2020 was an important year for Bitcoin, as an influx of institutional dollars spurred the asset to new all-time highs. But who benefited most from its booming prices? While there are many ways to approach the question, we decided to start with geography. Below, we break down estimated Bitcoin gains in 2020 by investors’ home country.

How did we do this? Geographic analysis in cryptocurrency is difficult due to the technology’s decentralized nature. It’s impossible to know for sure where the parties of any individual transaction are located. However, we can produce a good estimate using transaction data from the services Chainalysis tracks.

First, we measure the on-chain flows to each cryptocurrency exchange, and approximate the total U.S. dollar gains made on the asset in question (Bitcoin in this case) by measuring the differences in the asset’s price at the time it was withdrawn from the platform versus when it was received. We then distribute those gains (or losses) by country based on the share of web traffic each country accounts for on each exchange’s website, as we did when building our Global Crypto Adoption Index. That analysis gives us a reasonable estimate for the realized gains Bitcoin investors in each country earned in 2020, though it doesn’t account for gains on assets that have yet to be withdrawn from an exchange. For a more in-depth explanation of how we calculate cryptocurrency gains, check out our Market Intel Report from February 18, 2021.

Realized Bitcoin gains by country

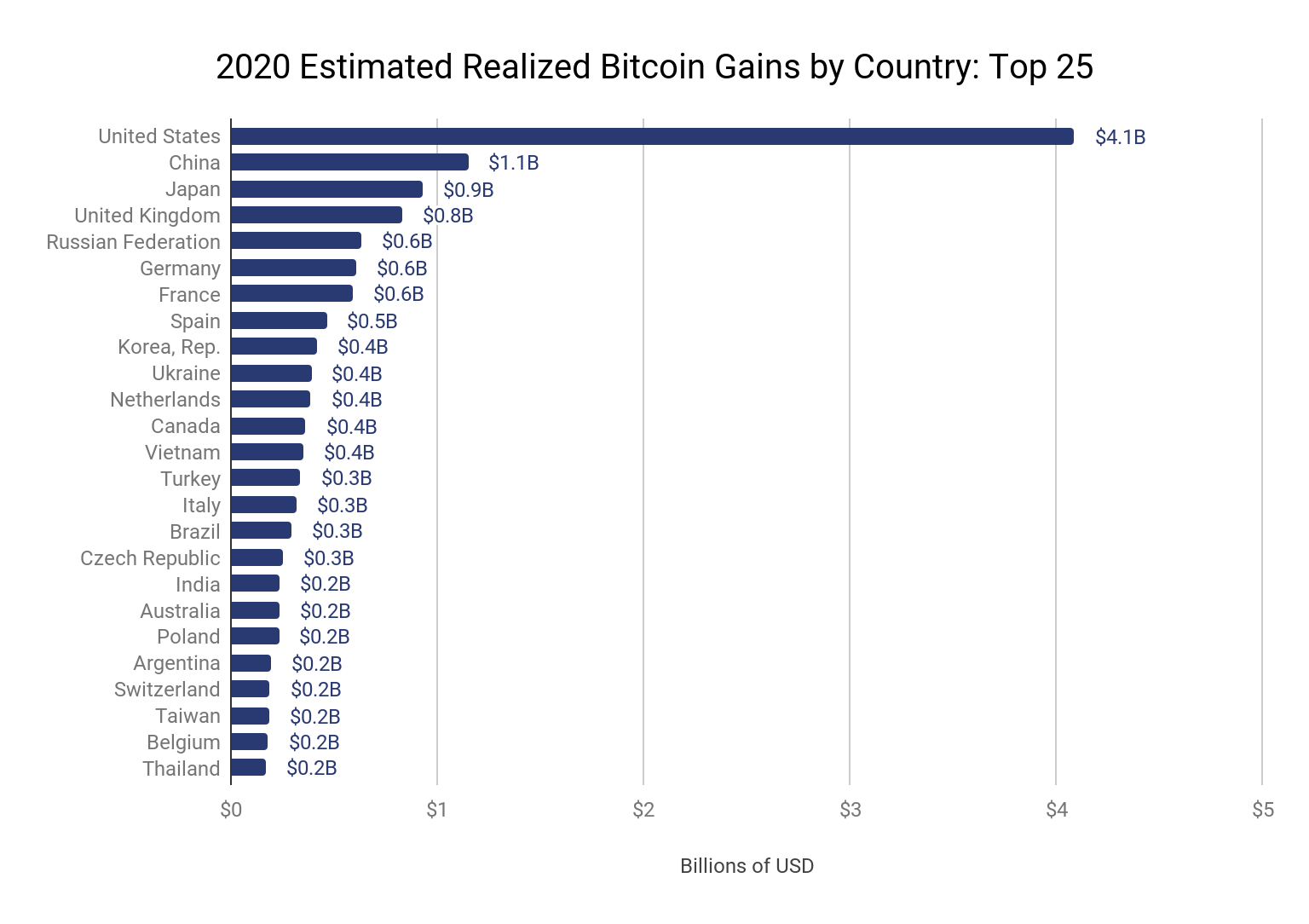

The graph below shows the rankings of the top 25 countries in realized Bitcoin gains for 2020.

The first thing most will notice is the United States’ apparent dominance. U.S. investors collectively made over $4 billion in realized Bitcoin gains in 2020, more than 3x the next highest country, China. This may seem surprising considering that China historically has by far the highest raw cryptocurrency transaction volume, but as we’ve covered previously, U.S.-focused exchanges saw huge inflows in 2020 that appear to have been realized toward the end of the year, which likely accounts for the country’s large gains.

