The financial landscape is changing and law enforcement must adapt with it. Cryptocurrency has taken the financial world by storm over the last year, but many law enforcement agencies, particularly at the state and local levels, don’t yet have the tools or data they need to effectively investigate cryptocurrency-related crime.

While our research and available data indicates the vast majority of cryptocurrency transactions are for legitimate purposes, cryptocurrency has a special appeal to certain bad actors and we expect to see more criminal cases involving cryptocurrency as global adoption grows. Furthermore, it’s not just sophisticated cybercrime investigations that have a cryptocurrency angle — the technology is already showing up in cases across all types of crime. This means law enforcement agencies at every level must increase their cryptocurrency literacy and develop effective investigative strategies. Below are three things every agency needs to know about cryptocurrency.

Cryptocurrency isn’t anonymous

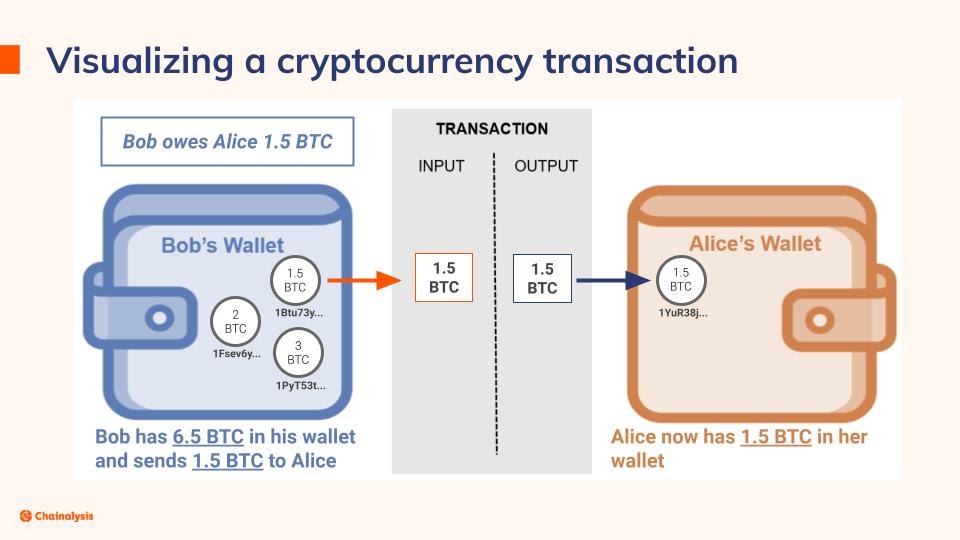

Cryptocurrency skeptics and public officials have expressed concerns about cryptocurrency’s anonymity, but this is a misconception. Cryptocurrency is in fact pseudonymous rather than anonymous. Users’ cryptocurrency balances and transaction histories are associated with unique addresses — expressed as long strings of letters and numbers and typically generated by a digital cryptocurrency wallet with many addresses — and are easily viewable on public blockchains.

In this way, cryptocurrency transactions are actually more transparent than ordinary financial transactions. Once recorded on the blockchain, records of transactions stay there permanently and can be viewed at any time, even years later.

However, what is not immediately visible on the blockchain is the real-world name of the individual or entity conducting a transaction. Does that make cryptocurrency anonymous? No, but it does mean there are further steps investigators have to take to determine who’s behind a suspicious cryptocurrency transaction. The vast majority of cryptocurrency transactions are conducted with addresses hosted by cryptocurrency exchanges and other services similar to conventional money services businesses (MSBs). Chainalysis maps these addresses to the specific services hosting them, and makes this information easily viewable for law enforcement.

But can you identify the individual service where a user is conducting a suspicious transaction? Yes. In most jurisdictions, these cryptocurrency services are regulated similarly to financial institutions, meaning they too must collect customer information, conduct Know Your Customer (KYC) checks on all users, and report any suspicious activity. When investigators identify an address hosted by a service engaging in suspicious or criminal activity, they can go to the service itself and quickly learn the identity of the users behind the activity by following standard legal processes.

Cryptocurrency impacts all major forms of criminal activity

Despite the low share of transactions associated with criminal activity, cryptocurrency is increasingly playing a role in nearly every type of criminal activity that law enforcement cares about. This shouldn’t be surprising. Most crime is financially motivated or at least contains a financial component, so it makes sense cryptocurrency would be involved in a wide range of criminal threats as a new form of digital currency. Criminals have always been early adopters of technology and cryptocurrency is no exception. Some forms of criminal activity involving cryptocurrency include:

- Trafficking. Darknet markets are online black markets where users can buy and sell drugs, as well as stolen data and tools used for hacking. In 2020, darknet markets collectively made at least $1.7 billion in cryptocurrency revenue, with the United States being the second-most active country for both buyers and sellers.

