This blog is an excerpt from the Chainalysis 2020 Geography of Cryptocurrency Report. Click here to download the whole thing!

Africa has the smallest cryptocurrency economy of any region we analyze in this report, with just $8.0 billion worth having been received and $8.1 billion sent on-chain in the last year. However, that relatively small amount of activity is creating life-changing value for users in the region facing economic instability, offering low-fee remittances and an alternative way to save.

Remittances are an early use case for this developing cryptocurrency economy

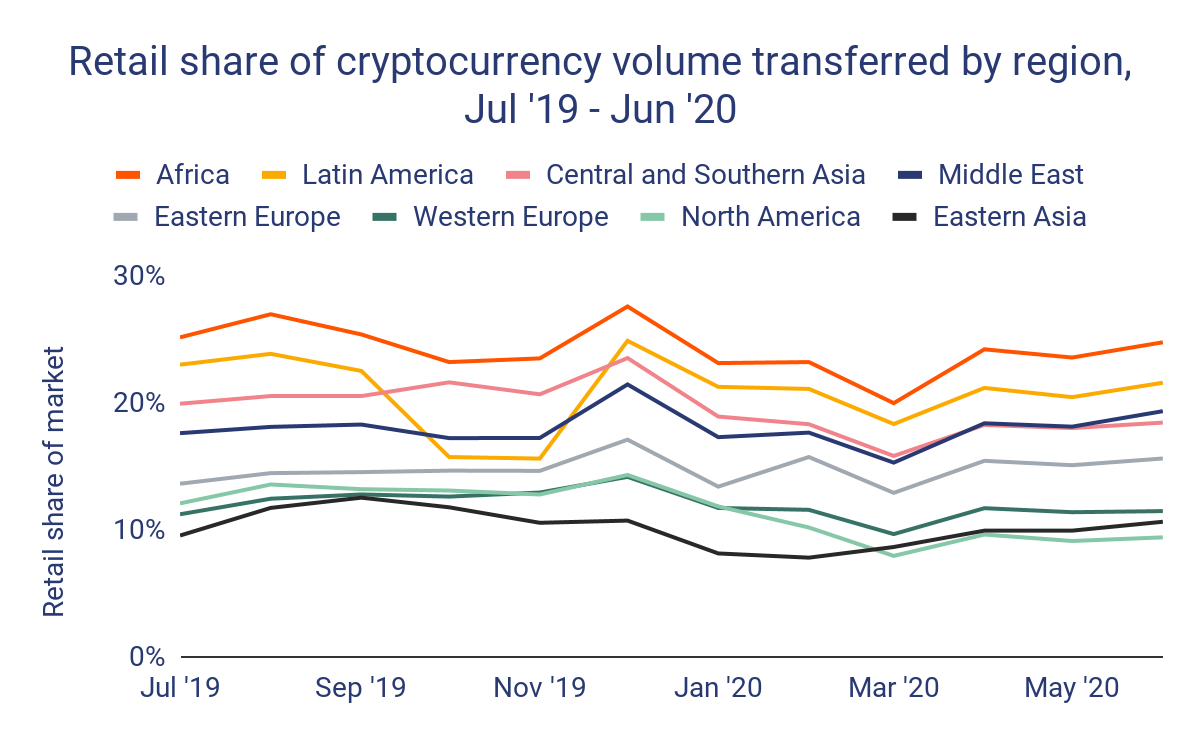

Retail-sized transfers (transfers under $10,000 USD) make up a larger share of Africa’s cryptocurrency activity than any other region, and the need for remittances is a big part of this.

Similar to Latin America and other regions in the developing world, overseas remittances are a crucial part of the economy for many parts of Africa. A 2018 study from the Pew Research Center found that Sub-Saharan Africa accounts for eight of the ten countries with the fastest-growing international migrant populations since 2010, growing by 50% between 2010 and 2017 compared to the worldwide average of 17%. The roughly 25 million expats of Sub-Saharan African countries living abroad remitted $48 billion in fiat back to the region in 2019.

