This post is an excerpt from our 2024 Geography of Cryptocurrency Report. Download your copy now!

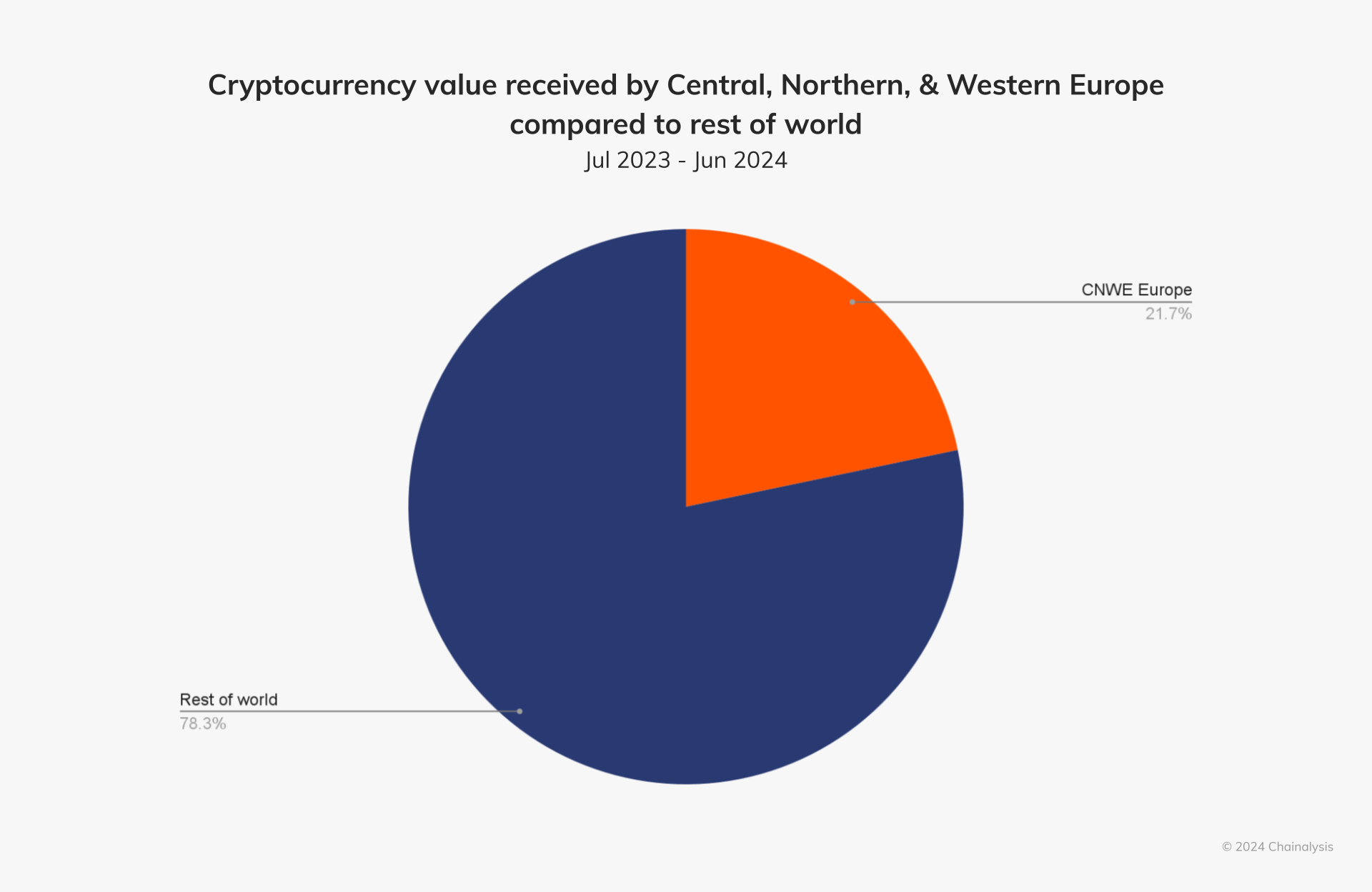

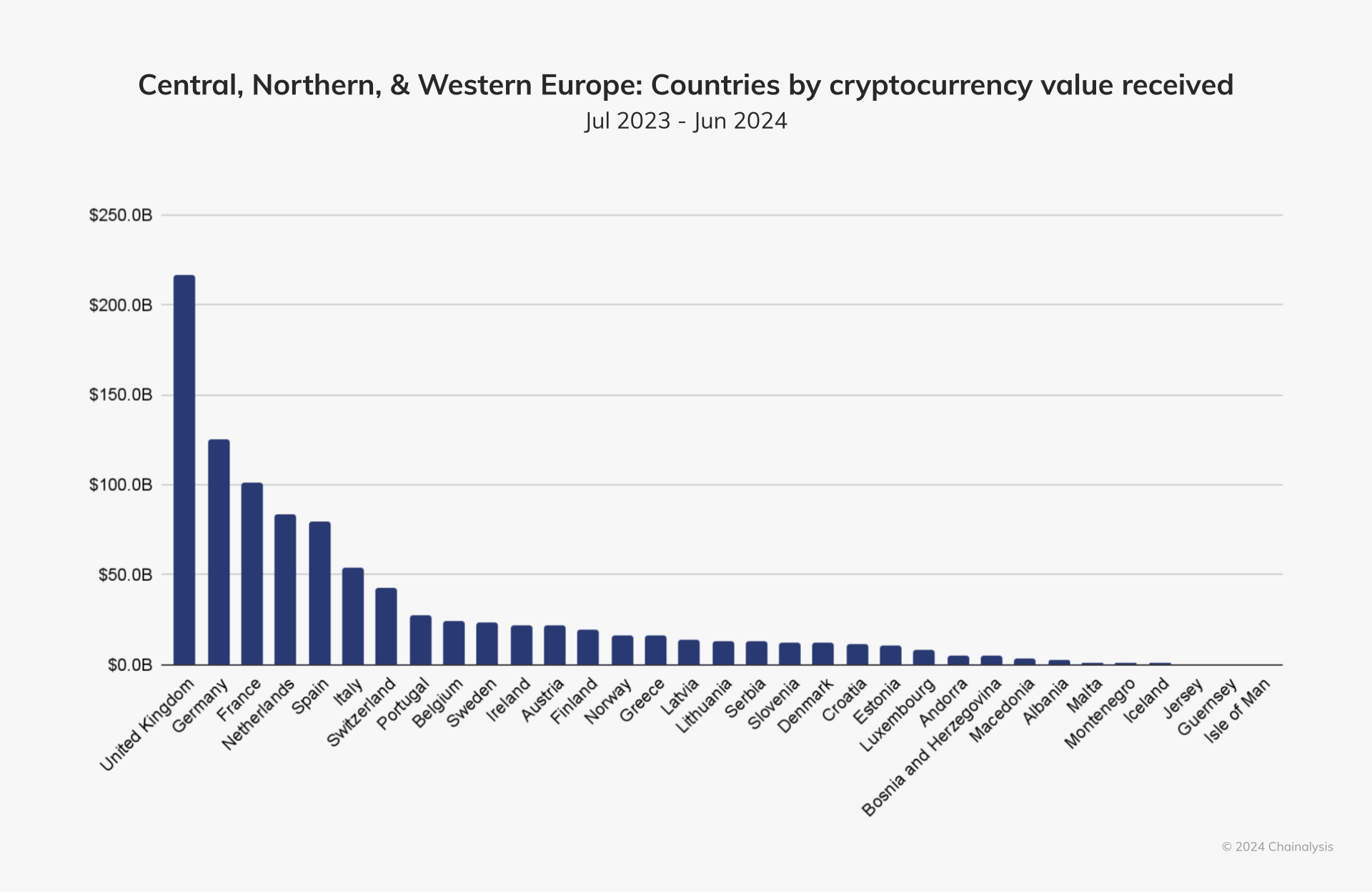

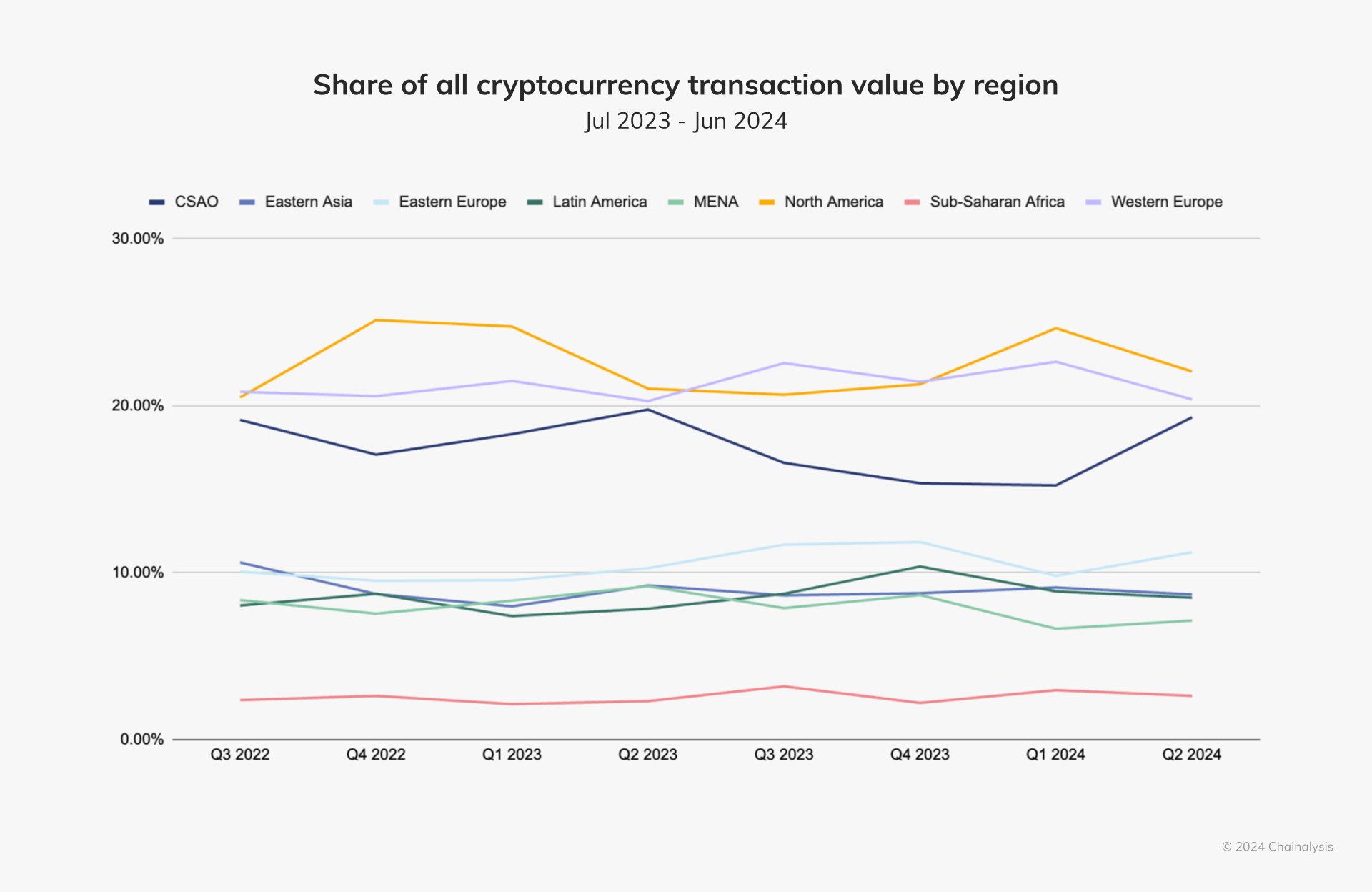

Central, Northern, & Western Europe (CNWE), the second largest cryptocurrency economy in the world after North America, received $987.25 billion in value on-chain between July 2023 and June 2024, accounting for 21.7% of global transaction volume. Most countries in CNWE saw crypto activity grow, averaging a 44% growth rate year-over-year (YoY). The United Kingdom (UK) remains CNWE’s largest cryptocurrency economy, receiving $217 billion in crypto, and ranking 12th in our global crypto adoption index.

For transactions below $1 million — i.e., professional ($10K-$1M) and retail (<$10K) transfers — Bitcoin (BTC) saw nearly 75% growth, the highest of all asset types in CNWE. Across all transaction sizes, BTC accounted for $212.3 billion — roughly one-fifth — of CNWE’s total value received on-chain. While CNWE’s BTC activity for transactions below $1 million grew at a lower rate than North America’s as seen in the chart below, the former outpaced the latter in growth across all other asset types, particularly in stablecoins.

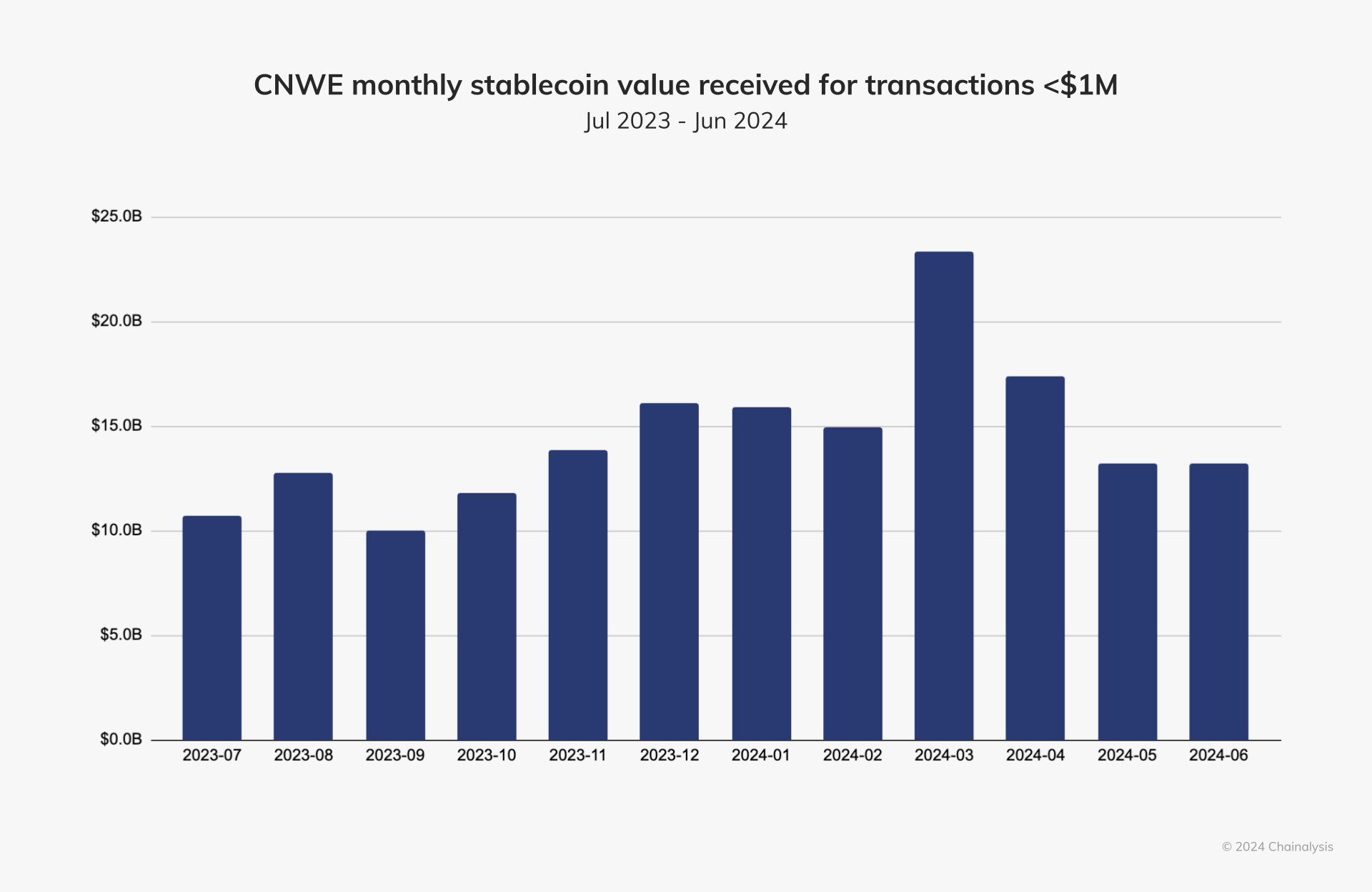

For transfers less than $1 million, CNWE saw growth in stablecoin volume 2.5x greater than North America. CNWE’s stablecoin value across all transaction sizes accounted for almost half ($422.3 billion) of its total crypto inflows. Looking at average monthly inflows, the chart below shows how stablecoin transfers below $1 million performed in the past year, averaging between $10-$15 billion monthly.

