Virtual Asset Service Providers (VASPs) play a crucial role in the cryptocurrency landscape by providing services that facilitate the use and adoption of digital assets by retail and institutional customers alike. From exchanges to custody providers to payment processors, VASPs are helping bridge the gap between traditional finance and the blockchain.

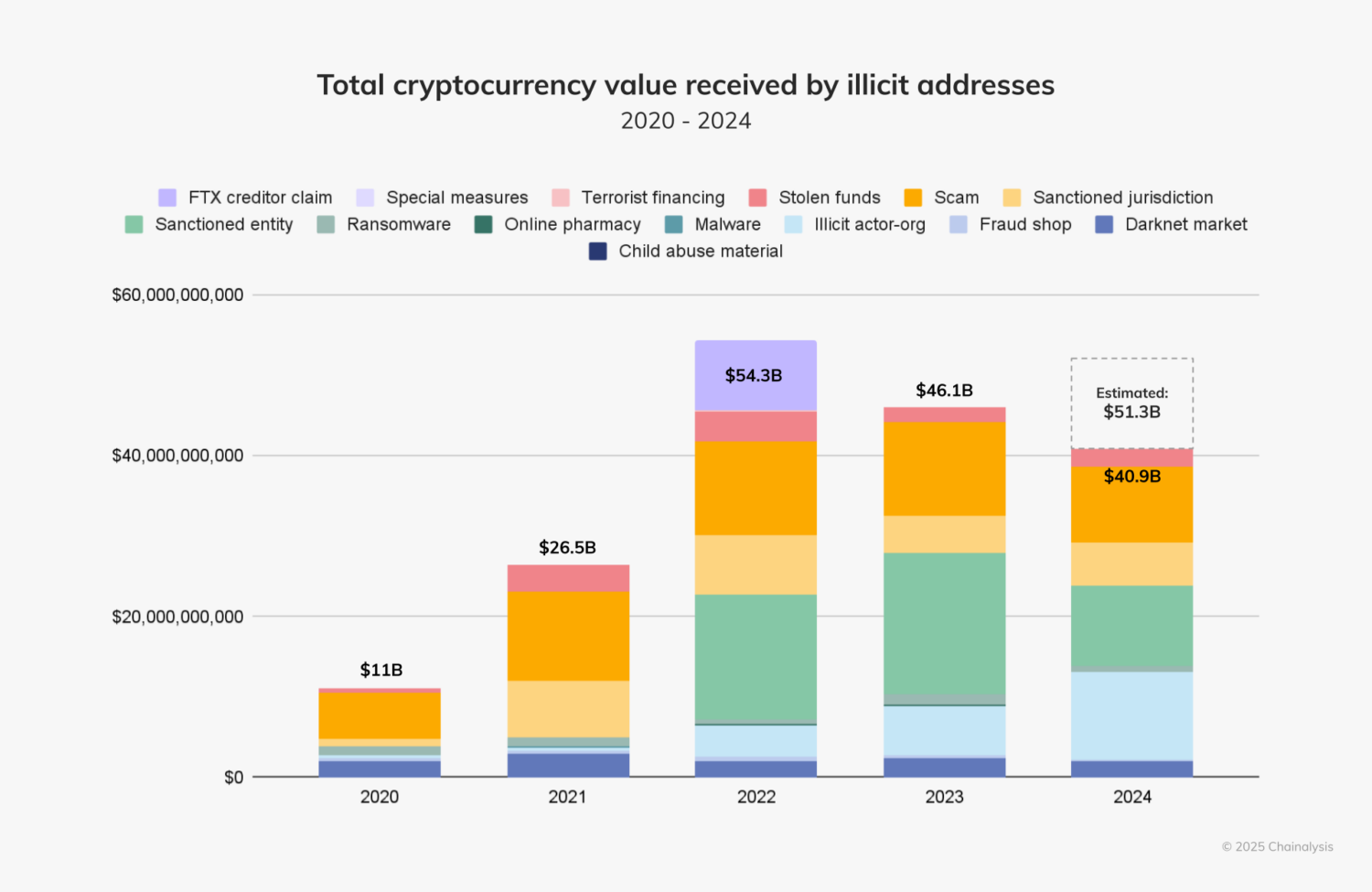

However, as crypto becomes more integrated into the financial system, it is critical to assess and understand the risks associated with VASPs. This principle, modeled on Know-Your-Customer (KYC), is often referred to as Know-Your-VASP. How does one get a clear picture of a specific VASP’s crypto risk? In 2024, over $40.9 billion in value was received by illicit addresses, as seen below. It is thus vital for FIs, crypto businesses, regulators, and others to be able to assess the risk and activities of VASPs accurately and on a timely basis to protect against illicit activity when onboarding clients, choosing business partners, or granting licenses.

Solving this problem requires sophisticated analysis of on-chain transactions directly and indirectly linked to VASPs to understand their exposure and counterparties. Users need to be able to evaluate a specific VASP against the broader category to understand if seemingly anomalous activity is consistent with that of similar VASPs. For example, a service might experience an increased amount of activity related to gambling, but in order to determine if action is needed, it is important to benchmark the amount of gambling exposure VASPs have across the whole industry.

