Bitcoin, along with the stock market and other traditional asset classes, saw its value plummet the week of March 9 as the Covid-19 pandemic intensified in the western world and wrought havoc on the economy. During that time, more Bitcoin flowed into exchanges than ever before, as traders looked to buy and sell amidst all of the volatility.

But while exchange activity tells us what investors are doing, what about the people who use Bitcoin to buy goods and services rather than to speculate? In this blog, we analyze Covid-19’s effect on the consumer side of Bitcoin by looking at how transaction patterns have changed across three service categories: merchant services, gambling services, and darknet markets. Covid-19 appears to have brought about a significant change in the way Bitcoin’s price impacts usage of some of these categories, speaking to the unprecedented nature of the crisis in which we find ourselves.

Usage of these services has declined, but not in the way we’d expect

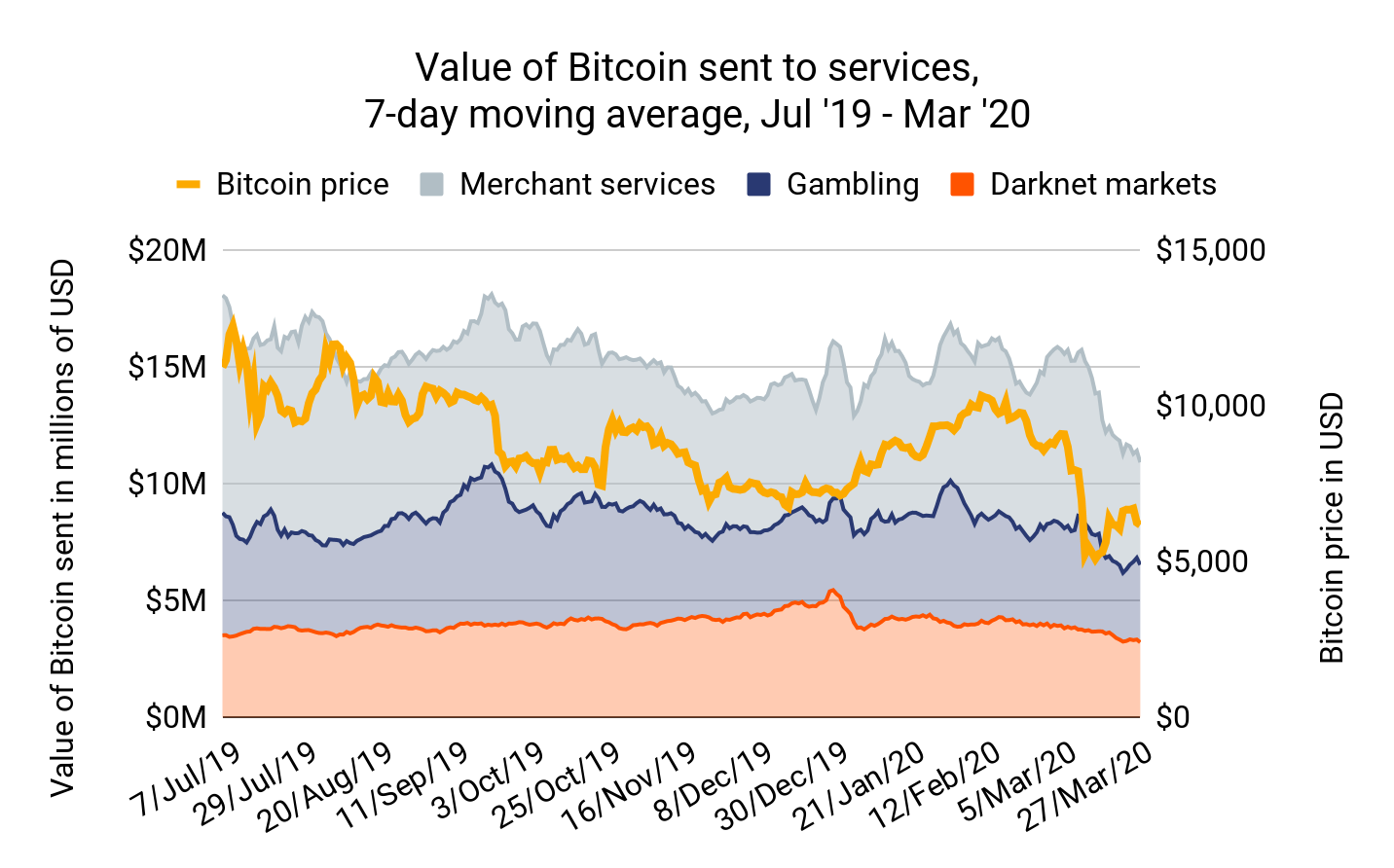

Above, we see that the amount of Bitcoin being sent to all three types of services has dropped significantly since March 9, coinciding with the price decline. That may strike you as unsurprising — how often does spending go up in an economic crisis? Perhaps people who would normally spend their Bitcoin sold instead to avoid further losses or are holding in the hopes it recovers its value.

