This post is an excerpt from our 2023 Geography of Cryptocurrency Report. Download your copy now!

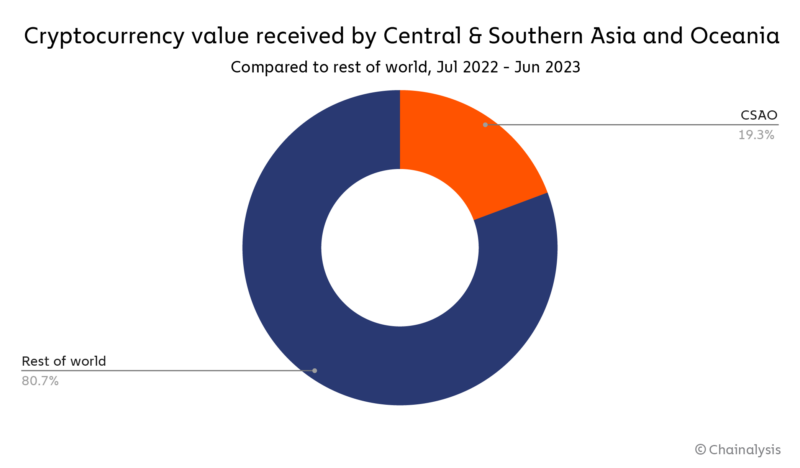

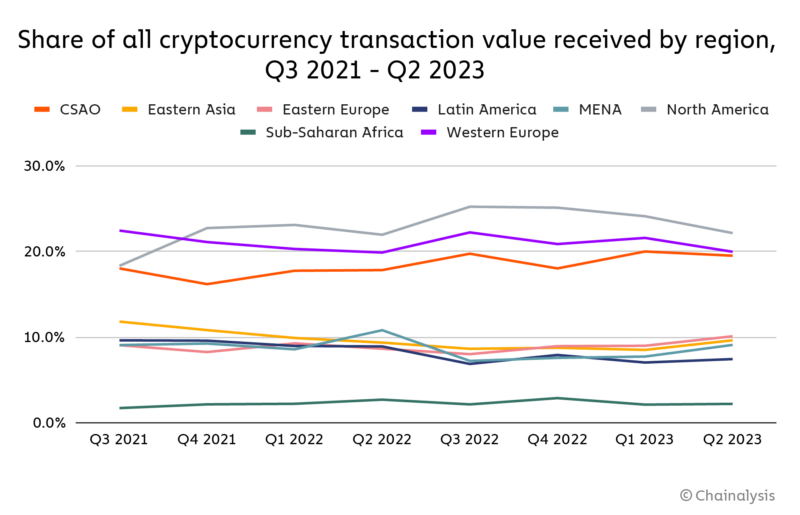

Central & Southern Asia and Oceania (CSAO) hosts what may be the world’s most dynamic and fascinating cryptocurrency market. Measured in raw transaction volume, CSAO is the third-largest crypto market we study, barely trailing North America and Central, Northern & Western Europe (CNWE), and accounting for just under 20% of global activity.