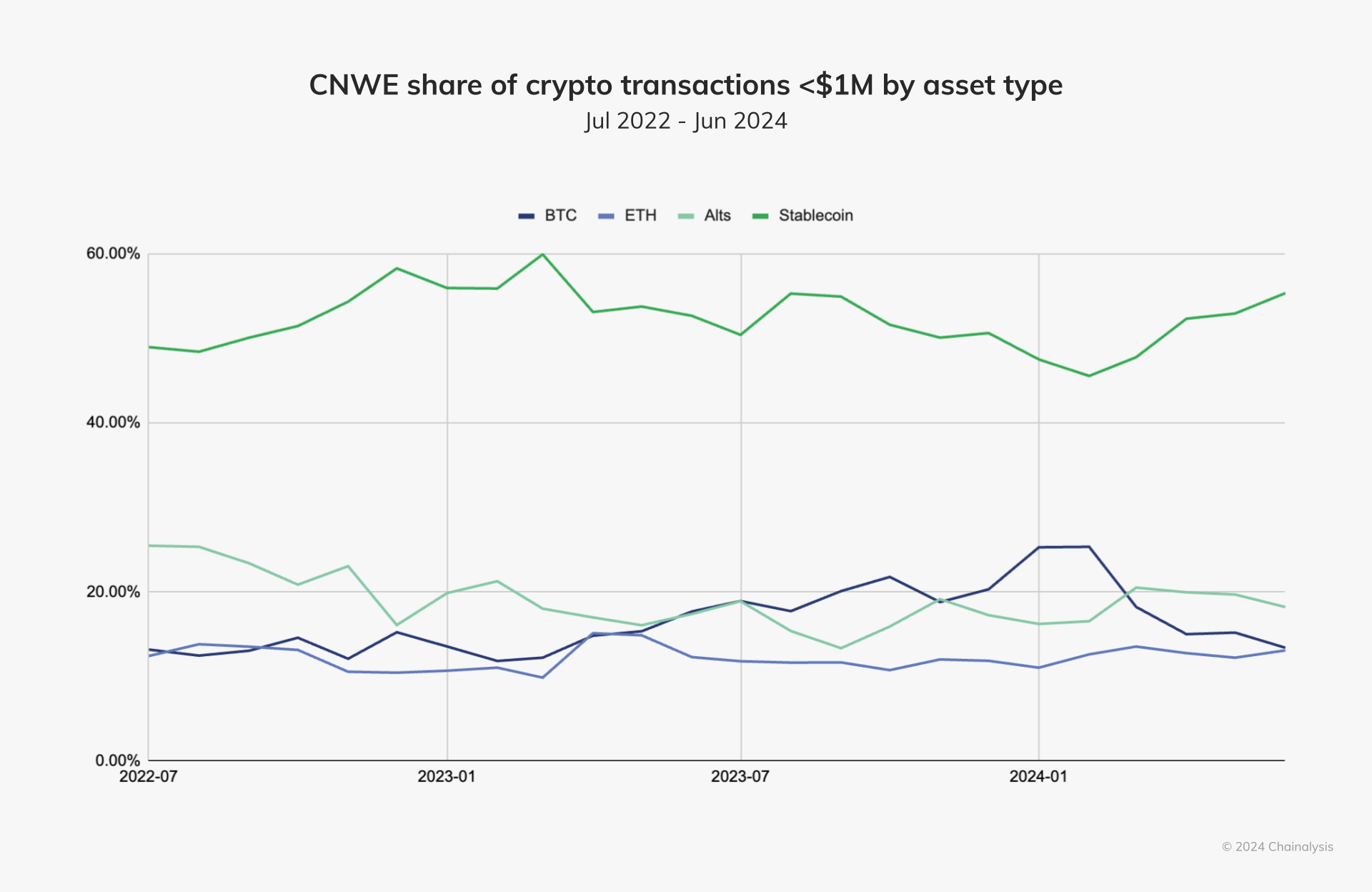

Though inflows decreased in May and June of 2024, the share of stablecoin transactions increased, indicating strong usage despite the post-bull run market decline. Looking back further at the last two years in CNWE, stablecoins have dominated other asset types. The chart below examines purchases made for less than $1 million by asset type. As we can see, stablecoins averaged a 52.36% share of transactions across asset types between July 2022 and June 2024.

In the last year, CNWE’s share of stablecoin purchases with fiat currency was disproportionately greater than that of BTC. The chart below uses order book data — a list of buy and sell orders for an asset or security — to complement on-chain activity, and shows the euro (EUR) has a 24% share of stablecoin purchases traded with fiat currencies, but only a 6% share of BTC purchases. Conversely, the U.S. dollar (USD) has a larger share of BTC purchases than it does stablecoin purchases.

The data suggest that, when it comes to crypto trades with fiat, CNWE is more optimized for crypto users making stablecoin purchases than for acquiring BTC.

To learn more about stablecoin activity in the region, we spoke with BVNK, a global company offering a multi-asset platform for stablecoin payments. Chris Harmse, co-founder and chief business officer at BVNK, said “Our fiat business is in service of our stablecoin platform. We think they coexist, and we need to bridge the gap into the fiat world.”

Harmse confirmed that Chainalysis’ findings on the region’s stablecoin usage were consistent with the company’s observations. BVNK’s business clients buy stablecoins to meet a variety of payments use cases. As for those businesses’ consumers, 90% of their payments are made using stablecoins. We’ll share more about BVNK in the next section.

