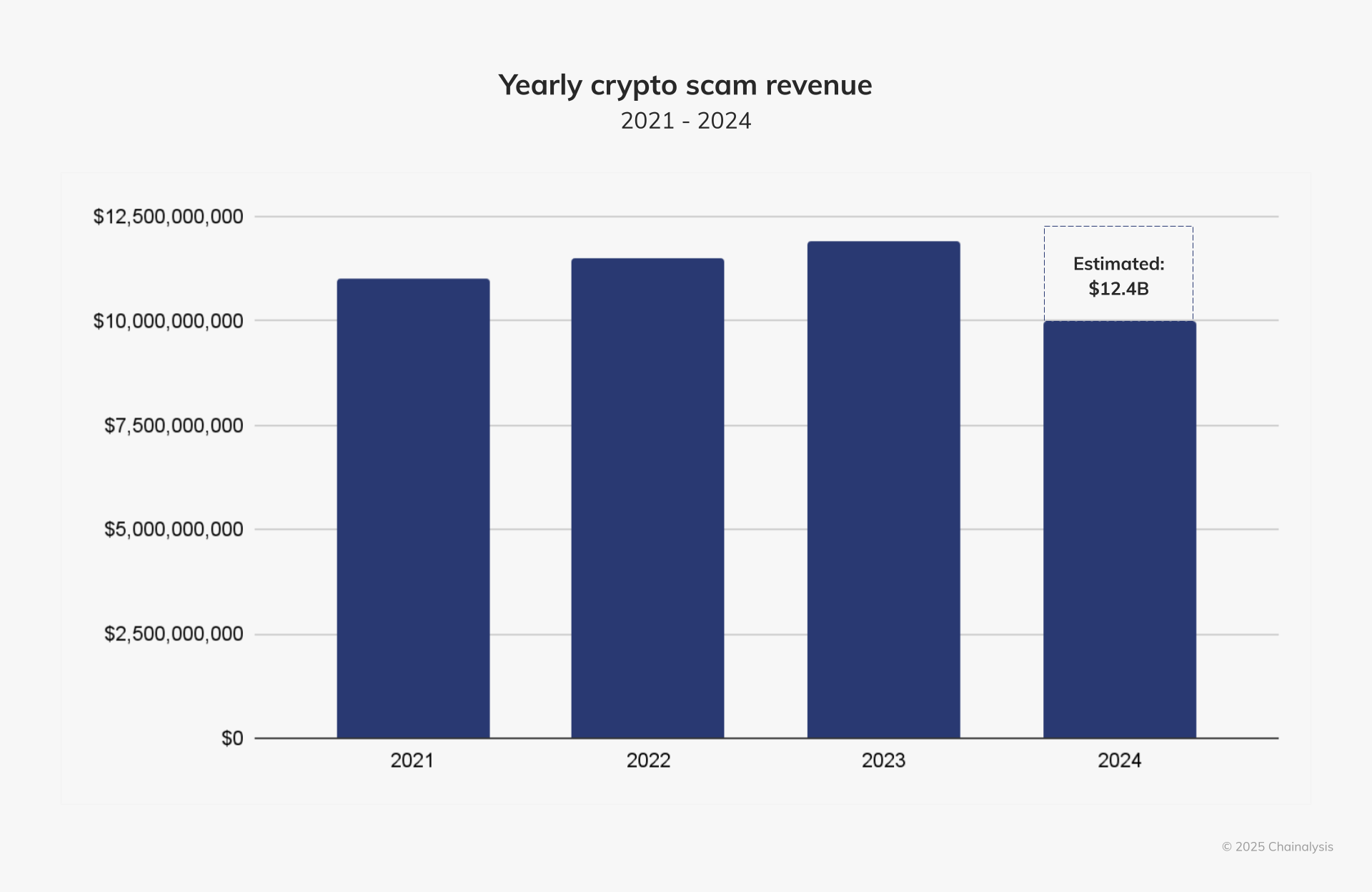

In 2024, cryptocurrency scams received at least $9.9 billion on-chain, an estimate that will increase as we identify more illicit addresses associated with fraud and scams in the coming months.

According to our metrics today, it looks like 2024 saw a drop in scam revenue; however, 2024 was likely a record year as these figures are lower-bound estimates based on inflows to the scam addresses we’ve identified up to today. A year from now, these totals will be higher, as we identify more illicit addresses and incorporate their historic activity into our estimates.

Since 2020, our annual estimates of scam activity have grown by an average of 24% between annual reporting periods. Assuming a similar growth rate between now and next year’s Crypto Crime Report, our annual totals for 2024 could surpass the $12 billion threshold.

Further, with our recent acquisition of Alterya, we will leverage AI-powered fraud and scam detection to augment our data, and expect our totals to become even more robust than our estimates based on historical increases. Alterya has worked with top cryptocurrency exchanges, fintech companies, and financial institutions to proactively prevent fraud and minimize losses. In 2024, the organization detected $10 billion sent to scams.

In the last few years, crypto fraud and scams have continued to increase in sophistication, as the fraud ecosystem becomes more professionalized. Operations like Huione Guarantee, a peer-to-peer (P2P) marketplace, offer a host of illicit services that support pig butchering scamming operations and serve as a one-stop-shop for scammers’ needs. These services range from the technology infrastructure required to initiate scams to money laundering services for obfuscating illicit activity and cashing out.

In this section, we’ll (1) discuss fraud and scam trends in 2024; (2) profile Huione Guarantee and its role in professionalizing the scam ecosystem, and; (3) explore a crypto ATM scam story, its implications for the elderly population, and emerging regulatory priorities.

