This blog is an excerpt from the Chainalysis 2020 Geography of Cryptocurrency Report. Sign up here and we’ll email you the full report as soon as it comes out in September!

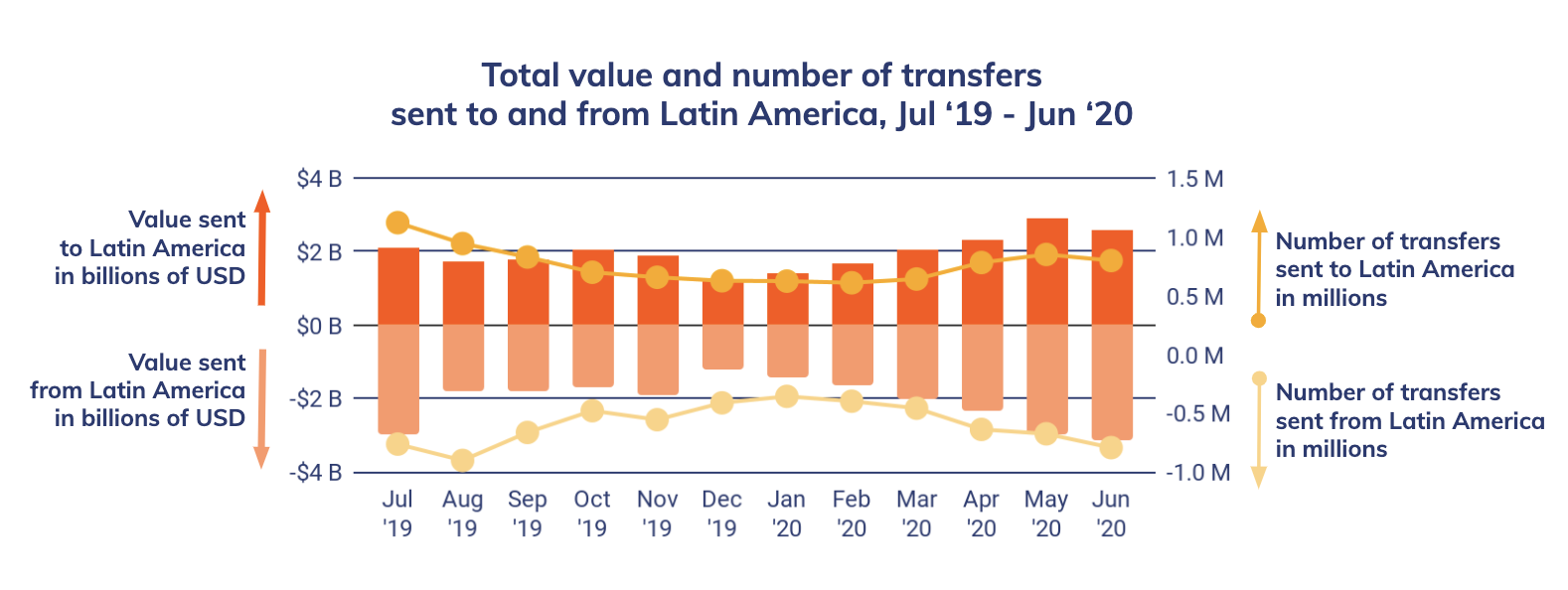

With $25 billion worth of cryptocurrency sent and $24 billion received over the last year, Latin America has one of the smaller crypto economies by volume transacted, ahead of just Africa and the Middle East. The region represented between 5% and 9% of all cryptocurrency activity in any given month over the last year. Counterintuitively, Latin America’s crypto economy has shown the second-lowest growth rate over the last year of any region we studied, despite being one of the hottest markets in the adjacent fintech industry. Despite this, our data, paired with interviews with experts in the region, reveals that some of the same factors fueling Latin America’s fintech wave, such as banking access issues and the need for remittances, are driving unique patterns of cryptocurrency usage beyond the speculative investment common to other regions. These issues are even driving Latin American businesses — not just individuals — to carry out commercial transactions with cryptocurrency.

Remittances are key

The high cost and wait times of remittances have long been considered a problem that cryptocurrency can solve today, as virtual assets can be moved overseas instantly without the high fees common to overseas transfers of fiat currency. Given the importance of remittances in the region, Latin America is one place we would expect to see such activity. According to the World Bank, remittances make up 1.7% of the total GDP in Latin America, with only the Middle East and North Africa (MENA) and sub-saharan Africa having a larger GDP share made up of transfers from overseas. The high-level on-chain data comports with this, with 90% of cryptocurrency received by Latin America coming from outside the region.

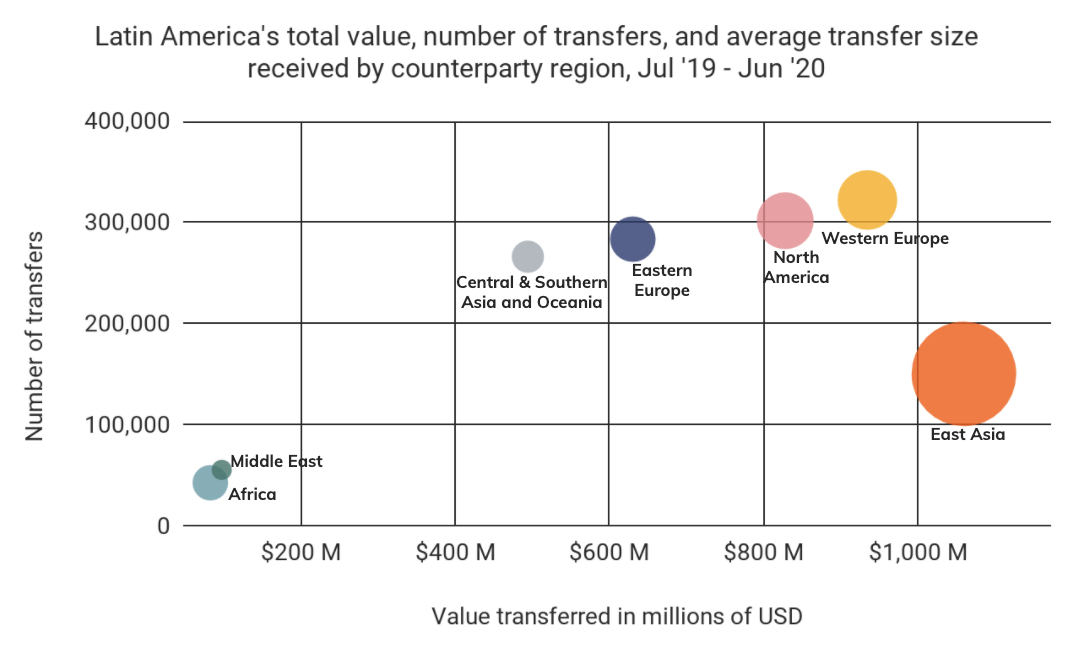

Let’s dig deeper into which countries are on the other side of Latin America’s cryptocurrency remittances, which we quantify below based on direct transfers from overseas to Latin America addresses.

