The 2022 Geography of Cryptocurrency Report

Everything you need to know about crypto trends in MENA and beyond!

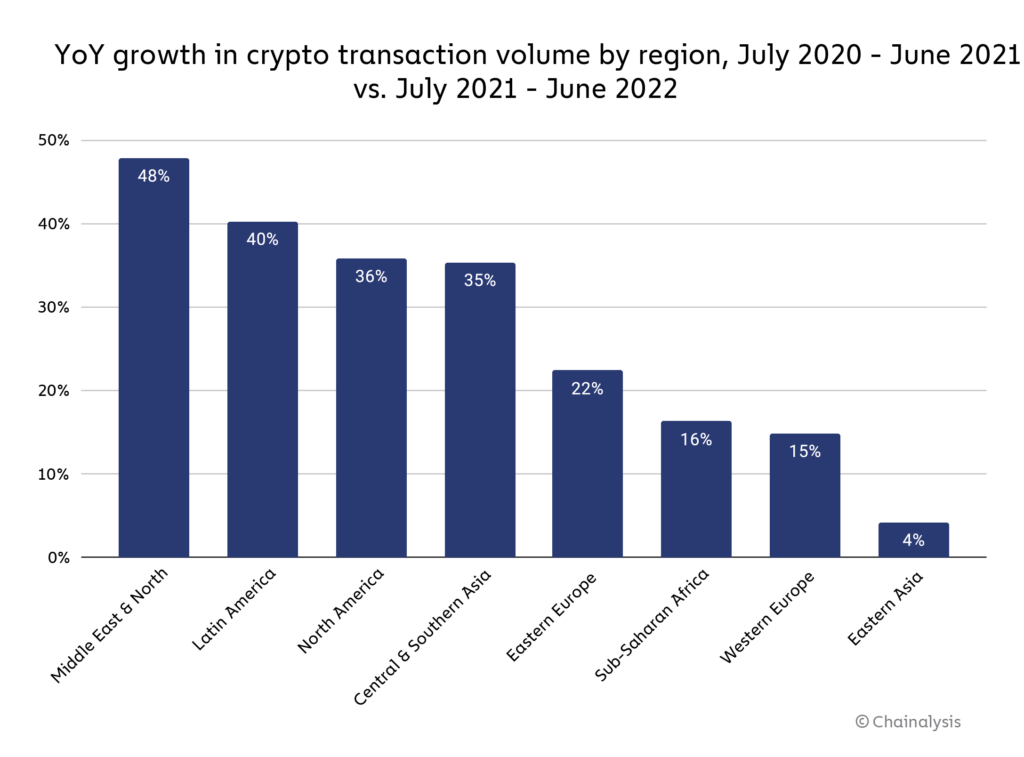

Middle East & North Africa (MENA) may be one of the smaller crypto markets in the 2022 Global Crypto Adoption Index, but it’s also the fastest growing. MENA-based users received $566 billion in cryptocurrency from July 2021 to June 2022, 48% more than they received the year prior.

