Cryptocurrency has grown significantly over the last year, but many don’t yet understand how diverse cryptocurrency really is as an asset class. Every major coin has its own unique use cases driving its growth. Using blockchain analysis to track transaction patterns and analyze the characteristics of the biggest wallets holding different types of cryptocurrencies, we can learn more about how those use cases differ and complement each other to create a dynamic crypto ecosystem.

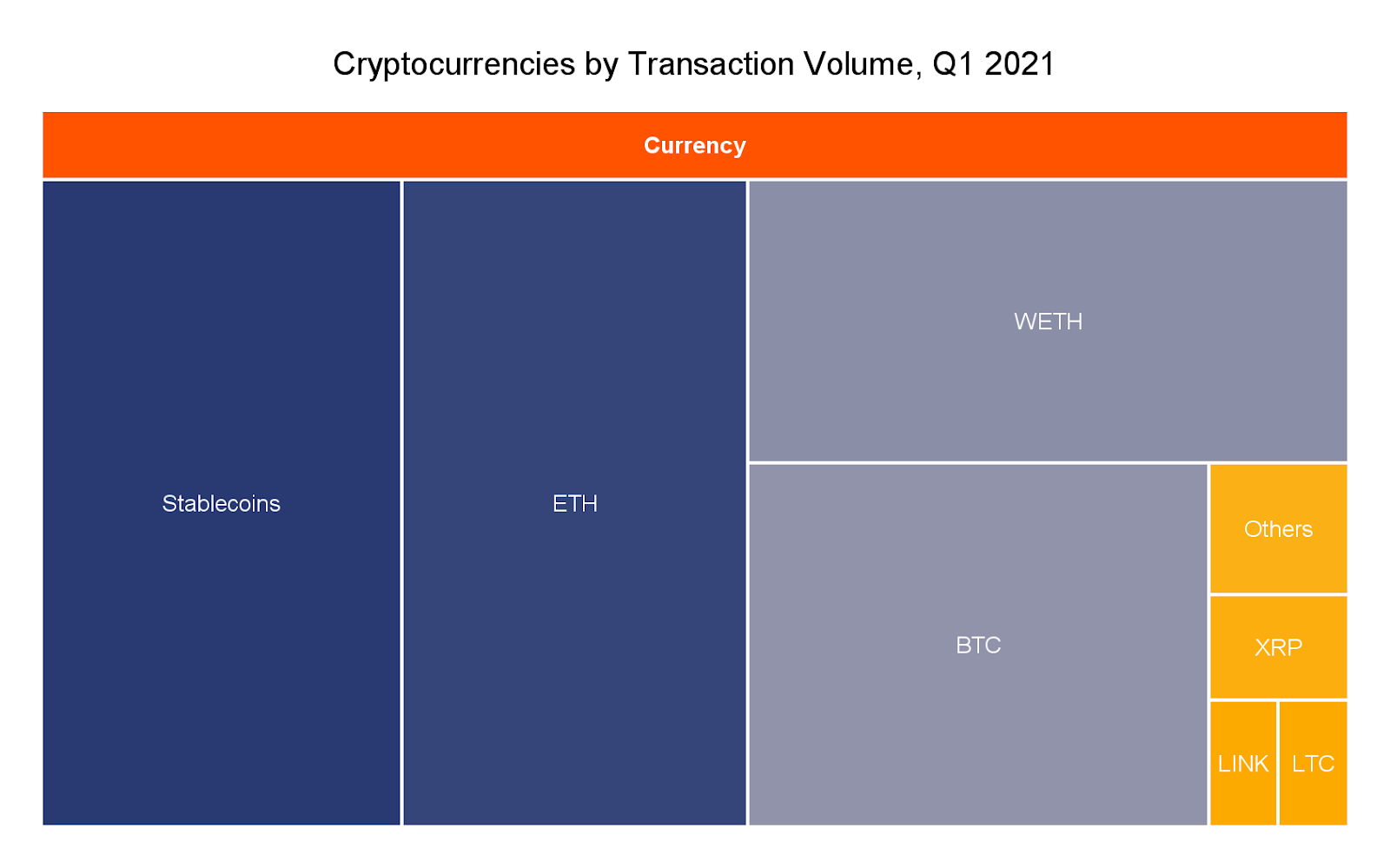