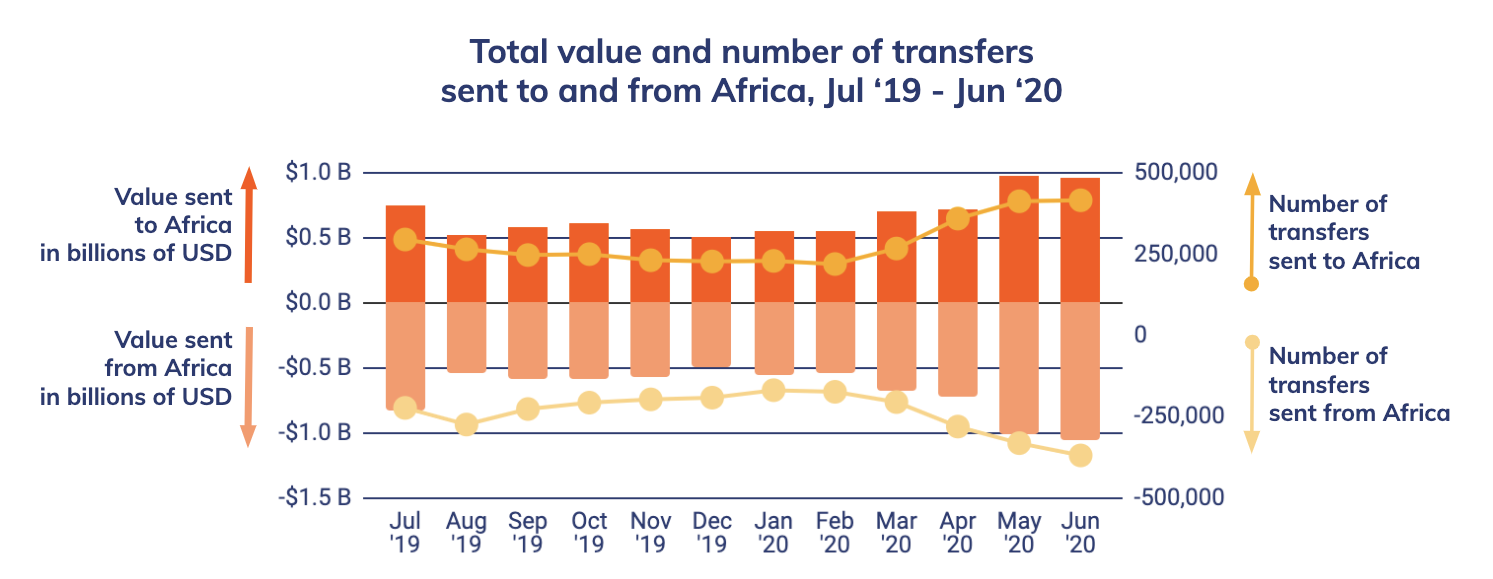

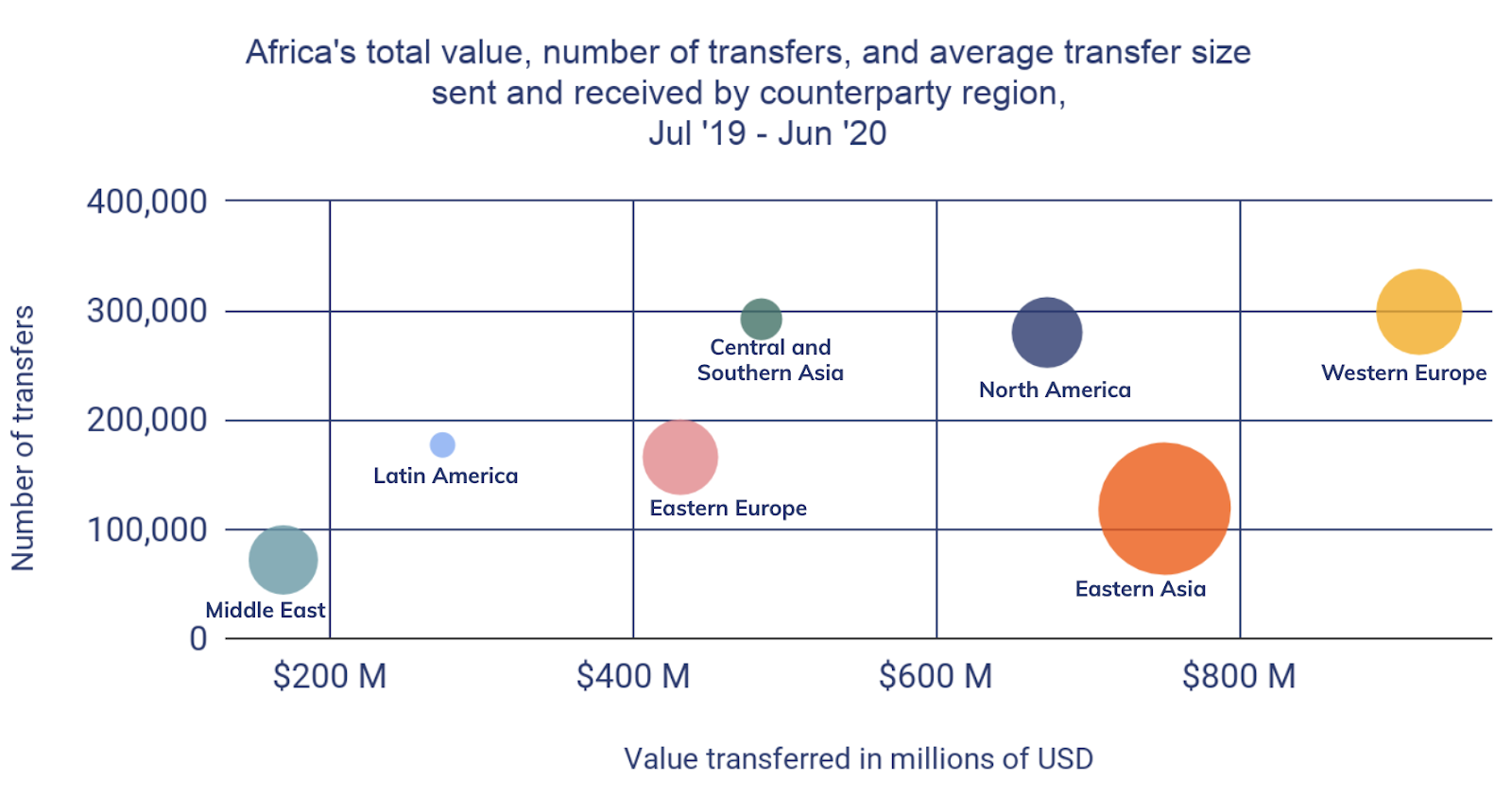

The chart above suggests many are turning to cryptocurrency to send funds back to the region as well. Roughly $562 million worth of cryptocurrency was transferred directly from overseas addresses to ones based in Africa in retail sized payments. While it’s highly unlikely that all of this represents remittances from expats, many regions with high concentrations of African migrants, such as North America, Western Europe, and East Asia, are well-represented.

But maybe just as important as overseas remittances are intra-region remittances between African countries, which have historically been made difficult by large fees. According to research from the World Bank, remittances below $200 between two Sub-Saharan African countries cost an average of 9% in fees, compared to the global average of 6.8%. For some country pairs that see large remittance flows, such as South African to Nigeria or South Africa to Malawi, the fees can be as high as 15%.

When we spoke with Ray Youssef, CEO and founder of peer-to-peer (P2P) cryptocurrency exchange Paxful, he emphasized the role these in-region remittances play for African users on the platform. “Some of our users in Africa are even building their own remittance businesses on top of Paxful. One man I spoke to who lives in South Africa but is originally from Nigeria saw how hard it was to send money back home, and started a business where he would take cash from other Nigerian expats, convert it into Bitcoin, send it to someone in Nigeria via Paxful, and have that person convert it into naira and deliver it to the person’s family. Another woman living in Kenya has done the same thing sending money back to people in Malawi.” Youssef also added that while Africa doesn’t account for the most cryptocurrency moved on the Paxful platform, it does account for the biggest share of individual transfers.

