This blog is an excerpt from the Chainalysis 2021 Crypto Crime Report. Click here to download the whole thing!

Darknet markets have long fascinated the public, starting with the infamous Silk Road, which accounted for nearly 20% of all Bitcoin activity during its heyday in 2013. Since then, though they now account for a much smaller percent of overall cryptocurrency activity, the darknet market ecosystem has grown significantly. In 2019, we found that darknet markets as a whole took in nearly $800 million worth of cryptocurrency in revenue, with 49 individual markets active during the year.

However, 2020 has been a different story. While total darknet market revenue has already surpassed 2019 totals, the overall number of purchases, and likely customers as well, has fallen significantly, though the remaining purchases are for higher values. Similarly, the number of active markets has fallen significantly, with several prominent ones shutting down and fewer new ones popping up to take their place.

Why is this happening? One might think the ongoing Covid crisis is the obvious answer. As we’ll explore below, the pandemic has indeed strained postal systems around the world, leading to delivery failures and delays for many darknet market vendors. But the experts we spoke to don’t think that Covid is to blame for this year’s rash of market closures. Instead, it appears that ever-increasing competition combined with the efforts of law enforcement are causing the darknet market ecosystem to consolidate to a few big players — a pattern common to the technology industry and other markets, both legal and illegal. Below, we’ll share our findings on darknet market activity in 2020, how it’s changed throughout the pandemic, and provide possible reasons why so many markets have closed.