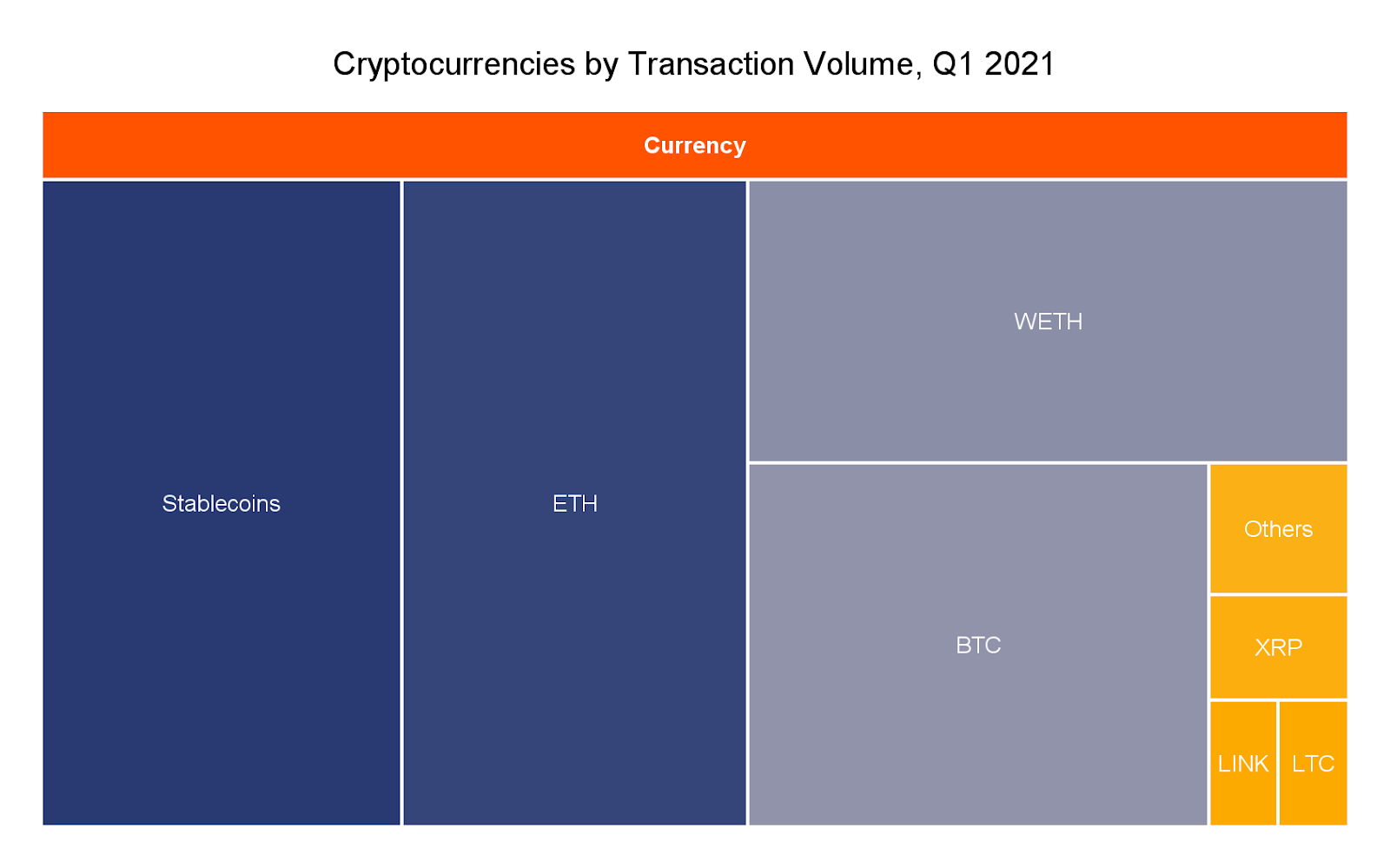

Looking across all cryptocurrencies during Q1 2021, the following have the highest transaction volumes:

- Stablecoins: $869 billion

- Ethereum: $840 billion

- Wrapped Ethereum (wETH): $635 billion (Note: wETH is an ERC-20 token of equivalent value to Ethereum commonly used on DeFi platforms.)

- Bitcoin: $623 billion

Together, these four categories make up the majority of cryptocurrency transaction volume. Below, we’ll analyze each category in greater detail to shed light on how and why people use them.

