This post is an excerpt from our 2024 Geography of Cryptocurrency Report. Download your copy now!

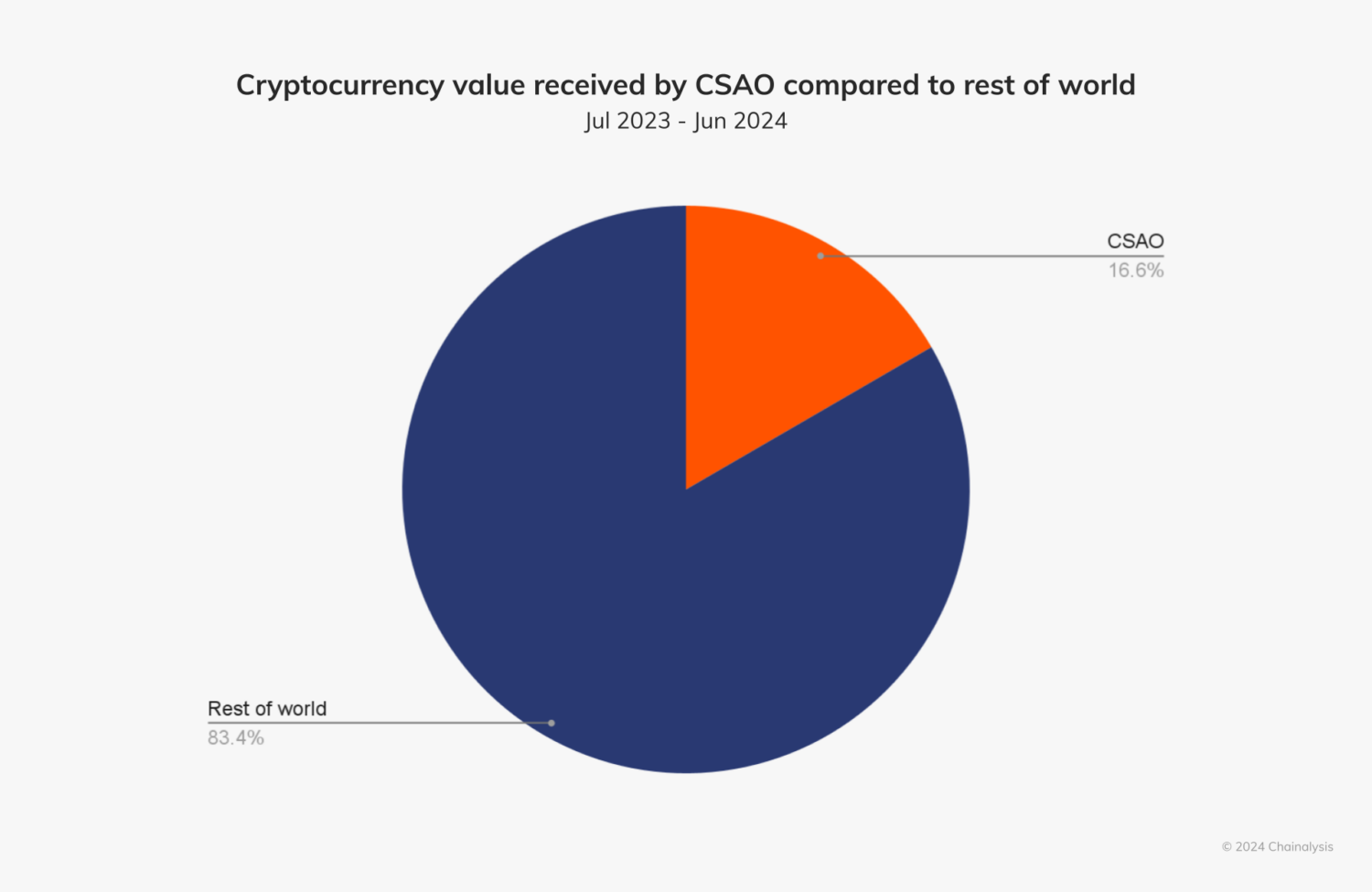

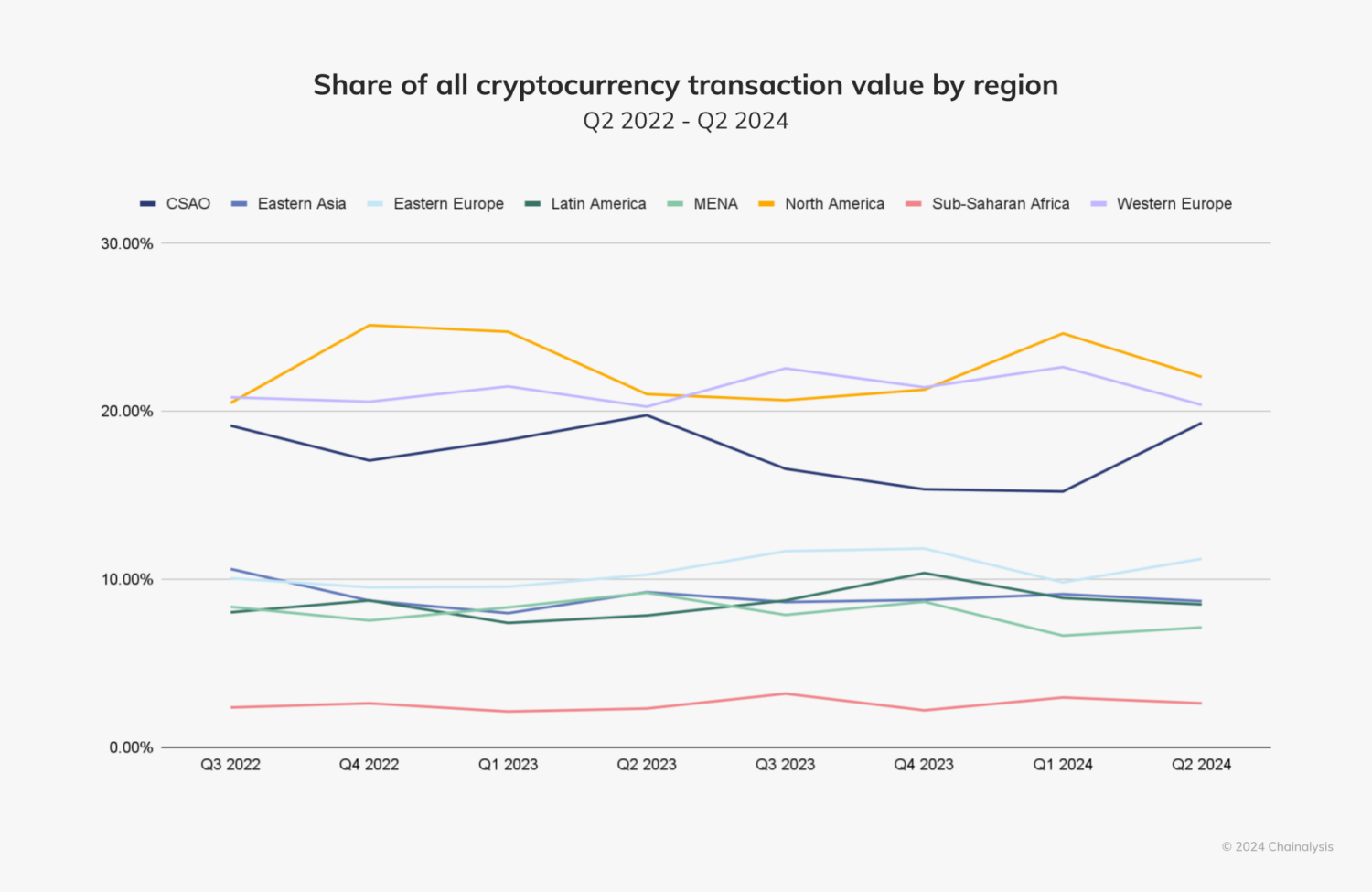

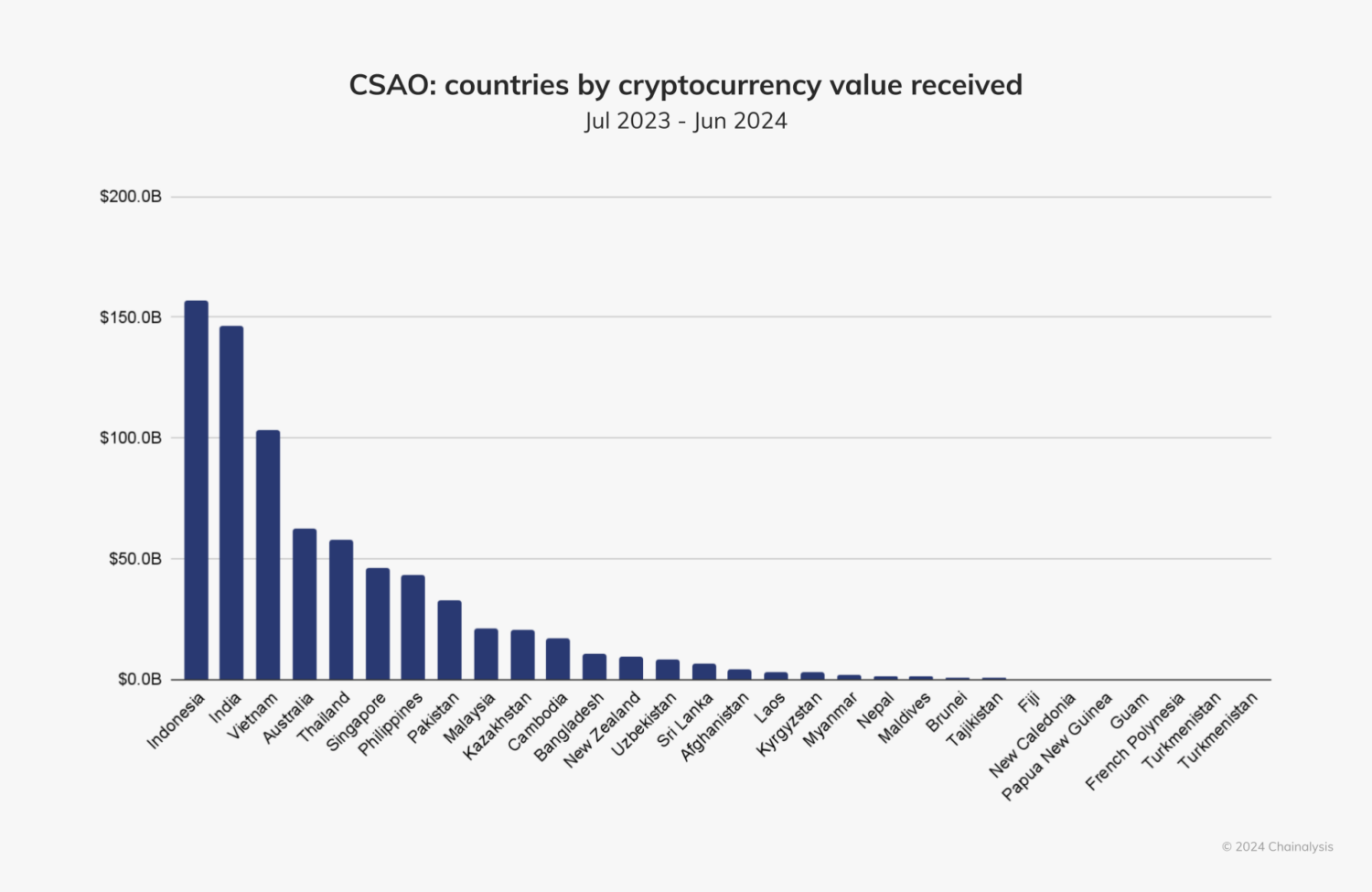

Similar to last year, Central & Southern Asia and Oceania (CSAO) is the third largest crypto region we studied, accounting for more than $750.0 billion in crypto asset inflows between July 2023 and June 2024. CSAO accounts for 16.6% of global value received, placing the region behind only North America and Western Europe, and well above the remaining regions.

