This blog is a preview of our 2021 Geography of Cryptocurrency report. Sign up here to download the whole thing!

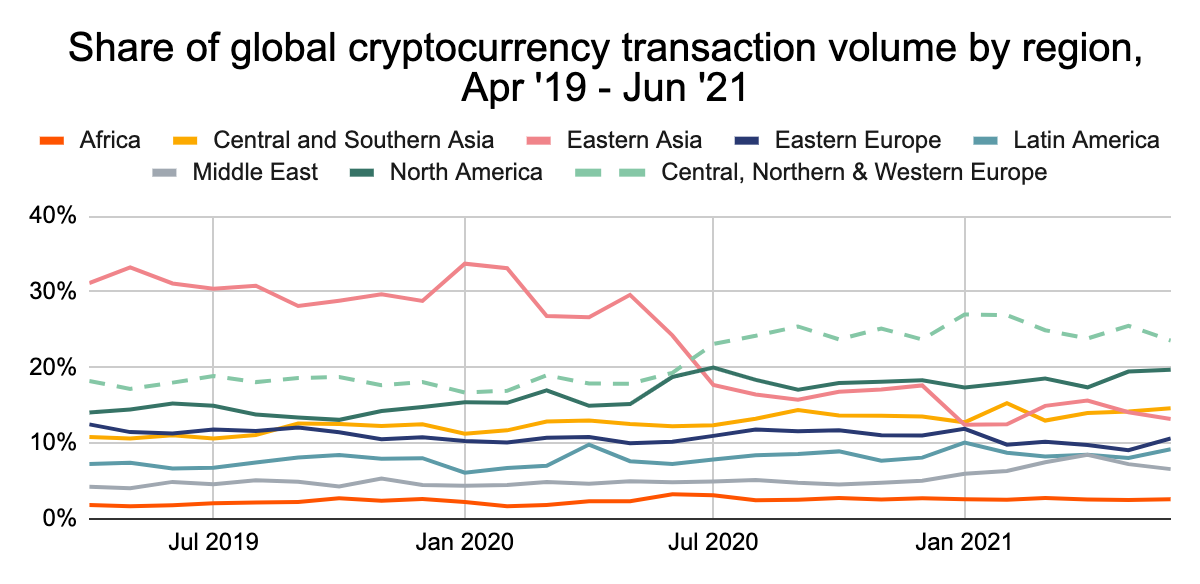

Central, Northern, & Western Europe (CNWE) has the biggest cryptocurrency economy in the world, receiving over $1 trillion worth of cryptocurrency over the last year, which represents 25% of global activity. Having ranked second last year, CNWE’s new position in the top spot is the result of tremendous growth starting in July 2020, combined with a relative decline in activity in Eastern Asia.

As we’ll explore below, CNWE’s transaction volume grew significantly across virtually all cryptocurrencies and service types, but especially on DeFi protocols. An influx of institutional investment, signaled by large transactions, drove most of the growth, though retail activity also increased.

Perhaps most interesting is CNWE’s unique status as an international hub in the world cryptocurrency economy.

