This post is an excerpt from our 2023 Geography of Cryptocurrency Report. Download your copy now!

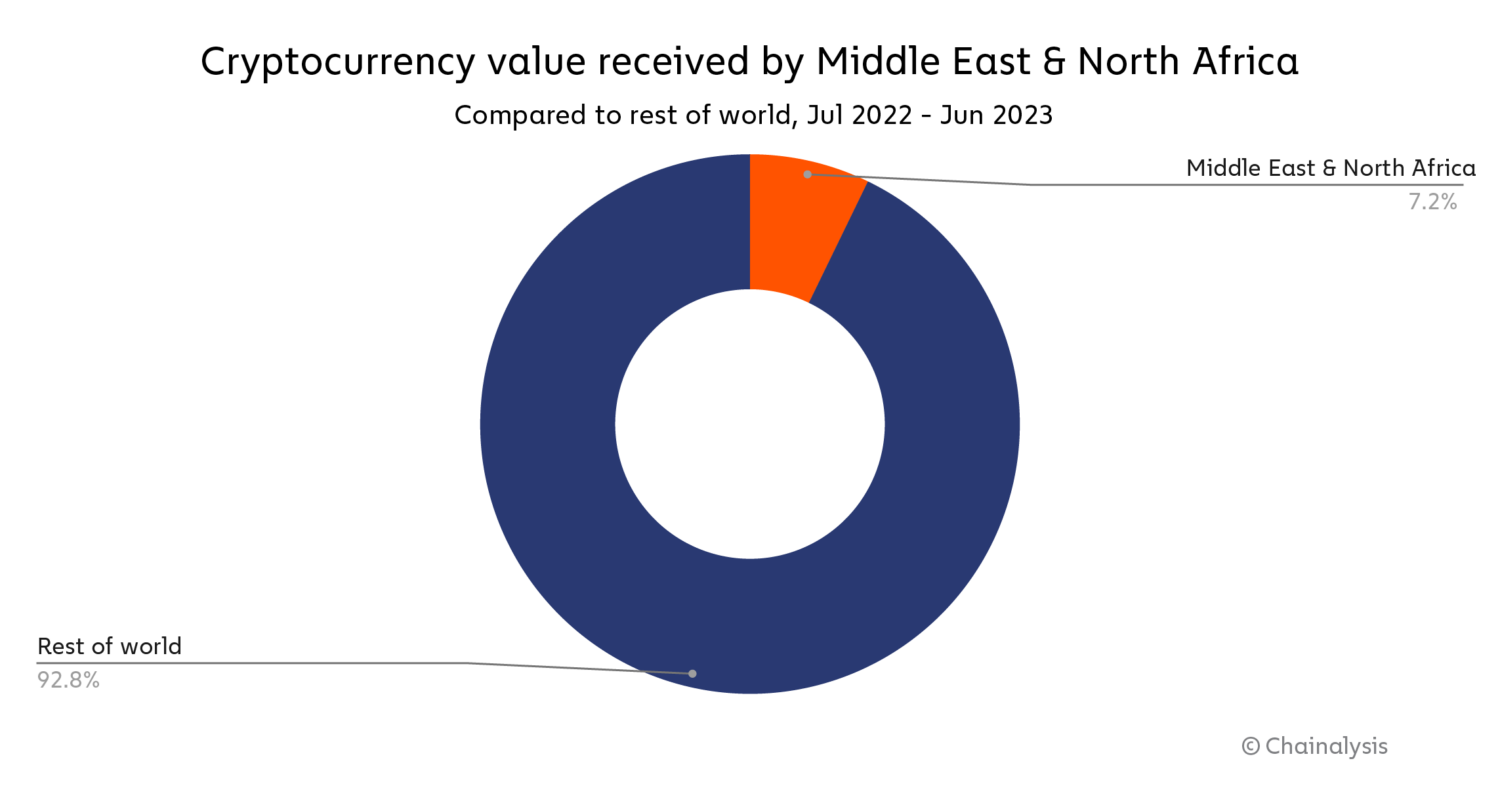

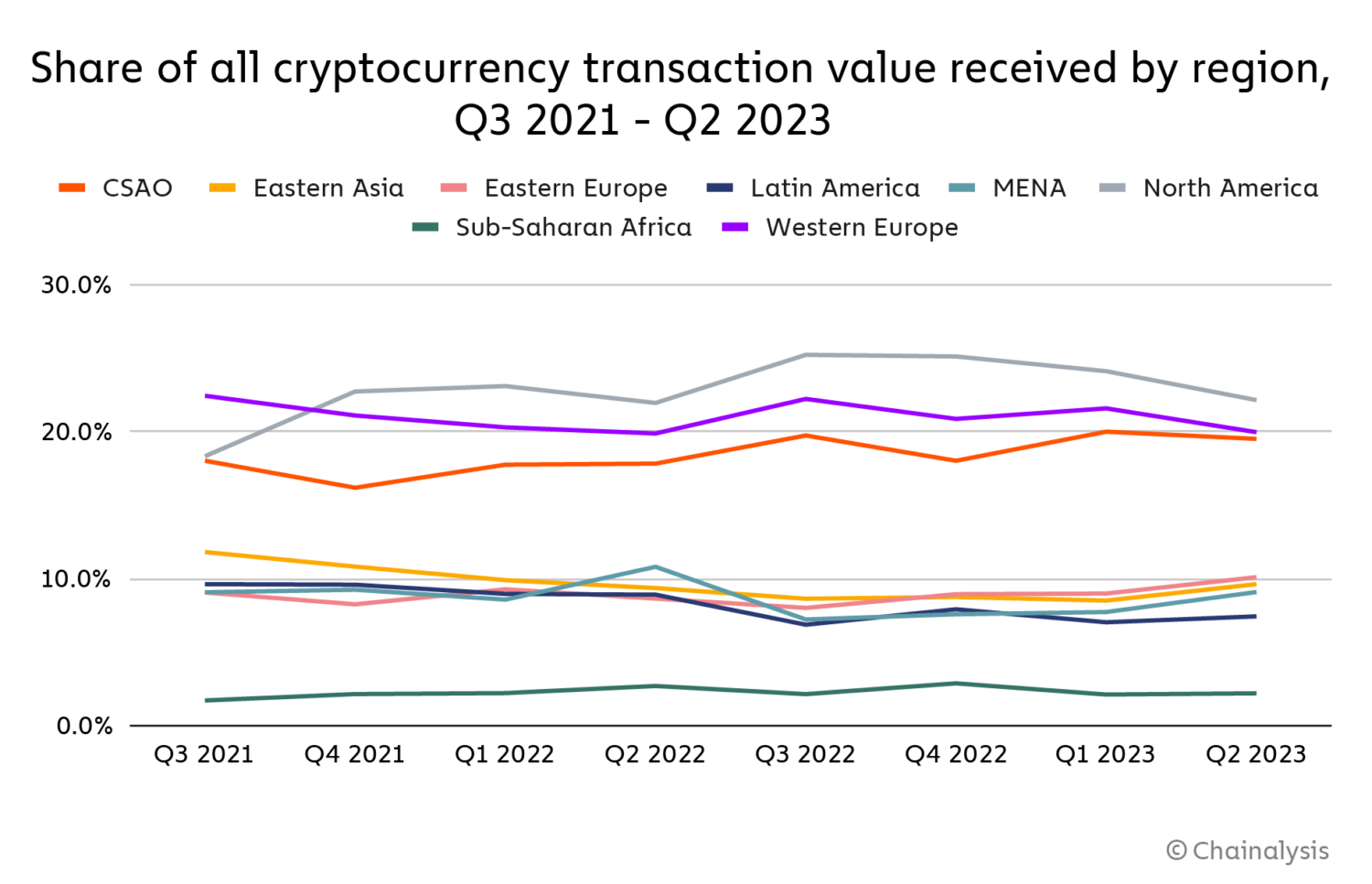

The Middle East & North Africa (MENA) has the sixth largest crypto economy of any region we study this year, with an estimated $389.8 billion in on-chain value received between July 2022 and June 2023. This represents nearly 7.2% of global transaction volume during the period studied.