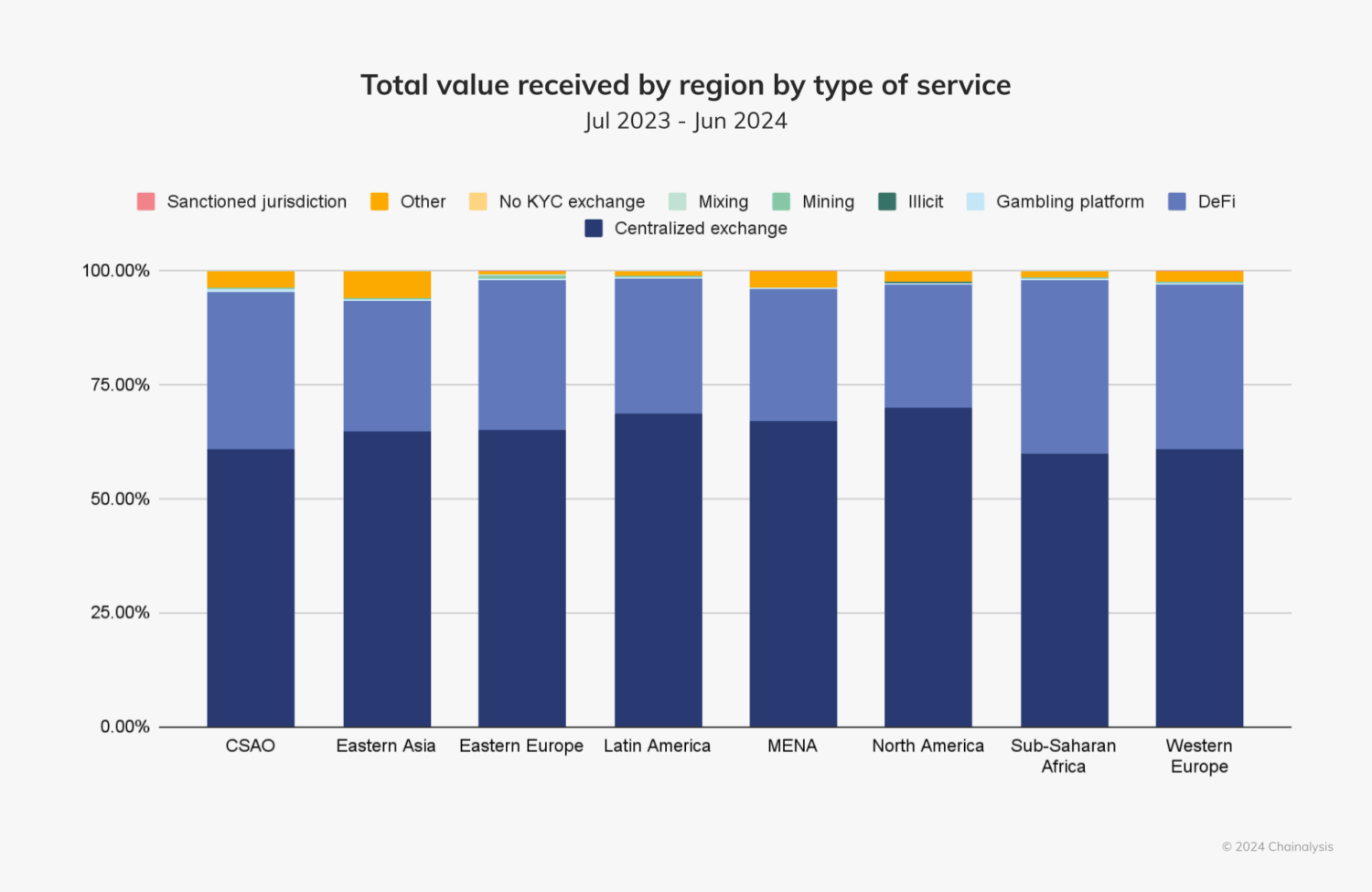

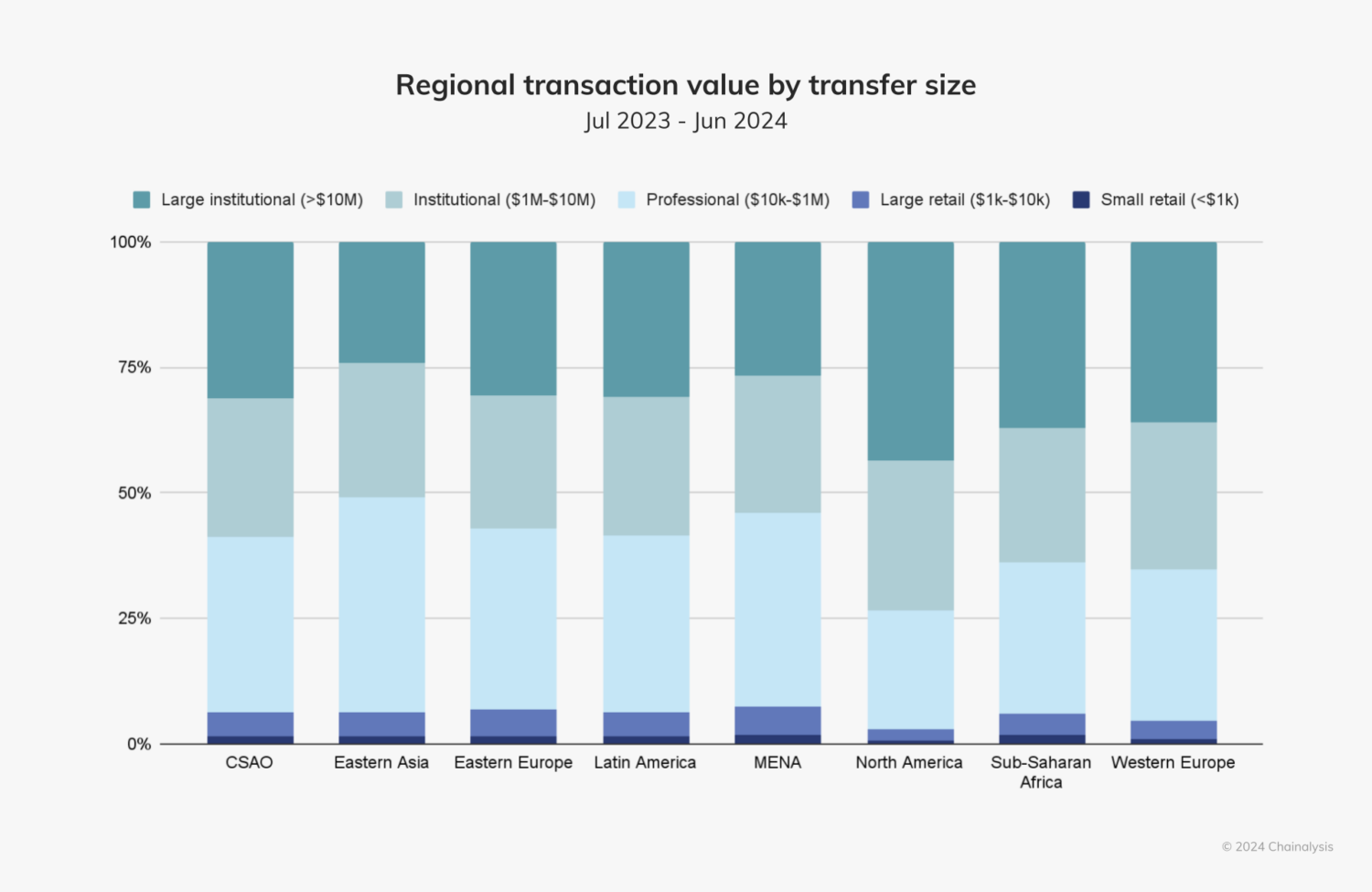

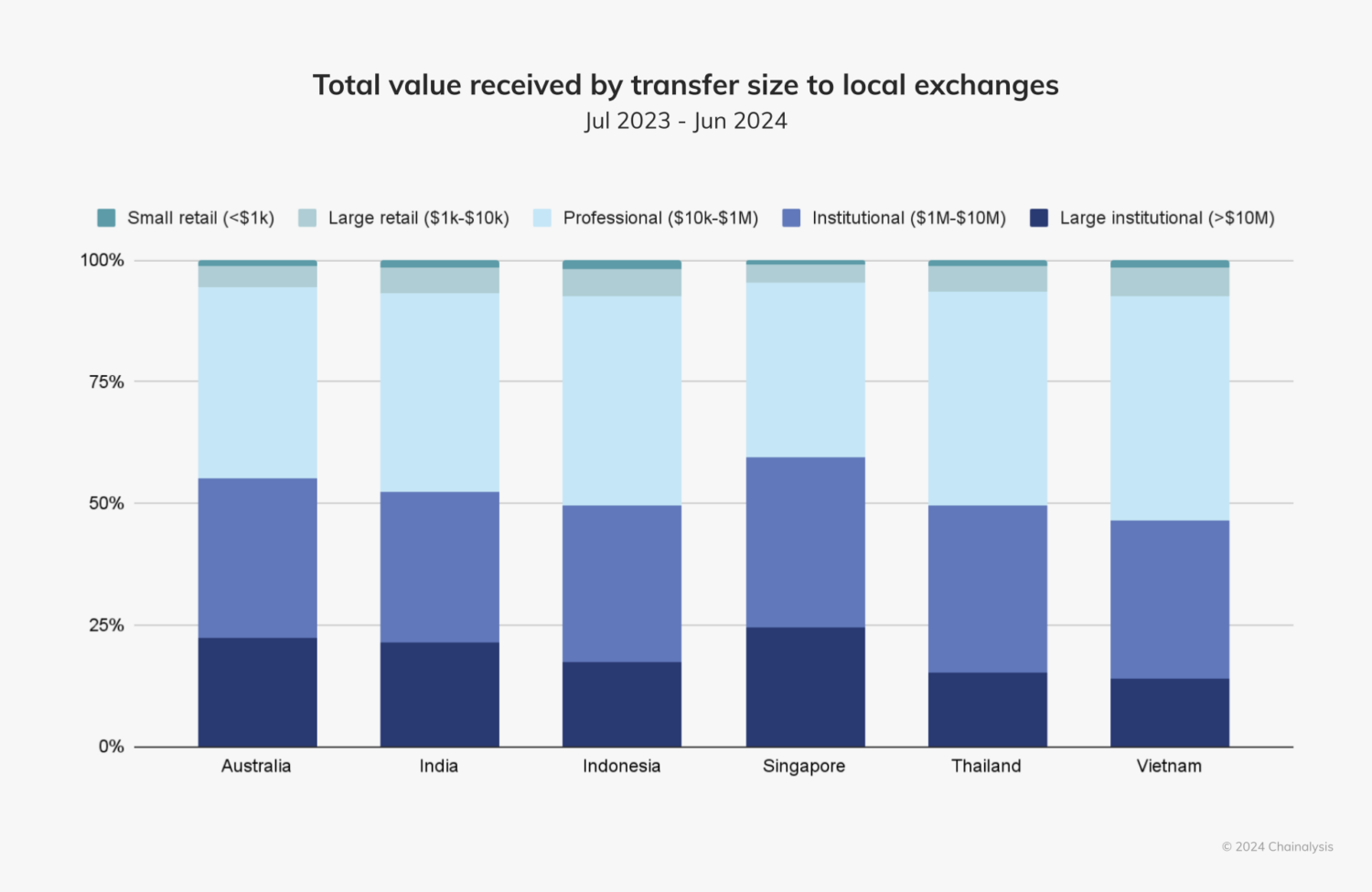

Crypto activity in CSAO is driven by centralized exchanges, with transfers in sizes above $10,000 representing the largest share of value received, suggesting substantial professional and institutional activity.

Indonesia leads the region in terms of cryptocurrency value received during the time period studied, at approximately $157.1 billion.

Seven of the top 20 countries in our Global Adoption Index are in the CSAO region: India (1), Indonesia (3), Vietnam (5), the Philippines (8), Pakistan (9), Thailand (16), and Cambodia (17). Keep reading for a brief update on India’s cryptocurrency regulation, and how institutions are driving crypto adoption in both Singapore and Indonesia.

