Yesterday, the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) sanctioned twelve individuals and entities across various jurisdictions for arms trafficking, money laundering, and illicit shipping of Iranian oil on behalf of Houthi rebels. Further, OFAC updated the sanctions designation of Sa’id al-Jamal, a key Iran-based Houthi financier and Iran’s Islamic Revolutionary Guard Corps-Qods Force (IRGC-QF), to include five cryptocurrency addresses belonging to him.

Below, we’ll explore the background of the Houthis and Sa’id al-Jamal, examine large-scale crypto funds transfers by the designated wallet addresses, and analyze yesterday’s disruption in the context of some of the Houthis’ key commercial and military facilitation relationships.

Who are the Houthis and Sa’id al-Jamal?

The Houthis control Yemen’s capital Sanaa and its northwest, including the Red Sea coastline, where most of the country’s population lives. With close military, economic, and logistical ties to Iran, the Houthis are a core part of ‘the Axis of Resistance,’ the grouping of Iran-backed proxies in the Middle East that also includes militias in Iraq, the former Assad regime in Syria, Lebanese Hizballah, and Hamas. In protest of the ongoing war in Gaza, the Houthis have targeted international shipping and commerce in the Red Sea, a critical transit point, with missiles and drones.

Al-Jamal was initially designated on June 10, 2021 for his role in providing material support to the IRGC-QF and acting as a financial facilitator for the Houthis’ front companies and smuggling networks. According to the designation, al-Jamal directs a network of front companies and vessels that evades sanctions on Iranian commodities by selling them throughout the Middle East, Africa, and Asia. Revenue from al-Jamal’s network, which had generated in the tens of millions of dollars as of mid-2021, is directed through a complex international network of intermediaries and exchange houses to the Houthis in Yemen and helps fund the Houthis, IRGC-QF, and Hizballah.

Large-scale fund transfers using crypto

The IRGC, Iran’s primary security force which also plays an outsized role in the country’s politics and economy, has a well-documented history of exploiting various financial channels to fund its activities and support proxy groups. Today’s designation update on al-Jamal shines light on how some of this activity occurs through the use of cryptocurrency.

Analyzing the five wallets included in today’s updated designation reveals:

- Al-Jamal received over $178 million in funds within the course of about a year.

- The average USDT transfer amount is approximately $638,000, when omitting transfers less than $1.

- Over 200 of the 1700 transfers were for amounts greater than $500,000, 121 of the transfers were for amounts greater than $1 million, and the largest single transfer was an outbound transfer of $6.8 million on October 7, 2024.