High-yield investment and pig butchering scams see highest crypto revenues

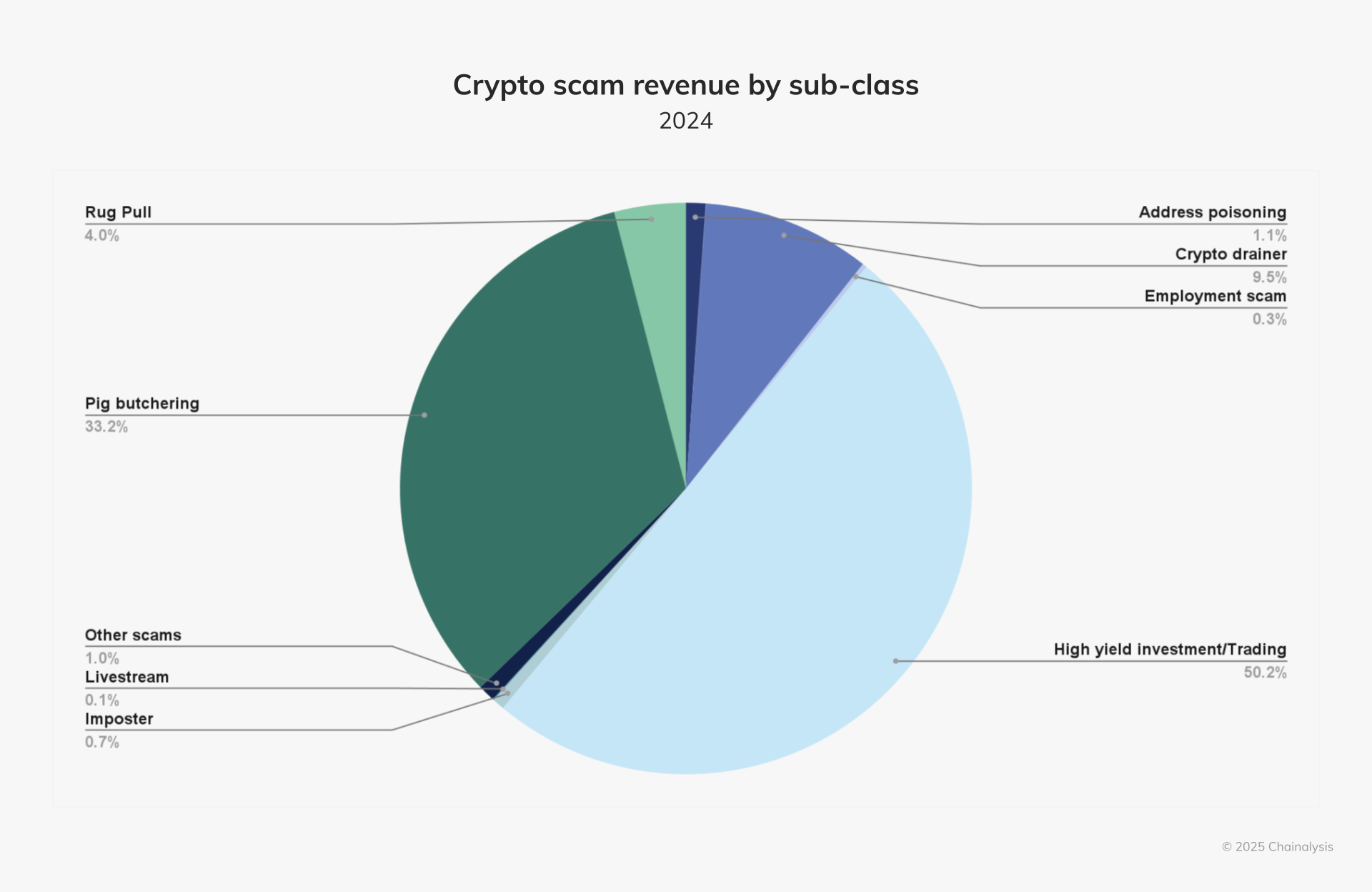

In the past year, high-yield investment scams (HYIS) and pig butchering scams received the most crypto among scam sub-classes, at 50.2% and 33.2% respectively.

Despite pulling in half of all scam revenue in 2024, HYIS inflows declined by 36.6% YoY, while pig butchering revenue increased by almost 40% YoY. These categories aside, the fraud and scam landscape is expanding into a variety of other subclasses that we’ll discuss.