Crypto activity thrives in India amid evolving regulatory environment

Last year, we noted that India remained a top global cryptocurrency market, amid evolving regulatory and tax environments. The country’s comparatively high crypto capital gains tax (at 30%) and 1% tax on all transactions — also known as a tax deducted at source (TDS) — may have drawn some Indian investors to explore international exchanges without such stringent regulatory requirements. Regardless, these developments didn’t seem to hinder crypto’s overall growth in the country, and it is the same this year. In addition to ranking second in the CSAO region in terms of cryptocurrency value received, India leads the world on this year’s Global Adoption Index.

In December 2023, India’s Financial Intelligence Unit (FIU) notified nine offshore exchanges — Binance, HTX (formerly Huobi), Kraken, Gate.io, KuCoin, Bitstamp, MEXC, Bittrex, and Bitfinex — that they were not compliant with India’s anti-money laundering laws, and consequently asked the Ministry of Electronics and Information Technology (MeitY) to block their URLs for India-based customers. However, contacts in the region explained to us that users were still able to access these exchanges if they had previously downloaded the apps and that certain apps were still accessible for new downloads. Interestingly, the Indian think tank Esya Center analyzed the impact of blocking of the URLs on the digital asset market and found it to be short-lived.

These factors would explain the sustained activity following the December 2023 show cause notice, shown in the chart below. This chart measures the total value received by the nine blocked exchanges compared to the total value received in India.

Similarly, Vikram Rangala, Executive Director of ZebPay, an India-based cryptocurrency exchange and wallet provider, told us that he did not anticipate that the FIU’s blocking order would last long, and expressed hope that India’s vibrant crypto and Web3 ecosystem would benefit from additional regulatory clarity. “Now we’re seeing that offshore exchanges will soon be brought into this emerging ecosystem. Earlier, we had a flight of investors away from Indian exchanges to global exchanges because of high taxes. I hope that, with regulatory clarity, we’ll also get a more workable tax arrangement that promotes innovation, and brings all aspects of crypto and Web3 into the economy in a sustainable way. There are a lot of brilliant Indian crypto startups. When they are finally given a healthy environment to work in, I think they’ll unleash magic. Think 100 Polygons and more.”

The good news is that India’s path to crypto adoption is becoming clearer, due to continued engagement between the industry and regulators. A significant indicator of this change is the FIU’s recent decision to lift Binance’s seven month block, following Binance’s registration as a reporting entity, allowing the exchange to re-enter the Indian market. Although this shift is more recent and not reflected in the above data, we look forward to seeing how India’s crypto market develops in the coming years.

Singapore sees recent interest in crypto merchant services

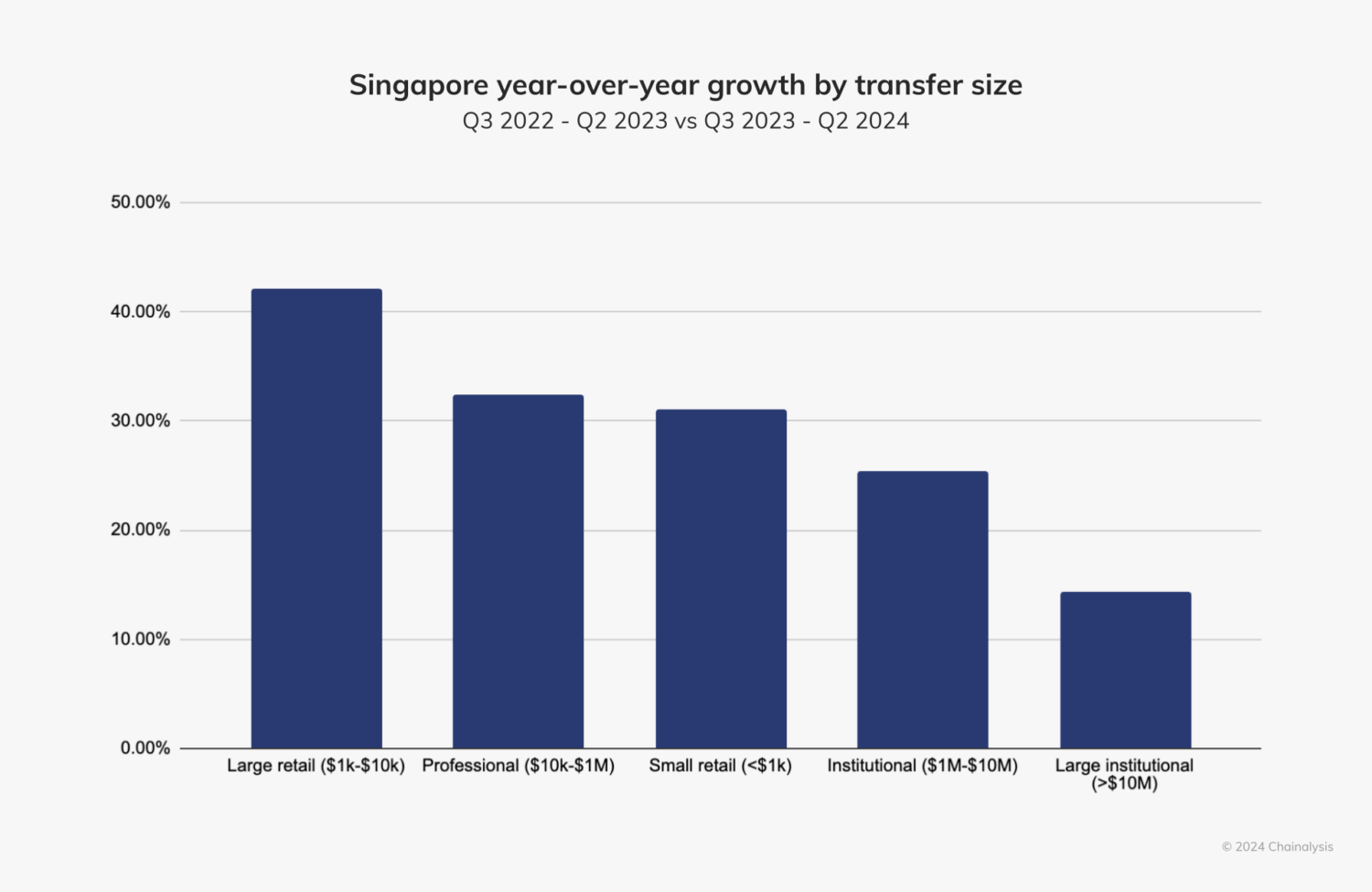

For the past several years, Singapore’s crypto market has been primarily institutionally-driven, but this trend appears to be shifting. As we see below, year-over-year growth by transfer size has been the most significant for retail and professional investors. It is possible that more favorable market conditions in comparison to the previous year’s conditions have motivated these investors to increase their participation. Additionally, as we will explore in more detail below, Singaporean regulators’ efforts to increase consumer protection rules may have given retail and professional investors more confidence to enter or re-enter the markets.

