When the Ethereum blockchain was released in 2015, it pioneered an ecosystem powered by smart contracts on top of which users can develop and interact with decentralized applications. As decentralized finance (DeFi) grew, it provided users with opportunities to participate in a broad range of peer-to-peer financial activities, including trading, borrowing, lending, and new strategies unique to the blockchain.

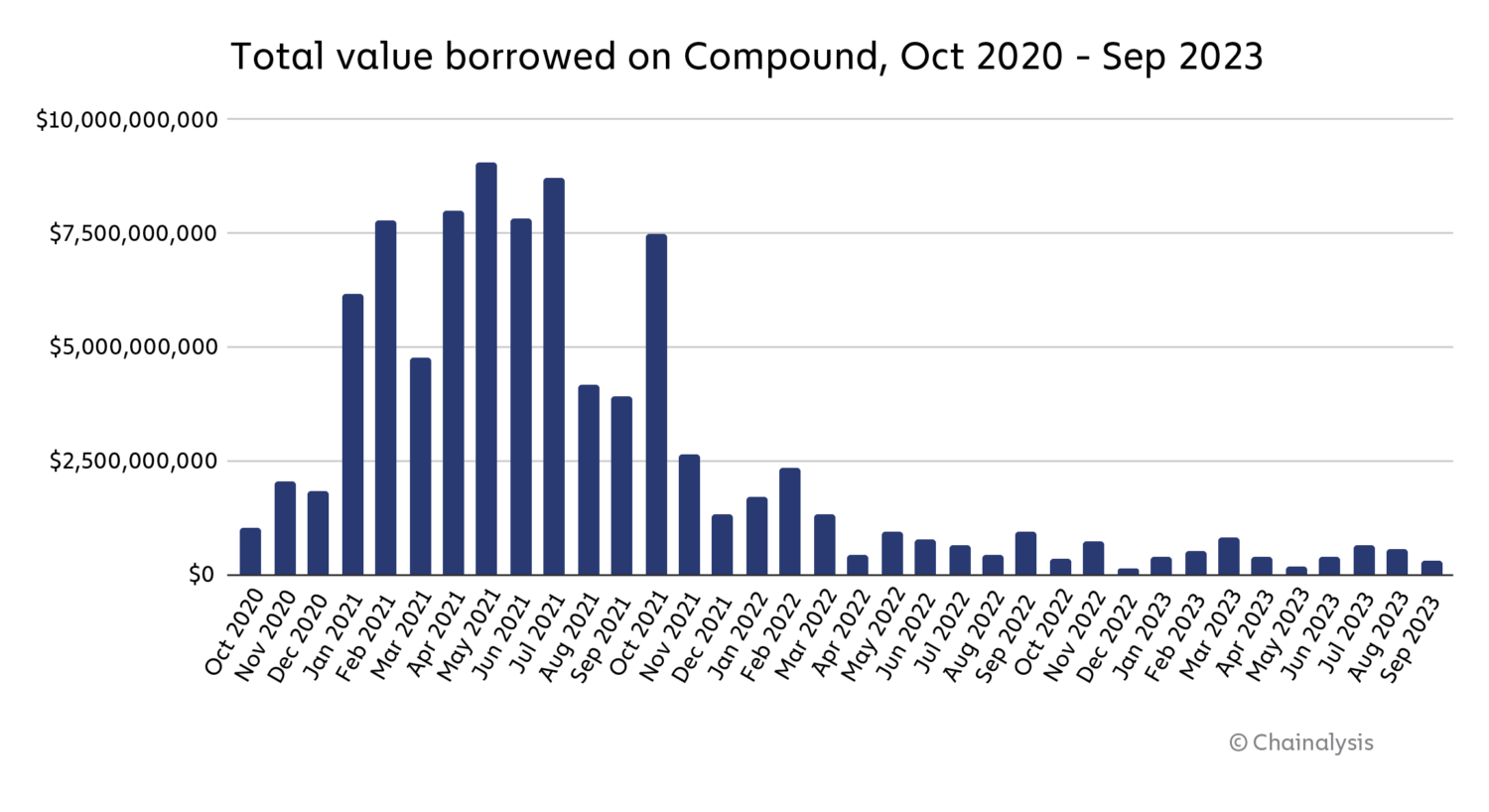

One of these new strategies began on Compound, a borrowing and lending protocol built on Ethereum. Compound distributed COMP tokens to its users, granting them governance rights to influence protocol activities and boost engagement. Within a single day of trading, Compound became the top DeFi protocol, reaching nearly $500 million in staked value. Activity as a result of Compound’s token distribution remained relatively strong with various spikes in activity until the end of 2021.

This data comes from Transpose, the comprehensive source for indexed real-time blockchain data. Click here to pull the data in this chart for yourself.

This historic moment in DeFi, as well as the ease with which Compound distributed tokens, inspired yield farming, which has been one of the main catalysts for DeFi growth.

