This post is an excerpt from our 2024 Geography of Cryptocurrency Report. Download your copy now!

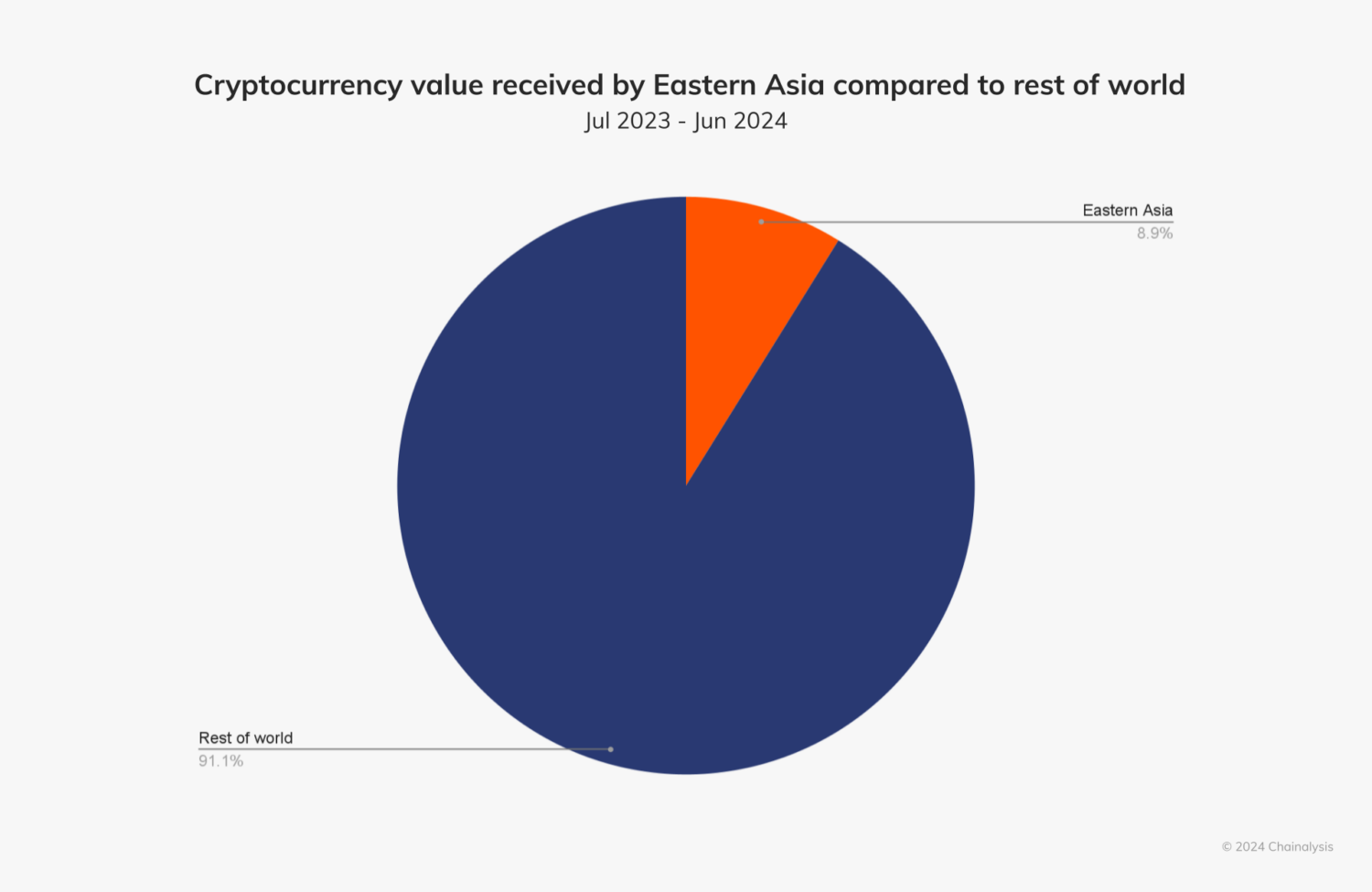

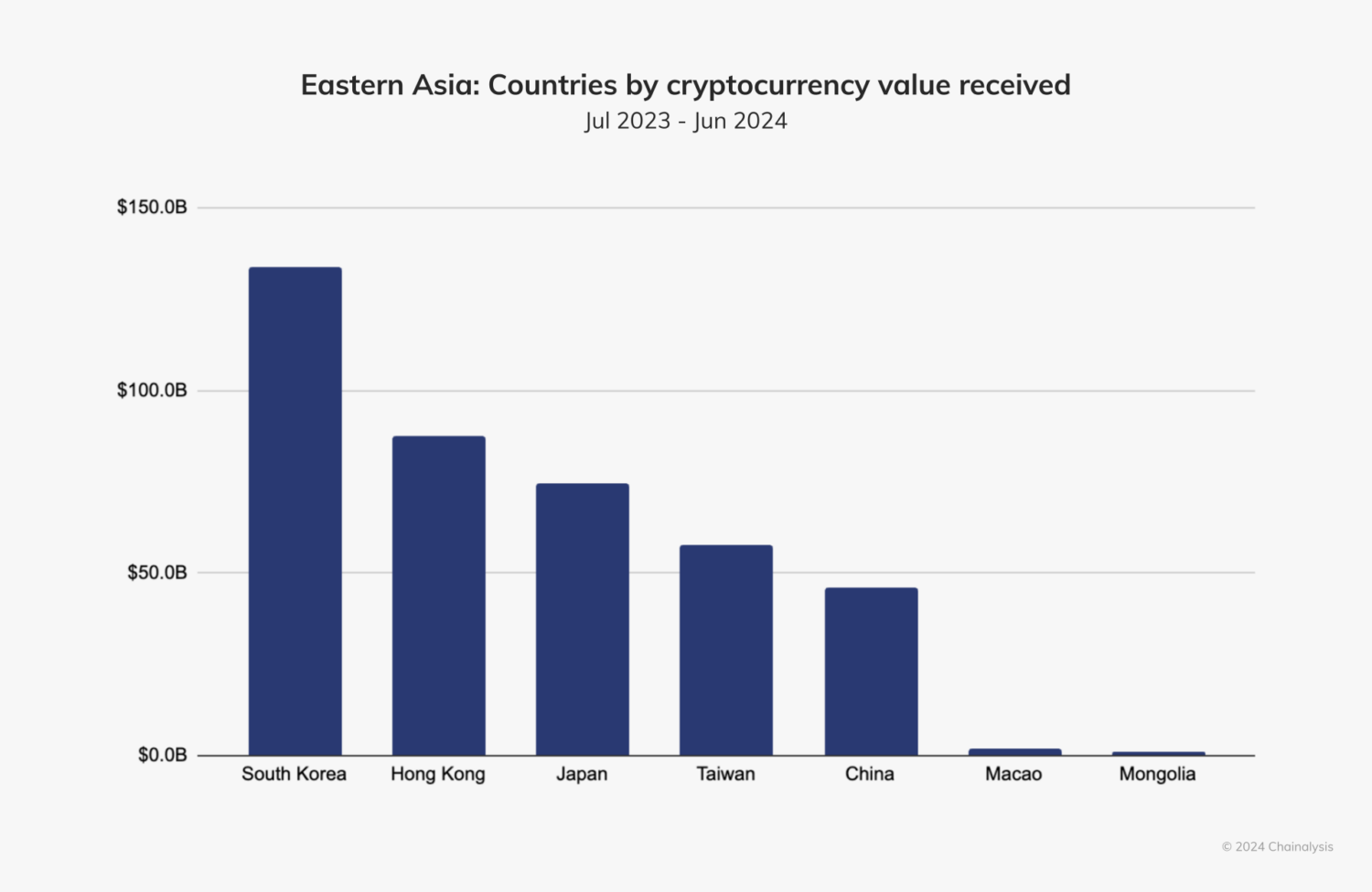

Eastern Asia is the sixth largest cryptocurrency economy in the world this year, accounting for 8.9% of global value received between July 2023 and June 2024. The region received more than $400 billion in on-chain value during the same time period.

