This blog is a preview of our report on cryptocurrency market events. Click here to download the full report!

Cryptocurrency markets are volatile, sometimes extremely so. While the causes of recent volatility in early March 2020 are clear — an unprecedented inflow of cryptocurrency to exchanges in response to the COVID-19 pandemic — it’s difficult to identify the causes of volatility in other cases. On-chain data can change that though. In the following report, we’ll show you how we can use on-chain data to algorithmically identify and investigate market events.

We define market events as periods of rapid change in exchange inflows — the amount of cryptocurrency flowing into exchanges. These on-chain changes often precede periods of increased trading activity and cryptocurrency price fluctuations. Our ability to measure exchange inflows is a significant differentiator for cryptocurrency markets. In fiat markets, we can only see data on the trades happening on a given exchange, but not data on the total assets entering that exchange over time. In cryptocurrency, transfers to exchanges are recorded on the blockchain, giving us greater insight into the motivations and timing of traders’ decisions.

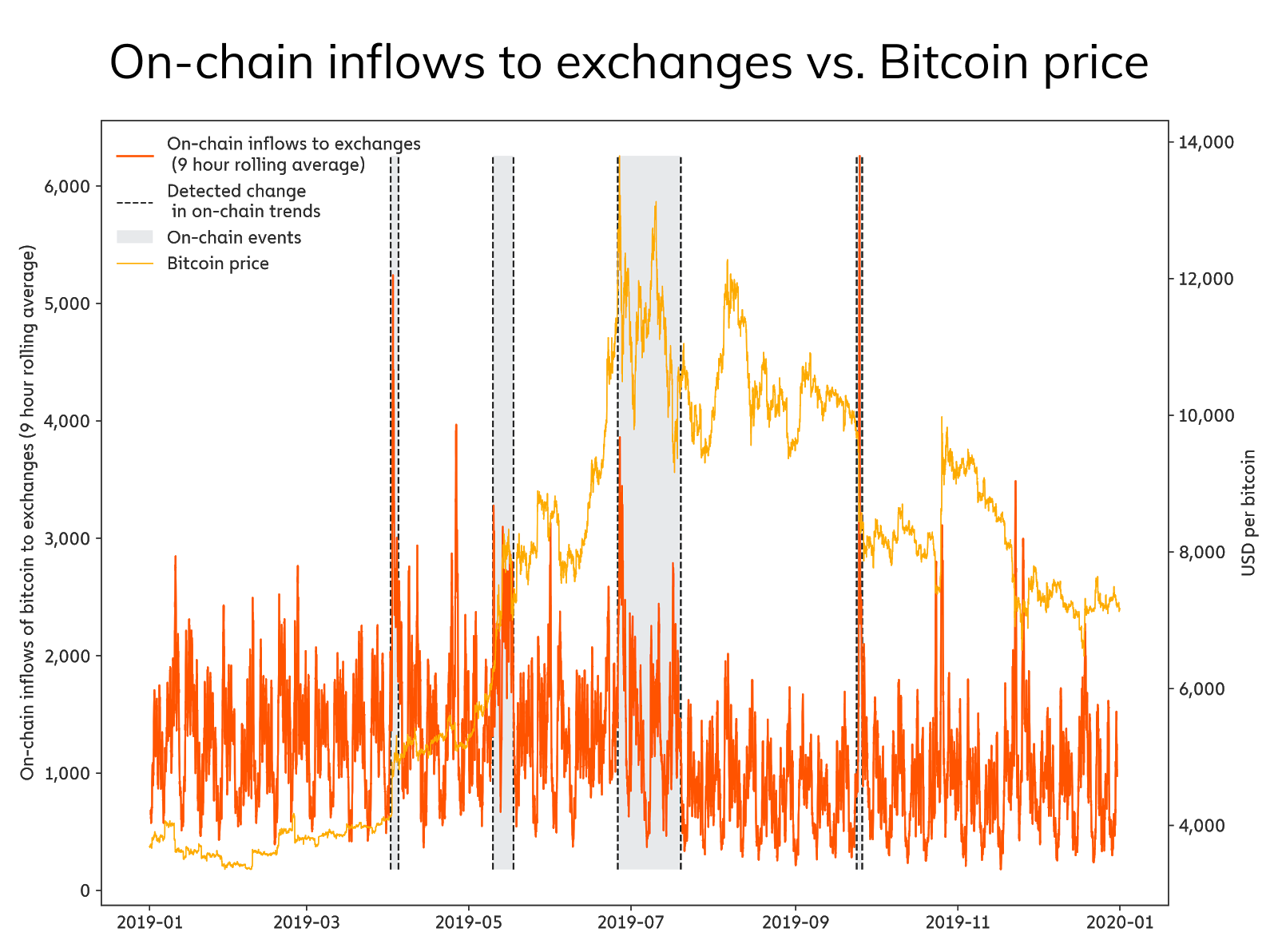

We can identify market events by analyzing trends in exchange inflows over time. A change in inflows means a change in the amount of cryptocurrency available to buy and sell. If there is a change in the trend of inflows — meaning they become significantly higher or lower for a period of time — traders may be changing their valuations. On the graph below, we look at market events in 2019 for Bitcoin specifically.

We algorithmically identify four market events in 2019 by detecting changes in inflow trends. These events are represented by the time periods of the graph shaded in grey — the dashed lines represent the changes in inflow trends that mark the beginning and end of each event. All four market events we identified in 2019 also corresponded with major fluctuations in Bitcoin’s price.

But what causes market events? We can investigate by looking at on-chain exchange inflow data in conjunction with trade data reported by exchanges. In this report, we do a deep dive into the market event that occurred from late June through mid-July of 2019, comparing the on-chain exchange inflow data to changes in market sentiment, which we approximate by measuring long vs. short positions on Bitcoin’s price taken on the BitMEX cryptocurrency derivatives exchange. In addition, we examine the concentration of both types of activity, approximating how many traders contribute to both changes in exchange inflows and relevant BitMEX positions on Bitcoin’s price. Taken together, this data enables us to reconstruct the causes of a market event. In this case, it may even show us a potential instance of Bitcoin price manipulation.

Click here to download the full case study and learn what on-chain data can teach us about the market events that impact cryptocurrency prices.