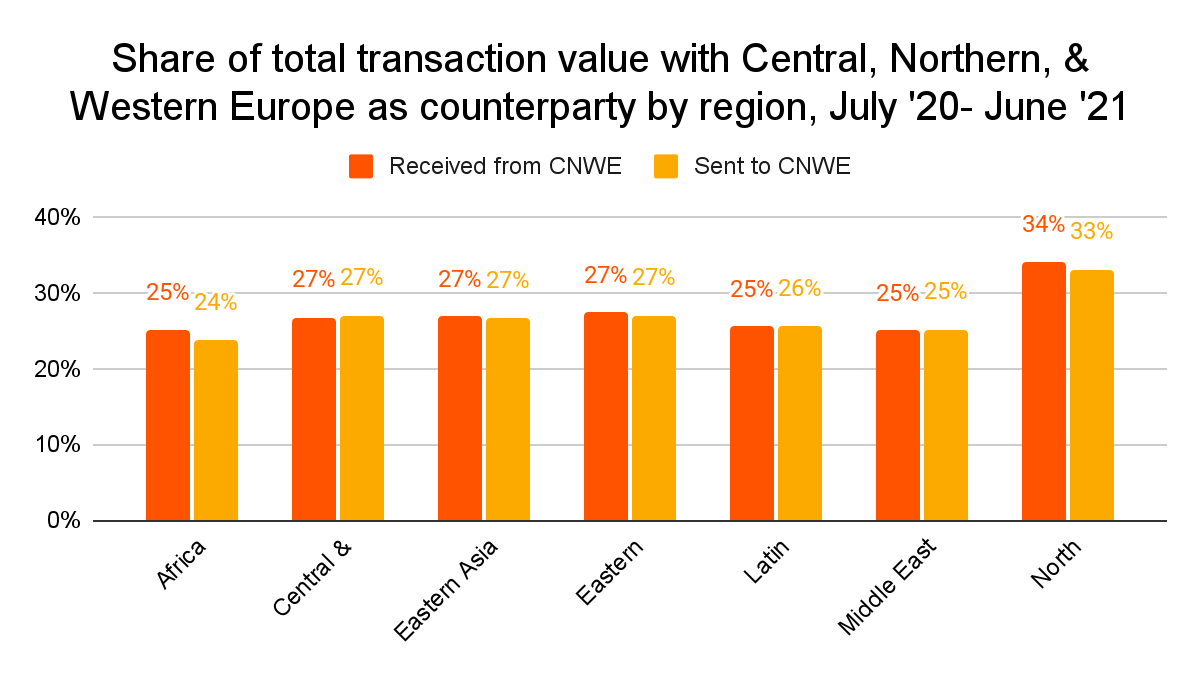

CNWE is the biggest cryptocurrency trading partner for every other region we study, sending at least 25% of all value received by other regions, including a whopping 34% for North America. We’ll look more at these trends below, and explain how CNWE’s cryptocurrency economy was able to develop into the world’s largest over the past year.

What drove Central, Northern & Western Europe’s growth over the last year?

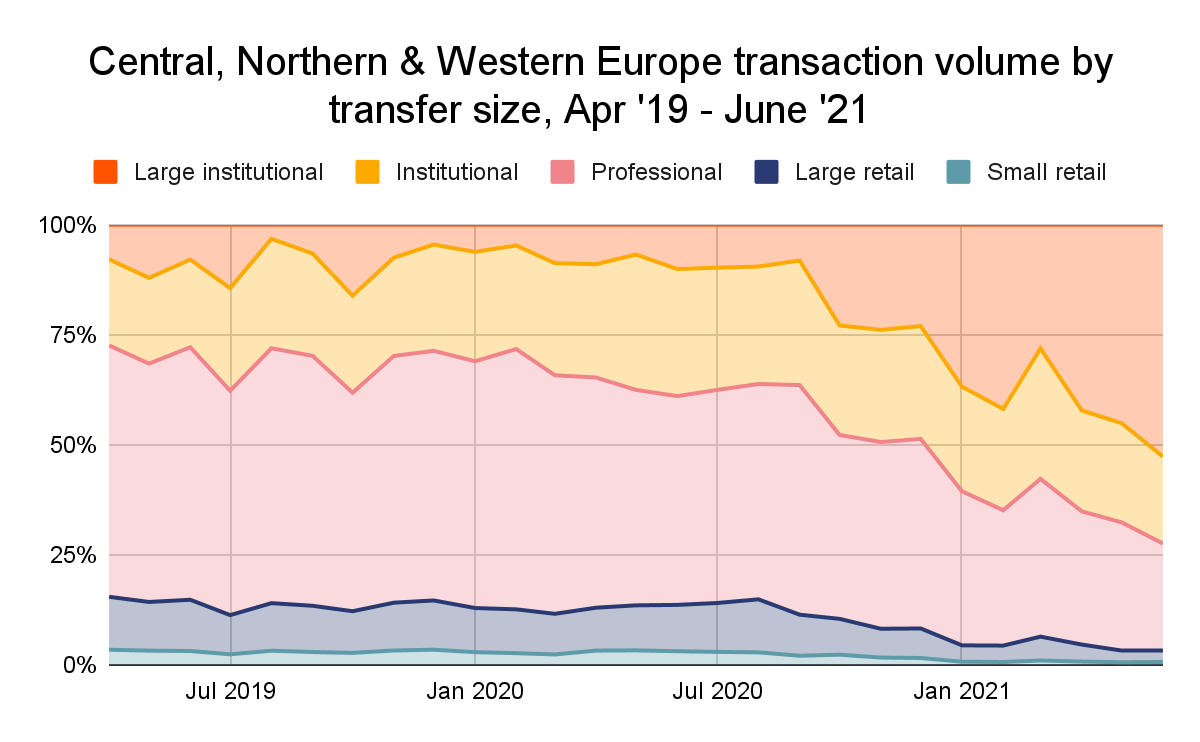

As we mentioned above, CNWE’s cryptocurrency economy began growing faster in July 2020. At this time, we saw a huge increase in large institutional-sized transactions, meaning transfers above $10 million worth of cryptocurrency.

Large institutional cryptocurrency transaction value grew from $1.4 billion in July 2020 to $46.3 billion in June 2021, at which point it made up more than half of all CNWE activity. Where did these large institutional transfers go?