But when you dig into the longer-term trends for each service category, you’ll see that this isn’t the behavior we’d expect.

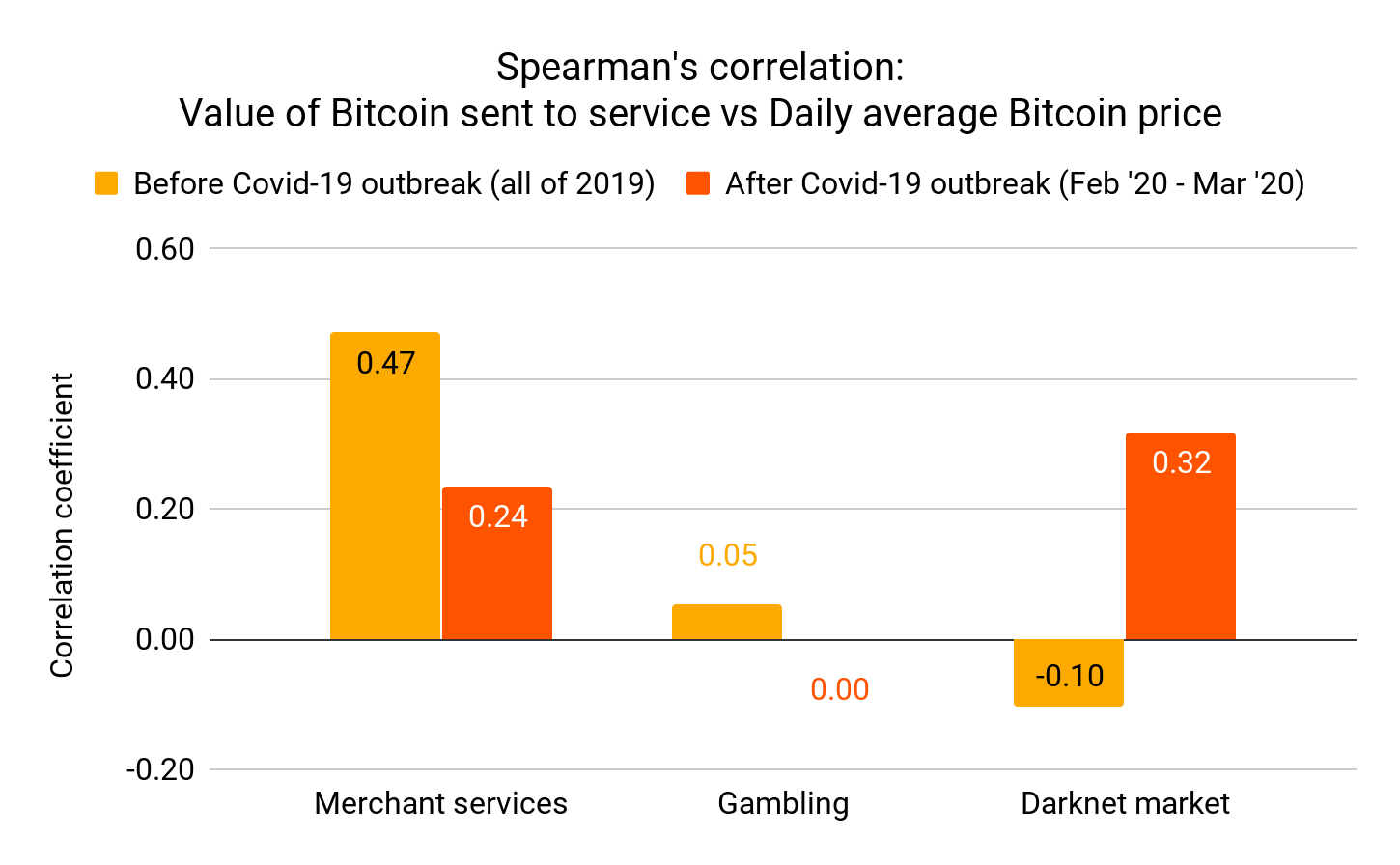

The graph above shows how strongly average daily Bitcoin price is correlated with daily Bitcoin receiving activity for the services we’re analyzing — meaning, the amount of Bitcoin customers send to those service types in a given day — both before and after Covid-19 reached North America. Before we continue, here are a few notes on how to interpret correlations/.

