This blog is a preview of our Crypto Myth Busting Report. Sign up here to download the full report!

From the TerraLUNA crash to the FTX collapse, 2022 went down as a tumultuous year for cryptocurrency. While the shake ups caused chaos, the cryptocurrency ecosystem has proven to be remarkably resilient. But bad news always leads, and when crypto scandals rise to the fore, so too do long-held myths about digital currency.

Now, as governments and financial institutions consider how to regulate and integrate cryptocurrency into the global financial system, it’s especially important to set the record straight. While there are certainly risks and valid concerns, blockchain technology has enormous potential to democratize finance, increase economic transparency, reduce costs of doing business, and spur innovation. Given that, we want to ensure financial institutions and regulators are focused on the right risks — the true, valid concerns — when they evaluate the opportunities posed by cryptocurrency. To that end, in our report, we dispel some misconceptions, and tackle 33 myths related to cryptocurrency’s safety, legitimacy, viability, and scalability. In this preview, we’ll share five myths covered in the report.

1. Crypto is completely unregulated.

Particularly over the past four years, we have seen countries steadily move forward to introduce regulations covering digital assets, on topics as diverse as anti-money laundering, consumer protection, market conduct, and prudential requirements. Below, we set out a few examples from across the world.

In 2019, the intergovernmental Financial Action Task Force (FATF) issued detailed global standards for combating illicit finance amongst its many participating countries, and those standards have been periodically updated since. At their core though, these standards call for crypto businesses to be subject to AML/CFT requirements such as customer due diligence and transaction monitoring, as well as the exchange and retention of certain transaction information under what is known as the “Travel Rule”.

Regulators globally have been working hard since then to translate FATF’s global standards into domestic rules. For instance, Singapore’s Monetary Authority of Singapore (MAS) regulates digital payment token (DPT) service providers under the 2019 Payment Services Act (PSA), with AML/CFT requirements stipulated in an accompanying Notice. In South Korea, virtual asset service providers have been regulated for AML/CFT purposes since 2021. Australia requires digital currency exchanges to be registered with AUSTRAC and is currently in the process of updating its AML/CFT rules to further align them with the FATF standards.

In the United States, crypto businesses that qualify as money services businesses (MSBs) are required to comply with anti-money laundering and counter-terrorist financing (AML/CFT) requirements under the Bank Secrecy Act. This means that a broad range of crypto businesses, such as exchanges, ATMs, brokers, custody providers, and more need to register as MSBs with the Financial Crimes Enforcement Network (FinCEN) and implement AML/CFT programs.

The U.S. government’s focus on digital assets has also grown beyond AML/CFT in recent years. In March of 2022, for example, President Biden signed an Executive Order on Ensuring Responsible Development of Digital Assets with objectives to expand America’s global leadership in digital assets, ensure financial stability, prevent illicit activity, protect national security, and help the U.S. take the lead on central bank digital currency (CBDC) research and development. Since 2022, the U.S. House of Representatives has been working on legislation that would improve regulatory clarity. The Chairmen of the House Financial Services Committee and House Agriculture Committee have recently released a joint discussion draft of legislation providing a statutory framework for digital asset regulation.

In 2022, the United Arab Emirates (UAE) launched its Virtual Asset Regulatory Authority (VARA), a government body dedicated to crypto regulation. Dubai-based VARA has since rolled out a comprehensive set of regulations and rulebooks covering seven types of virtual asset activities.

In April 2023, the EU parliament passed Markets in Crypto-assets (MiCA), the first comprehensive legislation in its region for regulating digital assets. Many other parts of the world are also pursuing crypto regulation. So, while there’s still uncertainty surrounding crypto in some parts of the world, these examples show the market is moving towards more regulatory clarity.

2. It’s impossible to know what cryptocurrency businesses do with their crypto, and therefore cryptocurrency businesses are too risky for banks to interact with.

Too many institutions regard the cryptocurrency industry as a high-risk monolith when it comes to compliance. In reality, the ecosystem is incredibly diverse. There are direct market participants, infrastructure and data providers, gaming and AI platforms, payment processors, and entirely new organizations that are creating novel ways of creating, socializing, and transacting. And due to the inherent transparency of blockchains, banks can see all of these companies’ crypto transactions in real time. Blockchain analysis tools allow financial institutions to analyze the risk of each platform’s transactions as they occur, which means they can support the most promising and innovative industry participants while still meeting their compliance needs.