Keep reading to learn about the following topics and more:

- What is DeFi yield farming?

- Mechanics of Defi yield farming

- Risks and challenges of DeFi yield farming

What is DeFi yield farming?

Yield farming involves depositing funds into decentralized protocols in exchange for interest, often in the form of protocol governance tokens or other monetary rewards. These funds then become available to other ecosystem participants to borrow on margin to use for various trading activities, or can act as liquidity to facilitate trading in the case of a decentralized exchange powered by an automated market maker (AMM). Consequently, yield farming provides both passive and active opportunities for users to put their capital to work when it otherwise may be sitting idle.

How DeFi yield farming is similar to and different from traditional investment methods

Although yield farming has been transformative for DeFi, the general concept is not new. In traditional finance, there are several methods for earning interest and rewards, such as opening a savings account, purchasing a certificate of deposit (CD), or investing in certain equities that provide dividends.

However, all of the above methods require the use of an intermediary or third party. Yield farming occurs in a decentralized environment; therefore, borrowing and lending are peer-to-peer (P2P) and executed automatically by smart contracts.

Benefits and advantages of DeFi yield farming

Yield farming is beneficial for both DeFi platforms and their users.

Platforms that distribute tokens increase token circulation, which helps boost user participation and liquidity. Additionally, if tokens provide governance rights, they help platforms maintain healthier levels of decentralization.

For users, yield farming opens opportunities for passive capital appreciation and active speculation, both of which may be more lucrative than interest rates available through traditional financial instruments. Additionally, yield farming is open to anyone — regardless of net worth — because there are fewer capital requirements than those of traditional banks.

Mechanics of DeFi yield farming

Similar to other investing and trading activities in DeFi, yield farming is powered by smart contracts, which automate borrowing, lending, and capital exchange. The assets themselves are deposited into a smart contract address associated with a given protocol and may have various lockup periods.

The specific mechanics of yield farming vary according to protocol and employed strategy.