The Bitcoin Ecosystem: A long-term investment

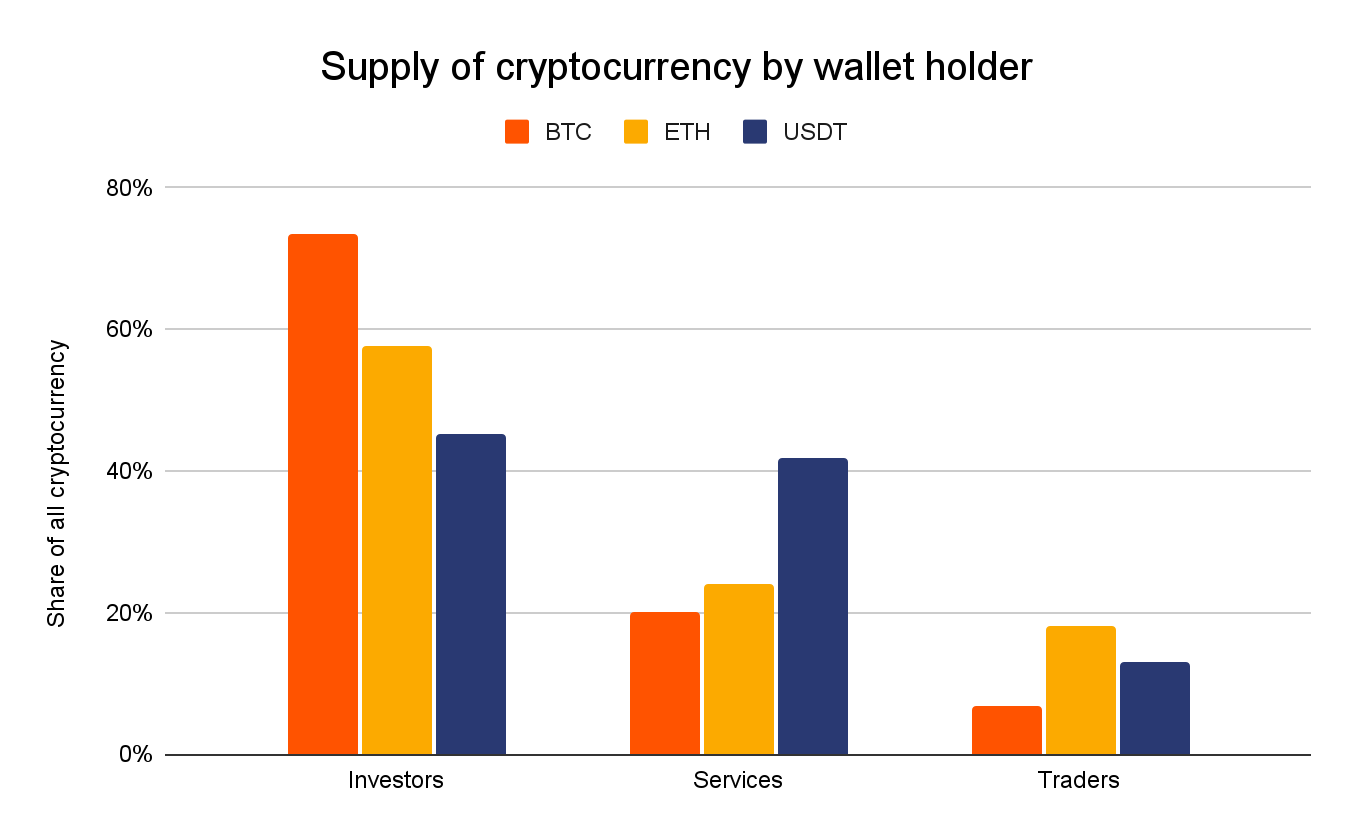

The data suggests that Bitcoin is primarily held as a long-term investment. First, we look at the breakdown of the types of wallets holding Bitcoin compared to wallets holding other assets. We separate wallets into three categories:

- Investors, which we define as self-hosted wallets that have held 75% or more of all cryptocurrency value they’ve ever received

- Traders, which we define as self-hosted wallets that have held less than 75% of all cryptocurrency value ever received

- Services, which are simply wallets hosted by services such as exchanges

73% of Bitcoin is held by investors, versus just 58% for Ethereum and 43% for the popular stablecoin USDT_ETH, which is an ERC-20 token version of Tether. Meanwhile, just 7% of all Bitcoin is held by traders, who tend to seek shorter-term gains by trading between a wider variety of assets, versus 18% for Ethereum and 14% for USDT_ETH.

