Today, the U.S. Department of Justice (DOJ) filed a civil forfeiture complaint against the largest ever seizure of digital assets: approximately 69,370.22491543 Bitcoin (BTC), 69,370.10730857 Bitcoin Gold (BTG), 69,370.10710518 Bitcoin SV (BSV), and 69,370.12818037 Bitcoin Cash (BCH), collectively worth more than $1 billion USD. Law enforcement agents used Chainalysis tools and investigative assistance to identify the largest cryptocurrency wallets with connections to Silk Road, the first modern darknet market, enabling them to generate this lead from evidence on the blockchain. This Bitcoin was seamlessly transferred to a government-controlled wallet, which, if forfeited, will be moved to the Treasury Forfeiture Fund (TFF). The TFF finances innovative law enforcement programs, like blockchain analysis tools and training, which will help agents identify and seize more illicit funds. Earlier this year, law enforcement agencies filed similar civil forfeiture actions against cryptoassets related to terrorism financing and North Korean hacking activities with the help of Chainalysis tools and investigative assistance.

On November 3, the Twitter bot @Whale_alert flagged a large transaction of 69,369 BTC, leading many to speculate whether the long-dormant wallet connected to Silk Road had been hacked or if the owner executed the transaction. In fact, this was law enforcement’s seizure of the funds as they moved the Bitcoin to the government-controlled wallet. This wallet is now labeled in Chainalysis products as “Silk Road Marketplace Seized Funds 2020-11-03.”

Background on Silk Road

Silk Road was the first major digital darknet market where illicit goods and services, including illegal drugs, were bought and sold by the site’s users. In 2013, law enforcement shut Silk Road down and arrested its owner and operator, Ross Ulbricht, who was also known as “Dread Pirate Roberts.”

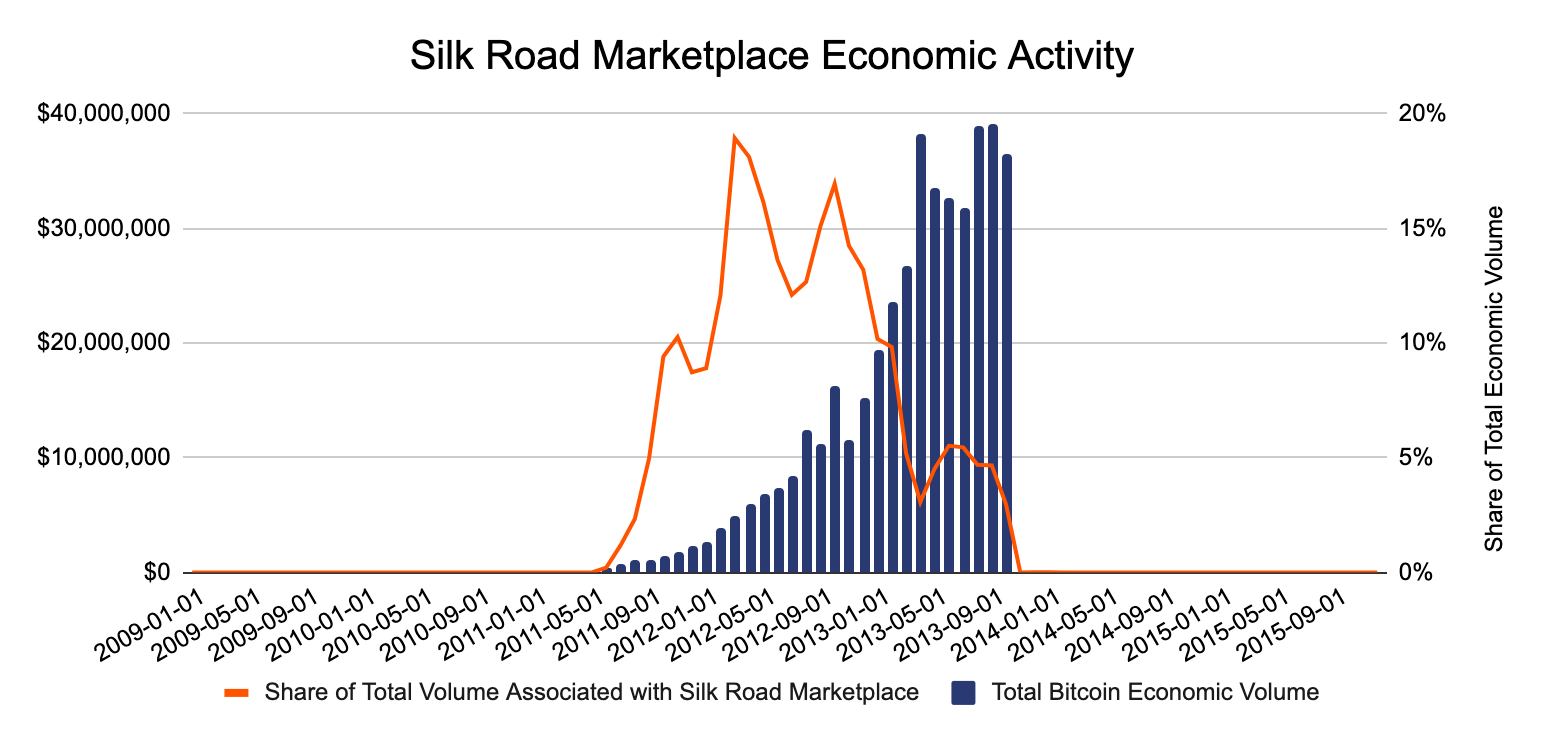

According to Chainalysis data, Silk Road accounted for nearly 20% of total Bitcoin economic activity at its peak in 2013. Silk Road’s economic activity reached $435 million total (calculated based on the price of Bitcoin at the time) with a peak of just under $40 million in monthly volume in September of 2013.