A notable aspect of Singapore’s crypto market is the growing adoption of crypto as a payment method for a variety of services. For instance, Singapore-based startup dtcpay enables merchants to accept payments in cryptocurrency. More recently in March 2024, Singapore-based super-app Grab, which offers access to taxi services, food deliveries, and other similar conveniences, began accepting top-ups to its e-wallet via cryptocurrencies. Users are now able to make payments in Bitcoin, Ether, Singapore’s local currency stablecoin XSGD, Circle USD, and Tether.

Additionally, momentum for crypto payments appears to be picking up. In the second quarter of 2024, the total value in crypto received by merchant services in Singapore reached nearly $1 billion — significantly higher than any other quarter in the past two years. This trend of crypto payments is interesting in a market where retail fiat payment systems are already highly efficient, as it hints at the ubiquity of crypto holdings among the population.

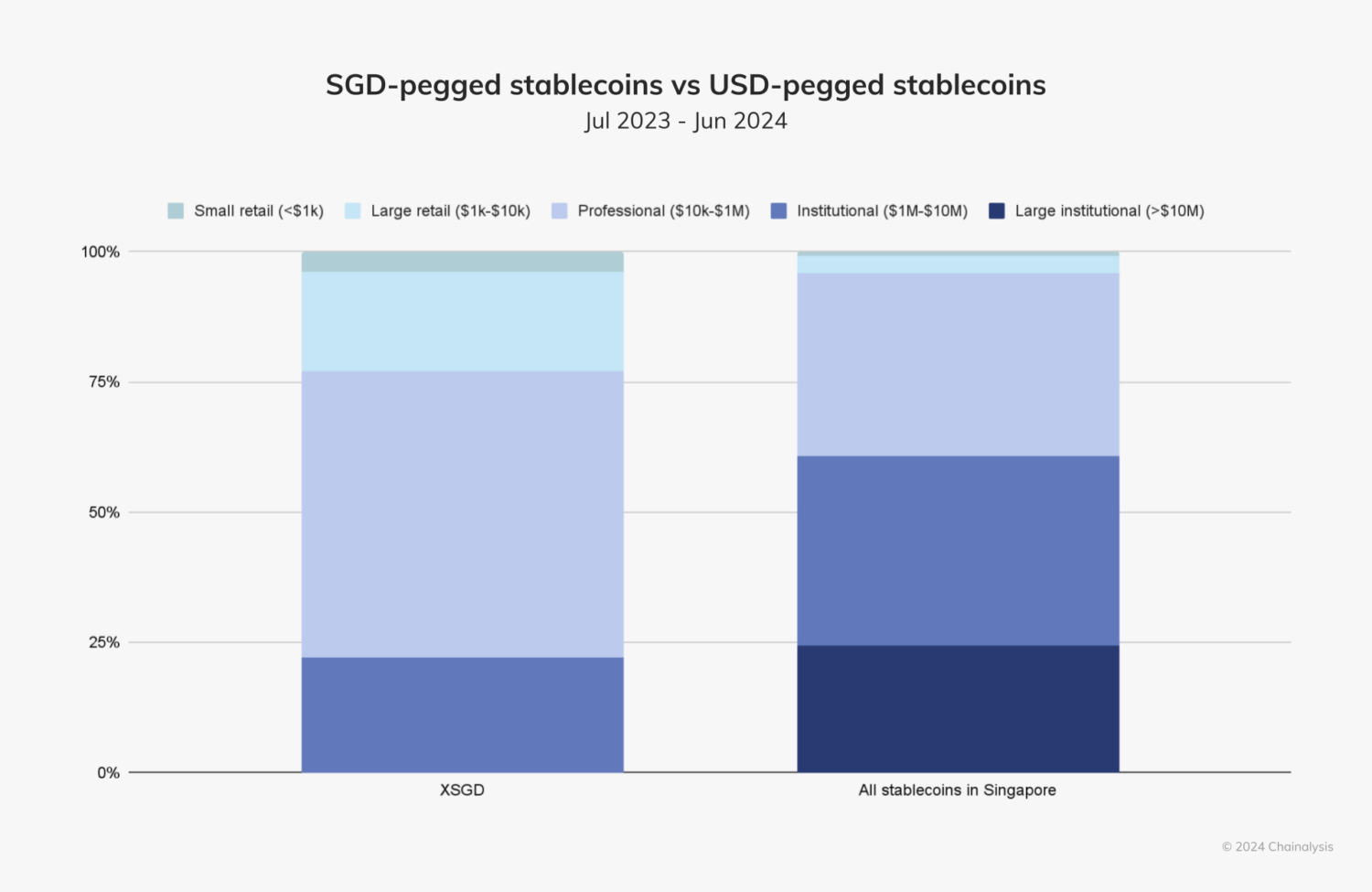

The steady local adoption of XSGD tells another interesting story. XSGD is issued by StraitsX, holder of a Major Payments Institution license in Singapore (MAS). More than 75% of XSGD value transferred during the time period studied took place in sizes of $1 million or below, with almost 25% of transfers under $10,000, suggesting a strong base of retail activity. In contrast, other stablecoins pegged to the U.S. dollar are mainly transferred in large sizes of above $1 million, suggestive of institutional activity.