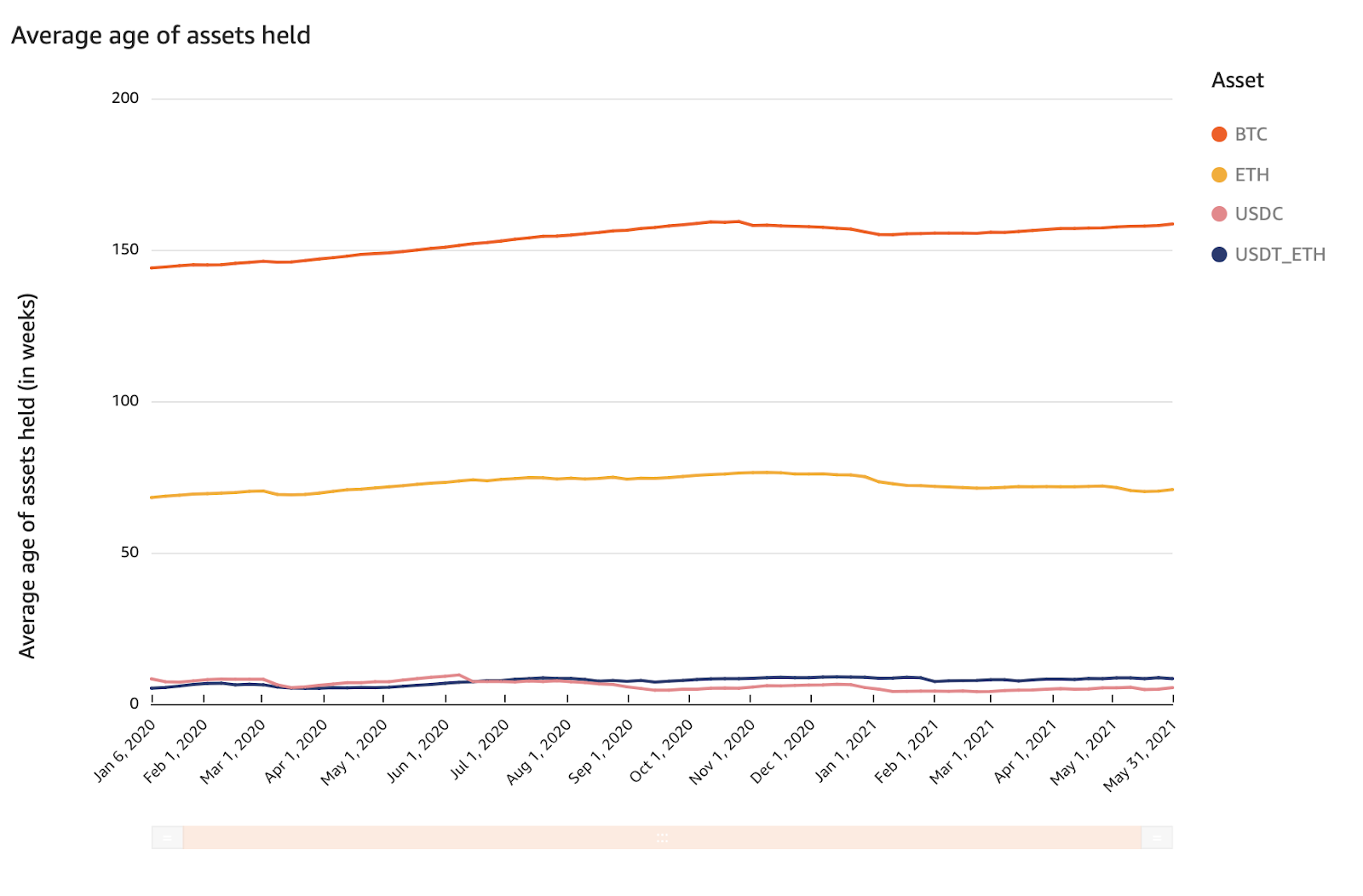

Bitcoin’s use case as a long-term investment becomes even clearer when we dig more into average “age” of each coin, meaning the amount of time it’s been in its current wallet.

The data is striking. The average Bitcoin held in a self-hosted wallet was acquired roughly 150 weeks ago, versus 75 weeks for Ethereum and six to seven weeks for popular stablecoins Tether and USDC. In other words, cryptocurrency users hold Bitcoin for roughly twice as long as they do Ethereum and more than 20x longer than they do stablecoins.

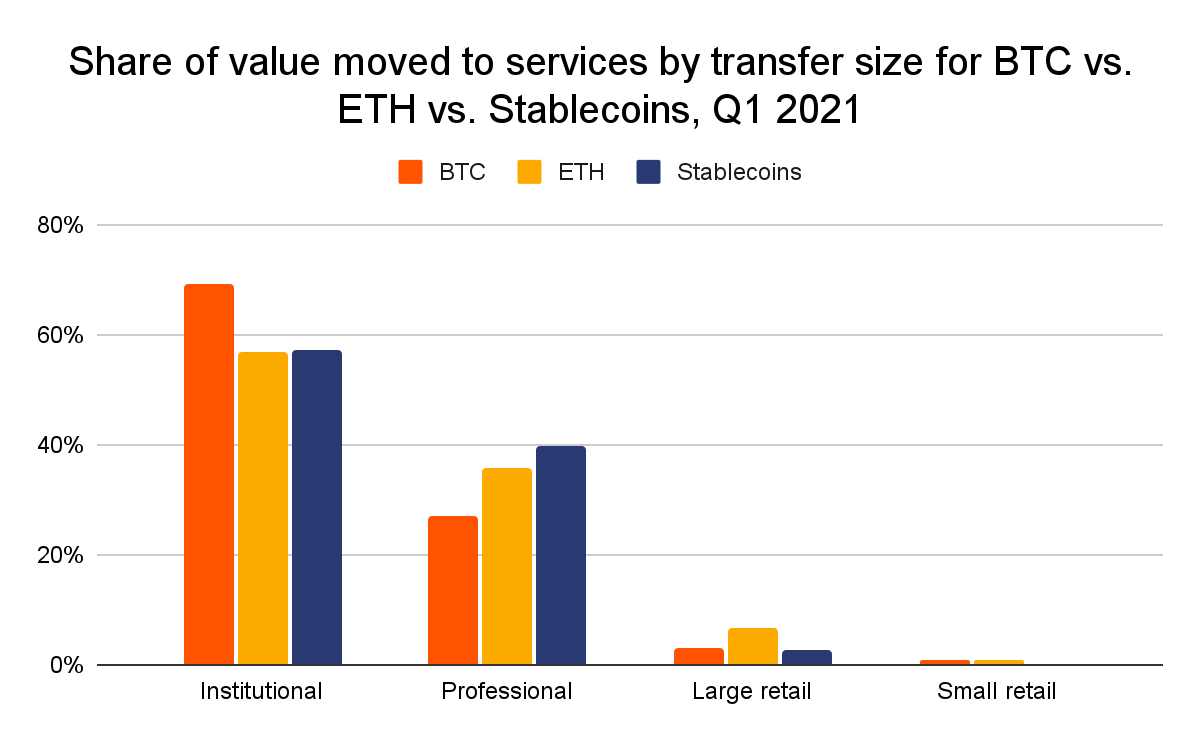

But who exactly are these long-term Bitcoin investors? Below, we investigate who’s using different types of cryptocurrencies based on transaction sizes, which we use to categorize the users behind the transactions.