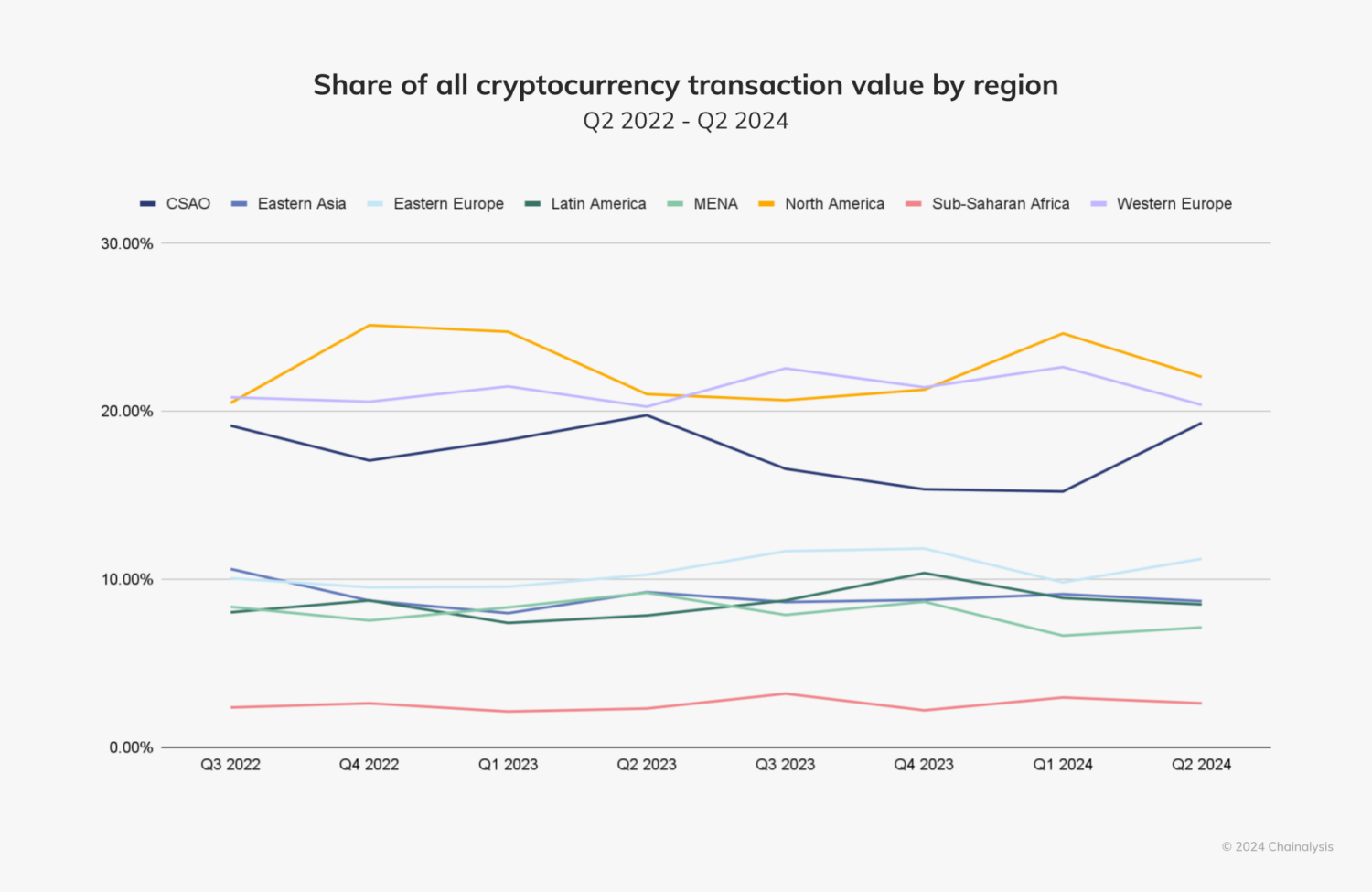

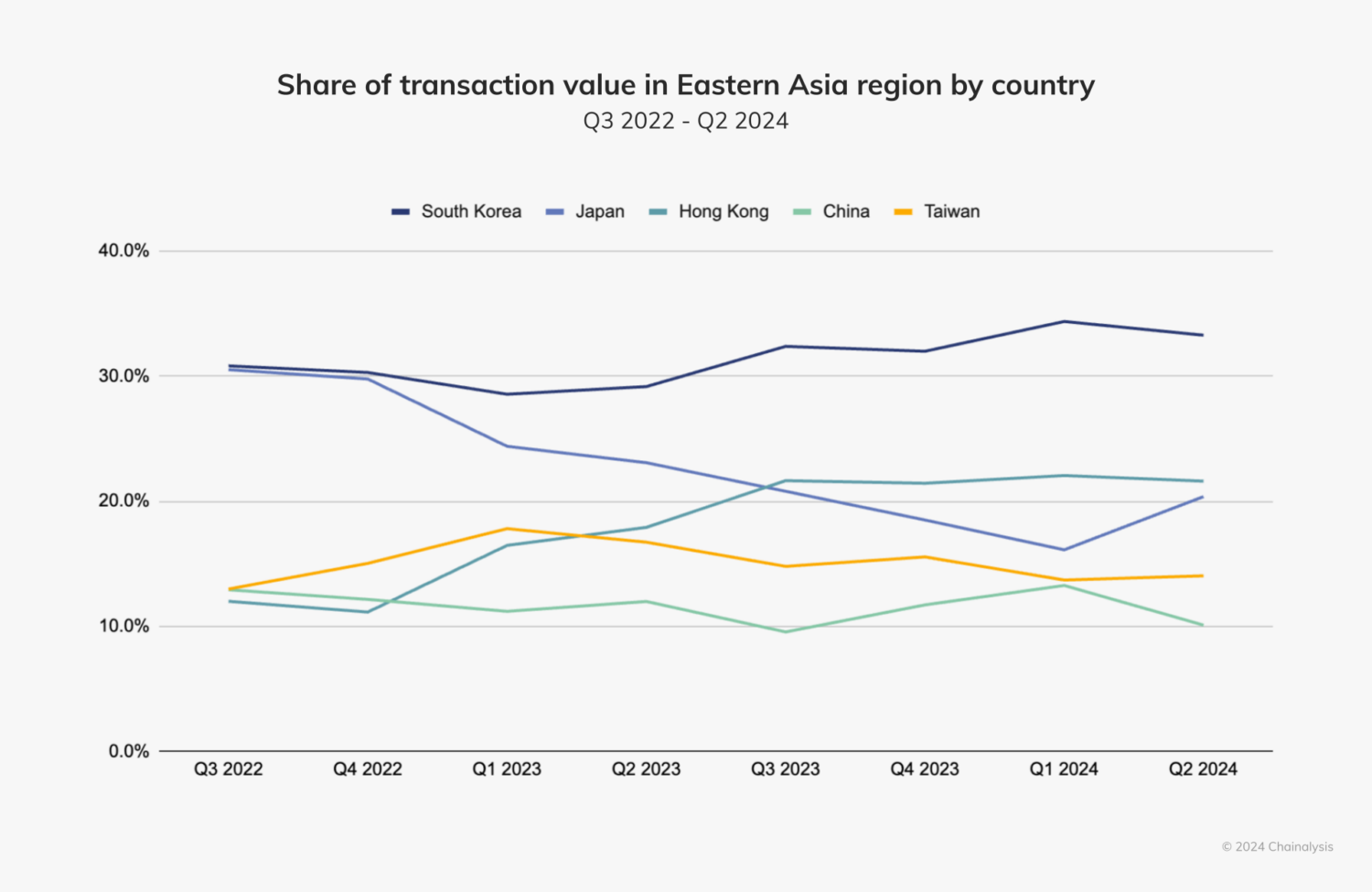

Eastern Asia’s share of cryptocurrency transaction value has remained relatively stable during the time period studied with no significant fluctuations.