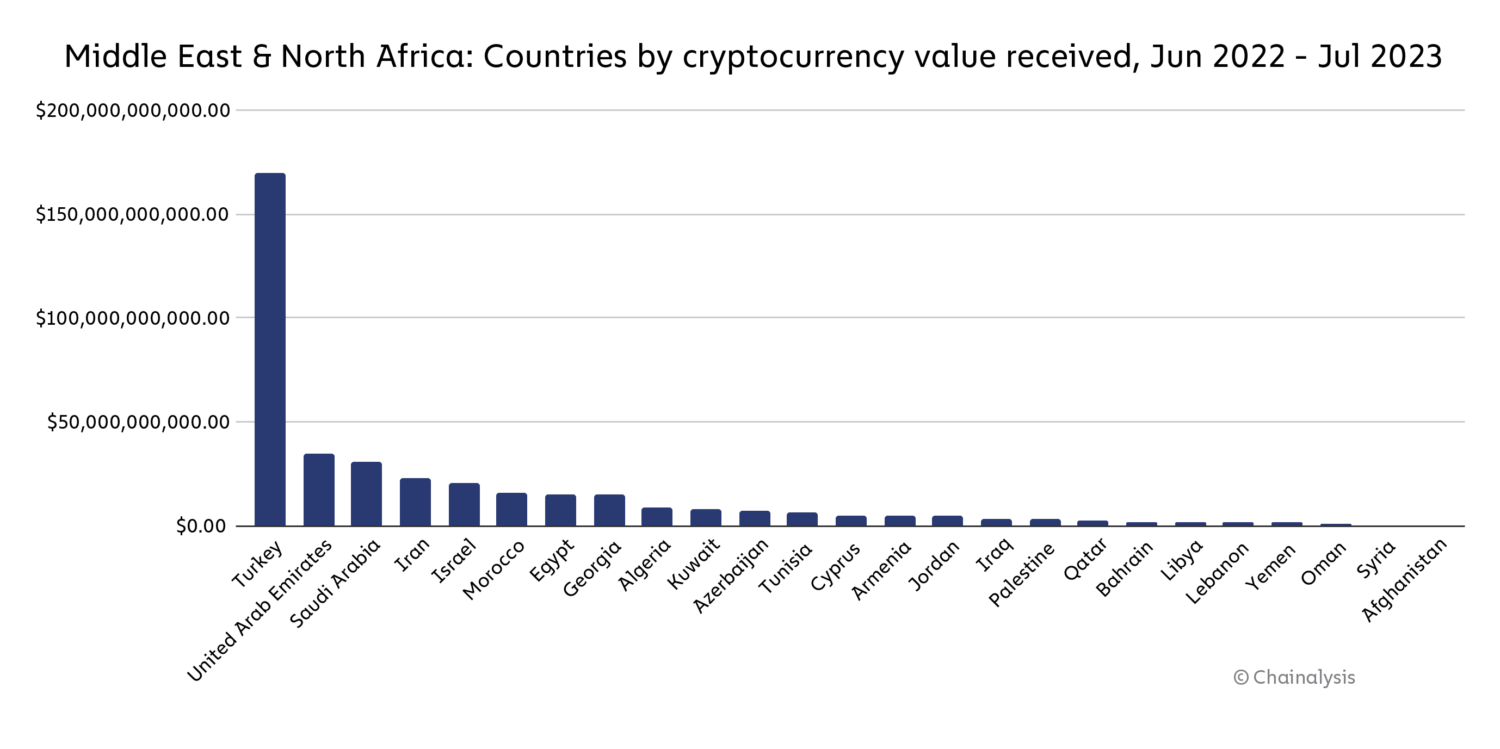

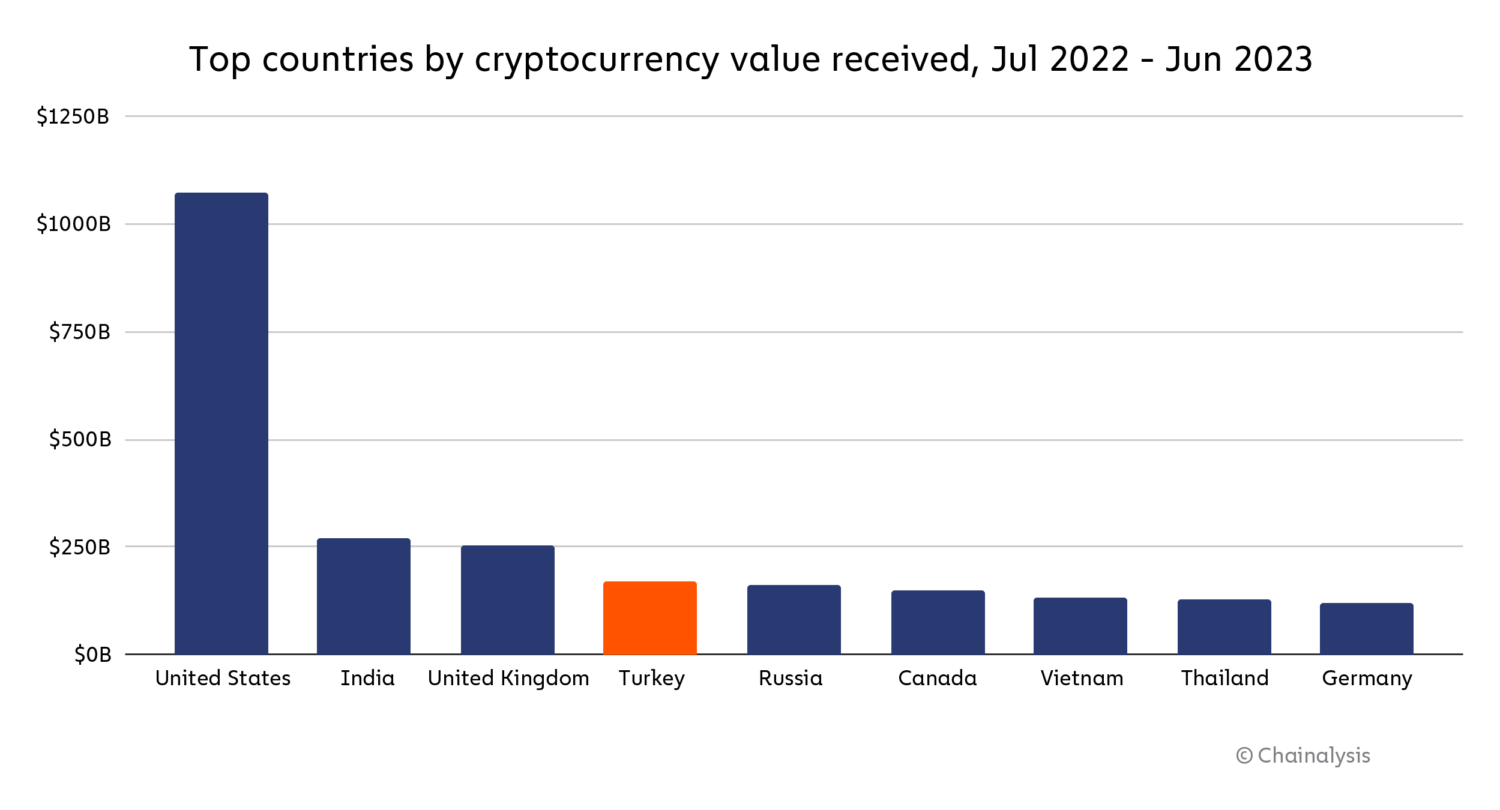

MENA is also home to three of the top 30 countries in this year’s index: Turkey (12), Morocco (20), and Iran (28). However, Turkey dominates in terms of raw transaction volume, as we see below.