Direction of correlation: A positive correlation here means that the service receives more Bitcoin from customers as Bitcoin’s price rises and less as price decreases, while a negative, or inverse correlation, means that the service receives less Bitcoin as price rises and more when price decreases.

Strength of correlation: The larger the correlation coefficient’s absolute value, the stronger the positive or inverse relationship between price and activity. Correlations close to 0 indicate lack of a relationship. Generally, correlations with an absolute value greater than 0.1 signify a small correlation or inverse correlation. Correlations 0.3 or higher are medium, while correlations 0.5 or higher are considered strong.

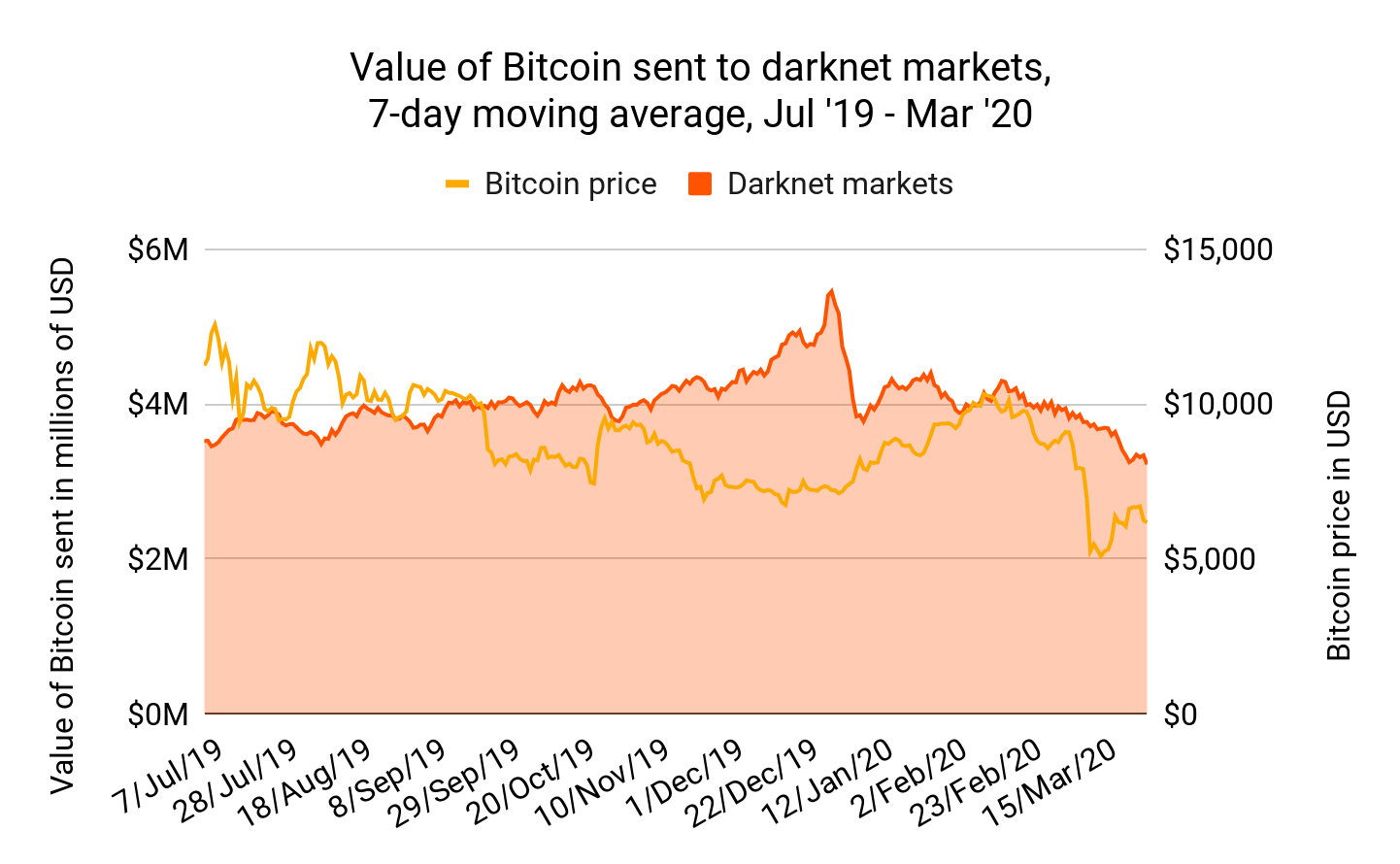

The level of correlation has changed for each of the service types we’re looking at. For darknet markets, revenue has become more correlated with Bitcoin’s price, meaning darknet markets have seen unexpectedly steep revenue declines since Bitcoin’s price began to drop. This is especially interesting considering darknet markets’ revenue previously had a small but significant inverse correlation with Bitcoin’s price, meaning we would have expected darknet markets to have slightly higher sales after the price drop.

Merchant services and gambling providers, on the other hand, have seen their revenue to Bitcoin price correlation drop, meaning they’ve proven more resilient and seen less of a revenue decrease than expected.

Let’s look at each category in more detail.

