On April 2, 2025, the United States Department of the Treasury’s Office of Foreign Assets Control (OFAC) sanctioned a network of financial and logistical facilitators tied to the Iran-backed Houthis, also known as Ansarallah. OFAC identified eight cryptocurrency wallets used to support the Houthis’ weapons, commodities procurement, and sanctions evasion efforts. The network, which includes Russia-based actors and shipping companies, has facilitated the movement of arms, stolen Ukrainian grain, and millions of dollars in illicit payments in support of the Houthis’ destabilizing activities in Yemen and the broader Red Sea region.

In this blog, we’ll look at how the Houthis operate, review the on-chain activity of the eight designated crypto addresses, and discuss what this means for the fight against terrorist financing.

A closer look at the Houthi-Russia weapons procurement and shipping nexus

Today’s sanctions target Russia-based Afghan nationals, Hushang and Sohrab Ghairat, who have facilitated commercial operations on behalf of the Houthis, and particularly Sa’id al-Jamal, who had cryptocurrency addresses included in his December 2024 sanctions designation. Acting under al-Jamal’s direction, the Ghairat brothers orchestrated shipments of arms and stolen Ukrainian grain, moving goods from Crimea to Yemen via the Russian-flagged vessel, Am Theseus (also known as Zafar).

The ship’s owner, Hong Kong-registered AM Asia M6 Ltd., and its two captains — Russian nationals Vyacheslav Vladimirovich Vidanov and Vladimirovich Belyakov — were also sanctioned. These actors played direct roles in the logistics enabling Houthi access to sensitive commodities.

Sohrab Ghairat also holds leadership positions in three Russian companies — LLC Sky Frame, LLC Edison, and LLC Kolibri Group — all of which OFAC designated for being under his control.