Imagine if a bank had this kind of transparency with all of its corporate clients’ funds. Blockchain analysis builds a picture of a business’s biggest counterparties and can flag cryptocurrency transactions that may present concerns or risks to its customers. These platforms also help compliance teams benchmark the activity of one cryptocurrency business against its peers. This picture provides an enormous amount of context in the onboarding process. Transaction activity that Chainalysis observes is perhaps the best reflection of the strength of a company’s transaction monitoring and AML programs.

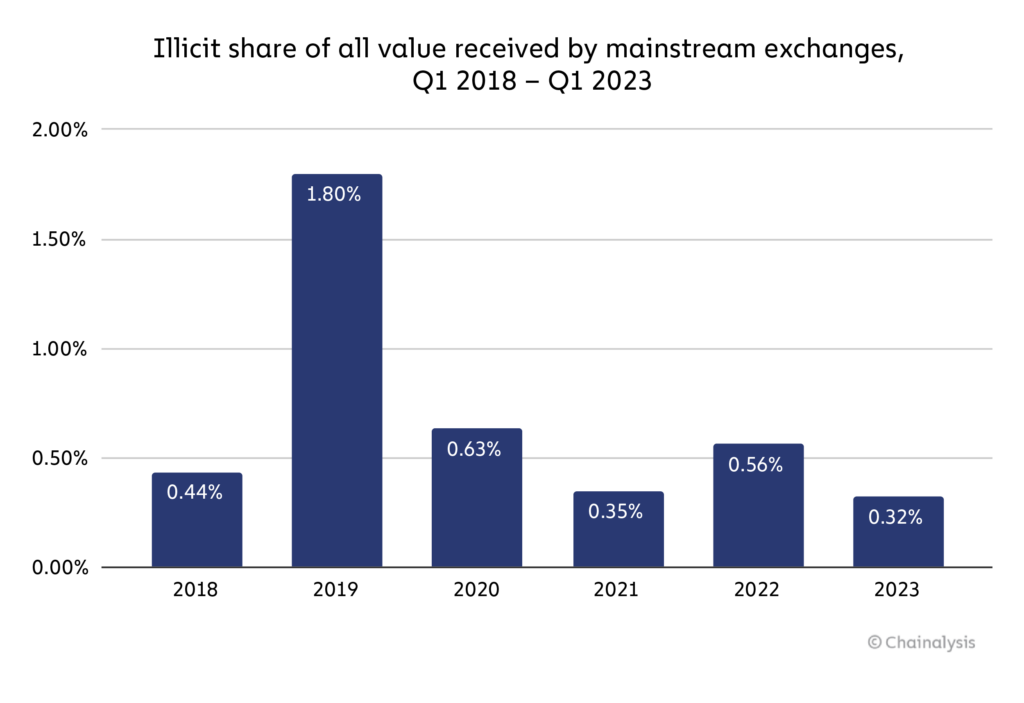

It’s also worth noting that if we apply blockchain analysis at scale, we can see that cryptocurrency businesses are generally quite safe. The chart below demonstrates that illicit exposure is a very small share of total inflows across mainstream exchanges. [1]

Aside from the anomalous year of 2019, which saw extreme levels of scamming activity, well below 1% of all value entering exchanges since 2018 has come from illicit addresses.

Of course, financial institutions must still remain vigilant. For banks considering cryptocurrency adoption, the key is to acquire the blockchain analysis expertise necessary for a compliance team to interpret the risks posed by blockchain entities — either through training or hiring — and analyze those risks within the framework of their strategy around market risk, KYC, AML/TF, sanctions, financial crimes, and fraud. We lay out some of the steps banks can take to accomplish this in our Crypto Maturity Model.

From there, moving into crypto with confidence also requires establishing a risk appetite and compliance procedures, and then, for retail banks, letting customers transact with those crypto businesses that are aligned in terms of risk. It used to be a challenge for banks to accurately assess the landscape, but tools like Kryptos provide in-depth on-chain metrics, which help banks grow exposure to the crypto ecosystem safely. With that foundation, banks can also start taking cryptocurrency businesses as clients, and offer services beyond just business banking, like advising crypto businesses on IPOs and mergers and acquisitions, or providing foreign exchange services.

