This blog is an excerpt from the Chainalysis 2020 Geography of Cryptocurrency Report. Click here to download the whole thing!

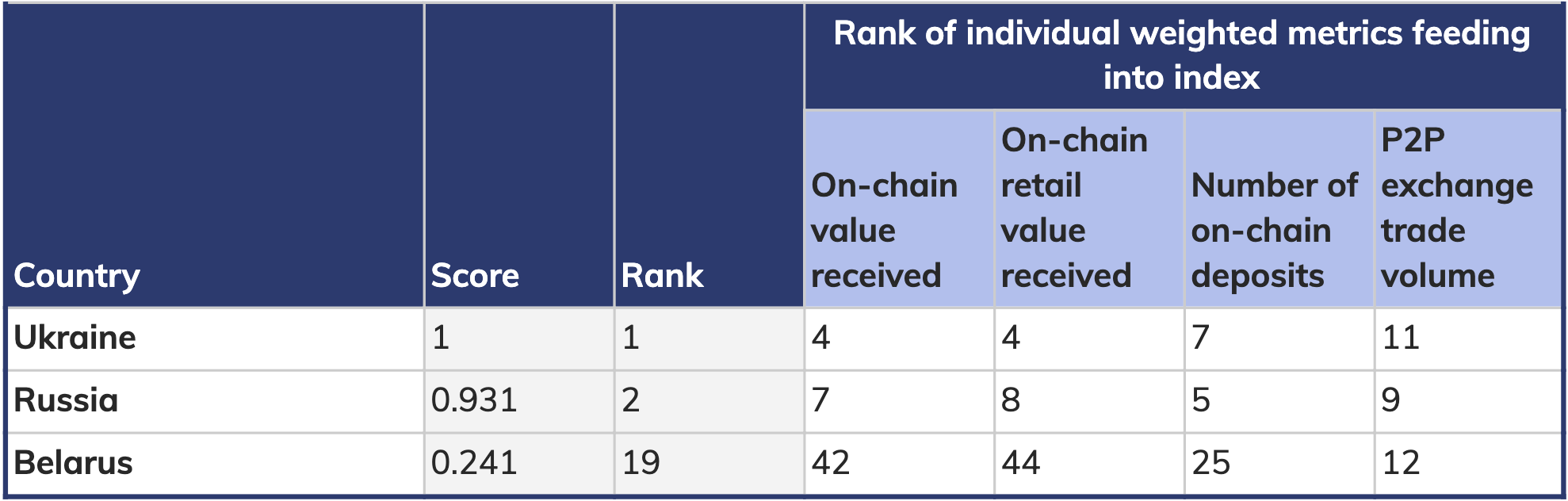

While Eastern Europe may only have the fourth-largest cryptocurrency market by transaction volume of all the regions we analyze, it also has the first and second-ranked countries on our Global Crypto Adoption Index: Ukraine and Russia.

How is this possible? Remember, our Adoption Index accounts for a country’s population and wealth in addition to pure market size, as the goal is to highlight the countries with the highest grassroots adoption by everyday users. Russia and Ukraine top the list because they have disproportionately high cryptocurrency usage across all components of the index, indicating that a larger share of residents have shifted more of their financial activity to cryptocurrency than residents of other countries.

Below, we’ll explore why that is, look at trends in Eastern Europe’s trading activity, and analyze the unique landscape of cryptocurrency-related crime in the region.

Ukraine and Russia lead the world in cryptocurrency adoption

Eastern Europe shows strong grassroots-level adoption of cryptocurrency, with Ukraine and Russia ranking first and second respectively in our Global Crypto Adoption Index. Belarus, also located in Eastern Europe, comes in at 19th.

