In many ways, exchanges are the face of the cryptocurrency industry. The vast majority of all blockchain transactions entail cryptocurrency moving to and from exchanges, and they function as the most common on-ramp to cryptocurrency for first-time investors. But the widespread issue of faked trade volumes has created trust issues among exchanges, their users, and the rest of the industry — not to mention the financial institutions and regulators who still eye cryptocurrency with caution.

The scale of the problem is huge, with Bitwise Asset Management claiming earlier this year that as much as 95% of all reported trade volume is fake. Trading on exchanges largely happens off-chain and is recorded in exchanges’ order books, which means that the volumes they self-report are easily faked or subject to wash trading. And the incentives to fake are clear: Higher trading volume suggests greater liquidity and market activity, which is useful for drawing in new users and attracting new coins looking to list. Trade volume increases also help exchanges climb the ranks on public industry data aggregators like CoinMarketCap, giving them greater visibility.

But all this comes at a cost to the cryptocurrency ecosystem as a whole. Faked trade volumes bring bad press for the industry and sow doubt amongst potential investors.

The good news is that blockchain analysis can help us see which cryptocurrency exchanges are most likely faking trade volumes. By comparing the amounts of cryptocurrency that enter exchanges via on-chain transactions to the off-chain trade volumes exchanges self-report, we can spot the differences between organic trading activity and instances of probable inflation.

How our analysis works

We use the term trade volume to refer to the volume of intra-exchange trading that exchanges self-report. All of these transactions occur off-chain and are recorded in exchanges’ order books and reported via APIs, which is why they’re easy to fake.

On-chain volume refers to the volume of cryptocurrency that users move into an exchange from the outside. These transactions are recorded on the blockchain, and therefore require actual cryptocurrency to be moved, making them much more difficult to fake.

The key to our analysis is the ratio between trade volumes and on-chain volumes at individual exchanges. That ratio shows us how much trading increases between users of an exchange as more funds flow into the exchange from the outside — essentially, how much bitcoin would we see traded on an exchange for every one bitcoin that comes in. We’d expect this ratio to stay relatively similar for large exchanges with similar user bases, absent any trade volume faking.

Establishing a baseline with the Bitwise 10

The first thing we need is a baseline trade volume to on-chain volume ratio for exchanges who are reporting accurate trade volumes. For that, we turned to the Bitwise 10. In addition to producing its report on trade volume faking as a whole, Bitwise Capital also analyzed trading patterns on several exchanges for suspicious activity. They identified ten large exchanges who they believe accurately report their trade volume, and the rest of the industry tends to agree. The exchanges that make up the Bitwise 10 are:

- Binance

- Bitfinex

- bitFlyer

- Bitstamp

- Bittrex

- Coinbase

- Gemini

- itBit

- Kraken

- Poloniex

We used the Bitwise 10 as our representative sample of large exchanges who report accurate trade volumes, and compared volumes for other exchanges to theirs in order to find irregularities suggesting overreporting.

