Executive summary

Here’s a brief summary of the key findings and takeaways from the research presented in this report:

- Opioids — in particular, synthetic opioids such as fentanyl — continue to cause considerable harm to United States citizens, with an increase in overdose deaths in recent years.

- China has been home to the largest chemical industry by revenue in the world since 2011. A 2020 Drug Enforcement Administration (DEA) intelligence report cited China as the top producer of fentanyl precursors in 2019. The DEA has noted a pattern of fentanyl production in which precursor chemicals are illegally shipped to Latin America, where they are used to manufacture fentanyl, which is then transported into the U.S. to be sold.

- Due to recent law enforcement actions and sanctions, we know that many illicit actors involved in fentanyl-related transactions use cryptocurrency. To analyze these patterns at scale, Chainalysis identified cryptocurrency addresses associated with suspected China-based fentanyl precursor sellers. These addresses have received more than $98 million worth of cryptocurrency since 2015. Latin America, North America, Europe, and Asia exhibit a high degree of exposure to these suspected chemical shop addresses.

- Using data from U.S. Customs and Border Protection, Chainalysis found that on-chain flows to suspected chemical shop addresses correlate with fentanyl seizures at the U.S.-Mexico border, suggesting that cryptocurrency-based transactions associated with fentanyl production match regional patterns previously identified by the DEA.

- Darknet markets also continue to facilitate global distribution of fentanyl and related substances. Their on-chain activity may provide useful information about crypto-related opioid trafficking.

Keep reading to learn more about the role of cryptocurrency in fentanyl sales across the globe.

New updates, 3/7/24: Crypto inflows to chemical precursor shops have exceeded $250 million since 2015

Last year, we analyzed the role of cryptocurrency in global fentanyl sales by looking at the on-chain activity of crypto addresses associated with suspected China-based chemical precursor shops. We found that those addresses received more than $37.8 million worth of cryptocurrency between January 2018 and April 2023.

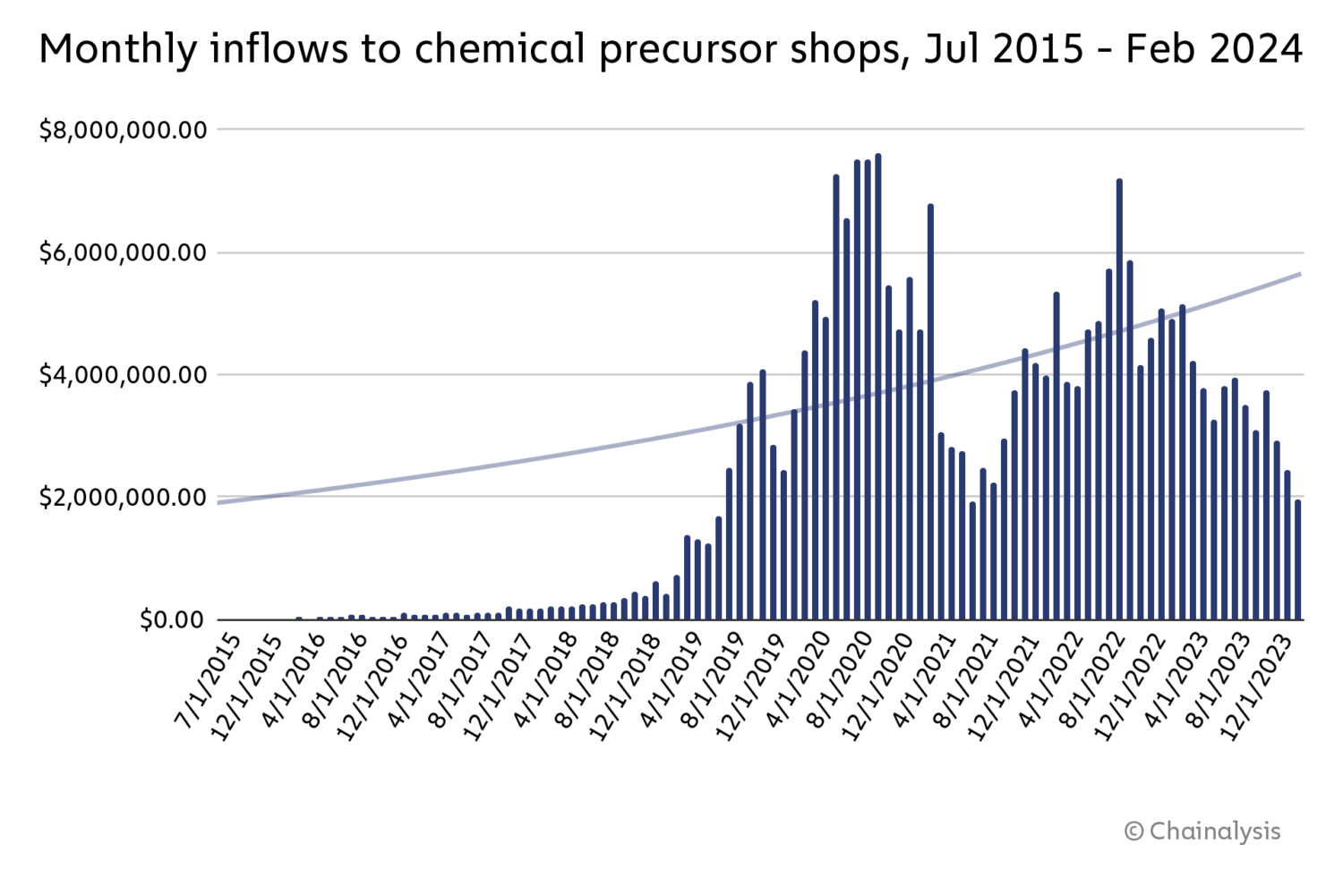

We recently updated our coverage to account for several thousand more addresses associated with new chemical precursor shops we’ve identified, and with entities we strongly suspect to be chemical precursor shops based on a comparative methodology that lets us uncover entities with similar on-chain behavior. Our updated chemical precursor shop dataset includes both exchange deposit addresses and a number of unique on-chain services and wallets. Total inflows to the expanded set of addresses are approximately $250 million, with activity dating back to July 2015.