Merchant services thrive in the UK

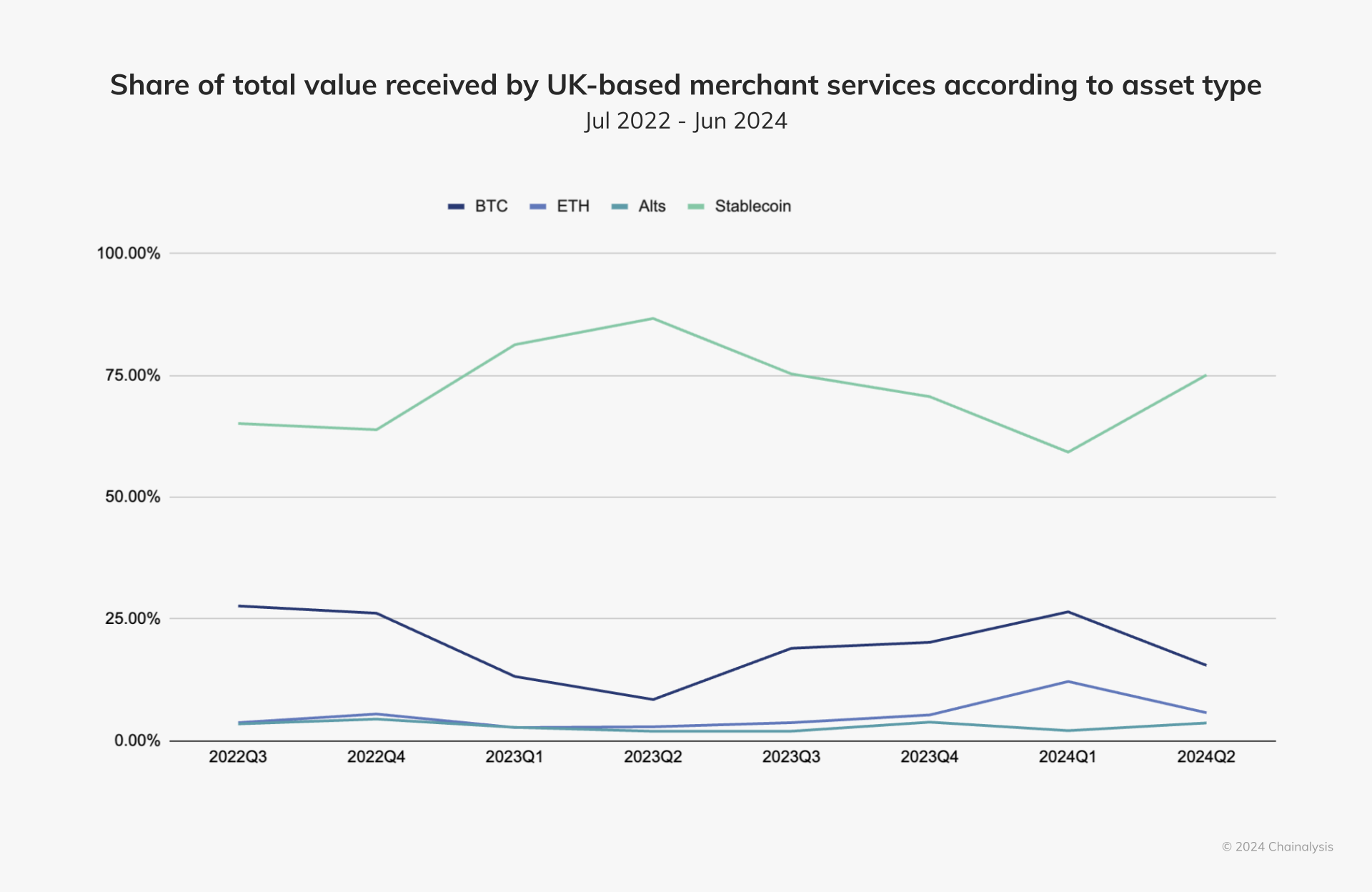

CNWE has the second largest merchant service market in the world next to CSAO, driven primarily by the UK, which saw 58.4% growth YoY.

Stablecoins are the most commonly used asset type in these services, consistently accounting for 60-80% of the market share each quarter, as seen in the chart below.

As one such merchant service provider enabling stablecoin transactions for businesses in the UK and Europe, BVNK covers B2B and B2B to consumer (B2B2C) use cases, such as the following examples:

- Settlements: Fintech or payment service providers help merchants settle invoices, offering payment rails that are faster and cheaper than those in traditional finance (TradFi).

- Pay-ins: When consumers want to pay a business using stablecoins (e.g., making a deposit on a trading platform, topping up a gaming or sports betting account, or making an online purchase), BVNK’s business customers leverage an API to deliver a crypto payment gateway.

- Payouts: Money service businesses (MSBs) use stablecoins to pay contractors or employees, many of whom live in South America, experience currency devaluation, and/or don’t have access to the U.S. dollar.

Speaking of which, citizens in countries like Argentina — which saw 143% inflation in the second half of 2024 — are turning to stablecoins to mitigate the effects of currency devaluation.

Harmse said, “There’s an emerging market where businesses are starting to see stablecoins as fungible. Much like consumers in Argentina who can’t get access to dollars in their market, businesses are hamstrung by traditional payment rails. They can’t pay invoices on time, and they’re tapping into the global trade flow by using stablecoins to make those payments.”

The average transaction size BVNK sees on its platform is between $100K and 250K, and payments in that range are typically large business transactions used to settle invoices, as described above. Most B2B transactions the company processes are cross-border payouts, with the majority of stablecoin payments going to Latin America. Consumer payments processed through BVNK’s platform range between $100 and $1K.

