On May 19, 2023, the U.S. Treasury’s Office of Foreign Assets Control (OFAC) sanctioned 22 individuals and 104 entities operating in 20 countries for their role in facilitating Russian sanctions evasion. Concurrently, OFAC has expanded its Russian sanctions program for future targeting of individuals and entities involved in key sectors of the Russian economy.

One of the individuals sanctioned today, an Irish national named John Desmond Hanafin, has an active Ethereum address included as an identifier on his SDN List entry. Hanafin is the founder and CEO of Huriya Private FZE LLE, a Dubai-based financial services company also sanctioned today for its role in funneling Russian funds into the UAE. We’ll look more at Hanafin and his crypto activity below.

John Hanafin and Huriya’s role in Russian sanctions evasion

John Hanafin is the founder and CEO of Huriya Private, a Dubai-based firm specializing in helping individuals and businesses relocate to and operate in foreign countries, and particularly the UAE.

According to OFAC’s press release, Hanafin in his role at Huriya has been working since the outset of the Russia-Ukraine War to help Russian nationals protect their assets from sanctions. Much of this activity has involved helping Russian nationals move their money into UAE bank accounts and obtain fraudulent passports.

John Hanafin’s on-chain transactions may shed light on Huriya’s Russian sanctions evasion operations

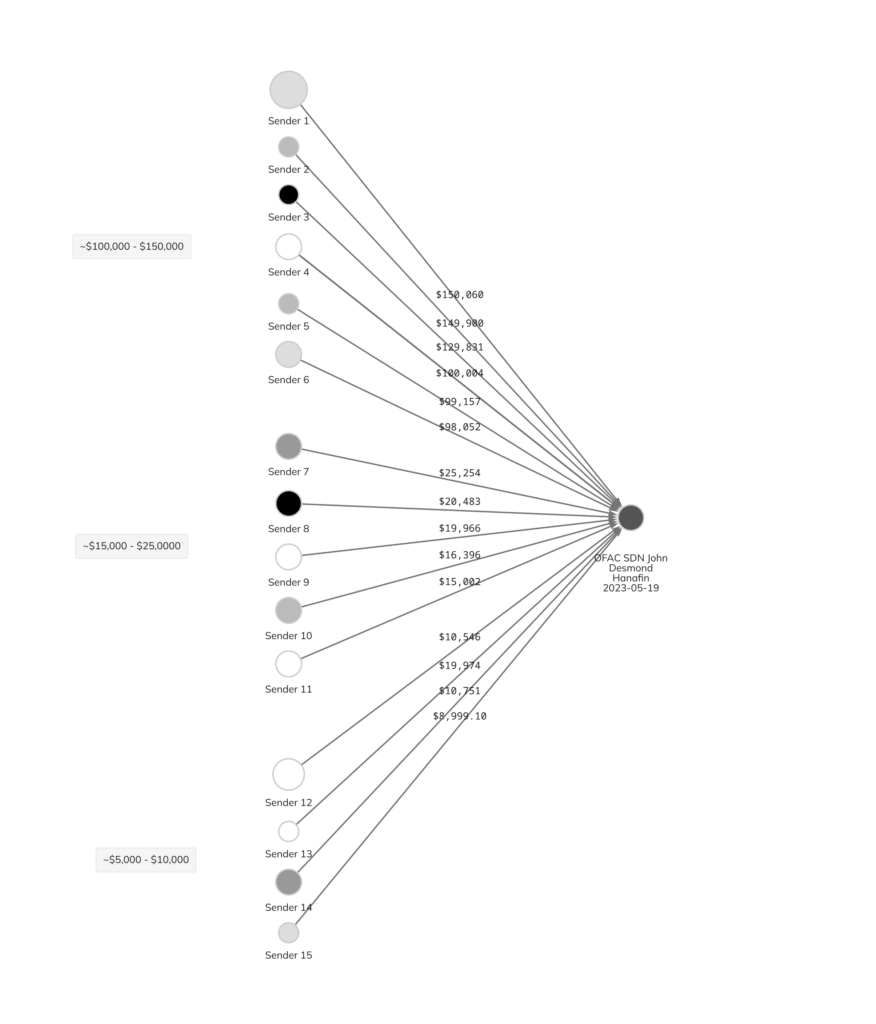

OFAC included a single Ethereum address as an identifier on Hanafin’s SDN list entry. That address is 0x38735f03b30FbC022DdD06ABED01F0Ca823C6a94. Since becoming active in January 2022, that address has received roughly $4.9 million worth of cryptocurrency, mostly in Tether (USDT).

One thing that stands out in analyzing Hanafin’s received transactions is the consistency with which transactions of certain sizes occur. Across the 75 USDT transactions received by Hanafin, we see several in amounts within the following ranges:

- $5,000 – $10,000

- $15,000 – $25,0000

- $100,000 – $150,000

We’ve included some examples of transactions within those ranges on the Chainalysis Reactor graph below.

Let’s keep those ranges in mind and examine some of the services offered by Huriya.

One notable Huriya service possibly related to the activity that resulted in its sanctions designation is citizenship by investment. Citizenship by investment is a legal process offered by some countries through which foreign nationals can become citizens of that country by making a qualifying investment — often a purchase of real estate located in the country or contribution to an economic development fund. Also known as “cash-for-passports,” these programs essentially allow people to purchase legal resident status in a new country. According to a blog post by another firm specializing in this area, several popular citizenship by investment destinations such as Dominica, St, Kitts & Nevis, Vanuatu, Grenada, and Saint Lucia require an investment between $100,000 and $150,000 — one of the high-frequency ranges for crypto transactions received by Hanfin. Coincidentally, Huriya offers citizenship by investment services for all five of those countries.

While we can’t be sure that any of the payments to Hanafin’s wallet reflect citizenship by investment purchasing, it certainly appears possible given this is a service Huriya offers, and Hanafin’s work acquiring false passports for Russian nationals as described by OFAC.

As for the high-frequency payments to Hanafin’s wallet that came in smaller amounts, it’s possible that those were related to lower-cost services Huriya offers, such as establishment of UAE bank accounts or corporate structuring.

Russian sanctions evasion: The crypto industry must stay vigilant

Today’s many sanctions designations show that the United States remains committed to ensuring Russian nationals close to the Putin regime are unable to interact with the world financial system. And the designation of Hanafin and Huriya in particular show that the agency is monitoring the intersection of Russian sanctions evasion and cryptocurrency. We commend OFAC for today’s sweeping designations, and have labeled Hanafin’s Ethereum address in all of our products.

While cryptocurrency may still play a role in Russian sanctions evasion, we hope that this blog shows why crypto is actually a poor tool for such nefarious activity. The transparency of blockchains means that blockchain analysis combined with open source data can open up valuable avenues for investigation. If the cryptocurrency industry does its part and bolsters compliance programs to block this activity, we can continue to reduce the abuse of crypto by sanctioned actors.

This material is for informational purposes only, and is not intended to provide legal, tax, financial, or investment advice. Recipients should consult their own advisors before making these types of decisions. Chainalysis has no responsibility or liability for any decision made or any other acts or omissions in connection with Recipient’s use of this material.

Chainalysis does not guarantee or warrant the accuracy, completeness, timeliness, suitability or validity of the information in this report and will not be responsible for any claim attributable to errors, omissions, or other inaccuracies of any part of such material.