It’s no surprise to see North America well-represented here, as the United States is the biggest source of remittances to Latin America in fiat currency. Patricia Risso, Head of Regulatory Risk at Bitso, an exchange primarily serving Mexico, Argentina, and Brazil, confirmed this in an interview with Chainalysis, noting that as we see in the fiat world, cryptocurrency remittances from the United States to Mexico are a common use case for her company’s exchange users. Indeed, our estimates show that Mexico received around 11% of the region’s retail payments, behind only Brazil and Venezuela. However, while they wouldn’t show up on the chart above, others also pointed out to us the importance of remittances between countries in Latin America, particularly from countries like Argentina and Colombia to Venezuela.

Interestingly, our data shows that East Asia is a significant counterparty for Latin America. In interviews with Latin America-based cryptocurrency operators, we learned that many of these payments are in fact commercial transactions between Asia-based exporters and Latin American businesses buying goods from them to sell retail at home. Luis Pomata, co-founder of the Paraguay-based exchange Cripex, gave us some insight into how this works.

“Lots of goods are imported into Paraguay from China, and then make their way to other countries like Brazil. Lots of the businesses buying these goods use Bitcoin because it’s faster and easier. Banks in Paraguay are worried about money laundering and picky with who they’ll work with, so the banking application process is long and difficult — many businesses are rejected. And even if you have a bank, it is still very hard and costly to make a wire transfer due to the amount of supporting documentation you need to provide. That is the main reason people switch to crypto.” Pomata also notes that in many of these cases involving commercial transactions, businesses are skirting import taxes, which can be easier if they buy using cryptocurrency.

A safe store of value in a tumultuous market

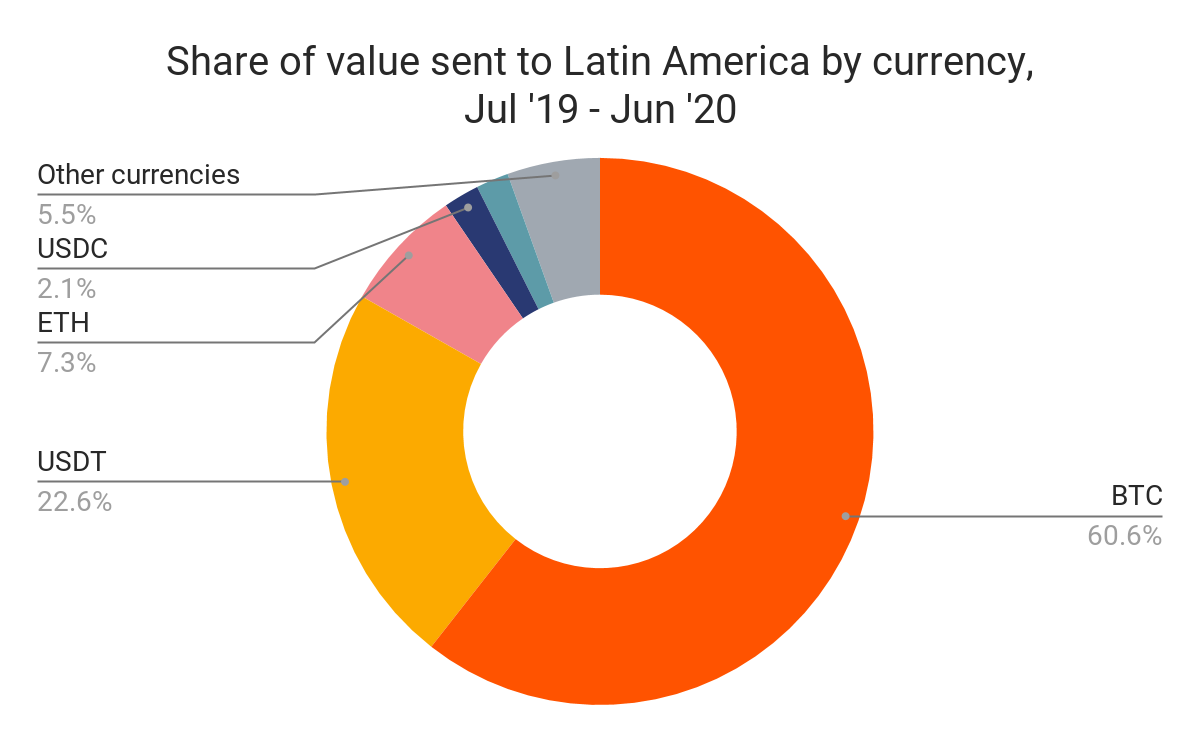

It’s not just businesses in Latin America having problems with banks. Many individuals are also unable to get bank accounts, which is another factor driving cryptocurrency adoption. “Lots of people here have uneven income because they do gig work for Uber or places like that, which makes it hard for them to get a bank account,” says Sebastian Villanueva, who manages the Chile operations of SatoshiTango, a cryptocurrency exchange serving several Latin American countries. Without easy banking access, many young people in Latin America turn to cryptocurrency as a means of storing value. Villanueva also notes the importance of stablecoins like DAI and USDC for Latin Americans looking to lock in their savings, which our data reflects as well.

Currency instability is another factor driving cryptocurrency adoption in Latin America. This has unfortunately been a problem in the region for decades. Wences Casares, CEO of the popular cryptocurrency wallet provider Xapo named the issue as a primary motivation for starting his company at a recent Chainalysis virtual event, citing the memory of his family seeing their savings decimated multiple times due to the collapse of the Argentine peso.