Chainalysis Know Your VASP solution

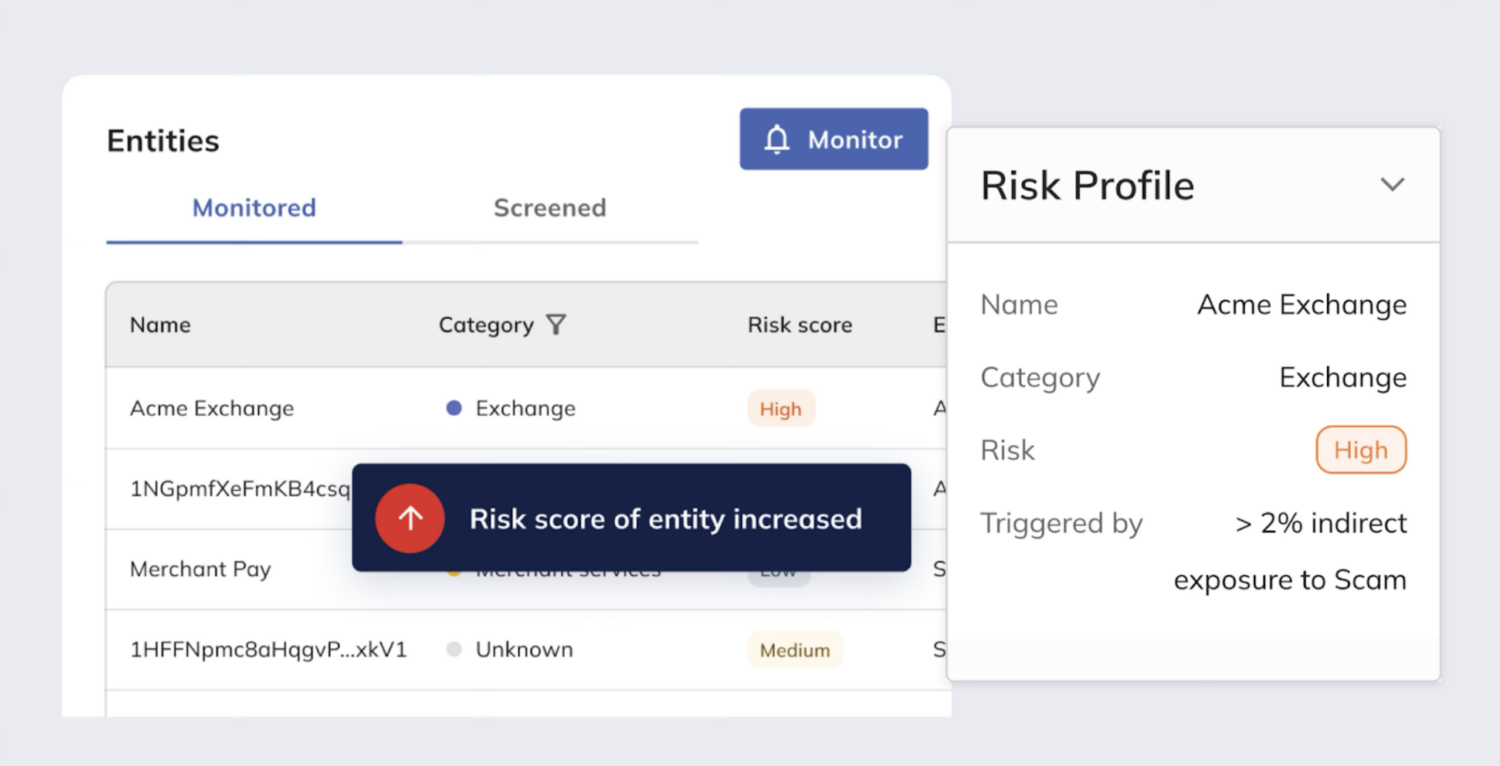

To address this critical need, Chainalysis provides VASP Risking with capabilities to fully understand and screen VASP risk. Built on the industry’s leading and trusted blockchain intelligence, which maps on-chain activity to real-world entities, users are able to assess VASPs’ exposure to illicit activity. Searching a VASP’s name or crypto address will generate a profile that provides insight across key risk categories. With VASP Risking, users can:

- View and monitor a VASP’s risk profile

- Understand its risk score

- Assess exposure and counterparties

- Compare against all similar VASPs

In addition, users can dive deeply into risk scores and profiles with control over settings, adjusting thresholds, risk severity, and more. With Chainalysis, compliance officers no longer need to periodically and manually rescreen VASPs. Chainalysis uniquely provides continuous monitoring for automatic alerts when a VASP’s activity changes its risk score.