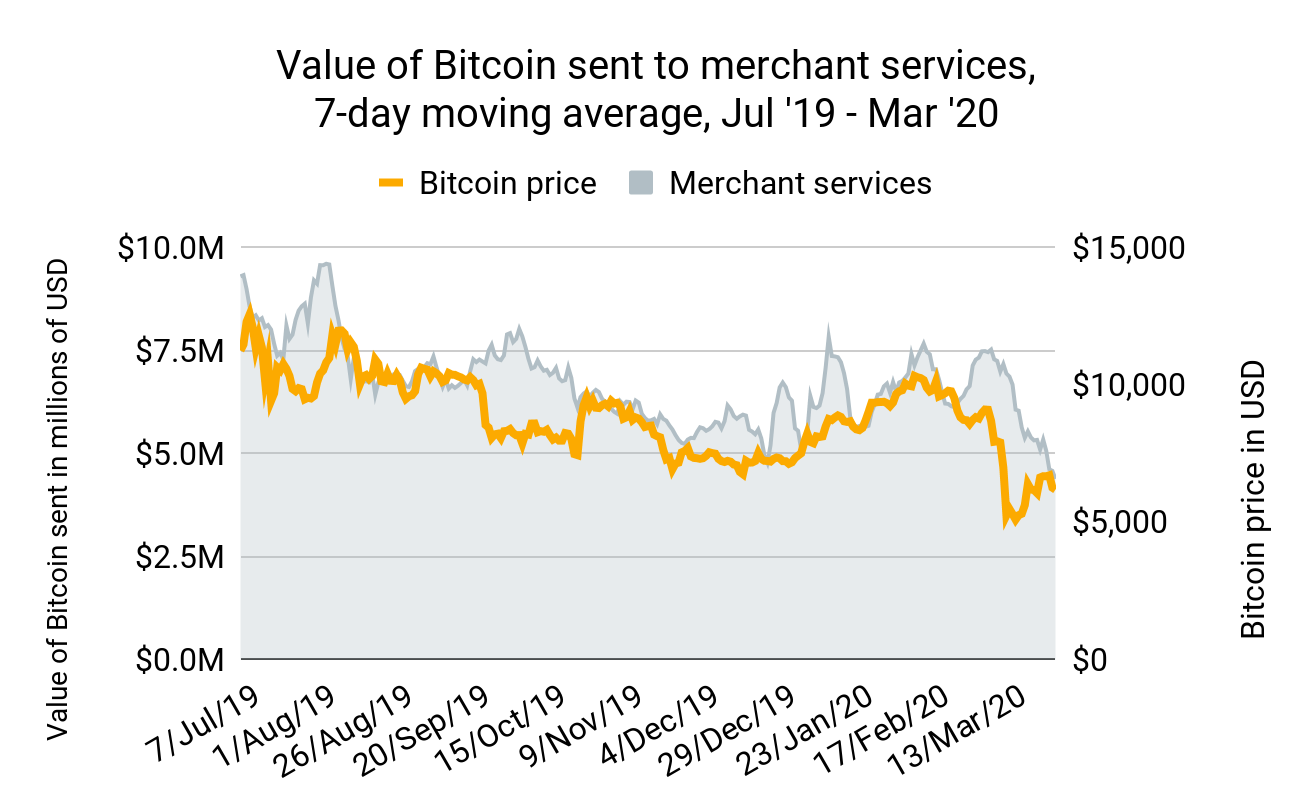

Merchant services are surprisingly resilient

Merchant services providers allow conventional businesses like Starbucks and Amazon to accept bitcoin from customers making purchases. Their Bitcoin-receiving activity is typically highly correlated with Bitcoin’s price, which makes sense intuitively: Bitcoin holders likely buy more when Bitcoin’s price is high and they feel richer. On the blockchain, we can only see funds moving to merchant services providers themselves, rather than to the specific businesses on whose behalf they’re accepting funds, so we can’t say which types of businesses drive the majority of merchant services activity generally or have seen the biggest drop offs in cryptocurrency spending due to Covid-19.

However, while merchant services purchasing has dropped, it hasn’t dropped nearly as much as we would’ve previously expected, as the correlation between merchant services activity and Bitcoin price has fallen by nearly half. There’s also some indication that the correlational relationship post-Covid-19 is no longer statistically significant, meaning Bitcoin price may only appear to influence merchant services activity by coincidence, though this is likely explained by the smaller two-month sample size.

We can only speculate as to why merchant services activity hasn’t dropped as much as we’d expect. One reason could be that cryptocurrency users are buying essentials via merchant services that they can’t get elsewhere with fiat currency, and therefore their usage can only drop so low. The need for merchant services could be augmented by local business closures in areas hit especially hard by Covid-19. Business services such as web hosting, which tend to have recurring payment plans, are also widely available via merchant services — spending on those services from pre-existing contracts could also be backstopping the category as a whole.

