Over the years, as the cryptocurrency landscape has grown beyond Bitcoin and Ethereum, we’ve seen a thriving ecosystem of numerous blockchains, each offering unique assets, functions, and communities. But with this expansion comes the rising demand to move data and value across different blockchains — a demand that’s as challenging as it is essential. Unlike centralized systems, individual blockchains operate in isolation, unable to natively verify or interact with other networks. This lack of “cross-chain communication” poses a fundamental problem: How do you securely transfer information or assets from one blockchain to another without direct trust or interoperability?

This is where cross-chain bridges come in. These innovative solutions are designed to enable communication between blockchains, allowing users to seamlessly move assets, data, and other values across the ecosystem.

In this blog, we’ll explore the following topics:

- What are cross-chain bridges?

- How do cross-chain bridges work?

- Benefits and use cases of cross-chain bridges

- Challenges of cross-chain bridges

- How Chainalysis supports cross-chain bridge investigations

What are cross-chain bridges?

Cross-chain bridges are the connective tissue that allow different blockchains to securely share data and assets. At their core, these bridges employ a messaging system that permits blockchains to pass information to each other in a verifiable way. Instead of relying on a centralized intermediary, trustless bridges use automated software on each blockchain to exchange and verify messages independently. This approach ensures that data and assets can move seamlessly across disparate networks, upholding the security and transparency that define blockchain technology.

How do cross-chain bridges work?

The mechanics of cross-chain bridges vary depending on the type of bridge, but their core purpose remains the same: to securely transfer data or assets between blockchains that would otherwise be unable to communicate. Below, we’ll look at hypothetical examples of transferring an asset to better understand how this process works.

Locking and Minting Process:

- Initiate a transfer on the source chain: Suppose you have an asset on Ethereum that you want to transfer to Solana. First, you send this asset on Ethereum to a bridge contract, which “locks” it in place.

- Register deposit and notify the target chain: Once the asset is locked, the Ethereum bridge contact registers the deposit and sends a secure message to its counterpart on the Solana blockchain.

- Create a wrapped asset on the target chain: Upon receiving the message, the Solana bridge contract creates a copy of the locked asset, known as a “wrapped” asset. This wrapped asset represents the original Ethereum asset and can be used on the Solana network as if it were native to Solana.

Unlocking and Burning Process (Reversing the Transfer):

- Burn the wrapped asset on the target chain: You send the wrapped asset on Solana to its bridge contract, effectively removing it from circulation. This process, known as “burning,” ensures that the wrapped asset no longer exists on Solana.

- Register burn and notify the source chain: The Solana bridge contract registers the burn and sends a message back to its Ethereum counterpart, confirming the removal of the wrapped asset.

- Unlock the original asset on the source chain: Upon receiving the message, the Ethereum bridge contract unlocks the original asset, returning it to the designated address.

Benefits and use cases of cross-chain bridges

Cross-chain bridges unlock new possibilities within the blockchain ecosystem, providing benefits and use cases that enhance the flexibility and reach of decentralized technologies. Here are some of their key advantages and applications:

- Enhanced interoperability: Cross-chain bridges allow different blockchains to communicate and share assets, promoting a more interconnected network. This interoperability is foundational for combining the unique strengths of different networks.

- Expanded decentralized finance (DeFi) opportunities: By bridging assets across blockchains, users can tap into DeFi platforms on multiple networks, accessing a wider range of lending, borrowing, and staking options.

- Multi-chain decentralized applications (DApps): Bridges enable developers to build decentralized applications that operate across multiple blockchains. For instance, yield farming platforms like Curve Finance and Aave use bridges to allow users to move liquidity between Ethereum and other networks like Polygon and Avalanche.

- Enhanced user choice and flexibility: With cross-chain bridges, users can choose blockchains that best suit their needs, whether that includes lower fees, faster transactions, or specific DApp functionalities. This flexibility ultimately broadens access to blockchain technologies.

As we see in the chart below, the high levels of monthly transaction volume bridged across chains demonstrate that users are actively leveraging cross-chain bridges for these diverse use cases. In 2024, monthly transaction volume has hovered between $1.5 billion and $3.2 billion.

Challenges of cross-chain bridges

While cross-chain bridges open up exciting opportunities, they also bring significant challenges. Here are some of the primary obstacles surrounding bridges:

- Fragmented data across chains: Monitoring cross-chain activity is complex due to fragmented data, as transactions span multiple blockchain platforms that do not naturally share information. This makes it harder to get a clear picture of activities.

- Obscured transaction paths: Cross-chain bridges introduce intricate transaction trails, often involving multiple smart contracts and intermediary steps. This complexity can make it difficult to detect illicit activities, money laundering, or other suspicious transactions.

- Security complications: Security is a top concern for cross-chain bridges, as they act as points of interaction between blockchains with different protocols and rules. These bridges are vulnerable to attack if any part of the bridge infrastructure is compromised, and even minor vulnerabilities can lead to large-scale exploits or asset losses.

