Salman Banaei is Chainalysis’ Head of Public Policy for North America

On February 4, the U.S. Department of the Treasury published a report on the facilitation of money laundering and the financing of terrorism through the trade in works of high-value art. As a part of this broader Report, Treasury directly acknowledges the risk that NFTs can be used to launder funds, and states that NFT platforms “may be considered virtual asset service providers (VASPs) by FATF and may come under FinCEN’s regulations.” In this blog, I’ll discuss what this might mean for NFT platforms, and how they can leverage the inherent transparency of blockchains to their advantage.

But first, let me provide a bit of context. The Financial Action Task Force (FATF) is the intergovernmental policy-making body that provides regulatory guidance on and sets international standards for anti-money laundering and combatting the financing of terrorism (AML/CFT). In all of its guidance related to cryptocurrencies, FATF uses the terms virtual assets (VAs) and virtual asset service providers (VASPs) to define which assets and businesses should be covered by the standards they set out.

In October, FATF released its updated guidance (FATF Guidance) for how member jurisdictions should regulate cryptocurrency businesses. The FATF Guidance clarified that, by default, NFTs are not considered VAs based on their general use as “collectibles.” However, FATF encourages jurisdictions to evaluate NFTs on a case-by-case basis and regulate them as VAs when their use conforms to the VA definition. Specifically, FATF says, “Some NFTs that on their face do not appear to constitute VAs may fall under the VA definition if they are to be used for payment or investment purposes in practice.”

Treasury’s new report reiterates FATF’s key message for NFT markets: focus on how NFTs are used functionally, rather than the underlying technology or the NFT label, to determine the applicability of relevant regulatory requirements.

When might NFT platforms come under AML/CFT requirements?

The Report suggests the Bank Secrecy Act (BSA) may apply to certain NFT platforms that offer NFTs that could be seen to have an investment or payment purpose, in line with October FATF Guidance. While Treasury could provide clarity here with rulemaking (something suggested by the FATF Guidance), that doesn’t currently appear to be a part of their public regulatory agenda. The report makes two key observations about NFTs:

- The Report notes that the velocity of NFT markets may make it impractical to conduct customer due diligence. Because NFT platforms often derive revenues from transaction volumes, they may err on the side of speed as opposed to due diligence. This “incentive to transact can potentially be higher than the incentive to verify the identity of the buyer of the work, or even can create a situation where it is not possible to conduct due diligence if transactions are conducted in rapid succession.”

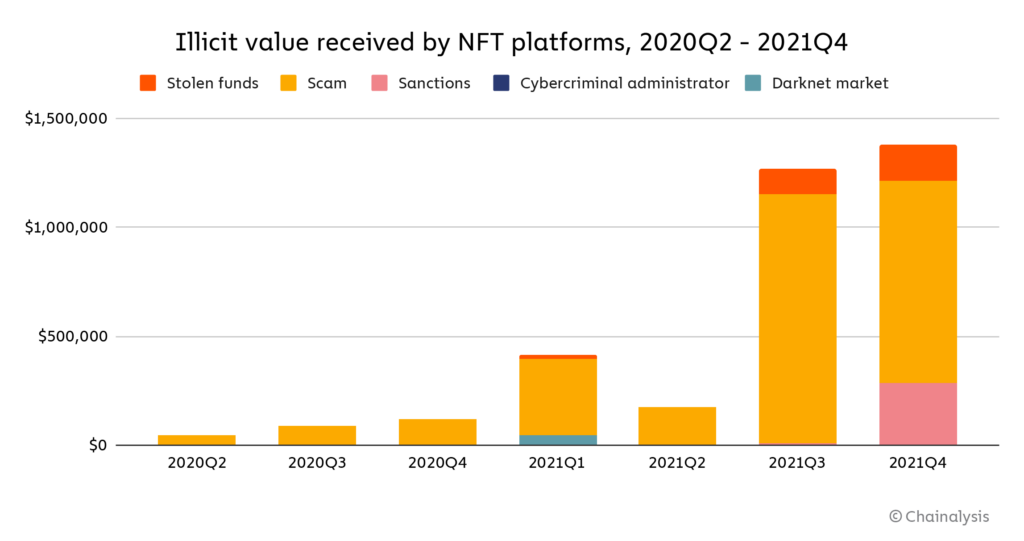

- The Report also suggests risks of buying and selling NFTs to facilitate money laundering, including “wash trading.”. “NFTs can be used to conduct self-laundering, where criminals may purchase an NFT with illicit funds and proceed to transact with themselves to create records of sales on the blockchain. The NFT could then be sold to an unwitting individual who would compensate the criminal with clean funds not tied to a prior crime.” This observation has been corroborated by Chainalysis’ recent analysis on the extent of wash trading in NFT markets. Quoting: “Value sent to NFT marketplaces by illicit addresses jumped significantly in the third quarter of 2021, crossing $1 million worth of cryptocurrency. The figure grew again in the fourth quarter, topping out at just under $1.4 million. In both quarters, the vast majority of this activity came from scam-associated addresses sending funds to NFT marketplaces to make purchases. Both quarters also saw significant amounts of stolen funds sent to marketplaces as well. Perhaps most concerningly, in the fourth quarter, we saw roughly $284,000 worth of cryptocurrency sent to NFT marketplaces from addresses with sanctions risk.”

The Report suggests that in the future (1) FinCEN could use recordkeeping and reporting requirements and (2) to bring certain art market participants, including NFT platforms and market participants, under the AML/CFT legal framework and obligating them to create and maintain AML/CFT programs

What steps should NFT platforms take?

NFT platforms should understand money laundering risks in order to take a risk-based approach. Risk factors suggested by the Report include, most importantly, whether the NFT platform (1) at least some of the volumes appear to be driven by investment or payment incentives and (2) transactions made through the platform have a reasonable risk of creating money laundering concerns, e.g., there is wash trading and some of the addresses are linked to illicit actors, then this would suggest a relatively high risk. NFT platforms that have a significant risk profile should also consider whether they derive their revenues from transaction volumes as that would appear to give rise to additional concern by FinCEN according to the Report.

Chainalysis is eager to help NFT platforms explore the benefits of transaction monitoring software like Chainalysis Know Your Transaction (KYT) as they think through options for compliance with evolving BSA requirements.

This material is for informational purposes only, and is not intended to provide legal, tax, financial, or investment advice. Recipients should consult their own advisors before making investment decisions. Chainalysis has no responsibility or liability for any decision made or any other acts or omissions in connection with Recipient’s use of this material.

Chainalysis does not guarantee or warrant the accuracy, completeness, timeliness, suitability or validity of the information in this report and will not be responsible for any claim attributable to errors, omissions, or other inaccuracies of any part of such material.