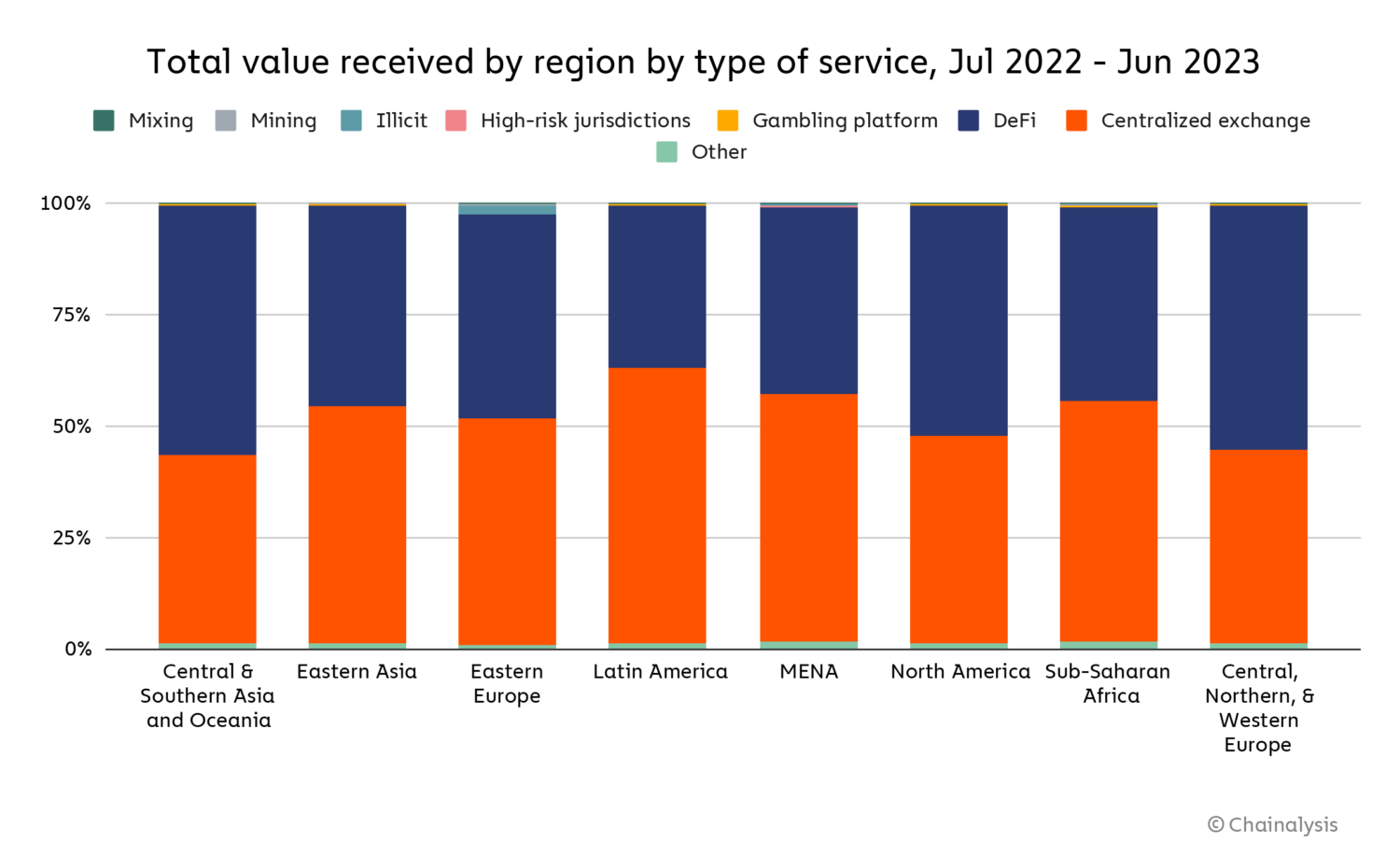

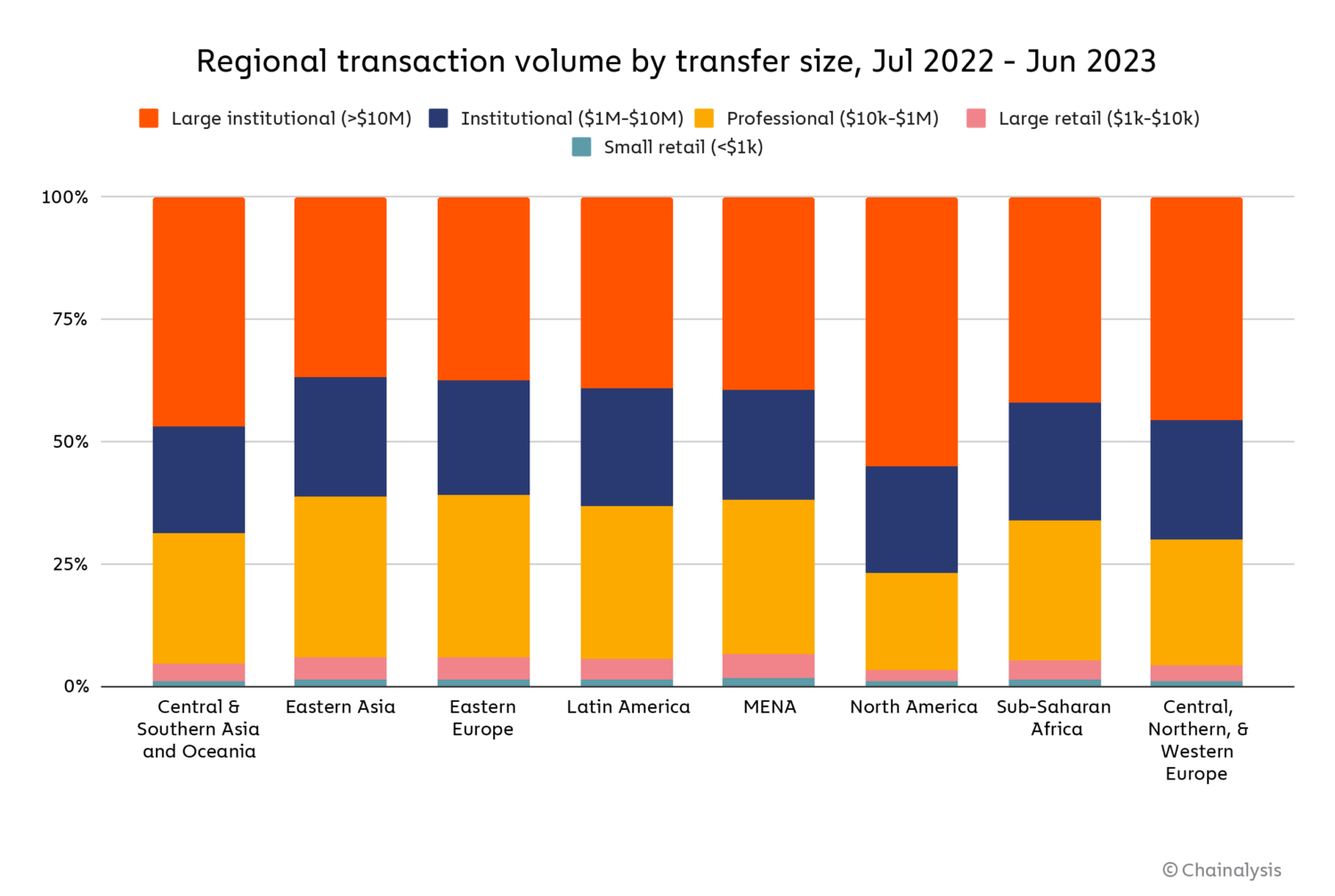

Overall, MENA transaction volumes are similar to other regions in terms of breakdown by transaction size and platform type.