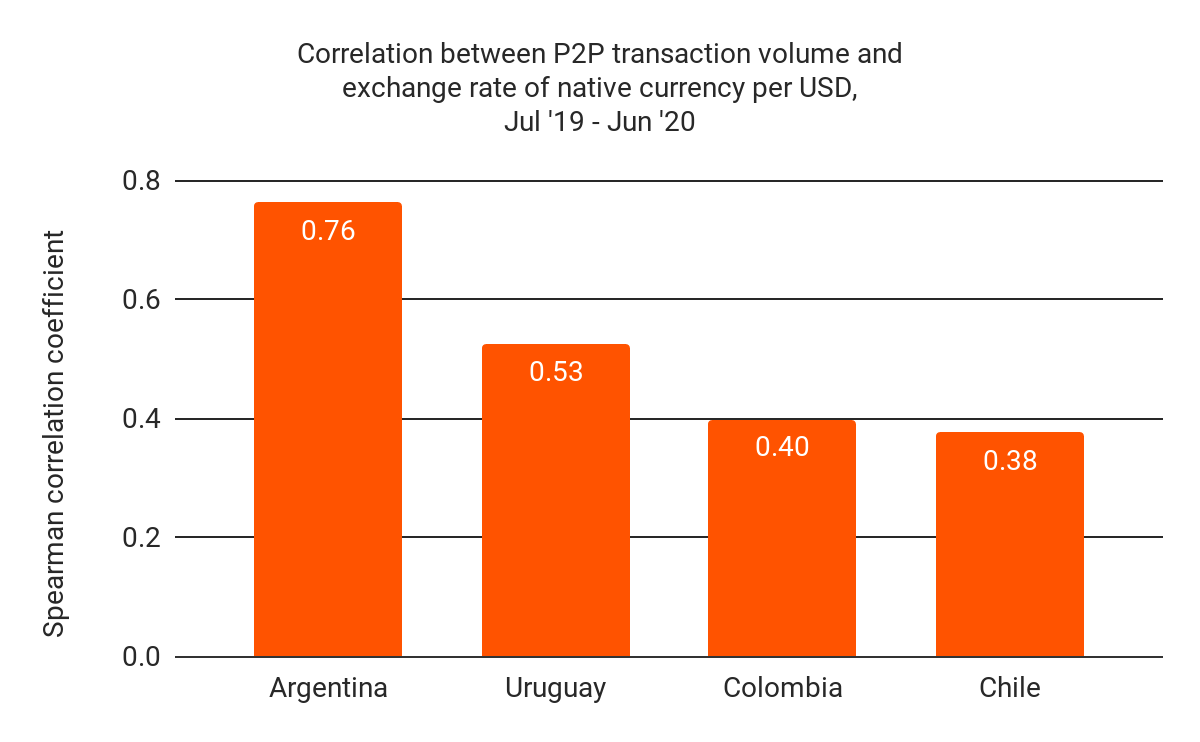

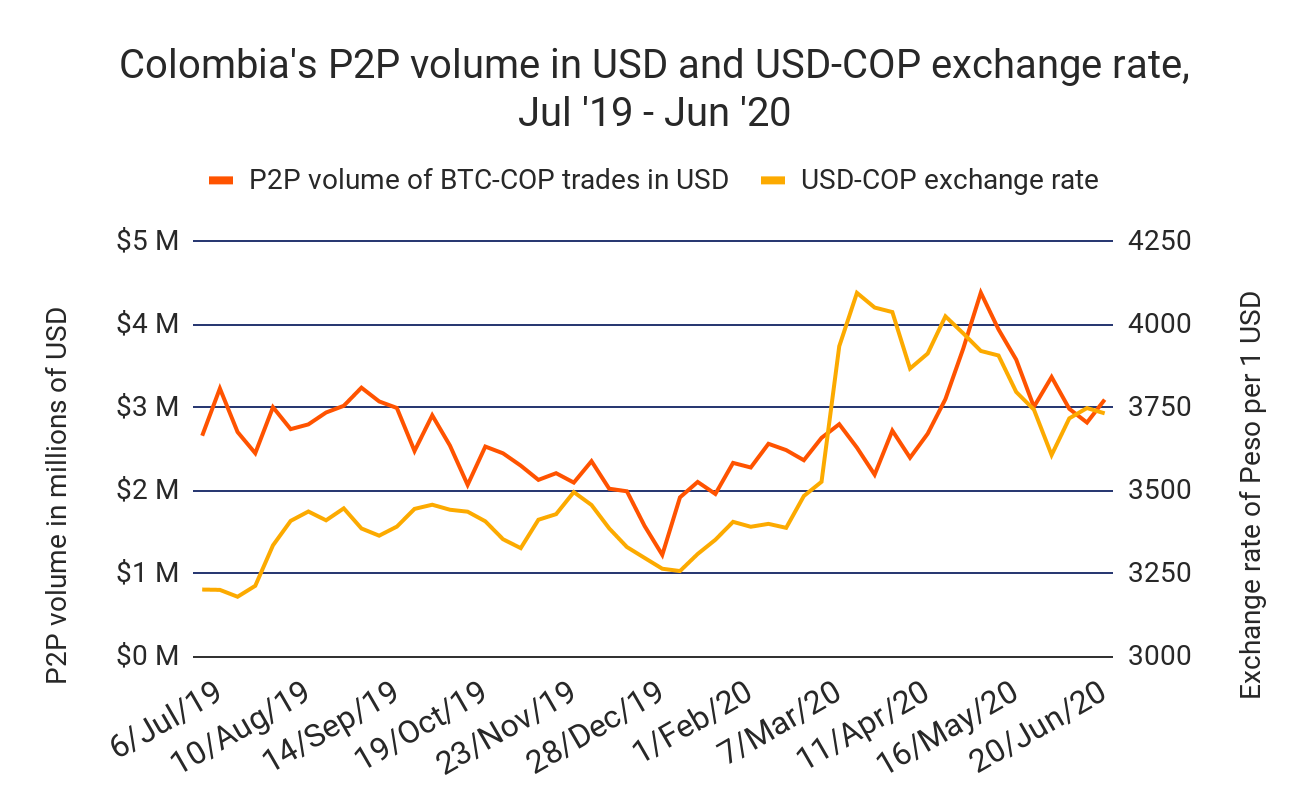

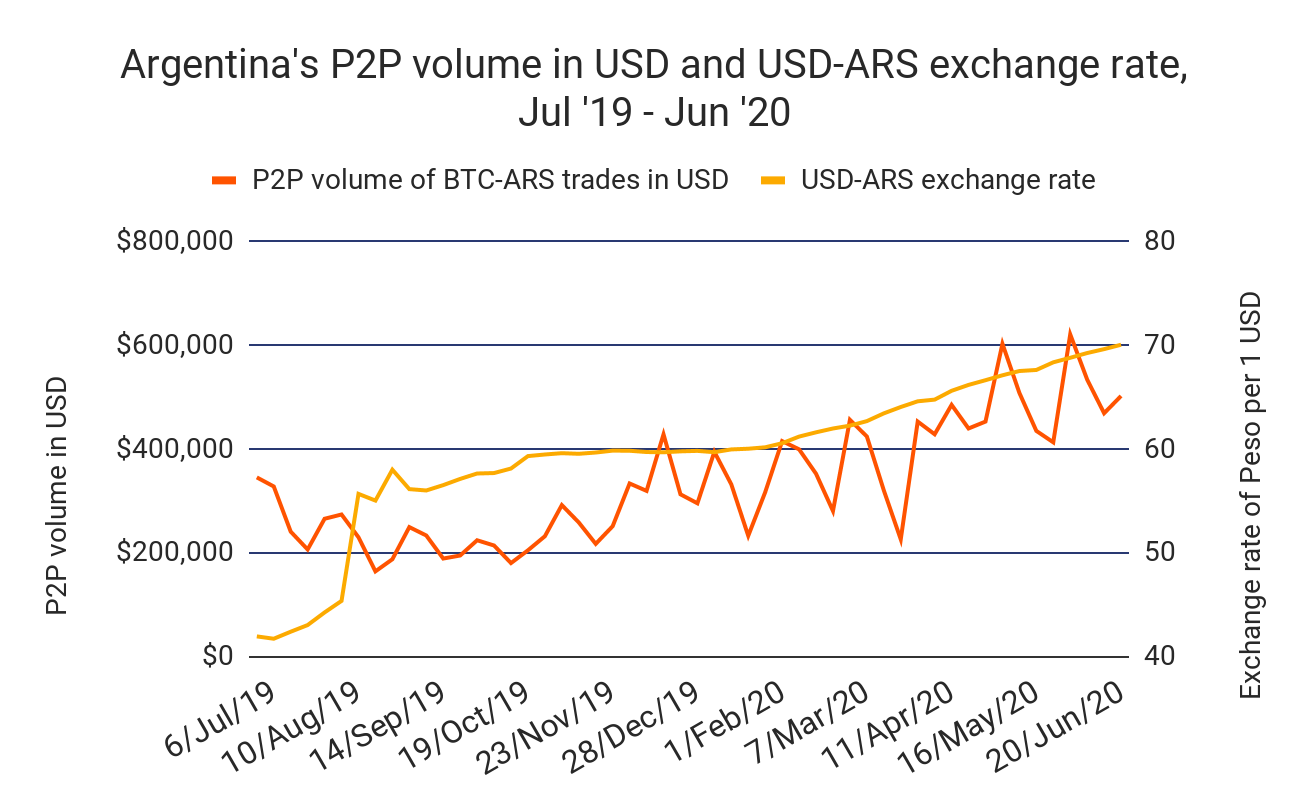

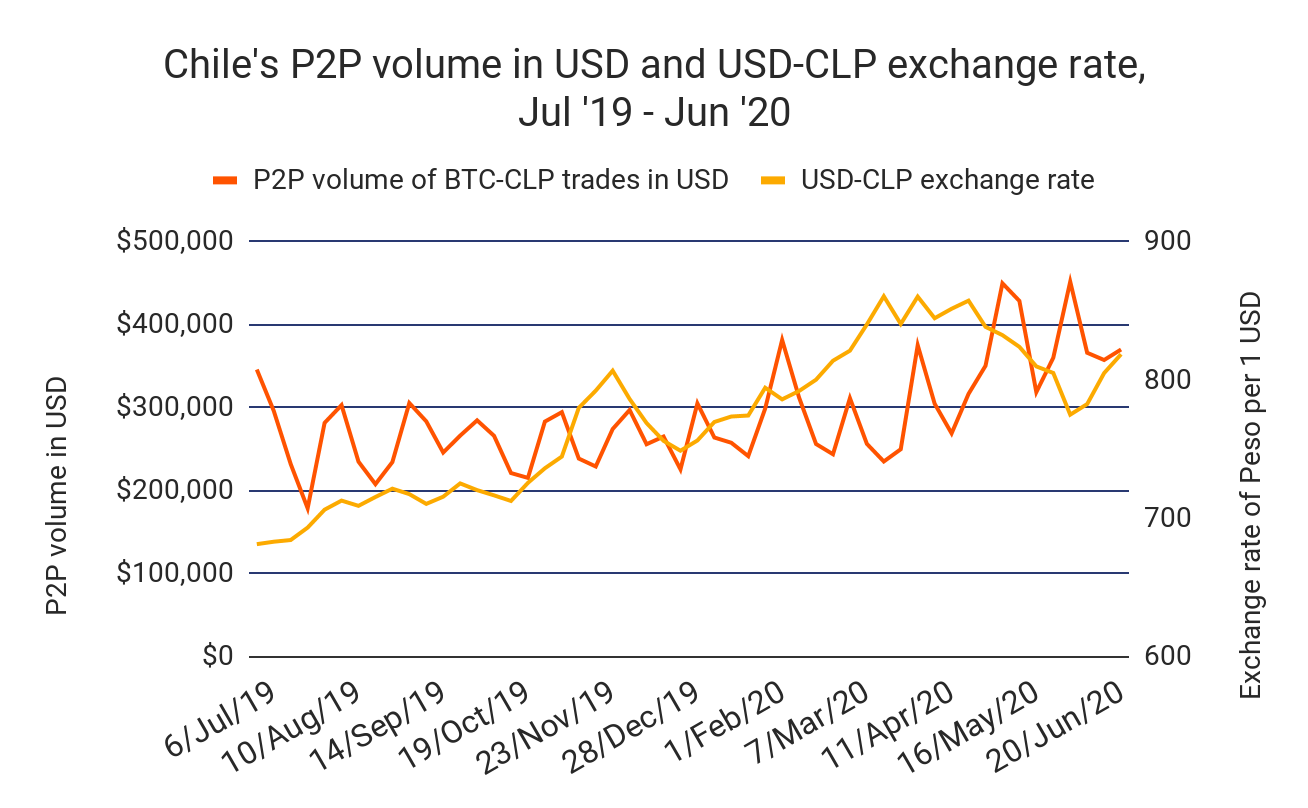

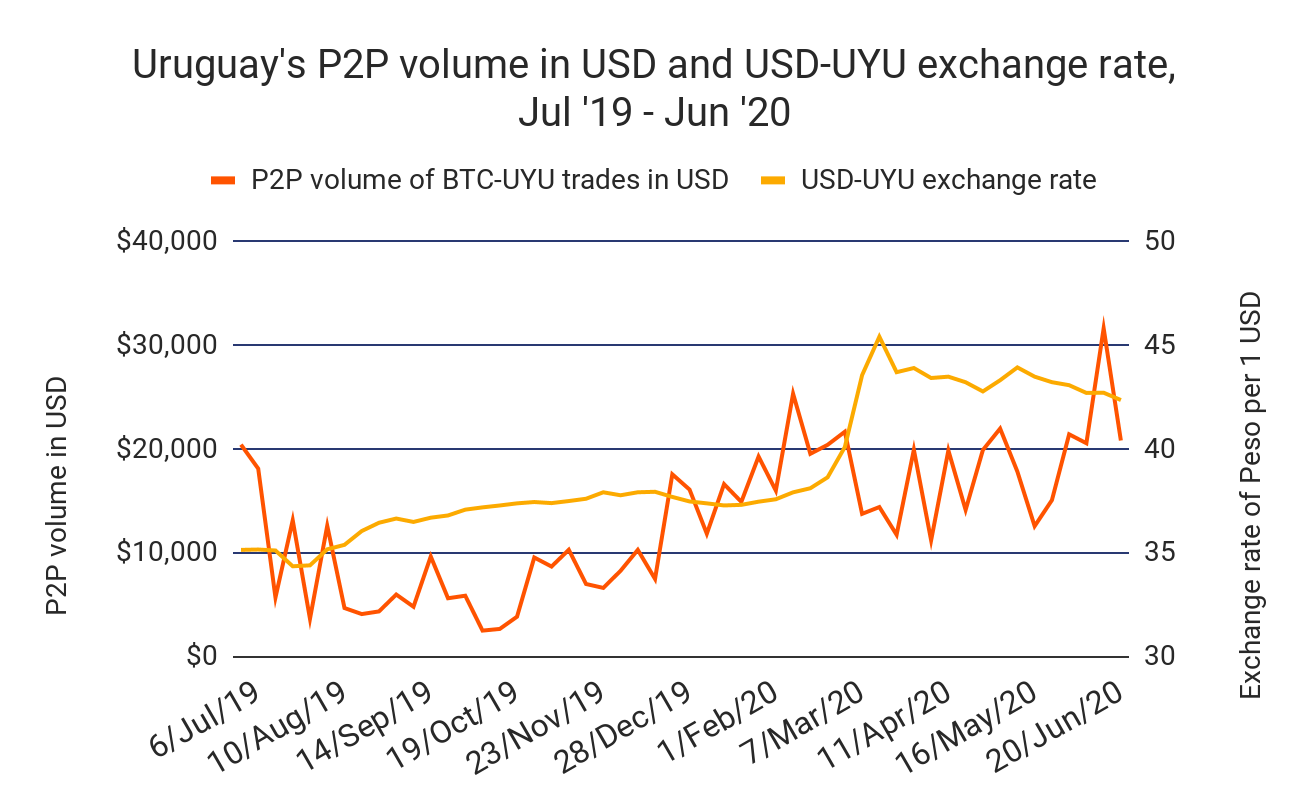

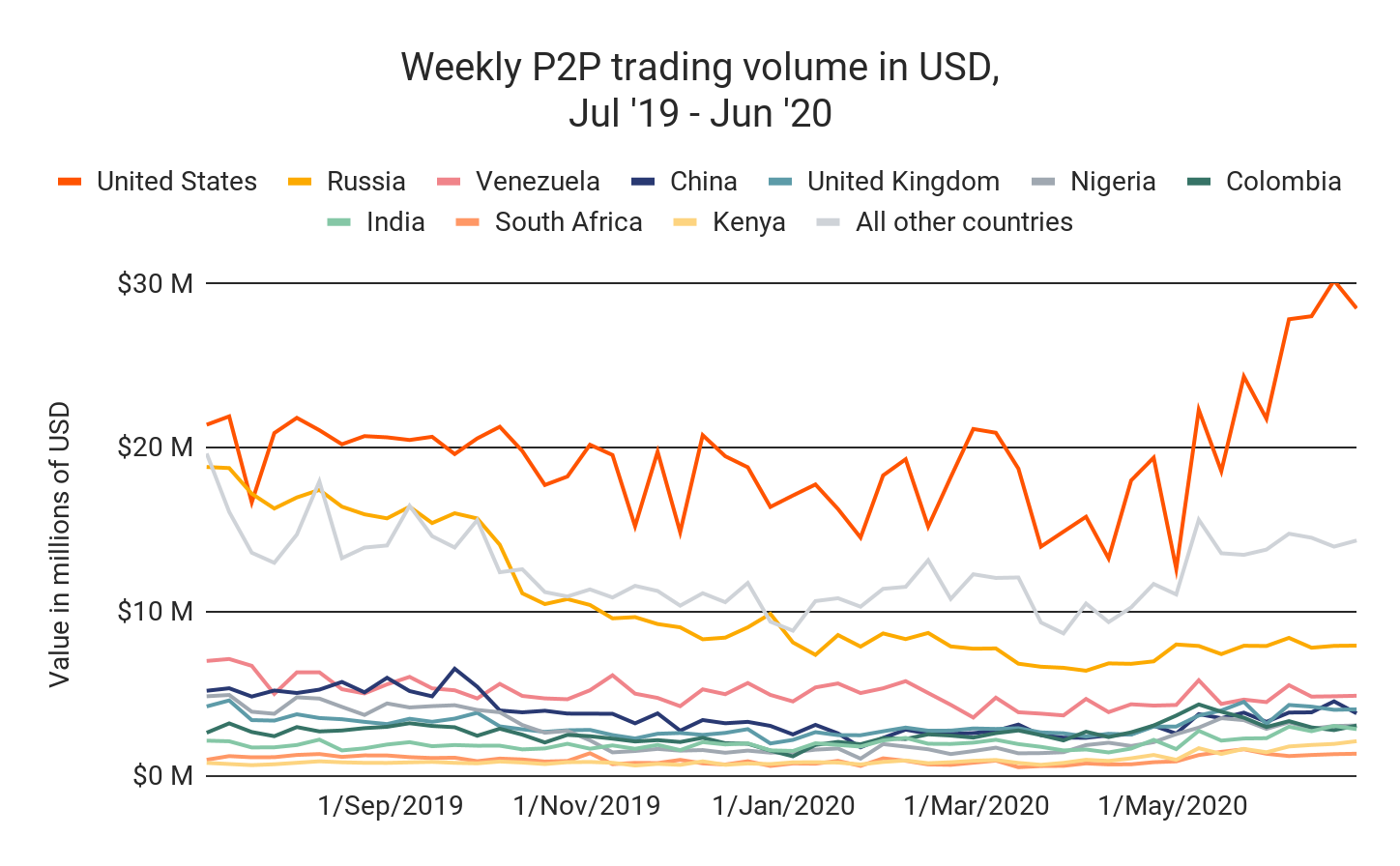

Analysis of peer-to-peer (P2P) exchange trading volume reveals just how much currency devaluation drives cryptocurrency adoption in many Latin American countries. The bar chart below shows the correlations between the USD value of P2P transaction volume and currency devaluation in several Latin American countries, measured by the amount of native currency units needed for $1 USD.