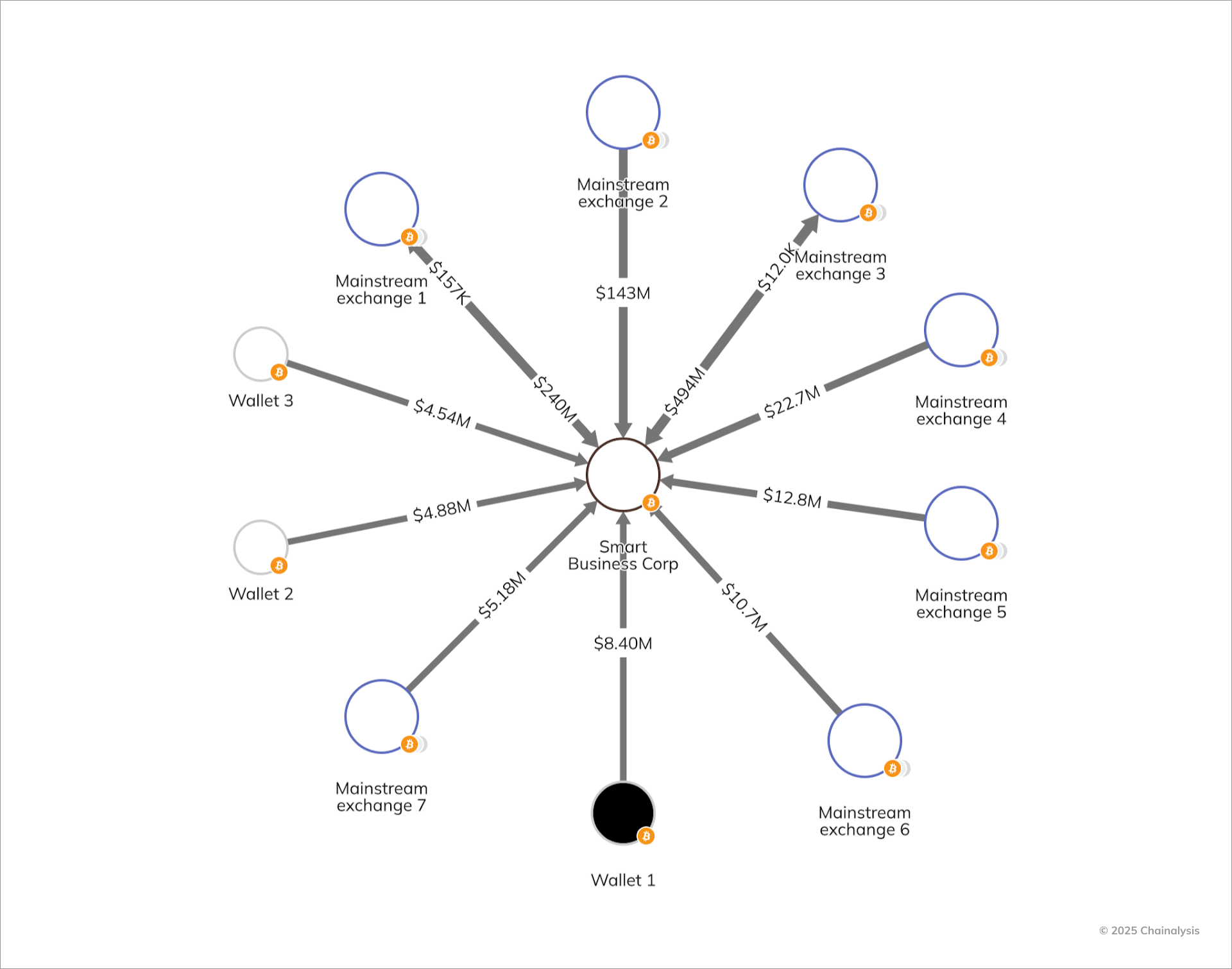

One lucrative HYIS active in 2024, Smart Business Corp, is a decade-old ponzi scheme targeting Spanish-speaking countries, particularly Mexico. In 2022, Smart Business Corp added bitcoin to its investment portfolio and promised affiliates outsized returns based on a tiered investment scheme. That same year, Mexican government consumer protection agency CONDUSEF warned that Smart Business Corp was not registered to offer securities in Mexico.

To date, Smart Business Corp has received $1.5 billion on-chain. The graph below shows its top 10 counterparties by crypto received, a combination of seven mainstream exchanges and three self-hosted wallets.

Pig butchering scams (also known as investment or romance scams) target and build relationships with individuals, convincing them to invest in fraudulent opportunities, and predominantly originate via large scam compounds in Southeast Asia. International Justice Mission (IJM), a global organization that protects people in poverty from violence, began observing forced labor cases tied to these operations in 2021, and has since observed immense growth of these crimes. IJM’s work in this region focuses on preventing human trafficking associated with these operations by strengthening justice systems.

Despite their prominent footprint in Southeast Asia, pig butchering scams have become more geographically dispersed. While none of these operations yet approach the scale of those in Southeast Asia, IJM has observed shifts to other countries over the past two years. Some recent examples:

- December 2024: Nigeria’s anti-graft agency announced the arrest of 48 Chinese and 40 Filipino nationals for running an investment scam operation that targeted people mostly from Europe and the Americas. Scam operators recruited Nigerians to prospect for victims online, whom the scammers then tricked into investing in fake crypto schemes.

- June 2024: Interpol coordinated a global operation to disrupt scam operations worldwide, including one in Namibia that forced 88 youths into conducting scams as part of an international scam network.

- October 2023: Malaysian authorities announced that Peruvian police had rescued 43 Malaysian citizens trafficked to Peru who were forced to work in a scam operation.