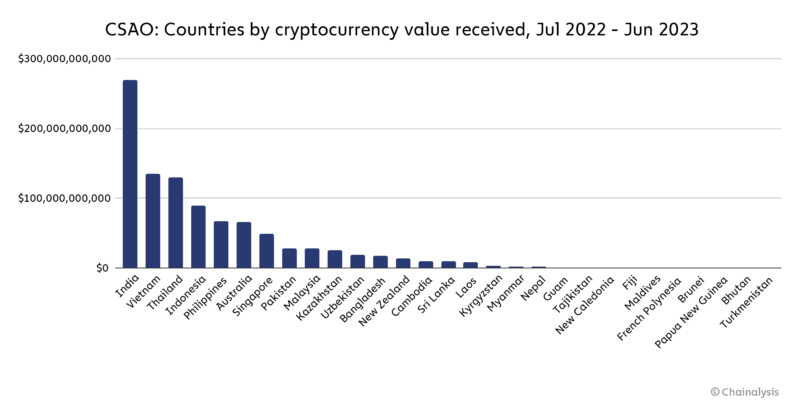

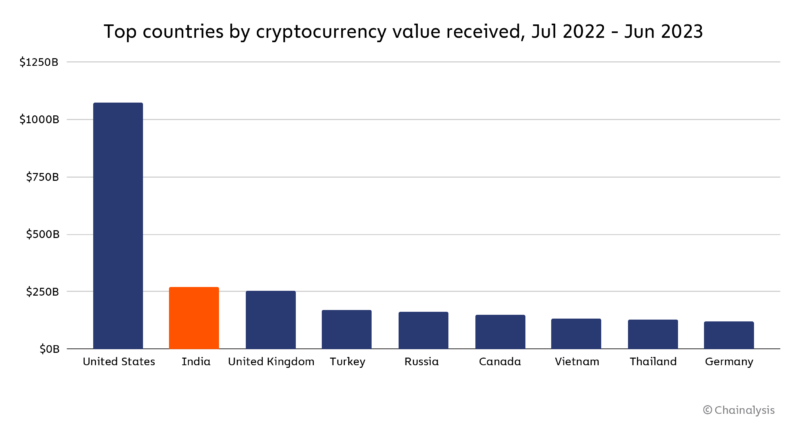

India leads the way in transaction volume, having received an estimated $268.9 billion in crypto assets during the time period studied.

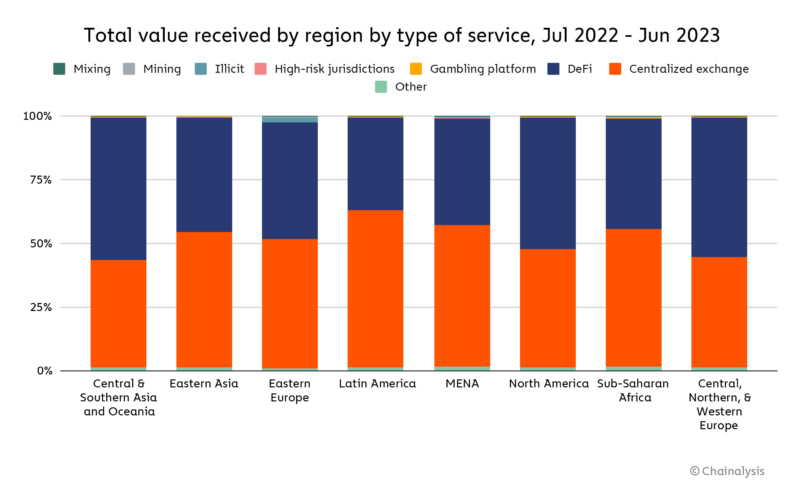

However, raw transaction volume doesn’t tell the full story. When we account for purchasing power and population to measure grassroots adoption, CSAO dominates. We see this in our Global Crypto Adoption Index, where six of the top ten countries are located in the region: India (1), Vietnam (3), the Philippines (6), Indonesia (7), Pakistan (8), and Thailand (10). In addition, the last year has seen DeFi take on a heightened role in CSAO, accounting for an estimated 55.8% of regional transaction volume between July 2022 and June 2023, compared to 35.2% in the previous year-long period. Institutional adoption in the region also appears to have picked up, with 68.8% of total transaction volume coming in transfers valued at $1 million or more, compared to 57.6% in the preceding time period.

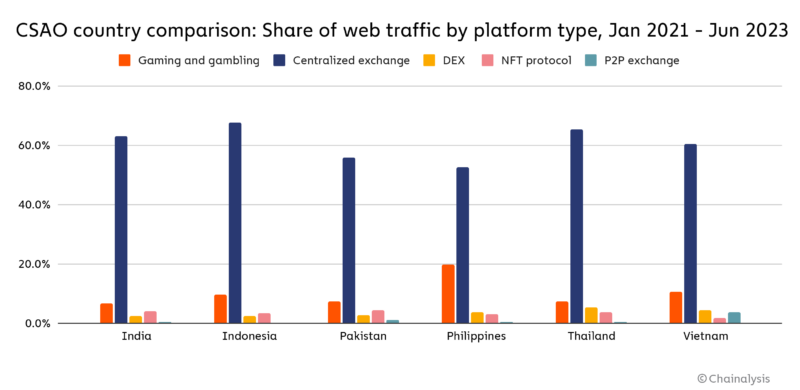

Crucially though, CSAO is not a monolith when it comes to cryptocurrency adoption. Different factors are driving adoption in different CSAO countries, which leads to different rates of usage for different types of cryptocurrency services. We can see this on the graph below, which shows the breakdown of web traffic to different types of cryptocurrency platforms for the top CSAO countries on the adoption index.

