Today, we’re excited to announce Chainalysis Storyline: the new, web3-native blockchain analysis tool, designed to visualize smart contract transactions, including DeFi and NFTs.

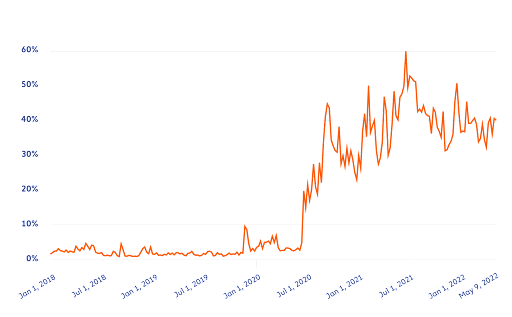

DeFi and NFTs are two of the fastest-growing areas of cryptocurrency, with nearly half of crypto transactions involving a decentralized financial provider, NFT collection or related smart contract.

% of all crypto transactions involving DeFi or NFT

or related smart contracts

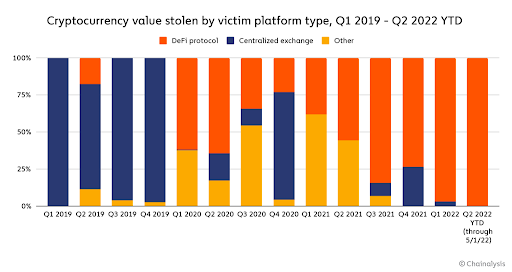

Likewise, DeFi’s role in cryptocurrency-based crime is also growing, as the total value moving to DeFi protocols from illicit addresses is increasing every year. Over the course of 2021, DeFi protocols became the go-to target for hackers looking to steal cryptocurrency.

DeFi protocols have accounted for an ever-growing share of all funds stolen from cryptocurrency platforms since the beginning of 2020, and lost the vast majority of stolen funds in 2021. As of May 1, DeFi protocols account for 97% of the $1.68 billion worth of cryptocurrency stolen in 2022.

Even worse, much of the cryptocurrency stolen from DeFi protocols has gone to hacking groups associated with the North Korean government, especially in 2022. The growth of DeFi transactions creates new technical challenges for cryptocurrency investigators and compliance teams, as decentralized protocols and the applications they power create more complex, difficult-to-trace transactions than traditional centralized services. Storyline mitigates these challenges in several ways, which we’ll explore below.

How Storyline reinvents investigations for web3

When Chainalysis invented blockchain analysis tools in 2014, very few people understood what was happening on Bitcoin blockchain. Transaction records were difficult to interpret and it was hard to distinguish between addresses in a private wallet and an address on a custodial exchange. Reactor solved this problem by providing an easy way to visualize relationships between on-chain transactions and real world identity. Our goal with Chainalysis Storyline is to bring this same simplicity to the more complex multi-chain world of DeFi, and make it easy for our users to comprehend the blockchains of the web3 era. How exactly does DeFi make cryptocurrency transactions more complicated for investigators? The core issue is chain hopping.

What is chain hopping?

DeFi protocols have made chain hopping easy, allowing users to switch between several different kinds of cryptocurrency in a single transaction. Cross-chain graphing in Chainalysis Reactor can mitigate much of the complexity of chain hopping, but tracking funds across blockchains to separate destinations can still be time-consuming. Learn more about Advanced Obfuscation Techniques: Mixing, CoinJoins, Chain Hopping, and Privacy Coins.

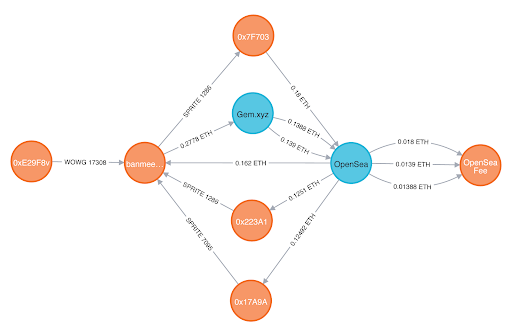

Another issue with chain hopping is that many seemingly simple DeFi transactions actually involve multiple smart contracts, making them appear more complex on the blockchain than they really are. For example, below we see what a typical NFT transaction looks like in a standard blockchain explorer.

Even though at its core, this transaction represents one wallet selling an NFT to another, there are multiple other smart contracts involved, which will therefore be reflected on the blockchain: OpenSea as the NFT marketplace, the NFT collection’s smart contract, both users’ proxy contracts, and a few others. While an investigator following the NFT is likely only interested in the wallets belonging to the buyer and sellers, they would still have to parse the other entities to follow the funds.

Chainalysis Storyline solves these complexities created by chain hopping with a new, web3-native blockchain analysis tool that provides a holistic view of the movements of all funds an address has transacted with across blockchains, but still allows investigators to concentrate on the transactions and funds that matter most to them.

With Storyline, a user constructs a new story by starting with a transaction hash. The easy-to-use interface allows you to focus on the transactions, assets and related wallets that are of most interest. With a few clicks you’ve built a timeline of the most important interactions that clearly illustrate the movement of tokens.

Storyline is able to interpret smart contracts and will automatically label common types of transactions like an NFT purchase or an asset swap. A user can quickly add additional related transactions in a timeline-based format with a transaction shown in each row and destination addresses — including those on new blockchains — as columns. That way, investigators know right away what tokens a wallet of interest swapped for and when.

Want to focus on the movements of funds from one specific address? Click on that address, and you can see the next five transactions just for funds held by that address. Users can also automate the tracing process for one particular branch of funds by clicking an address and selecting “Trace to end destination,” and skip directly to where the funds are at present. Best of all, Storyline supports all tokens and blockchains, so investigators can trace funds uninhibited regardless of any chain hopping that takes place.

Storyline users can and should still utilize Chainalysis Reactor to view the full transaction histories and exposure profiles of individual wallets and services relevant to their investigations. Together, the two tools work in conjunction to give users a comprehensive but intuitive timeline of cryptocurrency flows in a DeFi environment, until the funds in question reach an end destination or compliant service.

Blockchain intelligence for the web3 era

Storyline can help your organization manage DeFi risk and investigate and communicate complex web3 transactions.