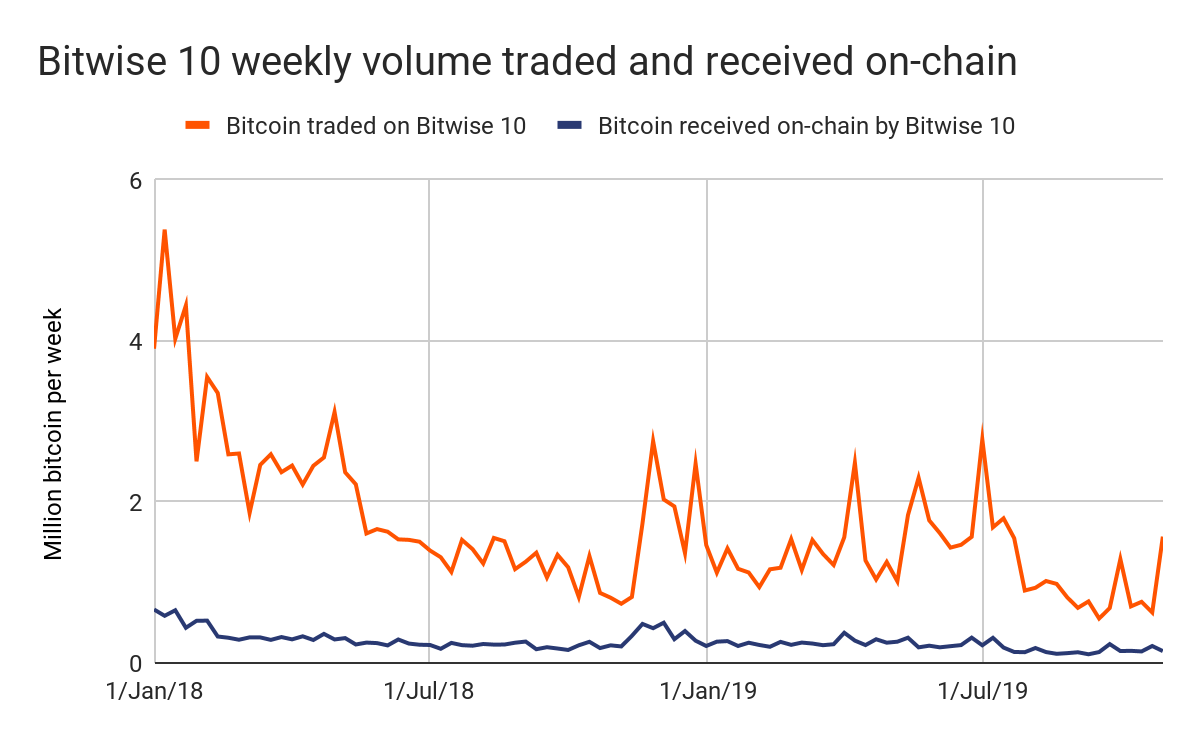

We started by comparing the week-to-week totals for both on-chain volume and trade volume for every exchange in the Bitwise 10 from the beginning of 2018 through November 3, 2019.

We see that trade volume always remains higher than on-chain volume received for the Bitwise 10. That matches our understanding of how most users trade on exchanges. They start by depositing funds from a wallet or elsewhere (an on-chain transaction), before trading with other users within the exchange who then trade with other users, and so on. All of those transactions happen off-chain and contribute to the Bitwise 10’s trade volume.