How Law Enforcement Identified and Seized the Funds

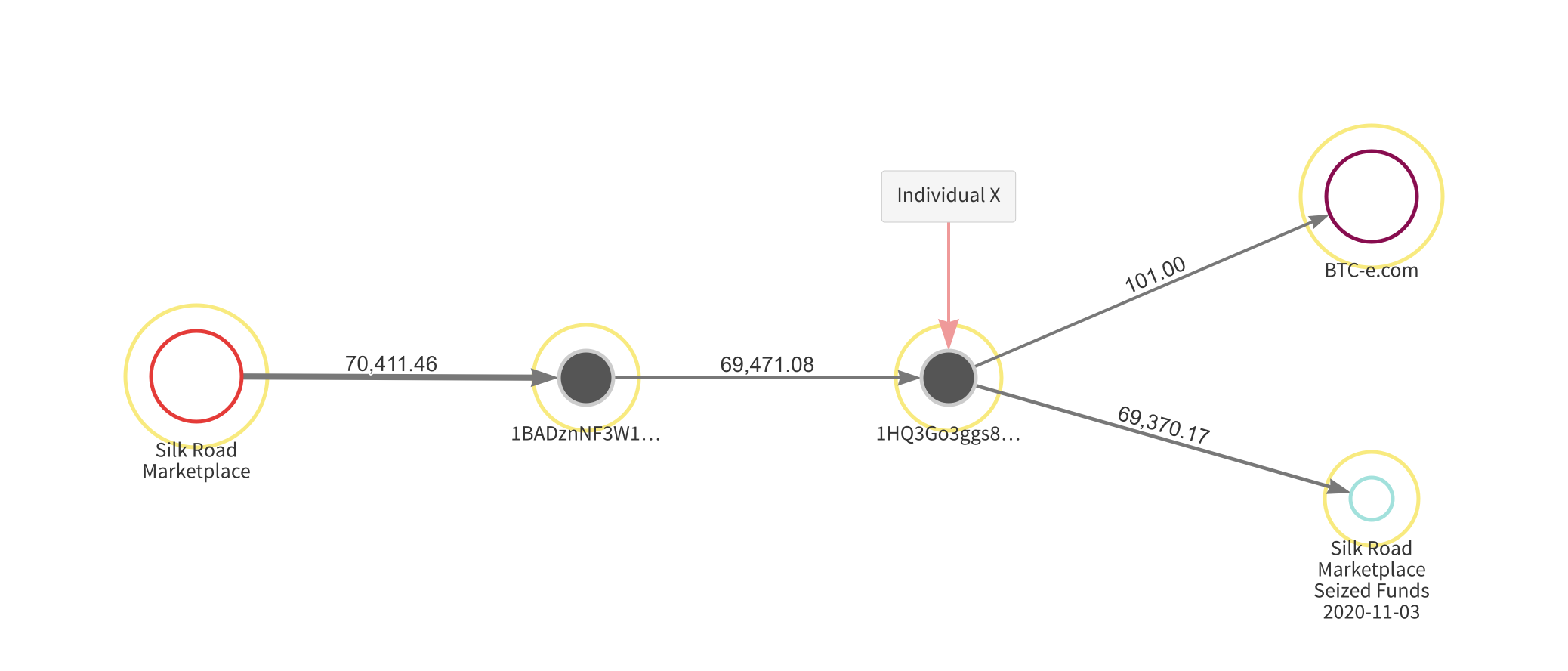

Earlier this year, IRS-CI agents used Chainalysis to analyze bitcoin transactions executed by Silk Road and identified 54 previously undetected bitcoin transactions representing the proceeds of unlawful activity. They also found that a hacker, known as Individual X, stole those funds from Silk Road.

In the Chainalysis Reactor graph below, we follow the money from Silk Road to another wallet (1BADzn…), to Individual X’s wallet (1HQ3Go…). In 2015, Individual X liquidated some of the stolen funds at BTC-e, a cryptocurrency exchange that was seized by US authorities in 2017 for money laundering. But the majority of the stolen funds were held in Individual X’s wallet as Bitcoin’s price climbed, until this week when they were seized and moved to the US government wallet. They are now worth over $1 billion.

This is yet another example of how investigators with the right tools can leverage the transparency of cryptocurrency to follow the flow of illicit funds. While this case is remarkable in the value of funds seized, it also shows that government agencies that invest in blockchain analysis can not only use that technology for proactive lead generation and case building, but also to locate and seize illicit proceeds. It also demonstrates that proceeds generated at any time can be seized years later using blockchain evidence.

Finally, it is also notable that the $1 billion seizure conducted this week was sent and confirmed within minutes. Unlike other cases involving fiat currency or personal property, where the government’s transfer of possession can take days or even months, cryptocurrency harnesses the power of technology to transfer funds in a matter of minutes.