The 2022 Geography of Cryptocurrency Report

Everything you need to know about crypto trends around the world!

Eastern Europe is the fifth-largest cryptocurrency market we study, with $630.9 billion in value received on-chain between July 2021 and June 2022. That represents just over 10% of global transaction activity during the time period studied.

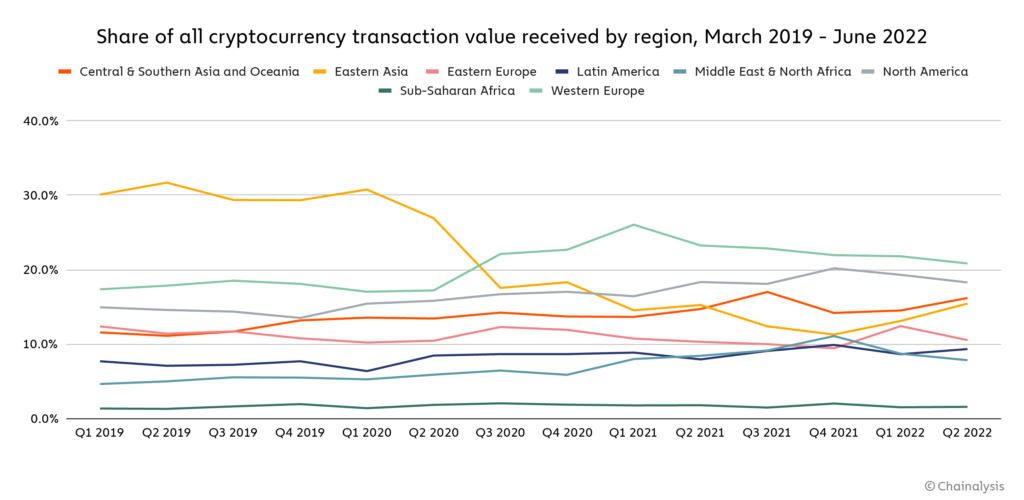

Eastern Europe’s comparative role in the bigger, worldwide crypto ecosystem has stayed surprisingly consistent over the last few years, generally hovering around 10%. Other regions, on the other hand, have seen more volatility.

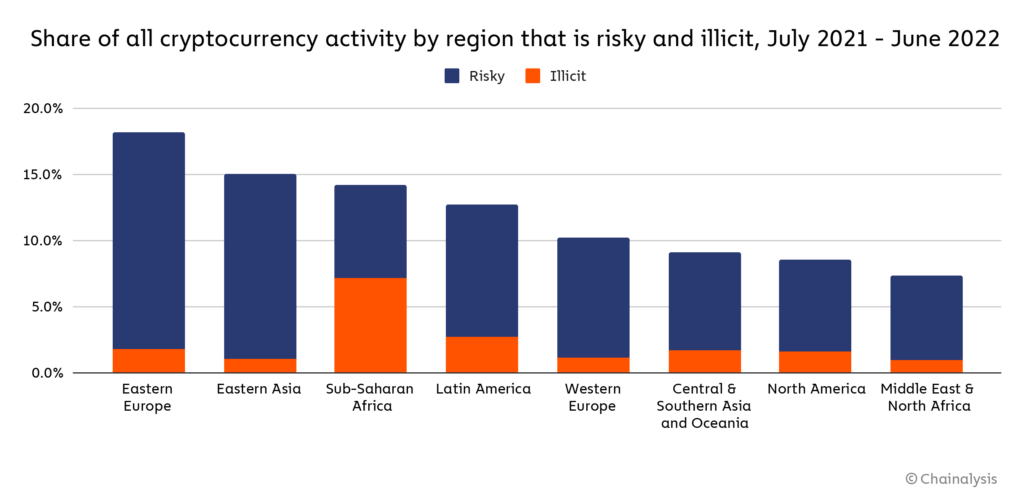

In prior research, we’ve looked a lot at Eastern Europe’s role in cryptocurrency-based crime — especially Russia. In particular, we’ve historically seen an outsized amount of ransomware and crypto-based money laundering in Eastern Europe, with the latter supported by a large ecosystem of risky cryptocurrency businesses. Some of those businesses, such as the OTC desk Suex, have even been sanctioned by the U.S. Treasury Department in response to this activity over the last year. Nevertheless, risky and illicit activity is still prominent when we look at Eastern Europe’s on-chain activity: High-risk exchanges – those with no or low KYC requirements – account for 6.1% of transaction activity in the region, compared to just 1.2% for the next-closest region. In fact, if we combine addresses associated with risky and illicit activity, we see that users in Eastern Europe interact with them at a much higher rate than users in other regions.

18.2% of all cryptocurrency received by Eastern Europe comes from addresses associated with risky or illicit activity, more than any other region.