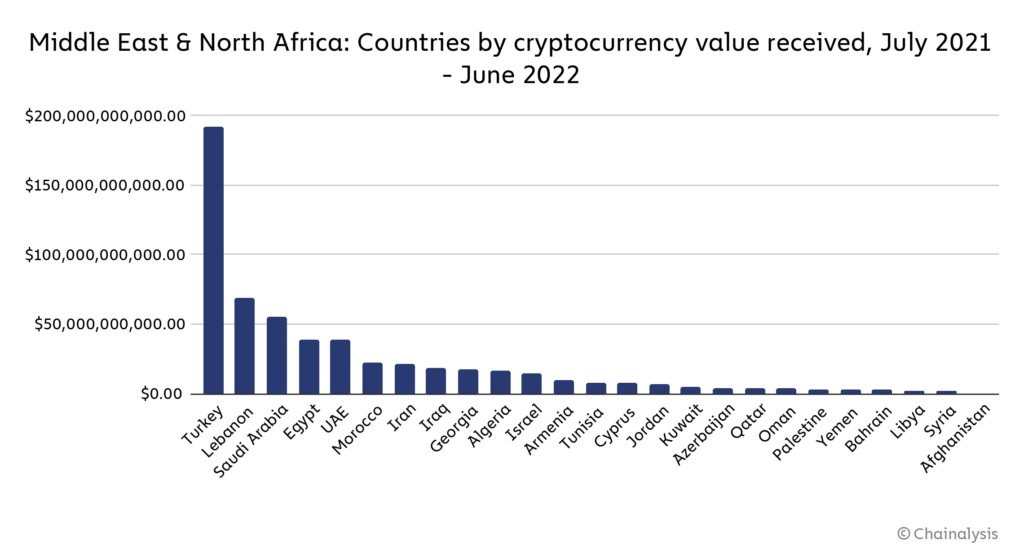

MENA is also home to three of the top thirty countries in this year’s index: Turkey (12), Morocco (14), and Egypt (24). Use cases around savings preservation and remittance payments as well as increasingly permissive crypto regulations help explain why.

In Turkey and Egypt, fluctuating cryptocurrency prices have coincided with rapid fiat currency devaluations, strengthening the appeal of crypto for savings preservation. The Turkish Lira has inflated by 80.5% in the last year; the Egyptian Pound has weakened by 13.5%. Also significant, however, is Egypt’s remittance market. Remittance payments account for about 8% of Egypt’s GDP, and the country’s national bank has already begun a project to build a crypto-based remittance corridor between Egypt and the UAE, where many Egyptian natives work.

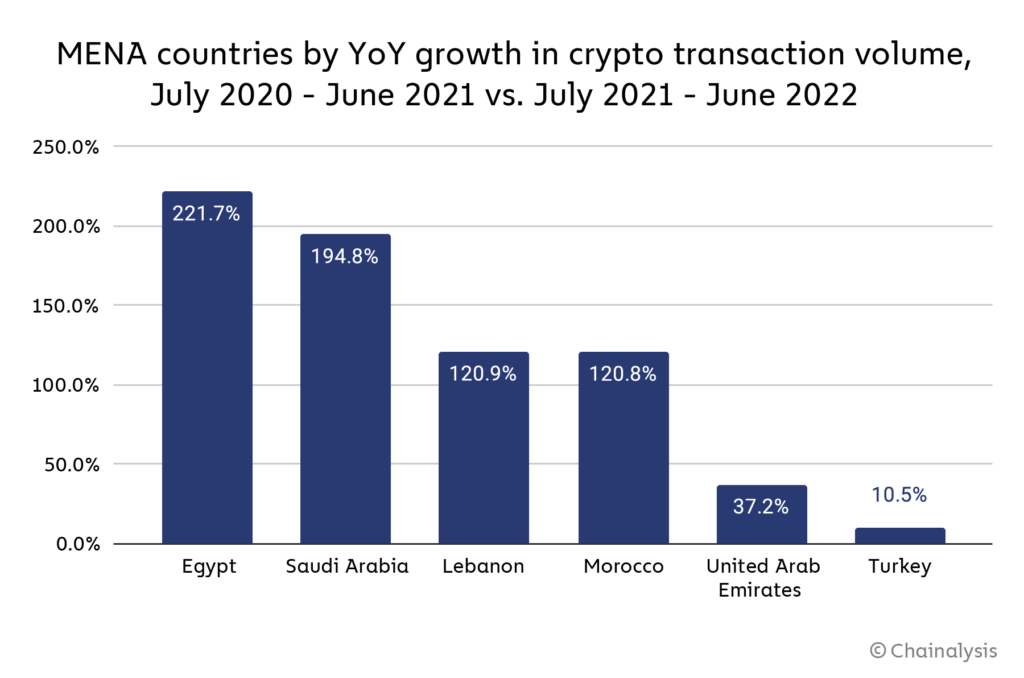

Egypt’s position at the intersection of growing crypto remittances and increased inflationary pressures help explain why it’s the fastest growing crypto market in all of MENA this year. Between July 2021 and June 2022, transaction volume in Egypt tripled compared to the preceding year. Turkey, meanwhile, remains the largest cryptocurrency market in the region, its citizens having received $192 billion from July 2021 to June 2022, but has seen much slower YoY growth.