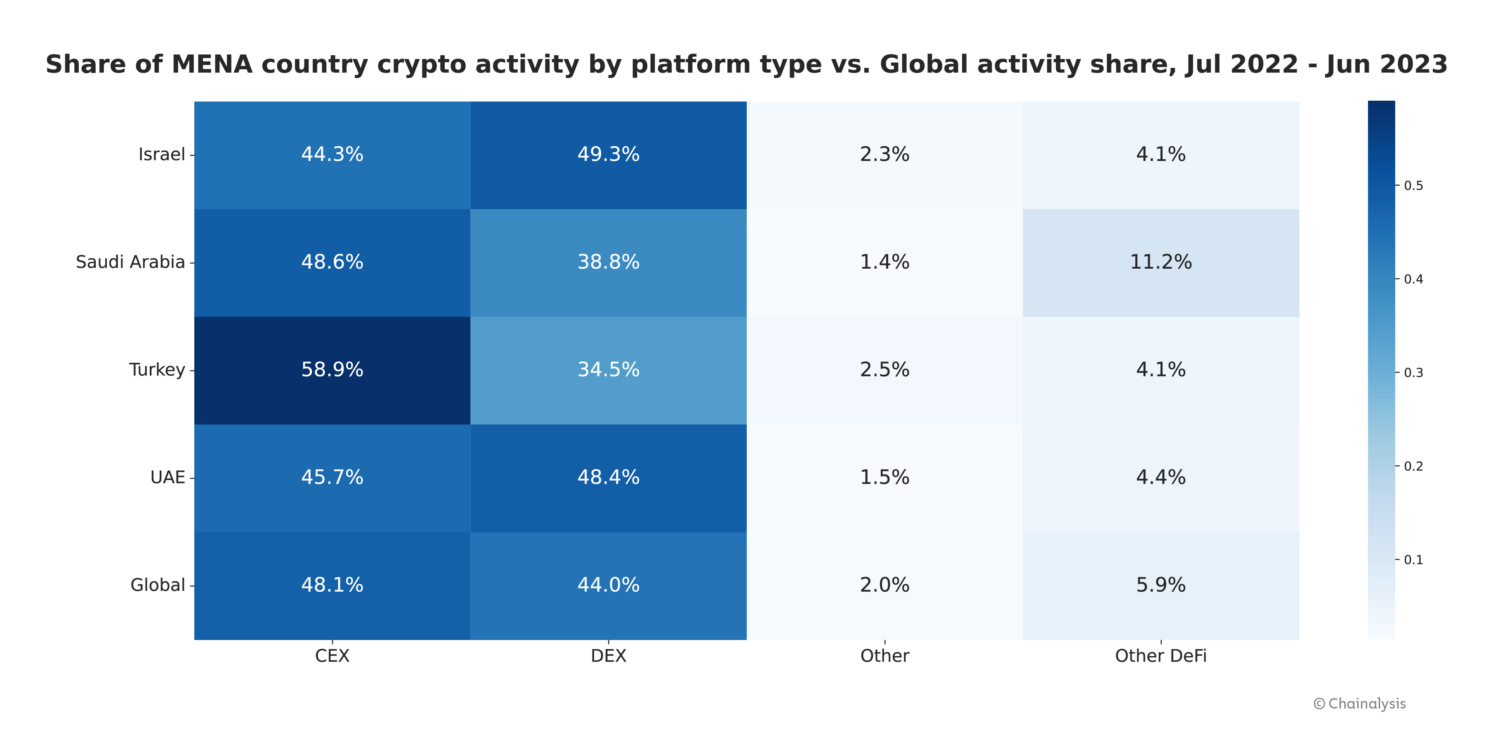

However, we see significant differences between countries within the region. Check out the heat map below, which compares some of MENA’s top crypto economies’ activity by platform type over the last year.

The biggest standout is the UAE, which sees a much higher share of crypto activity taking place on DeFi protocols compared to its regional neighbors, apart from Israel. One reason for this may be that the UAE has turned itself into a world crypto hub by passing innovation-friendly regulatory frameworks that allow groundbreaking crypto platforms to develop with oversight that keeps consumers safe. Those regulatory frameworks have attracted many crypto entrepreneurs and enthusiasts to the region, which may be why DeFi — which represents the cutting edge of blockchain technology in many ways — sees more usage there. Turkey, on the other hand, puts more of its activity into centralized exchanges, as its users appear more focused on acquiring crypto to counteract currency devaluation. We’ll explore those trends and more below.

The United Arab Emirates (UAE): How forward-looking regulators are shaping a global crypto hub

The UAE has a history of attracting top financiers, young tech entrepreneurs, and innovative companies from across the globe due to its uniquely innovation-friendly regulatory focus. The UAE is also ahead of the curve when it comes to adopting advanced technologies to help make businesses more efficient and improve quality of life for its citizens. The same holds true for blockchain technology.

UAE regulators were early to cryptocurrency, with Dubai, the country’s most populous city, first launching a blockchain strategy in 2016. Since then, UAE regulators have remained at the forefront of the industry. In 2018, the Abu Dhabi Global Market (ADGM) established the world’s first regulatory framework for cryptocurrency, with the goal of establishing forward-looking regulatory frameworks for crypto that foster innovation while protecting consumers, and ensuring the UAE is positioned as a leader in the digital economy. Dubai established its own Virtual Asset Regulatory Authority (VARA) in 2022, which works towards similar goals. The UAE passed further crypto regulations at the federal level earlier this year, which allows local regulators like VARA flexibility in how they regulate and maintains economic free zones to attract crypto innovation.

We spoke with Akos Erzse to learn more about how regulators like VARA are fostering a dynamic environment for crypto businesses to operate in the UAE. Erzse is Senior Manager for Public Policy at BitOasis, a popular cryptocurrency trading platform headquartered in Dubai. He praised a comprehensive regulatory framework VARA released in February 2023. “VARA has brought new momentum for forward-looking regulatory clarity in the region, which has attracted a high number of crypto players to the UAE,” said Erzse. According to him, what sets VARA’s framework apart from others around the world is the specificity with which it approaches different kinds of virtual asset services and activities. “There are distinct rulebooks for staking, broker-dealers, advisory services, custodians — this makes it easier for businesses to understand what the specific regulatory requirements are for providing certain services.” VARA has worked to ensure the rules are responsive to industry needs — Erzse cites as an example a recent amendment VARA made to its custody rulebook, which now allows custodians to stake assets from custody. “This responsiveness allows us and businesses like ours to innovate at pace.”

Erzse says the UAE’s unique and dynamically-evolving frameworks are especially important at a time when regulatory momentum has picked up in other parts of the world. “There’s an ongoing regulatory competition between markets that are looking to establish themselves as crypto hubs, and smaller markets are moving quickly.” The UAE’s regulatory approach has allowed it to attract global businesses and crypto entrepreneurs, and along with them high-net-worth individuals looking to invest in virtual assets through regulated platforms.

Asked about what the future could hold for cryptocurrency in the UAE, Erzse expressed excitement about innovative new crypto business models such as asset tokenization. TOKO, a crypto platform focused on tokenization, has recently acquired a license from VARA to provide such services from the Emirate.