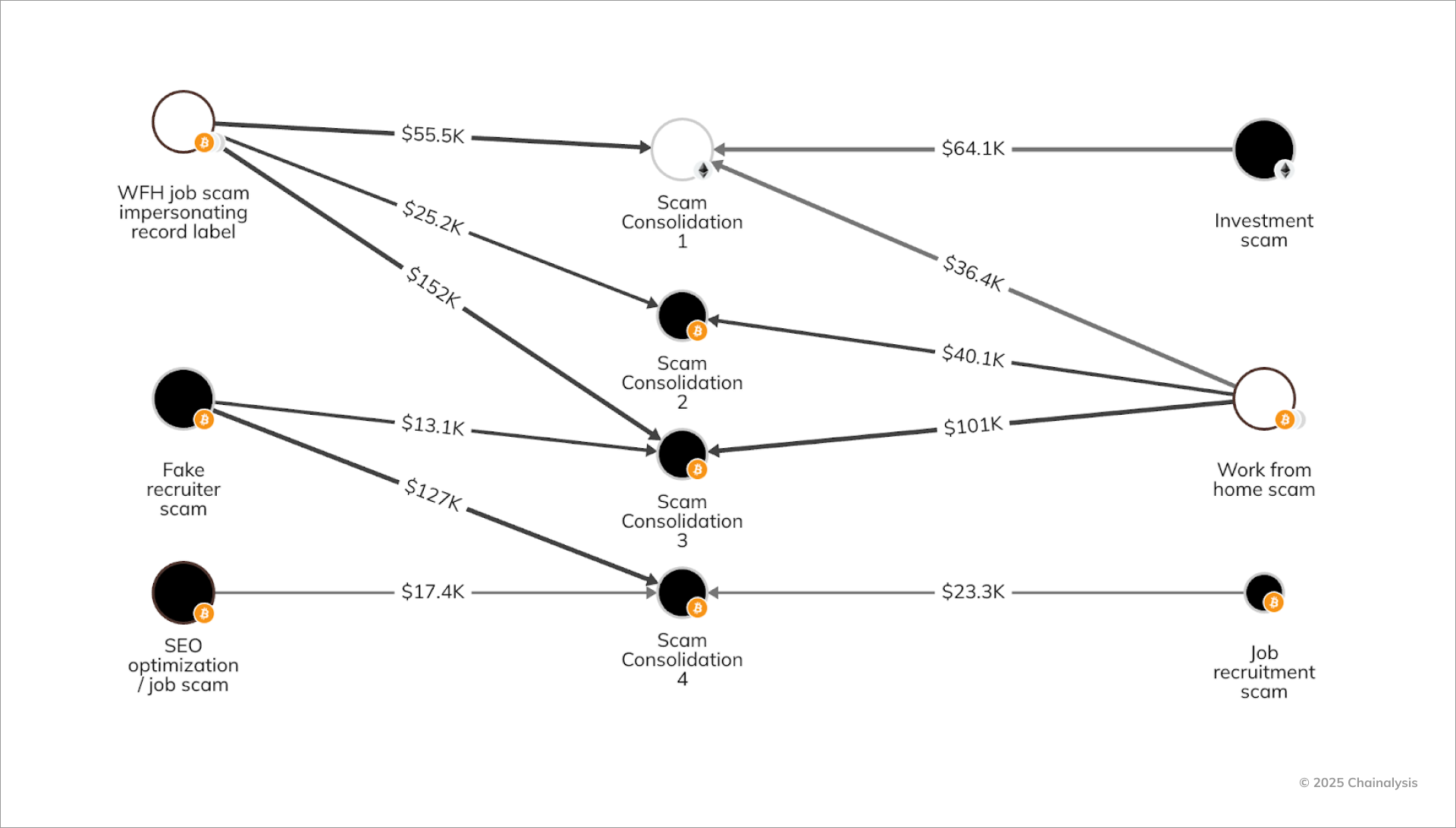

Pig butchering scammers have also evolved to diversify their business model beyond the “long con” of pig butchering scams — which can take months and even years of developing a relationship before receiving victim payments — to quicker turnaround employment or work-from-home scams that typically yield smaller victim deposits.

One such example, a fraudulent job site impersonating a record label offering work-from-home jobs, sent crypto to consolidation wallets where a pig butchering scam also sent funds, as seen in the top left of the graph below. Researchers at cybersecurity company Proofpoint assess with a high degree of confidence that the same actors conducted these seemingly disparate pig butchering and employment scams. Chainalysis was separately able to connect these scam domains on-chain by shared consolidation addresses that Proofpoint had connected.

Though employment scam inflows represented less than 1% of total on-chain value that scams received last year, thousands of people unwittingly paid into fake job platforms and the FBI warned U.S. citizens about these schemes in 2024. Proofpoint attests that many of these platforms are getting savvier, including registering multiple backup domains for every site in case they are taken down. Scam operators are also likely wisening up to the traceability of cryptocurrency, and are now having victims reach out to “customer service” representatives to obtain a crypto address. Some scammers are foregoing cryptocurrency as a payment option altogether and are instead directing scam victims to other payment services.

IJM began seeing instances of work-from-home scams in mid-2023, with paid social media ads using the names of real companies. Since then, it appears tactics have changed to sending targets text messages with vague job details, sometimes pretending to be from legitimate job boards. “These scams are particularly devious because anyone who has put their resume out there and is looking for a job could easily be hooked by these, especially those desperate for work,” says Eric Heintz, global analyst at IJM.

Heintz said that while the scam has a few variations, generally speaking, after the target accepts the “job,” the scammer has them join a platform where they complete tasks and accrue “payments”. In order to withdraw money, the victim must pay a percentage in “tax”, with a lower percentage required if they wait to withdraw large amounts, which causes the victim to lose even more money. The scam seems to have originally targeted people in Asia and, in 2024, shifted focus to North America and Europe.

“While pig butchering scams garner the most attention, large scam compounds are essentially havens for any type of scam that can be carried out via the internet, and it’s not uncommon to have multiple criminal groups operating within the same compound focusing on different scams,” says Heintz.

