The Federal Trade Commission (FTC) recently issued a press release, warning consumers of scammers impersonating FTC staff members in attempts to steal money from innocent victims. According to the FTC, these scammers typically fabricate urgent financial scenarios and threaten consumers, and some have even referred victims to Bitcoin ATMs. In one instance, FTC impersonators stole approximately $2 million from a woman after warning her that her social security number was compromised and even fabricating a letter from the FTC, stating that her accounts were under investigation.

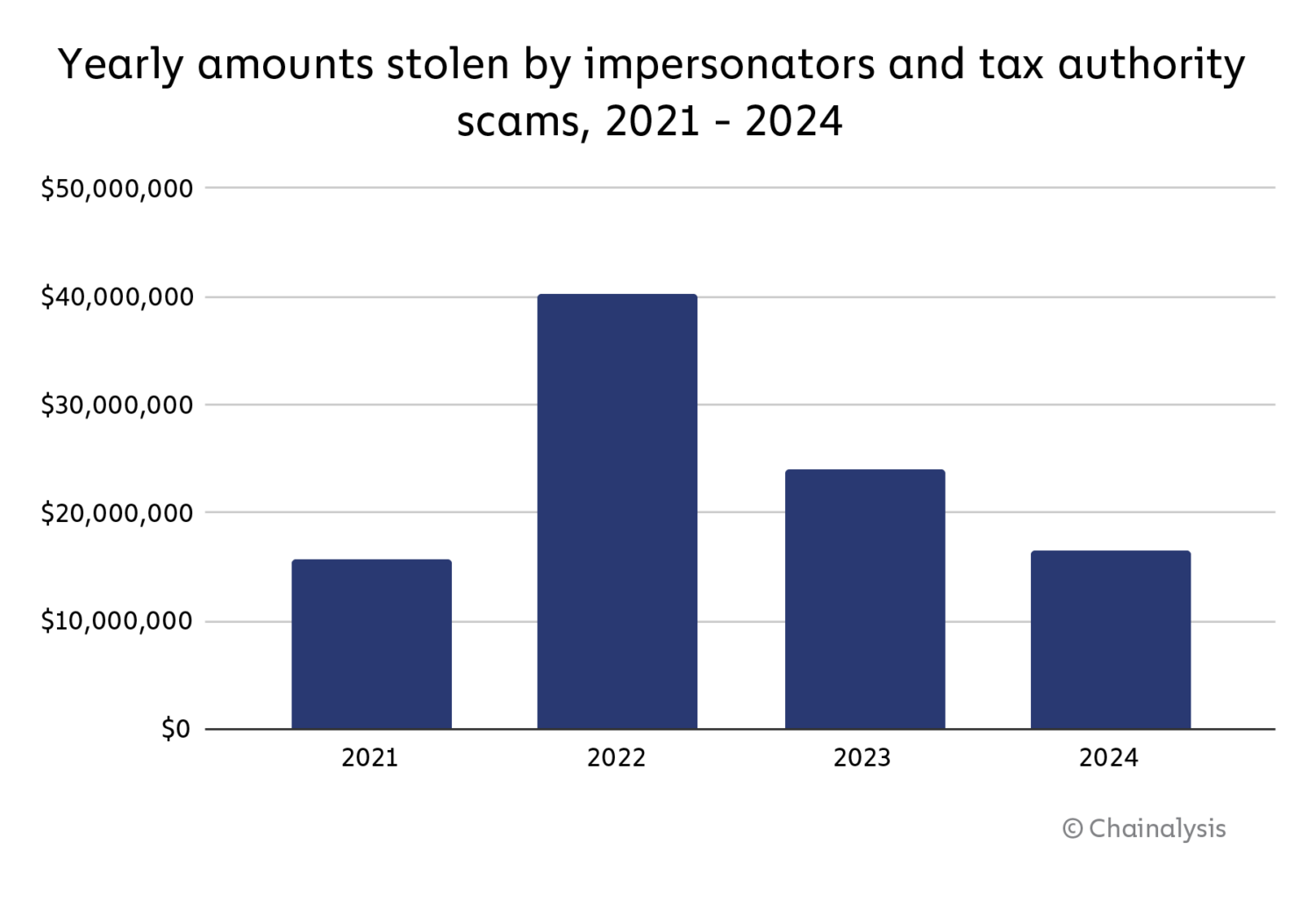

Unfortunately, impersonation scams are on the rise — losses reported to the FTC in 2023 were more than $1 billion. Although most of these impersonators operate using fiat currency, they are increasingly turning to cryptocurrency due to its increased adoption by the consumer population. As we discussed in our 2024 Crypto Crime Report, we estimate that the amount of crypto stolen by impersonators and tax authority scams was approximately $24 million in 2023. In 2024, we estimate that the total amount stolen is nearly $17 million as of April 2024.

In this blog, we’ll look at on-chain activity of suspected FTC impersonators and illustrate how we examined the potential scale of these scams after acquiring a few scammer addresses from victims.