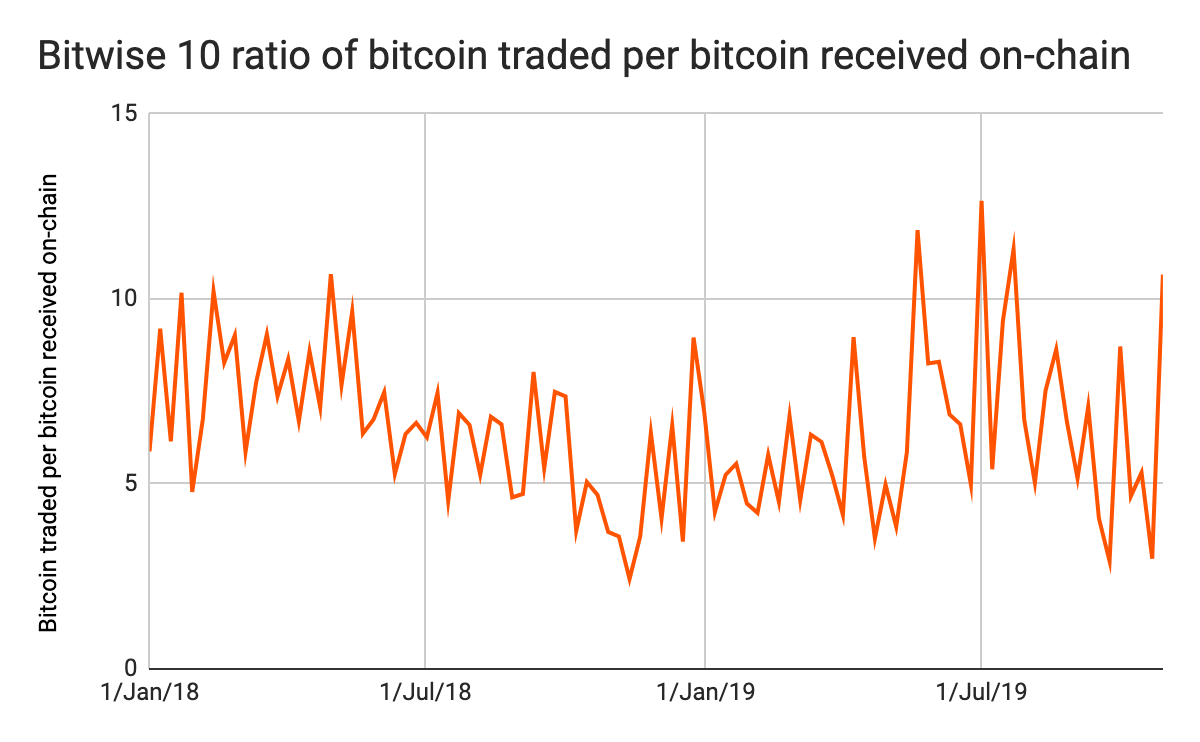

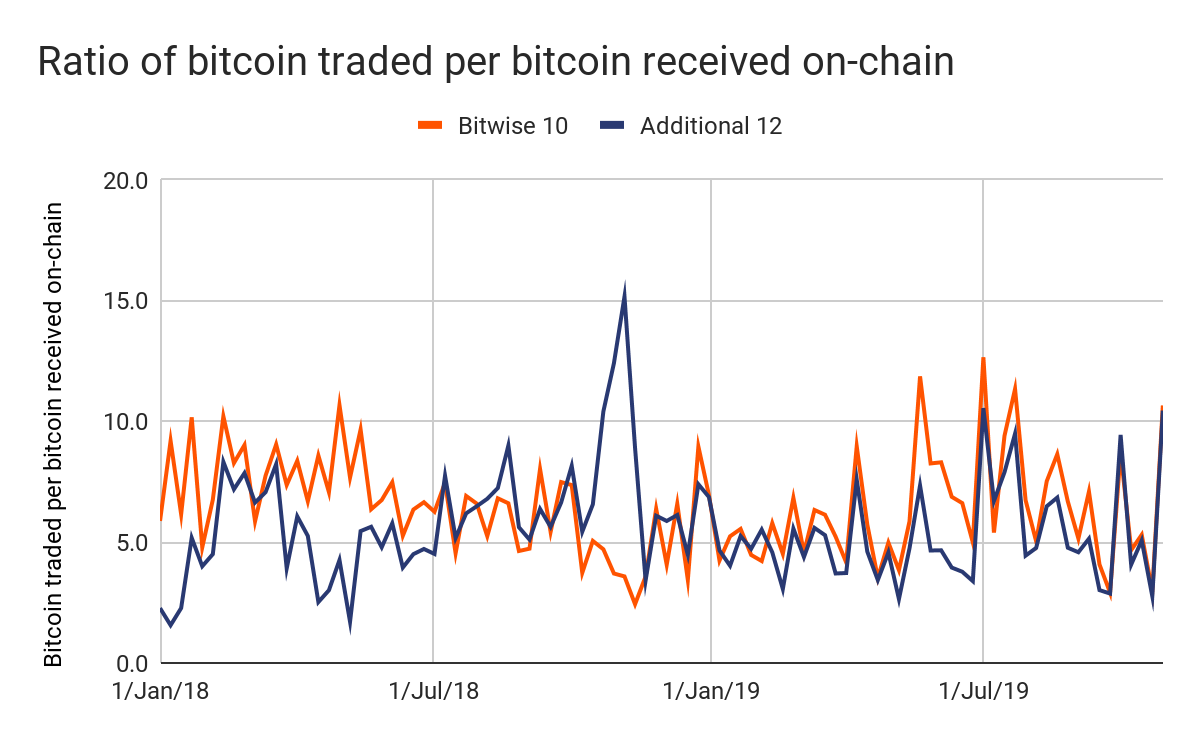

Using the data from the chart above, we can graph the ratio over time between trade volume and on-chain volume received for the Bitwise 10.

Over the course of nearly two years, the ratio averages out to roughly 6:1. That means that the Bitwise 10 see roughly 6 bitcoin in trade volume for every 1 bitcoin received on-chain. Any exchange with a substantially higher ratio may be overreporting its trade volume.

