This blog is an excerpt from the Chainalysis 2020 Geography of Cryptocurrency Report. Sign up here and we’ll email you the full report as soon as it comes out in September

Venezuela is suffering through one of the worst economic crises in modern history, with its national currency, the Bolivar, becoming practically worthless as hyperinflation rates hit 10,000,000% last year. It’s nearly impossible to overstate how badly these conditions affect the average Venezuelan. “This is the worst humanitarian crisis in modern Latin American history,” says Moises Rendon, a Venezuela expert at the Center for Strategic & International Studies (CSIS). “Venezuela used to be one of the wealthiest countries in Latin America. Now, it’s one of the poorest, facing water shortages, blackouts, and hospitals with practically no supplies. This has destabilized the entire region.”

Under these circumstances, cryptocurrency has taken on an important role in Venezuela’s economy. In fact, Venezuela’s cryptocurrency market represents a confluence of several topics at the core of cryptocurrency’s key value propositions and risk factors. The country has reached one of the highest rates of cryptocurrency usage in the world, placing third on our Global Crypto Adoption Index, as many Venezuelans rely on cryptocurrency to receive remittances from abroad and preserve their savings against hyperinflation. At the same time, Venezuela’s contested government, led by OFAC-sanctioned Nicolas Maduro and known for its corruption and human rights abuses, has launched its own cryptocurrency projects it claims will mitigate poor economic conditions for its citizens. However, officials have also stated that bypassing sanctions — a point of concern around cryptocurrency for the U.S. and its allies — is a key goal of these projects.

Aside from the concerns around sanctions violations, the Maduro regime’s cryptocurrency projects raise questions of whether people would embrace government-led efforts to utilize a tool initially designed to immunize currency from government financial policy — especially when that government has so squandered its people’s trust as Venezuela’s has. Below, we examine the role that cryptocurrency plays in Venezuela’s economy and compare the country’s usage of mainstream P2P exchanges with that of the government-sponsored exchanges.

The Maduro regime’s cryptocurrency project

In 2018, the Venezuelan government started the PETRO: a national cryptocurrency said to be backed by the country’s oil reserves. While the goal of the project is ostensibly to combat the currency devaluation hurting Venezuela today, government officials have also stated that evading sanctions is another goal.

In addition to creating the PETRO, the Maduro regime also gave seven cryptocurrency exchanges permission to operate in the country, their goal being to facilitate the exchange of the PETRO so that it can circulate in the global cryptocurrency economy.

These exchanges aren’t limited to the PETRO, of course — just like any other, users can buy and sell popular cryptocurrencies like Bitcoin. These exchanges also represent a risk of sanctions evasions, as individuals connected to the Maduro regime could theoretically use them to receive transfers from citizens of the U.S., E.U., or other jurisdictions that have Venezuela-related sanctions.

How big is the sanctions evasion threat? And conversely, are Venezuela’s state-approved cryptocurrency exchanges mitigating poverty in the country? We can try to answer these questions by analyzing one of the platform’s transaction activity. Criptolago will be our example.

According to reporting from financial intelligence provider Sayari, Criptolago is owned by Venezuela’s Zulia state, and its top management position is occupied by that state’s governor, Omar Prieto. Prieto is a staunch Maduro ally who is personally under U.S. sanctions for refusal to deliver humanitarian aid.