When asked about new or surprising stablecoin use cases, Harmse mentioned micropayments to freelancers in the gig economy — again, these are typically cross-border payments for which traditional payment methods would be too cost-prohibitive. He also mentioned the region is starting to see more nonprofits and NGOs using crypto payouts — in stablecoins specifically — in times of crisis, to get aid to conflict zones more quickly.

Payhound is another company in CNWE offering merchant services. It’s a Malta-based crypto payment processor serving the country’s online gaming industry, and offers settlements and large-volume trading. While the latter drives most of Payhound’s revenue, the company also recognizes the value and potential of its payment processing product.

Elton Dimech, Managing Director at Payhound, said, “We believe that there will be a lot of appetite and interest from online businesses to offer as many options as are available, especially more innovative payment methods.”

Real-world asset tokenization gains traction

Regional experts this year shared that real-world asset (RWA) tokenization, while nascent, is gaining traction in CNWE. Philipp Bohrn is VP, public and regulatory affairs at Bitpanda, a cryptocurrency exchange based in Austria. “Across Europe, we are seeing tokenisation projects for RWAs gaining traction, particularly in sectors such as real estate, intellectual property and collectibles such as art, cars or wine,” he said.

We also spoke with Sylvain Prigent, chief product officer at Societe Generale-FORGE (SG-FORGE) a fully integrated and regulated subsidiary of Societe Generale Group. SG-FORGE is paving the way in security token adoption, notably with its first digital green bond issuance directly registered on the Ethereum public blockchain last year with increased transparency and traceability on ESG data. Prigent thinks that security tokens and RWAs in general will create an accessible investment opportunity in the traditionally competitive securities market. A lot of development has been done to make this new infrastructure smoothly available to TradFi, according to Prigent.

CNWE fourth in the world for DeFi growth

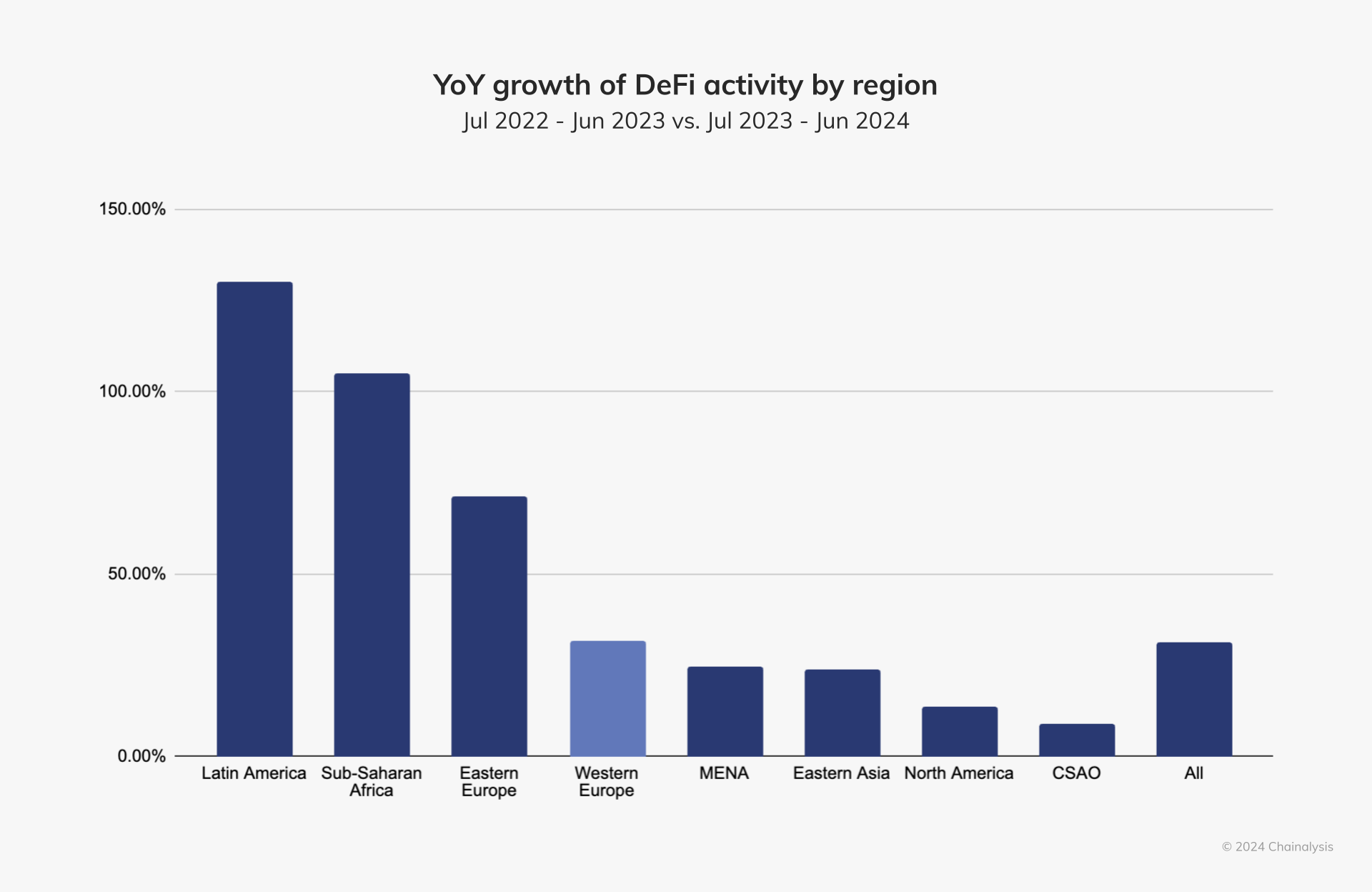

CNWE’s DeFi activity in the past year was on par with the global average. The region outperformed North America, Eastern Asia, and MENA in YoY growth, accounting for $270.5B of all crypto received in the region.

