On July 21, 2022, Atlanta film producer Ryan Felton pleaded guilty to multiple counts of wire fraud, securities fraud, and money laundering. This is the second time Chainalysis has taken the stand to demonstrate the true transparency of blockchains, following another case in Canada that also resulted in a conviction.

An investigation is only as successful as its prosecution, and this case sets a precedent that blockchain analyses can be used in much the same ways as texts, emails, and other forms of electronic evidence. To the best of our knowledge, we are now the first and only blockchain analysis tool to be tested in U.S. courts.

Here’s how U.S. Head of Investigations Beth Bisbee’s testimony helped secure Felton’s guilty plea.

Evidence of wire fraud

The charges against Felton arose from his fraudulent promotion of the initial coin offerings (ICOs) of two companies:

- FLiK, a streaming platform that Felton falsely represented was co-owned by the rapper T.I., and

- CoinSpark, a cryptocurrency exchange that promised investors a quarterly dividend amounting to 25% of the exchange’s net profits.

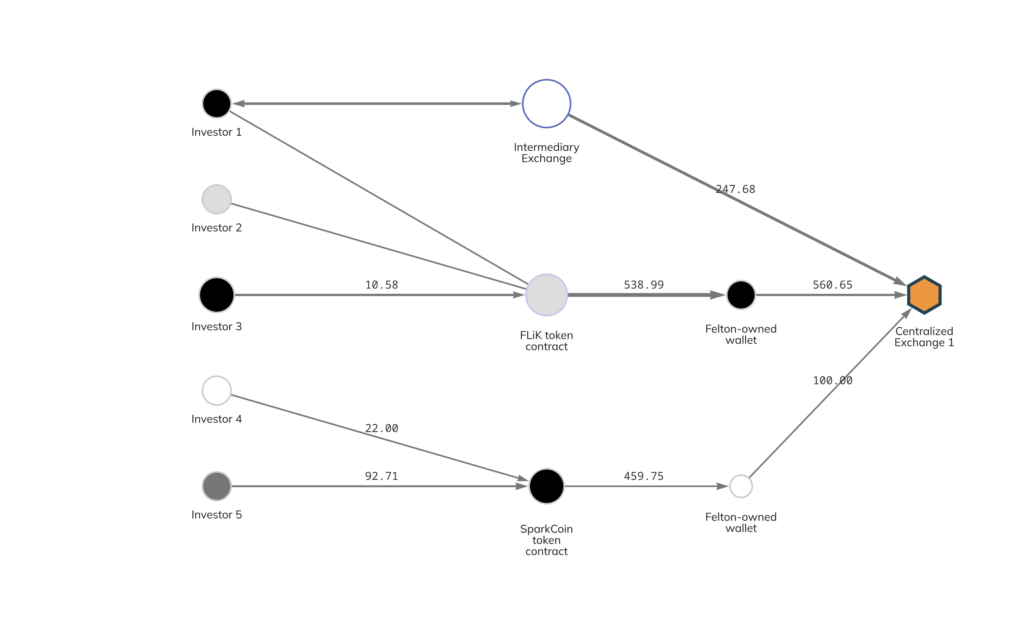

Due to misrepresentations and omissions made by Felton, numerous investors sent wire transfers of cryptocurrency to the ICO smart contracts in exchange for FLiK and SPARK tokens. These transactions – several of which Beth detailed in her testimony – led Felton to be charged with 16 counts of wire fraud.

