, the emerging relevance of RWAs is a major step toward a future where the majority of value transfer occurs on the blockchain, fostering a unified, open, and less frictional global market.

What crypto industry maturity might mean for organizations

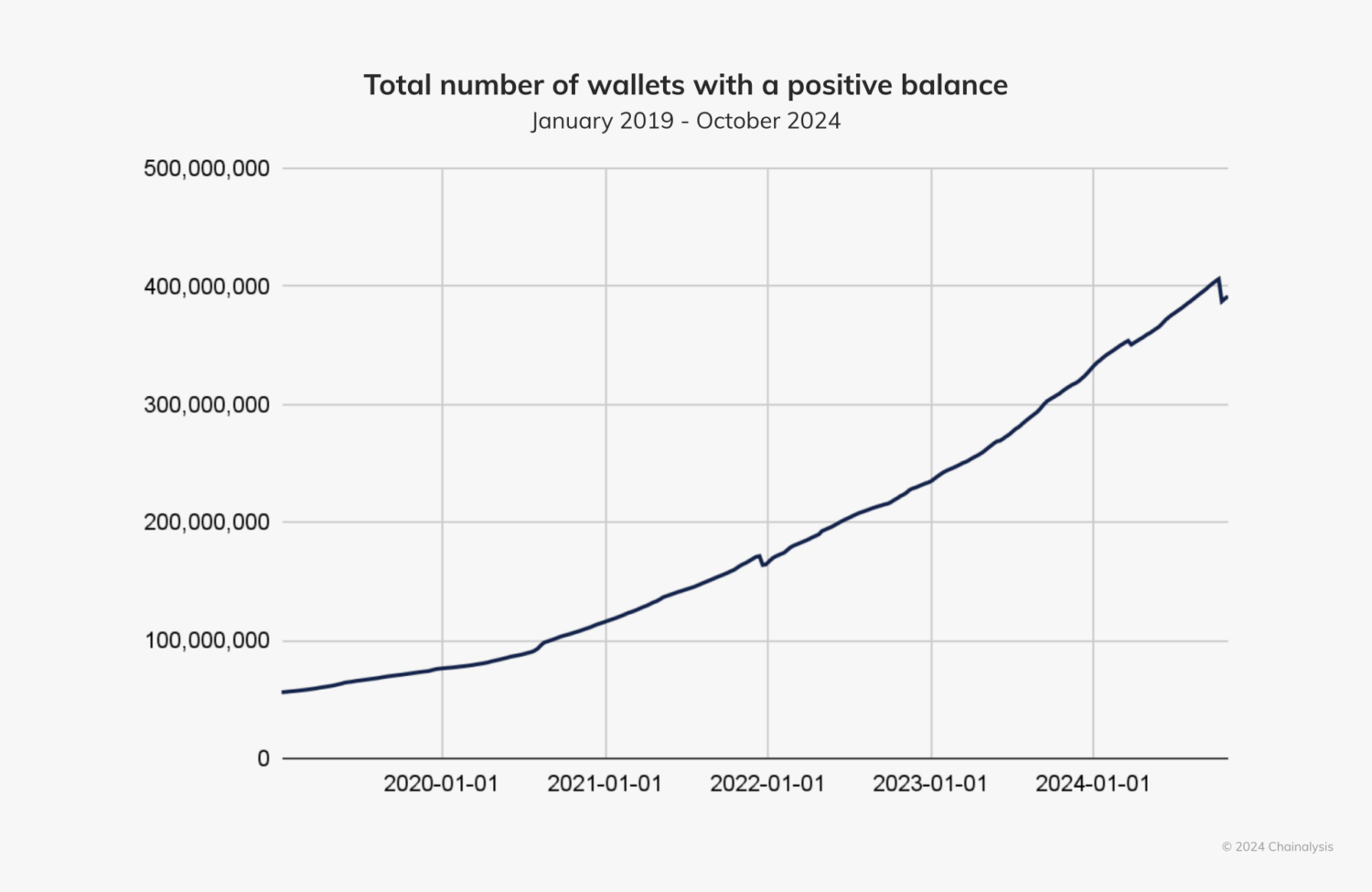

When we examine the progress of the crypto ecosystem, it is clear that we’re experiencing a seismic shift in both perception and usage. Although the cryptocurrency market can be volatile with extended bear cycles, one trend is consistent: the linear and upward growth of wallets with a positive balance. Today over 400 million wallets actively hold cryptocurrency.

Though one wallet does not imply one user, as institutions and individuals can manage multiple wallets, the sheer volume of growth suggests that cryptocurrency adoption is steadily growing.

As the footprint of crypto continually expands, it is important to weigh what success looks like in this new paradigm. For organizations, adapting to an on-chain reality involves more than just keeping pace with technological advancements — it requires a thorough reassessment of operational models to leverage the unique opportunities afforded by blockchain. This transition is especially pertinent for financial institutions, both decentralized and centralized, who stand at the forefront of integrating crypto into the mainstream. Chainalysis enables institutions to scale with confidence, navigating the unique risks and complexities of this domain.

For government agencies and the public sector writ large, the mainstreaming of crypto introduces both challenges and opportunities. As the utility of crypto expands, so does its potential misuse by bad actors. With comprehensive data and intelligence tools, Chainalysis empowers law enforcement and other public sector stakeholders to stay a step ahead, helping maintain the integrity and security of the ecosystem at large. Our commitment to pioneering advancements in investigations and risk management positions our clients — not only to contend with — but also to thrive in this new reality.

The transition from winter is not just a revival of fortunes but a significant step towards a future where blockchain technology and crypto assets are integral to our financial and operational landscapes. The journey ahead is filled with both obstacles and possibilities.With an approach that marries cautious optimism with a commitment to innovation, the financial infrastructure of the world has never been more ripe for disruption.

This material is for informational purposes only, and is not intended to provide legal, tax, financial, or investment advice. Recipients should consult their own advisors before making these types of decisions. Chainalysis has no responsibility or liability for any decision made or any other acts or omissions in connection with Recipient’s use of this material.

This article contains links to third-party sites that are not under the control of Chainalysis, Inc. or its affiliates (collectively “Chainalysis”). Access to such information does not imply association with, endorsement of, approval of, or recommendation by Chainalysis of the site or its operators, and Chainalysis is not responsible for the products, services, or other content hosted therein.

Chainalysis does not guarantee or warrant the accuracy, completeness, timeliness, suitability or validity of the information in this article and will not be responsible for any claim attributable to errors, omissions, or other inaccuracies of any part of such material.

All trademarks, logos and brand names are the property of their respective owners. All company, product and service names used in this website are for identification purposes