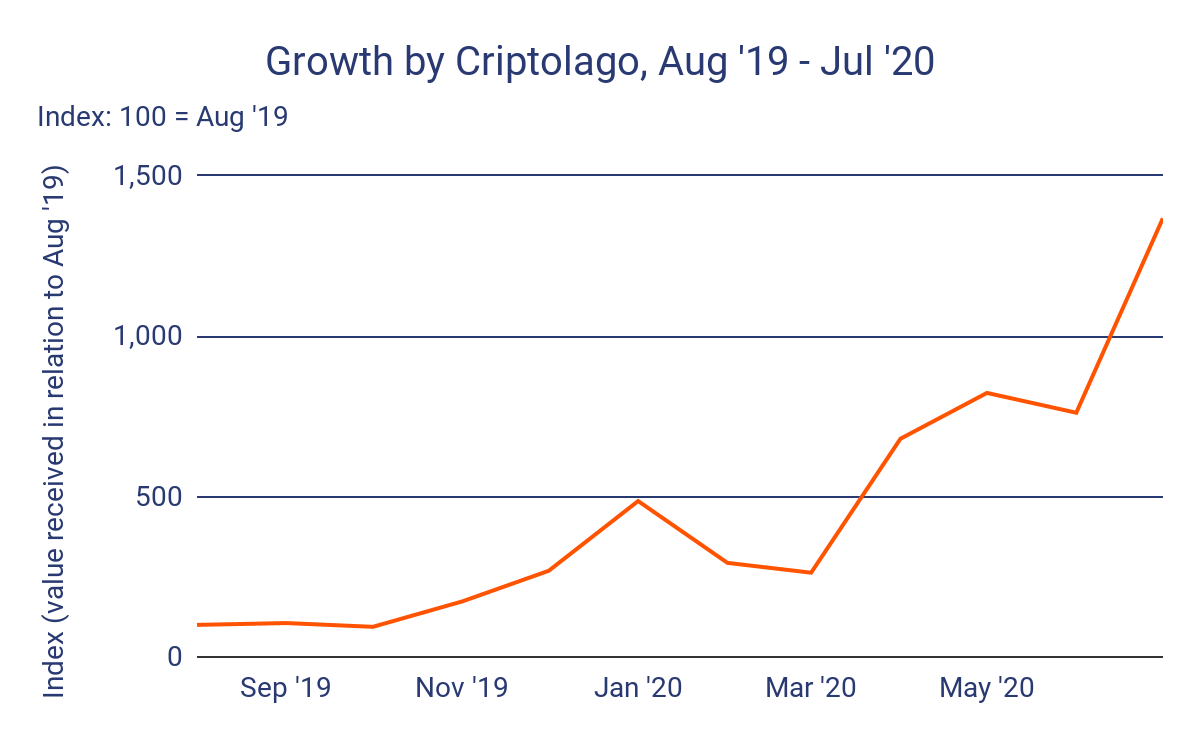

Over the last year, Criptolago addresses have received over $380,000 worth of Bitcoin over 3,916 transfers and sent over $360,000 worth over 2,297 transfers. Below, we see an index charting Criptolago’s total month-over-month growth since August 2019.

On the face of it, Criptolago’s growth looks strong, as transfer volume has gotten over 13x bigger in the last year. But if we dig into the data on the transfers themselves, it doesn’t appear that Criptolago is helping the Venezuelans struggling most.

