The Securities and Exchange Commission’s (SEC) approval of spot Bitcoin exchange-traded funds (ETFs) on January 10, 2024, marked a significant milestone in the landscape of crypto investment in the United States. Bitcoin ETFs provide a scalable bridge from traditional finance to crypto — a pivotal integration point. “This is the moment that crypto’s gone mainstream,” said Brett Tejpaul, the head of Coinbase Institutional, speaking on a panel discussing the impact of the Bitcoin ETF at Chainalysis Links NYC 2024.

A popular vehicle of investment for assets like gold, Bitcoin ETFs mark the entrance of a brand new asset class under the ETF wrapper, allowing investors to gain exposure to Bitcoin without having to navigate purchasing and holding the cryptocurrency directly and bypassing the potential complexities of the crypto ecosystem. This model mirrors traditional investment structures, fitting neatly into the portfolios of mainstream investors and potentially broadening Bitcoin’s investor base among both retail and institutional investors.

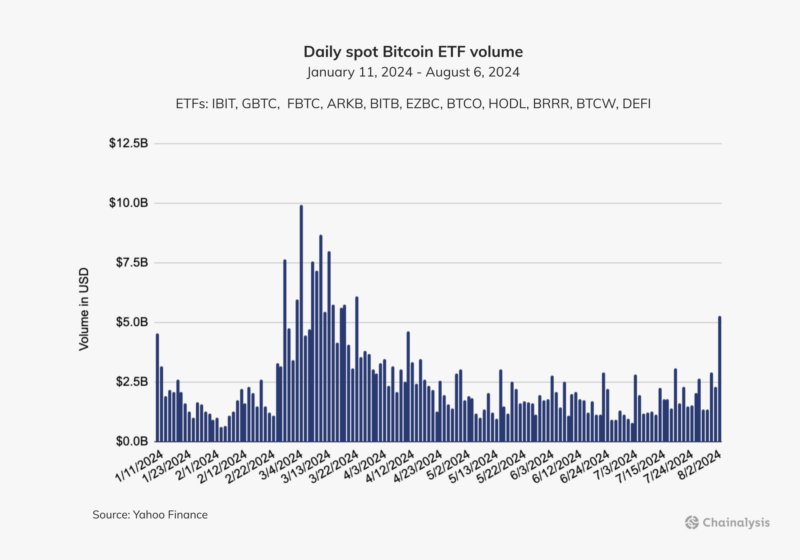

In the wake of the spot Bitcoin ETF approval and launch, daily ETF volumes have surged, approaching nearly $10 billion in daily volume in March and consistently trading in the billions.

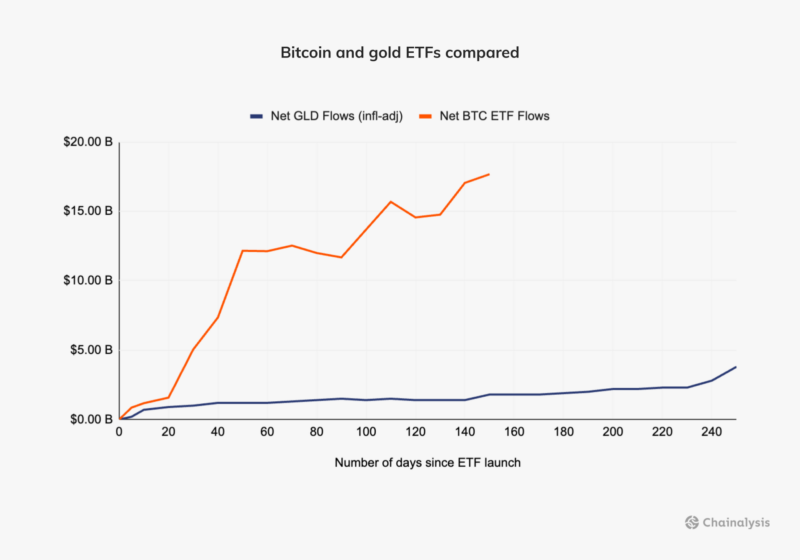

BTC ETF flows are also outpacing that of the first net gold ETF (inflation-adjusted) from its 2005 launch.

With billions of dollars in inflows since January 10, 2024, Bitcoin ETFs have collectively become the most popular ETF of all time.