Darknet markets’ initial reaction to the Covid pandemic and trends since March

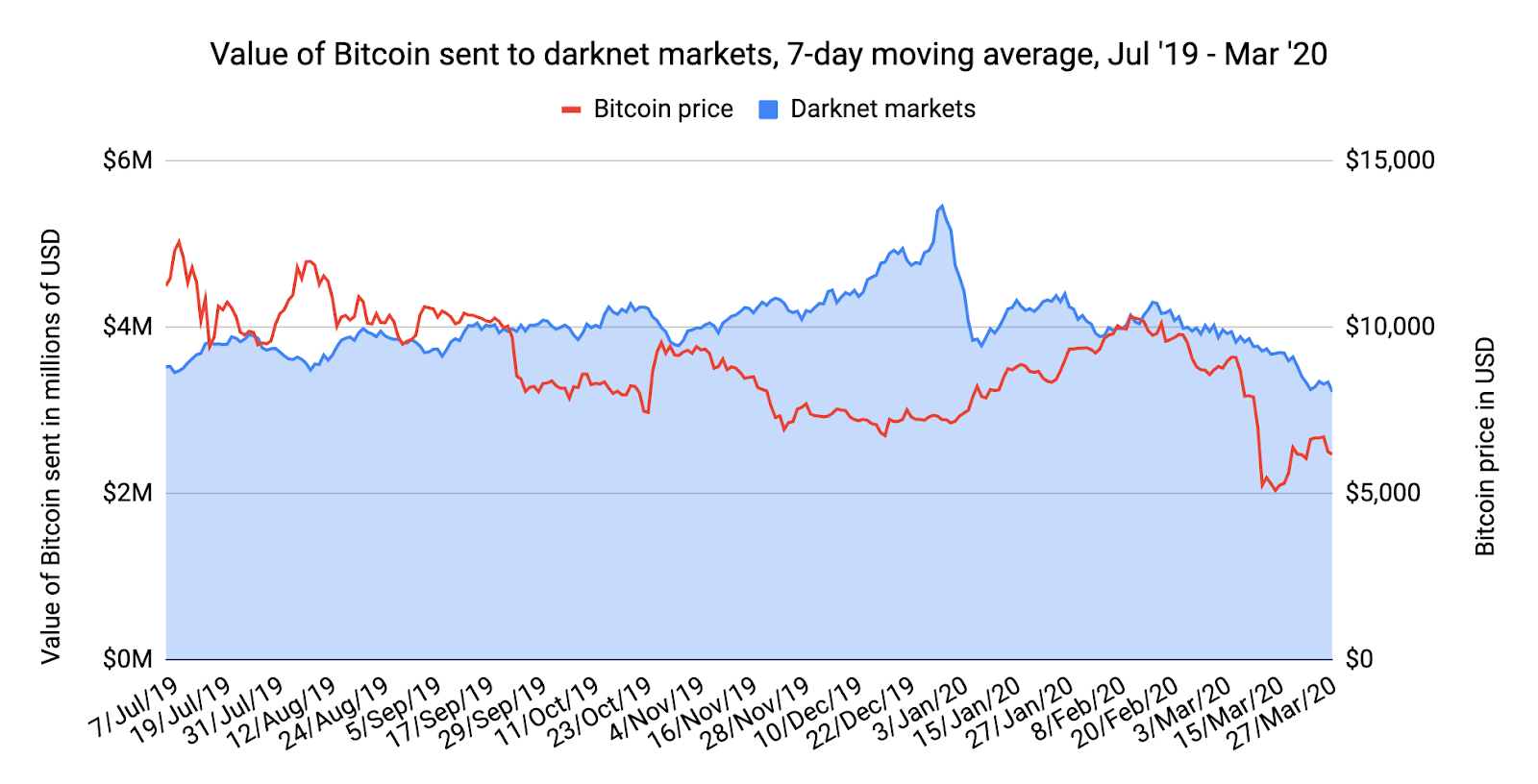

Earlier this year, roughly three weeks after lockdowns began in the United States, we examined the pandemic’s effects on darknet market activity and found that darknet market transaction activity had dropped following a sharp decline in the price of Bitcoin and other cryptocurrencies.

Notable in our findings was the fact that up until this point, darknet market activity appeared to be impervious to Bitcoin market activity. Fluctuations in Bitcoin’s value, which have always been common, rarely appeared to play a role in darknet market consumers’ purchasing activity. However, when Bitcoin’s price began to fall in mid-March following the first round of U.S. lockdowns, so too did darknet market activity.