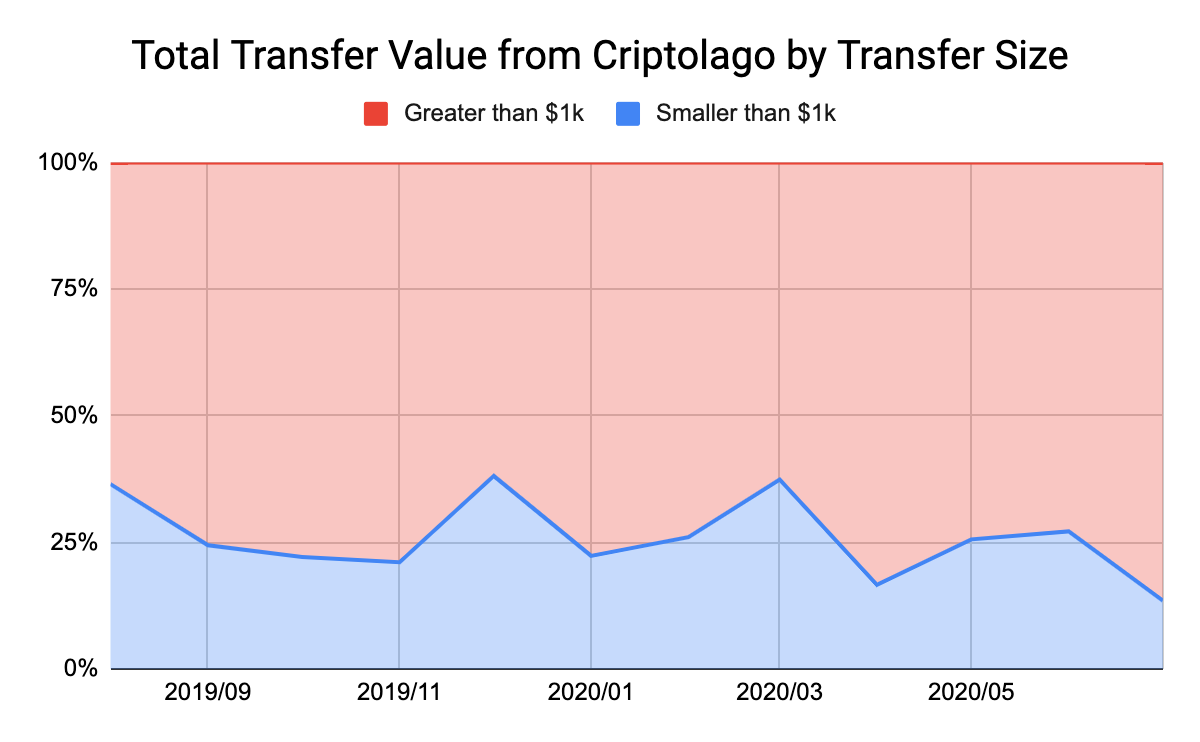

More than 75% of transfer volume is moved in transactions of $1,000 USD or more worth of cryptocurrency. However, the average Venezuelan earns just 72 cents per day, meaning very few of them could afford such transfers. Rendon agreed with us that it was unlikely everyday Venezuelans are using Criptolago when he reviewed our data. “I suspect that most of the users of this platform are people close to the Maduro regime or otherwise able to take advantage of Venezuela’s corruption to make money — the large transfers on Criptolago are likely them trying to preserve this wealth or move it somewhere to evade sanctions, as most of these high profile Venezuelans can’t open bank accounts in other countries.”

He added, “I think most Venezuelans would want to avoid a platform that could be monitored by the government. The Maduro regime is infamous, for example, for retroactively declaring certain activities illegal and prosecuting those who have taken them.” Rendon here brings up the key issue of trust. The desire for an economic system detached from monetary policy, where participants could know based on an algorithm how much currency is and will be available without having to trust a government to get it right, is one of the primary reasons Bitcoin was invented in the first place. In Venezuela, the lack of trust in the Maduro regime appears to be pushing citizens away from government-connected cryptocurrency platforms. Instead, as we’ll explore below, they’re going to P2P exchanges that serve the world independent of any government, which is more in line with Bitcoin’s original premise.

Cryptocurrency usage in Venezuela

As the Venezueln bolivar has lost value in the midst of hyperinflation, Venezuela has become one of the most active cryptocurrency trading countries on earth. As we mentioned earlier, Venezuela is ranked third on our Geographic Crypto Usage Index, with a score of 0.80 on a scale of 0 to 1. Most of this activity is driven by P2P exchange activity, specifically on LocalBitcoins. LocalBitcoins has active users all over the world, yet Venezuela is the third-most active country on the platform, or second-most active when we scale by the number of internet users and purchasing power parity per capita.