Growth across the fraud and scam ecosystem

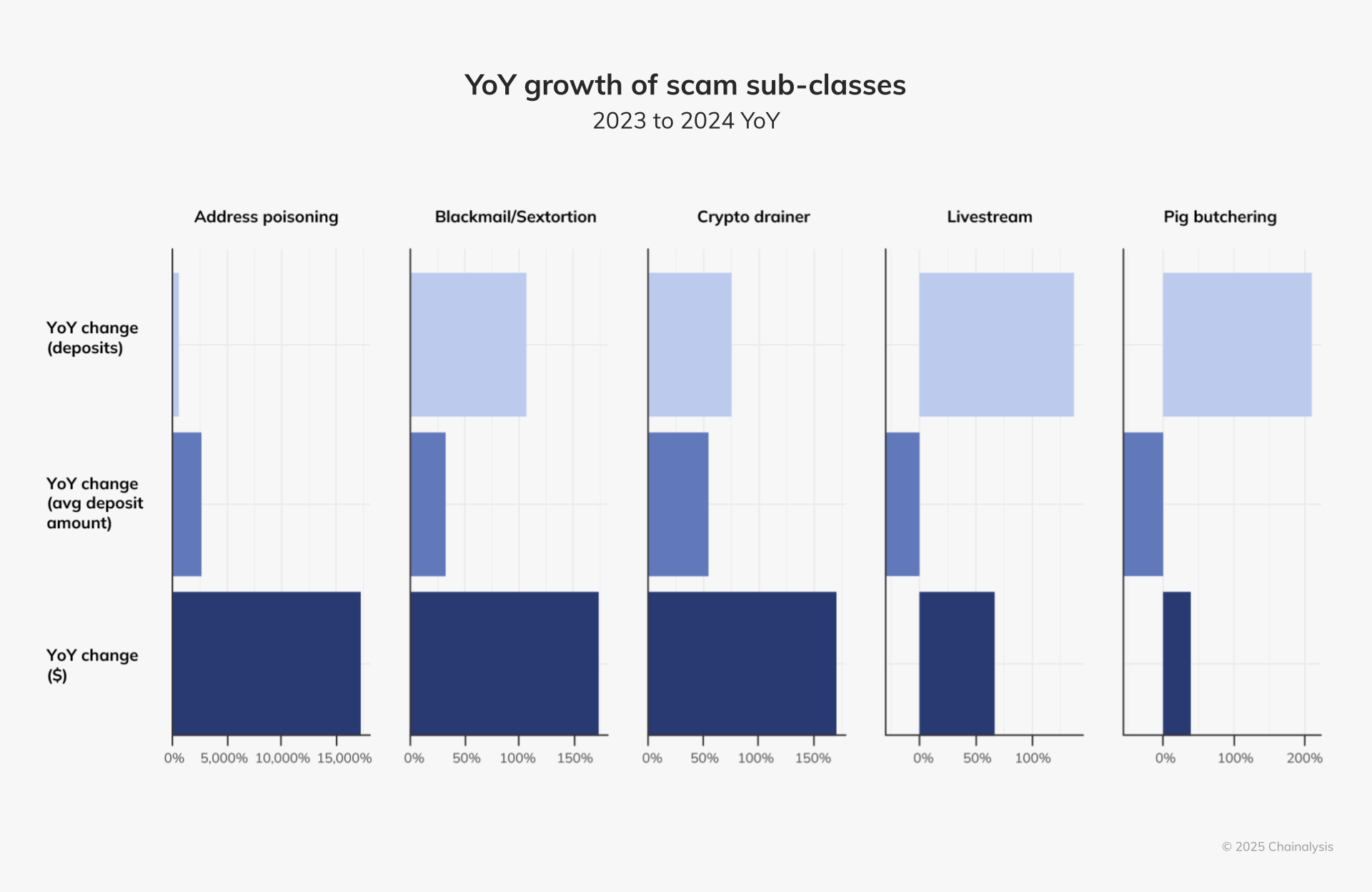

In 2024, on-chain activity indicates that five scam types grew: pig butchering, address poisoning, crypto drainers, livestream, and blackmail/sextortion scams.

In 2024, pig butchering revenue grew nearly 40% YoY and the number of deposits to pig butchering scams grew nearly 210% YoY, potentially indicating an expansion of the victim pool. Conversely, the average deposit amount to pig butchering scams declined 55% YoY. The combination of lower payment amounts and increased deposits could indicate a change in strategy for pig butchering scams. Scammers could be spending less time priming targets, and therefore, receiving smaller payments, in exchange for targeting more victims.

Another destination for heavy scam flows, crypto drainers continued to proliferate and grew across the board — nearly 170% YoY revenue growth, almost 55% YoY increase in deposit size, and 75% YoY growth in number of deposits. Notably, in January of 2024, a drainer posing as the U.S. Securities and Exchange Commission (SEC) prompted users to connect their wallets to claim fake tokens through an airdrop after the SEC’s X account was compromised.

Like crypto drainers, address poisoning attacks use on-chain infrastructure to scam victims out of their funds. Scammers pick a target and study their transaction patterns and most frequent counterparties. Using an algorithm, scammers then will generate a new crypto address similar to one the target interacts with regularly, and send a small transaction from this newly created address to “poison” the target’s address book. In 2024, crypto sent to address poisoning scams grew over 15,000%, largely driven by a single massive attack in May. On-chain data shows that address poisoning scammers target users with higher than average wallet balances.