Many of the new entities we’ve added are also known or suspected to be based in China. Inflows to chemical precursor shops suspected to be based in China total more than $98 million in the new address set.

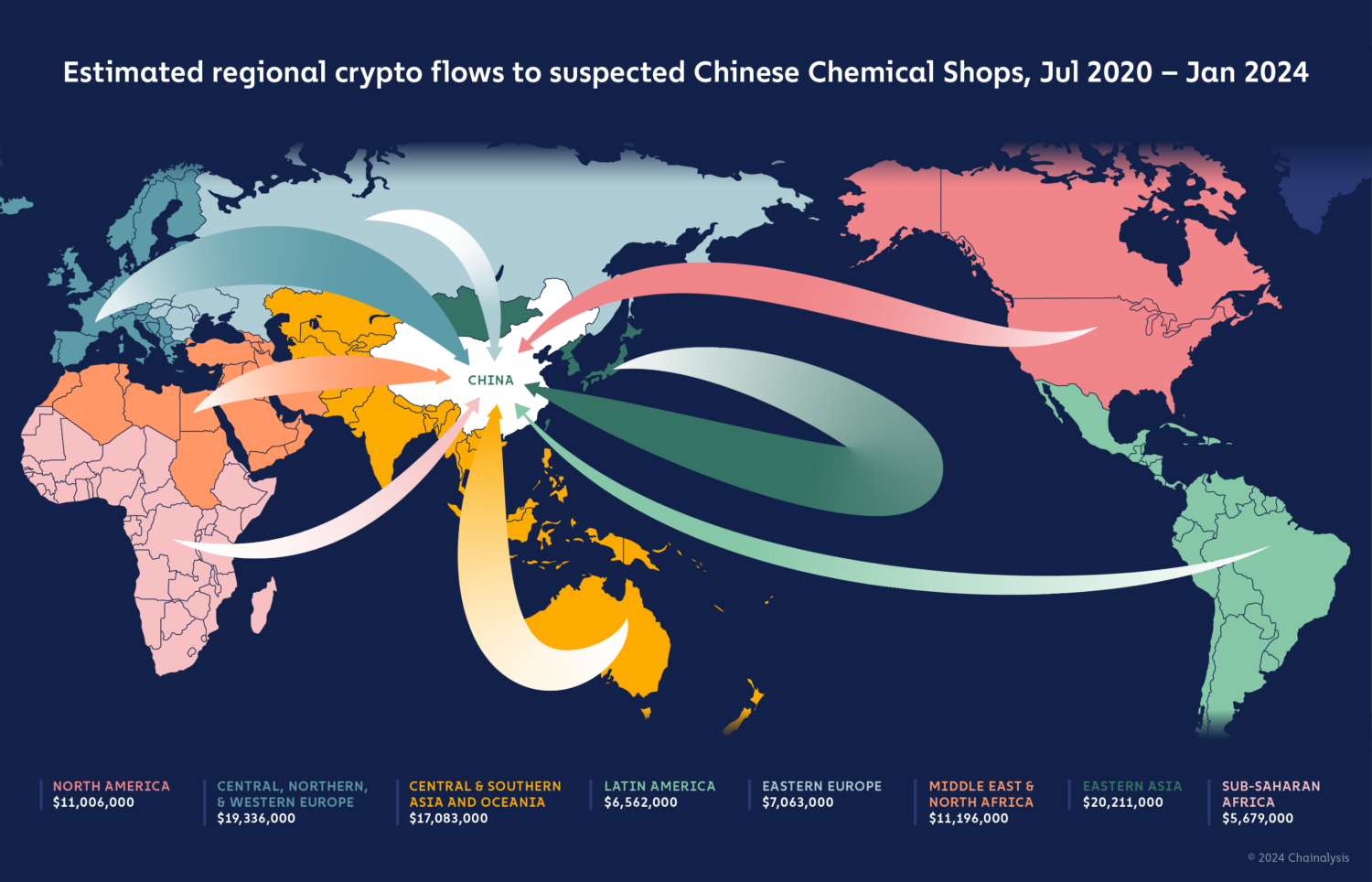

Using the same geographic estimation methodology we employed previously, we were able to estimate the regional origins of crypto sent to the above entities. Regional exposure seems heavily weighted toward Asia, North America, and Europe.

Using the same geographic estimation methodology we employed previously, we were able to estimate the regional origins of crypto sent to the above entities. Regional exposure seems heavily weighted toward Asia, North America, and Europe.