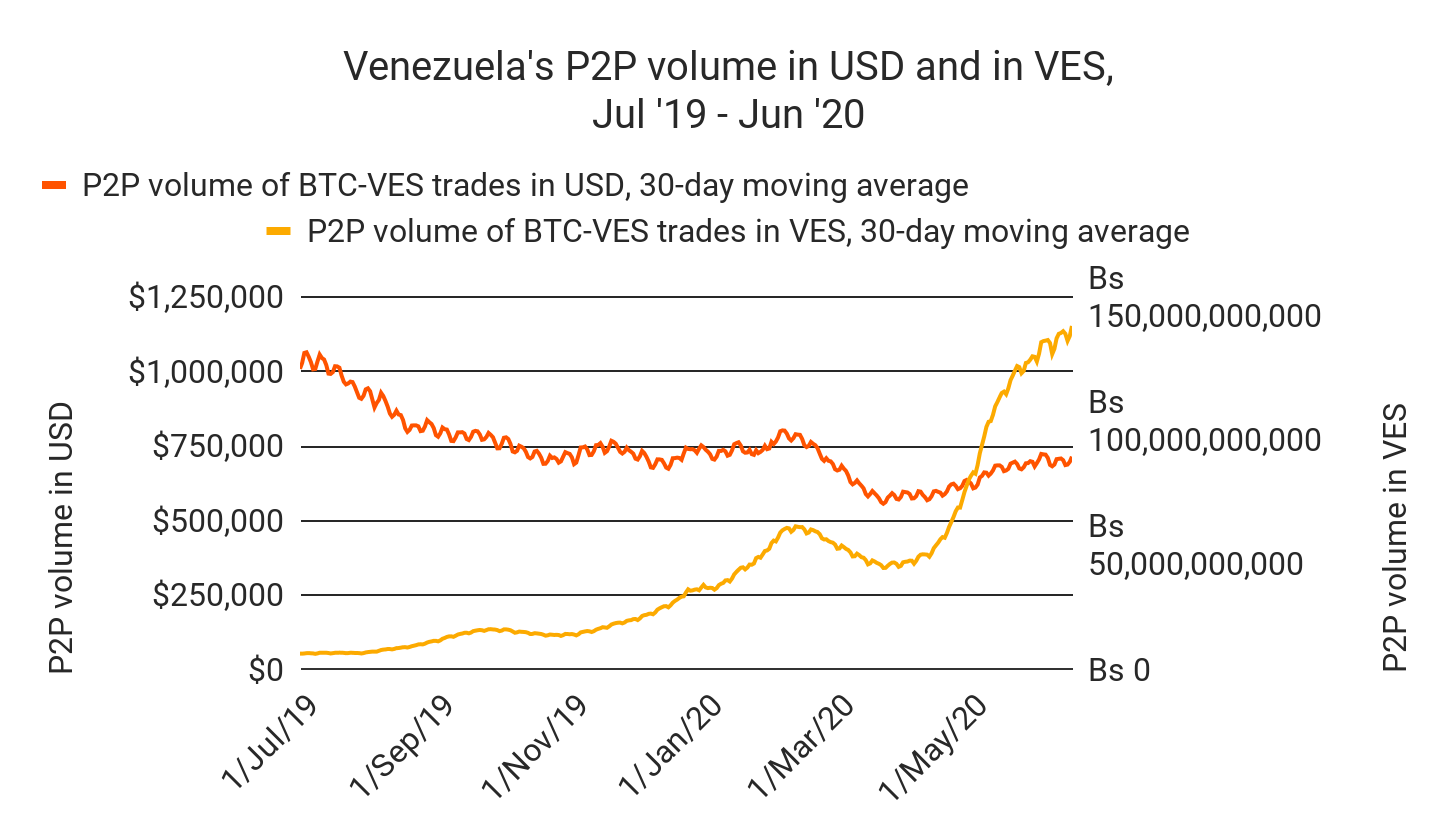

Venezuela ranks 3rd for P2P trading volume in USD, after the U.S. and Russia, but can we confirm that P2P usage coincides with periods of hyperinflation? At first glance, the yellow line of P2P volume traded on LocalBitcoins in Venezuelan Bolivar would seem to indicate that P2P activity skyrockets in the presence of hyperinflation; however, the rapid rise in this line mostly stems from hyperinflation: more bolivars are required to purchase the same amount of Bitcoin over time. The orange line shows Venezuela’s P2P volume in USD which is slower to increase in recent weeks. In the presence of hyperinflation, people are probably putting a larger share of their wealth into cryptocurrency, but it’s hard to measure how people are adjusting their behavior day-to-day. The true growth pattern is likely somewhere in between the two lines.

We do however, have a lot of anecdotal evidence that people in Venezuela have become increasingly interested in cryptocurrency. That fits with our interviews of cryptocurrency experts on the ground in Latin America — users not just in Venezuela, but in other countries facing harsh economic conditions, turn to cryptocurrency to preserve their savings in the face of monetary devaluation. While not necessarily reflected on this chart, cryptocurrency is also important for remittances. Roughly 5 million Venezuelans have left the country to seek opportunity elsewhere during this economic crisis, and many of their friends and family back home rely on them to send money from abroad. Cryptocurrency is hugely helpful here, as users can use it to send funds overseas faster and with lower fees than they can with fiat. Cryptocurrency also enables them to do this without a bank account, which Rendon told to us is extremely hard to get for Venezuelans. “American banks, which offer money transfer services like Bank of America’s Zelle, began closing Venezuelans’ bank accounts because of sanctions concerns, as the balances on these accounts aren’t high enough to justify the banks’ costs of monitoring for sanctions violations,” he explained.

But Rendon is encouraged by Venezuela’s skyrocketing cryptocurrency usage. “I think that what we’re seeing is the Venezuelan people reclaiming their economic sovereignty. Crypto just makes sense for this country.” So far, the data suggests that international cryptocurrency exchanges that connect Venezuela to the rest of the world, rather than insular government-run exchanges, are the platforms delivering those positive results.

Want more insights into how cryptocurrency usage differs by region? Sign up here to get the full Geography of Cryptocurrency Report delivered to your inbox as soon as it comes out! You’ll get more original data and research on inter-regional trading patterns, the state of regulation by region, how cryptocurrency mitigates economic instability in the developing world, and more!