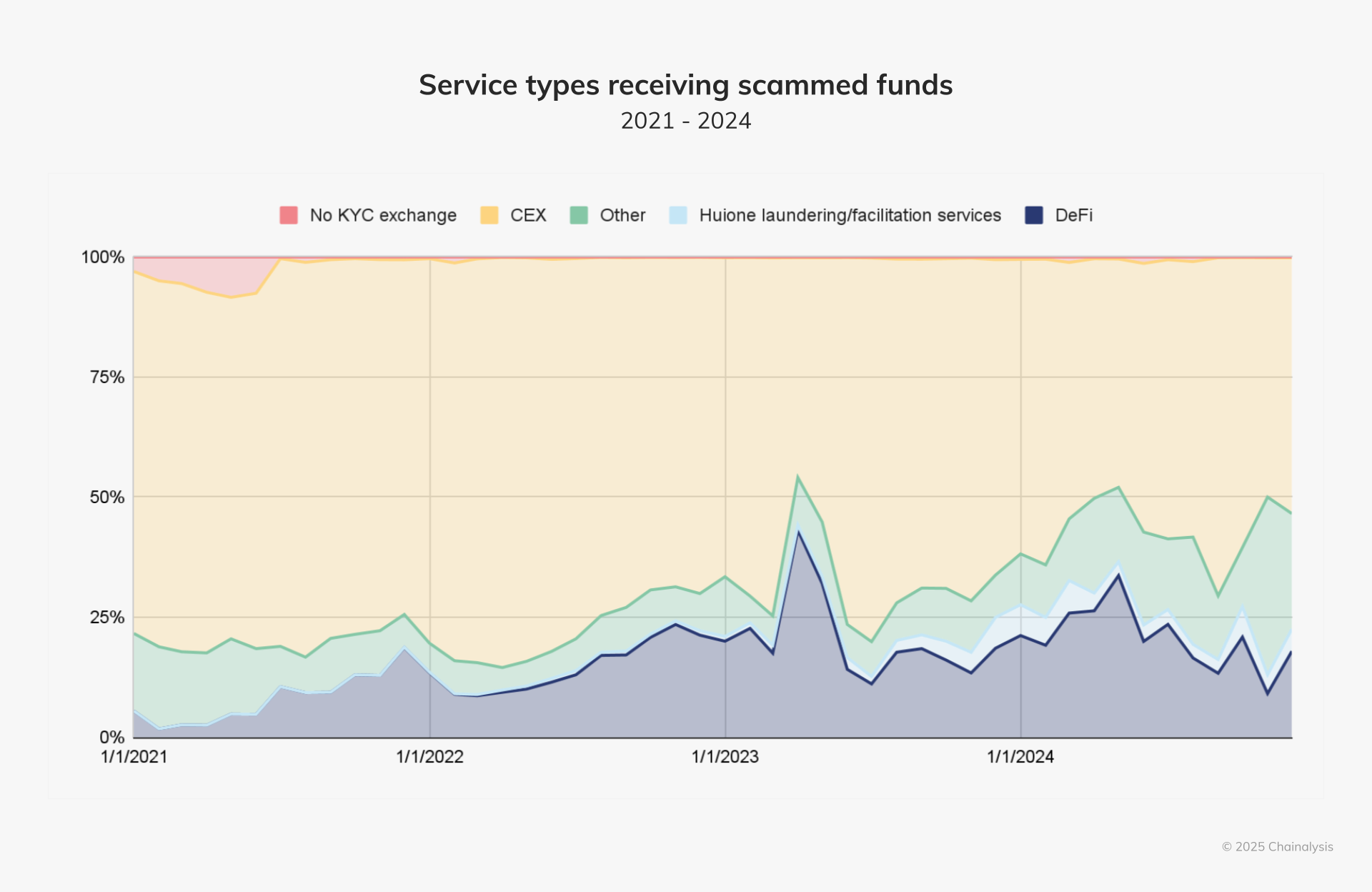

Where scammers send illicit crypto

In the last few years, destinations for scammed funds have remained relatively the same, with most funds going to centralized exchanges (CEXs). But as scams on more blockchains including Ethereum, Tron, and Solana have grown, so too has the use of DeFi protocols.

Since mid-2023, crypto sent from scams to Huione money laundering services has also grown. Money laundering is just one type of illicit activity the Huione Guarantee platform supports, among a host of services that facilitate scams.

How Huione Guarantee is professionalizing the scam ecosystem

Huione Group, a Cambodian conglomerate known to offer legitimate services like remittances, insurance products, and, for a time, luxury tourism offerings, is also known to facilitate cybercrime. Since 2021, Huione Guarantee — an online forum and P2P marketplace affiliated with Huione Group — has processed $70 billion in crypto transactions. [1] On-chain activity indicates Huione Guarantee is heavily used for illicit crypto-based activities supporting the growing pig butchering industry in Southeast Asia, including the sale of scam technology products, money laundering services, and much more.

Specifically, Huoine Guarantee has become a one-stop-shop for illicit actors needing the technology, infrastructure, and resources to conduct scams — assets like targeted data lists, web hosting services, social media accounts and content creation, and AI software. In addition to these offerings, Huione has also bolstered scores of money laundering operations that scammers use to obfuscate their illicit activity. In short, Huione Guarantee has driven and enabled a scam ecosystem that is massive, growing, and interconnected.