Upon further inspection, what stands out the most is the number of countries that appear to be punching above their weight in Bitcoin investment as compared to their rankings in traditional economic metrics. Vietnam is the perfect example. While Vietnam has seen extraordinary economic growth over the last 20 years, cutting its poverty rate from over 70% to below 6% since 2002, the country ranks 53rd in GDP at $262 billion and is categorized as a lower-middle income country by the World Bank. However, Vietnam has a high level of grassroots cryptocurrency adoption, ranking tenth overall on our Global Crypto Adoption Index. In 2020, Vietnam ranked 13th in Bitcoin investment gains at $351 million, outperforming countries that rank higher in traditional economic measures such as Australia, Saudi Arabia, and Belgium. This phenomenon played out in several other countries as well:

- The Czech Republic ranks 54th in GDP at $251 billion but is 18th in realized Bitcoin investment gains at $281 million.

- Turkey ranks 25th in GDP at $761 billion but 16th in realized Bitcoin investment gains at $300 million.

- Spain ranks 19th in GDP at $1.4 trillion but 9th in realized Bitcoin gains at $554 million.

Other countries follow the opposite pattern, with India being the best example. With more than a billion citizens, India is the world’s second most populous country, and has the fifth largest economy with a GDP of $2.9 trillion. However, the country ranks a surprisingly low 18th in Bitcoin investment gains at $241 million. This may be a result of the Indian government’s historical unfriendliness to cryptocurrency. Until a Supreme Court ruling in March 2020, India banned all banks from any dealings with cryptocurrency businesses, making it extremely difficult for residents to purchase or trade cryptocurrency. While the ruling prompted optimism from the country’s cryptocurrency community, the government has since proposed a blanket ban that would forbid residents from buying, selling, holding, or mining cryptocurrency. These rules may have prevented Indian investors from taking advantage of the recent cryptocurrency boom to the extent of investors in its peer countries. As the Turkish government takes a harsher stance on cryptocurrency, an example of which includes its recent ban on cryptocurrency payments, it’s possible that cryptocurrency investors in the country may be unable to continue their recent success.