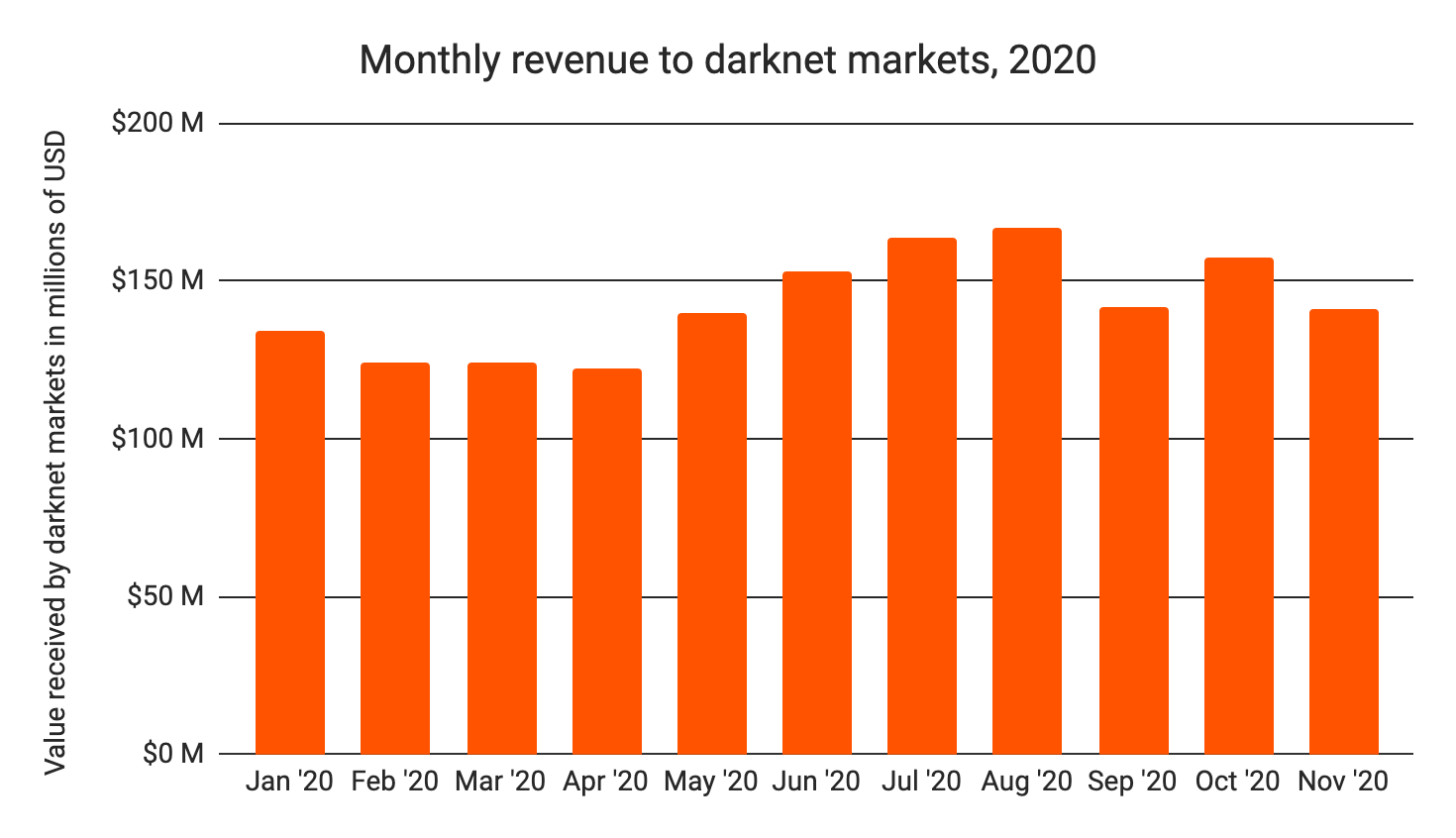

But this change would prove to only be temporary. Starting around May, darknet market revenue returned to its previous state, no longer shifting in sync with Bitcoin’s price. Since then, darknet markets’ monthly revenue has steadily grown, save for small drops in September and November, which largely fall in line with seasonal trends.

With these latest developments, overall darknet market revenue for 2020 has surpassed that of 2019, with one month left to go. But while total revenue may not change, other numbers indicate that tough times could be ahead for darknet markets.