A large and growing fraud ecosystem

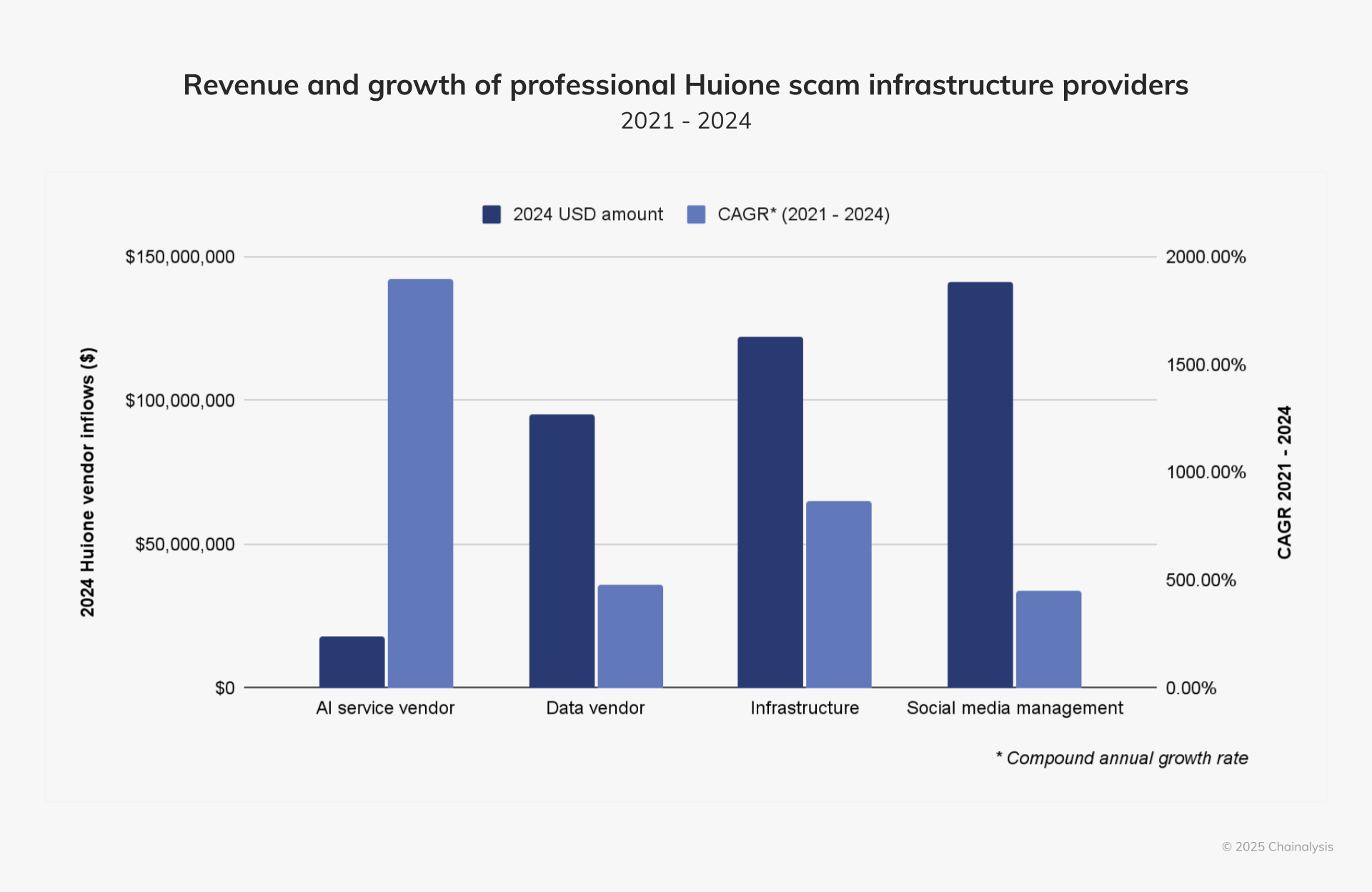

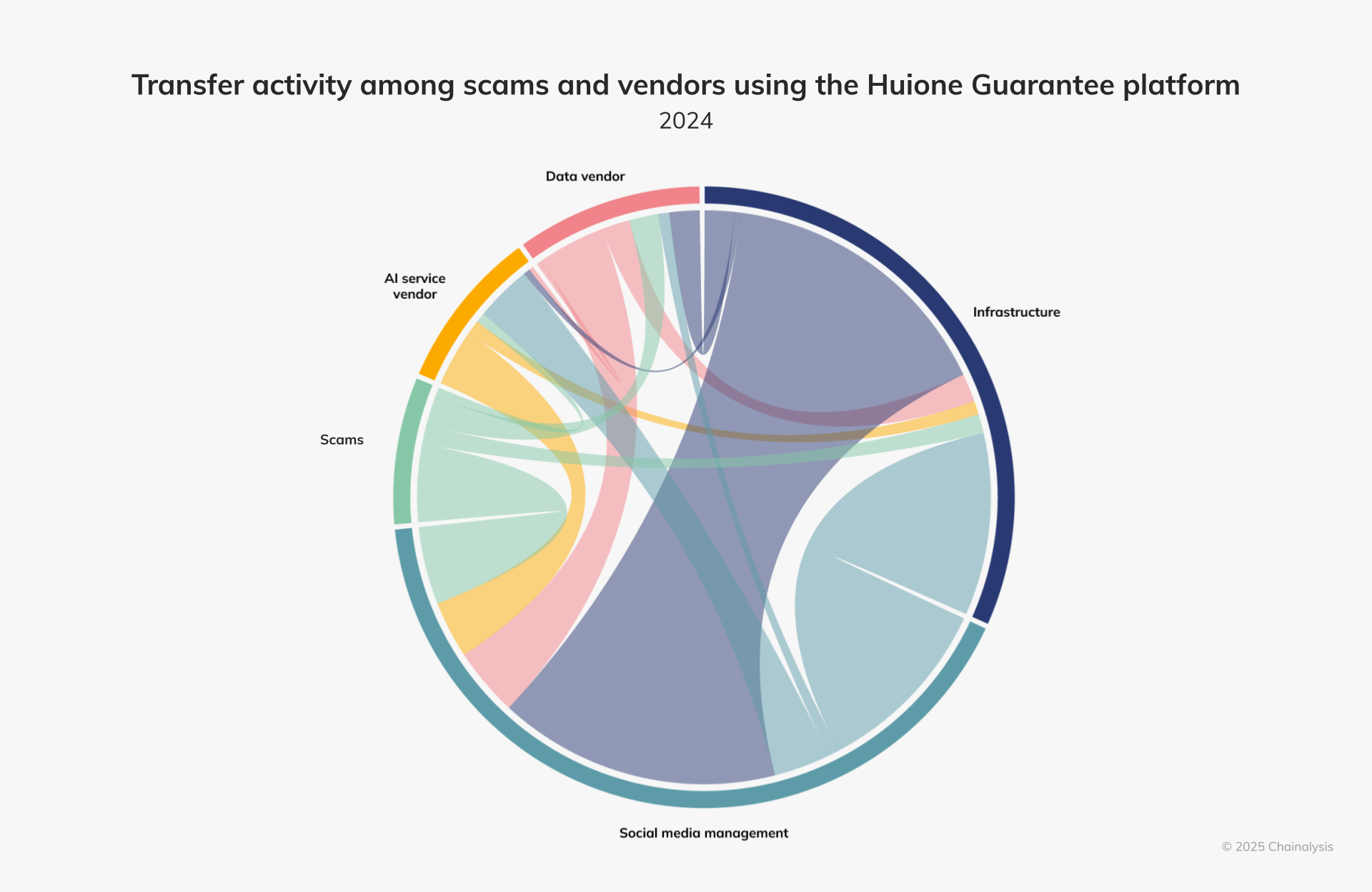

In 2024, Huione scam technology vendors collectively received at least $375.9 million in cryptocurrency. The chart below examines the types of vendors capitalizing on products and services used to facilitate scams, including, but not limited to AI services, data, infrastructure, and social media management.