Since the third quarter of 2022, the transfer value of XSGD has been steady, with most quarters experiencing activity of more than $200 million.

In addition to Singaporean merchants adopting crypto, the country’s recent regulatory clarity may be bolstering confidence in stablecoins. For instance, in August 2023, MAS finalized its stablecoin regulatory framework, which includes new requirements for stablecoin issuers, and details segregation and custody procedures for customer assets. Additionally, Singapore’s central bank implemented crypto custody and licensing requirements in April 2024. This combination of regulatory clarity and merchant adoption suggests that Singapore is positioning itself as a major hub for digital assets, which could eventually attract more global businesses and investors.

Trading opportunities drive Indonesia’s crypto market

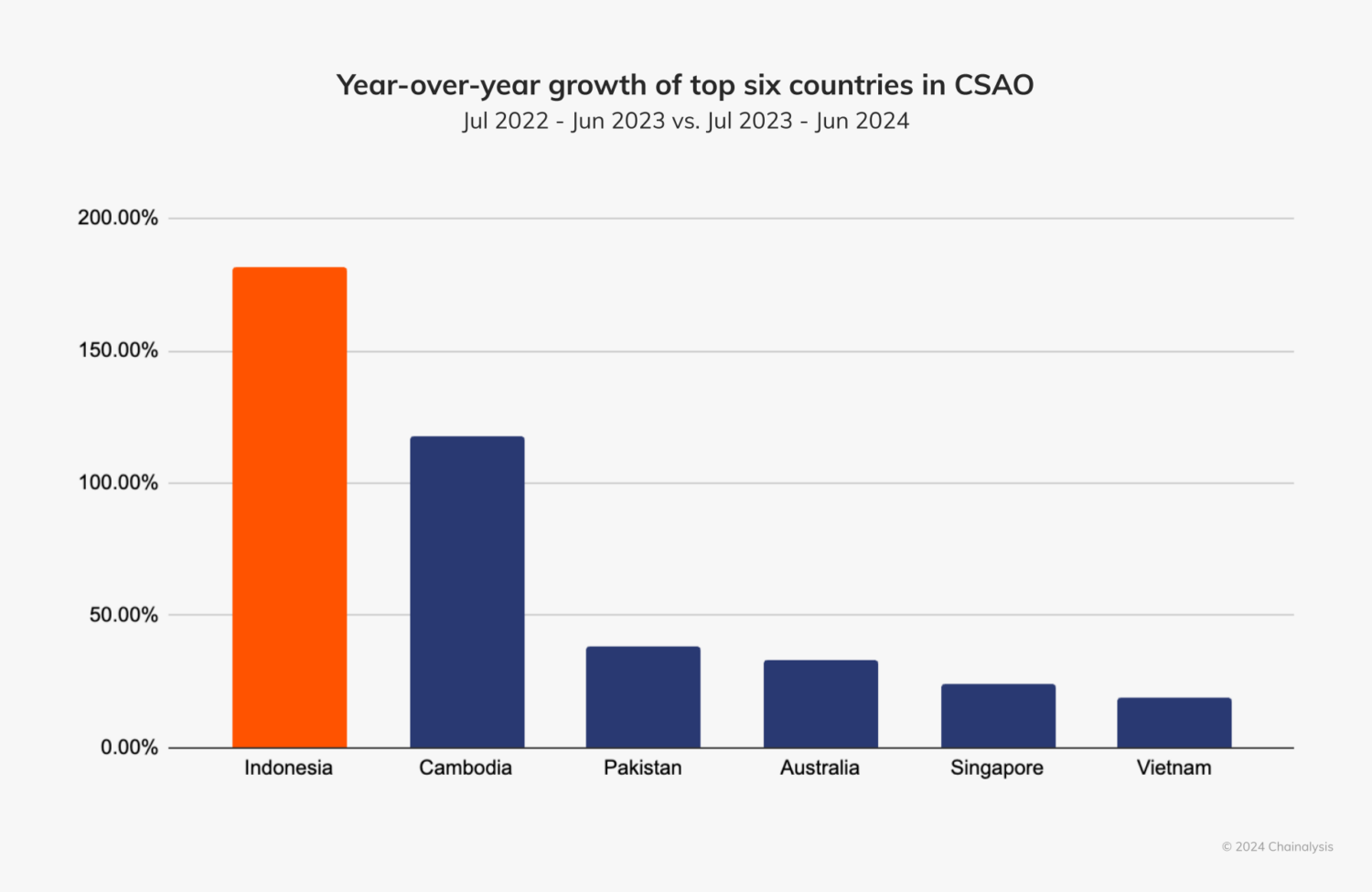

While other countries in the CSAO region, such as Singapore, are seeing crypto adoption fueled by regulatory progress and merchant services, Indonesia’s market is particularly dynamic and showcases crypto’s diverse use cases beyond the typical. Indonesia is one of the fastest-growing crypto markets in the region and has the highest year-over-year growth at nearly 200%.

It appears that much of this activity is driven by trading. According to Indonesia’s Commodity Futures Trading Regulatory Agency, 2024 has seen a recent surge in cryptocurrency transactions, the number of crypto investors located in the country, and interest in meme coins.

To learn more about crypto growth in Indonesia, we spoke to Barry Matthew Meyer, Product Manager at Pintu, an Indonesia-based crypto exchange company whose main offering is trading. “I believe Indonesia’s growing crypto market is primarily due to the novelty of crypto and the promise of quick profits — many people still see crypto as a speculative financial instrument,” he explained. “A lot of people right now are flocking to Telegram groups to provide and look for trading signals, similar to what they have been doing in equities for quite some time. However, crypto activity is more intense because there are a lot of new tokens.” Meyer also explained that the Indonesia Stock Exchange’s recent introduction of full call auction (FCA) measures may be driving people to move to crypto. “The exchange is imposing more strict rules for a stock to be considered, which has affected users’ sentiments on the Indonesian stock market and is causing them to look for alternative trading vehicles.”

This activity is reflected in our data. As the below chart illustrates, more than a third (43.0%) of value received by local exchanges in Indonesia came from transfers of $10,000 to $1 million in size, suggesting that these flows may have been driven by professional trading activity. Indonesia also has a higher share of transfers of $1,000 to $10,000 than any of the top countries in terms of cryptocurrency value received.