African users aren’t just using cryptocurrency for overseas transfers between individuals. Our interviews suggest that a significant share of transactions between Africa and other regions — particularly East Asia — are for business purposes. Ray Youssef has seen examples of this activity amongst Paxful users as well. “In one instance, a user ran a business importing video games from China to sell in Nigeria. His bank wouldn’t let him wire money to China, so historically he had to get U.S. dollars on the black market and somehow get it to China, usually via Hong Kong. But with cryptocurrency, he can sell bitcoin to receive CNY in any major Chinese digital wallet and send it directly to his counterparty in China.”

Dovey Wan, a venture fund founder and cryptocurrency expert based in China, described similar dynamics when we asked her about the high volume of cryptocurrency transferred between Africa and East Asia. However, she indicated that in many cases, Chinese nationals account for both sides of the transactions. “Lots of Chinese merchants are living in Africa for business, and use cryptocurrency to send funds home.” For example, she indicated that some of these users are running mining rigs, as many parts of Africa offer cheap hydropower. Others may be inclined to send cryptocurrency home rather than go through banks if they’re working on business ventures that aren’t entirely legal, such as those operating in the illicit diamond trade.

Cryptocurrency mitigates currency instability

Many African countries suffer from severe currency devaluation and instability, which makes it difficult for residents’ savings to hold their value. The South African Rand (ZAR), for example, has lost over 50% of its value against the U.S. dollar in the last decade and is consistently one of the most volatile fiat currencies. Nigeria, Egypt, Algeria, Ethiopia, and Ghana face similar issues with their own currencies.