Original Post, 5/24/23: The ongoing opioid crisis

Since 1999, nearly one million people in the United States have died from drug overdoses, with an increasing share of those deaths coming from opioids specifically. The year 2020 saw new highs with approximately 69,000 opioid-related deaths, 82% of which involved synthetic substances such as fentanyl. Similarly, the CDC reported a significant increase in law enforcement encounters involving positive tests for fentanyl, beginning in 2013. These statistics indicate that fentanyl is causing significant harm to U.S. citizens.

Despite the traceability of cryptocurrency, illicit actors involved in the sale of fentanyl and fentanyl precursor chemicals are often drawn to crypto due to its near-instant, cross-border, and pseudonymous features. Many drug traffickers use crypto in attempts to evade law enforcement, thus facilitating the ongoing opioid epidemic in the United States and other drug-related crises worldwide.

In this blog, we’ll explore the role of cryptocurrency in global fentanyl sales by analyzing the activity of crypto addresses associated with chemical shops suspected of selling fentanyl precursors, some of which come from shops involved in recent criminal cases. We’ll also look at the ongoing role of darknet markets in fentanyl sales.

A background on fentanyl precursor chemical sales

The manufacturing of fentanyl is an international process, often requiring the purchase of precursor chemicals that usually originate outside of the United States — typically China. China has been home to the largest chemical industry by revenue in the world since 2011. China was also identified as the world’s leader in chemical exports, with more than $100 billion worth in 2021 alone.

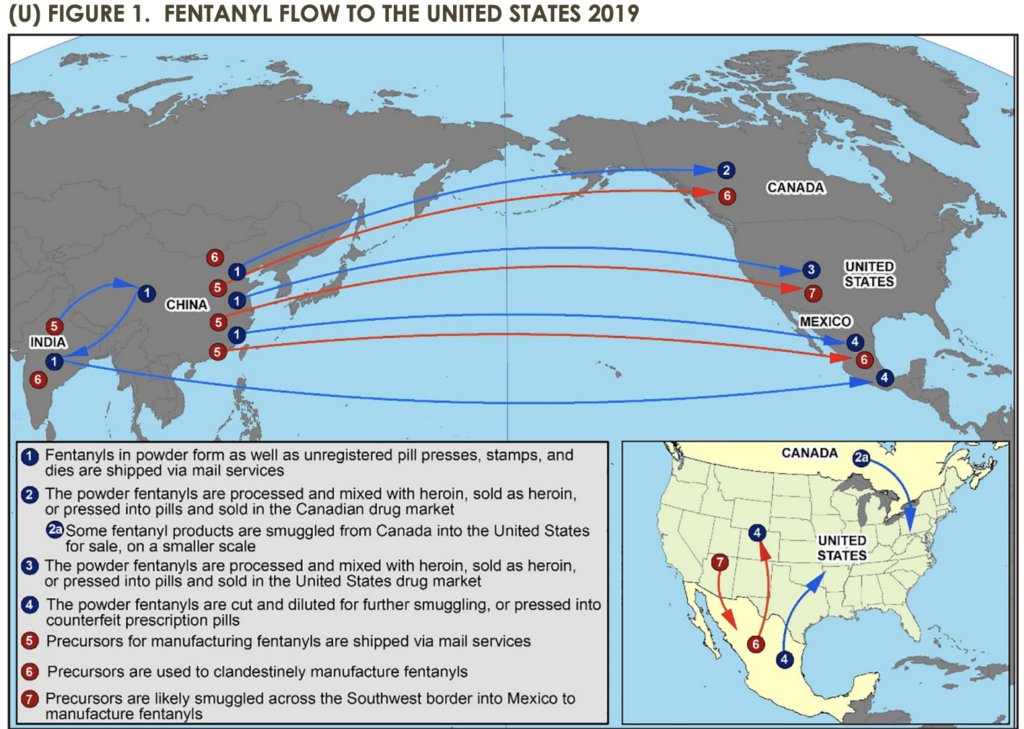

A 2020 Drug Enforcement Administration (DEA) intelligence report cited China as the top producer of fentanyl precursors in 2019, with India also noted as a heavy producer. Some of the chemical shops in these countries may sell fentanyl precursors legally to legitimate pharmaceutical companies, while others sell them under the table to drug trafficking organizations who then use them to illegally manufacture and sell fentanyl as a street drug. Although these patterns may change over time, the DEA estimated that the geographic flows of fentanyl and fentanyl precursor chemicals to North America looked like this in 2019:

Source: DEA

This process typically involves the following steps: First, Chinese and Indian chemical shops send fentanyl precursors to Mexico and Central America. Here, drug cartels create and package fentanyl products, which they then send across the border into the United States.

The DEA, the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC), and the U.S. Department of Justice (DOJ) have made substantial efforts aimed at reducing this drug trafficking. For instance, the Federal Bureau of Investigation (FBI) helped take down large darknet markets such as AlphaBay and Wall Street Market, which collectively received almost $800 million during the course of their operations. Additionally, in 2018, the DOJ established Joint Criminal Opioid Darknet Enforcement (J-CODE), a specialized unit that investigates the sale of fentanyl and other opioids specifically on the darknet. J-CODE led Operation Disarray and Operation SaboTor, which resulted in 61 arrests and the closure of 50 darknet market accounts involved in illegal activities.

Due to law enforcement actions and sanctions over the past few years, we know that many illicit actors involved in fentanyl and fentanyl precursor transactions use cryptocurrency. One instance of this occurred in 2019 when OFAC identified several Chinese nationals who participated in international drug trafficking of synthetic opioids and precursor chemicals, and laundered money using Bitcoin.