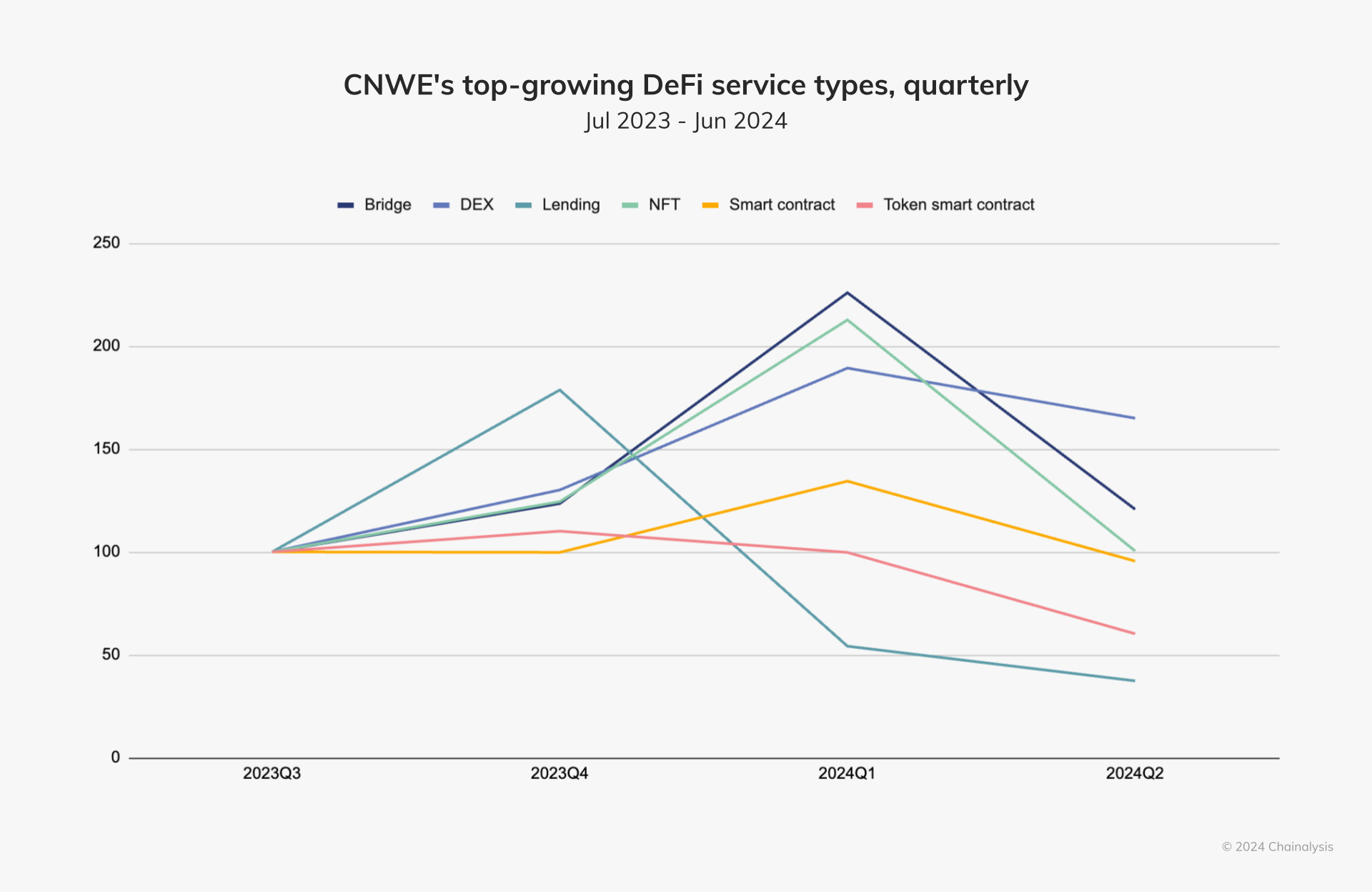

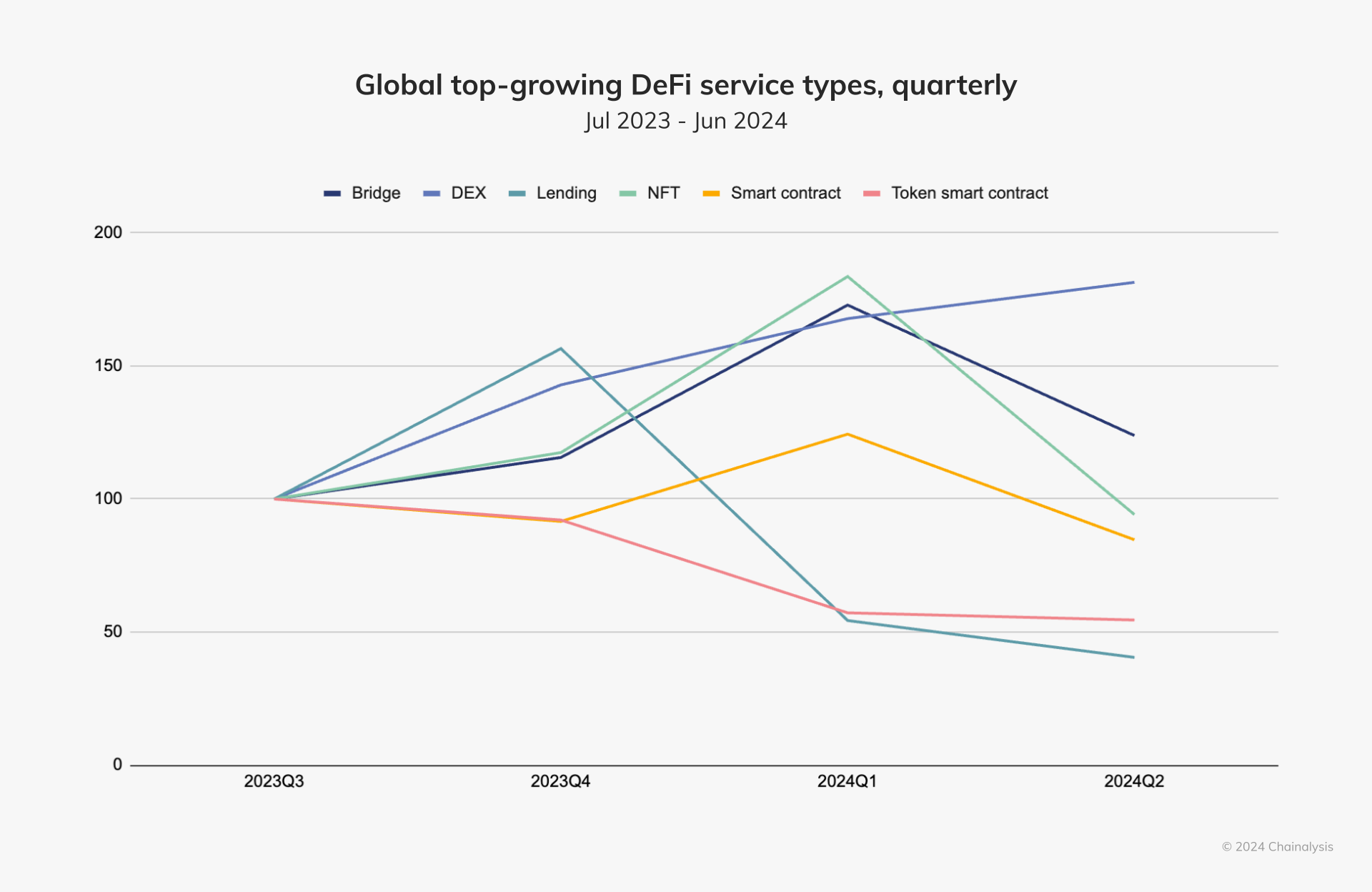

Decentralized exchanges (DEXes) drove most of CNWE’s DeFi growth, while most other DeFi service categories’ inflows declined in recent quarters. In Q1 of this year, NFTs and bridges saw a temporary surge, which then subsided, with levels returning to those of previous years. Lending saw an upswing leading up to Q4 of 2023, but steadily declined going into 2024 and has yet to bounce back.

Although similar growth trends were largely mirrored around the world, DeFi grew faster in CNWE than it did globally. In CNWE, the growth rate for bridges and NFTs was 2x and only 1.5x in the rest of the world.

The future of crypto in Central, Northern, & Western Europe

This summer, the European Union (EU)’s Markets in Crypto-Assets Regulation (MiCA) went into effect for stablecoins, which have been gaining market share across CNWE in the past year. However, the region has yet to feel MiCA’s regulatory effects on crypto-asset service providers (CASPs), a benchmark which will take effect in December. We interviewed several experts on the potential regulatory impacts of MiCA across the EU.

“A major challenge that remains is regulatory uncertainty and the complexity of cross-border compliance,” says Philipp Bohrn at Bitpanda. “There also seems to be an education gap, with many participants unaware of how tokenisation projects work and what the benefits and risks can be. However, we see great opportunity here — by bridging this knowledge gap and creating clear regulatory frameworks, we can unlock the true potential of asset tokenisation, driving innovation, and strong growth in the global financial markets.”