Centralized exchanges take up the majority of web traffic in all of these countries, as is the case around the world. But we see major differences elsewhere. For instance, the Philippines has a huge share of crypto-related web traffic going to gaming and gambling platforms at 19.9% — Vietnam is next at just 10.8%. Meanwhile, countries like Pakistan and Vietnam see a higher share of activity happening on P2P exchanges, which are more commonly used in emerging markets or in countries with stricter capital controls.

Below, we’ll explore two CSAO countries with different adoption drivers — the Philippines and Pakistan — and examine how those differences result in different usage patterns. We’ll then take a look at some of the latest trends in India, the country leading the world in grassroots crypto adoption.

The Axie Infinity craze kicked off crypto adoption in the Philippines, but what comes next?

Crypto enthusiasts have long touted the $217 billion video game industry as one where cryptocurrency can make a positive impact, such as by enabling players to earn, buy, and sell in-game items. We’ve already seen some ambitious projects start to tackle this problem with varying degrees of success, and no country has embraced those projects like the Philippines, with play-to-earn game Axie Infinity in particular capturing the nation’s attention. To learn more, we spoke to Donald Lim, an advertising and marketing veteran in the Philippines whose work has spanned several industries, and who has now entered the world of cryptocurrency, becoming the first ever president of the Blockchain Council of the Philippines and principal organizer of Philippine Blockchain Week.

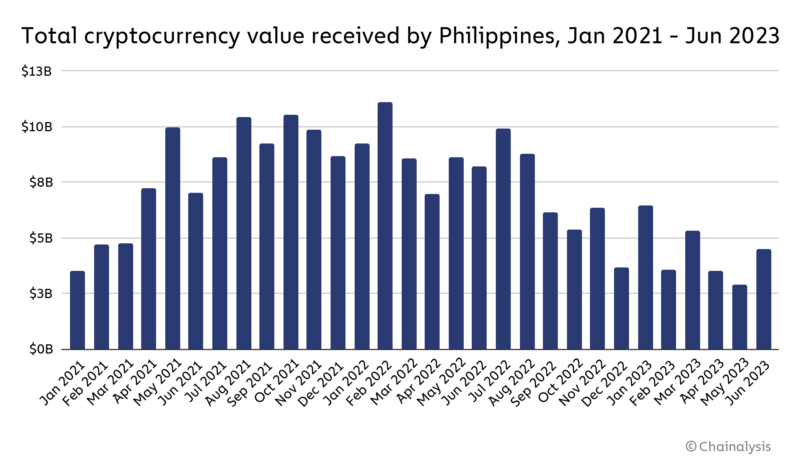

“I think Axie Infinity was the moment crypto really arrived in the Philippines,” said Lim. While the game was most popular amongst the younger generation, Lim saw people from all walks of life playing. “You’d get into a pedicab and see that the driver had his phone mounted at the top of the windshield playing Axie — there were so many stories like that.” Indeed, the Philippines accounted for the biggest share of total Axie Infinity web traffic at 28.3%, and on-chain data shows that the country saw increases in cryptocurrency transaction volume coinciding with Axie’s growth in summer of 2021.

What made the Philippines so receptive to a play-to-earn game like Axie Infinity? Lim has several reasons. For one, the Philippines has a young, tech-savvy population that had already embraced digital wallets for fiat such as GCash. At the time Axie Infinity launched and began gaining steam, the world was in the midst of the COVID pandemic, with many stuck at home and out of work — Axie provided entertainment and a way to earn extra cash. It also gave people a social outlet. “Filipinos are used to putting in the effort to connect online and through social media, because as a nation of many small islands, we’re naturally disconnected. We’re also the world’s biggest exporter of human capital, and Filipinos abroad want to connect with people at home,” Lim explained. According to him, the Philippines’ heavy social media usage made it easier for the game to go viral and reach users through tactics like influencer marketing.