Market Changes and Crypto’s Role in the Russia-Ukraine War

Of course, the biggest news in Eastern Europe this past year has been Russia’s invasion of Ukraine in February 2022 and the subsequent, ongoing war. The war has affected virtually all aspects of life in the two countries, and cryptocurrency is no exception.

Soon after the war began, the United States and several other countries began levying sanctions against Russian oligarchs and other individuals connected to Vladimir Putin’s government. This, combined with Russia’s historical embrace of cryptocurrency for both licit and illicit uses, prompted questions of whether Russians would seek to use cryptocurrency to evade sanctions. Our research showed that cryptocurrency markets likely aren’t liquid enough to support mass scale, systematic sanctions evasion. Given that, plus this report’s focus on grassroots cryptocurrency adoption, we’re going to use on-chain data to analyze how the general populace of both countries have turned to cryptocurrency since the war began, rather than just the wealthy or those subject to sanctions.

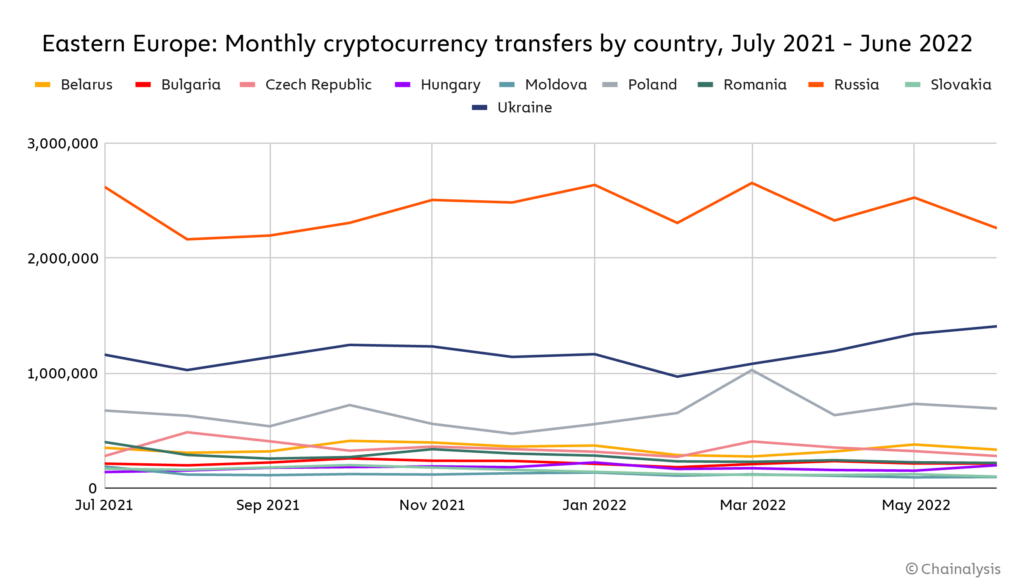

After all, the war had a serious economic impact on citizens of both countries. Ukraine has seen extremely high inflation, with a July New York Times article citing 90% increases in fuel costs and 35% increases in food costs. Russia has also seen high inflation at times since the invasion, and has faced difficulties in international commerce — in particular, exporting commodities like oil — due to its removal from the SWIFT banking network. With that context in mind, let’s look at how Russian and Ukrainian crypto usage changed as the war got underway. Right off the bat, we can see that both countries saw an initial increase in cryptocurrency transfers in March 2022, soon after the war began on February 24.

Trends diverge after that though. Russia saw transactions grow and shrink within a relatively narrow range over the following months. Ukraine, on the other hand, saw a steady increase in cryptocurrency transfers from the outset of the war through June 2022. It’s possible that Russian users’ cryptocurrency activity was impacted by restrictions placed on them by many services in response to the invasion.