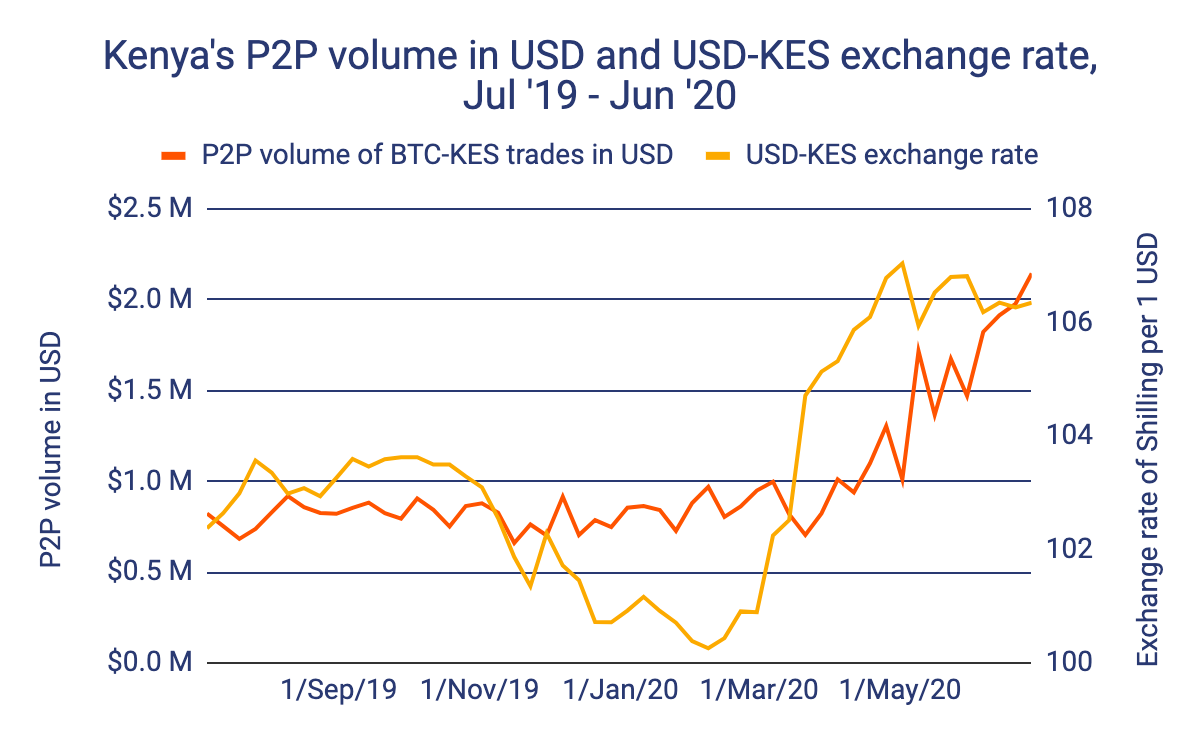

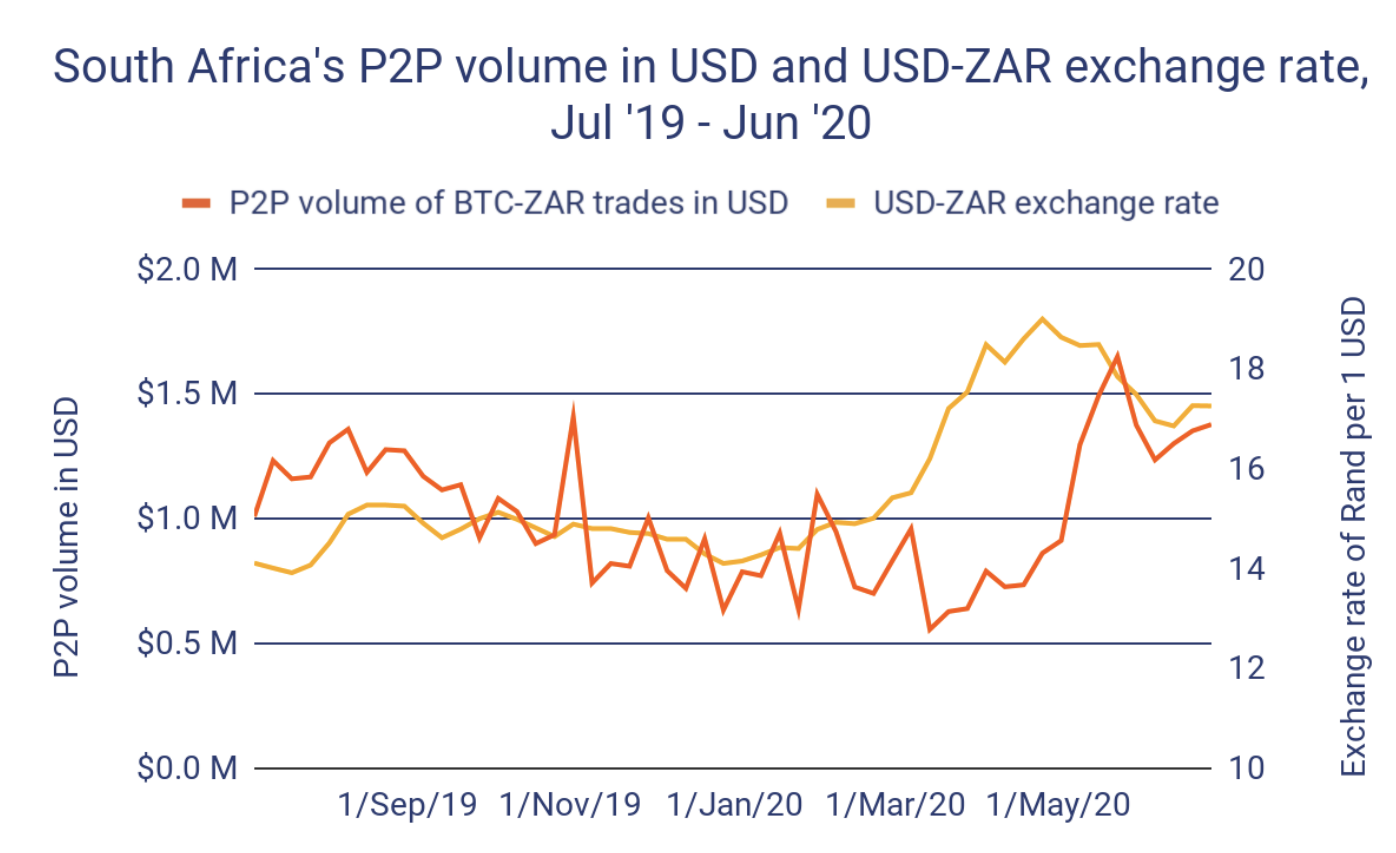

Cryptocurrency can act as a more stable value store for people living under these conditions. Anecdotally, we’ve heard several examples of this use case in Africa, and our data confirms that this is likely happening. The charts below show the level of currency devaluation, expressed as the amount of native currency units needed to trade for $1 USD — the faster that number grows, the more currency devaluation is happening — and P2P cryptocurrency trading volumes in two African countries: South Africa and Kenya.