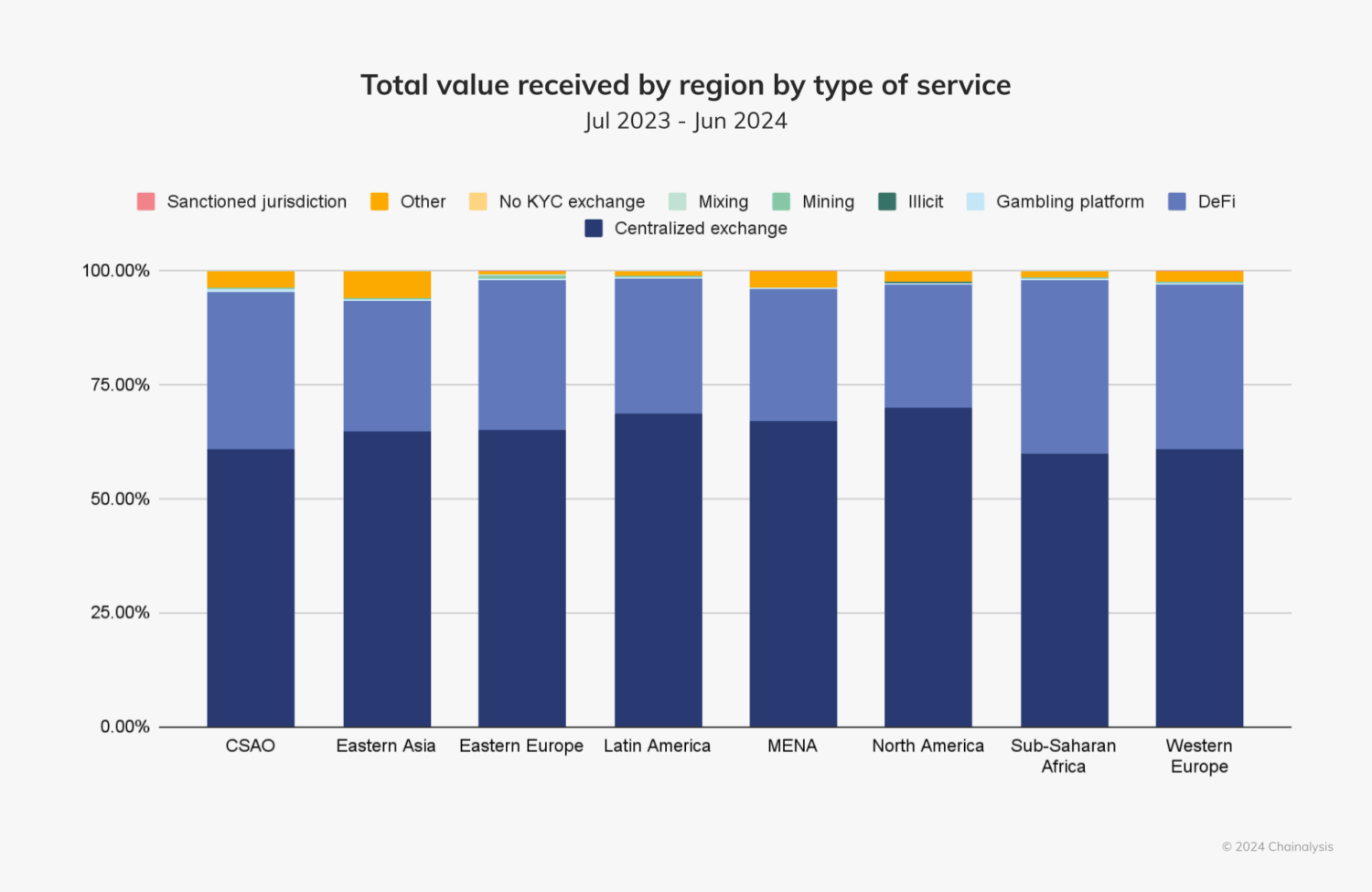

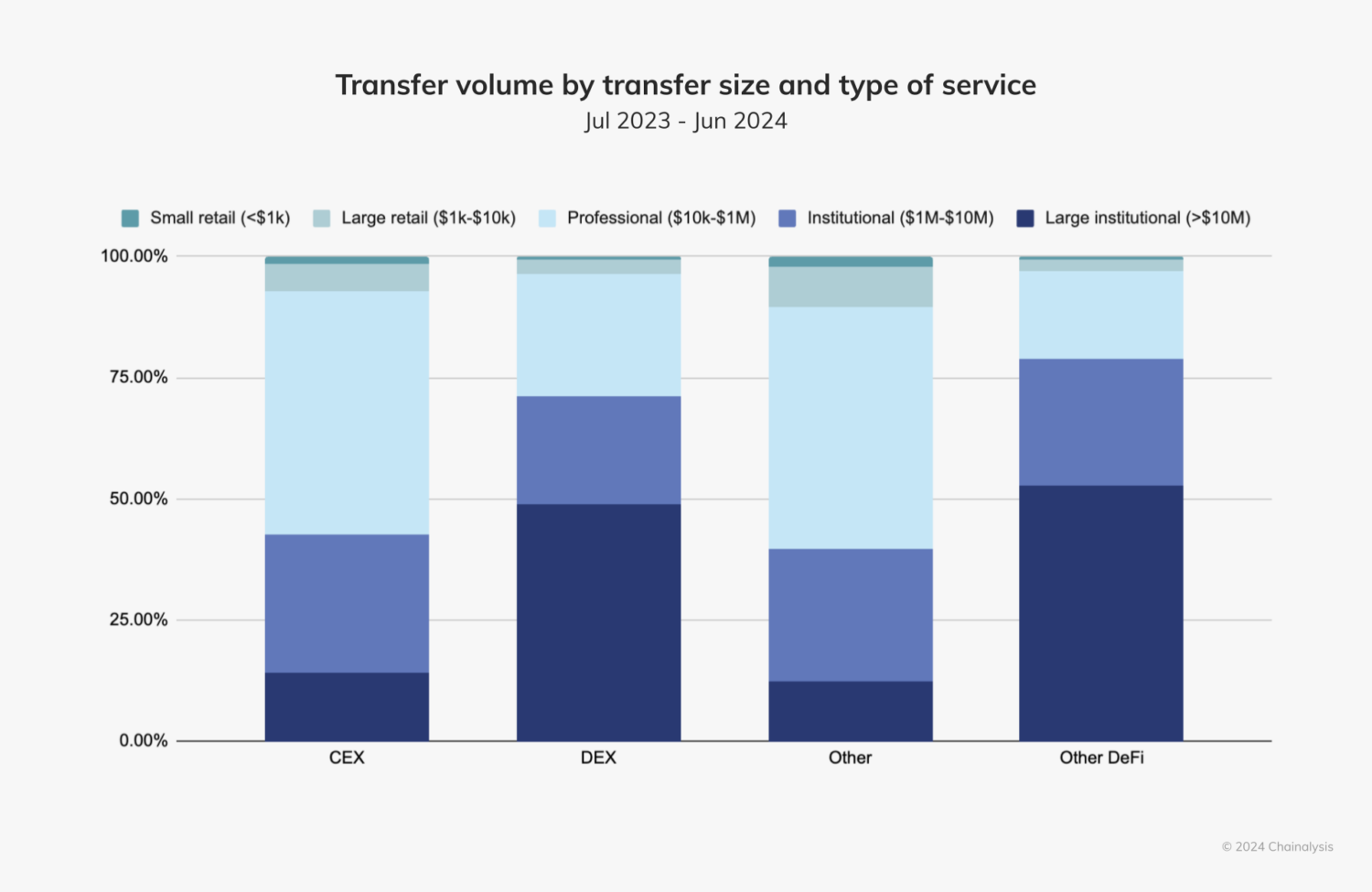

Similar to all other regions in this report, centralized exchanges are the most popular service category in Eastern Asia, accounting for 64.7% of cryptocurrency value received.

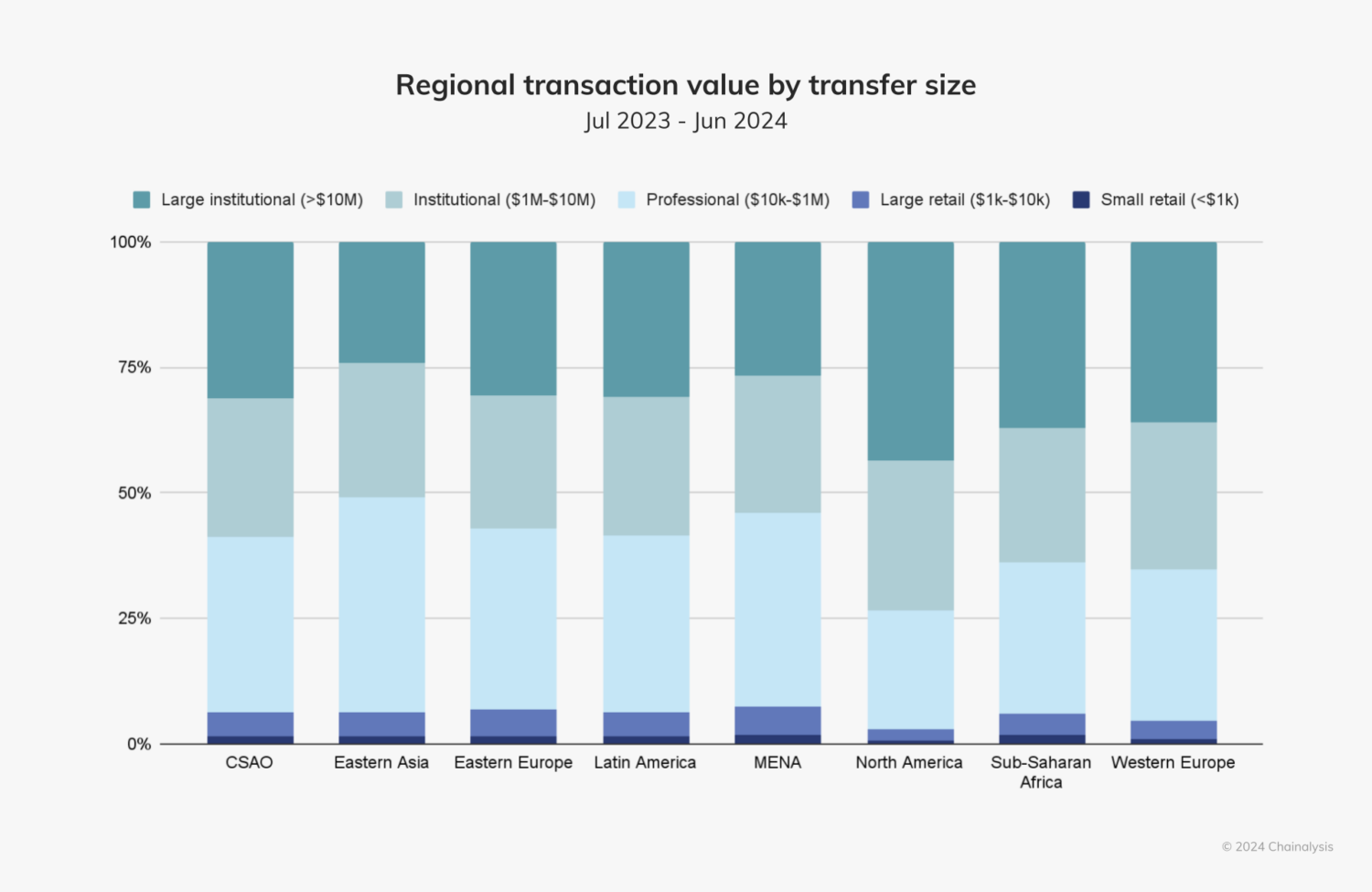

Most of this activity was driven by large transfers suggestive of institutions and professional investors. Notably, Eastern Asia accounts for the largest share of professional-sized transfers compared to any other region studied in this report.

There is a stark contrast between the services used by professional investors and those used by institutional investors. As we see below, professional investors primarily used centralized exchanges (CEXes), whereas institutional investors used decentralized exchanges (DEXes) and other decentralized services (DeFi). We speculate that institutional investors often seek investment strategies that capitalize on market inefficiencies; DEXes typically offer more arbitrage opportunities than CEXes due to their diverse asset coverage.

Eastern Asia includes five of the 50 highest grassroot adopters of cryptocurrency around the world: South Korea (19), China (20), Japan (23), Hong Kong (29), and Taiwan (40). Below, we’ll explore in detail what is driving crypto adoption in these countries.