- Fraud. Scams are the highest-grossing form of cryptocurrency-based crime, with fraudsters taking in over $2.6 billion worth of cryptocurrency in 2020, and a whopping $9 billion the year before. The true scope and impact is probably even higher given the underreporting and the hesitancy of victims to come forward. These crimes may be executed remotely but the impact is felt locally. Scammers often take advantage of the most vulnerable in our communities including the elderly, the lonely or those unfamiliar with cryptocurrency. Cryptocurrency thieves pitch unrealistic investment opportunities or request payments be made in cryptocurrency. They have successfully defrauded millions of people around the world.

- Child Sexual Abuse Material (CSAM). Chainalysis tracked more than $2 million in cryptocurrency payments to addresses associated with known CSAM distributors between 2015 and April 2020. The secretive and elusive nature of this perverse and illicit activity is a stain on humanity and the utilization of cryptocurrency makes it all the more a public threat. In 2019, authorities took down the largest cryptocurrency-based CSAM website ever observed. The operation led to the arrest of over 300 site users in 38 different countries. Law enforcement around the globe must unite to combat the plague of CSAM and become familiar with how cryptocurrency is being used to fuel this crime.

- National Security. Designated terrorist groups such as the al-Qassam Brigades have been using cryptocurrency to receive donations since at least 2016. The ability to leverage cryptocurrency and crowdsource domestic and international terrorism is both easy to do and frightening in its implications. In addition, ransomware attacks have more than quadrupled between 2019 and 2020. Ransomware frequently targets government agencies and critical infrastructure providers such as the Colonial Pipeline most recently. Ransomware is the fastest growing category of illicit cryptocurrency use and continues to have a significant impact on the lives and livelihoods of many.

Law enforcement agencies must quickly develop the expertise and acquire the data and tools it needs to investigate cryptocurrency related crime in order to stay ahead of the threat.

Cryptocurrency is here to stay

Skeptics have been predicting cryptocurrency’s demise for more than a decade and have continuously been proven wrong. Uncertainty and volatility are common to the emergence of any new asset class and that has certainly been true for cryptocurrency. However, a growing number of public officials and leaders in the financial world have acknowledged the significance and potential role cryptocurrency will play in the world’s financial future.

A recent report from Crypto.com used blockchain analysis and other factors to estimate that as of January 2021, roughly 106 million people now hold cryptocurrency or put differently roughly one in every 73 people on the planet. That figure represents a 77% increase from the firm’s previous estimate in May 2020, and a 16% increase from December 2020 alone. Other sources estimate similar adoption growth for this new asset class. What will the next three to five years bring? Is law enforcement prepared for the trillions of dollars that will be transacted and the untold billions in illicit activity?