The data shows that institutional investors likely accounted for 69% of all Bitcoin transaction volume during the time period studied, based on the sizes of the individual transactions.

Taken together, the data largely fits the narrative we’ve heard over the last year: Investors, especially those from mainstream financial institutions, have embraced Bitcoin as a long-term investment, with many positioning the asset as a hedge against inflation and other worrisome economic trends. That’s why we see such a high percentage of Bitcoin being held for long periods of time compared to other cryptocurrencies, and so much held by investors whose large transaction sizes suggest they’re at the professional or institutional level.

The Ethereum Ecosystem: A currency of innovation

As a reminder, despite its lower market capitalization and less frequent media coverage, Ethereum had more transaction volume than Bitcoin in Q1 2021.

In fact, if we were to combine Ethereum’s transaction volume with that of wETH, its ERC-20 token equivalent, Ethereum would have by far the highest transaction volume of any cryptocurrency.

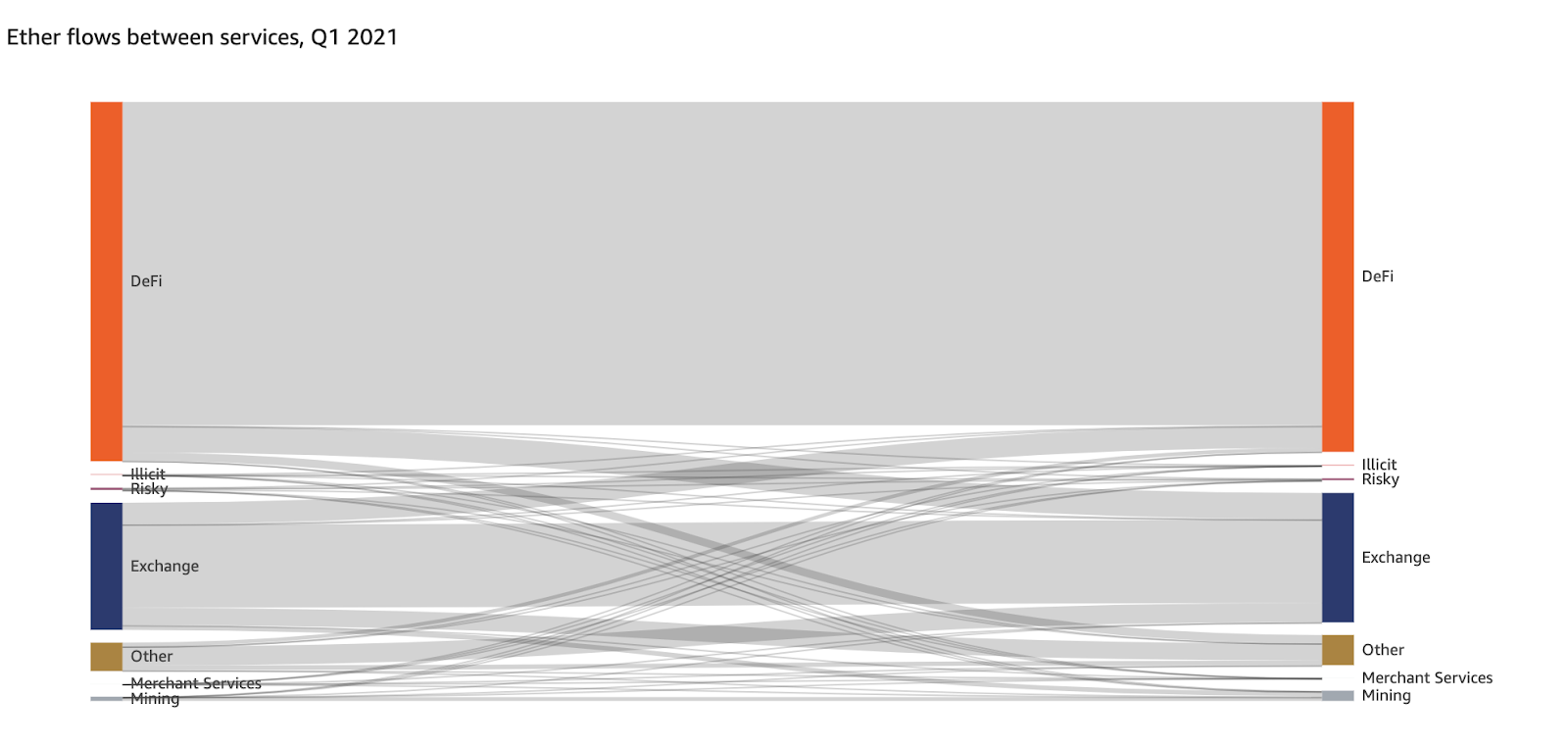

But which services account for these Ethereum transactions?