South Korea remains Eastern Asia’s largest market

South Korea leads the Eastern Asia region in terms of cryptocurrency value received, at approximately $130 billion during the time period studied.

Since the first quarter of 2023, South Korea’s share of transaction value in Eastern Asia has also been steadily increasing. We spoke to a leader at a top South Korean crypto exchange who speculates that several factors have contributed to this growth: “Mistrust in traditional financial systems has led investors to seek out cryptocurrencies as alternative assets. The public’s perception of crypto as a viable investment option has been further solidified by adoption of blockchain by major corporations like Samsung and large enterprises in the region that are working to enhance operational transparency and efficiency.”

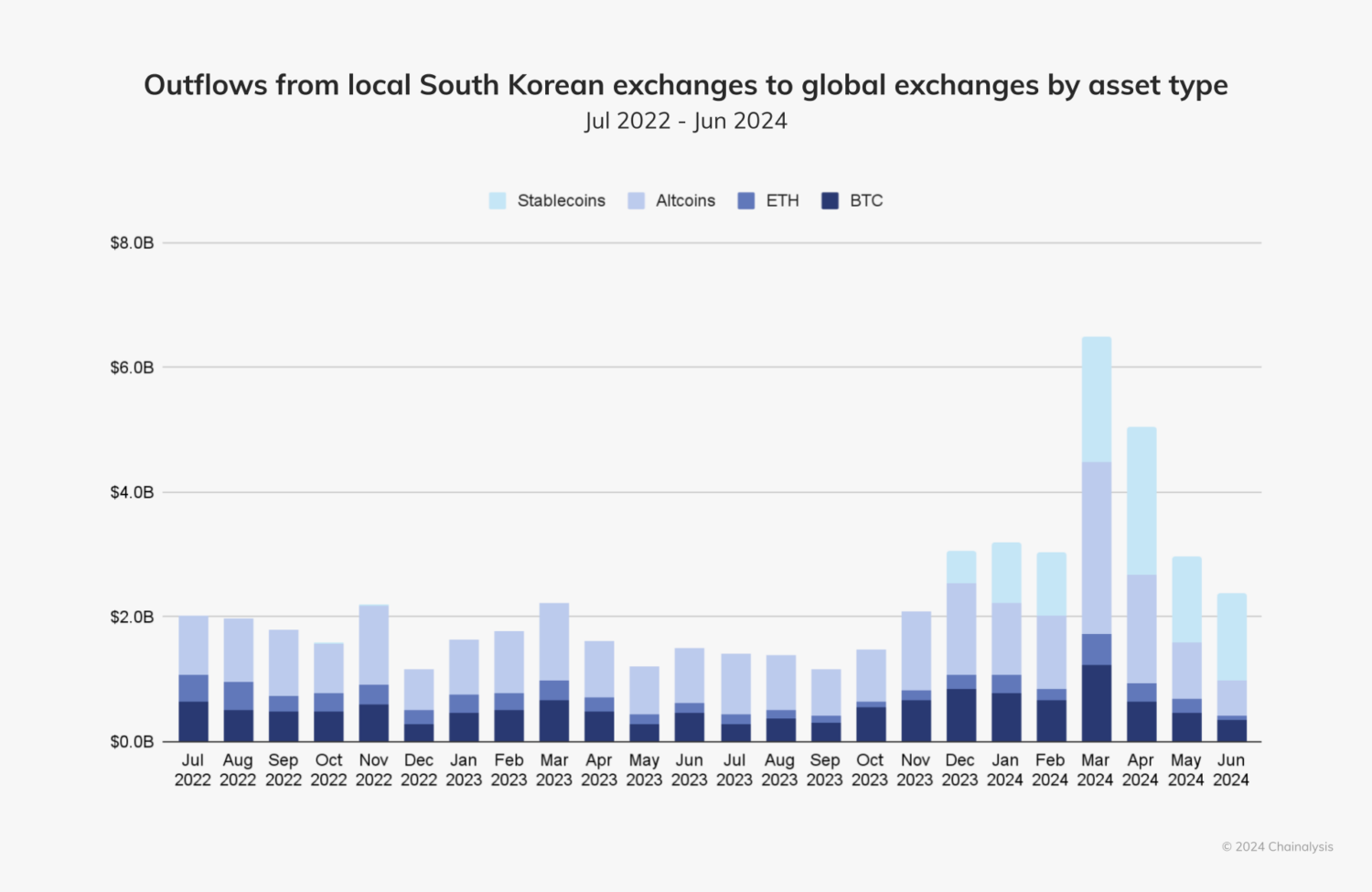

A leader at another South Korea-based exchange provided us with more insights into these trends: “As a top IT nation, the Republic of Korea provides easy access to digital asset trading through mobile apps and PCs. The general population’s interest in crypto has grown, especially after Bitcoin surpassed $70,000 in January 2024.” This uptick in trading activity is evident in numerous places — more specifically with altcoins and stablecoins. Altcoins, which South Koreans mainly use to trade with the Korean Won (KRW), have accounted for higher outflows to global exchanges than any other crypto asset. The increase in stablecoin outflows beginning in December 2023 shown in the below chart coincides with the USDT listings on major Korean exchanges, such as Coinone and Bithumb.

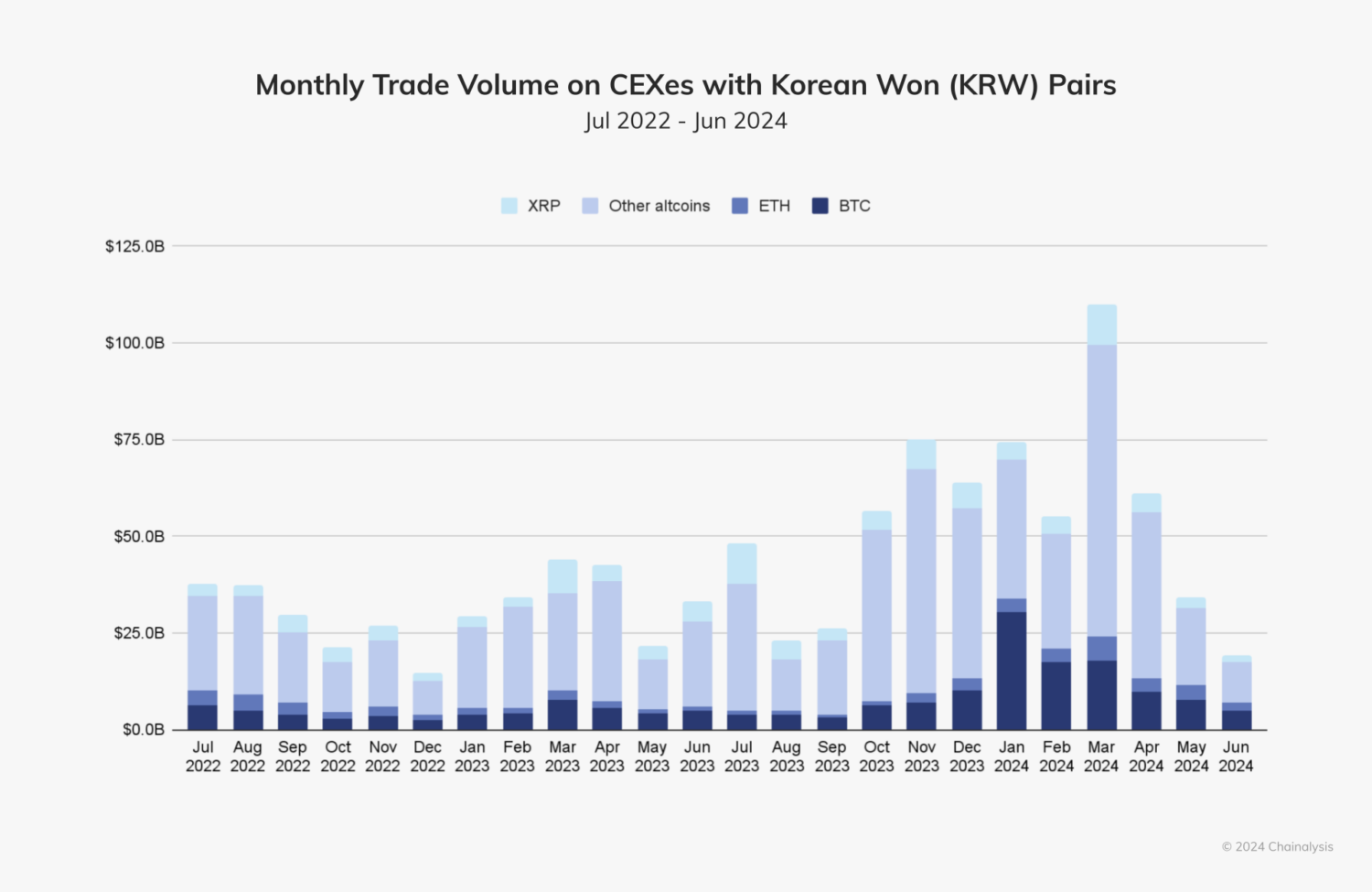

After altcoins, Bitcoin (BTC) is the second most traded cryptocurrency with the Korean Won.

“Ripple has been very popular in Korea since 2017 when it was expected to replace the SWIFT international remittance system,” the leader from the second exchange noted, referring to the international messaging system for international payments and settlements. “We attribute this popularity to Ripple’s very fast transfer speed of about two seconds, and its relatively low price per unit compared to BTC and ETH.”