The correlations, each of which is statistically significant, suggest that cryptocurrency users in Argentina, Uruguay, Colombia, and Chile in particular are turning to cryptocurrency as a means to store value when their native fiat currencies are losing value.

Indeed, the amount of P2P trading volume in many Latin American countries rises as native currency depreciates. Latin America-based cryptocurrency operators gave us first-hand accounts of how currency devaluation and economic instability bring users to their platforms. “Venezuela and Argentina especially are printing money like crazy, so their fiat currencies are losing value. That drives a lot of cryptocurrency adoption,” said Sebastian Villanueva of SatoshiTango. He also notes that some countries, like Argentina, limit the amount of U.S. dollars citizens can buy per month, which further limits their options for secure savings and increases the need for cryptocurrency.

Villanueva went on to describe how worsening economic conditions and associated civil unrest drive cryptocurrency adoption. “Last October in Chile, there were mass protests over education, healthcare, and overall economic conditions. Fiat pay platforms saw huge decreases in activity during that time, but we grew by about 35%,” he remembers. “People just want a safe way to store money, and there are no gatekeepers in crypto.”

Trading and speculation, but also scamming

While Latin America has unique cryptocurrency usage patterns based on value storage and transfer for the underbanked, there’s also a robust trading and speculation market in the region similar to what we see in the rest of the world.