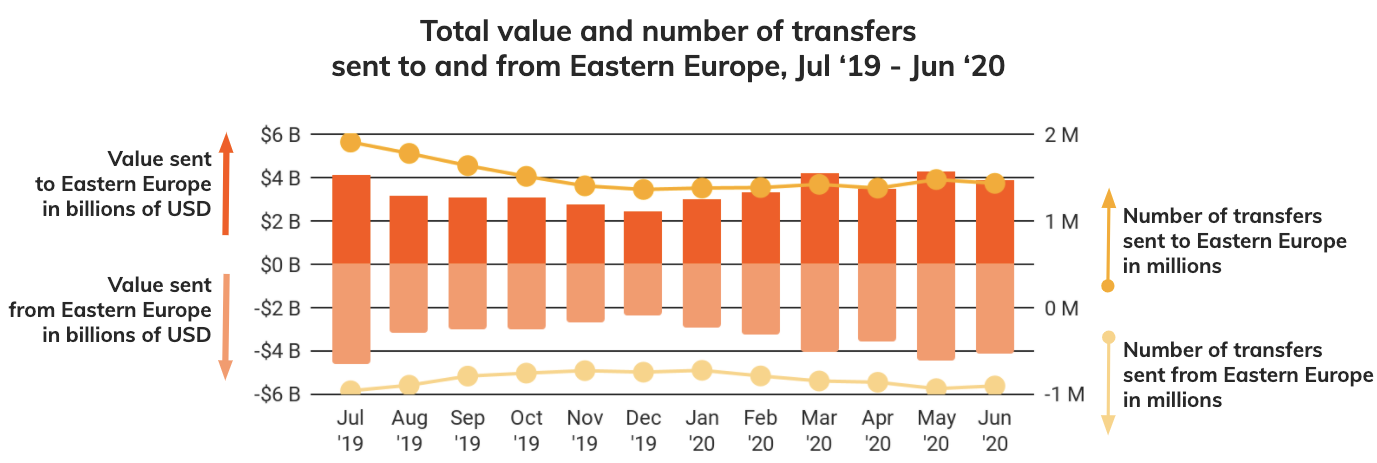

In the 12-month period studied, we estimate that Russia has sent over $16.8 billion USD worth of cryptocurrency and received $16.6 billion, while Ukraine has sent $8.2 billion USD and received $8.0 billion. While those numbers are much lower than the amounts we see for China, the US, and other leading countries, they indicate a much higher level of adoption when we consider the size of both countries’ populations and economies. Our index also factors in two other on-chain metrics as well as peer-to-peer trade (P2P) volumes. Belarus, for example, ranked third in the region and 19th overall largely because of its strong P2P activity. Neither Ukraine nor Russia ranks first in terms of the four individual metrics in the index, but they outperform many countries in terms of consistently ranking among the top ten to eleven countries for those metrics.

Why do we see such high adoption in Russia and Ukraine? There are a few possible reasons.

One is the widespread lack of public trust, with a recent survey from public relations firm Edelman placing Russia dead last in public trust in government, business, and media. Bribery, cronyism, and other forms of corruption are common in both countries, and it’s common knowledge that funds can be seized from businesses and private citizens who find themselves out of favor with government officials. Banks in particular face a lack of trust, with one recent study from the Herald of the Russian Academy of Sciences finding that 56% of Russians don’t trust banks, with much of the negative sentiment stemming from the nation’s economic crises in the 1990s. Ukraine has also seen its citizens’ trust in banks diminish following the collapse of several prominent ones in the country over the last decade. Distrust of banks and/or government financial policy famously inspired many of the original proponents of Bitcoin, and we believe it could also be fueling outsized adoption of cryptocurrencies in Russia, Ukraine, and other parts of Eastern Europe.

In addition, consumers in both countries have a pre-existing familiarity with electronic payments and e-money that may have made cryptocurrency adoption easier. A 2014 poll from a UK-based retail shopping trade organization, for instance, found that 46% of internet users in Russia regularly used e-money for online purchase, mostly through platforms like Yandex, WebMoney, and Qiwi. For comparison, as of 2019, even as electronic payments offerings have become more robust, just 26% of American consumers report electronic payments as their first choice for online purchases.

Roman Sannikov, Director of Cybercrime and Underground Intelligence at cybersecurity provider Recorded Future, told us more about the unique payments landscape in Russia specifically. “The banking industry in the Eastern Block did not develop the same way it did in the West. Particularly, the process of transferring funds between accounts and overseas was particularly problematic because much of the infrastructure was simply not there,” he said. “As a result, a lot of homegrown and unofficial methods were created to move funds. Even before the use of cryptocurrencies, there were other financial instruments such as vouchers and hawala type exchanges. Many of these had very limited know your customer standards, if any, and allowed for rampant money laundering, and capital flight.” Payments systems developed in Russia following the Cold War allowed for significant financial crime. This may also be one reason behind the unique role crime plays in Eastern Europe’s cryptocurrency economy, as we’ll explore later.