The Houthis’ on-chain activities

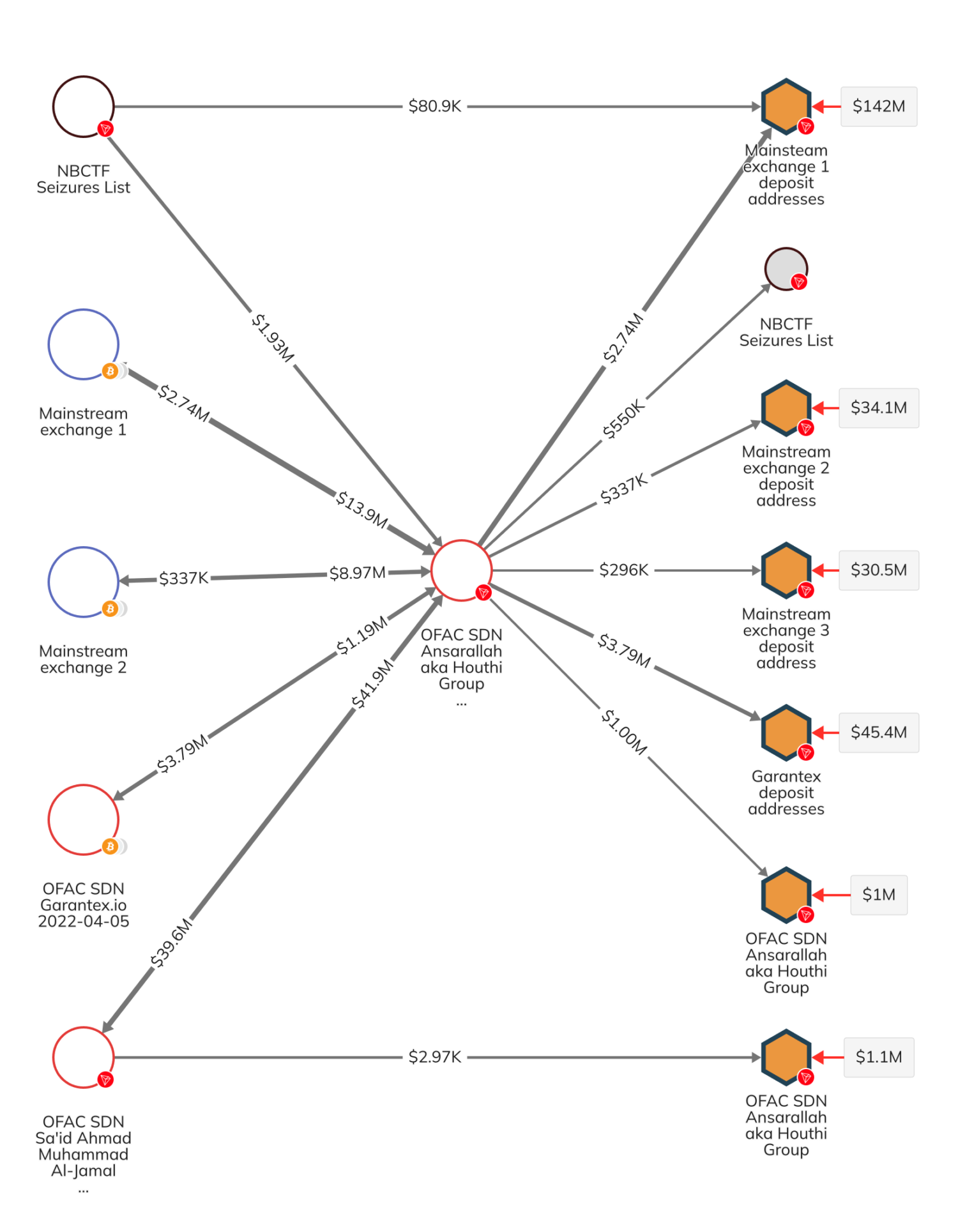

Included in today’s sanctions designations are eight crypto wallets controlled by the Houthis, including six private wallet addresses and two deposit addresses at mainstream services that have moved nearly $1 billion in illicit funds. The Houthi network’s on-chain activities are consistent with details included in OFAC’s designation, such as heavy movement of funds between the Houthi wallets and the wallets belonging to al-Jamal, as well as to Russian counterparts.

Further, the Houthis leveraged several deposit addresses at OFAC SDN Garantex that received more than $45 million in total, and processed nearly $2.5 million involving wallets designated by Israel’s National Bureau for Counter Terror Financing (NBCTF) — including addresses identified as being involved in facilitating activity on behalf of Hamas, therefore further highlighting Iranian proxy networks supporting both Hamas and the Houthis. In the Chainalysis Reactor graph below, we see that Houthi wallets also heavily leveraged several mainstream exchanges, with cash-out points at those services receiving more than $200 million in the aggregate.

Crypto’s role in terrorist financing under greater scrutiny

OFAC’s actions today are part of a wider United States strategy to cut off financial lifelines to the Houthis, which was a group designated in February 2024. While the Houthis have long relied on state sponsors like Iran, their growing ability to leverage commercial actors, cryptocurrency, and global shipping networks represents an evolving threat.

By targeting the financial infrastructure that enables missile attacks, drone strikes, and disruptions of regional security and international commerce in the Red Sea, OFAC is reinforcing that terrorist financing — whether facilitated by crypto or not — will face sustained pressure.

We will continue monitoring this network and provide updates when possible.

This website contains links to third-party sites that are not under the control of Chainalysis, Inc. or its affiliates (collectively “Chainalysis”). Access to such information does not imply association with, endorsement of, approval of, or recommendation by Chainalysis of the site or its operators, and Chainalysis is not responsible for the products, services, or other content hosted therein.

This material is for informational purposes only, and is not intended to provide legal, tax, financial, or investment advice. Recipients should consult their own advisors before making these types of decisions. Chainalysis has no responsibility or liability for any decision made or any other acts or omissions in connection with Recipient’s use of this material.

Chainalysis does not guarantee or warrant the accuracy, completeness, timeliness, suitability or validity of the information in this report and will not be responsible for any claim attributable to errors, omissions, or other inaccuracies of any part of such material.