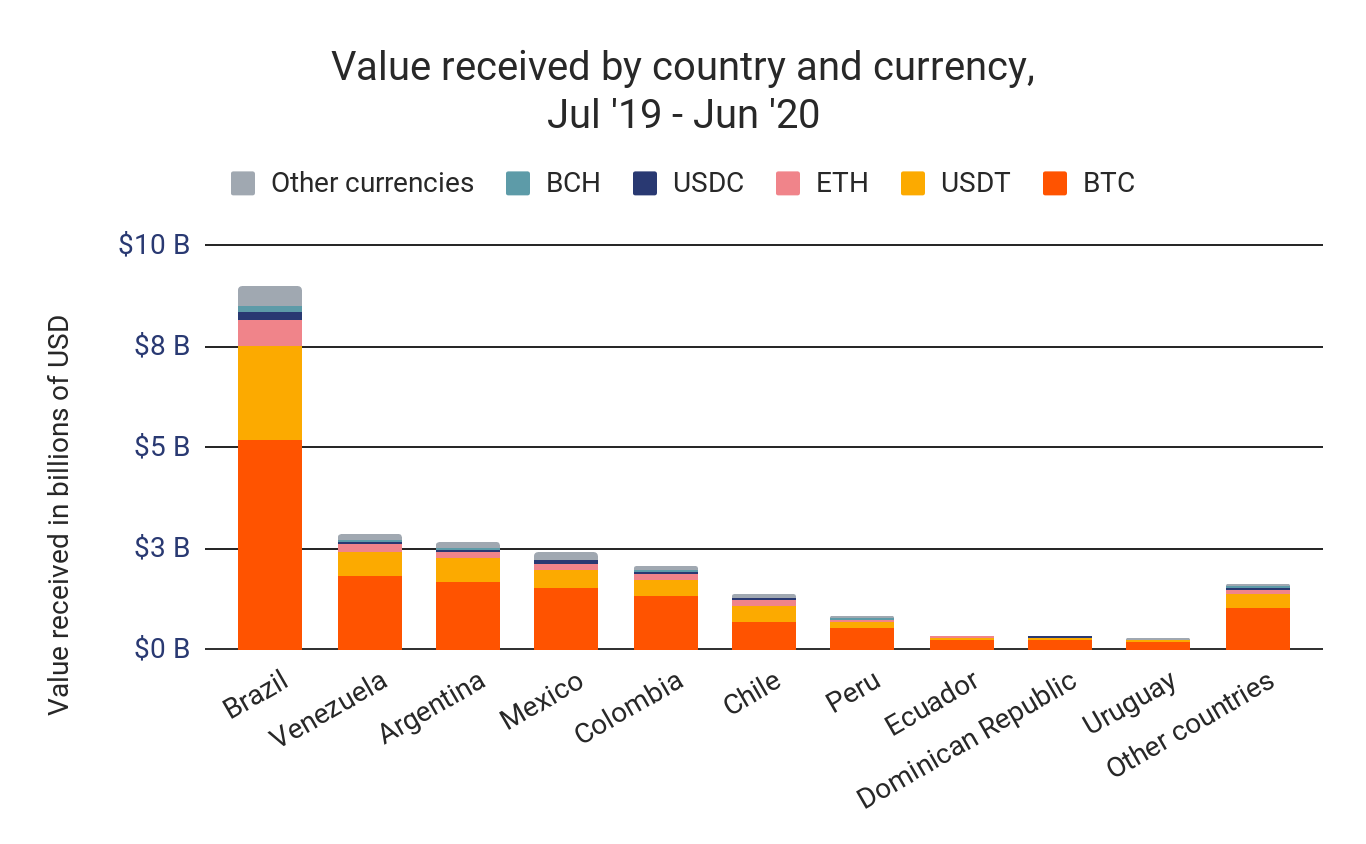

Let’s start with a country by country breakdown.

Brazil accounts for by far the most cryptocurrency usage by on-chain volume of all Latin American countries. However, while Venezuela appears to be a distant second, its role becomes more pronounced when we look at P2P trading volumes. In fact, Venezuelans account for the third-highest number of transfers on LocalBitcoins and Paxful, two of the most popular worldwide P2P exchanges.

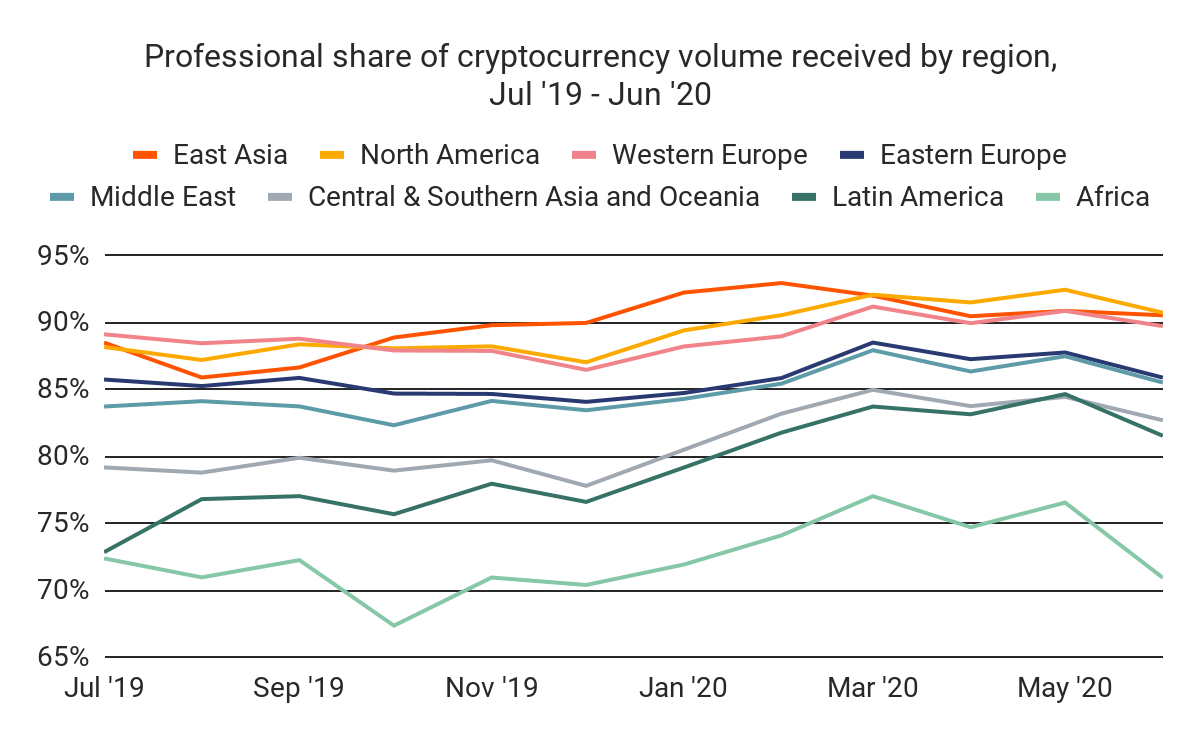

While Latin America has the second-highest share of total activity composed of retail trades (defined as transfers of under $10,000 USD worth of cryptocurrency), the professional market still accounts for roughly 80% of all volume transferred in a given month.

We spoke with representatives from Hashdex, a cryptocurrency-focused hedge fund headquartered in Brazil, who told us that a desire for potential high yield assets with uncorrelated returns is driving cryptocurrency adoption amongst professional investors, such as those representing pension funds and family offices.