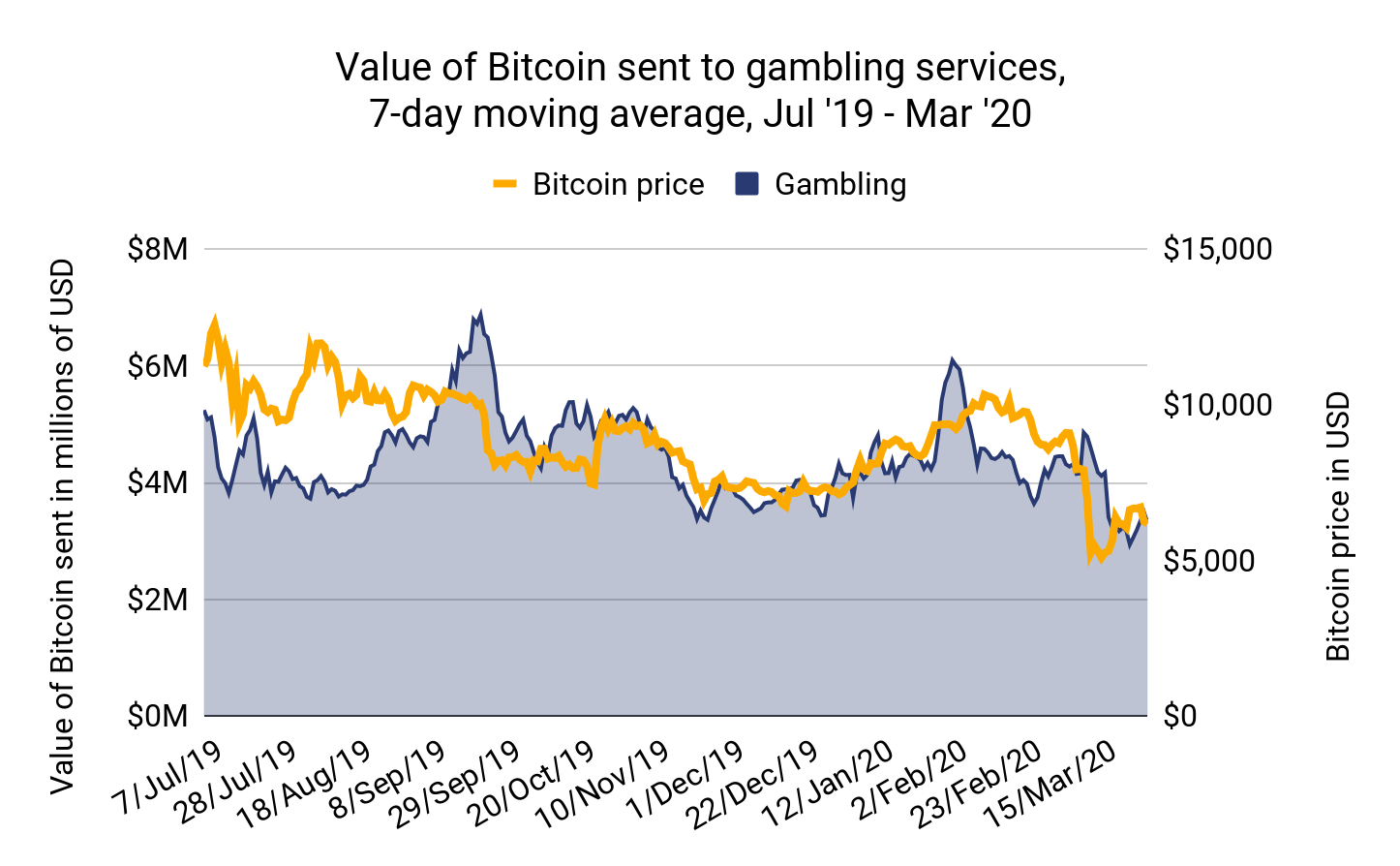

Dip in gambling activity appears unrelated to Bitcoin price drop

You may think that Covid-19 would be a boon to cryptocurrency-based gambling services. After all, wouldn’t regular users gamble more if they’re shut in their houses all day? That doesn’t appear to be the case thus far though. Bitcoin flows to gambling services have dropped since the week of March 9, just like the other services we look at here. However, the timing of those drops doesn’t suggest a correlation between gambling activity and Bitcoin price. Gambling usage didn’t start to fall until some time after the Bitcoin price drop, and continued to fall even when Bitcoin’s price started to recover.

This trend isn’t new. Gambling services’ revenue has always had an extremely weak, virtually non-existent correlation with Bitcoin’s price. Perhaps that’s because most people don’t approach gambling rationally or with an expectation of profit, but rather as a way to have fun. Research on gambling suggests this is true for non-cryptocurrency gambling as well, with one study finding it difficult to predict how gambling activity changes during recessions due to large variance in consumer behavior — some people will gamble less in order to save money, while others will find the small chance of winning a large jackpot more enticing during times of economic struggle.

Thus far into the Covid-19 pandemic, gambling activity’s lack of correlation with Bitcoin price has held strong, setting gambling apart from merchant services and, as we’ll examine below, darknet markets.

Darknet markets reacting to Bitcoin price like never before

The effects of the Covid-19 price drop on darknet markets is especially interesting. Historically, darknet markets’ revenue has had a weak inverse correlation with Bitcoin’s price. As we’ve noted in the past, darknet market activity is much less affected by the ebbs and flows of the market than other types of services, suggesting typical customers are willing to spend on drugs (and, to a lesser degree, other illicit stock such as stolen credit card data, firearms, and more) no matter how much their Bitcoin is worth. However, the correlational relationship has now reversed, and darknet market revenue has fallen much more than we’d expect following Bitcoin’s recent major price drop.

Perhaps darknet market customers aren’t buying as many drugs given the public health crisis. It’s also possible that vendors slowed down sales during the price drop, out of fear that the Bitcoin they accept one day could be worthless the next. But it’s also likely that Covid-19 itself is making it harder to sell drugs at the moment. Recent reports point out that Mexican drug cartels are having a harder time sourcing fentanyl, as China’s Hubei province — a hub of the global fentanyl trade — has been hit hard as the epicenter of the outbreak. Such disruptions to global supply chains could be hampering darknet market vendors’ ability to do business.