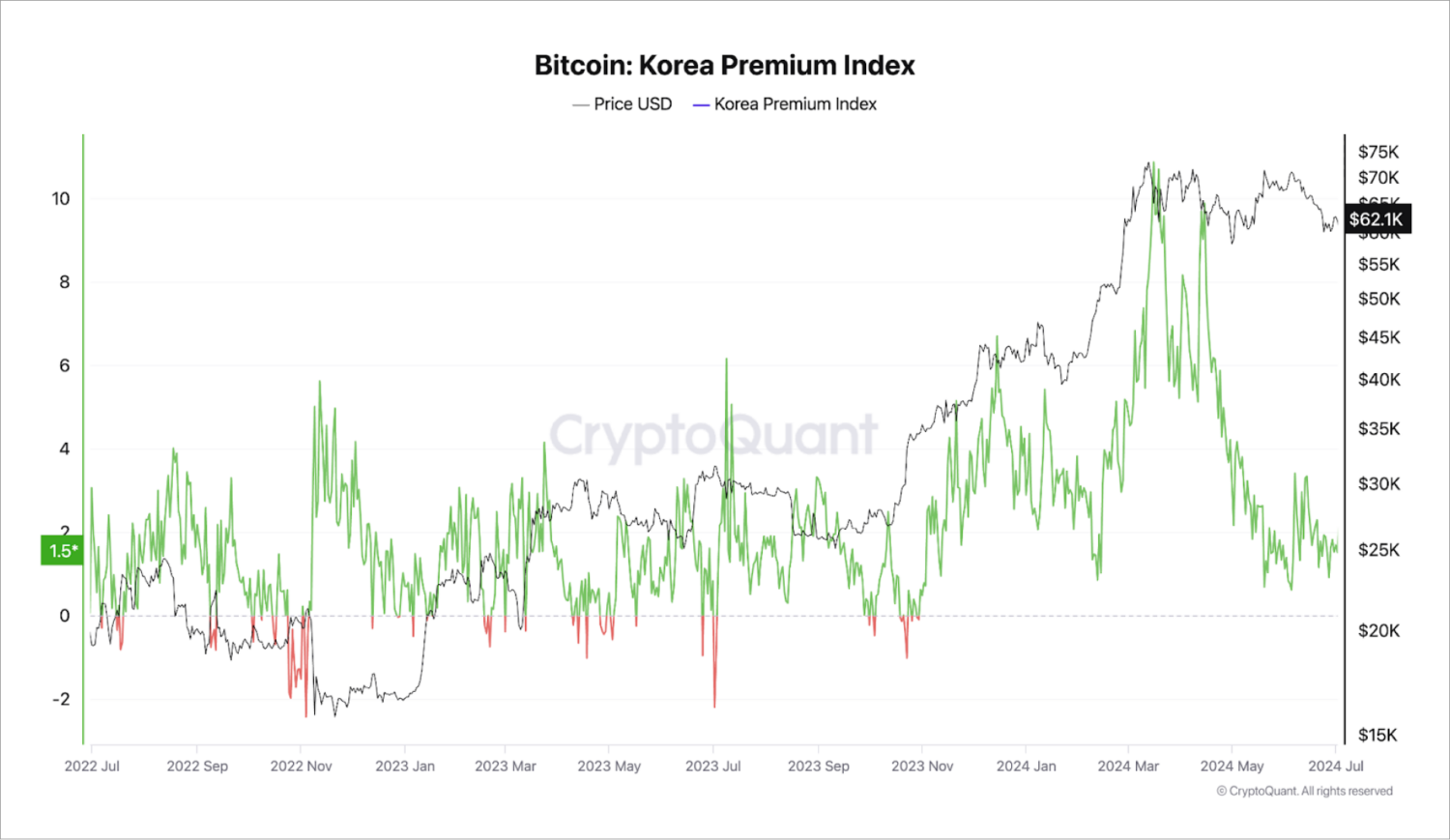

In terms of actual trading strategies, it appears that South Koreans often use local exchanges to on-ramp and move funds to global exchanges, which provide access to diverse assets, arbitrage opportunities, margin, and off-ramping. The volume of funds transferred from these local exchanges to global exchanges is highly correlated with the Korean Premium index, indicating arbitrage opportunities.

The leader from the first exchange explained, “The kimchi premium refers to the phenomenon where prices of cryptocurrencies in South Korea’s market are higher compared to global markets. This is primarily due to higher demand within South Korea relative to global markets. The Kimchi premium exhibits volatility depending on market conditions and regulatory changes, making it a popular phenomenon among traders.” Notably, the kimchi premium soared in March 2024 when Bitcoin reached a new all-time high.

The burgeoning interest in altcoins and diverse trading opportunities described above signals a robust future for South Korea as a regional leader in cryptocurrency innovation. As we’ll explore shortly, this interest, as well as supportive regulatory frameworks in other regions, could further accelerate cryptocurrency’s prominence across Eastern Asia.

Hong Kong may finally influence China to re-open its doors to crypto

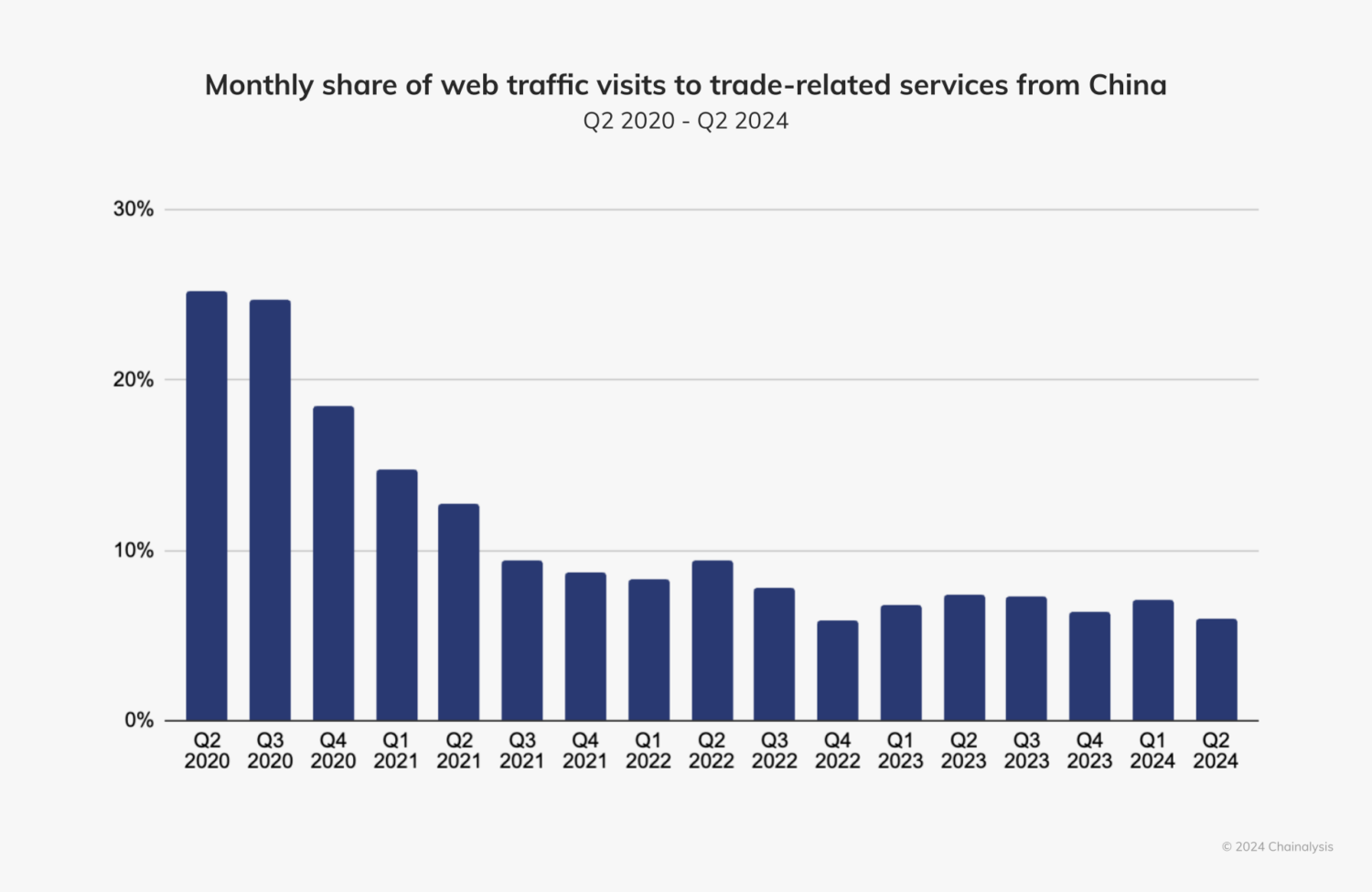

As we’ve explored in previous years, China has had a tumultuous relationship with crypto, marked by numerous crackdowns and regulatory changes. Despite being an early hub for crypto mining and trading, China’s government increasingly imposed stringent restrictions on permissionless crypto activity, citing concerns over financial stability, fraud, and capital flight. These actions led to broad-based restrictions on crypto-related business activities in China in 2021, and have undoubtedly led to a decrease in overall crypto-related web traffic visits to trade-related services coming from China, beginning in mid-2020.