Both countries follow a clear pattern: When the native currency loses value, P2P trading volumes rise soon after. We believe this reflects users’ strategy of mitigating currency devaluation by shifting savings and possibly even remittances and other payments to cryptocurrency assets.

Activity consolidating on the biggest platforms

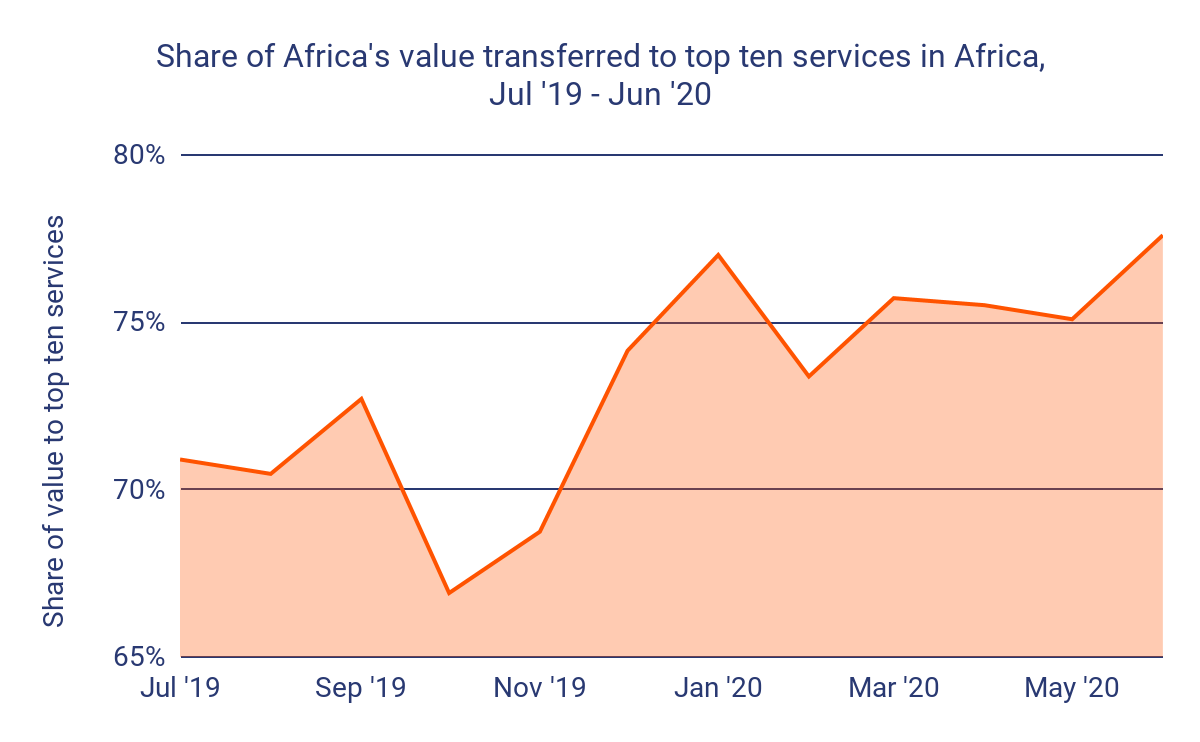

Over the last year, Africa’s on-chain cryptocurrency activity has consolidated further onto the ten largest services in the region by volume, with those services’ share of overall activity in the region rising from 66% in October 2019 to 78% today.