Axie Infinity has since seen large decreases in both overall usage and in its token price, and many in both the Philippines and elsewhere who have abandoned the game are no better off financially than they were before. But the game’s success set the stage for further crypto adoption, as the many Filipinos who played now have functioning wallets that can be used for other purposes.

Lim believes the best way to convert that initial momentum into beneficial crypto adoption is for regulators and large web2 companies to step up. “Crypto adoption can’t only be bottom up. The government needs to set rules, and the biggest companies need to incorporate cryptocurrency into their offerings.” Already, there’s been positive momentum on both fronts. The Philippines government has designated a special economic zone in the Bataan region where cryptocurrency companies who set up shop can get tax benefits and operate in a regulatory sandbox designed to nurture innovation. On the private sector side, Philippines Airlines recently launched a utility-driven NFT collection that gives users access to special perks, while Filipino financial services firm Cebuana Lhuillier has announced an integration with the Stellar blockchain to offer faster, cheaper remittances — crucial for a country that receives as much money from abroad as the Philippines.

Lim is confident that the Philippines has what it takes to be a leader in cryptocurrency. “We can become the blockchain capital of Asia. Look at the developer talent, look at all of the online groups devoted to trading and NFTs — it’s just a matter of time.”

In Pakistan, necessity drives adoption of crypto — especially stablecoins

Despite lower overall transaction volumes, Pakistan is a world leader in grassroots cryptocurrency adoption, not far behind the Philippines. But adoption patterns in the two countries are quite different. While social connection and speculation have driven many Filipinos to enter crypto via play-to-earn gaming, a need for wealth preservation in the face of high inflation and currency devaluation appears to be the reason many Pakistanis have turned to crypto. We spoke with Zeeshan Ahmed, Country General Manager for Pakistan of popular crypto exchange Rain, to learn more. Rain operates in several countries in the region and, while it currently conducts no commercial activity in Pakistan given crypto trading is currently banned in the country by law, is working to one day obtain a regulatory license.

When we asked Ahmed what drives Pakistani crypto adoption, he replied with some sobering statistics. “Five years ago, Pakistan’s inflation was 10.6%. Right now, it’s officially reported as 29.4%, but in reality much higher. The major spike came in the last 16 months, as the rupee’s value has dropped from 178 PKR per U.S. dollar in January of 2022 to 320 PKR as of August.” Unfortunately, challenging economic conditions in Pakistan have meant savings can be eroded rapidly. And on top of that, there aren’t many good options for ordinary people to invest in the current environment. “The equities market and stock exchange have tanked. And any gains you achieve can be wiped out by inflation,” Ahmed explained. Pakistani citizens are also barred from holding physical foreign currency — it has to be deposited in a bank. For many, this makes crypto, and in particular stablecoins, a necessity. “It’s the only option we have to hedge.”

It’s also important to note that on-chain data can’t tell the full story on crypto adoption for a country like Pakistan. Much of the country’s transaction volume, and in particular the acquisition of stablecoins, takes place through informal peer-to-peer markets, and can’t easily be identified on-chain. As such, it’s difficult to know exactly how many individuals are holding or acquiring cryptocurrency at any given time. Further, experts speculate that businesses in Pakistan use stablecoins like USDT to import goods from abroad and hedge against inflation and currency devaluation, which is difficult to confirm.

While cryptocurrency trading is formally banned in Pakistan, Ahmed believes that a clear regulatory framework could help make the crypto market more productive for Pakistani citizens. Though the official stance has not changed, Ahmed says he is sensing some recent progress on this front. “Eight months ago, our regulators didn’t even want to talk about crypto. But recently in July of this year, we submitted to them a white paper on how crypto could be regulated, and they seem to be moving forward.” Future regulation could, for instance, allow Pakistanis to move funds to exchanges from a bank account, which would make it much easier and more cost-effective to acquire the digital assets they need, setting the stage for further growth.

India remains a top crypto market despite difficulties around tax laws

While other markets in the region are dynamic and can help us understand the unique drivers of crypto adoption, the biggest CSAO cryptocurrency market by far is India. India leads the world in grassroots adoption as measured by our Global Crypto Adoption Index, but perhaps even more impressively has become the second-largest crypto market in the world by raw estimated transaction volume, beating out several wealthier nations.