In Morocco, inflation rates have been contained to a more manageable 5.3%. In fact, the North African country’s notable levels of grassroots adoption seem to be more tied to the government’s newly permissive crypto stance than to any particular macroeconomic tailwinds. In 2017, the central bank of Morocco declared that “penalties and fines” will follow any crypto transaction within the country. But earlier this year, it struck a partnership with the IMF and the World Bank to create crypto regulations that emphasize innovation and consumer protection.

The Gulf Cooperation Council and the rise of institutional crypto in MENA

As key business hubs of the MENA region, the member states of the Gulf Cooperation Council (GCC) – Saudi Arabia, Kuwait, the United Arab Emirates, Qatar, Bahrain, and Oman – seldom make it to the top of our grassroots crypto adoption index, as it weighs countries by purchasing power parity per capita, which favors poorer nations. Nevertheless, their role in the crypto ecosystem should not be underestimated. Saudi Arabia, for example, is the third-largest crypto market in all of MENA, and UAE is fifth. They also have deep ties to the global crypto markets: in our Sub-saharan Africa and Central & Southern Asia sections, we find that Dubai has become a hub for crypto companies that serve customers all across Asia and Africa, not just in the Middle East.

As Akos Erzse, Senior Manager for Public Policy at the Dubai-based crypto exchange BitOasis, explained, the main drivers of crypto adoption in the GCC are different from those in the rest of MENA. “When you look at markets in the GCC, we take the view that this adoption is driven by young, tech-savvy early adopters with relatively high disposable incomes, that are, you know, searching for investment options, and have a conviction in crypto right now.” Moreover, adoption is “not just on the retail or customer side, but also in the ecosystem, with financial institutions and banks beginning to work with businesses like us.” Erzse also emphasized the role that recent inflation has played in pushing cryptocurrency adoption in other parts of the region.

The Taliban’s crackdown brings Afghanistan’s crypto markets to a standstill

One former MENA leader in grassroots crypto adoption has since had a major downturn: Afghanistan.