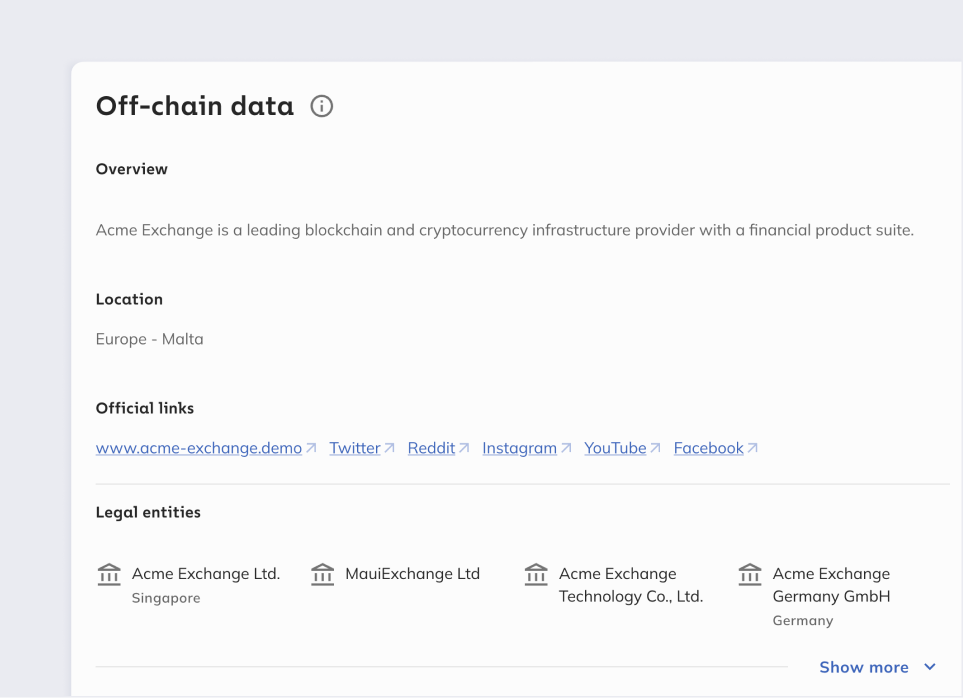

Off-chain data in partnership with Lukka

To enhance VASP Risking capabilities, Chainalysis has partnered with Lukka to integrate critical off-chain information into the VASP Risking product. Users now gain a more comprehensive view of a VASP with consolidated data of interest, such as including legal entity names, regulatory licenses, jurisdictional information, and more.

Having visibility into a VASP’s on- and off-chain characteristics is essential for thorough due diligence and compliance. It provides a fast, clear, and actionable snapshot to help users determine whether they should invest in the full due diligence process for a VASP, saving time and resources.

Walkthrough of Off-Chain data

The integration of off-chain data into VASP Risking significantly enhances the assessment process. Here’s a brief walkthrough of some of the key information that off-chain data brings:

- Legal Entity Names and Territories: A comprehensive list of legal entity names associated with a given VASP, along with the jurisdictions in which they operate.

- Regulatory Licenses: Information about the licenses held by a VASP, including the licensing authority and the date of issuance.

- KYC and AML Statuses: Details about a VASP’s Know Your Customer (KYC) and Anti-Money Laundering (AML) policies.

- Services Offered: The range of services provided by a VASP, such as spot crypto trading, fiat trading, derivative trading, NFTs, staking, and lending.

- Restricted and Allowed Jurisdictions: A list of countries where a VASP is restricted or allowed to operate.

Want to learn more?

To learn more about VASP Risking and how it can enhance your compliance and due diligence processes, and off-chain data for compliance more generally, please join our upcoming webinar. In this session, you will learn more about VASP Risking, gain familiarity with key capabilities, and watch a live VASP Risking demonstration.

👉 Register for the webinar here!

About Lukka

Lukka serves risk-mature businesses worldwide with enterprise data, software and compliance solutions. Lukka solves financial, risk, compliance, and trade finance use cases that are complicated by the characteristics of blockchain data. Lukka’s data and software products are award-winning, independently audited, and designed to exceed institutional standards, such as those issued by the AICPA, ISO, IOSCO, and other trusted organizations, that focus on data quality, financial calculation accuracy & completeness, and managing technology operational risks. Lukka provides software and data solutions for crypto assets used by financial institutions, tax professionals, enterprises, and consumers.

About Chainalysis

Chainalysis is the blockchain data platform, making it easy to connect the movement of digital assets to real-world services. Organizations can track illicit activity, manage risk exposure, and develop innovative market solutions with intelligent customer insights. Our mission is to build trust in blockchains, blending safety and security with an unwavering commitment to growth and innovation.

This website contains links to third-party sites that are not under the control of Chainalysis, Inc. or its affiliates (collectively “Chainalysis”). Access to such information does not imply association with, endorsement of, approval of, or recommendation by Chainalysis of the site or its operators, and Chainalysis is not responsible for the products, services, or other content hosted therein.

This material is for informational purposes only, and is not intended to provide legal, tax, financial, or investment advice. Recipients should consult their own advisors before making these types of decisions. Chainalysis has no responsibility or liability for any decision made or any other acts or omissions in connection with Recipient’s use of this material.

Chainalysis does not guarantee or warrant the accuracy, completeness, timeliness, suitability or validity of the information in this report and will not be responsible for any claim attributable to errors, omissions, or other inaccuracies of any part of such material.