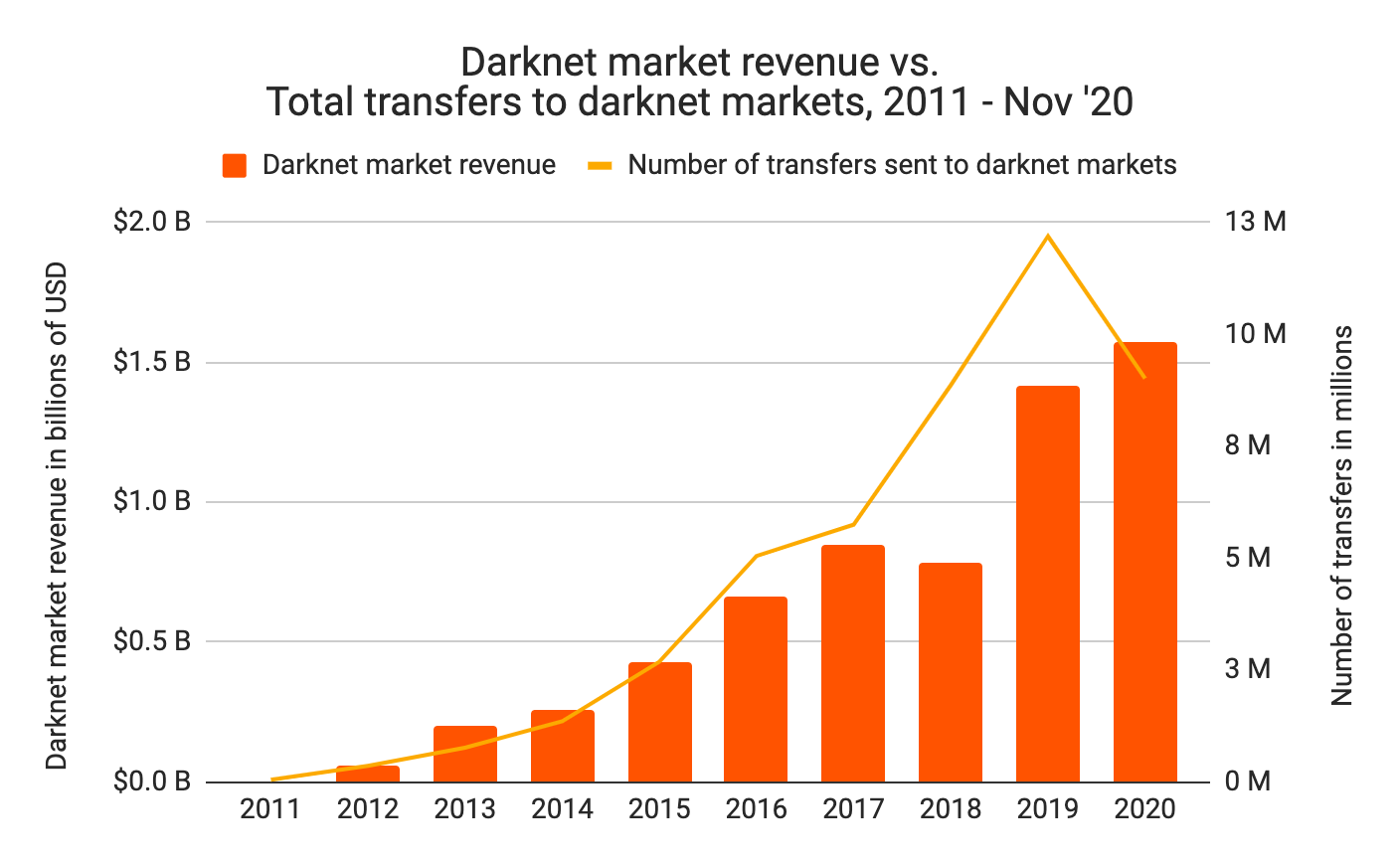

The graph above shows both total darknet market revenue by year, as well as the total number of transfers to darknet markets, which we can use to roughly approximate the number of individual customers and purchases. Interestingly, we see that while revenue has already surpassed its 2019 total (again, with one month left to go), total transfers to darknet markets stand at just over 9 million — well below pace to meet the 2019 total of over 12.0 million. The numbers show that customers in 2020 are making fewer purchases but for larger amounts per purchase compared to 2019. This could indicate that casual buyers or those buying drugs for personal use are shifting away from darknet markets, while those buying in larger amounts — either for personal use or to sell to others — are purchasing more. It could also mean that some casual buyers have begun placing larger orders to stock up amidst uncertainty.