Examining the scale of funds stolen by suspected FTC impersonators

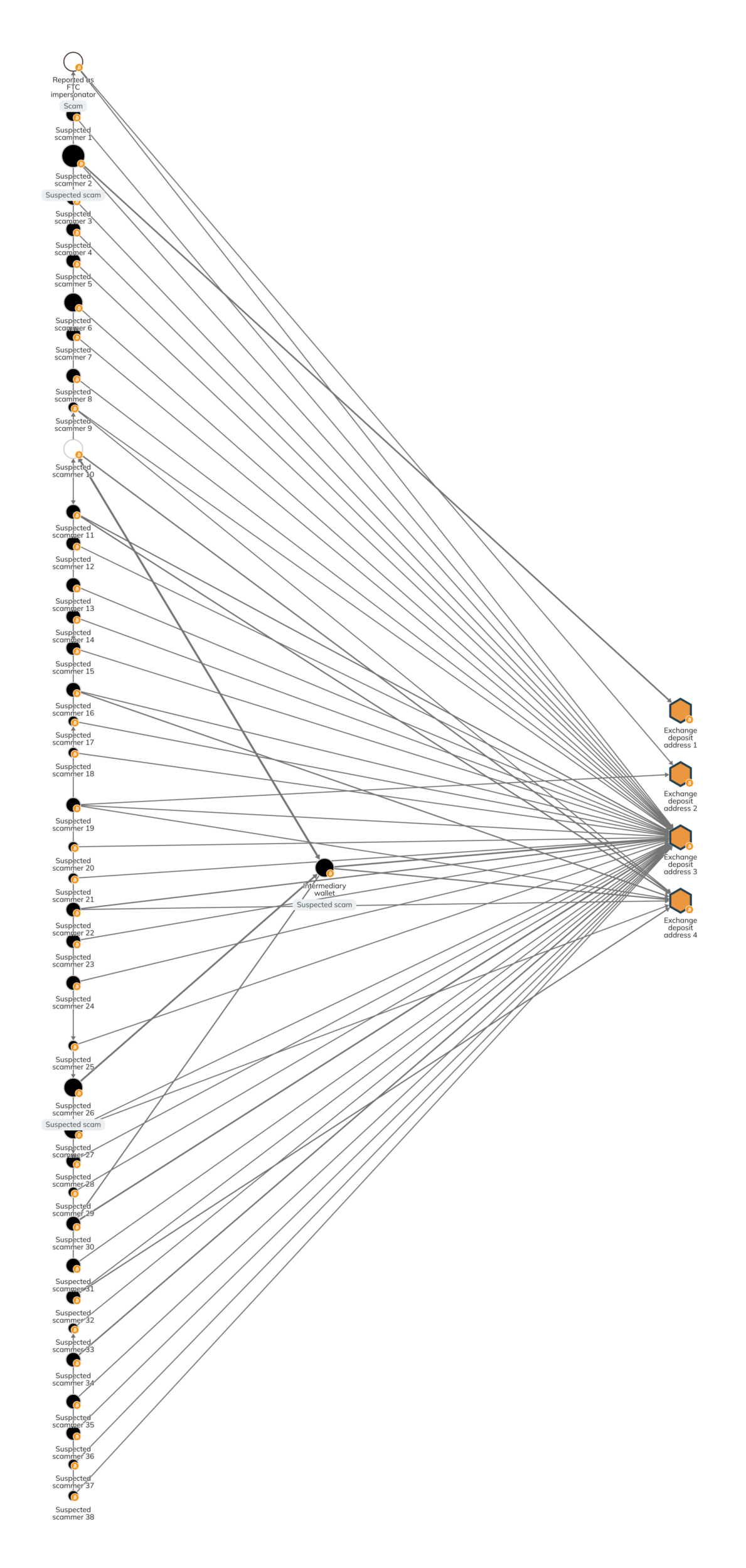

Our on-chain analysis of this suspicious activity began when a victim of an FTC impersonator provided us with the impersonator’s crypto address, which is represented in the top left corner in the below Chainalysis Reactor graph. After successfully acquiring funds from the victim, the operator of this address made several transfers to exchange deposit addresses, which likely represent the cash-out points.

Once we identified the exchange deposit addresses, we were able to look at their receiving exposure, which revealed nearly 40 addresses that behave similarly to the one originally reported by the victim. Given that these addresses have sent funds to the same four exchange deposit addresses, it is likely that they belong to the same scam group sharing crypto wallets or are working with the same money launderer. In total, these addresses represent approximately $1.7 million worth of potential scam activity, illustrating that these losses can be significant, as the real FTC reported.

