Executive summary

- Transnational criminal organizations have adopted cryptocurrencies. Mexican and Colombian drug cartels have turned to cryptocurrency to make fast, pseudonymous payments, as have traffickers smuggling cocaine from South America through Europe and the Balkans. Furthermore, the authors of the 2021 Trafficking in Persons report noted that authorities have observed human trafficking networks increasingly using cryptocurrency to launder the proceeds of their crimes.

- As credit card processors have shied away from certain services, websites linked to the commercial sex market, which can facilitate human trafficking, are increasingly accepting cryptocurrency. The authors of a February 2022 Government Accountability Office study found that of 27 of these websites, 15 accepted cryptocurrencies. The Polaris Project, an NGO that works to combat and prevent human trafficking, found that some platforms offer discounted rates to customers who pay with cryptocurrency.

- Cryptocurrency ATMs, a valuable tool for cross-border remittances and payments, may play a role in both human and drug trafficking. In several ongoing and since-closed cases, trafficking suspects have leveraged high-risk crypto ATMs to make payments, procure false identity documents, and launder money. According to Chainalysis data, crypto ATMs on the I-10 corridor near the southern border of the United States also receive a higher share of USD than other regions, and users along the corridor transact with crypto ATMs at higher rates.

- Blockchains’ transparency gives investigators an unparalleled view into illicit financial flows. In the traditional financial system, efforts to follow the money can be a difficult undertaking. On blockchains, where transactions are permanently, publicly recorded, it’s straightforward to visualize. Investigators can leverage tools like Chainalysis Reactor to identify the cash-out points of illicit actors laundering cryptocurrency.

Introduction

The trafficking of humans, drugs, and counterfeit goods are massive illicit industries and are motivated by profits. According to Global Financial Integrity, a think tank, these three crimes generate more than a trillion dollars in annual revenue. Beyond their financial impact, they erode communities, destroy lives, and contribute to corruption worldwide. Understanding how the money moves and the choice of payment rails is key to disrupting trafficking operations.

All types of cryptocurrency crimes, by comparison, generated a collective $14 billion last year. But this number represents a 79% jump year-over-year, and may significantly understate the true amount of cryptocurrency-based criminal activity; while the estimate captures the transaction activity between known illicit entities, traffickers moving large amounts of cryptocurrency between private wallets, for example, are not included in the counting.

This trend towards more private transactions is partially observable when analyzing darknet market-related activity. We’ve found that many drug buyers and vendors who have previously transacted with a darknet market as an escrow agent have now begun to transact directly, bypassing the darknet market and sending cryptocurrency from one private wallet to another. At least $112 million worth of drug payments were sent in this way last year, with buyers sending, on average, $8,441 to their chosen seller yearly.

Cryptocurrency is also accepted on many platforms in the commercial sex market, which can facilitate human trafficking. According to a February 2022 Government Accountability Office report, 15 out of 27 of these websites accepted cryptocurrency. Among the 40 websites analyzed in a similar study by Polaris, that count was 23. Polaris also found that some platforms offer discounted rates to customers who pay with cryptocurrency. Credit cards were still the most accepted form of payment.

As people around the world have grown in their technological proficiency and cryptocurrencies have become more user-friendly, there is reason to suspect that criminals with larger logistical networks have begun turning to cryptocurrency. Furthermore, there is a growing body of evidence that transnational criminal organizations are using cryptocurrency to conduct their trafficking operations and launder money.

As the controllers of centralized payments rails seek to identify and distance themselves from risky activity, criminals may seek out new technologies they believe offer them greater anonymity, such as cryptocurrency. But thanks to the transparency of blockchains, investigators can leverage blockchain analytics tools to map and disrupt these networks.

Traffickers recognize cryptocurrencies’ speed, pseudonymity, and cross-border functionality

Criminals turn to crypto for many of the same reasons as legitimate consumers: for its speed, pseudonymity, and cross-border functionality. To combat this illicit use of cryptocurrency by criminals, investigators must also grow their knowledge and capabilities to keep pace with the speed of crypto.

There have been major successes on this front already, such as law enforcement’s seizure of $1 billion connected to the Silk Road, the takedown of WelcomeToVideo, the largest child sexual abuse site, and the shutdown of Hydra marketplace, the largest darknet market in history. Cases like these demonstrate that when law enforcement is adequately resourced, they are able to combat these crimes and bring justice to their perpetrators.