What is a spot Bitcoin ETF?

Spot Bitcoin ETFs are financial instruments that track Bitcoin’s price by holding the actual cryptocurrency in reserve and backing each share of the ETF with real Bitcoin. These ETFs provide investors with direct exposure to Bitcoin’s price movements without the need to buy, store, or manage Bitcoin themselves. They function similarly to traditional ETFs but focus specifically on BTC as the underlying asset. There are eleven spot Bitcoin ETFs available today in the United States.

The difference between spot Bitcoin ETFs and Bitcoin futures

Spot Bitcoin ETFs and Bitcoin futures offer different approaches to Bitcoin investment. Spot Bitcoin ETFs purchase and hold real Bitcoin in a custodial account, with the ETF shares reflecting the market price of Bitcoin. These ETFs operate within regulated financial markets, ensuring security and compliance with legal standards, and reputable custodians manage Bitcoin storage to mitigate risks like hacking or loss.

In contrast, Bitcoin futures are a derivative contract that track Bitcoin futures contracts, which are agreements to buy or sell Bitcoin at a future date for a predetermined price. While spot ETFs provide direct exposure to actual Bitcoin, futures ETFs involve rolling over futures contracts, introducing complexities and additional costs. Spot ETFs track the price of Bitcoin in real-time, whereas futures ETFs track the price of futures contracts, which might differ from the spot price due to market speculation and futures market dynamics.

How Bitcoin ETFs appeal to institutional and retail investors

Spot Bitcoin ETFs offer several advantages for both individual investors and institutions. For individual investors, they provide an easy way to gain exposure to Bitcoin without managing crypto wallets or navigating cryptocurrency exchanges, making Bitcoin investments more accessible for some. For institutions, ETFs offer a regulated and secure method to include Bitcoin in their portfolios, aiding in diversification and potentially enhancing returns. Institutions can trade these ETFs on traditional stock exchanges, simplifying the incorporation of Bitcoin into their existing investment strategies. This creates a pathway for institutional and retail capital to find its place in the cryptocurrency marketplace

Institutional investment

Institutions that invest in spot Bitcoin ETFs typically use brokerage accounts to purchase ETF shares, incorporating these into their diversified portfolios. The ETFs provide institutions with a liquid, tradable asset that aligns with their investment strategies and regulatory compliance requirements. Additionally, institutions may benefit from the oversight and security measures provided by custodians managing the ETFs’ underlying Bitcoin holdings.