Regardless, Hong Kong has emerged as a crypto hub in the Greater China region, where regulators’ openness to crypto and decisiveness in laying down a regulatory framework have furthered institutional adoption. Hong Kong is not an independent country, but rather a Special Administrative Region of China with a distinct legal and regulatory framework. Its unique status allows more flexibility to foster financial innovation, which is why we treat it separately from mainland China in this report.

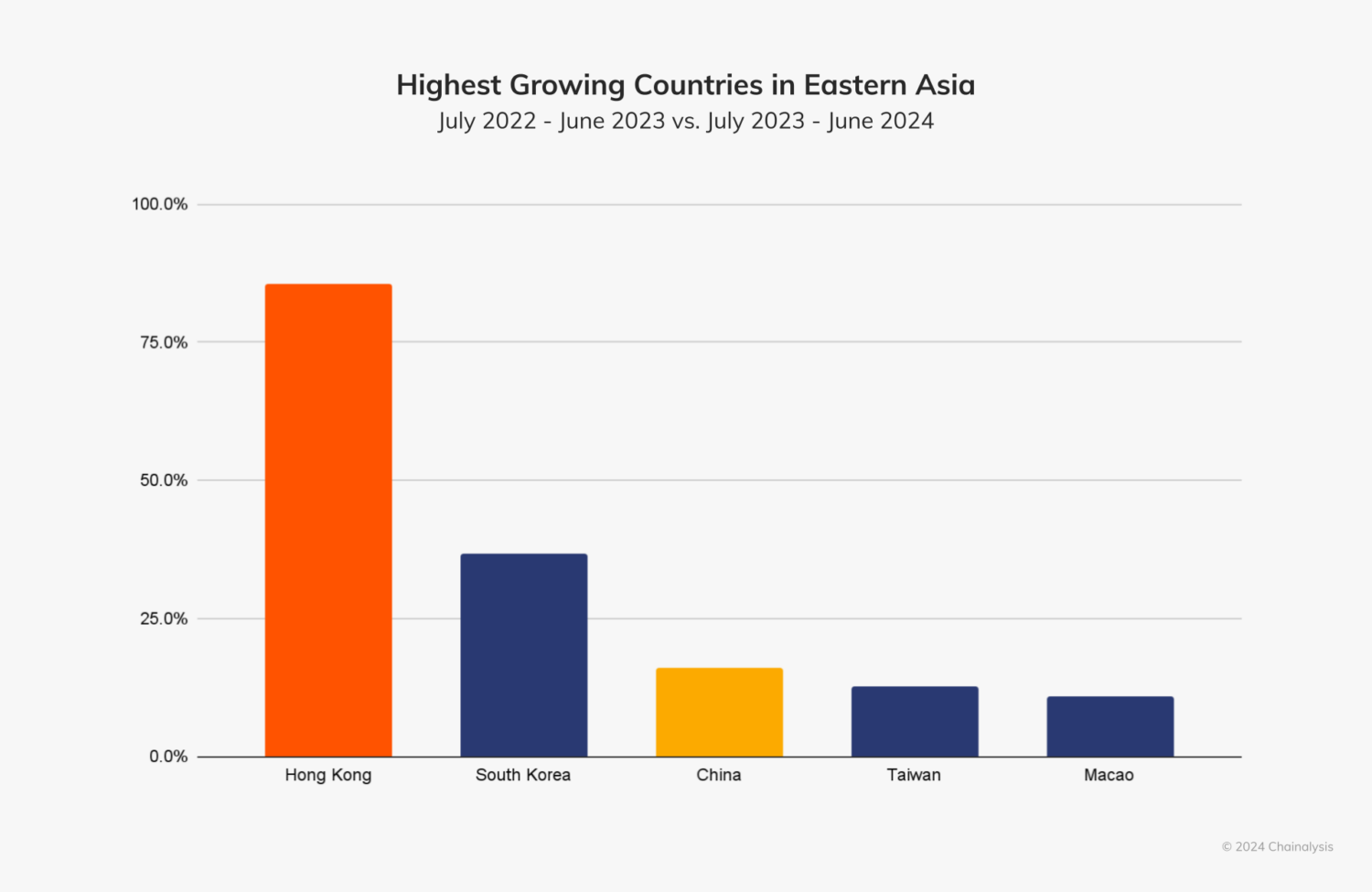

Unsurprisingly, Hong Kong has experienced the largest year-over-year growth in Eastern Asia at 85.6%, and ranks 30th in the world on our Global Crypto Adoption Index.

Below, we’ll look at some recent trends in mainland China and Hong Kong.

Chinese citizens use crypto to preserve wealth

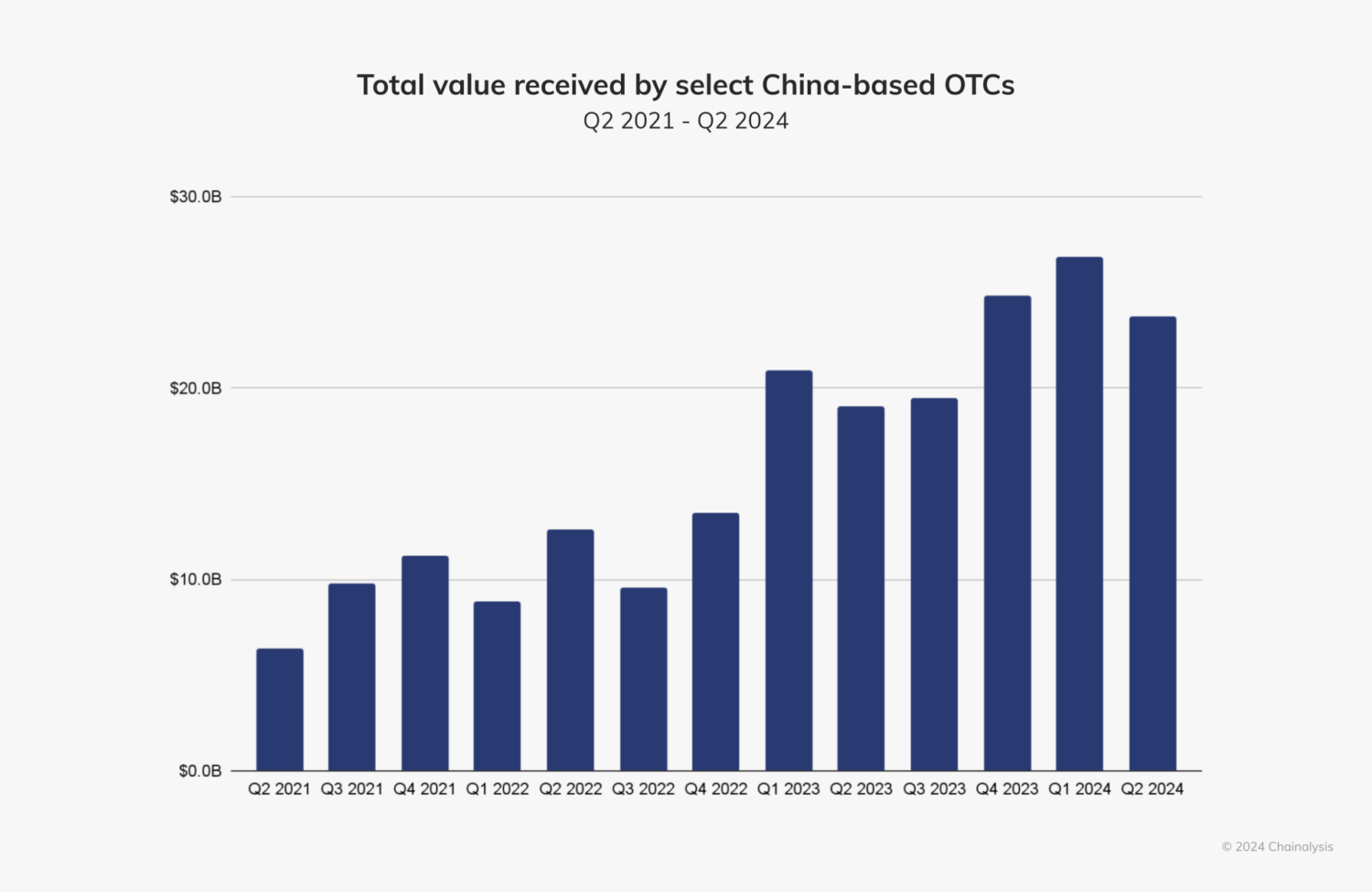

After the Chinese government shut down access to mainstream crypto exchanges in 2021, users began to look elsewhere, turning to over-the-counter (OTC) platforms and P2P trading networks. If we look at a selection of China-based OTC platforms, we see tremendous growth, particularly since mid-2023. Many of these platforms have capitalized on the enduring interest in crypto among Chinese investors and found innovative ways to facilitate crypto trading, and some have adapted to the regulatory environment.

We spoke to Ben Charoenwong, associate professor of finance at INSEAD’s Asia Campus, to learn more about the role of crypto in China’s economy. “The general sentiment toward the Chinese economy has been negative, so people are looking for ways to move money out of the country. Around fifteen years ago, people used Swiss banks and smaller-tier banks to do this, both of which have stopped providing these services. So, people put their money into local investments because there was nowhere to go,” he told us. “Nowadays, if you want to move money out of China through traditional unofficial means like using mules, fees can be as high as 25 to 30 percent. The increasing use of OTC crypto in China suggests that people are looking for faster options to move money.”

Charoenwong also noted that, post-COVID, downward shifts in the property market motivated Chinese citizens — particularly those who are wealthy — to immediately purchase luxury goods and crypto in an attempt to secure their assets. We can see these trends below. As the Chinese real estate market tumbled, more funds flocked into crypto through OTCs, most notably at the end of 2023. We visualized this trend by looking at the price of the China Vanke, which is one of the largest real estate developers in China with a substantial influence on the country’s urbanization and housing market.