Traffickers may exploit crypto ATMs

Cryptocurrency ATMs (cATMs) are invaluable tools for cross-border remittances and payments, but they can be exploited. Chainalysis data shows that crypto users along the United States’ I-10 corridor—an area known to be a drug trafficking hotspot—send a higher percentage of funds to crypto ATMs than the national average, and a larger share of private wallets there transact exclusively with crypto ATMs. This could be indicative of a number of things, including cryptocurrency being used for remittances, but it could also be indicative of their use in trafficking.

In several ongoing investigations and since-resolved cases, trafficking suspects have leveraged high-risk ATMs to make payments, deposit funds to procure fraudulent identity documents, and/or launder money. And because not all cATMs collect customer information as recommended by the Financial Action Task Force and mandated by AML and KYC policies—a compliance standard we’re helping to implement through our membership in the Cryptocurrency Compliance Cooperative—cATMs are potentially more likely to be exploited by criminals than other methods.

Traffickers believe that because they are using cATMs, their activity is anonymous; thanks to blockchain’s transparency, this isn’t necessarily a reality. With blockchain analysis, investigators can trace crypto transactions and tie them to real-world entities. Here’s how it works: once investigators determine that a suspect they are investigating is using cryptocurrency illicitly — perhaps because bank records obtained through legal process show transfers to cATMs or cryptocurrency exchanges — they can serve legal process to any virtual asset service provider shown on the bank records, obtain associated cryptocurrency addresses, and conduct blockchain analysis to determine how the cryptocurrency is being used.

How transnational criminal organizations have adopted cryptocurrency for cross-border transactions

Cash is heavy, and transporting it across borders exposes criminals to considerable risk. Sending funds through bank systems designed to flag suspicious activity is dangerous too due to well established anti-money laundering controls. A drop in seizures of hard currency from $741 million to $234 million from 2011 to 2018 – most of it from Colombian and Mexican cartels – suggests criminals could be improving their ability to evade detection and may be finding other alternatives to moving their money.

With blockchain analysis, however, we can step beyond the suggestion into the realm of evidence. Consider the following case study:

Cocaine trafficking from South America and Asia Minor to Eastern Europe

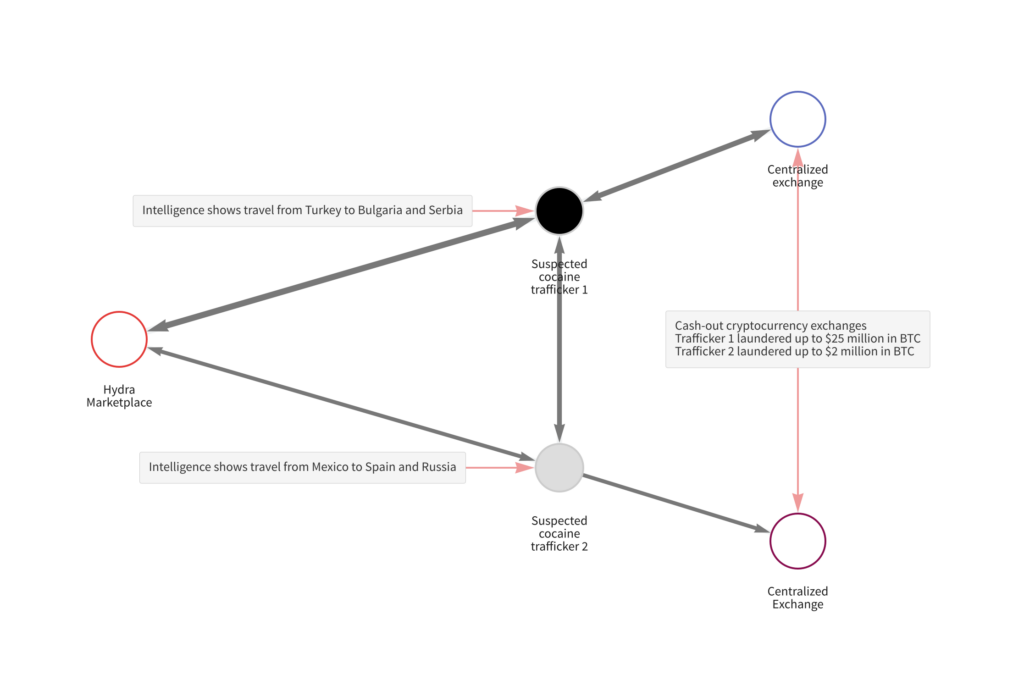

In 2022, an investigator using Chainalysis Reactor identified two suspicious clusters based on travel patterns, locations frequented, and ties to Hydra Marketplace, the largest darknet drug market globally until it was shut down by German and U.S. authorities in April 2022.