How Chainalysis simplifies cross-chain bridge investigations

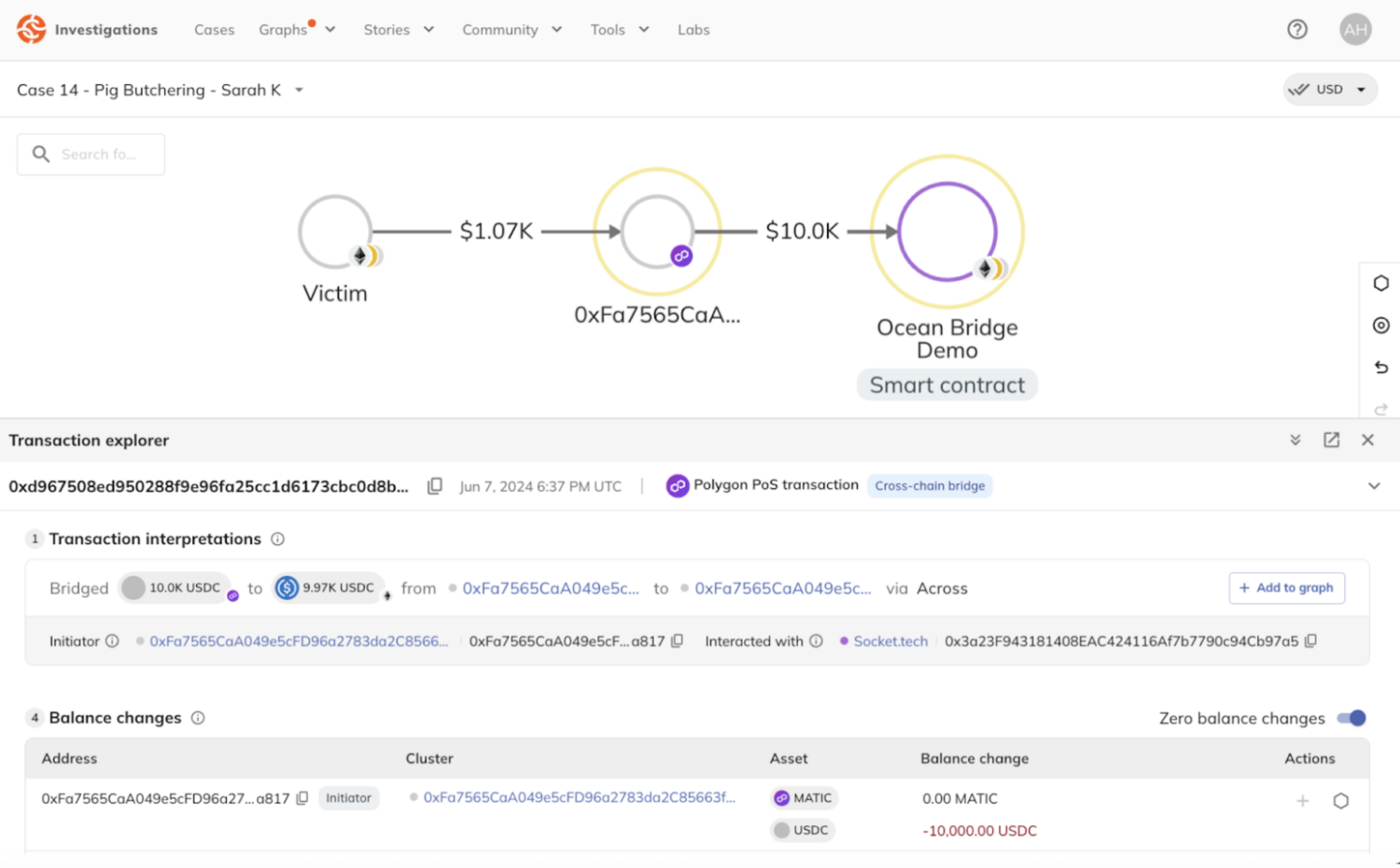

Tracing funds across blockchains doesn’t have to be complicated. With Chainalysis Reactor’s Transaction Explorer, investigators can seamlessly and precisely follow funds across hundreds of bridge protocols and decentralized exchanges (DEXs) with a single click.

Our clear, human-readable interpretations simplify smart contract activity, making it easy to understand transactions like NFT sales, DEX swaps, approvals, token transfers, and more, without deep technical expertise.

Chainalysis offers unmatched data coverage, spanning more than 25 blockchains, 17 million assets, and 220 million bridge transactions. Investigators can trace through even the most intricate financial trails, uncovering where funds originated, where they’re headed, and every connection along the way.

Request a demo to see how Chainalysis Crypto Investigations Solution makes this possible.

This website contains links to third-party sites that are not under the control of Chainalysis, Inc. or its affiliates (collectively “Chainalysis”). Access to such information does not imply association with, endorsement of, approval of, or recommendation by Chainalysis of the site or its operators, and Chainalysis is not responsible for the products, services, or other content hosted therein.

This material is for informational purposes only, and is not intended to provide legal, tax, financial, or investment advice. Recipients should consult their own advisors before making these types of decisions. Chainalysis has no responsibility or liability for any decision made or any other acts or omissions in connection with Recipient’s use of this material.

Chainalysis does not guarantee or warrant the accuracy, completeness, timeliness, suitability or validity of the information in this report and will not be responsible for any claim attributable to errors, omissions, or other inaccuracies of any part of such material.