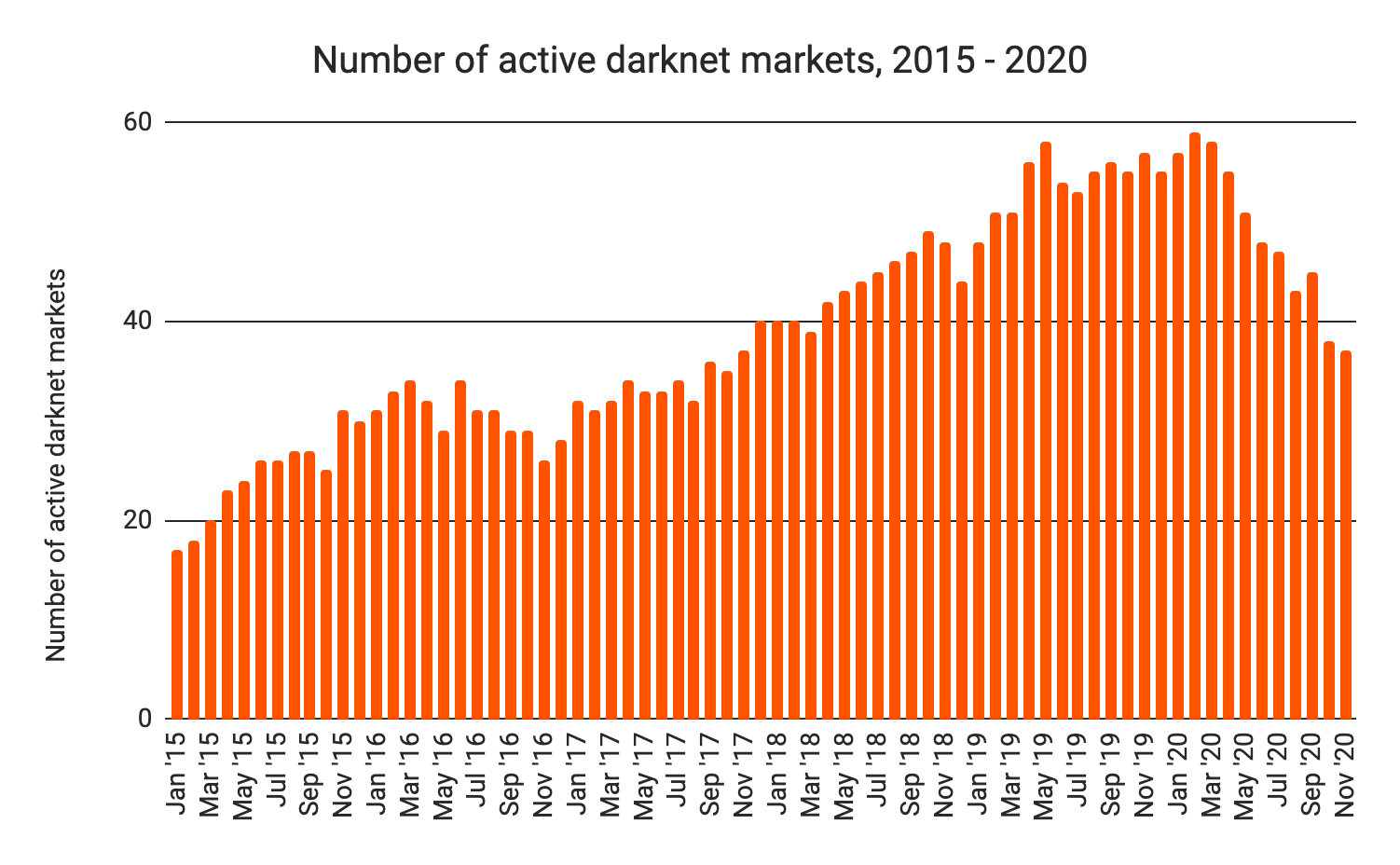

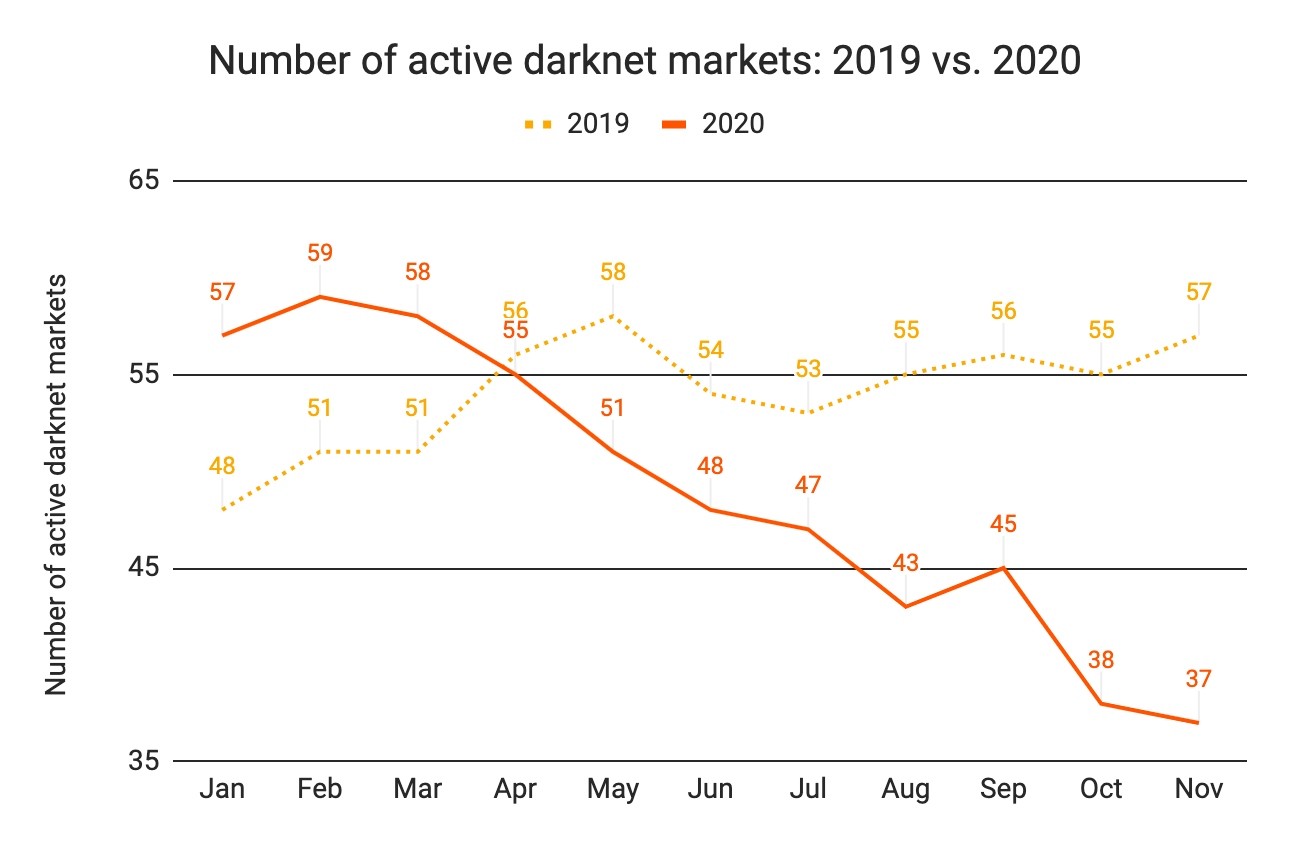

We’ve also seen more darknet market closures in 2020, including prominent markets like Flugsvamp 2.0 and Empire. We see this reflected in the graph below, which shows the number of active markets in each month (active meaning the market has received at least $100 worth of cryptocurrency in a given month) since January 2015.

While some markets claim their closures are only temporary, the 37 darknet markets active in November 2020 is the lowest total since November 2017. We saw no such decline in 2019. In fact, this year’s decline in active markets follows a period of sustained growth in the number of active markets from 2018 through February 2020.

It’s often difficult to tell why markets shut down when they do, as administrators often pull exit scams, in which the market ceases operations but publicly appears to still be active so that administrators can continue collecting money from purchases that will never be fulfilled. Other markets have fallen victim to denial-of-service (DoS) attacks from other markets, in some cases closing as an apparent result. We saw both phenomena in the case of Empire Market, a large and widely trusted darknet market whose operators exit scammed earlier this year two days after being hit by a DoS attack.

Is Covid causing darknet markets to close?