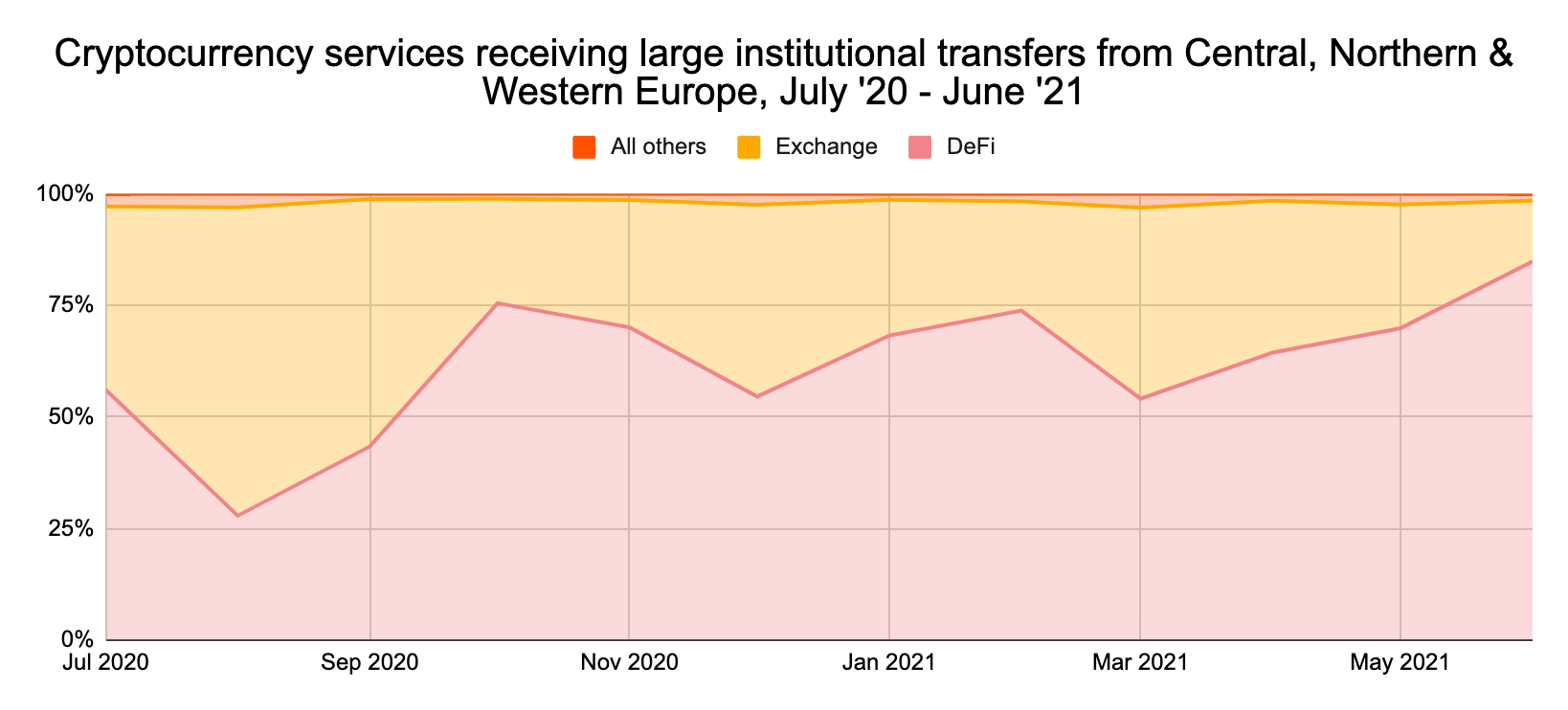

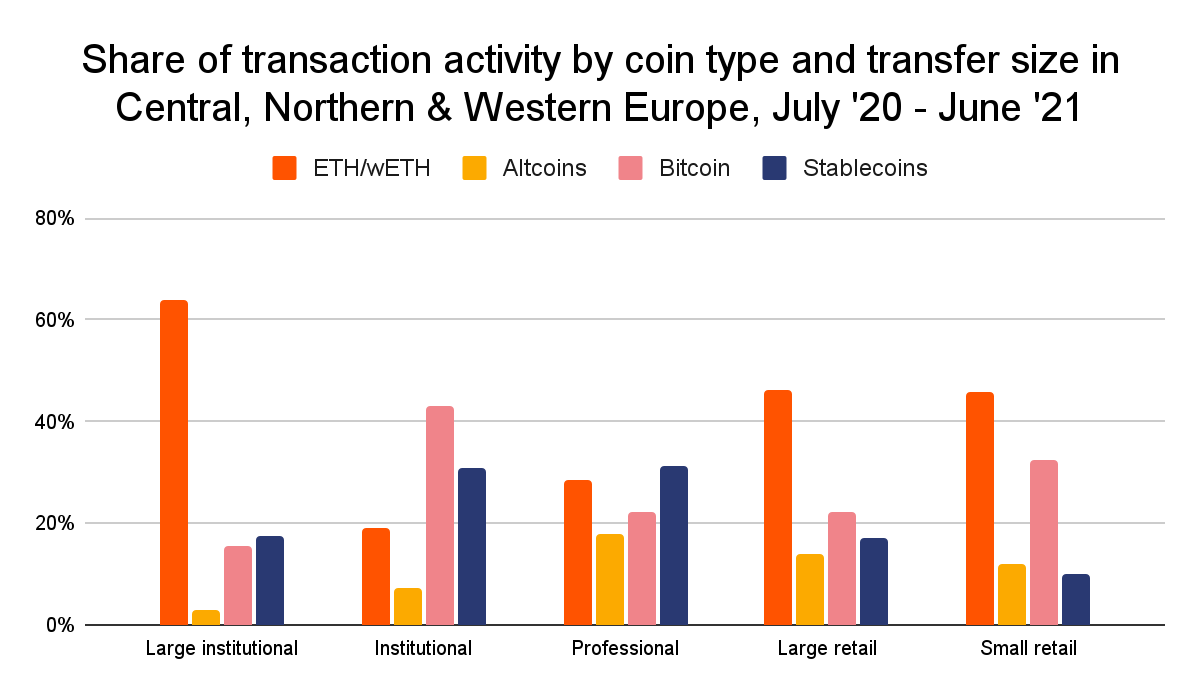

The data shows that over the last 12 months, the majority of large institutional-sized transfers went to DeFi platforms. Given that, it’s not surprising that the majority of those large institutional transfers were made in Ethereum and wrapped Ethereum (wETH), an ERC-20 token of equivalent value to Ethereum commonly used in DeFi protocols.