Since January 2020, the majority of Ethereum transactions have involved at least one DeFi platform, with the majority of these occurring between two DeFi platforms. DeFi platforms are cryptocurrency services built on top of smart contract-enriched blockchains. Once built, they can run autonomously, executing specific financial functions — trades, loans, or other transactions — automatically when specific conditions are met as defined by the underlying code. Because of this, DeFi platforms can exist independently of a company or other governing body.

Crucially, nearly all DeFi platforms are built on the Ethereum blockchain. That means they primarily accept Ethereum, as well as ERC-20 tokens. ERC-20 tokens are unique cryptocurrencies also built on the Ethereum blockchain, meaning they can be sent and received from an Ethereum wallet. Many ERC-20 tokens are designed to mirror the price of existing assets. For instance, wrapped Bitcoin (wBTC) is an ERC-20 token that matches Bitcoin’s price, while wETH fulfills the same function for Ethereum. USDT_ETH and USDC_ETH match the price of the stablecoins Tether and USDC respectively, which in turn are pegged to the U.S. dollar.

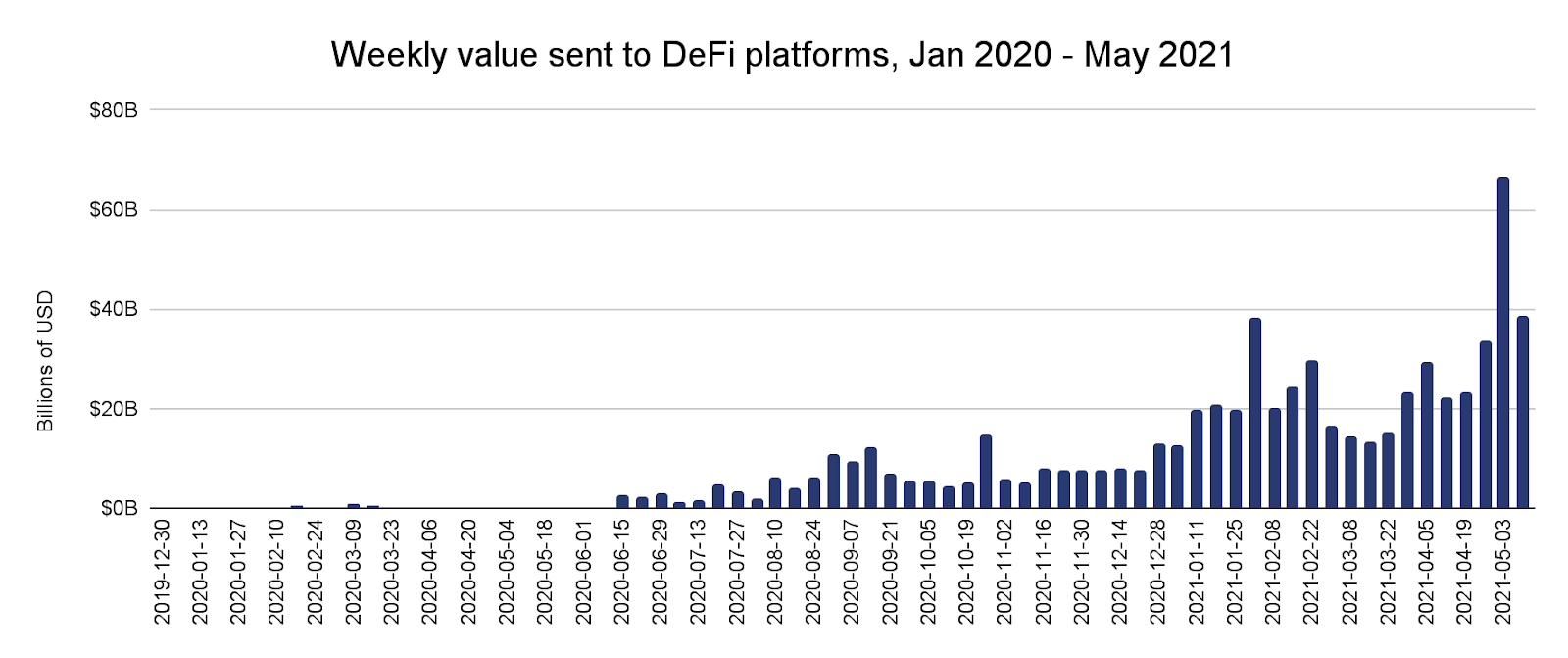

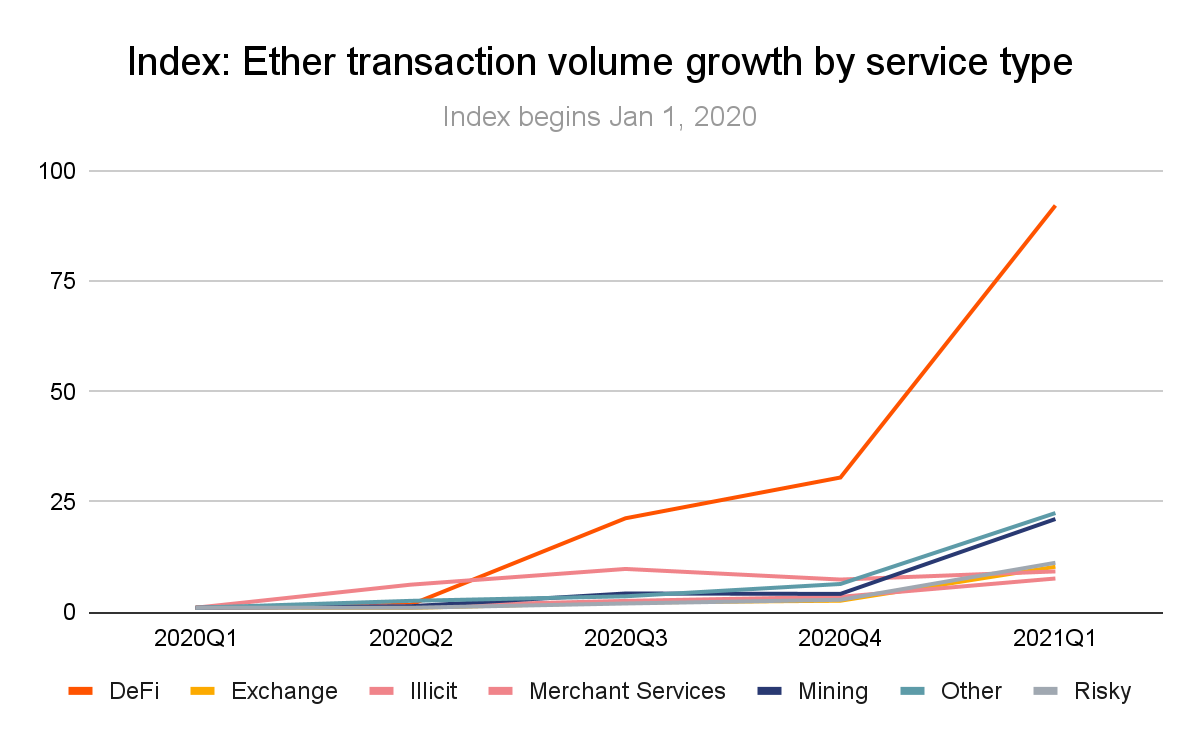

DeFi’s growth is a relatively recent development. In June 2020, DeFi platforms collectively were receiving between $2 and $3 billion in total weekly value. That figure began to grow quickly in August, and now consistently stands above $20 billion per week as of May 2021, at times spiking above $60 billion.