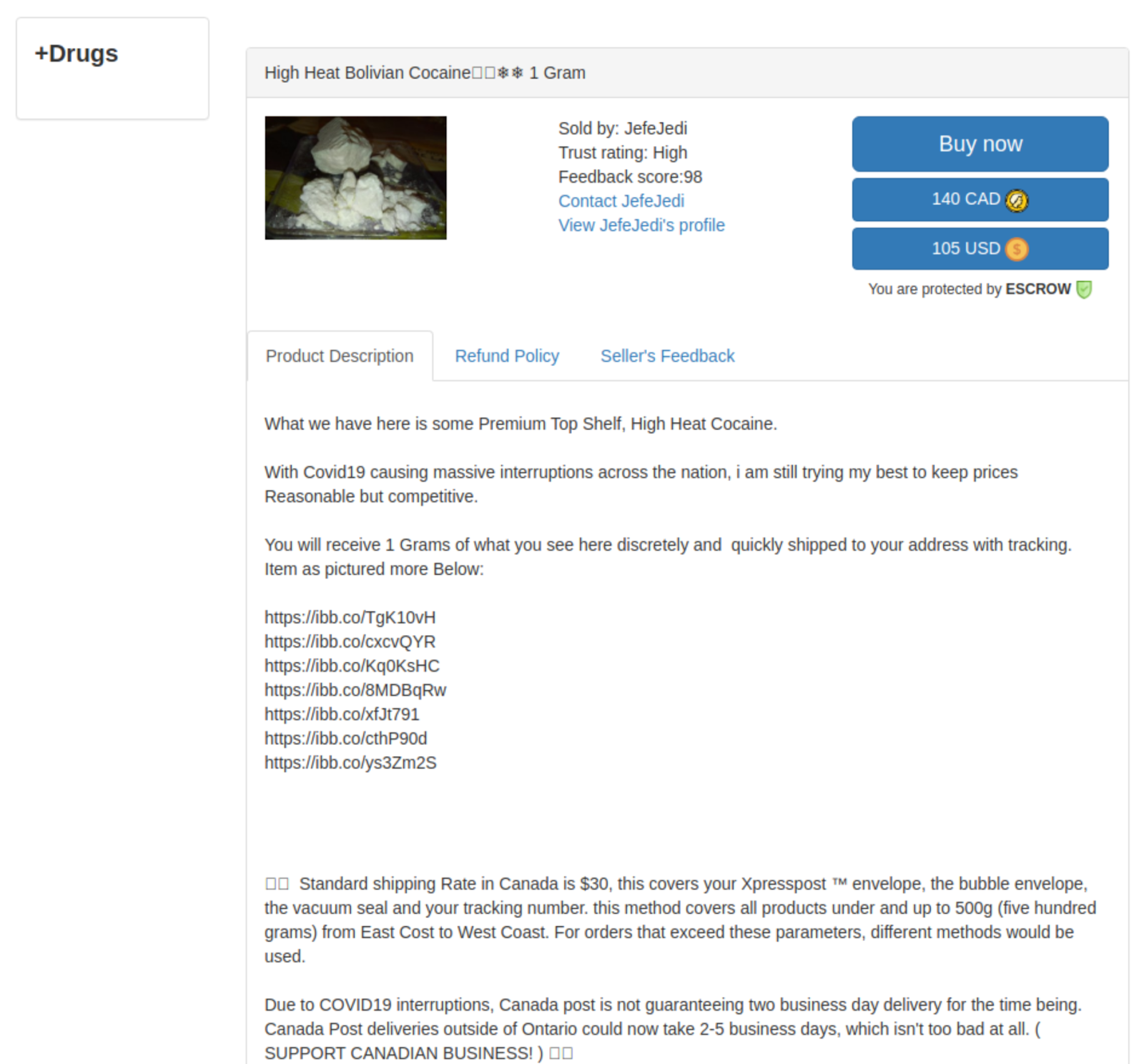

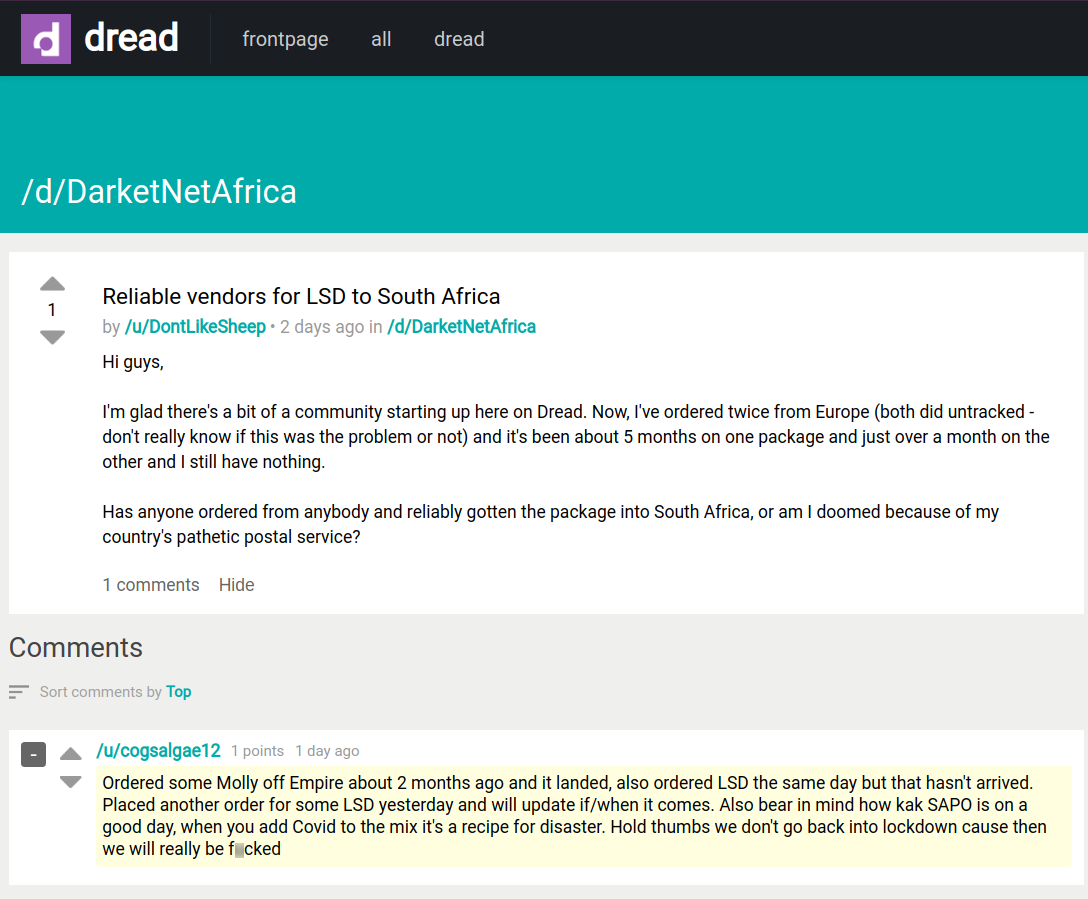

Covid has undoubtedly hindered darknet markets’ sales and operations by causing supply chain disruptions, particularly shipping delays. Darknet market observers have seen this in the form of customer complaints on darknet market-focused forums like Dread and in notes from vendors setting expectations for buyers.

The evidence isn’t just anecdotal either. Criminology researchers Andréanne Bergeron, David Décary-Hétu, and Luca Giommoni recently published a study analyzing hundreds of darknet market drug sales made before and after Covid lockdowns began in the U.S. and Europe to determine how much the virus impacted operations. They found that in the pre-Covid period of January 1 to March 21 2020, between 60% and 100% of all orders on any given day were successful. After Covid lockdowns began, however, the study found that just 21% of all deliveries were successful and on time. Customers and vendors blaming Covid for longer delivery times therefore appear to be correct.

But are shipping delays and other Covid-related operational difficulties causing markets to shut down? We followed up with Lecturer Andréanne Bergeron and Professor David Décary-Hétu, two of the researchers behind the study, to ask their opinion. They reiterated their point that Covid has caused ongoing darknet market delivery delays by placing more strain on postal services. “The world hasn’t gone back to normal yet, so it is unsurprising that the market hasn’t corrected itself yet. Postal services aren’t doing great,” said Bergeron.