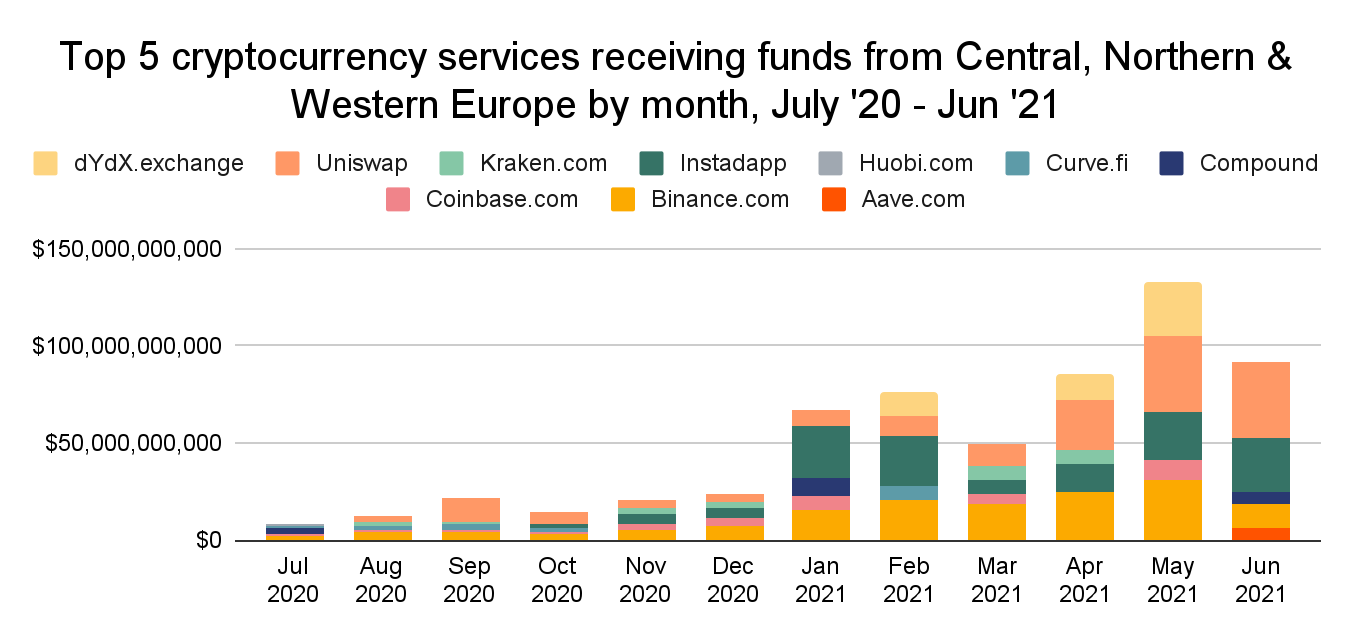

Looking at CNWE’s top five services by transaction volume each month for the last year shows the huge impact DeFi has had.

DeFi protocols represent three to four of the top five services in most months, with Uniswap, Instadapp, and dydx making frequent appearances. Binance and Coinbase, meanwhile, remain the most popular centralized exchanges.