He also cited remittances as an important use case for crypto to address in the UAE and the broader region. “We’re a remittance hub, and people are definitely already using crypto to send money home, but it will be exciting to see which dedicated products emerge, leveraging the regulatory frameworks available.” Indeed, the fact that India, the Philippines, and Pakistan were all ranked among the top 10 in our Adoption Index also bodes well for the UAE. These nationalities represent a significant portion of the UAE’s expat population, and the surging popularity among people in these nations is likely to correlate with increased crypto adoption in the UAE as well. Sure enough, VARA has a rulebook available that addresses the use case.

Rising inflation in Turkey fuels crypto adoption

In addition to ranking 12th on our Global Crypto Adoption Index, Turkey is also fourth worldwide in raw crypto transaction volume, receiving approximately $170 billion over the last year. That puts it behind only the United States, India, and the United Kingdom.

Yasin Oral, CEO and founder of Turkish cryptocurrency exchange Paribu, noted that Turkey’s relatively high level of crypto adoption is not entirely surprising for several reasons, such as the country’s recent macroeconomic climate and its young population’s interest in innovation and technology. He explained, “A difficult year was left behind globally with the impact of tightening monetary policies, which also affected Turkey. Under such conditions, individuals tend to seek alternatives, like cryptocurrencies, to store value, diversify their investment portfolios, and engage with new asset classes. In relation to this behavior, as each market cycle attracts new investors and adopters, more individuals and entities learn about the promises and benefits of blockchain, which ultimately results in an increasing level of crypto adoption.”

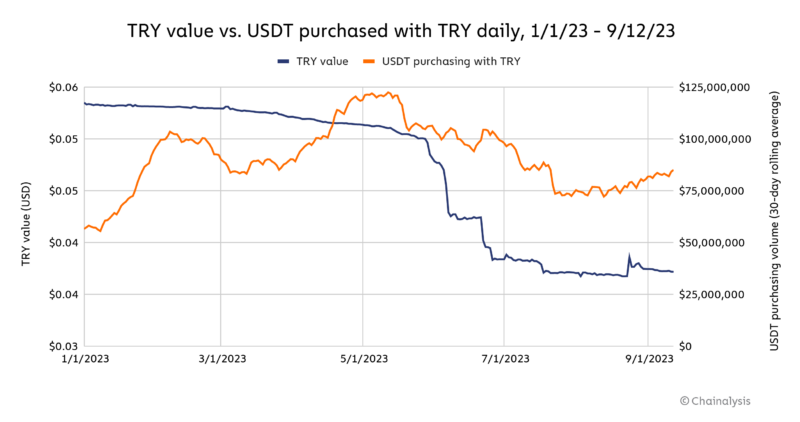

Indeed, Turkey has been facing rising inflation, which reached nearly 60% in August 2023. Additionally, the Turkish Lira crashed in 2021 after the central bank cut interest rates by 100 basis points. Since then, the Lira hasn’t recovered — in fact, it reached record lows in mid-2023. We can see evidence of Turkish currency devaluation driving interest in crypto on the chart below, which shows the value of the Turkish lira versus USDT purchasing volume in Turkish lira across several exchanges. There was one big buying spike starting around March 30, when analysts announced that they expected the lira to fall significantly in value, regardless of who won the country’s May elections, at a time when the currency was already weakening. After a sustained decrease, USDT buying picked up again in late July, soon after the lira hit a new low of under $0.04 in value and citizens awaited a central bank announcement on interest rates. Keep in mind too that our figures for UDST purchasing in lira are displayed as a 30-day average, which can add a slight delay in the pickup of new trends.