Since the beginning of 2020, DeFi has been the fastest growing service category by far, nearly all driven by Ethereum. In that way, Ethereum is playing a crucial role in cryptocurrency innovation, as DeFi is the site of development for several new types of financial services and instruments, including NFTs, decentralized exchanges, and automated loan platforms.

DeFi has also given cryptocurrency a way to tap into community to launch new platforms. Founders of traditional, centralized exchanges and other services would typically have to raise capital themselves to build a new platform and provide it with its initial liquidity. With DeFi, founders can instead borrow funds from users or other backers, who in return get unique tokens associated with the platform that entitle them to a share of the platform’s fees. We expect to see more innovation in DeFi over the coming years, most of which will likely be powered by Ethereum.

The Stablecoin Ecosystem: A profit saving mechanism

The stablecoin ecosystem consists of cryptocurrencies pegged to the price of existing non-crypto assets. The two most popular stablecoins, Tether and U.S. Dollar Coin (USDC), are pegged to the U.S. dollar.

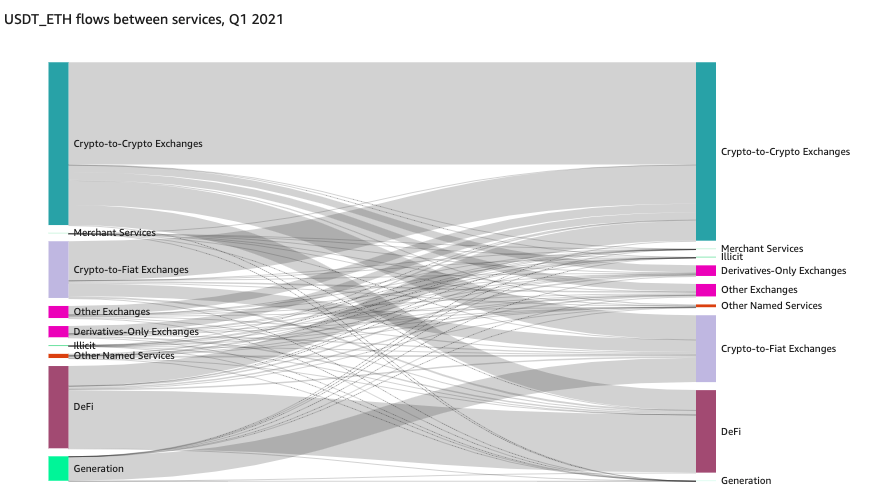

Stablecoins have a higher collective transaction volume than both Bitcoin and Ethereum, but where are these transactions happening? Let’s look at Tether as an example.