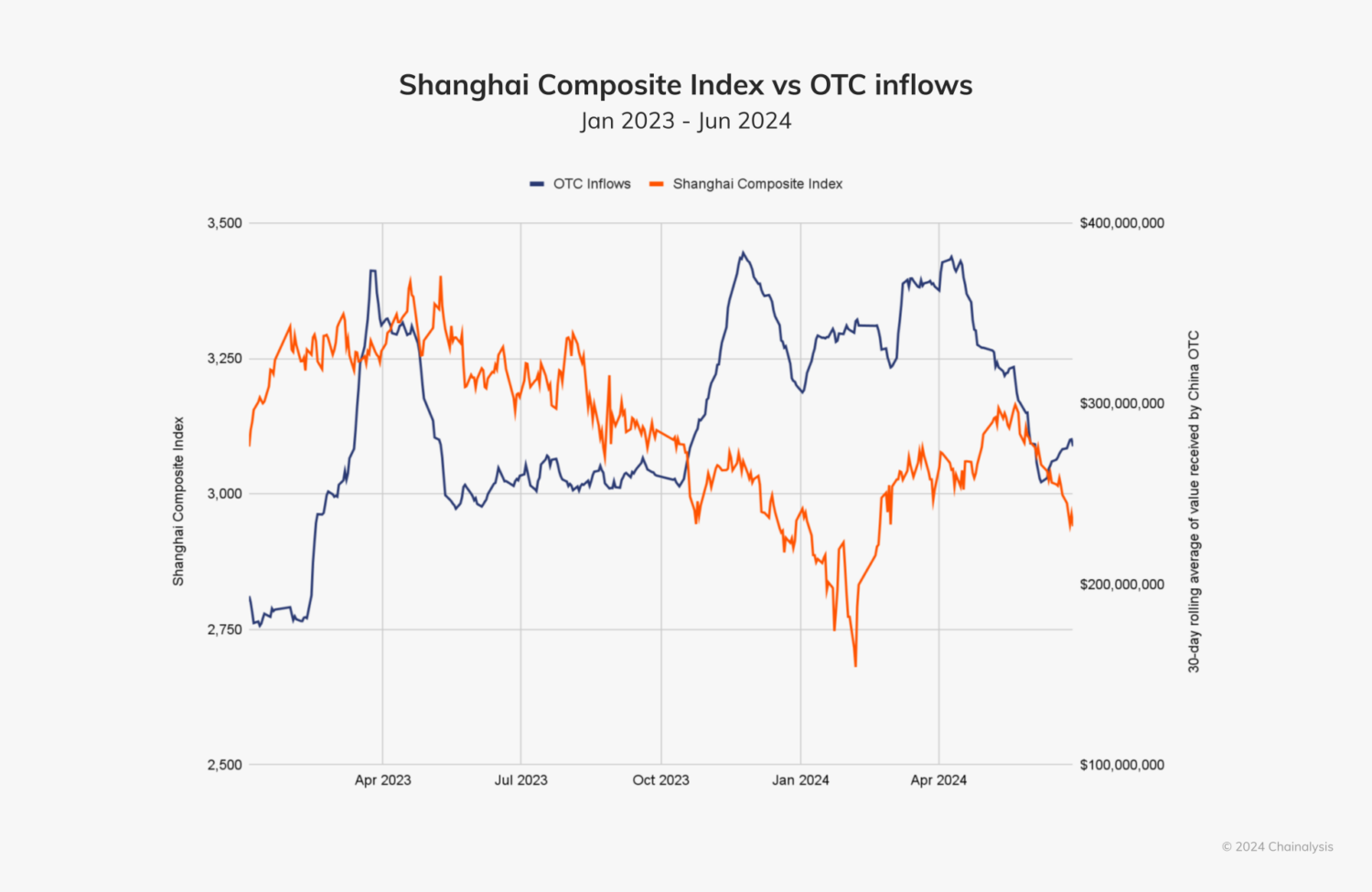

The same pattern holds true when we look at the relationship between inflows to crypto OTCs and a decline in the Shanghai composite index, which measures stocks traded at the Shanghai Stock Exchange.

“Crypto is a way to preserve wealth when things are uncertain and mitigate the effects of authoritarianism in China,” said Charoenwong. “It’s a question of property rights.”

Hong Kong’s supportive regulatory frameworks fuel institutional adoption

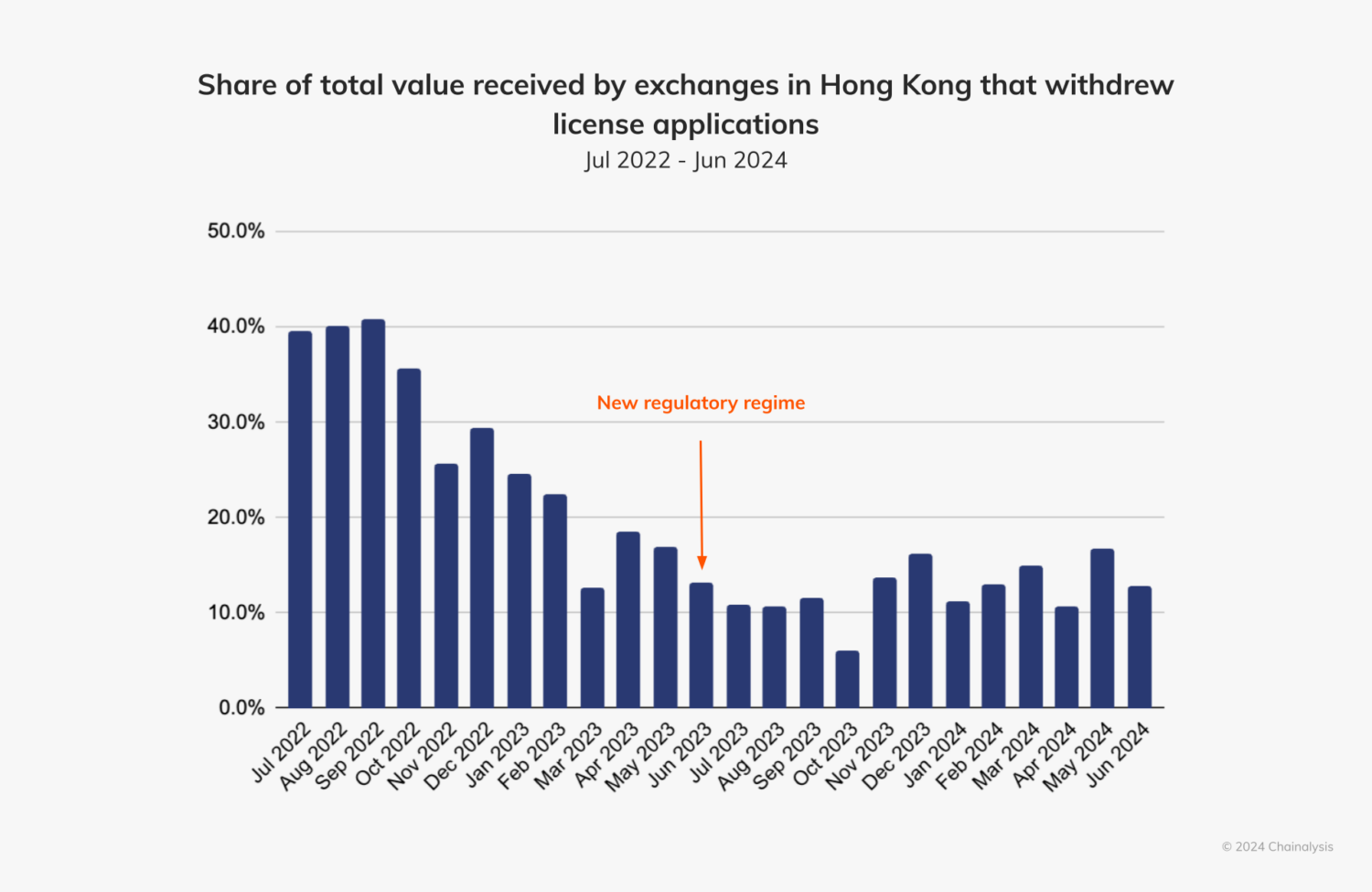

In June 2023, Hong Kong’s securities regulator implemented a new regulatory regime for virtual asset trading platforms (VATPs). This regime provides a regulated path for retail investors to access crypto, but also lays out stringent prudential, consumer protection, and AML/CFT standards. Over the past year, regulators in Hong Kong have been working to implement this new regime.

May 31, 2024 marked the end of the transitional period to this new regime, meaning that exchanges could only operate in Hong Kong if they were licensed or “deemed” to be licensed. Several popular exchanges, whose local affiliates withdrew their license applications ahead of May 31, have therefore had to cease providing trading services to Hong Kong residents. Given that their volume had been in the hundreds of millions of dollars since 2022, these developments may spark a shift toward licensed or “deemed” exchanges, or decrease activity as a whole. As we see below, the share of value received by these exchanges has experienced a steady decline with recent activity hovering around 10 to 15%.