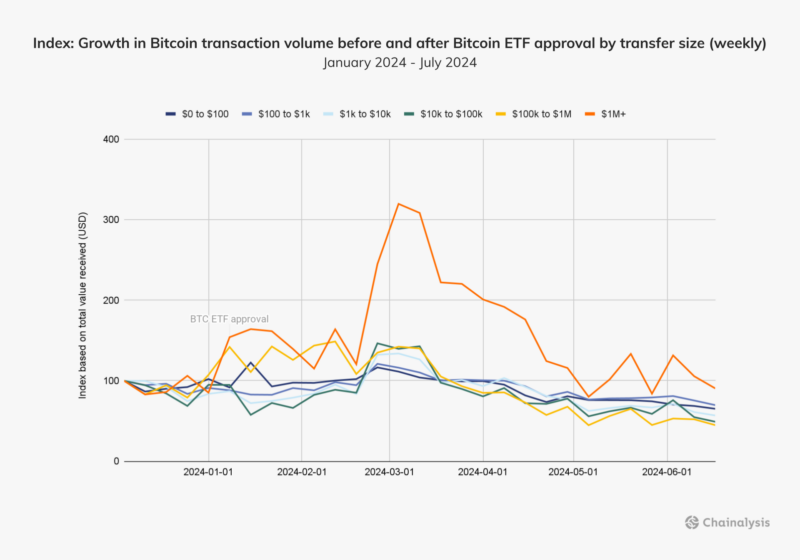

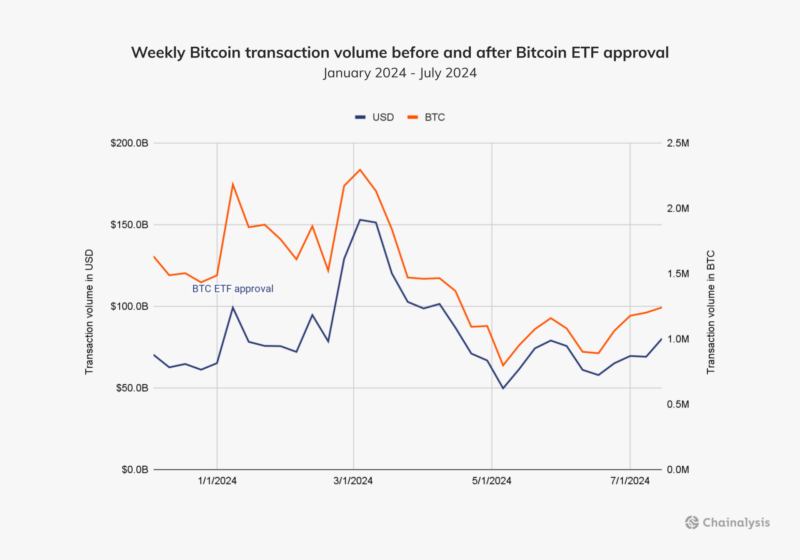

When examining the growth of Bitcoin transaction volume after ETF approval, volumes of transfers that are larger than $1 million increased the most, with a major peak of institutional volume transfers observed in March.

This influx of institutional capital not only highlights significant investor interest but also signals a shift towards larger, more strategic crypto investments. The second largest increase was observed in transfers ranging from $100,000 to $1 million until February, with both professional and retail investors joining the rally shortly thereafter.

Retail investment

Retail investors also use brokerage accounts to invest in spot Bitcoin ETFs. They can buy and sell ETF shares through the market or limit orders, much like trading stocks. This process is straightforward and familiar to those accustomed to traditional investments. In both retail and institutional use cases, investors benefit from the liquidity and transparency of ETFs, along with the reduced complexity and enhanced security of regulated financial products.

Market impacts of Bitcoin ETFs

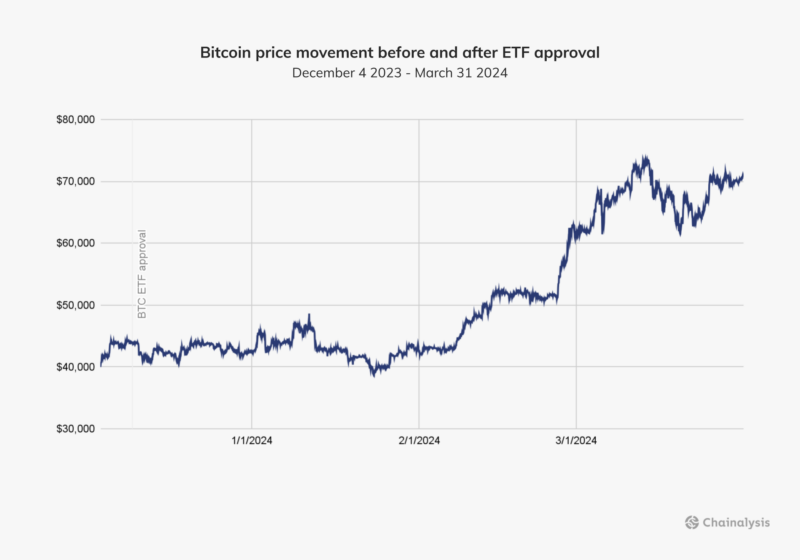

The price of Bitcoin began an upward ascent soon after news of the Bitcoin ETF approval broke on January 10, 2024 and trading commenced soon after, with an unprecedented 11 ETFs trading on day one.

At the same time, there was a substantial spike in Bitcoin transfer volumes during the week of the ETF’s approval.

Spot Bitcoin ETFs enhance accessibility by allowing investors to buy and sell shares through traditional brokerage accounts, just like stocks or other ETFs. This can reduce the complexity of purchasing and securely storing Bitcoin. Regulatory oversight from financial authorities ensures these ETFs operate within a legal framework, offering a high degree of investor protection and confidence. This regulatory environment helps mitigate risks related to fraud and market manipulation, making investments in Bitcoin secure and trustworthy.