BitForex’s suspicious numbers

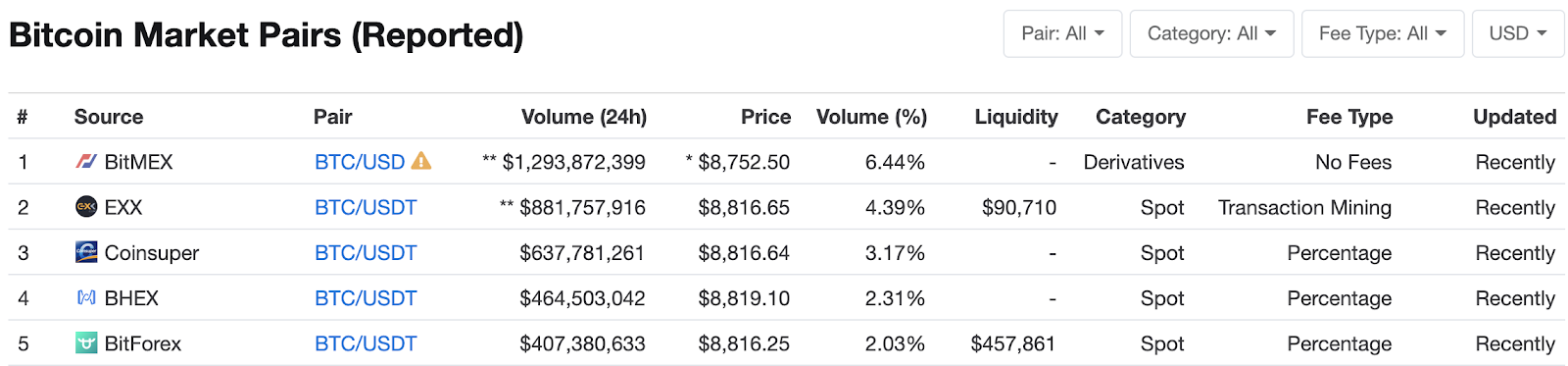

The natural next question is: Are there any exchanges with large reported trade volumes, whose ratio of trade volume to on-chain volume differs significantly from the 6:1 ratio we see for the Bitwise 10? We analyzed CoinMarketCap’s top five exchanges by reported bitcoin trading volumes and found one example: Bitforex, an exchange currently ranked number five on the list as of November 13, 2019.