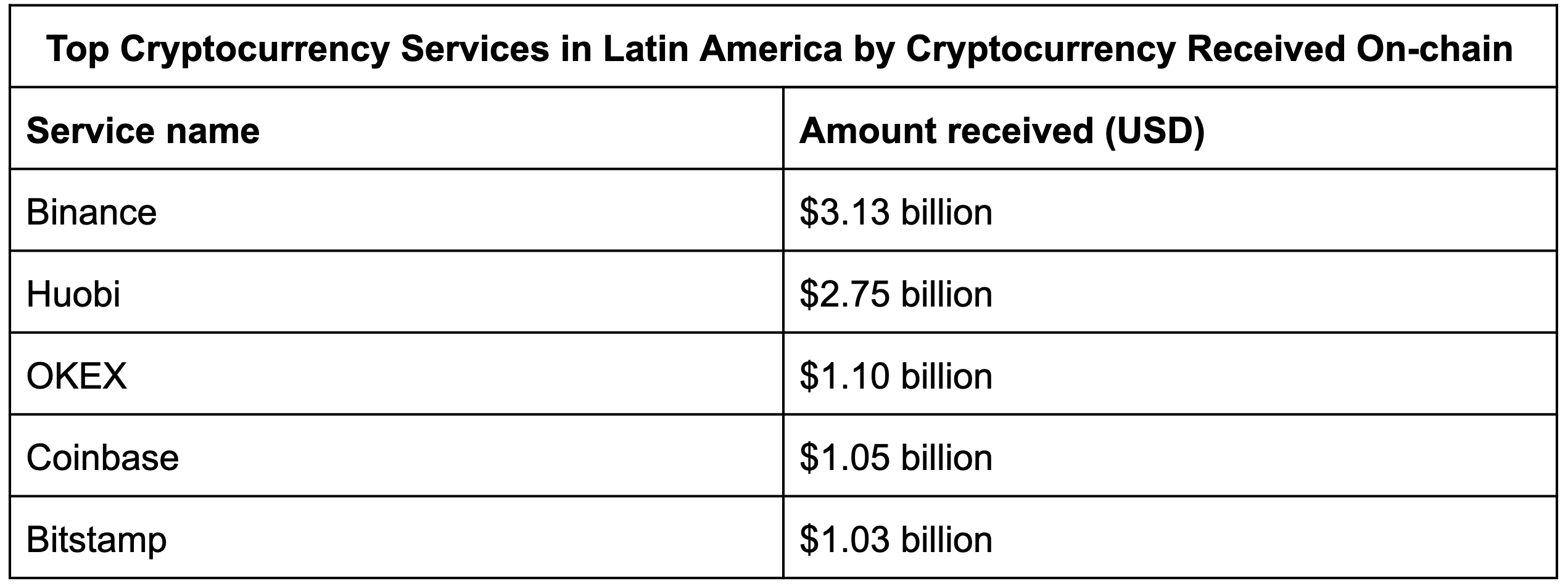

However, similar to other parts of the world, Latin America has a class of quasi-professional investors engaging in significant trading and speculation. Most of these traders prefer to operate on large, international exchanges like Binance, which we see reflected in the table below showing the top five services receiving cryptocurrency from and sending it to Latin America:

Bitso Head of Regulatory Risk Patricia Risso explained to us that many traders will use fiat to buy Bitcoin or stablecoins like Tether from local services or P2P exchanges, and then use those funds as an on-ramp to larger exchanges like Binance, where they can access more trading pairs and greater liquidity. Several other sources confirmed this is a common pattern not just in Latin America, but in other developing regions as well. We believe that this activity makes up a significant share of the stablecoin transfer volume we note elsewhere in this section.

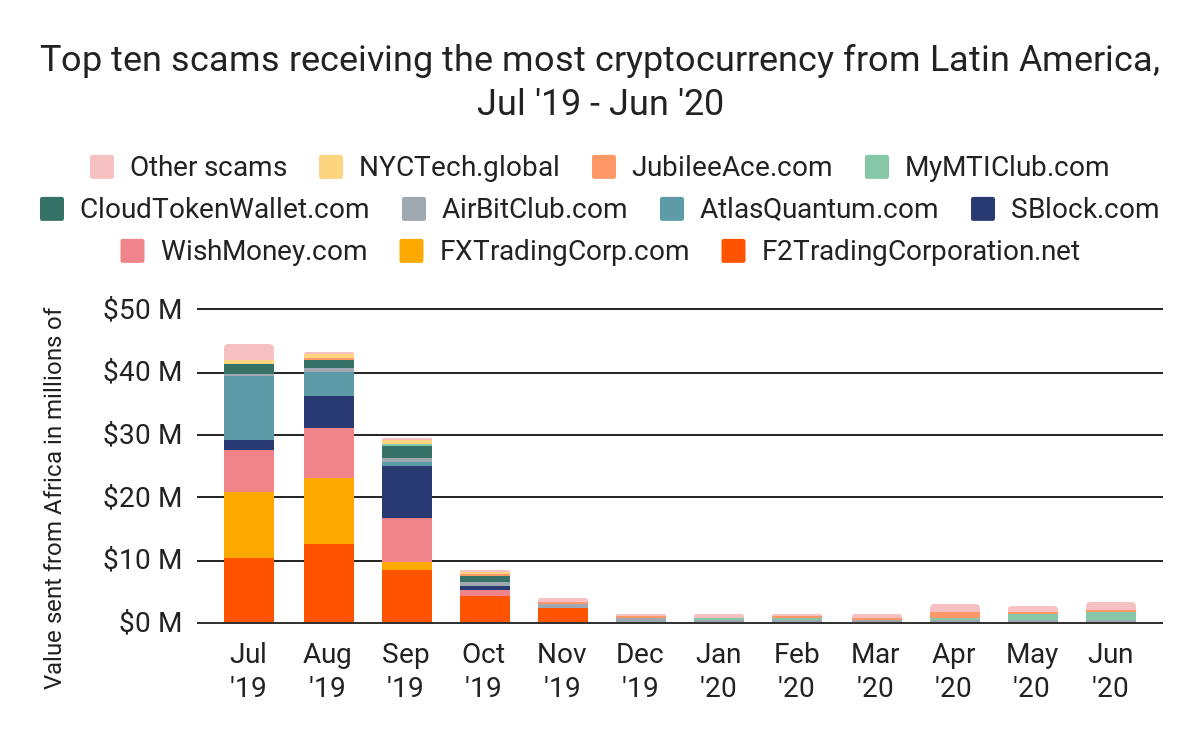

Latin America also has the highest share of cryptocurrency activity made up of transfers to or from criminal entities, making up 2.4% of all the region’s receiving volume moved over the last year and 1.6% of sending volume. 61% of this activity is related to cryptocurrency scams, the largest collecting value from Latin American victims being F2TradingCorp, FXTradingCorp, and WishMoney, which accounted for most of the illicit transfers between July and November 2019 when Latin America crypto crime was at its highest. For the time being though, illicit transfers in Latin America appear to be on a sharp decline.

Want more insights into how cryptocurrency usage differs by region? Sign up here to get the full Geography of Cryptocurrency Report delivered to your inbox as soon as it comes out! You’ll get more original data and research on inter-regional trading patterns, the state of crypto crime by region, how cryptocurrency mitigates economic instability in the developing world, and more!