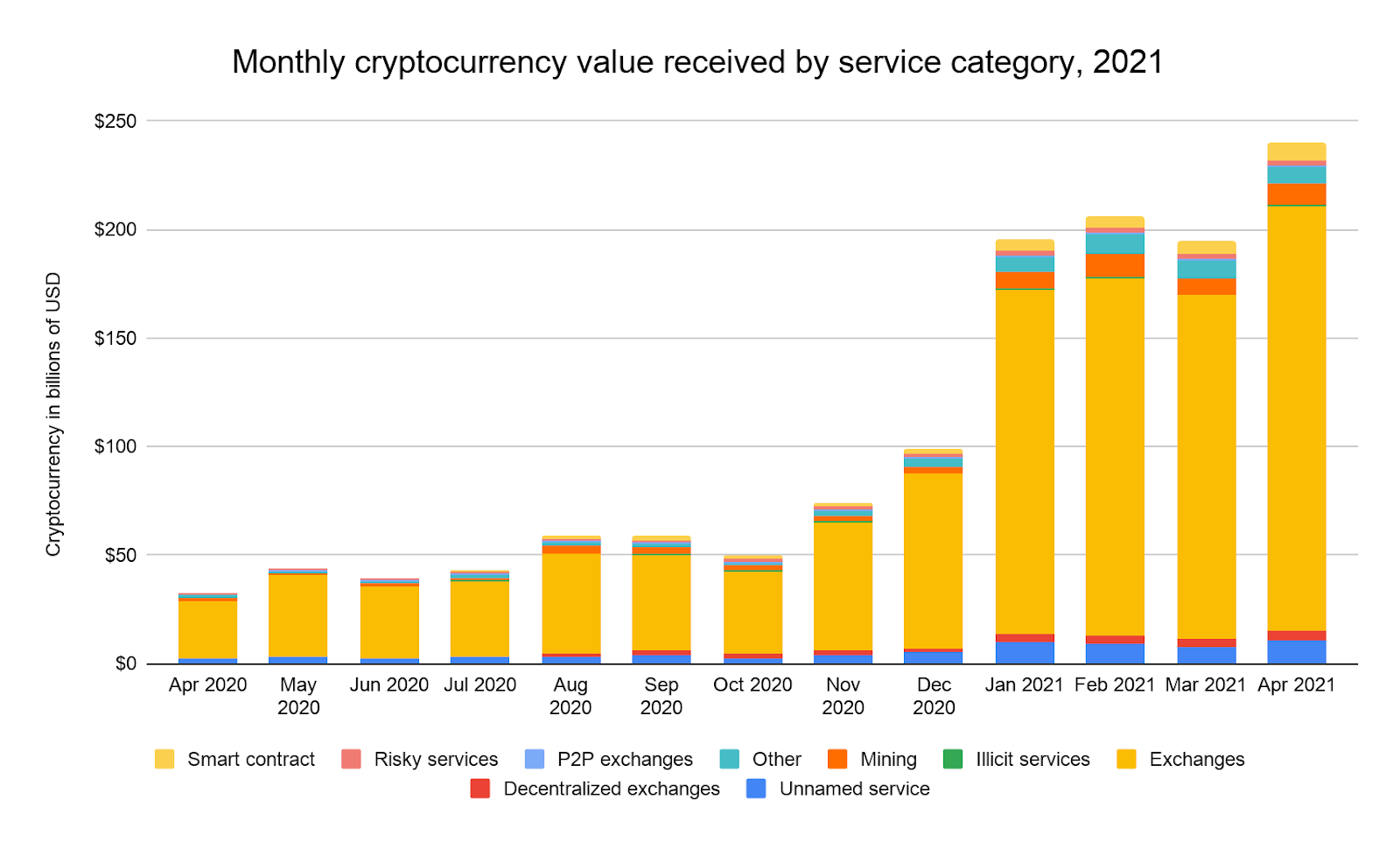

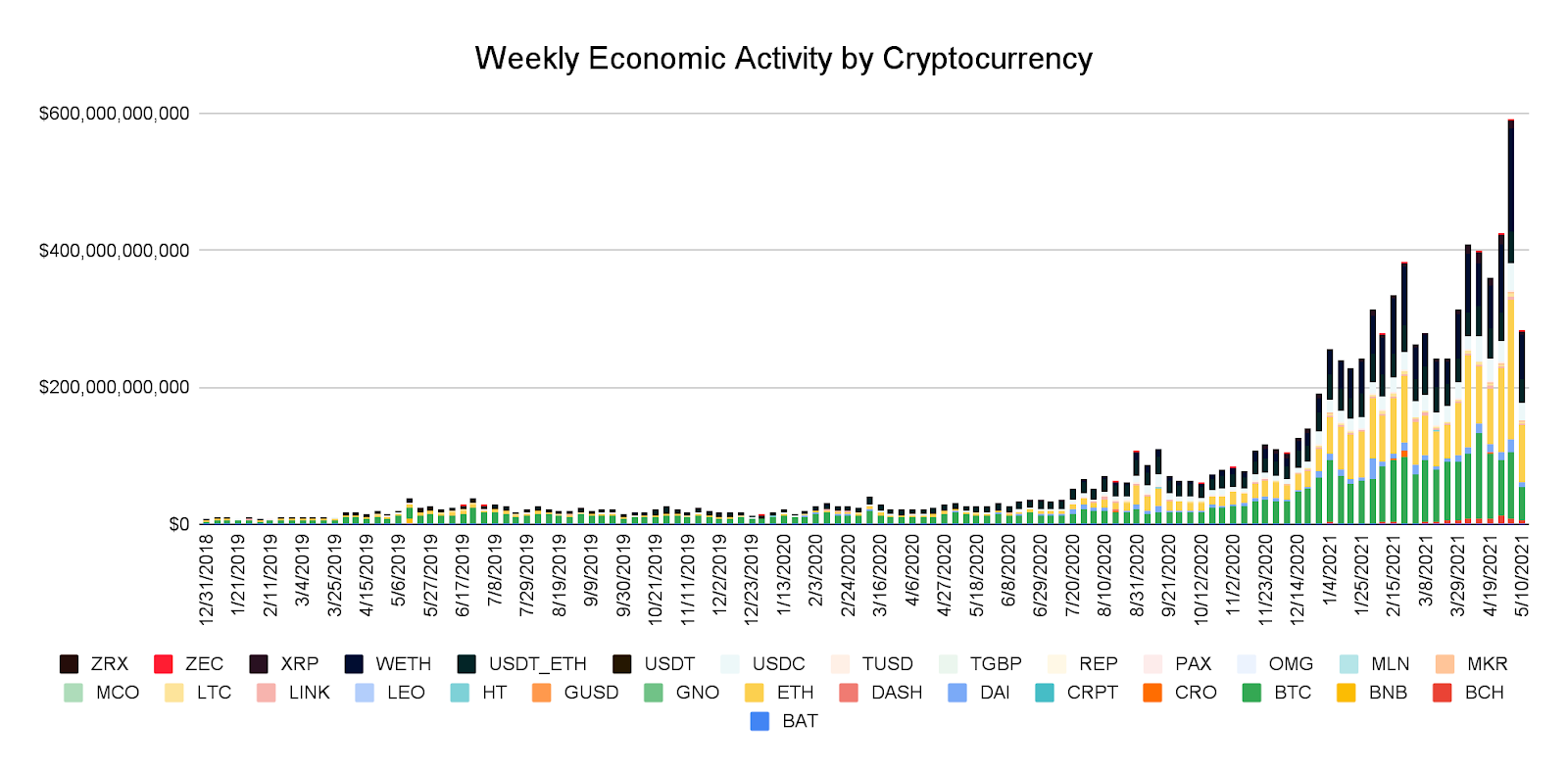

We can see much of this growth reflected in cryptocurrency transaction volume and other adoption metrics. According to Chainalysis data, weekly cryptocurrency transaction volume has grown from roughly $8.9 billion in late December 2018 to over $591 billion during the week of May 3, 2021. It’s also important to pay attention to where specifically cryptocurrency usage is most active. Last year, Chainalysis created the Global Crypto Adoption Index, which ranks countries by cryptocurrency adoption adjusted for countries’ population and economic size, in order to capture mainstream, grassroots adoption.

The countries leading the way in cryptocurrency adoption include some of the largest markets in the world, such as China and the United States, along with some of the fastest growing such as Kenya, Nigeria, and Vietnam. Market traction in these key regions suggests cryptocurrency usage will continue to grow as the world’s population and number of mobile and internet users increase.

Adoption is fueled by the growing popularity and availability of decentralized finance (DeFi) networks as a means of transferring value. As governments, financial institutions, and businesses also embrace the cryptocurrency economy we are likely to see greater stability and transparency. Global adoption rates are increasing and with this adoption will come ever larger volumes of transactions and trillions of dollars in value transfers.

Criminals and illicit actors always follow the money and they too are incorporating cryptocurrency into their criminal enterprises. We are likely to see a greater use of scams, frauds and other cyber and ransomware extortions involving cryptocurrency. We are also likely to see a greater level of sophistication employed as criminals adopt the blockchain as a way to move funds instantaneously across borders to evade detection, taxation, and launder the proceeds of their crimes.

The time to learn is now

Cryptocurrency isn’t just a cybercrime issue or something to be relegated to the few highly-trained investigators working complex financial fraud matters. It’s a global phenomenon and tool more and more criminals of all types are incorporating into their activities. As such, it’s essential to bring cryptocurrency literacy to all levels of any law enforcement agency. Investigators who don’t become cryptocurrency savvy may soon find themselves out of date and losing the upper hand to cybercriminals and threat actors who do.

Agencies can grow their cryptocurrency literacy and formulate effective processes for cryptocurrency investigations by learning how to use blockchain analysis tools. More information can be found on the Chainalysis blog, where I will share additional updates on practical ways agencies can address cryptocurrency-related threats. That’s the first step for agencies to equip themselves to identify, track, and seize illicit cryptocurrency funds, ensuring both the safety of the wider cryptocurrency economy and the protection of consumers.