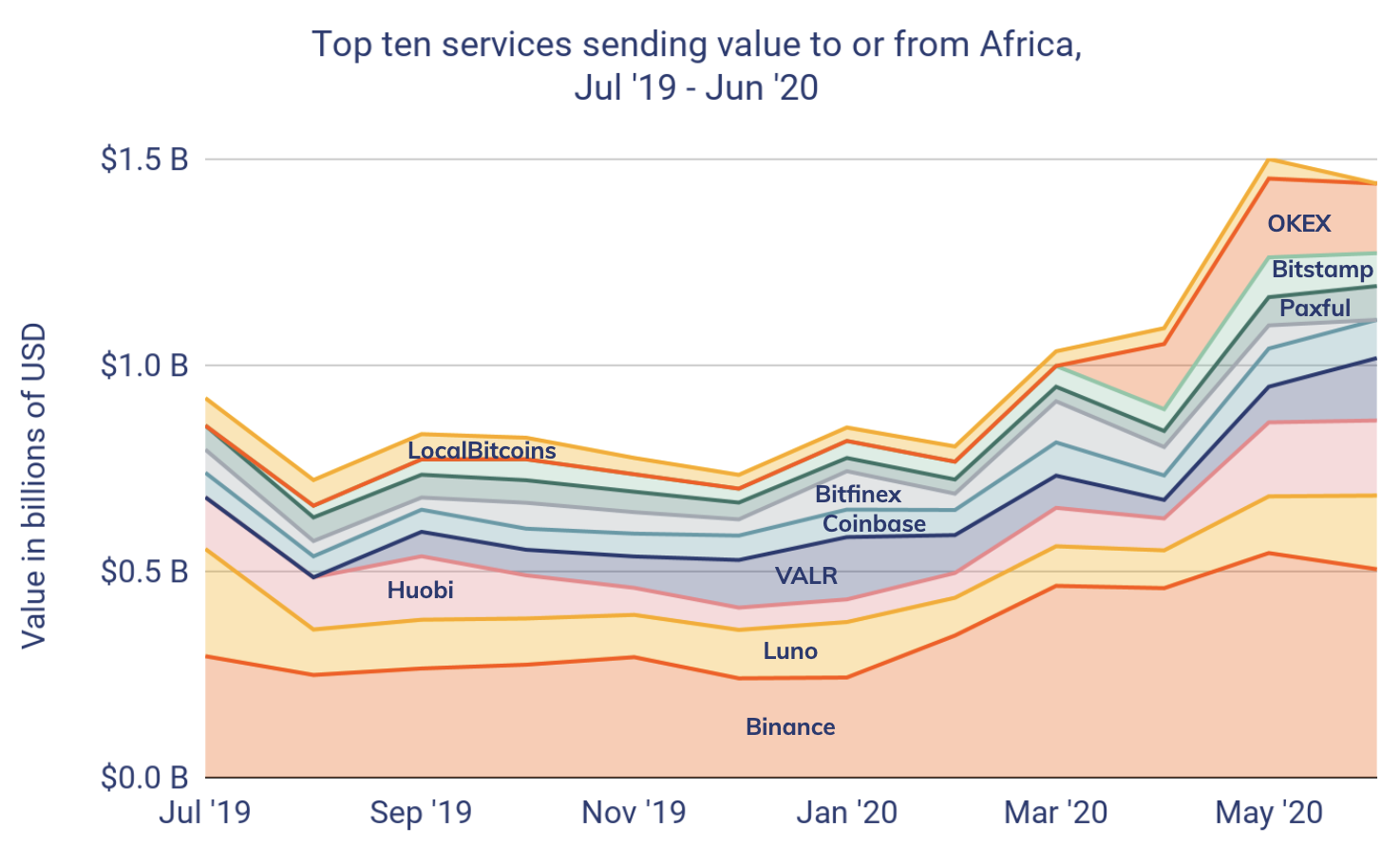

A large portion of that activity is going to Binance, whose share of all cryptocurrency activity in Africa has risen sharply since the beginning of 2020. Adedeji Owonibi, a senior partner at the Nigeria-based blockchain forensics consultancy A&D Forensics and expert in cryptocurrency activity in the region, wasn’t surprised when we showed him this data. “When Binance came to Nigeria, it afforded the opportunity to many to buy and trade. I was able to perform fiat-crypto transactions I could never before. They have more liquidity than other exchanges within the region, recruit local community managers from the cryptocurrency communities in the region, and they provide free rewards to get new people to sign up.” Owonibi also pointed to Binance’s aggressive marketing strategy in Africa, which he said focuses heavily on educating novices on how to use cryptocurrency.