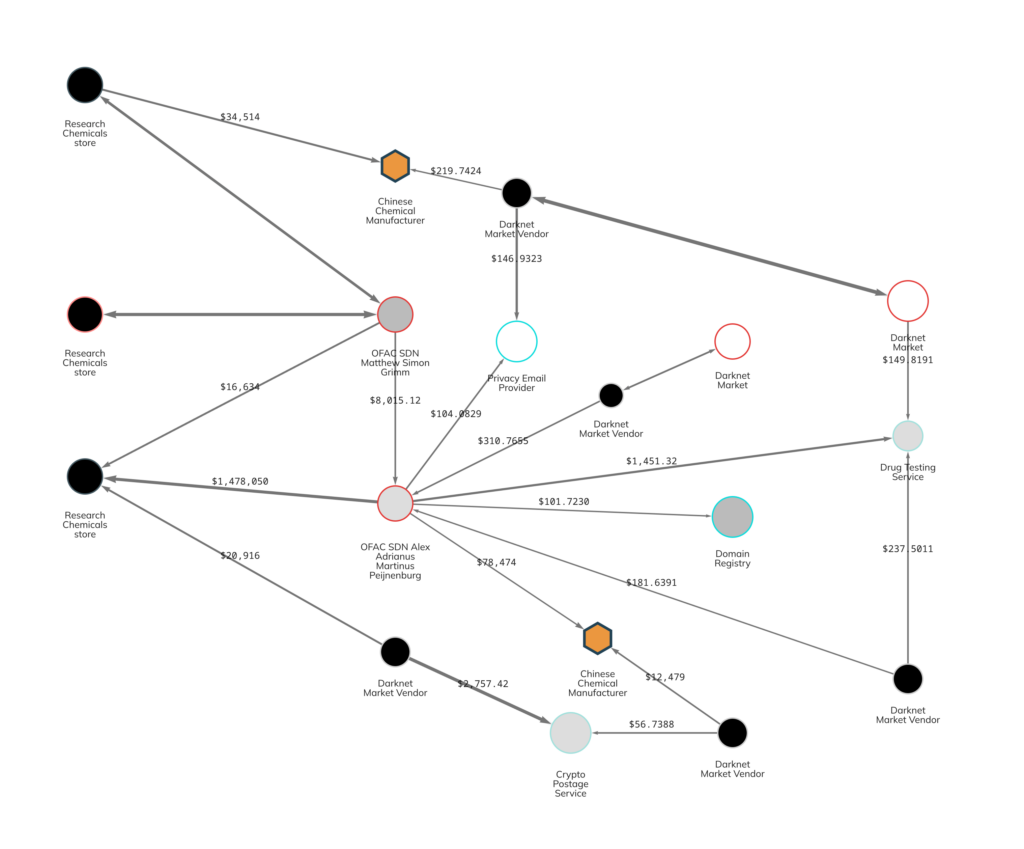

In a separate case, OFAC sanctioned several Dutch and U.K. nationals in November 2022 for selling illicit synthetic substances to U.S. consumers using darknet markets and shell companies. OFAC included Bitcoin, Bitcoin Cash, and Ethereum addresses as identifiers for two of these individuals, Alex Adrianus Martinus Peijnenburg and Matthew Simon Grimm. Peijnenburg’s wallet received inflows of more than $25 million, whereas Grimm’s wallet received nearly $5.5 million.

The Chainalysis Reactor graph below showcases the on-chain complexity of Peijnenburg’s and Grimm’s operation, and some of their direct overlapping transactions involving darknet markets and research chemicals stores. They also transacted with a privacy email provider and a crypto-based postage service using cryptocurrency, presumably purchasing their services in support of their drug enterprise.

More recently, on April 14, 2023, OFAC and the DOJ sanctioned and charged individuals and entities who used cryptocurrency addresses to sell illicit fentanyl and other synthetic drugs. Wuhan Shuokang Biological Technology (WSBT) and Suzhou Xiaoli Pharmatech (SXPC) are two of these organizations. Based in China, these two chemical labs sold fentanyl precursors to brokers in Latin America, who sold them to drug cartels in Mexico. The drug cartels then created fentanyl products and shipped them into the U.S.