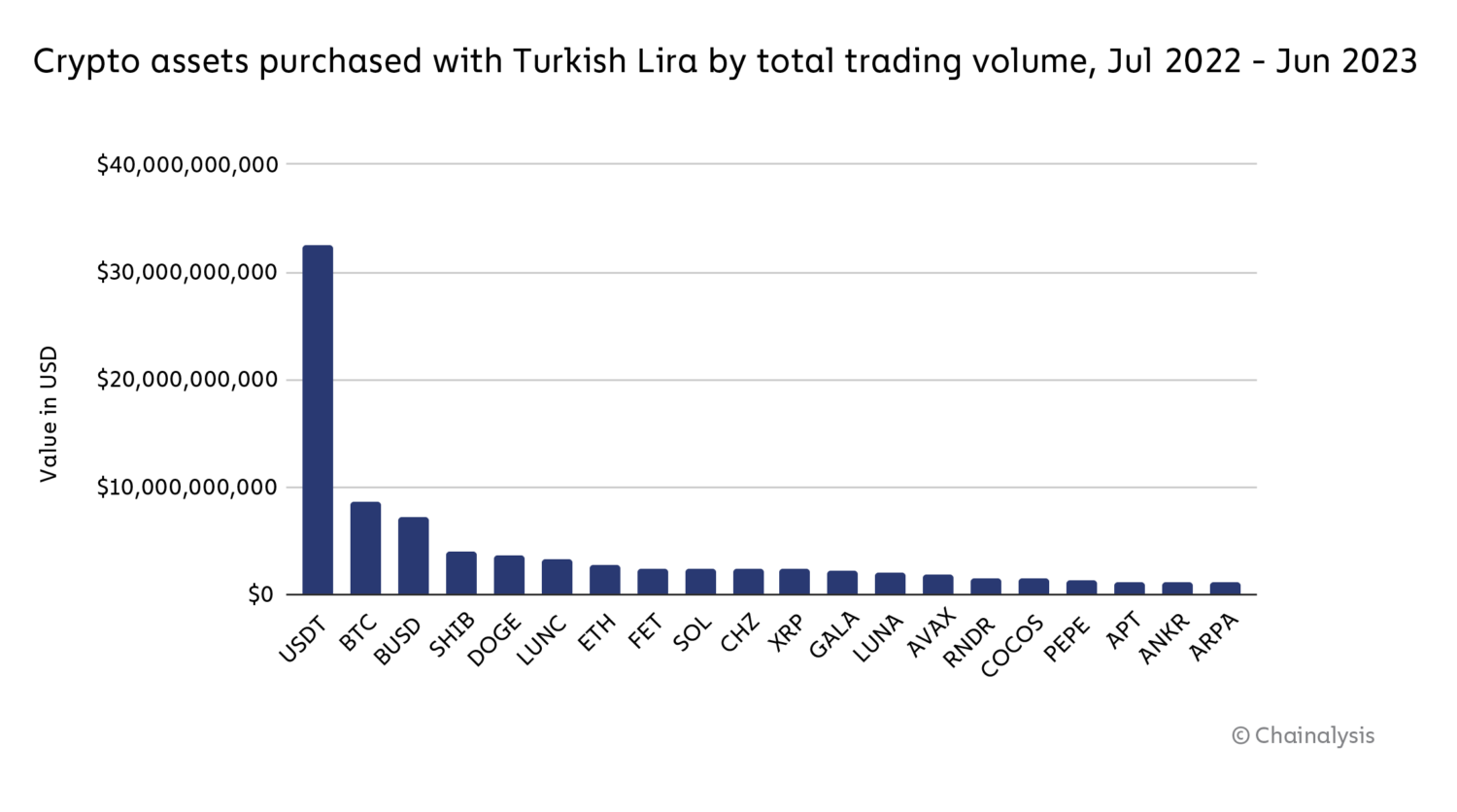

Generally speaking, we also see that USDT is the crypto asset most commonly purchased with the Lira across global exchanges.

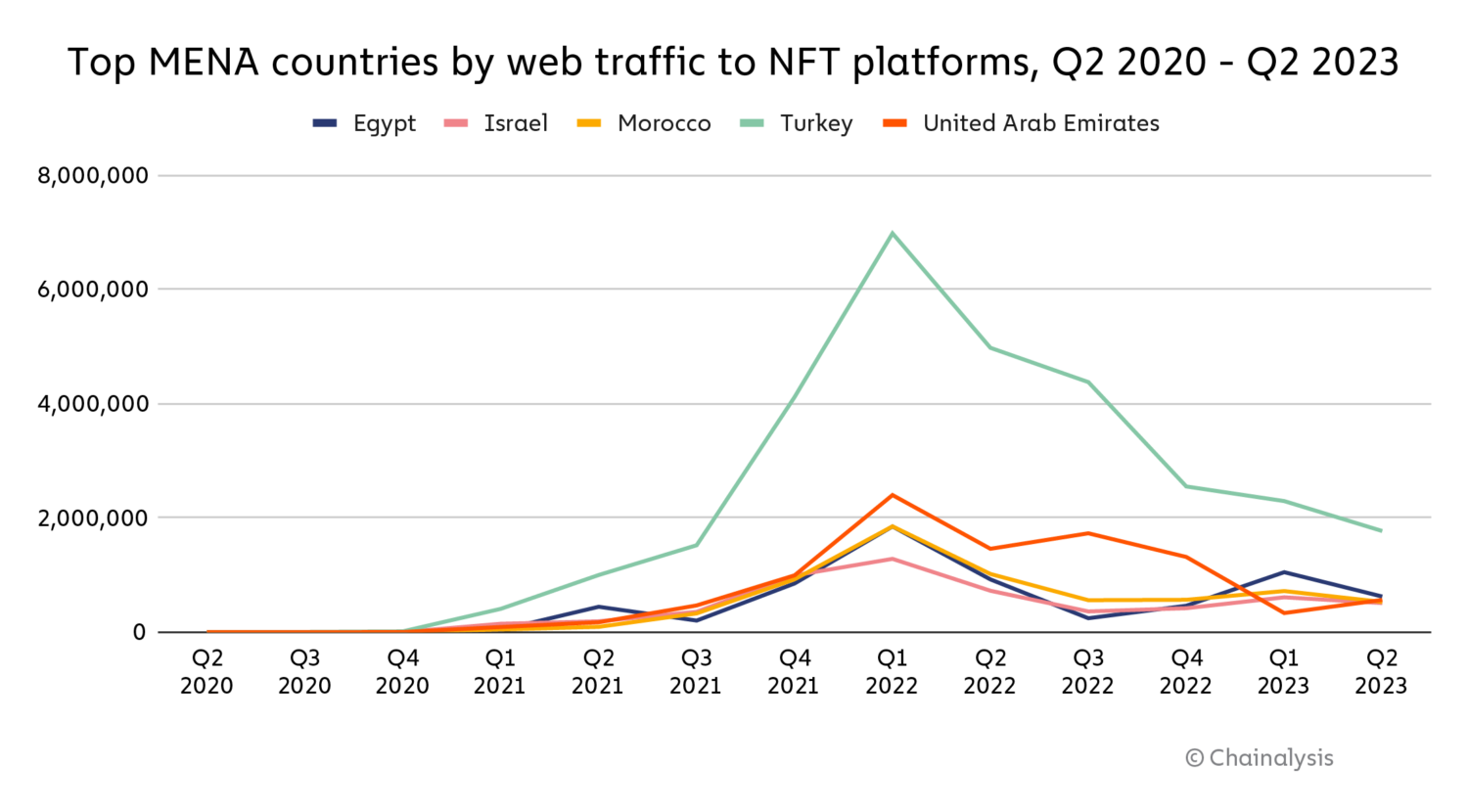

However, Turkey doesn’t devote all of its crypto activity to stablecoins. A broader analysis reveals that Turkey is the top country in the region by web traffic to NFT platforms, despite the overall decline in NFT activity since mid-2022.

Artists like Refik Anadol, a Turkish-American entrepreneur who was one of the first to use artificial intelligence to create immersive artwork, helped pioneer the Turkish NFT craze. Throughout this period, local crypto platforms like Paribu attracted and supported NFT activity. Recent market turmoil has likely contributed to the waning popularity of NFTs, but Oral is confident that NFTs will play a significant role in the future. “As we see it, NFTs and utility tokens are essential to define innovative solutions in many industries, such as retail, entertainment, and art. Turkey will indeed become a significant hub for the next wave of blockchain-based solutions, and NFT technology will be a crucial component of the mix.”