Underlying protocols and mechanisms

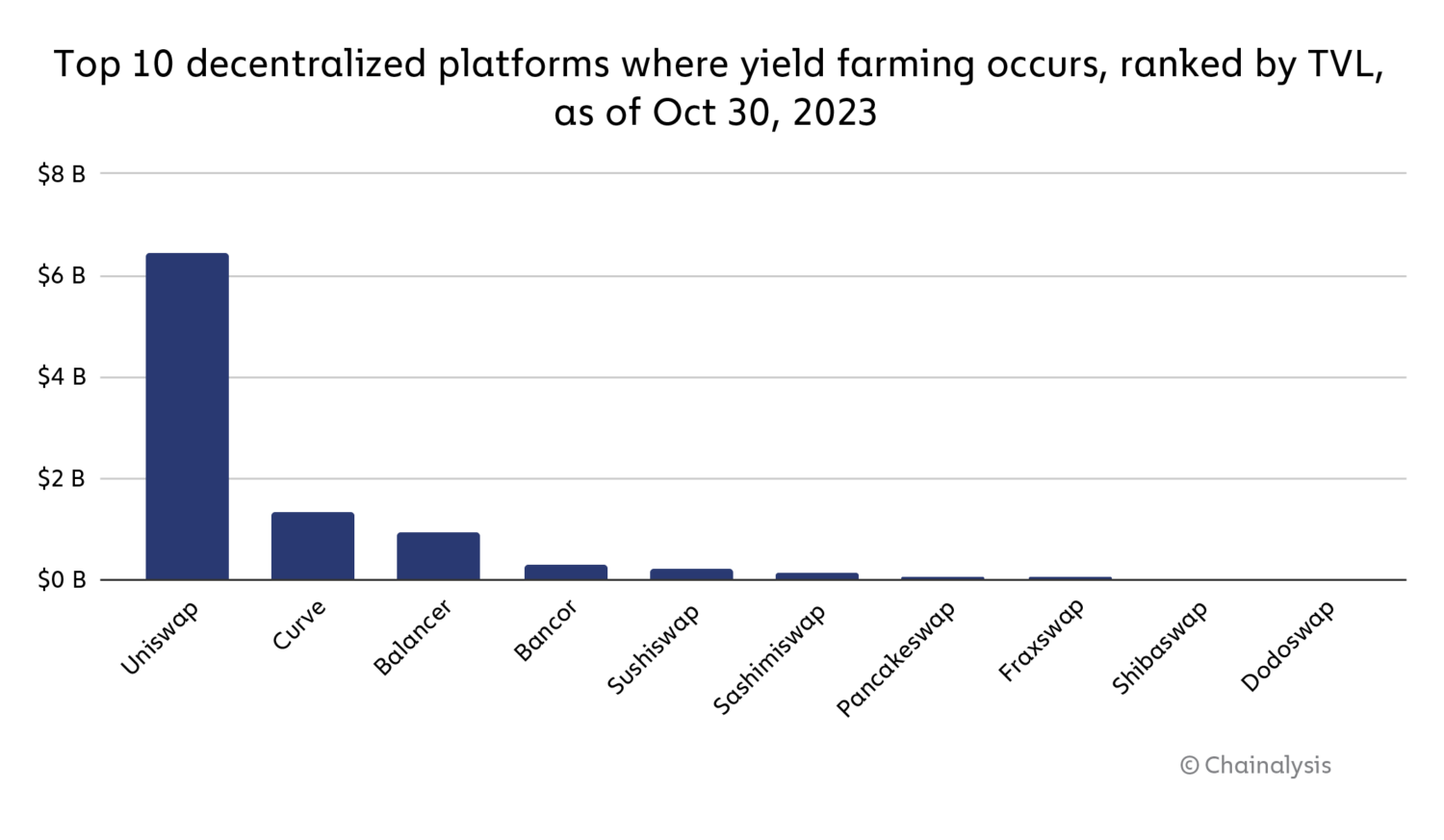

Yield farming is possible on the Ethereum network using ERC-20 tokens. Within Ethereum, yield farming occurs on a variety of different platforms, such as decentralized exchanges (DEXs), lending and borrowing protocols, and liquid staking providers. Popular platforms where yield farming occurs include Aave, Curve Finance, Uniswap, Balancer, and Yearn Finance.

Below are the top 10 DeFi platforms where yield farming occurs, ranked by total value locked (TVL). We analyzed this data using Transpose, a data and infrastructure company we acquired this year that allows users to explore historical and real-time blockchain activities.

Pull this data yourself on Transpose

Currently, yield farming does not occur on Bitcoin. However, wrapped Bitcoin (wBTC) allows users to bring Bitcoin to the Ethereum network and other DeFi protocols for similar borrowing and lending opportunities.

Key components of Defi yield farming

Although there are many yield farming strategies — both active and passive — the three major components are staking, lending, and providing liquidity.

- Staking occurs when platform participants purchase and lock up tokens for a given period in exchange for interest.

- Lending occurs when platform participants make deposited funds available to others to borrow on margin.

- Providing liquidity occurs when participants deposit tokens into decentralized exchanges (DEXs) to boost capital availability and share in trading revenue.

Risks and challenges of DeFi yield farming

Most high-reward strategies — both in traditional financial markets and cryptocurrency markets — come with high risk. Yield farming is no different. Below, we’ll explore some of the risks of yield farming, including smart contract vulnerabilities, impermanent loss on returns, and market volatility.

Smart contract vulnerabilities

Smart contracts ensure that transactions involved in yield farming are automatically executed. Although smart contracts boost efficiency and accuracy, a bug in their code could lead to vulnerabilities to hacking and fraud, and cause a token’s price to drop. For instance, DeFi protocol Harvest Finance was the victim of a multi-million dollar flash loan attack in 2020.

Impermanent loss and impact on returns

Impermanent loss is the difference between the initial value of funds deposited into a liquidity pool and their subsequent value. Impermanent loss can impact yield farming in a variety of ways. For example, rapid token price shifts may cause deposited funds to lose most of their value.

Yield farmers may be able to mitigate impermanent loss or negative impact on returns in certain situations, such as depositing asset-backed stablecoins, which typically experience lower price volatility than other digital assets. Another way is to participate in a platform that offers high transaction fee revenue, which can compensate investors for some losses.

Market volatility impact

Market cycles may bring higher levels of volatility, which directly affect token price and available interest rates. However, yield farmers who are skilled at analyzing market volatility may be able to benefit from arbitrage opportunities or other cyclical strategies.

How Chainalysis uses Transpose to analyze yield farming

Chainalysis and its customers can leverage Transpose’s structured blockchain data to analyze a variety of activities on the blockchain. Decentralized protocols offering yield may benefit from Transpose to populate their frontend interfaces, provide transaction status updates, and build improved user experiences. Yield farmers themselves can examine historical and real-time activity to better evaluate protocols and tokens. Visit Transpose for more information and to explore these data capabilities.

Want to explore the power of real-time, indexed blockchain data?

Check out Transpose's structured blockchain data set to streamline your development process at scale.

This website contains links to third-party sites that are not under the control of Chainalysis, Inc. or its affiliates (collectively “Chainalysis”). Access to such information does not imply association with, endorsement of, approval of, or recommendation by Chainalysis of the site or its operators, and Chainalysis is not responsible for the products, services, or other content hosted therein.

This material is for informational purposes only, and is not intended to provide legal, tax, financial, or investment advice. Recipients should consult their own advisors before making these types of decisions. Chainalysis has no responsibility or liability for any decision made or any other acts or omissions in connection with Recipient’s use of this material.

Chainalysis does not guarantee or warrant the accuracy, completeness, timeliness, suitability or validity of the information in this report and will not be responsible for any claim attributable to errors, omissions, or other inaccuracies of any part of such material.