According to a recent CoinTelegraph article, many institutional investors who have either embraced cryptocurrency previously or even built their strategy around cryptocurrency are turning to DeFi for staking. With staking, investors can lend their cryptocurrency to DeFi protocols in order to provide them liquidity. Those funds are then lent out to borrowers, and the interest generated goes back to the stakers. Staking allows investors to generate cash without selling their crypto assets, making it a good source of returns for those who wish to hold. Staking with DeFi protocols can be thought of as analogous to a money market in conventional finance, but with lower fees due to the lessened need for human intermediaries given that the protocols run autonomously.

Central, Northern & Western Europe: The hub of the global cryptocurrency economy

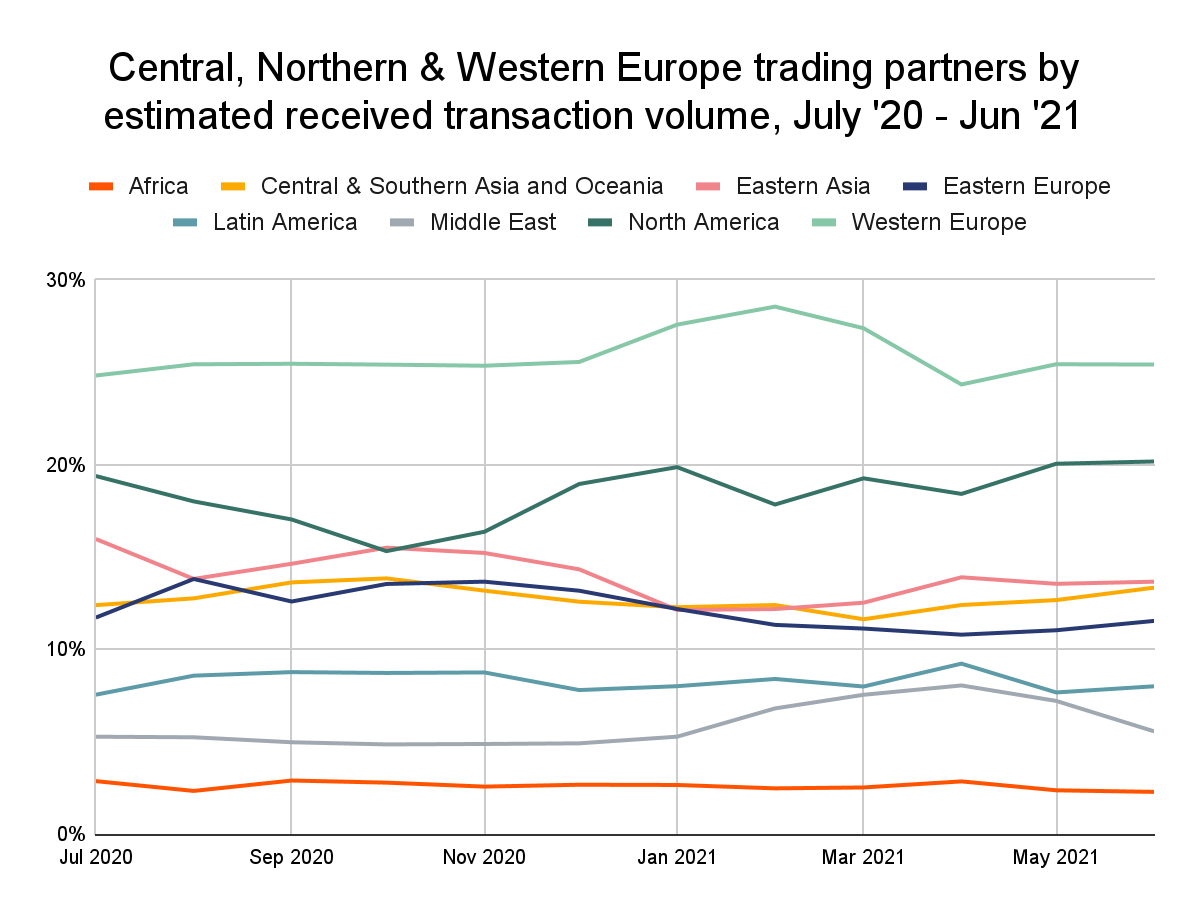

As the biggest counterparty to every other region, CNWE is a key source of liquidity to cryptocurrency investors around the world.