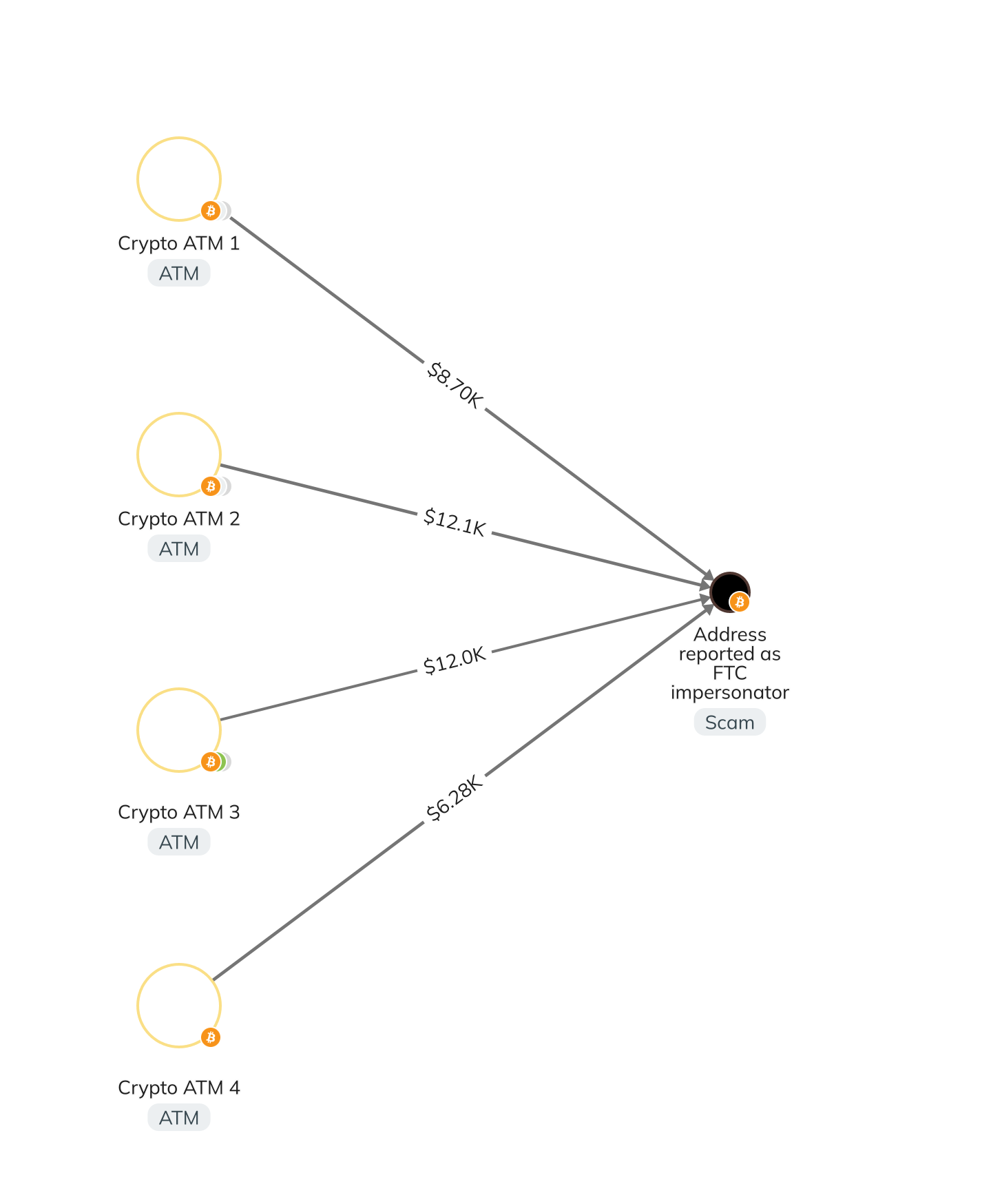

Another factor we examined to determine the likelihood of these addresses belonging to FTC impersonators or a larger scam group is that they received funds from crypto ATMs, which the real FTC identified as a strategy to attract victims. In the below Chainalysis Reactor graph, we see how another address reported to us as an FTC scammer received funds from several crypto ATMs.

FTC Impersonators creating fake “asset recovery” websites

Unfortunately, scammers like the ones above not only approach victims by impersonating organizations, but often prey on victims who have already lost money by creating fake “asset recovery” websites to steal even more money.

