This blog is an excerpt from our report on the changing competitive landscape of cryptocurrency exchanges. Click here to download the whole thing and learn what separates successful exchanges as competition in the space heats up.

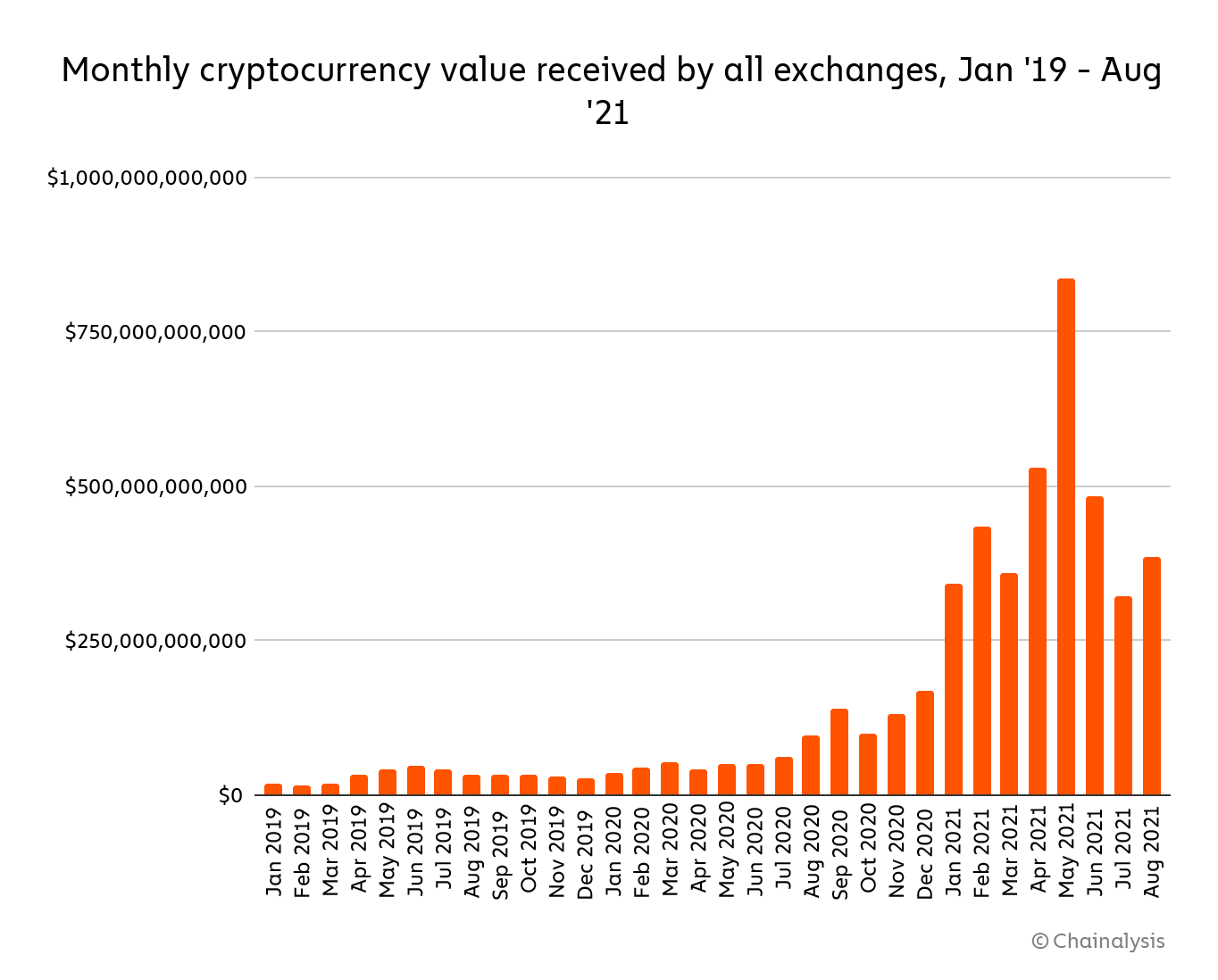

Cryptocurrency adoption and prices have grown steadily over the last few years, allowing the asset class to attract institutional investors and continue growing. Against this backdrop, the businesses making up the cryptocurrency industry have also undergone a period of sustained growth. Check out the graph below, which shows monthly cryptocurrency value received by exchanges since 2019.