How to buy into spot Bitcoin ETFs

buy spot Bitcoin ETFs, investors must have a brokerage account to purchase ETF shares like stocks or other ETFs, using market or limit orders with the ETF’s ticker symbol. Selling shares follows a similar process through the brokerage account. ETFs are generally liquid, allowing trading during market hours, though liquidity depends on trading volume and the underlying asset. Transaction costs include brokerage fees and annual expense ratios for operational costs, which are automatically deducted. The ETF’s price may fluctuate from its Net Asset Value (NAV) due to supply and demand, but authorized participants can create or redeem shares to align the ETF price with the NAV. Trading is subject to the market hours of the exchange where the ETF is listed.

Challenges and risks

The primary risk of spot Bitcoin ETFs lies in Bitcoin’s inherent volatility, which can lead to significant fluctuations in the ETF value. Investors must be prepared for rapid price changes and potential losses. Additionally, ETF management involves fees, such as expense ratios, which can impact overall returns.

Regulatory changes could also affect the operation and availability of spot Bitcoin ETFs. Furthermore, secure and reliable custody solutions are important for managing the underlying Bitcoin holdings, as any security breaches could undermine investor confidence. Tax implications may differ from direct holding Bitcoin depending on the jurisdiction, requiring investors to be aware of tax considerations specific to their locality.

The future of crypto ETFs: Ethereum and beyond

Interoperability is a major marker of maturity in the crypto ecosystem, with ETFs playing a pivotal role in this advancement. As the market continues to mature and blend with traditional financial systems, the demand for regulated and secure investment options, like spot Bitcoin ETFs, is expected to rise. With major regulatory bodies such as the SEC approving these ETFs, the stage is set for broader adoption by both retail and institutional investors. This growth will likely be fueled by growing acceptance of Bitcoin as a legitimate asset class, heightened investor interest, and the possible creation of more advanced financial products that use spot Bitcoin ETFs.

Spot Ethereum ETFs

Also available in markets like Hong Kong and Australia, new spot ETFs for Ethereum have begun to trade in the United States. The approval and launch of Ethereum ETFs provide investors with another major digital asset option within a regulated framework. Like Bitcoin ETFs, these funds track the price of Ethereum — the second most popular cryptocurrency — without requiring the investor to directly hold the asset. Ether’s wide range of applications like DeFi could make it an attractive ETF option for investors to diversify their crypto holdings beyond Bitcoin. The success and acceptance of Ethereum ETFs might pave the way for other cryptocurrency ETFs, further expanding the options available to investors.

Other cryptocurrency ETFs

The future of crypto ETFs is bright. In the coming years, we might see ETFs that encompass a broader range of digital assets. As the market evolves, more sophisticated financial products, such as leveraged and inverse crypto ETFs, may also emerge, enabling investors to take various positions on crypto price movements. Additionally, thematic ETFs focusing on specific areas like blockchain applications and tokenization could enter the market. The ongoing development of regulatory frameworks will be critical in shaping these innovations, ensuring both investor protection and market stability.

Collaborative regulation drives the future of Bitcoin and other cryptocurrency ETFs

The integration of Bitcoin ETFs into the financial ecosystem signifies a pivotal moment for both traditional finance and the crypto space. Positive regulatory developments, such as approval from the SEC, boost the credibility and acceptance of these investment vehicles.

Regulatory oversight ensures investor protection, market stability, and legal compliance, making spot Bitcoin ETFs appealing to a broader range of investors. However, stringent regulations and potential policy changes could pose challenges, limiting the growth and flexibility of these ETFs. Ongoing dialogue between regulators, financial institutions, and market participants will be essential for navigating these challenges and supporting the continued evolution of cryptocurrency ETFs.

By prioritizing education, fostering open communication with regulators, and embracing regulatory developments, we can pave the way for a more secure, inclusive, and innovative investment landscape to see that the potential of cryptocurrency ETFs is fully realized — benefiting investors and the broader financial system alike.

This material is for informational purposes only, and is not intended to provide legal, tax, financial, or investment advice. Recipients should consult their own advisors before making these types of decisions. Chainalysis has no responsibility or liability for any decision made or any other acts or omissions in connection with Recipient’s use of this material.

Chainalysis does not guarantee or warrant the accuracy, completeness, timeliness, suitability or validity of the information in this report and will not be responsible for any claim attributable to errors, omissions, or other inaccuracies of any part of such material.

All trademarks, logos and brand names are the property of their respective owners. All company, product and service names used in this website are for identification purposes.