India’s cryptocurrency usage spans several different forms of activity, as the country ranks in the top ten in usage for cryptocurrency services in a varied set of categories.

| Crypto platform type | India’s rank in usage by estimated transaction volume |

| DEX | 2 |

| Centralized exchange | 4 |

| Lending protocol | 4 |

| Token smart contract | 4 |

| NFT protocol | 9 |

Perhaps most impressive of all is that India’s emergence as a top cryptocurrency market comes in spite of a regulatory and tax environment that can be challenging for the industry to navigate. Within the last year, regulatory agencies have provided more clarity on many issues, for instance formally decreeing that its money laundering rules will apply to cryptocurrency transactions. However, India taxes cryptocurrency activity at a much higher rate than most other countries, with a 30% tax on gains — a rate unique to crypto and higher than the country’s tax rate on other investments such as equities — and a 1% tax on all transactions, also known as a tax deducted at source (TDS), meaning that crypto platforms must deduct the amount from the user’s balance at the time of the trade in order for the trade to be completed.

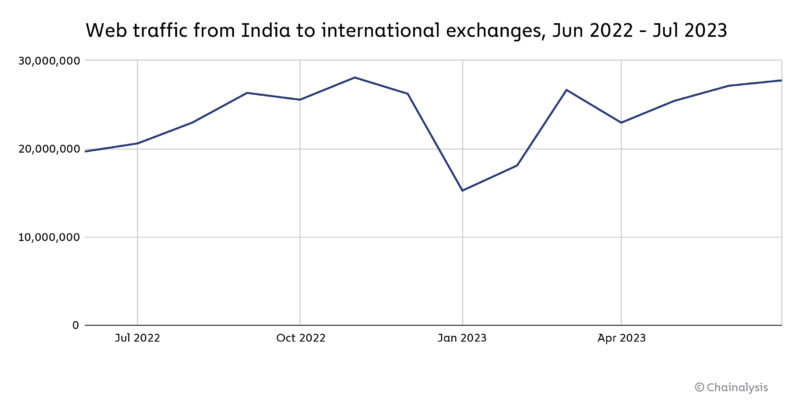

Recent reporting further confirmed to us by industry players in the region indicates that uneven implementation of TDS may be making it more difficult for homegrown Indian exchanges to compete. While every exchange operating in the country is required to collect TDS taxes from Indian users, many international exchanges aren’t doing so effectively, which may be drawing Indian users to them as opposed to exchanges focused primarily on India. We can see some evidence of this on the chart below, which shows that web traffic from India to international exchanges spiked immediately when TDS was implemented in July 2022.

The trend underlines the importance of strictly enforcing local rules like TDS for all exchanges operating in a given country. Doing otherwise can create an environment of regulatory arbitrage that hurts the country’s native crypto industry.

However, while those issues are important, they don’t appear to have dampened India’s enormous demand for cryptocurrency — as long as that demand is there, crypto will always have a place in the world’s second-largest country.

CSAO shows that cryptocurrency can be adapted to local circumstances

No region provides more reason to believe that cryptocurrency is the future than CSAO, and it’s not just because the region so many CSAO countries rank highly for grassroots adoption. It’s because those countries have wide-ranging, unique economic needs, and different crypto platforms and assets have arisen to meet them in each case. In the Philippines, where many want to speculate on new assets, make extra cash, and connect digitally with others, play-to-earn games were able to gain an enormous foothold. The games act as an entry point into the wider digital asset economy, and now thousands of Filipinos have crypto wallets they can use for other purposes. In Pakistan, where the economic situation is more dire — consider Pakistan’s $5,680 PPP per capita versus the Philippines’ $9,210 on top of the currency devaluation we described — stablecoins are providing economic relief. If Pakistan’s government passes reasonable crypto regulations, its existing users can be the foundation of a thriving crypto market, as we’ve seen play out in India. CSAO shows that regardless of a country’s circumstances, cryptocurrency has a valuable role to play.

This material is for informational purposes only, and is not intended to provide legal, tax, financial, or investment advice. Recipients should consult their own advisors before making these types of decisions. Chainalysis has no responsibility or liability for any decision made or any other acts or omissions in connection with Recipient’s use of this material.