The suspicious clusters came to the investigator’s attention as they were trying to identify clusters with travel movements that mirrored a common international cocaine trafficking route.

In this longstanding route, cocaine emanates from South America into Western Europe before being moved through the Balkans into Eastern Europe.

Chainalysis intelligence indicates that the two suspicious clusters could be involved in cocaine trafficking of a similar sort—the only difference being that the end-buyers of these drugs were on the internet. The funds from the first cluster traveled from Turkey to Serbia and Bulgaria, while the second traveled through Mexico to Spain and Russia. In total, from 2019 to 2022, the suspicious clusters sent more than $13 million in Bitcoin between each other and collected $29 million from Hydra sales. $21 million has since been sent to two centralized exchanges for laundering.

Analyses like these—as well as equivalent assessments of travel patterns from Latin America to North America and elsewhere—are straightforward to make in Reactor with the investigations API, and can be a powerful generator of intelligence opportunities. How many other such clusters are waiting to be discovered on the blockchain and disrupted?

Organized crime groups are also using crypto for money laundering

Cryptocurrency’s utility for organized crime groups goes far beyond darknet markets, especially when it comes to money laundering. For example, Chainalysis’ 2021 Crypto Crime Report details one case in which a cocaine smuggling ring operating in the United Kingdom and Australia used cryptocurrency to set up a complex system for cross-border payments and money laundering, moving millions of dollars between dealers and suppliers around the world. Other outlets have reported similar examples of crime syndicates like Mexico-based drug trafficking organizations (DTOs) using digital payment systems to launder funds through China-based criminal enterprises. Once these payments are identified, investigators can use Reactor to trace the funds and hopefully seize them.

Customs and border protection agencies need cryptocurrency tools to fight trafficking crime

Traffickers are often early adopters of technologies that make their operations more profitable and less prone to law enforcement detection. But cryptocurrency is fundamentally transparent compared to traditional mediums of value transfer, and investigators with the proper tools, data, and know-how can observe and interdict these operations with unparalleled clarity and speed.

A twenty-first century crime deserves a twenty-first century solution. Blockchain analytics allows investigators to follow the money and in some cases recover funds for victims before they disappear. We have seen a number of great successes on this front, including an investigation that led to the largest financial seizure ever – $3.6 billion in stolen cryptocurrency. As Deputy Attorney General Lisa O. Monaco stated, this demonstrates that “cryptocurrency is not a safe haven for criminals.”

Governments and private sector partners around the world are adopting the data, tools, and understanding needed to stay ahead of the threat. Reactor customers in over 70 countries now use our platform to move fast, fill gaps, and solve cases with confidence.

But there’s still much work to be done. Chainalysis has mapped $14 trillion in cryptocurrency value to real-world entities since 2014, and maps millions more daily. We’ve begun to see cryptocurrencies’ role in trafficking extend across countries and continents, and believe that increasing the level of crypto-literacy and blockchain capabilities across customs and border protection agencies will allow investigators to keep up with the ways in which illicit actors exploit digital assets. Because as long as traffickers use cryptocurrencies to hide, we need blockchain-empowered investigators to seek, find, and seize those funds.

About the author: Gurvais C. Grigg is a bilingual technology executive and recognized thought leader with over 27 years of public and private sector experience leading complex organizations, investigations, and technical programs. Gurvais retired from the FBI after 23 years and joined Chainalysis as the Global Public Sector Chief Technology Officer (CTO). He is responsible for connecting global governments with the cryptocurrency industry and providing them with the best data and tools to manage risk, address threats, and conduct effective investigations.

This website contains links to third-party sites that are not under the control of Chainalysis, Inc. or its affiliates (collectively “Chainalysis”). Access to such information does not imply association with, endorsement of, approval of, or recommendation by Chainalysis of the site or its operators, and Chainalysis is not responsible for the products, services, or other content hosted therein.

Chainalysis does not guarantee or warrant the accuracy, completeness, timeliness, suitability or validity of the information in this report and will not be responsible for any claim attributable to errors, omissions, or other inaccuracies of any part of such material.