3. Crypto has no real-world use case.

Cryptocurrency has several real-world use cases, especially in emerging markets, many of which are leading the way in grassroots crypto adoption. One of those use cases is remittances. In our 2022 Geography of Cryptocurrency Report, we found that international payments for individuals and small business owners are increasingly being carried out in cryptocurrency due to both increased speed and lower costs. Remittances are also enabling charitable giving. For instance, in the year following the outbreak of the Russia-Ukraine War, cryptocurrency users donated over $56 million worth of crypto to war-torn Ukraine. In February 2023, crypto donations again played a significant role in providing relief to victims of the earthquake that rocked Turkey and Syria, with users sending nearly $6 million in the days following.

Additionally, we’ve also seen cryptocurrency used as an alternative store of value during times of financial instability. Venezuela offers a useful example. The country has suffered from frequent bouts of hyperinflation, and holders of its national currency, the bolivar, have seen their purchasing power and savings drastically decrease. That may be one reason the country has embraced cryptocurrency so much — we estimate Venezuelans received over $37.4 billion worth of crypto in 2022, the sixth most of any Latin American country, despite Venezuela having one of the lowest GDPs per capita in the region.

The data even suggests that at times of high inflation and currency depreciation, Venezuelans have sought to protect themselves by acquiring more cryptocurrency. Check out the chart below, which plots the bolivar-USD exchange rate against bolivar-for-Bitcoin trading volume on P2P exchange LocalBitcoins.

We can see that as the exchange rate fell and the bolivar weakened between 2019 and 2021, Venezuelans moved to acquire more Bitcoin. We’ve seen similar dynamics in other countries like Argentina, Nigeria, and Kenya during times of currency instability.

Though not yet as prevalent as others, retail purchasing is a growing crypto use case. According to a survey PYMNTS conducted of merchants with annual online sales totaling at least $250 million, 46% of merchants accept crypto as payment. PYMTS also found that “85% of businesses with more than $1 billion in annual online sales say they accept some form of crypto-enabled payment method.” Deloitte’s 2021 Merchants getting ready for crypto study, which polled 2,000 senior executives at U.S. retail organizations, found that over 75% of merchants reported plans to accept stablecoin and cryptocurrency payments in the next two years.

4. Crypto is a fad.

Fifteen years after Satoshi Nakamoto’s Bitcoin whitepaper, digital currencies have exploded from the concept of a single digital asset to a thriving ecosystem with a global market cap of $1.18 trillion. Additionally, governments are now implementing or investigating the feasibility of blockchain-based central bank digital currencies (CBDCs), as well as providing regulatory clarity for existing cryptocurrency. Of 45 countries that the Atlantic Council studied, nearly three-quarters are in the process of making substantial changes to their regulatory framework for crypto.

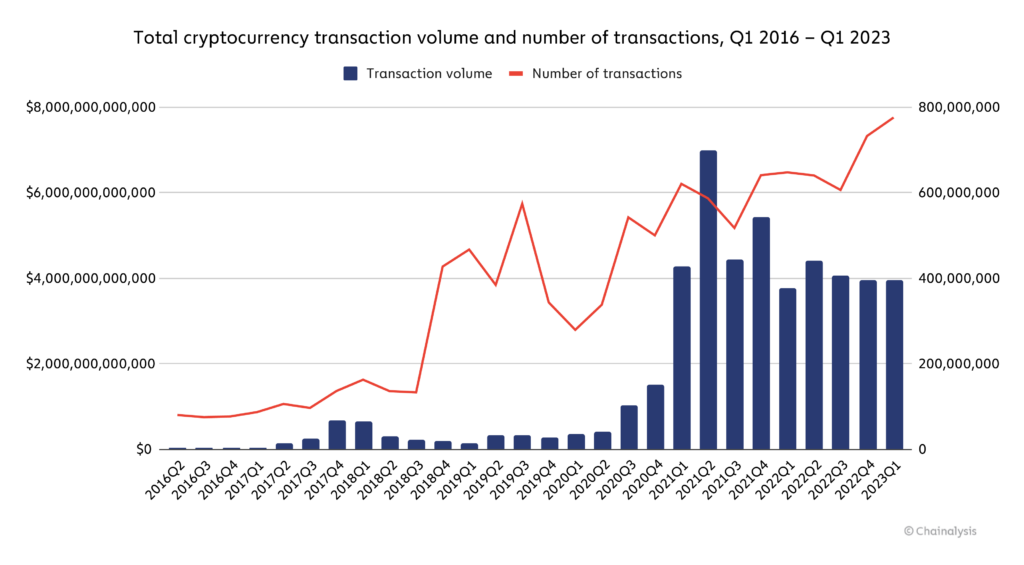

While disruptive events dampened crypto market capitalization and usage in 2022, transaction volume is still much higher than it was in 2019 and 2020, and the raw number of transactions happening is higher than ever. In other words, crypto usage is still rising even if transaction values aren’t as high.