However, the researchers didn’t think that any of the darknet market closures in 2020 were a direct result of Covid. “It’s becoming more challenging than ever to run a darknet market — you have to enable security and guard against DoS attacks, and then on top of that there’s competition. All of these factors limit the availability of drugs,” said Décary-Hétu. He believes that these natural forces of competition, rather than the Covid crisis, were the real reason for increased closures, pointing to Chainalysis data to make his point.

“Excluding Hydra, if all darknet markets take in $250 million per year and administrators make 5% commission, that’s $12.5 million total divided by all the markets, where a lot of employees have to be paid. It’s simply not worth the risk of spending 100+ years in jail,” said Décary-Hétu.

What’s next for darknet markets?

Darknet markets appear to be in a precarious position in 2020, with several closing down and the remainder relying on a shrinking pool of customers for revenue. Counterintuitively, and despite its impact on shipping times, Covid doesn’t appear to be the primary cause of these issues. Instead, darknet market consolidation may be the result of competitive forces endemic to the category itself, with Covid at most simply speeding up a trend that already existed.

We see a similar dynamic play out in so-called winner-takes-all markets like technology, in which competition over time naturally whittles the market down to the biggest, most efficient players. There are of course key differences between darknet markets and technology companies — Apple, for instance, doesn’t need to worry about being shut down by law enforcement. But still, as Professor Décary-Hétu points out, darknet markets are a tough business, and the dwindling number of markets suggests that not all of those standing today will survive.

This blog is an excerpt from the Chainalysis 2021 Crypto Crime Report. Click here to download the whole thing!