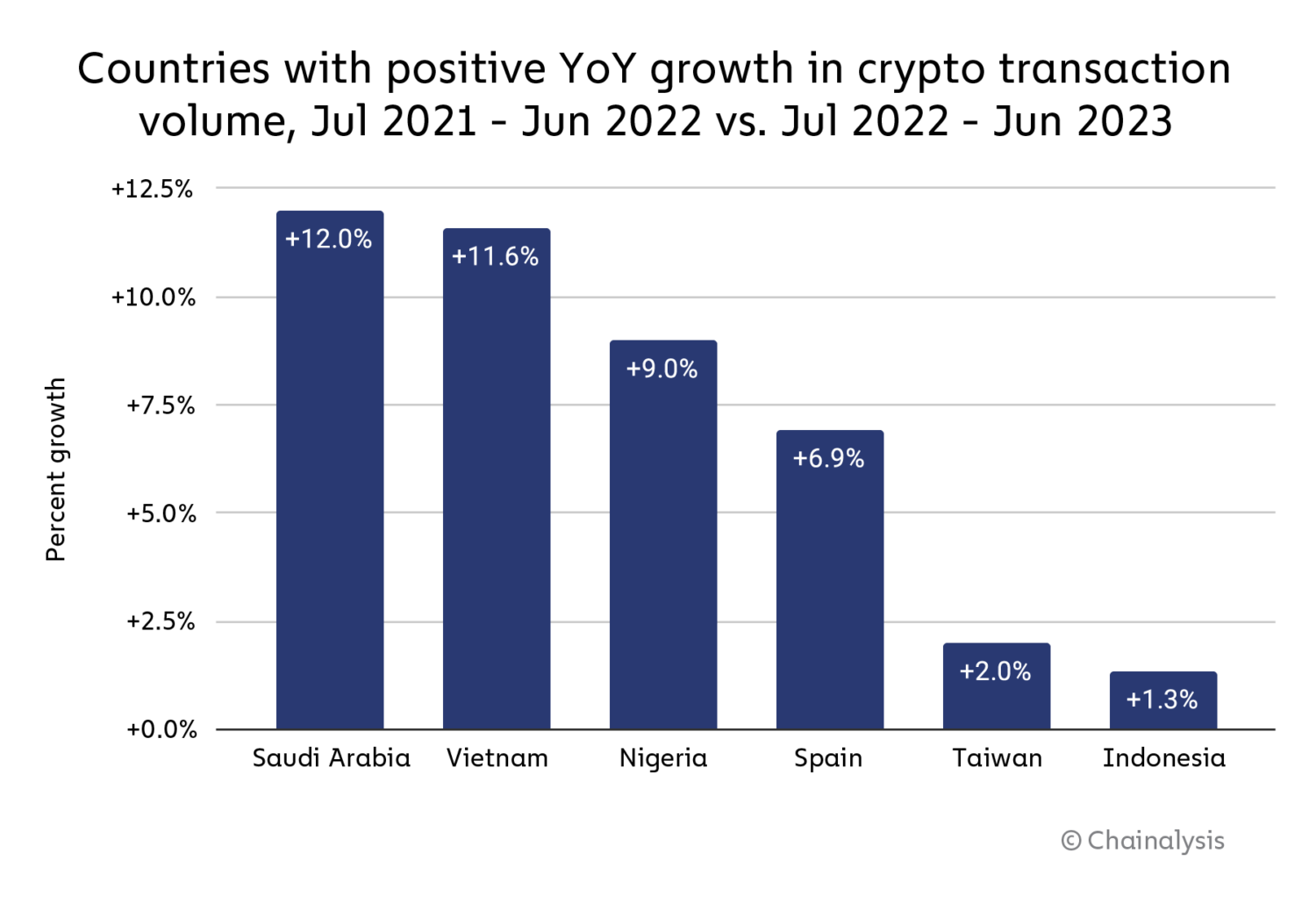

Saudi Arabia leads the world in year-over-year crypto transaction growth

No country saw its crypto economy grow more this past year than Saudi Arabia, with year-over-year transaction volume growth of 12.0%. In fact, Saudi Arabia is one of only six countries to see any year-over-year transaction volume growth during the time period studied.

Abdulmajed Alhamzah, Country General Manager for Saudi Arabia at crypto exchange Rain, described what makes cryptocurrency attractive to Saudi users. “Retail investors are often the largest demographic turning to crypto, seeking to diversify their portfolios. Many already have investments in real estate, stocks, and other assets, and they’re keen to include crypto. They recall the internet’s transformative impact and are eager to engage with crypto early on, anticipating significant growth in the coming years,” he elaborated. He also noted a rise in crypto adoption in the region and institutional interest, which constitutes a substantial portion of Rain’s institutional clientele there. “Many of the businesses we collaborate with see long-term value in crypto. Crypto is seen as an investable asset class in a diverse portfolio for clients.”

Those positive use cases, along with the growth of the crypto market generally, may prompt Saudi Arabia’s government to warm up to cryptocurrency. In 2018, the Saudi government stated that the use of Bitcoin was illegal and issued warnings about potential risks associated with trading other cryptocurrencies. But the country’s crypto market grew nevertheless, and in September 2022, the Saudi Central Bank hired tech entrepreneur Mohsen Al Zahrani as so-called “Crypto Chief” to lead a digital transformation in the centralized banking system. Additionally, Saudi Arabia has expressed interest in diversifying its economy by fostering Web3 and blockchain gaming projects. One such project is a partnership with The Sandbox to explore the metaverse. Abdulmajed sees this as reason for optimism. “Regulators in the region are working very hard to provide a robust regulatory framework that fuels innovation in the space but more importantly, protect customer funds, as well as safeguarding customers from potential scams.”

MENA’s future growth potential

Overall, our data and interviews with MENA-based cryptocurrency companies illustrate that the region embraces crypto for a variety of reasons. In countries with unstable currency or inflation, crypto is useful to safeguard wealth, while users in more economically stable countries like the UAE may be more inclined to explore more investment-focused, cutting edge use cases. The UAE also provides a valuable example of how regulatory clarity and rules designed to allow innovation can enable countries to establish themselves as crypto hubs, bolstering the local economy.

This material is for informational purposes only, and is not intended to provide legal, tax, financial, or investment advice. Recipients should consult their own advisors before making these types of decisions. Chainalysis does not guarantee or warrant the accuracy, completeness, timeliness, suitability or validity of the information in this report and will not be responsible for any claim attributable to errors, omissions, or other inaccuracies of any part of such material.