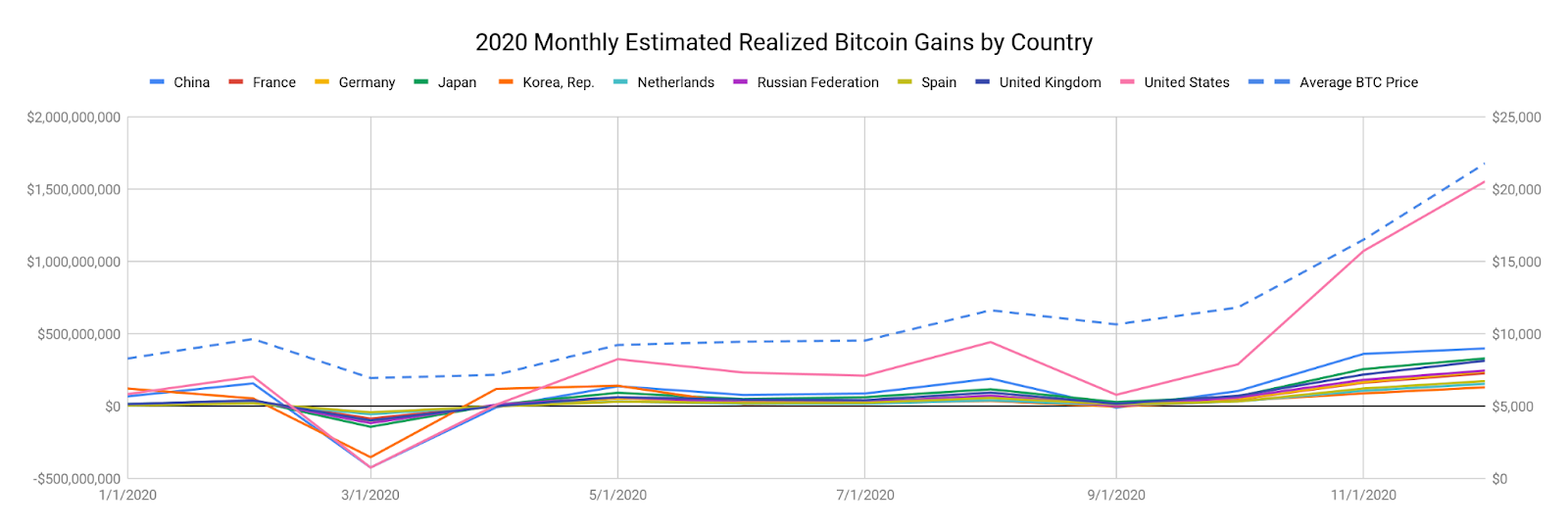

Looking at realized gains over time, we see that investors in nearly all countries saw the biggest increases toward the end of the year. That’s when U.S. investors really broke away from the pack, with most of their gains coming from activity on Coinbase. These gains were driven by a sharp rise in Bitcoin’s price that began in mid-October 2020 and accelerated in mid-December. During that time period, Bitcoin’s price increased from $11,471 on October 14 to $29,111 on December 31. Bitcoin’s price continued to rise after that until January 8, at which point it decreased until early February 2021, at which point it began to rise again, hitting an all-time high of nearly $65,000 in April. The chart above reflects our previous findings that long-term investors around the world sold their cryptocurrency to newer investors as prices rose, thereby adding to their realized gains. However, the steepness of the U.S. realized gains curve during this time suggests American investors sold at higher prices, while those in other countries held more.

Unlocking opportunity

Overall, our analysis of Bitcoin gains by country in 2020 should be encouraging for the cryptocurrency world. The data suggests that Bitcoin has given investors in emerging markets access to a high-performing asset, the likes of which they may not have otherwise had access to. On the other side of the coin, it also suggests that countries attempting to limit cryptocurrency usage through harsh regulations are preventing their citizens from taking advantage of the opportunity.

Want more data on cryptocurrency flows and analysis of what it means for the market? Check out Chainalysis Market Intel and subscribe to our weekly Market Intel Report.