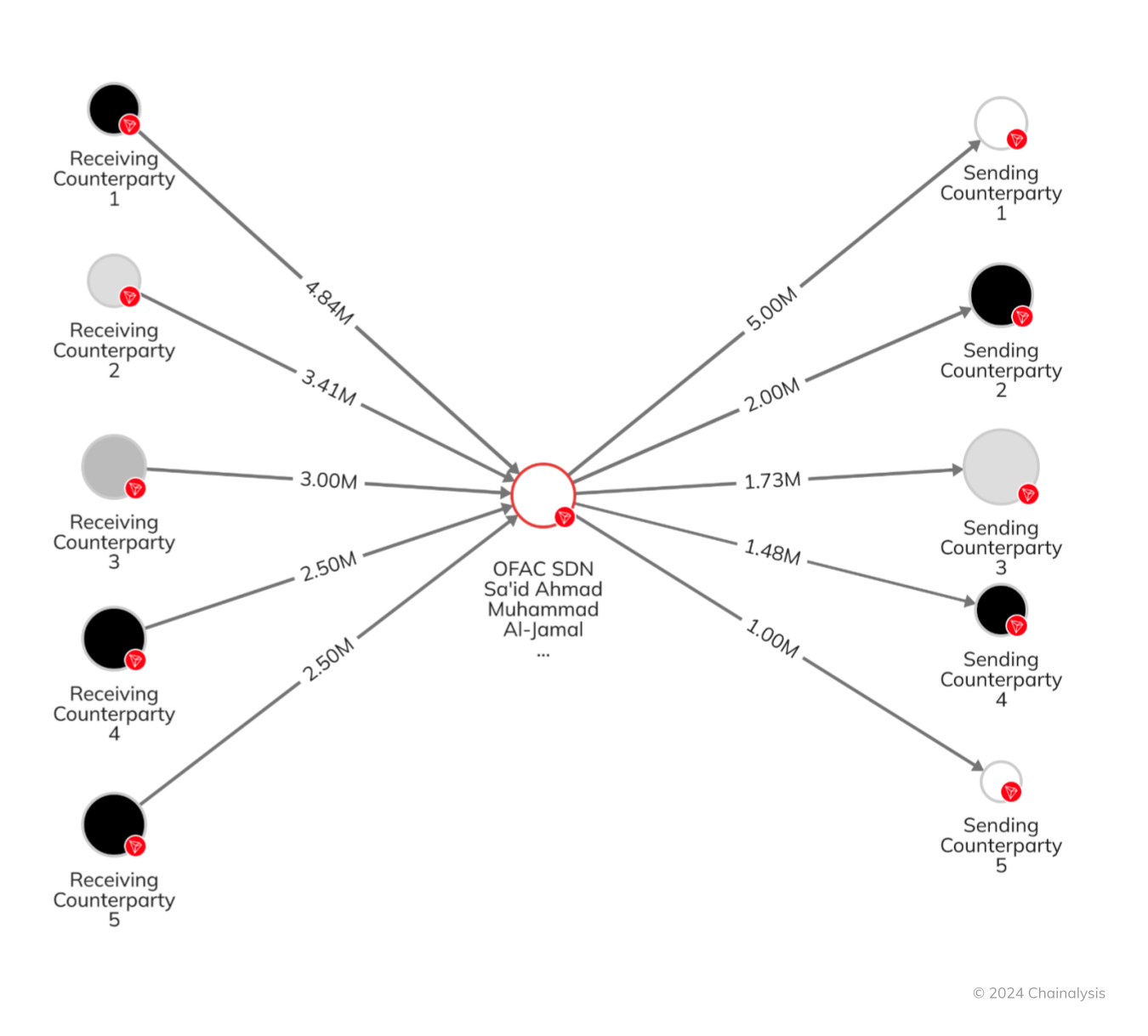

While cryptocurrency’s borderless and instantaneous features may make it appealing for moving large amounts of value, it also provides unprecedented transparency into al-Jamal’s financial network and the Houthis’ illicit financial activity. As al-Jamal used front companies in traditional finance to launder money, he appears to have used similar techniques on-chain. Chainalysis data show that al-Jamal’s addresses have little direct exposure to mainstream services, and instead appear to move and launder funds through more informal networks. In the following Chainalysis Reactor graph, we see a sample of high value transfers with unnamed counterparties.

Contextualizing the disruption

The Treasury’s action against al-Jamal highlights another disruption in the use of cryptocurrency by IRGC-affiliated actors. This is not the first time we’ve seen Iranian proxies’ usage of cryptocurrency disrupted, as $1.7M was seized from a joint Hizballah-IRGC infrastructure in June 2023 by Israeli authorities. Today’s action illustrates OFAC’s continued efforts to combat crypto-related activities related to Iran and its proxies across the region.

The Houthis’ commercial and logistical ties to China and Russia also speak to the group’s international reach and strategic depth beyond its ties to Iran. Of note, yesterday’s designation also singled out the existence of China-based Houthi operatives and shipping firms used to procure dual-use items and weapons with offices in both Yemen and China. In addition to the Houthis’ close ties to Iran, earlier this year the Houthis reached an agreement with Chinese and Russian officials in which the Houthis would reportedly abstain from targeting maritime assets belonging to the two countries in the Red Sea in exchange for diplomatic support. More recently, a Houthi-linked company has facilitated the travel of Yemeni mercenaries to fight on the front lines in Ukraine, and Western officials have confirmed Russia is pursuing contact with the Houthis and weapons transfers to the group.

Following the decimation of Hizballah leadership earlier this year and the recent collapse of the Assad regime in Syria, the strength of the Axis of Resistance has been called into question. We will continue to monitor the role played by Houthi financial facilitation networks, especially those with a crypto nexus or sanctions evasion element, in the region and beyond.