Finally, there may be a remittances use case for cryptocurrency in Ukraine and other Eastern European countries. Peter Toth, co-founder of Block Unison, a Slovakia-based software development studio providing blockchain-focused engineering as part of Hotovo Group, told us more about it. “Many Ukrainians are migrating to neighboring countries within Eastern Europe like Slovakia in the last couple of years, and are using cryptocurrencies to send funds back to friends and family at home,” said Toth.

High cryptocurrency adoption in both countries has come amidst regulatory uncertainty. Ukraine currently has no cryptocurrency regulations, though its lead financial intelligence unit (FIU) began monitoring cryptocurrency activity in the country in April and its parliament is currently drafting the country’s first cryptocurrency laws. Russia, on the other hand, has sent mixed signals on cryptocurrency’s legal status. Though President Vladimir Putin recently signed the country’s first cryptocurrency law giving virtual assets legal recognition in the country, Russia’s parliament also recently passed a new measure banning deposits to anonymous online wallets, affecting users of both cryptocurrencies and popular e-money services. While some experts don’t believe the anonymous wallet ban will end up affecting cryptocurrency usage, it calls into question the Russian government’s overall stance on the technology. However, if Russia and Ukraine write and enforce fair, reasonable cryptocurrency regulations, it could mean adoption will continue to grow.

Popular services and cryptocurrency trends in Eastern Europe

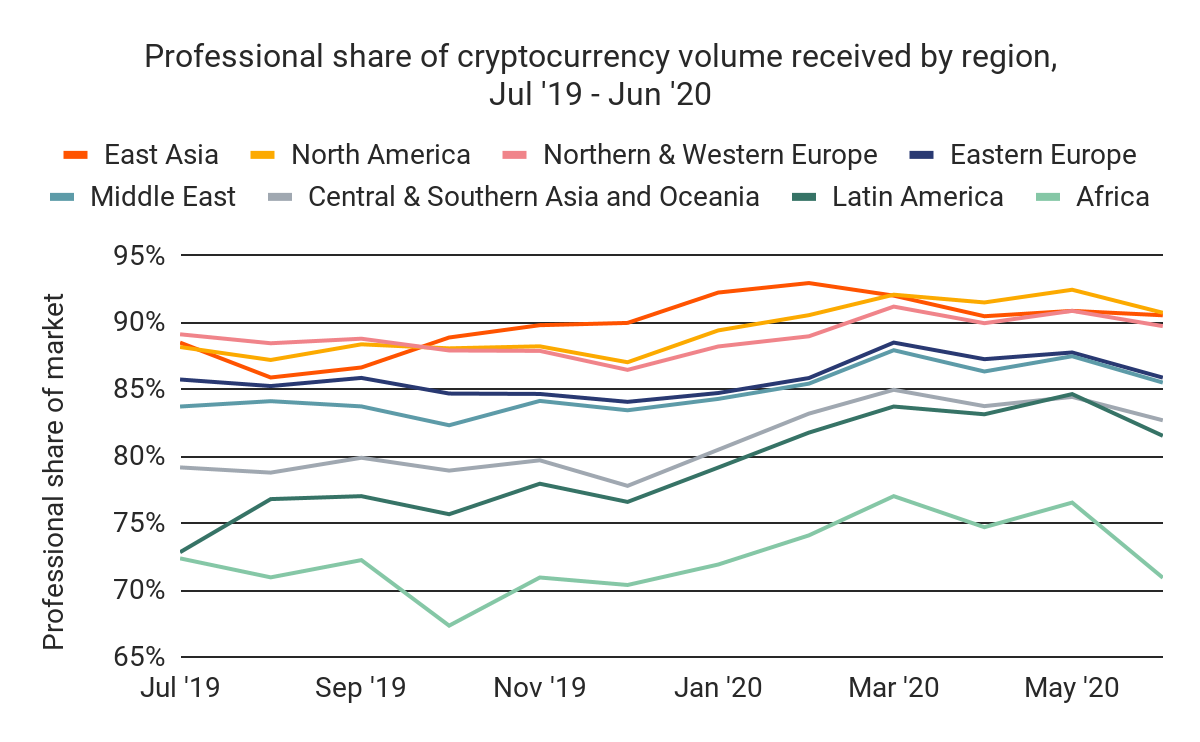

Like other regions with large cryptocurrency markets, most of Eastern Europe’s cryptocurrency activity is driven by the professional market.