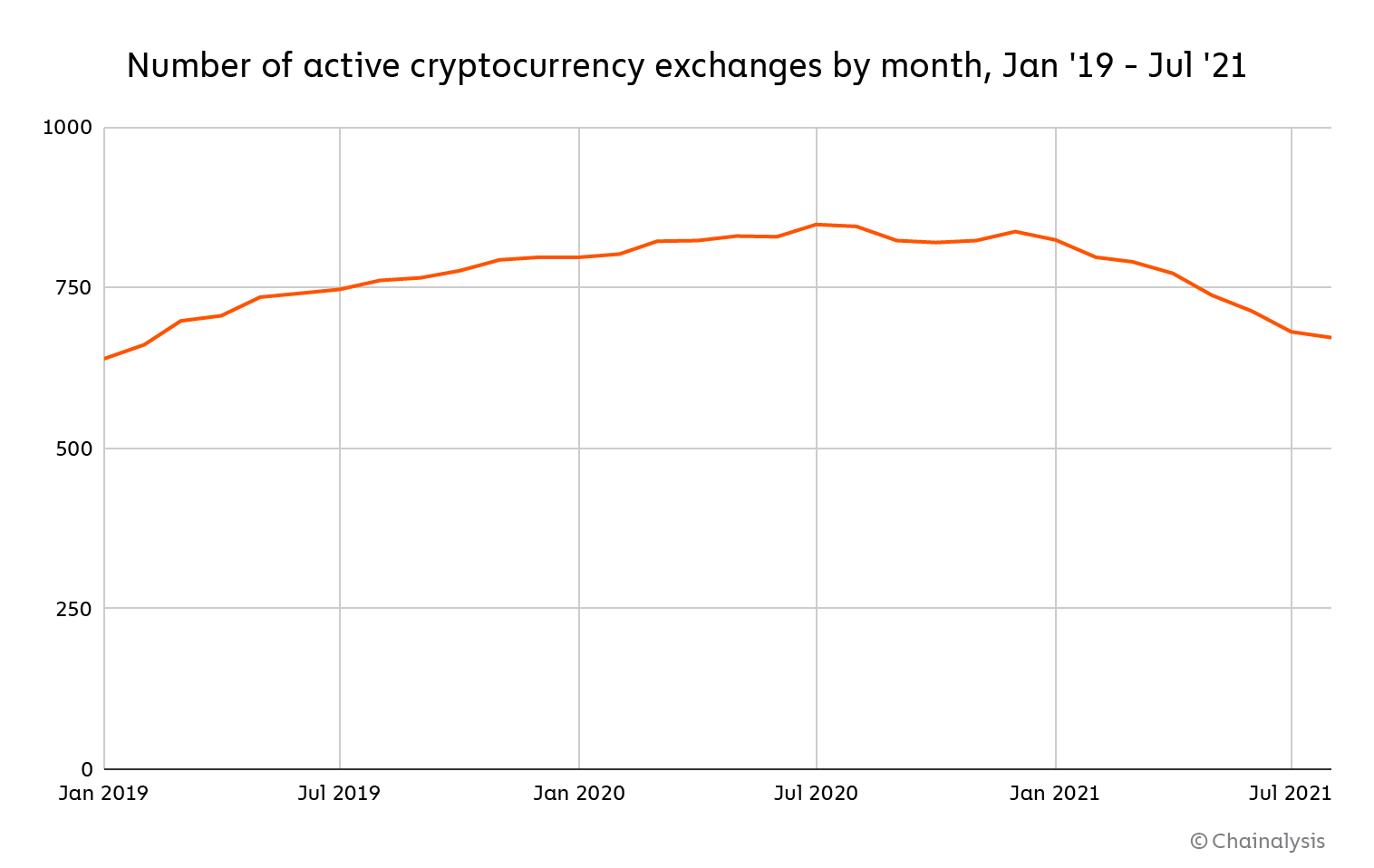

While the monthly increases aren’t constant, the value moving to exchanges is generally trending upwards. However, over the last year, the cryptocurrency exchange landscape has become extremely competitive and now appears to be consolidating. We can see this on the graph below, which shows the number of active exchanges each month from January 2019 to the present.

The number of active exchanges flattens around July 2020 and then starts to fall. It sits at 672 as of August 2021, having peaked at 845 in August 2020. Why is the number of active cryptocurrency exchanges dropping? And what differentiates the most successful of those left standing? In this report, we try to answer those questions by looking at differences in exchange growth trends across a number of variables.