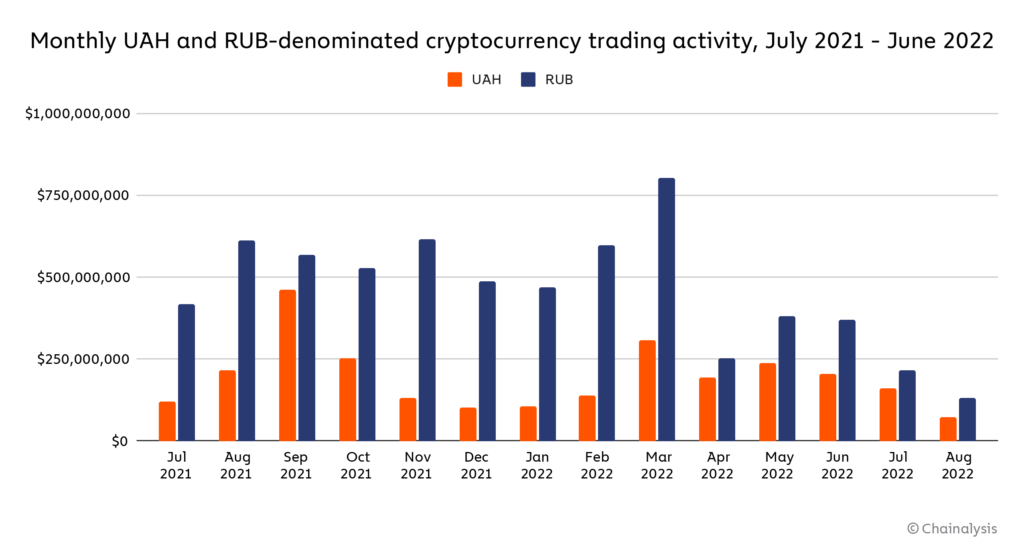

Of course, given the economic issues faced by both countries, looking at transactions as a whole may not be where we’d expect to find the most telling trends. Much of that transaction activity is made up of crypto-to-crypto trades — in an emergency or potential hyperinflation scenario though, we’d expect people to be more focused on protecting or moving their fiat assets. We can measure at least some of this by looking at trade volume denominated in the Russian ruble and Ukrainian hryvnia, using order book data for two exchanges that accept those currencies: Binance and LocalBitcoins.

The trend here is even stronger, especially in March, immediately after the war began. That month, Ukrainian hryvnia-denominated trade volume rose 121% to $307 million, while Russian ruble-denominated trade volume rose 35% to $805 million. After that, we see volumes drop off for both countries, ebbing and flowing through August, but never reaching their March highs. The true scale of this activity is also likely much higher than the totals we see above, as this data comes from just two exchanges accepting both countries’ fiat currencies, but we can still draw conclusions from the directional trends.

We showed our data to Tatiana Dmytrenko, a high-ranking adviser in Ukraine’s Ministry of Finance and member of the World Economic Forum’s Digital Assets Task Force, and asked what use cases may have accounted for the spikes in hryvnia-for-crypto trading. She cited currency controls implemented by the Ukrainian government. “Due to the introduction of martial law in Ukraine, the Ukrainian Central Bank imposed restrictions on currency cash transactions, such as buying dollars or euros,” she said. Transfers of currency funds abroad were also restricted soon after that — Dmytrenko believes some Ukrainians may have looked to exchange their hryvnia for cryptocurrency in response to these measures. She also pointed out that these currency controls were relaxed in July 2022, at which point we see hryvnia-for-crypto trading decline.

To learn more about similar activity in Russia, we spoke with a regional money laundering expert who’s worked with financial intelligence units in Eastern Europe as well as several international organizations. While he asked to remain anonymous, he gave us permission to quote him on how to interpret this data in light of what he’s seen in Russia since the war began.