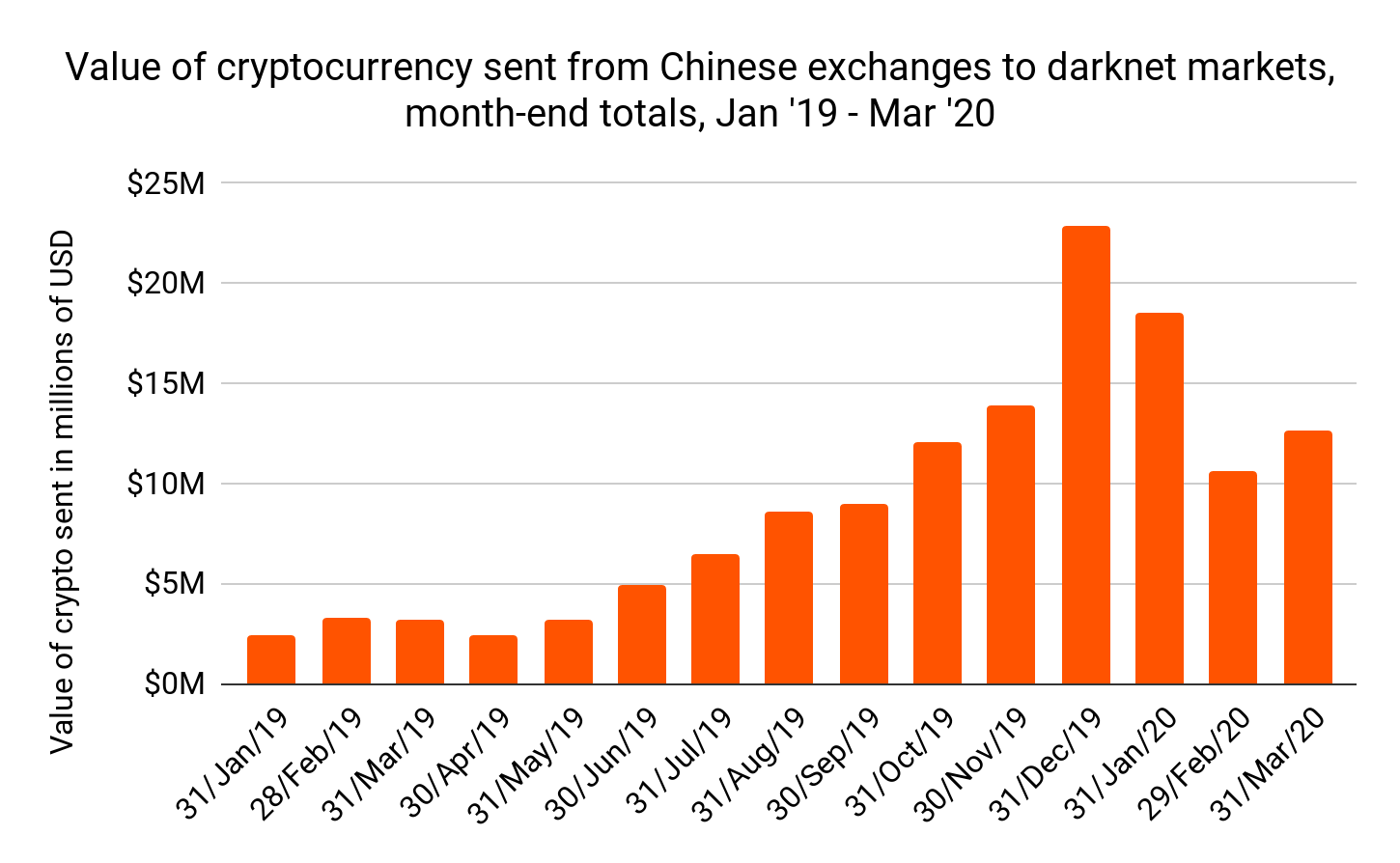

Indeed, as China recovers from its Covid-19 outbreak, its darknet market purchasing appears to be picking back up as well. Still, it remains to be seen whether darknet markets’ new Bitcoin price sensitivity will be a one-time blip or a new trend moving forward.

A one-of-a-kind event

The drastic changes in usage patterns for different types of cryptocurrency businesses make it clear that this is no ordinary Bitcoin price drop. It’s a one-of-a-kind market event brought on by an unprecedented public health crisis. The question for cryptocurrency businesses is whether or not they’ll be able to return to their previous transaction levels and if their customers’ usage patterns will return to normal as both Bitcoin and the economy itself recover.

If you want to keep up with how Covid-19 is impacting cryptocurrency markets, then join us for our Part 1 of our two-part Covid-19 webinar series on April 8, 2020 at 11am ET! Our Chief Economist Philip Gradwell will walk you through the latest trading trends, contributing factors to Bitcoin’s recent price stability, and more!