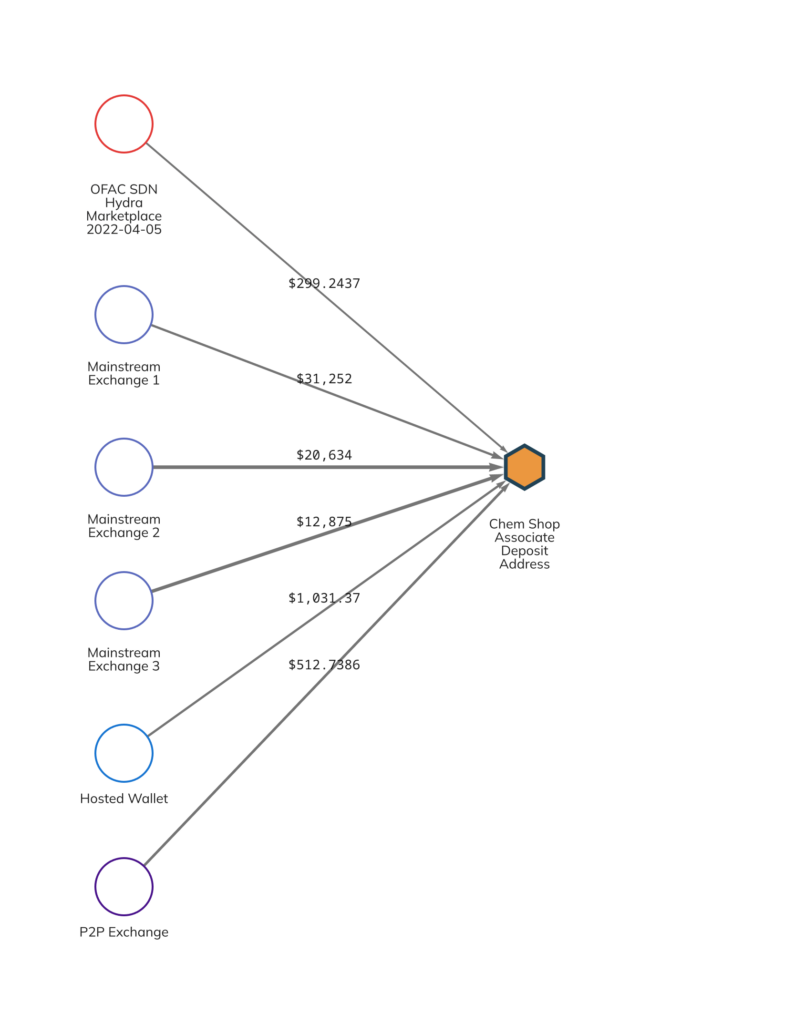

WSBT and SXPC both accepted Bitcoin for purchases. One address belonging to an associate of WSBT received approximately $366,000 in Bitcoin as part of these transactions, most of which was sent from mainstream exchanges and the now-sanctioned darknet market Hydra.

Finally, on May 2, 2023, the DOJ and J-CODE announced the successful results of Operation SpecTor, an internationally-coordinated operation formed to disrupt illegal drug trafficking on darknet markets. Operation SpecTor led to a record-breaking 288 arrests and seizures of 64 kilograms of fentanyl and fentanyl-related substances, plus $53.4 million in cash and cryptocurrency.

These cases underline the role of cryptocurrency in trafficking both fentanyl and fentanyl precursor chemicals. The good news is that government agencies can leverage Chainalysis Reactor to trace the flow of funds and better understand fentanyl’s supply chain.

Geographic estimation of cryptocurrency-related fentanyl precursor flows

The cases described above are examples of crypto-based fentanyl transactions that span the globe. Chainalysis sought to analyze at scale crypto transactions associated with fentanyl precursor chemical sales specifically, and to examine whether they mirror the geographic patterns identified previously by the DEA.

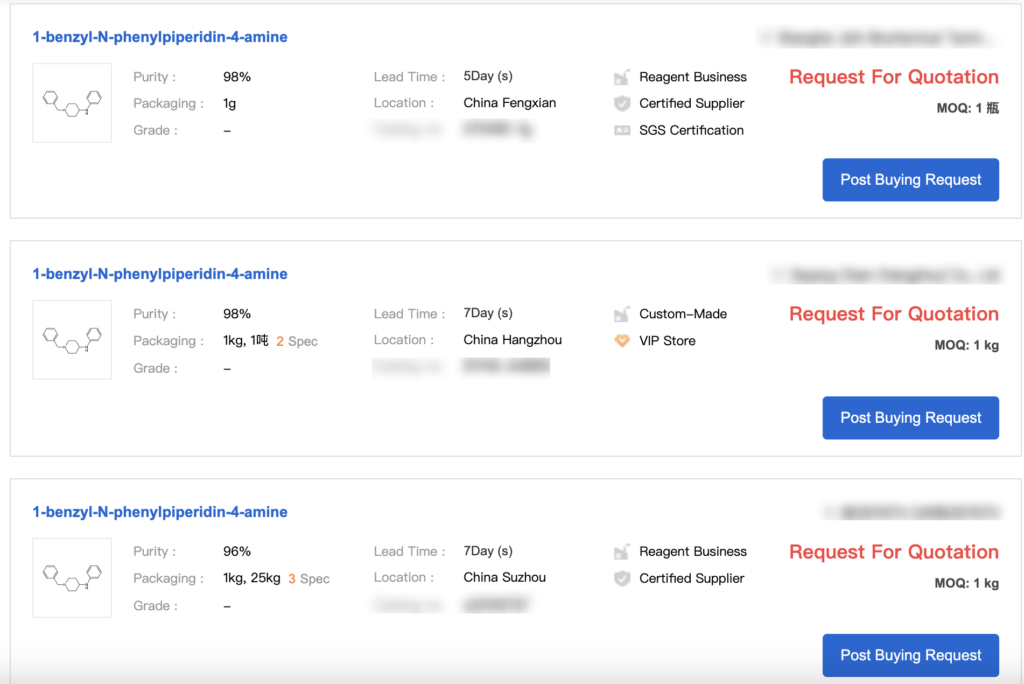

To do this, we first pulled four cryptocurrency addresses identified in some of the cases described above as belonging to Chinese chemical shops selling fentanyl precursors. We then applied a comparative methodology to find dozens of other addresses that closely resemble the first four. Based on similarities in their activity, we assess on a predictive basis that these additional addresses are also associated with Chinese chemical shops. In some cases, we were able to find the specific, active shops associated with these addresses and confirm the validity of our projections. The screenshot below shows fentanyl precursor chemicals available on the website of one such shop whose address was surfaced by our comparative methodology. [1]