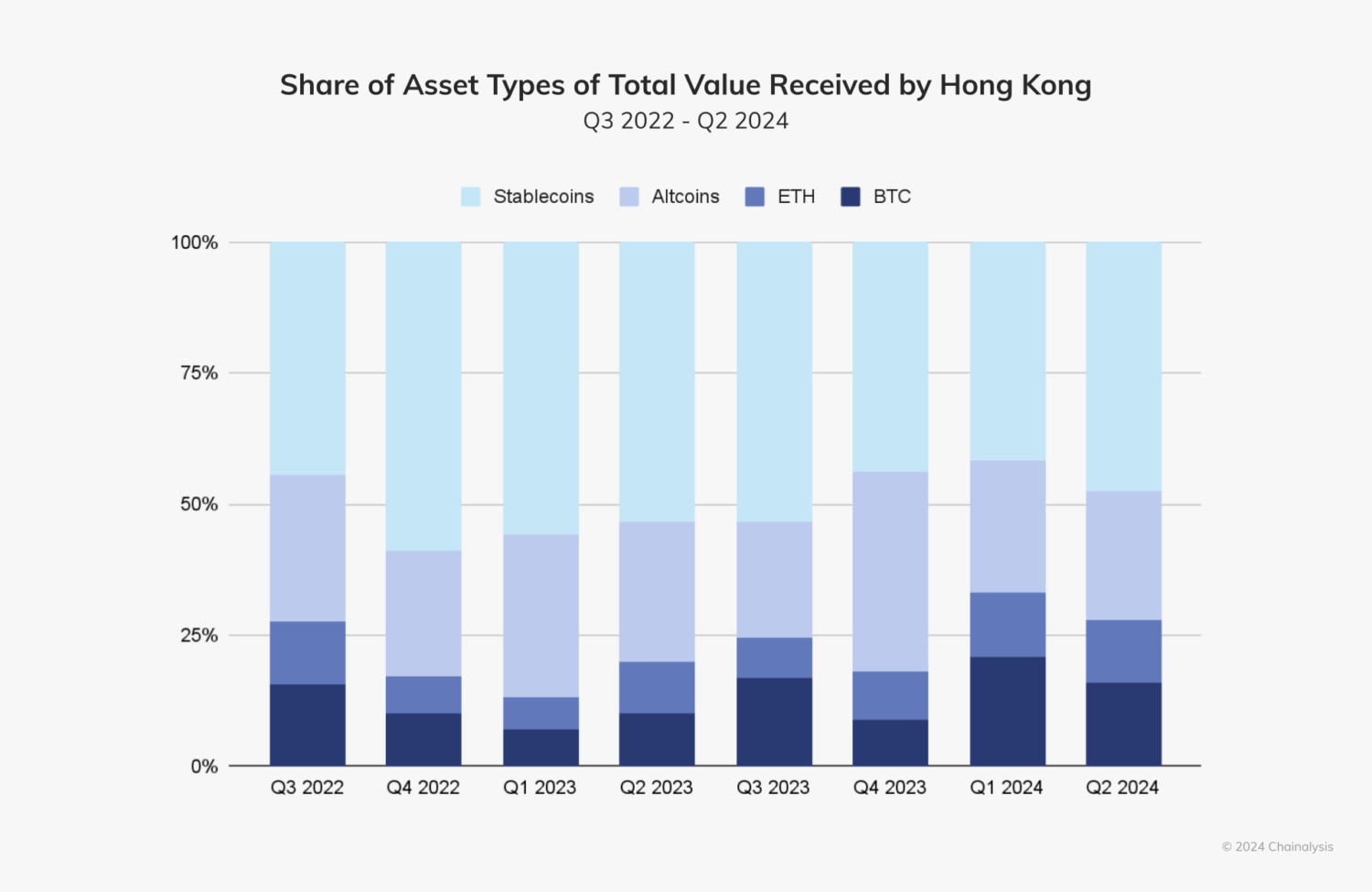

Stablecoins accounted for more than 40% of total value received by Hong Kong each quarter; this will likely grow as the Hong Kong Monetary Authority (HKMA)’s regulatory framework comes into force, as regulated stablecoins will be permitted for offering to retail investors in Hong Kong.

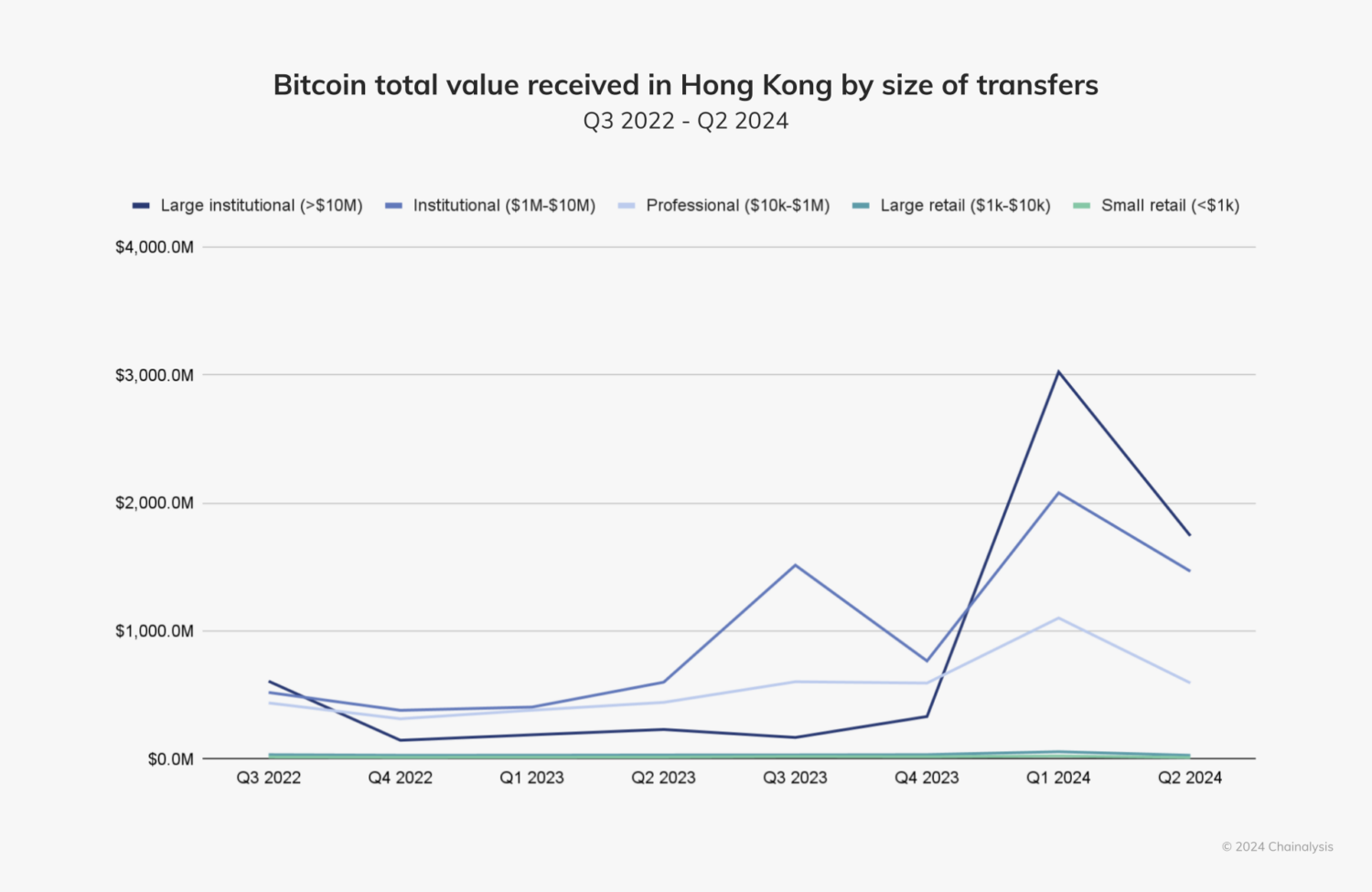

On April 30, 2024, Hong Kong’s financial regulator, the Securities and Futures Commission (SFC), approved three Bitcoin and three Ether-based spot Bitcoin ETFs to start publicly trading. A month before this launch, we saw a significant increase in institutional Bitcoin transfers, many of which occurred on mainstream exchanges working with institutional-facing businesses.

Kevin Cui, Chief Executive Officer of OSL, a leading digital asset trading platform in Hong Kong that offers institutional-grade services for cryptocurrency trading, explained how these ETFs have impacted the market. “As market conditions improve, we are seeing indications of a growing institutional interest that could lead to increased capital inflows in the near future. These ETFs have not only provided a regulated pathway for investment in digital assets, but have also spurred interest in direct holdings in BTC and ETH. This shift is significant, as it marks a transition from traditional financial instruments toward more direct engagement with digital assets, reflecting a broader acceptance and understanding of their potential within the institutional investment community.”

Want to see the full index ranking for all countries?

Get the 2024 Geography of Cryptocurrency Report

This website contains links to third-party sites that are not under the control of Chainalysis, Inc. or its affiliates (collectively “Chainalysis”). Access to such information does not imply association with, endorsement of, approval of, or recommendation by Chainalysis of the site or its operators, and Chainalysis is not responsible for the products, services, or other content hosted therein.

This material is for informational purposes only, and is not intended to provide legal, tax, financial, or investment advice. Recipients should consult their own advisors before making these types of decisions. Chainalysis has no responsibility or liability for any decision made or any other acts or omissions in connection with Recipient’s use of this material.

Chainalysis does not guarantee or warrant the accuracy, completeness, timeliness, suitability or validity of the information in this report and will not be responsible for any claim attributable to errors, omissions, or other inaccuracies of any part of such material.