The data shows that the majority of Tether moves between exchanges — especially crypto-to-crypto (C2C) exchanges, meaning those that only allow users to exchange cryptocurrencies for other cryptocurrencies, and not for fiat currency. This reflects the crucial role that stablecoins play in trade settlement on exchanges, and especially C2C exchanges. Thanks to their, well, stability, stablecoins allow traders to lock in the value of their cryptocurrency in what amounts to U.S. dollars, shielding themselves from the volatility of cryptocurrency without having to move funds off exchanges.

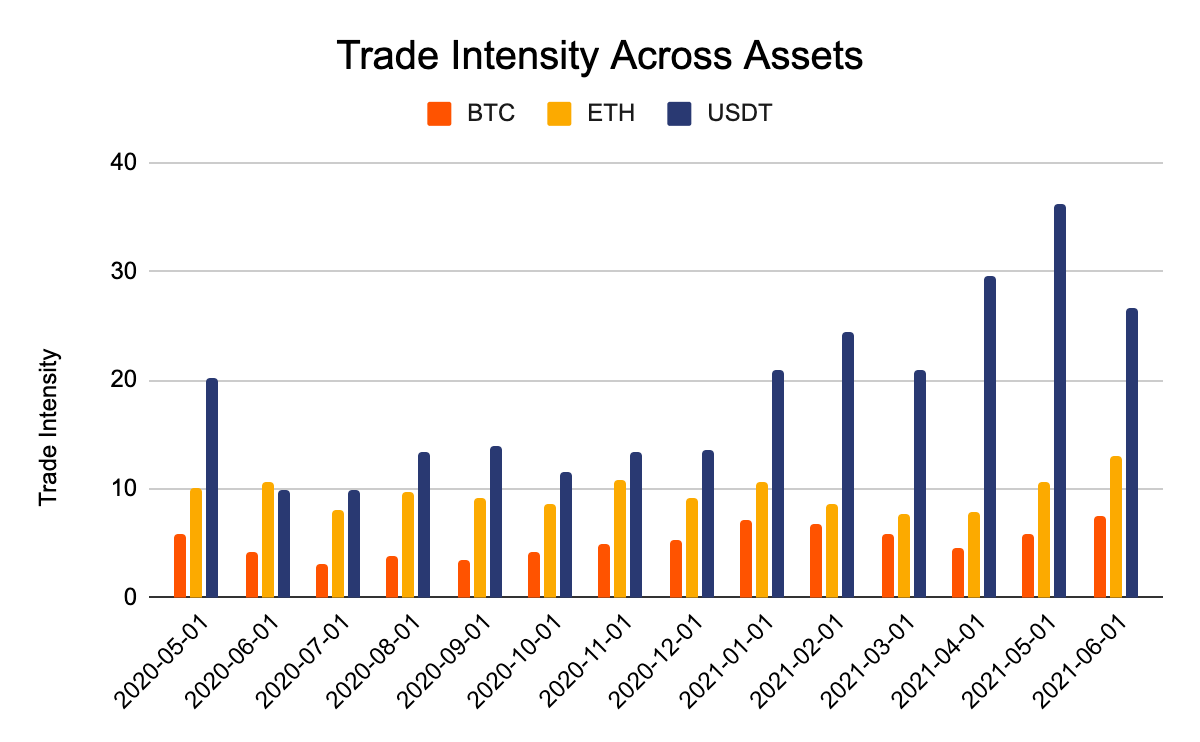

This role makes stablecoins by far the most frequently traded assets in the crypto ecosystem. Remember, most trading happens within the walled gardens of individual exchanges, which doesn’t show up in the on-chain volume data we cited at the beginning of the article — that data is instead recorded within exchanges’ order books. We can use order book data to compare the rate at which different cryptocurrencies are traded once they reach an exchange using a metric called trade intensity. Trade intensity measures the number of time a coin is traded between the time it’s deposited to an exchange and the time it’s withdrawn. Below, we compare trade intensity for Tether, the most popular stablecoin, versus Bitcoin and Ethereum.

Though trade intensity has ebbed and flowed over time, stablecoins have the highest trade intensity by far in most months. We’d expect to see this given how often traders exchange other cryptocurrencies for stablecoins in order to store funds in a more stable asset.

Anecdotally, we also know that stablecoins are frequently used for commercial transactions, especially in China and areas where Chinese merchants do business abroad. Stablecoins’ popularity for this purpose can again largely be attributed to its stability, and their utility as a U.S. dollar replacement that can be used outside the traditional financial system.

No two digital currencies are alike

Blockchain analysis reveals that the story of cryptocurrency is bigger than any one asset or investing strategy. There are well-defined use cases for each of the most important, widely used crypto assets:

- Bitcoin acts as a long-term investment

- Ethereum is more frequently traded and used to power innovative new DeFi platforms

- Stablecoins are the most frequently traded, acting as a settlement system and source of stable storage for traders

Each asset plays a key role in the wider cryptocurrency ecosystem. As that ecosystem continues to evolve, new coins will likely crop up to address new use cases, and the utility of existing coins will shift as well.

Download the Chainalysis Report: Key Players in the Cryptocurrency Ecosystem