Roughly 85% of all Eastern European transaction volume in the 12-month period we study is made up of professional-sized transfers of over $10,000 worth of cryptocurrency. Though institutional investment in cryptocurrency in Eastern Europe hasn’t yet reached the level of other regions like North America and Northern & Western Europe (NWE), some asset managers in the region have given the new asset class a shot. One example is ITI Funds, which launched a $70 million cryptocurrency fund in 2019 focused on both cryptocurrencies themselves and investments in early-stage industry projects. ITI also claims to have built a cryptocurrency investment platform with built-in compliance measures in an effort to attract dollars from other institutional investors.

P2P exchanges also appear to be gaining traction in Eastern Europe and in Russia in particular, where high P2P trading volumes contribute greatly to the country’s high ranking on our Global Crypto Adoption Index. Representatives from popular P2P exchange Paxful said in late July 2020 that its Russian user base has grown 350% over the course of the Covid-19 pandemic, with the exchange’s Russia market manager attributing much of the success to a lack of other compelling investment options offered by the country’s “monolithic banking system…dominated by a few players.” According to him, cryptocurrency presents Russian users with a new means of growing their earnings and participating in financial markets.

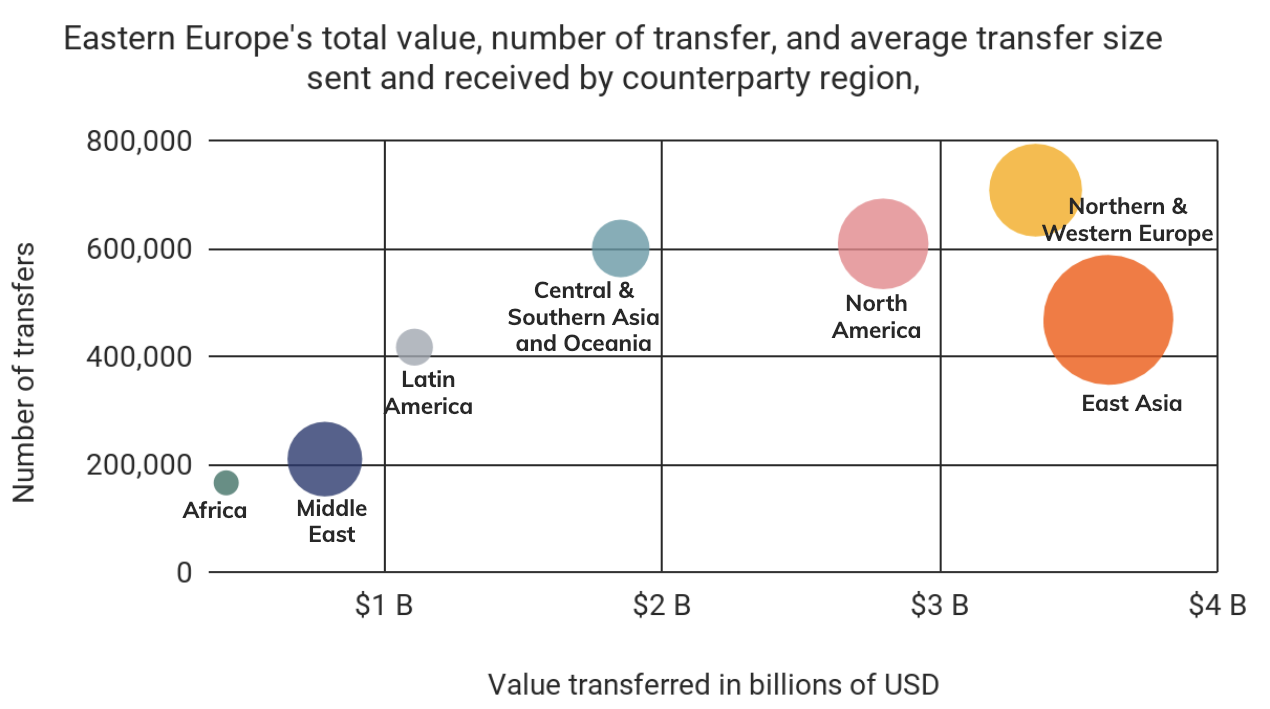

Eastern Europe’s regional counterparties also resemble those of other regions, with East Asia leading the way, followed by NWE and North America.

Some of the volume moving between Eastern Europe and East Asia likely represents Chinese merchants operating in the region sending funds home, a dynamic we also observe in Africa. In fact, a recent report from Coindesk claims that these merchants are buying up to $30 million worth of Tether per day from Russian OTC desks for this purpose. Historically, China has strong trade relationships with Russia, Belarus, and other countries in the region, though we’re unable at this time to verify if cryptocurrency is being used to facilitate commercial transactions between businesses in China and Eastern Europe, as we see in other regions like Latin America.

However, where Eastern Europe sets itself apart is in the specific services and types of services that account for most of its cryptocurrency activity.