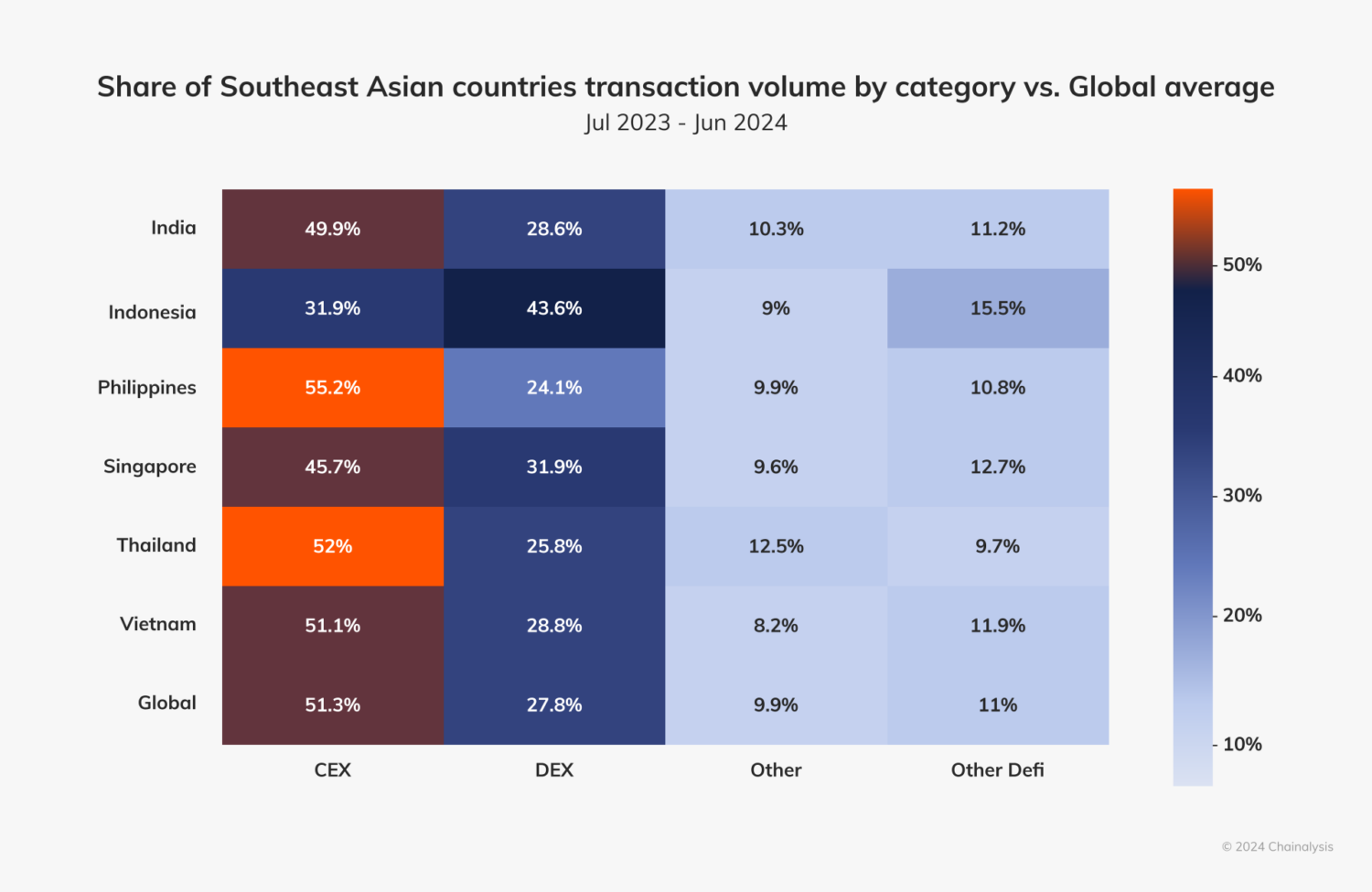

Indonesia’s burgeoning Web3 market has also produced interesting trends during the time period studied. As we see in the chart below, Indonesia has a higher share of both decentralized exchange (DEX) and decentralized finance (DeFi) activity than those of other countries in the region, as well as the global average.

According to Asih Karnengsih, Executive Director of Asosiasi Blockchain Indonesia, a non-profit organization dedicated to fostering blockchain development, adoption, and education, “As understanding of crypto assets improves in Indonesia, more users are exploring advanced platforms and services. This trend has led to the rise of the ‘crypto degen’ community, where members actively participate in yield farming, staking, and various token projects on DeFi platforms.”

As is the case in many countries around the world, these alternative investment opportunities attract young adults interested in emerging technologies and ways to make quick profits. Millennials and Gen Z users reportedly comprise more than 50% of Indonesia’s current investor base. “We believe that this interest presents a vibrant market for innovation and new technologies,” said Karnengsih. “Associations — including our own — local exchanges, and the government frequently conduct educational programs at Indonesian universities, further fueling interest and knowledge among these young investors. We place great emphasis on encouraging young talent to explore blockchain, which helps them become more informed and confident in navigating the crypto market, fostering a dynamic and innovative investment landscape in the country.”

Want to see the full index ranking for all countries?

Get the 2024 Geography of Cryptocurrency Report

This website contains links to third-party sites that are not under the control of Chainalysis, Inc. or its affiliates (collectively “Chainalysis”). Access to such information does not imply association with, endorsement of, approval of, or recommendation by Chainalysis of the site or its operators, and Chainalysis is not responsible for the products, services, or other content hosted therein.

This material is for informational purposes only, and is not intended to provide legal, tax, financial, or investment advice. Recipients should consult their own advisors before making these types of decisions. Chainalysis has no responsibility or liability for any decision made or any other acts or omissions in connection with Recipient’s use of this material.

Chainalysis does not guarantee or warrant the accuracy, completeness, timeliness, suitability or validity of the information in this report and will not be responsible for any claim attributable to errors, omissions, or other inaccuracies of any part of such material.