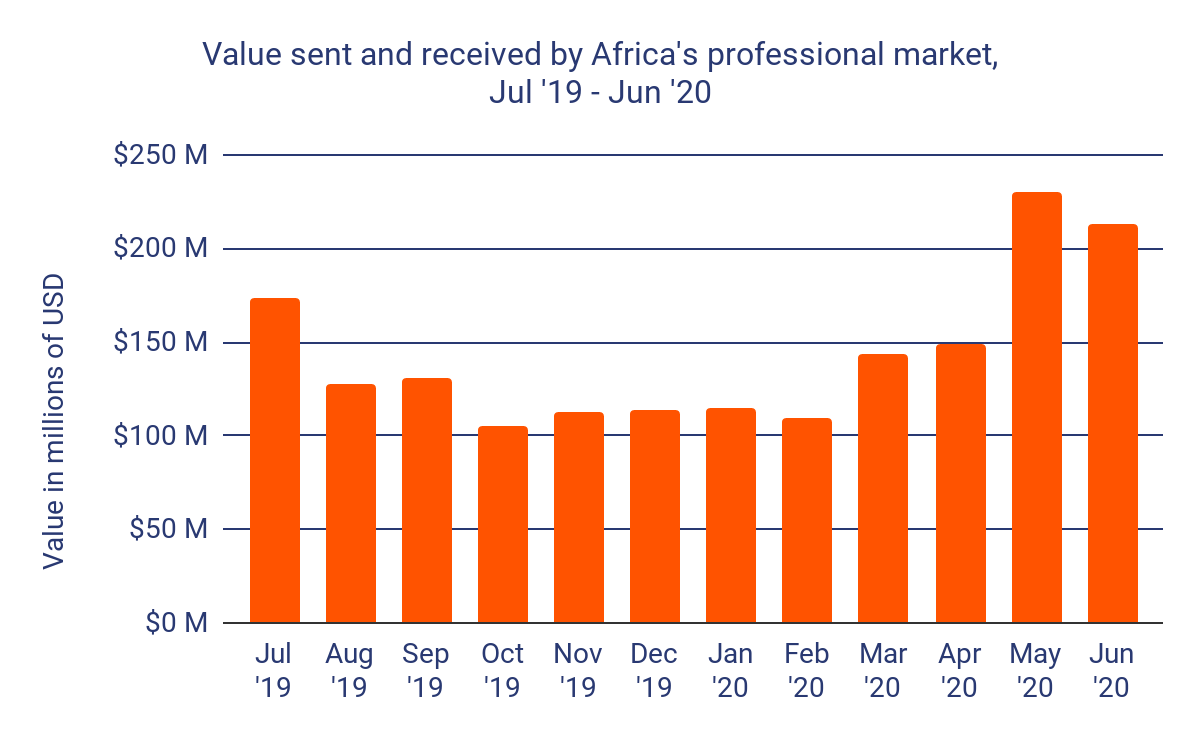

The liquidity and variety of trading pairs offered by top exchanges like Binance are likely attractive to the growing professional trading market (which we define as being made up of transfers above $10,000 USD worth of cryptocurrency), which despite making up a lower share of Africa’s overall activity compared to other regions, still accounts for 70% of all on-chain volume transacted. This appears to be confirmed by the graph below charting the growth of Africa’s professional market over the last 12 months, as the rises in professional activity coincide with rises in African transaction volume on Binance.

In a recent YouTube Ask Me Anything (Q&A session), Binance CEO Changpeng Zhao, better known as CZ, cited his company’s ability to build relationships with local banks, who in turn allow users to on-ramp from fiat to cryptocurrency on Binance, as crucial to the platform’s growth in Africa over the last two years.

Want more insights into how cryptocurrency usage differs by region? Click here to download the full Geography of Cryptocurrency Report! You’ll get more original data and research on inter-regional trading patterns, the state of crypto crime by region, how cryptocurrency mitigates economic instability in the developing world, and more!