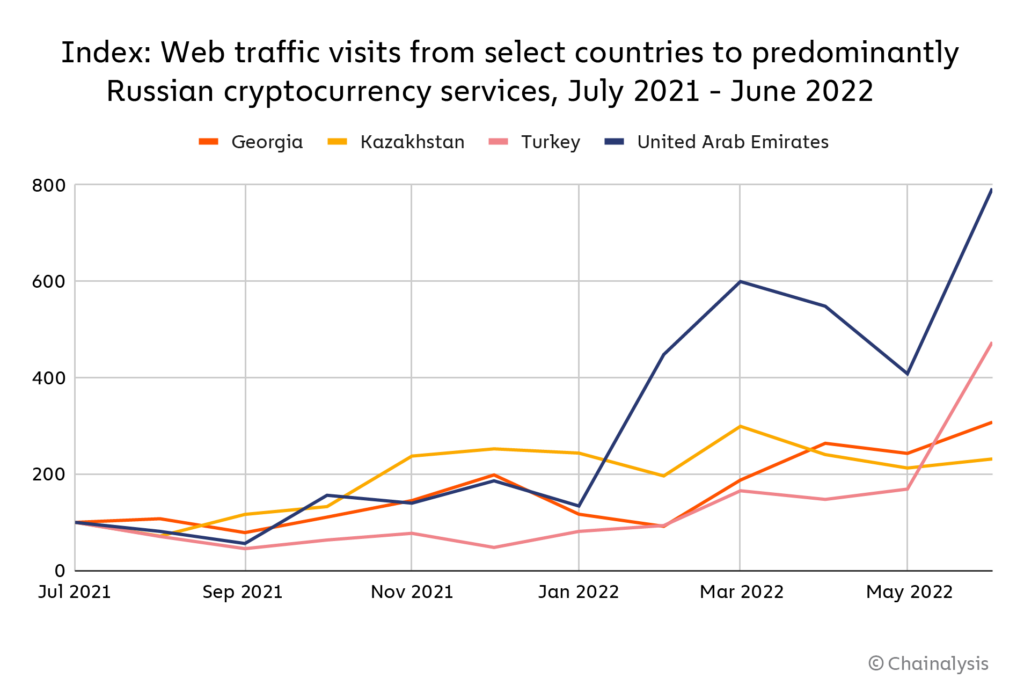

“The major question not just for oligarchs but also ordinary Russians became, ‘How do you get money out of Russia?’” the expert said. “Many began looking for new places where they could cash out their crypto.” He cited the UAE and Turkey as countries they have relied on in the past, and also pointed to Kazakhstan and Georgia as countries that may have been able to absorb the increased demand for such services once the war began. While this activity is difficult to quantify, web visits from these countries to cryptocurrency services primarily serving Russian users could be one useful proxy metric. All four countries saw spikes in web visits to Russian cryptocurrency services after the war began in February, as seen in the chart below.

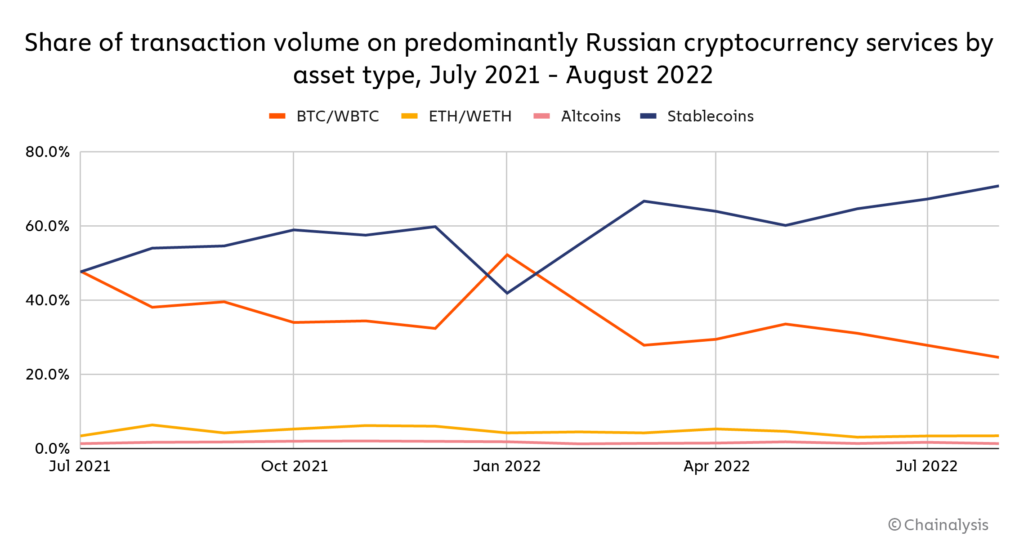

The expert also told us about the role that cryptocurrency could play in financing foreign trade for Russia following its removal from SWIFT. Russia’s national bank recently agreed to legalize the use of cryptocurrency for cross-border payments and international commerce, and the expert told us that he suspects some Russian companies have already begun to execute these transactions. “This is probably already happening on a small and medium scale, but it could become more widespread.” This expert cited China and Iran as possible trading partners in such a scheme, noting that the latter has initiated experiments with crypto-for-imports already. He also explained that stablecoins would likely be the preferred medium of exchange for this use case given that they don’t see the price volatility of assets like Bitcoin. Our data suggests that stablecoin usage in Russia has indeed increased since the war began.

In January, stablecoins made up 42% of transaction volume on primarily Russian services. That share skyrocketed to 55% in February and 67% in March after the invasion. While some of that may be due to businesses embracing cryptocurrency for international transactions, it’s also likely that some of the increase is due to ordinary Russian citizens trading for stablecoins in order to protect their assets’ value, as we discussed previously.

Crypto-for-imports schemes would open up many questions about how to make sanctions against countries like Russia more effective. However, one area where crypto has played an unambiguously positive role during this war is in the donations we’ve seen to the Ukrainian cause. Since the beginning of the war, cryptocurrency users have donated over $65 million in humanitarian aid, showing the power cryptocurrency can have to unify people across borders in support of international causes.

This blog is an excerpt from our 2022 Geography of Cryptocurrency Report. Sign up to download your copy today!

This website contains links to third-party sites that are not under the control of Chainalysis, Inc. or its affiliates (collectively “Chainalysis”). Access to such information does not imply association with, endorsement of, approval of, or recommendation by Chainalysis of the site or its operators, and Chainalysis is not responsible for the products, services, or other content hosted therein.

Chainalysis does not guarantee or warrant the accuracy, completeness, timeliness, suitability or validity of the information in this report and will not be responsible for any claim attributable to errors, omissions, or other inaccuracies of any part of such material.