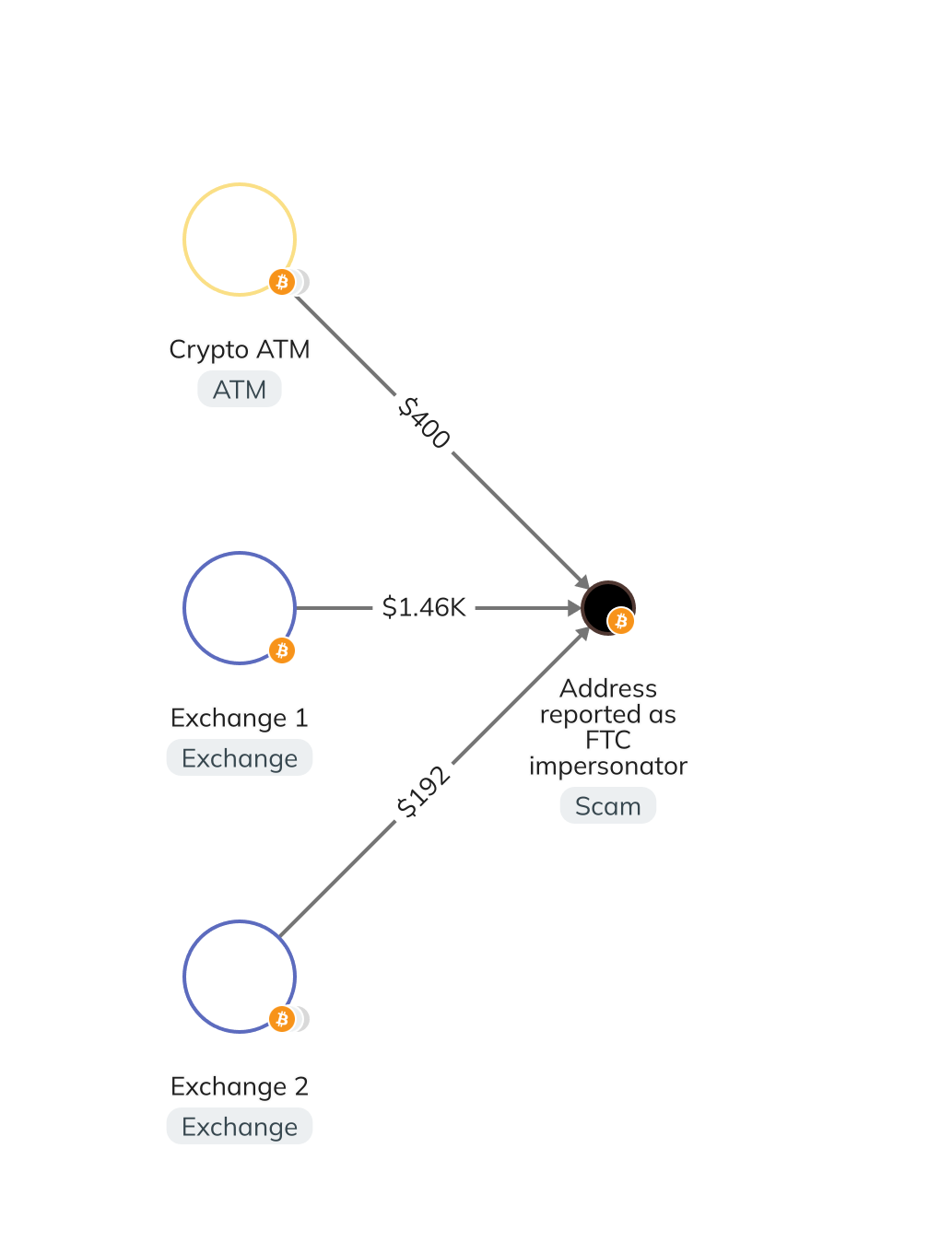

One example of this is a report we received regarding a website that appears to be a submission form created by more FTC impersonators who encourage victims to report scams. The operators of this site likely follow up with victims to trick them into paying more money to “recover their original assets.” The reported address has received payments from both a crypto ATM and exchanges.

How to protect against crypto-related impersonation scams

As the FTC stated in its press release, it “will never send consumers to a Bitcoin ATM, tell them to go buy gold bars, or demand they withdraw cash and take it to someone in person. It will also never contact consumers to demand money, threaten to arrest or deport them, or promise a prize.” Additionally, the FTC implemented its Impersonation Rule on April 1, 2024, outlining the most common impersonation scams and granting the agency more effective tools to deter scammers.

Consumers who come across this suspicious activity or who have been scammed can report it to relevant authorities like the FTC. We hope to help combat these crypto-related scams by providing law enforcement with the best on-chain data and solutions to investigate and bring scammers to justice.

This website contains links to third-party sites that are not under the control of Chainalysis, Inc. or its affiliates (collectively “Chainalysis”). Access to such information does not imply association with, endorsement of, approval of, or recommendation by Chainalysis of the site or its operators, and Chainalysis is not responsible for the products, services, or other content hosted therein.

This material is for informational purposes only, and is not intended to provide legal, tax, financial, or investment advice. Recipients should consult their own advisors before making these types of decisions. Chainalysis has no responsibility or liability for any decision made or any other acts or omissions in connection with Recipient’s use of this material.

Chainalysis does not guarantee or warrant the accuracy, completeness, timeliness, suitability or validity of the information in this report and will not be responsible for any claim attributable to errors, omissions, or other inaccuracies of any part of such material.