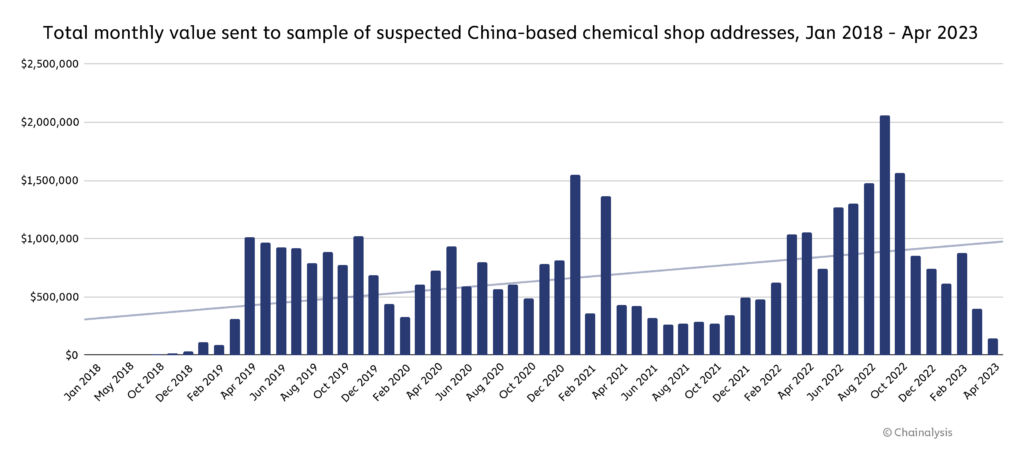

Below, we can see the total monthly flows since January 2018 to the addresses we identified, plus the original four pulled from public case files. As of April 2023, inflows have totaled approximately $38 million.

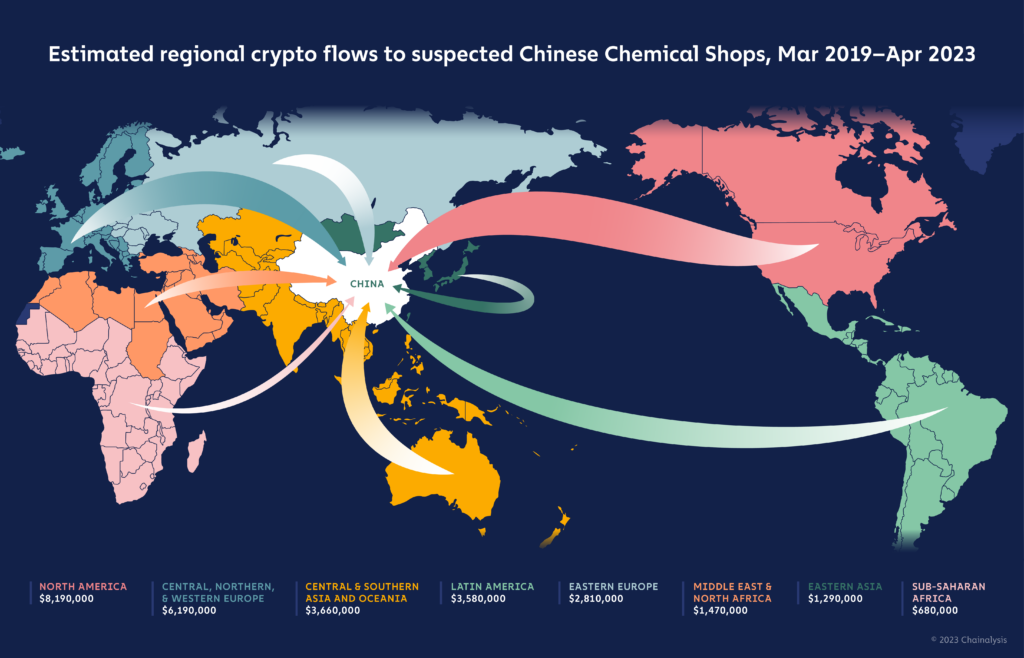

Using our geographic estimation methodology, we were able to estimate the regional origins of cryptocurrency sent to these addresses during the time period studied. [2]

Much of the activity we see here would fit into the patterns outlined by the DEA, with Latin America-based crypto users estimated to have sent nearly $3.6 million worth of cryptocurrency to China-based chemical shops. However, we also see other regions with high exposure, including North America and Europe. Since these chemical shops sell more than just fentanyl precursor chemicals, it is possible that some of the regional exposure contains elements unrelated to opioid distribution. [3]

Comparing on-chain activity to fentanyl seizures at the U.S. border

According to the DEA’s report, the most common flow of fentanyl involves the movement of chemicals from China to Latin America, after which Mexican drug cartels package the chemicals into fentanyl products and smuggle them into the United States.