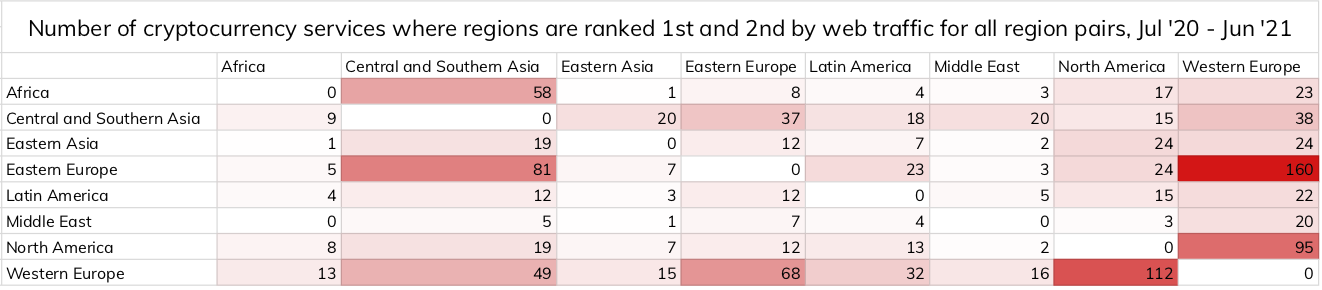

CNWE’s biggest trading partner is North America, followed by Eastern Asia, Central & Southern Asia, and Eastern Europe. The region’s status as a global hub becomes even clearer when we look at the overlap of the services most used in CNWE and the rest of the world. The matrix below shows which regions have the heaviest overlap, with each cell showing the number of services for which the region in the column is ranked first in web traffic, and the region in the row is ranked second in web traffic.

CNWE has high service overlap with more regions than any other, displaying particularly strong relationships with Eastern Europe, North America, and Central & Southern Asia. Services contributing to this dynamic include eToro, Bitstamp, and CryptoKitties. We believe that for some regions like North America, this dynamic reflects a convergence of institutional investors and professional traders on a handful of platforms. On the other hand, for regions like Eastern Europe and Central & Southern Asia, we believe the service overlap in those cases is also driven by remittance payments being sent from CNWE, as this would mirror remittance activity we see in the fiat world.