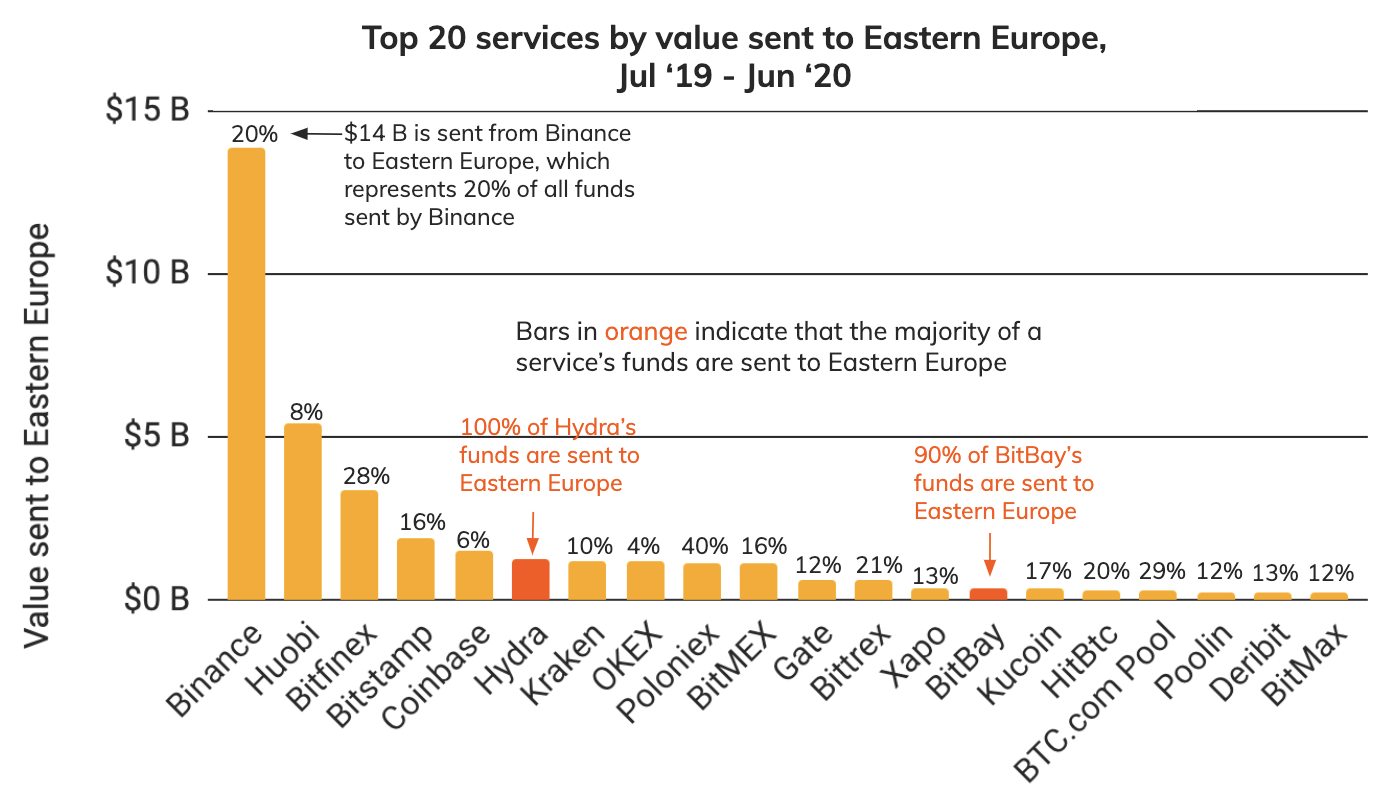

Above, we see the cryptocurrency services sending the highest volume of funds to Eastern European addresses, along with the percentages of those services’ total transaction volume that Eastern Europe accounts for. A few things stand out. Unsurprisingly, most of the top services interacting with Eastern Europe addresses are large exchanges. However, what’s interesting is that Eastern Europe makes up a small share of those exchanges’ overall activity. This isn’t the case for other regions. East Asia, for instance, has lots of cryptocurrency activity concentrated on Huobi, OKEX, and Bithumb, and accounts for 52%, 80% and 96% of the platform’s total activity, respectively. Similarly, North America has exchanges like Coinbase and Gemini in its top ten services for the region, and accounts 46% and 82% to each platform’s respectively total activity. However, most of Eastern Europe’s cryptocurrency transaction volume goes through services that cater primarily to other regions. We believe this is likely a function of the lack of regulatory clarity with regards to cryptocurrency in Russia and Ukraine. Both countries drive most cryptocurrency transaction volume in Eastern Europe, but it’s possible entrepreneurs in Russia and Ukraine shied away from starting cryptocurrency businesses since cryptocurrency did not have legal status in Russia until very recently, and still doesn’t in Ukraine.

The one exception to the seeming lack of homegrown Eastern European cryptocurrency businesses with significant volume is the darknet market Hydra Marketplace. With over $1.2B worth of cryptocurrency in revenue between June 2019 and July 2020, Hydra is one of the largest darknet markets in the world, despite the fact that it only serves vendors and buyers in Eastern Europe, with 100% of its transaction volume attributed to the region. Below, we’ll explore the role that crime and illicit activity play in Eastern Europe’s cryptocurrency economy.