Source: DEA

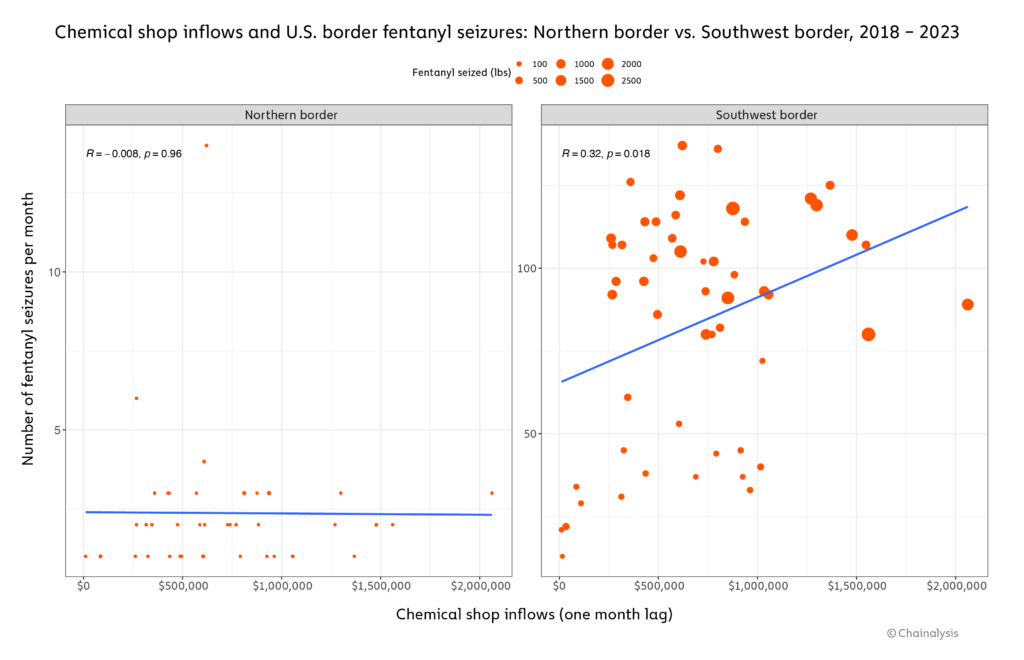

We would expect that, due to the established pattern and our findings that Latin America-based wallets transact significantly with the identified chemical shop addresses, any increase in cryptocurrency moving to those chemical shop addresses would in turn lead to more fentanyl flowing into the United States. In order to test that theory, we compared on-chain flows to our identified addresses to monthly fentanyl-related drug seizures at the U.S.-Mexico and U.S.-Canada borders, using data from the U.S. Customs and Border Protection.

Since the flow of funds on-chain would likely happen before the shipment of precursor chemicals, the assembly of finished narcotics in Mexico, and the interdiction of those drugs at the U.S.-Mexico border, we looked for an association between monthly on-chain chemical shop transaction volumes and the following month’s border interdictions.

As illustrated below, the transaction volume of Chinese chemical shops correlates positively with fentanyl interdictions the next month at the U.S. southern border. There is no evidence of a similar association at the U.S.-Canada border, however, suggesting that these chemical shops might be facilitating production, distribution, and trafficking of fentanyl in Mexico and Central America, but not Canada.

The chart suggests that more chemical shop transaction volume may lead to an increase in fentanyl moving from Mexico to the U.S., based on the higher number of seizures one month after higher volumes in chemical shop crypto revenue. This mirrors the established modus operandi of Mexican cartels purchasing fentanyl precursors from Chinese chemical shops, which they then use to develop fentanyl products to ship north. The only difference here is that the precursor purchases are made (and traced) in cryptocurrency.

This association between on-chain flows and off-chain interdiction data aligns with the basic flow pattern illustrated by the DEA, and suggests that on-chain data can be a powerful early warning indicator for those combating fentanyl trafficking.

Fentanyl sales on darknet markets

Darknet market activity may also provide useful information about patterns of fentanyl trafficking into the United States. Vendors and customers on these platforms have historically used cryptocurrencies for drug transactions. For instance, Silk Road, a darknet market launched in 2011, was home to some of Bitcoin’s early adopters.

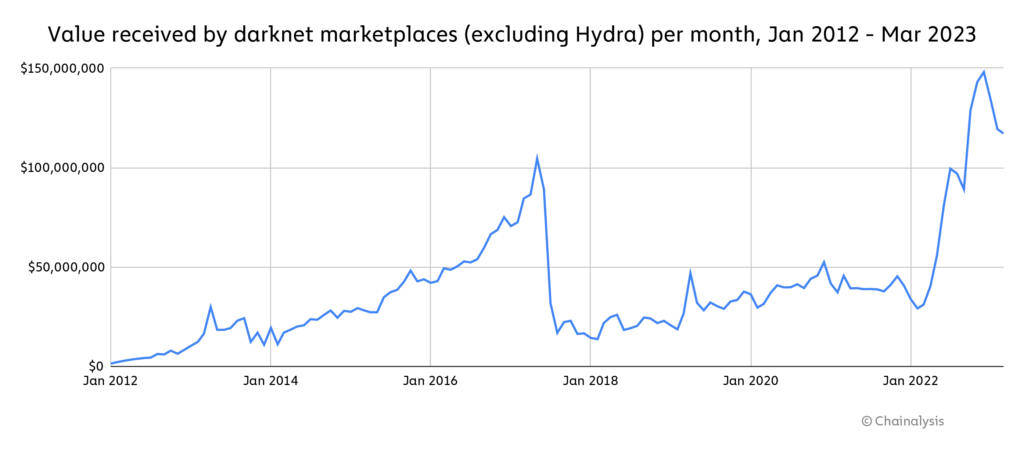

Darknet market transaction volumes – excluding Hydra, the massive Russia-based market that was shut down by law enforcement in 2022 – have increased between June 2011 and March 2023. The significant drawdown in inflows in 2017 is due to the closures of AlphaBay and Hansa. After this, value remained relatively steady with an increase toward the end of 2022 that reached new all-time highs of nearly $150 million.