5. Blockchain doesn’t scale.

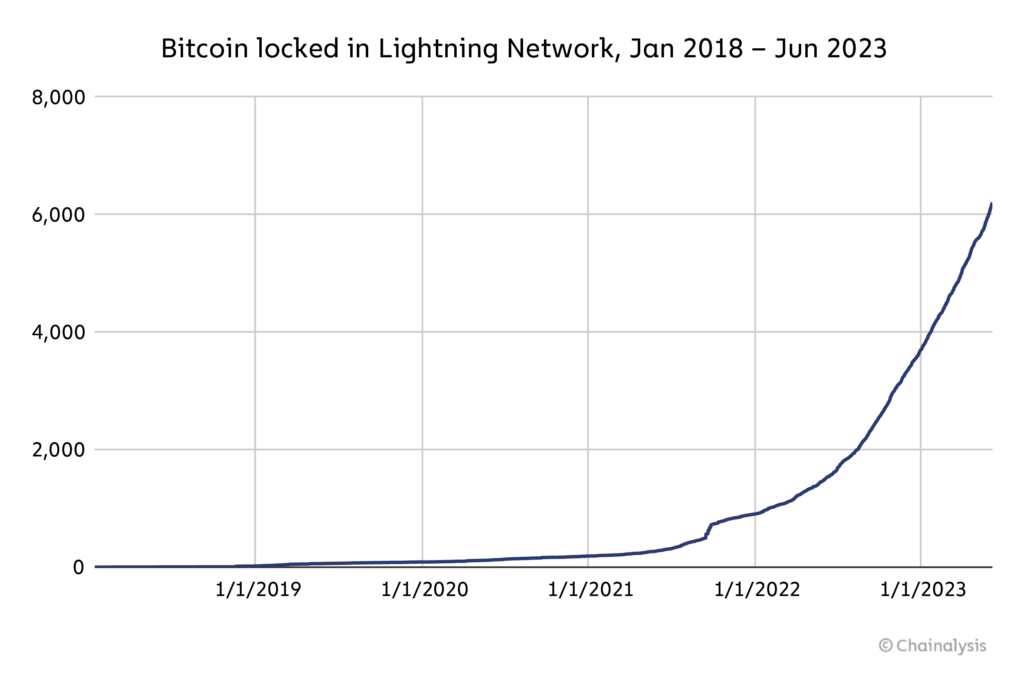

Many blockchains have run into issues of scalability, which essentially boil down to their ability to process transactions efficiently as their usage increases. Blockchains like Bitcoin, for example, can only process five to seven transactions per second — much fewer than fiat solutions — and in general when any blockchain becomes congested, transactions slow down and fees go up. However, there are solutions to these problems. In the case of Bitcoin, developers have come up with the Lightning Network, which allows users to lock Bitcoin into payment channels, make many small Bitcoin transactions off-chain, then settle them all at once on-chain later in one big transaction using the initial amount locked.

Similarly, Ethereum and other smart contract-enabled blockchains support layer 2 blockchains — these sit atop the primary blockchain but process transactions themselves, then record them later on the primary blockchain. Others have built entirely new blockchains specifically designed to solve the scalability problem, with varying degrees of success — Solana, Algorand, and Avalanche are three popular examples.

More generally, blockchain is still a young technology. If one believes it can improve on our current financial system and solve real world problems, it follows that incentives are there to attract innovators who can solve scalability problems.

End notes:

[1] Notes on our illicit transaction volume chart:

- These are lower bound estimates that will likely rise over time as additional illicit activity is discovered.

- This does not include off-chain criminal activity where proceeds may have been moved into crypto for laundering, though that activity can still be traced.

- This does not include volumes associated with centralized services that collapsed in 2022, some of which are facing charges of fraud.

Not Investment or Other Advice

This material is for informational purposes only, and is not intended to provide legal, tax, financial, or investment advice. Recipients should consult their own advisors before making these types of decisions. Chainalysis does not guarantee or warrant the accuracy, completeness, timeliness, suitability or validity of the information herein. Chainalysis has no responsibility or liability for any decision made or any other acts or omissions in connection with Recipient’s use of this material.