Ryan Felton’s on-chain connections to the ICOs

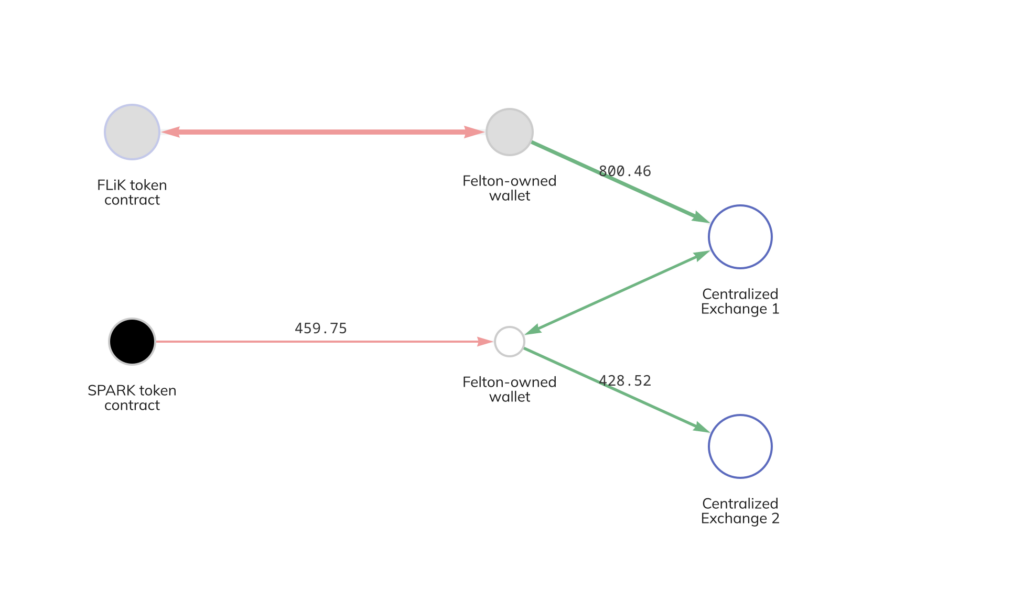

Felton claimed that the funds raised from the FLiK and CoinSpark ICOs would go towards developing their respective platforms. Instead, they were deposited into Felton’s personal accounts at two crypto exchanges, where they were then cashed out for a combined $2.5 million.

Beth Bisbee presented the following Reactor graph in her testimony to visualize how Felton diverted investors funds into his own accounts.

Felton spent these funds extravagantly, making all-cash purchases of a $1.5 million residence, a $180,000 Ferrari, a $58,250 Chevy Tahoe, and approximately $30,000 in diamond jewelry.

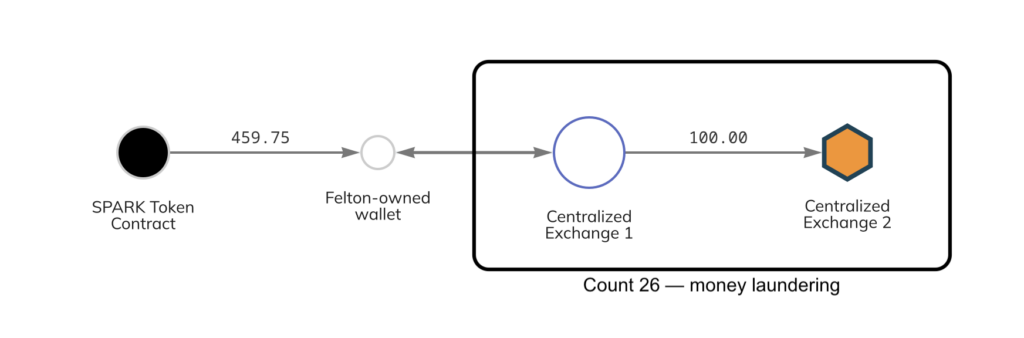

Evidence of on-chain money laundering

Beth’s testimony also presented blockchain evidence of Felton’s guilt with respect to one of the several money laundering charges against him. Through a review of Felton’s accounts, Beth was able to trace the movement of 100 ETH from one exchange to another.

The result: a win against fraudulent investment schemes

We commend the U.S. Attorney’s Office for the Northern District of Georgia for their work bringing this fraudulent ICO promoter to justice. This case demonstrates that blockchain analysis is now one of many tools law enforcement has to generate leads and collect evidence that can stand up in court.

As always, Chainalysis is ready to support government agencies combating any type of crypto crime at any investigative stage, from lead generation to prosecution. That’s why we recently introduced Chainalysis Government Solutions: to deepen our engagement with governments.