This blog is a preview of our Money Laundering and Cryptocurrency Report. We’re excited to debut first-of-its-kind research that dives deep into the complexities of money laundering in the crypto ecoystem. Building on the analyses we publish in our annual Crypto Crime Report, this comprehensive report not only shows how to trace known illicit funds on the blockchain but also introduces advanced data techniques to identify potential money laundering activities for lead generation. It also explores global anti-money laundering policy (AML/CFT) and strategies for both crypto-native and non-crypto-native scenarios. Discover how blockchain intelligence and data-driven insights are the cornerstone of crypto investigations and how technology is empowering institutions in the fight against money laundering and other financial crimes.

While public blockchains are inherently transparent and traceable, illicit actors turn to cryptocurrencies to launder ill-gotten gains for the same reasons people use them for legitimate purposes: they are cross-border, virtually instant, and generally inexpensive to transact. Money laundering in the crypto context is typically associated with cybercriminals attempting to conceal the flow of funds related to on-chain crimes, such as darknet market and ransomware operations. However, cryptocurrency is increasingly being used to launder funds from a broader range of illicit activities beyond the conventional understanding of crypto crime. The growing ubiquity of crypto has made it a tool for laundering proceeds from various off-chain crimes, such as narcotics trafficking and fraud. In 2024, money laundering in crypto encompasses all crime — not just that which is inherently tied to the crypto ecosystem.

This shift carries significant implications for investigators. First, expertise in cryptocurrency must extend beyond specialized cybercrime units to include law enforcement agencies of all kinds. Cryptocurrency is now one of the payment methods used by illicit actors worldwide, and therefore this expertise must encompass both blockchain transaction tracing and a comprehensive understanding of traditional money laundering tactics. Second, there is a silver lining: with the right data and tools, investigators in the public and private sectors can leverage the transparency of blockchain to uncover illicit activity that may otherwise go undetected. Blockchain analysis can generate both intelligence signals for proactive lead generation and more concrete evidence of illicit flows in existing investigations, helping a broad range of analysts and investigators unravel increasingly sophisticated money laundering networks.

What is money laundering?

Money laundering is the process of concealing the origins of money obtained from illegal activities so that the funds can be used without drawing attention to their illicit source. This typically involves making large sums of money generated by criminal activities, such as drug trafficking or terrorist financing, appear legitimate.

The process of money laundering generally consists of three stages: placement, layering, and integration. Placement is the initial stage in which illicit money is introduced into the financial system. Layering involves moving the money through a series of financial transactions to obscure its origin. Finally, integration is the process of re-entering the money into the legitimate economy, making it appear as though it has come from a legitimate source.

Chainalysis has published money laundering analyses in our annual Crypto Crime Reports for several years, dissecting the flow of funds from known illicit wallets during the placement stage, to conversion services which represent the layering stage of laundering. Known illicit wallets hold funds connected to confirmed crypto-native criminal activity like exchange heists, crypto scams, and darknet market proceeds. Conversion services swap cryptocurrencies for fiat, other types of crypto, or provide some other service. Examples of conversion services include centralized exchanges, DeFi services, gambling sites, mixers, and bridges. Because this activity occurs entirely on-chain, we refer to it as crypto-native money laundering. This type of money laundering can be traced and analyzed with a higher degree of accuracy and speed compared to traditional financial systems thanks to the inherent transparency of blockchain.