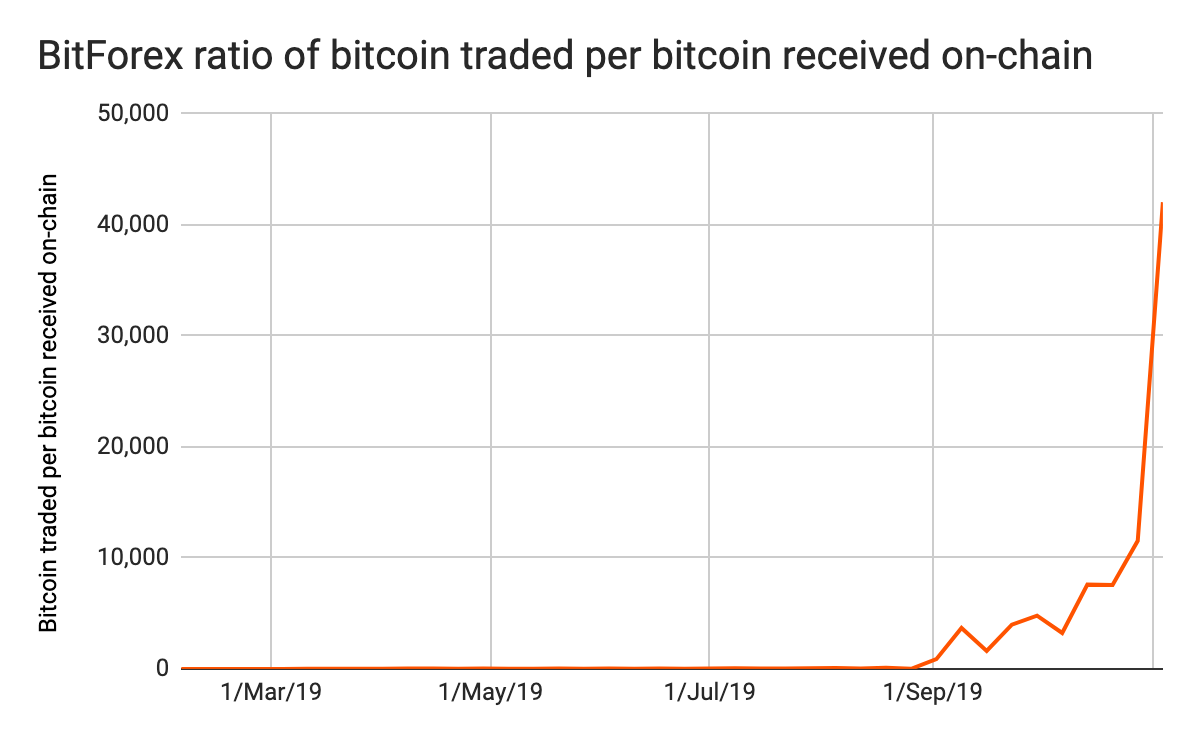

BitForex’s reported trade volume has grown quickly since its launch in 2018, but the exchange’s extremely high trade volume to on-chain volume ratio dwarfs the baseline we established with the Bitwise 10, suggesting a substantial amount of its trade volume has been faked.

The graph above shows BitForex’s ratio of trade volume to on-chain volume over time from the beginning of 2019 through November. The ratio begins to spike around August, when we see huge increases in trade volume. By the end of the time period measured, BitForex reports a trade volume ratio of 40,000:1. Again, that means that Bitforex reports 40,000 bitcoin worth of trade volume for every 1 bitcoin that enters the exchange, compared to just 6 for the exchanges in the Bitwise 10.

Based on this data, we can say with a high degree of certainty that Bitforex is greatly overreporting its trade volumes. Our finding seems to be validated by CoinMarketCap’s new exchange liquidity metric, which was rolled out specifically to address inflated exchange volumes. In that analysis, as of November 13, 2019, BitForex’s liquidity is 800 times smaller than its reported volume.

Other exchanges with irregular trade volume ratios

For the next phase of our analysis, we looked at 25 exchanges with large on-chain volumes that are not in the Bitwise 10. We identified 12 more exchanges whose trade volume to on-chain volume ratios differed from the Bitwise 10 in 2018, but have since fallen more in line.

Those 12 exchanges are:

- Bit2c.co.il

- Bitbank.com

- Bithumb.com

- Bitso.com

- CoinCheck.jp

- Coinfloor.co.uk

- CoinOne.co.kr

- Huobi.com

- Korbit.co.kr

- OKCoin.com

- UPbit.com

- Zaif.jp

Below, we can see those 12 exchanges’ on-chain volume to trade volume ratio compared to the Bitwise 10.

Based on this data, we can conclude that it’s likely these 12 exchanges were faking trade volume in 2018, specifically during the period between July and January 2019 where we see a large spike in those exchanges’ trade volume to on-chain volume ratios. This also coincides with news coverage in late 2018 calling attention to trade volume faking by many exchanges, some of which (Bithumb and UPbit, for example) appear on this list of 12 we analyzed. Since 2019, these 12 exchanges’ trade volume ratios track more closely with those of the Bitwise 10, suggesting that they’re no longer faking volumes. Please note that this is not an endorsement of those exchanges’ compliance and safety practices as a whole, but simply an observation that their current reported trade volumes appear to be legitimate.

On-chain data brings transparency to exchange trade volumes

Our industry needs to address the issue of inaccurate exchange trade volumes. Cryptocurrency is going to face more and more regulatory pressure as it becomes mainstream, and practices like these make it more difficult for honest providers to form banking relationships and expand service to more users — not to mention the fact that misleading customers is the wrong thing to do.

We’re optimistic that Chainalysis can help. As this study shows, our comprehensive blockchain data set puts us in a unique position to identify which exchanges are faking volume, which is the first step to solving the problem. And while we did find examples of exchanges likely faking substantial trade volumes, most large exchanges appear to have ceased these deceptive practices in the last year. All this, plus other efforts from around the industry such as CoinMarketCap’s new faking-resistant liquidity metric, is evidence that the industry is taking the problem seriously.