Darknet markets and ransomware drive crypto crime in Eastern Europe

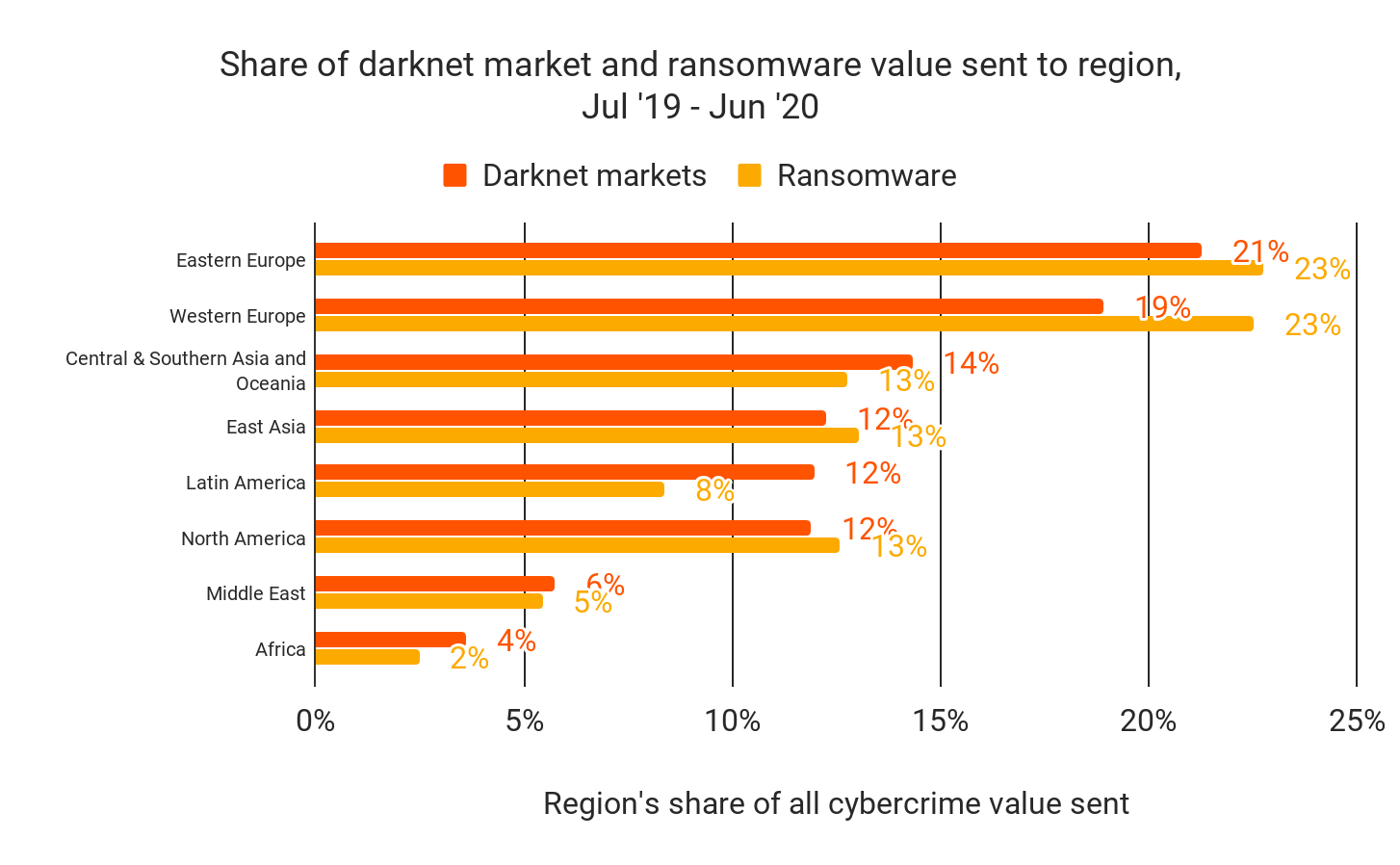

With 1.4% of its $41 billion in total transaction volume sent to illicit entities, Eastern Europe is second only to Latin America with 1.6% of its volume sent to illicit entities. Darknet markets account for most of Eastern Europe’s illicit value sent in many months during the 12-month period studied, and on the whole account for the vast majority of sending activity, which would indicate a high volume of funds being paid out to darknet vendors in Eastern Europe from the markets themselves. In fact, Eastern Europe accounts for more global darknet market activity than any other region.

As we mentioned previously, most of Eastern Europe’s darknet market transaction activity occurs on Hydra Marketplace, which is the sixth-largest service by volume in the region — no other region has a darknet market or other illicit service in its top ten services. As one of the largest darknet markets in the world, Hydra has built out a complex drug delivery system in Russia and other Eastern European countries, in which couriers receive delivery orders in a manner similar to Uber drivers and drop off packages in discrete locations broadcast to buyers later so that neither party ever has to see each other or make an in-person exchange. No other regions are comparable in terms of darknet market revenue or sophistication of operations.

Our data also shows that Eastern Europe leads the world in ransomware. The region accounts for more than 23% of funds received from ransomware addresses, indicating that Eastern Europe is home to the highest-earning ransomware network administrators and ransomware-as-a-service (RaaS) operators. While we can’t say for sure why this is, security researcher Brian Krebs attributes the comparative hacking prowess of Russia specifically to the greater emphasis on computer science in youth education, estimating that more than double the number of Russian secondary school students take the country’s national computer science test than American students do for their equivalent test. Higher prevalence of computer science education, combined with lower economic opportunity and, in some cases, government sponsorship of hacking activities, may explain why Eastern Europe accounts for such a high share of ransomware activity.

Want more insights into how cryptocurrency usage differs by region? Click here to download the full Geography of Cryptocurrency Report! You’ll get more original data and research on inter-regional trading patterns, the state of crypto crime by region, how cryptocurrency mitigates economic instability in the developing world, and more!