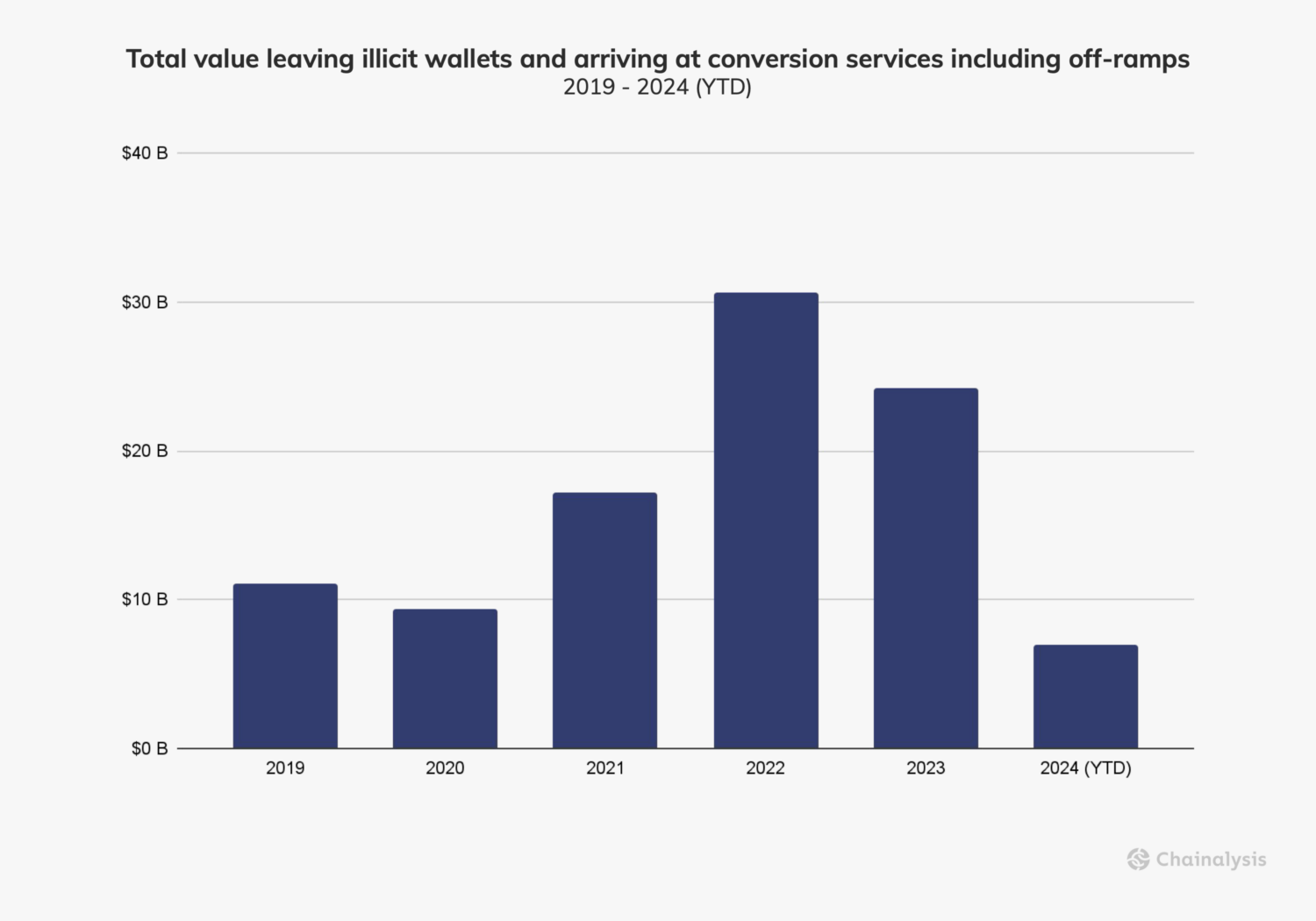

As shown below, since 2019, nearly $100 billion in funds have been sent from known illicit wallets to conversion services. The highest amount recorded was in 2022, with $30 billion identified, largely attributable to transactions involving sanctioned services such as the Russian exchange Garantex.

These amounts represent the dollar value of the assets at the time they leave wallets associated with illicit actors. These estimates only include the totals moved from illicit sources to crypto services, and do not include the value sent and received among intermediaries – a process described below – which can include tens or hundreds of individual transactions. This estimate also does not include transactions where cryptocurrency is used to launder funds, but the source of the illicit activity is unidentified or off-chain. For example, consider a drug cartel selling narcotics and paying a distributor using cryptocurrency. If this transaction flows directly between two known exchanges, it would be indistinguishable on-chain from legitimate service-to-service transfers without specific lead information. However, investigators can still follow these funds using a combination of off-chain intelligence and on-chain analysis, and compliance teams can flag unusual transactions outside of their customers’ business profiles.

In this report, we aim to broaden our analysis of money laundering to encompass not only crypto-native money laundering, but also suspicious transaction patterns that may indicate money laundering activities tied to off-chain crime that would require deeper investigation to confirm.

This material is not intended to provide legal, tax, financial, investment, regulatory or other professional advice, nor is it to be relied upon as a professional opinion. Recipients should consult their own advisors before making these types of decisions. Chainalysis does not guarantee or warrant the accuracy, completeness, timeliness, suitability or validity of the information herein, and assumes no obligation to update any forward-looking statements to reflect any circumstances that may arise after the date such statements are made. Chainalysis has no responsibility or liability for any decision made or any other acts or omissions in connection with Recipient’s use of this material.