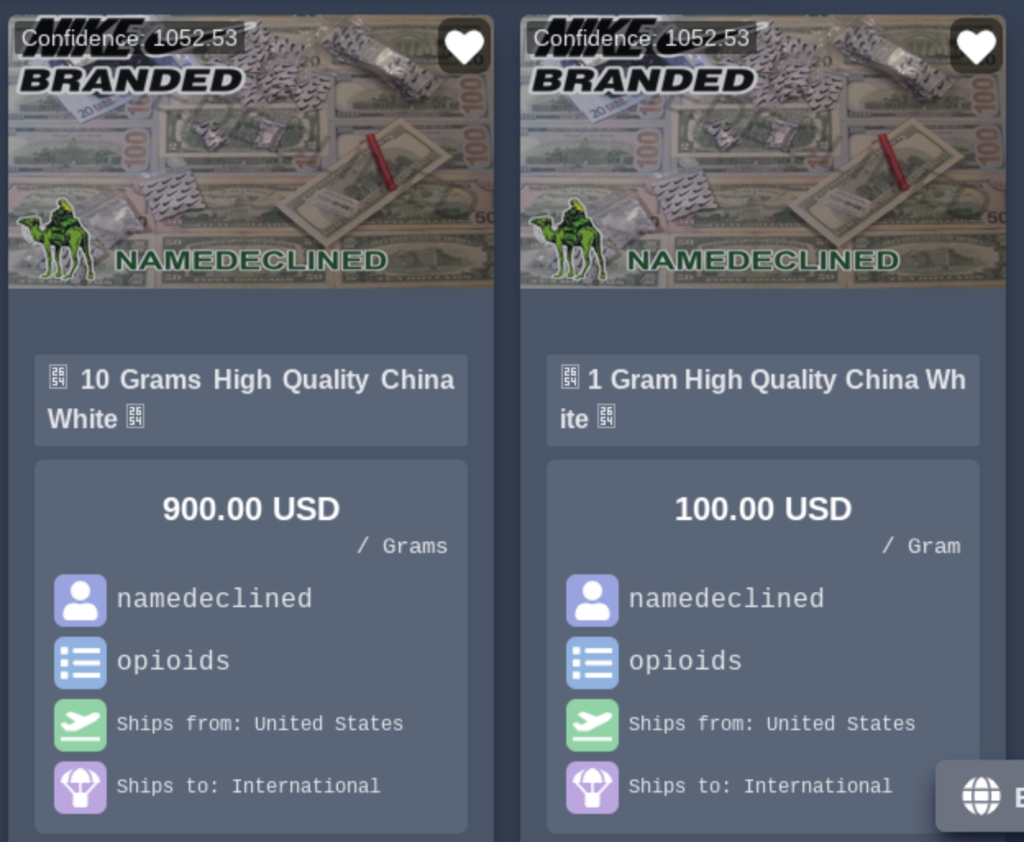

Most darknet markets explicitly ban fentanyl products from their platforms to avoid attracting the attention of U.S. law enforcement. For instance, Incognito Market outlines its fentanyl ban by stating, “We disallow any sale of fentanyl or its analogues and related chemicals, including carfentanyl or products containing fentanyl or carfentanyl. Any vendor found to be selling products containing fentanyl or carfentanyl under a different name to circumvent this rule will be promptly banned.”

Regardless, many seemingly compliant vendors find a way around fentanyl prohibitions by naming fentanyl products with certain keywords or phrases known to the community. Darknet markets are often complicit in these sales and do not ban every vendor. For example, the Incognito Market vendor in the screenshot below used the words “China White” to advertise products, likely referring to fentanyl:

The growth in inflows to darknet markets, when combined with the relative ease with which vendors skirt nominal prohibitions on the sale of fentanyl, emphasize the continued importance of government and law enforcement surveillance.

Empowering law enforcement to reduce fentanyl sales

The conclusions from our analysis all point in the same direction — that fentanyl sales using cryptocurrency happen on a large scale. With the proper tools and training, law enforcement can monitor fentanyl sales, identify criminals, reduce drug trafficking into the U.S., and build strong cases for juries, all through the lens of cryptocurrency use. Ideally, these resources will help manage the opioids crisis and create a safer environment for citizens globally.

Endnotes:

[1] This data is currently being used only for research purposes and is not available in Chainalysis Reactor or KYT.

[2] While we track payments to our full set of suspected chemical shop addresses beginning in January 2018, we only attribute regional exposure to these addresses beginning in March 2019, as that is the furthest back our web traffic data goes. Our full geographic estimation methodology is detailed in The Chainalysis 2022 Geography of Cryptocurrency Report.

[3] Keep in mind that our numbers here do not reflect the full scale of crypto-based fentanyl precursor chemical transactions — they only include addresses uncovered through comparison to our original set of four addresses. The true cryptocurrency transaction volume totals for this activity during the time period we studied is likely much higher and encompasses other addresses not identified here. However, data suggest that certain regions are more heavily weighted than others toward fentanyl precursors.

This material is for informational purposes only, and is not intended to provide legal, tax, financial, or investment advice. Recipients should consult their own advisors before making these types of decisions. Chainalysis has no responsibility or liability for any decision made or any other acts or omissions in connection with Recipient’s use of this material.

Chainalysis does not guarantee or warrant the accuracy, completeness, timeliness, suitability or validity of the information in this report and will not be responsible for any claim attributable to errors, omissions, or other inaccuracies of any part of such material.