Breaking exchanges down by business model

We break exchanges down into six different categories based on their business models and technical infrastructure in order to investigate which types are thriving as the industry becomes more competitive. Those exchange categories are:

- Centralized exchanges

- Decentralized exchanges (DEXes)

- High-risk exchanges, meaning those with minimal KYC requirements

- OTC brokers

- Derivatives exchanges

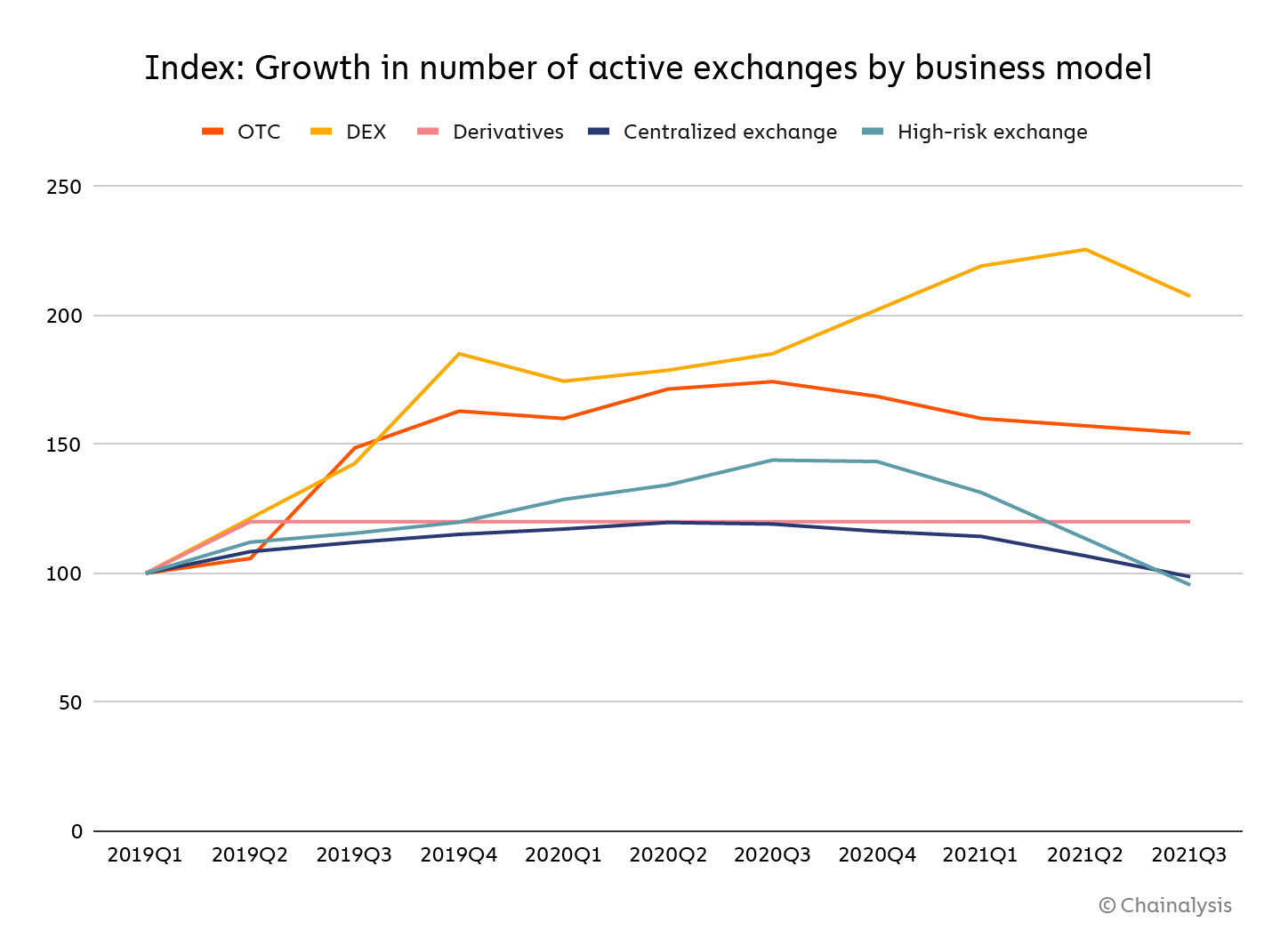

Using these categories, let’s look at which categories have grown or shrunk by number of active exchanges since the beginning of 2019.

The data shows that the number of active DEXes and OTC brokers has climbed significantly since 2019, with derivatives exchanges also growing modestly. Centralized exchanges and high-risk exchanges, meanwhile, have seen their numbers dip slightly after initial increases.

Beyond that, we also further break down each of those categories based on size, number of assets available, and whether or not they allow users to convert between cryptocurrency and fiat to learn more about which types of exchanges are excelling in today’s competitive environment.

Want to read the rest of our findings on what kinds of exchanges are thriving in 2021? Click here to download the full report.