This post is the first in our “Crypto Crime” series, detailing the recent trends in crypto crime and our predictions for the coming year. Sign up here for access to the complete Chainalysis Crypto Crime Report: Decoding Hacks, Darknet Markets, and Scams.

The whack-a-mole problem with darknet markets

Darknet market activity has been remarkably resilient over the last few years, despite continued efforts by law enforcement to shut down illicit activities. When one darknet market closes, others pop up to take its place.

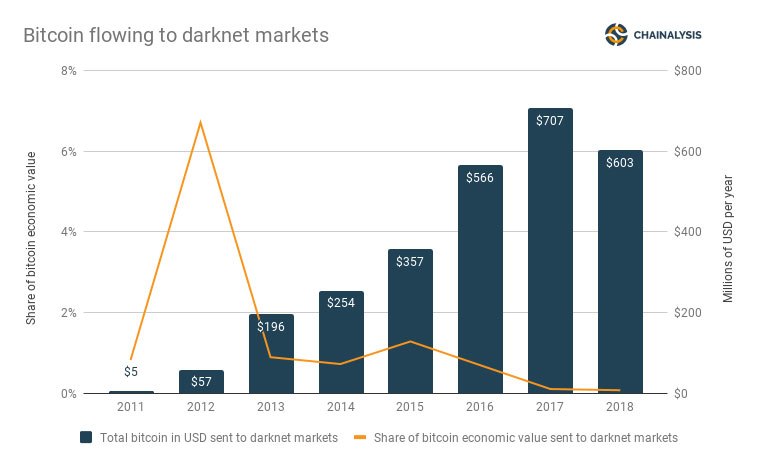

As the chart below shows, volumes going to identified darknet marketplaces peaked in 2017, hitting nearly $700 million USD. Darknet market activity fell by 60% after AlphaBay closed in mid-2017, but the slowdown was short-lived.

Much of the activity that once went to AlphaBay has now been redirected to another popular darknet market which now dominates this space and was four times the size of AlphaBay at its peak. This brings up a fundamental problem with darknet markets: closing one darknet market often just leads people to use other platforms.

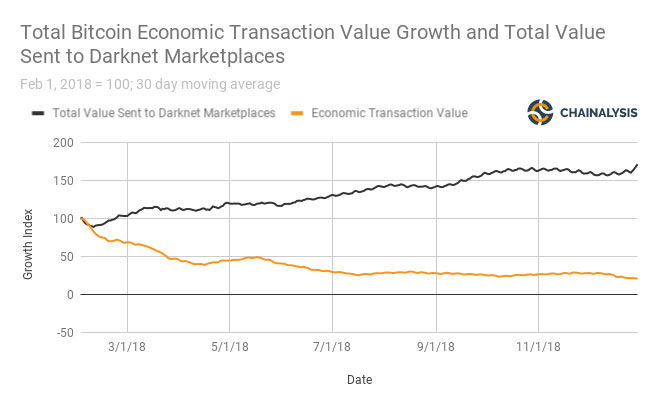

Darknet market activity is relatively price inelastic; that is, you don’t see a drop in this type of activity when cryptocurrency prices fall. In fact, in 2018, darknet market activity and overall market performance had an inverse relationship.

Darknet markets are thriving despite law enforcement’s best efforts

Law enforcement has been working hard to stop illicit activity on darknet markets, and there have been some notable successes like the closure of AlphaBay. But so far, darknet market activity has simply migrated to new platforms. There’s some evidence that darknet activity even increases after closures.

There are, however, some interesting findings from our data that point to behavioral patterns specific to darknet market activity. With these insights we highlight what actions cryptocurrency businesses can take to better prepare against exposure to darknet market activity.