Comparing activity across Central, Northern & Western European countries

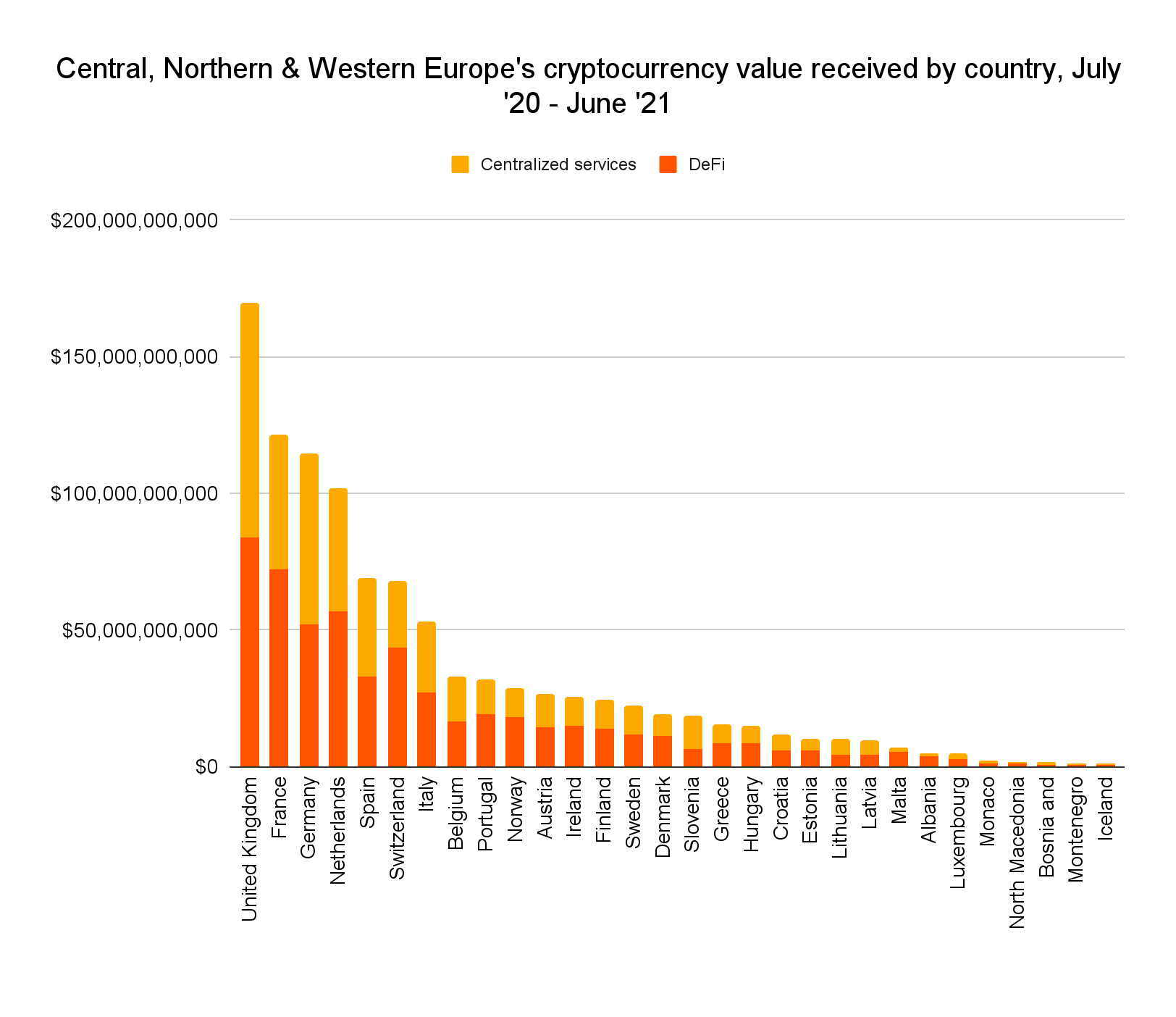

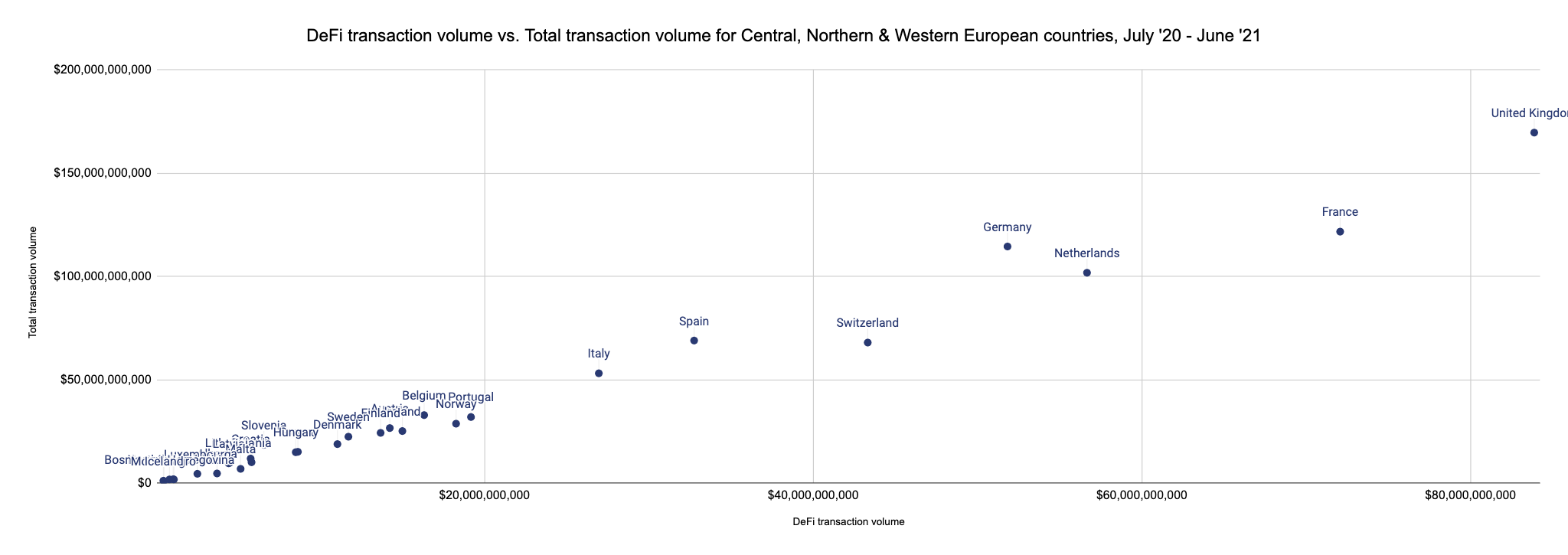

Which countries are driving the most cryptocurrency activity in CNWE? The chart below shows all countries in the region by value received, with value received by DeFi protocols called out.

The United Kingdom leads by a wide margin at $170 billion, 49% of which is from value sent to DeFi protocols. France, Germany, the Netherlands, and Switzerland round out the top five. DeFi’s share of all activity is relatively uniform across all countries in CNWE, though we do see some outliers like Albania, where it makes up nearly half of all activity.