Elton Dimech at Payhound discussed how MiCA could affect payment processors, particularly those that serve the online gaming industry in CNWE. “In Malta, we have a robust framework and have to compete with other businesses that have little regulation. So, if a merchant wants the easier way out, we won’t be the right option for them. When MiCA goes into effect, this will completely change, and I’m hoping that the regulators within the EU will enforce this new regulation so that we have a level playing field for all crypto-asset service providers.”

With MiCA’s rules for CASPs set to take effect in December, compliance teams will be at the forefront of implementation and associated control enhancements. Sophie Bowler, Group Chief Compliance Officer at UK-based Zodia Custody, a firm that bridges the TradFi-crypto gap, shared her company’s sentiments.

“We believe regulation is the key to mainstream adoption and further success and innovation of digital assets,” Bowler said. “Regulatory clarity will not only enable digital asset firms to develop new products with confidence, but it will encourage more traditional financial institutions to engage with digital assets within a well-defined regulatory framework.”

And as MiCA unfolds in the EU, the UK continues to evolve its own regulatory framework.

“For firms that are unable or unwilling to meet MiCA’s requirements, there may be a short-term shift to the UK market,” Bowler said. “However, we believe this will be temporary, as UK crypto legislation is expected to closely align with MiCA, and the FCA’s roadmap for the crypto legislative package, along with related consultation papers, is anticipated to be introduced in early 2025. This roadmap will provide us greater clarity on the timelines for these legislative changes.”

At Chainalysis, we’ll be monitoring the final phase of MiCA’s rollout, as well as regulatory developments in the UK, and are eager to see how these measures impact crypto adoption in the coming year.