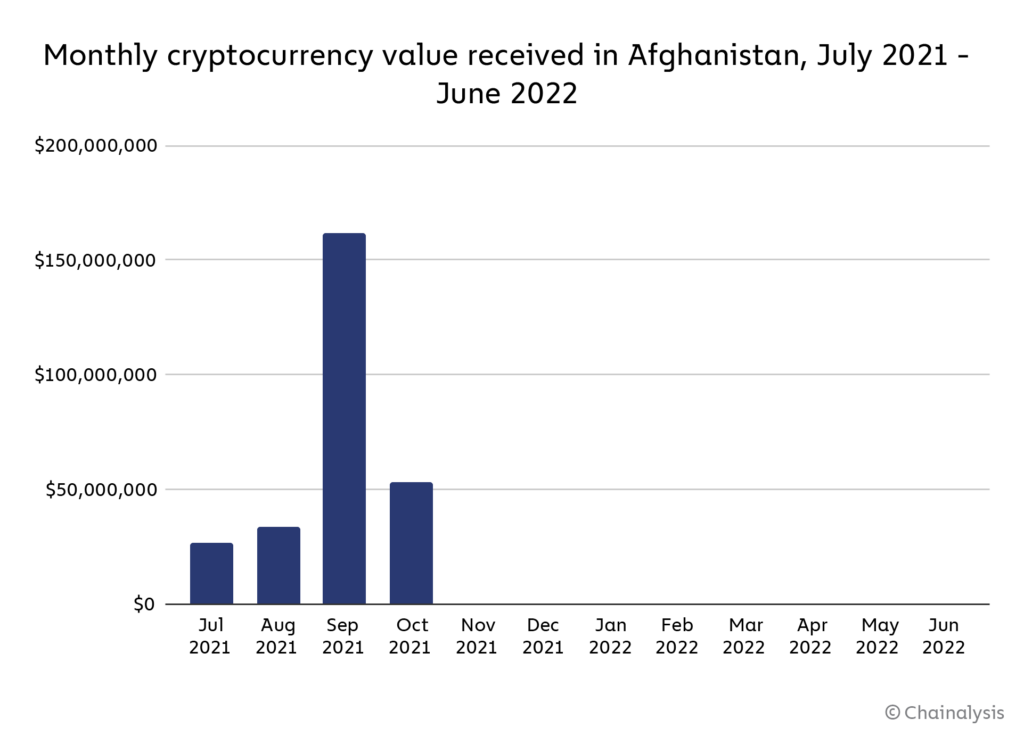

Afghanistan placed 20th in our 2021 crypto adoption index, but since the Taliban’s takeover last August, has fallen to the bottom of the list. Under the Taliban’s rule, dozens of crypto dealers have been arrested, and the ruling state agency, the Ministry for the Propagation of Virtue and the Prevention of Vice, has equated cryptocurrency to gambling and declared it haram.

We find that in August and September – right after the Taliban’s takeover – Afghanistan’s on-chain activity spiked to a temporary high before taking an unprecedented nosedive. From November 2021 to today, the on-chain value received by users based in Afghanistan has averaged less than $80,000 a month, a far cry from the $68 million its citizens received in the average month preceding the takeover.

The Taliban’s crackdown has had a massive chilling effect on the country’s crypto markets. Under current conditions, crypto dealers are left with three options: flee the country, cease operations, or risk arrest.

As for how much of the ceased and continued crypto activity was and is legitimate versus illicit, “A small portion of that [continued activity] is just young people who have a few hundred bucks [available to day trade],” an anonymous source with knowledge of the matter shared with us. “… But I would say most of it, the only use I’ve seen is money laundering, where the source of the money is illegal. A lot of it is either bribes or drug money.”

As our source explained, it’s not that crypto can’t eventually be a net positive for the region – a way to bank the unbanked, act as a store of value, or become a means of payment. The problem is that it’s exceptionally hard to implement, especially given Afghanistan’s small number of smartphone users and sparse cellular networks.

[Afghanistan] has been through so much that I can use US dollars almost anywhere. Even if it’s a cart on the side of the road, selling potatoes, I am 100% confident that they will take my dollar. They will not give me change in dollars, but they will always accept it, because their understanding of the volatility of currency is there. A crypto solution, it could work, but the obstacles are always overlooked when there is an initiative being planned. … There is such a difference between the plan and the reality that usually it just never works out.

Future crypto initiatives seem highly unlikely to be attempted, let alone implemented, under the current Taliban regime, but those who manage to acquire cryptocurrency clandestinely may be able to insulate themselves from any future economic shocks, as we’ve seen in other countries.

This blog is an excerpt from our 2022 Geography of Cryptocurrency Report. Sign up to download your copy today!

This website contains links to third-party sites that are not under the control of Chainalysis, Inc. or its affiliates (collectively “Chainalysis”). Access to such information does not imply association with, endorsement of, approval of, or recommendation by Chainalysis of the site or its operators, and Chainalysis is not responsible for the products, services, or other content hosted therein.

Chainalysis does not guarantee or warrant the accuracy, completeness, timeliness, suitability or validity of the information in this report and will not be responsible for any claim attributable to errors, omissions, or other inaccuracies of any part of such material.