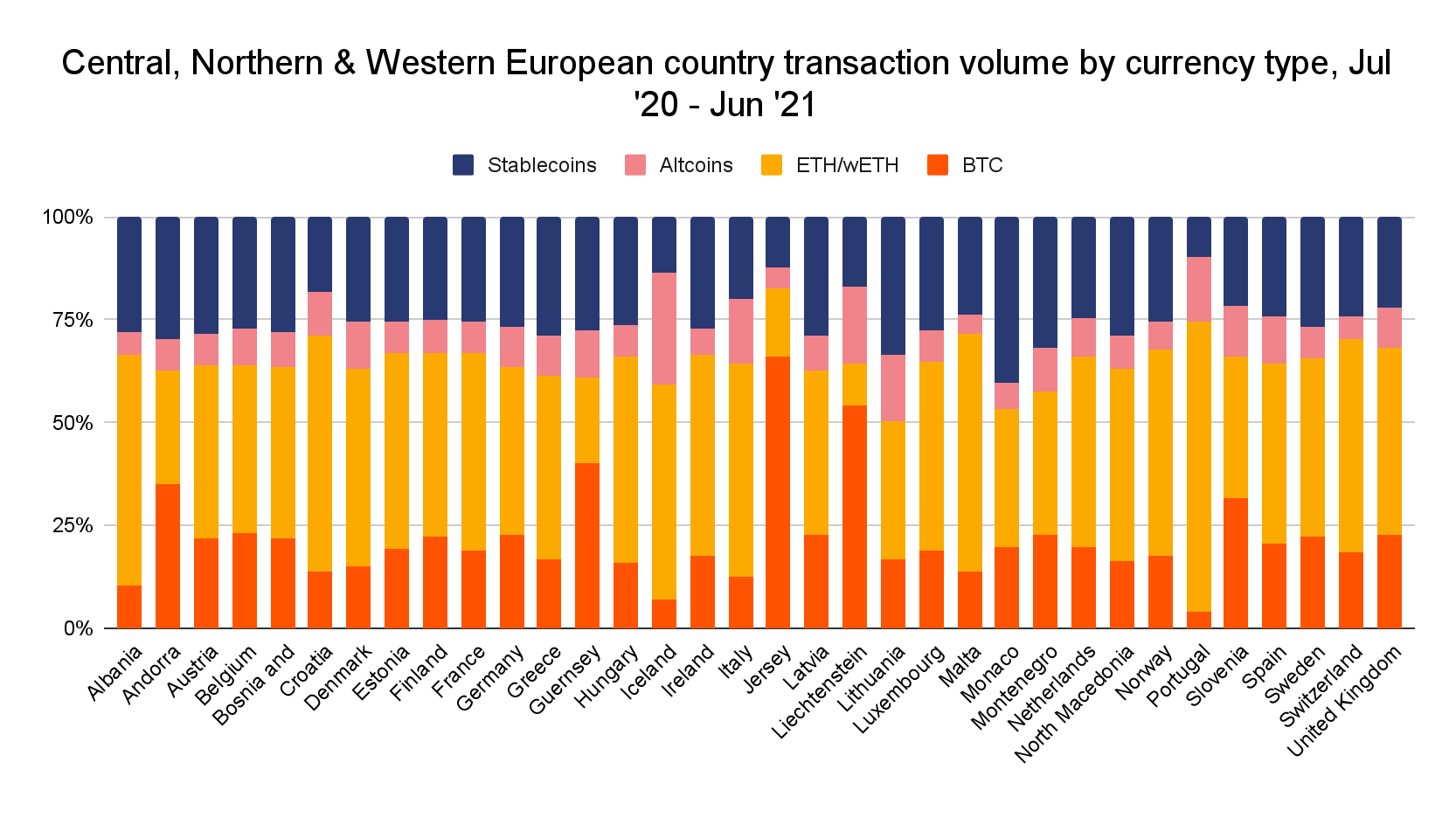

However, we see a bit more variance in the types of cryptocurrencies used.

Stablecoin usage is consistently between 25% and 30% of all transaction volume for most countries, save for outliers like Monaco, where stablecoins account for 39% of activity. Altcoin usage is similarly consistent at 8% to 11% for most regions. However, we see more variance in the breakdown between Bitcoin and Ethereum or wETH. Combined, Ethereum and wETH are the most popular cryptocurrency in nearly every country. Looking at the biggest markets, we see that the UK and Germany are similar in this area: Bitcoin makes up 27% of the UK’s transaction value while Ethereum and wETH make up 40%. In Germany, Bitcoin makes up 28% of transaction volume while Ethereum and wETH make up 36%. France, on the other hand, devotes just 20% of transaction volume to Bitcoin and 45% to Ethereum and wETH. That figure is likely related to France’s slightly higher rate of transaction volume going to DeFi protocols, as Ethereum and wETH are the most commonly used currencies on those platforms.

Overall, though, while there are small differences between the individual countries’ exact breakdown of activity, one thing is clear: CNWE has become the world’s biggest cryptocurrency market, and its growth over the last year was largely driven by institutional investors and other whales moving into DeFi.

This blog is a preview of our 2021 Geography of Cryptocurrency report. Sign up here to download the whole thing!