When comparing crypto flows from 2021 through 2024 based on a compound annual growth rate, Huione scam infrastructure providers’ revenue has increased exponentially, with AI service vendors’ revenue growing by 1900%, indicating an explosion in the use of AI technology to facilitate scams. AI vendors offer technology that helps scammers impersonate others or generate realistic content that tricks victims into making fraudulent investments.

Huione data vendors sell stolen data such as personally identifiable information (PII) that bad actors can exploit for illicit purposes, often with information on “quick kill” targets (i.e., potential victims who are most susceptible to being scammed). Web infrastructure providers offer technology services like website hosting and mechanisms to bypass authentication on app stores, which lend credence to fake websites and apps used to scam victims. Additionally, services that facilitate mass text message marketing help scammers extend their reach across the globe to a wider set of potential victims. As for social media services, scammers can boost the legitimacy of their campaigns by leveraging services that enhance the clout of their social media accounts. The growth in data vendors, while lower than that of AI service vendors, has still seen exponential increases in inbound funds YoY.

Generative AI software: Creating fake personas for scammers

While generative AI can accelerate legitimate innovation, it can also make scams more scalable and affordable for bad actors to conduct.

“GenAI is amplifying scams, the leading threat to financial institutions, by enabling high-fidelity, low-cost, and highly scalable fraud that exploits human vulnerabilities,” says Elad Fouks, head of fraud products at Chainalysis and co-founder of Alterya. “It facilitates the creation of synthetic and fake identities, allowing fraudsters to impersonate real users and bypass identity verification controls.”

In fact, Alterya found that 85% of scams involve fully verified accounts that bypass traditional identity-based solutions.

“Additionally, GenAI enables the generation of realistic fake content, including websites and listings, to power investment scams, purchase scams, and more, making these attacks more convincing and harder to detect,” said Fouks.

With this technology, scammers can deceive targets into authorizing payments under false pretenses, often known as authorized push payment (APP) fraud.

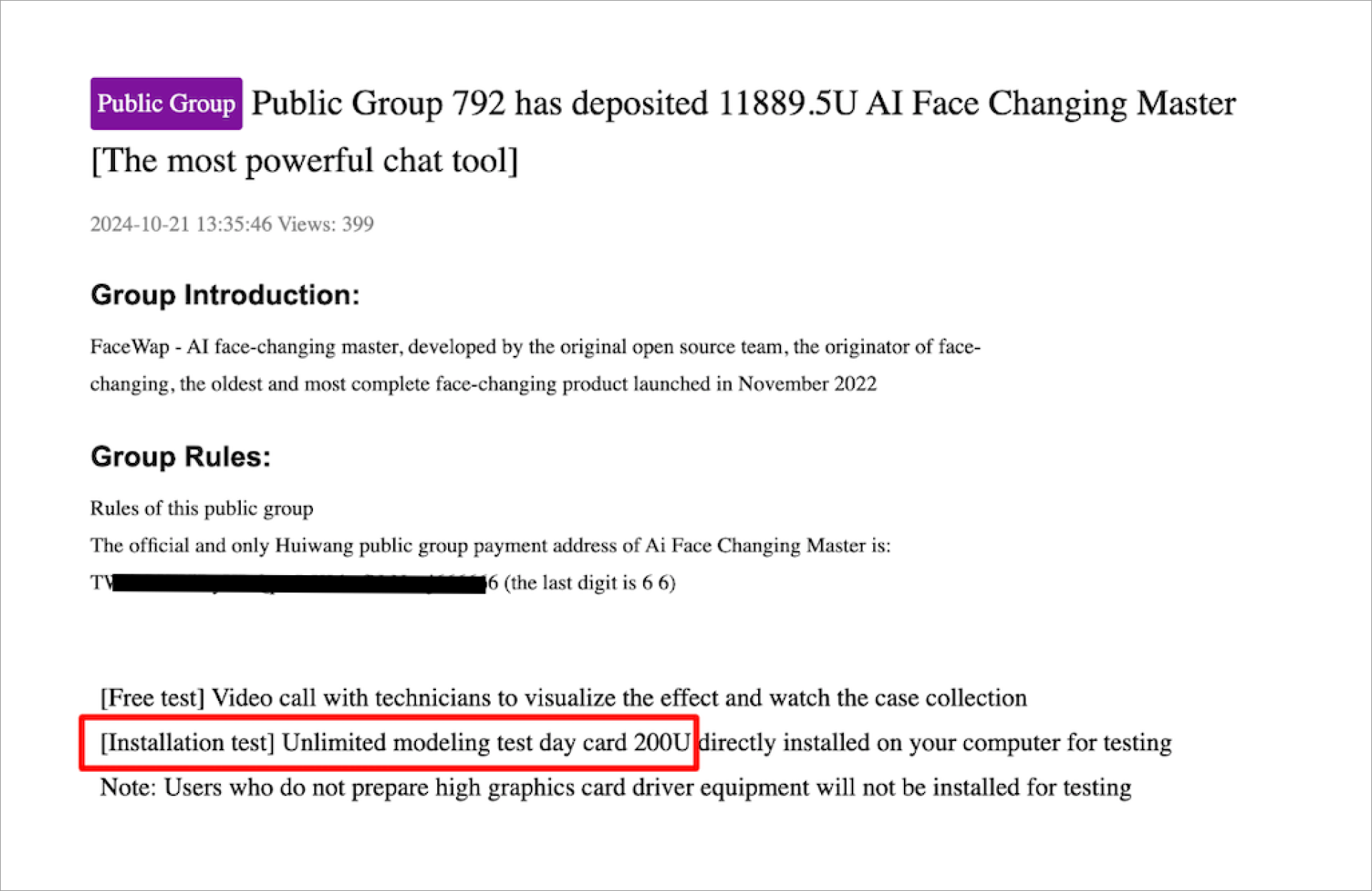

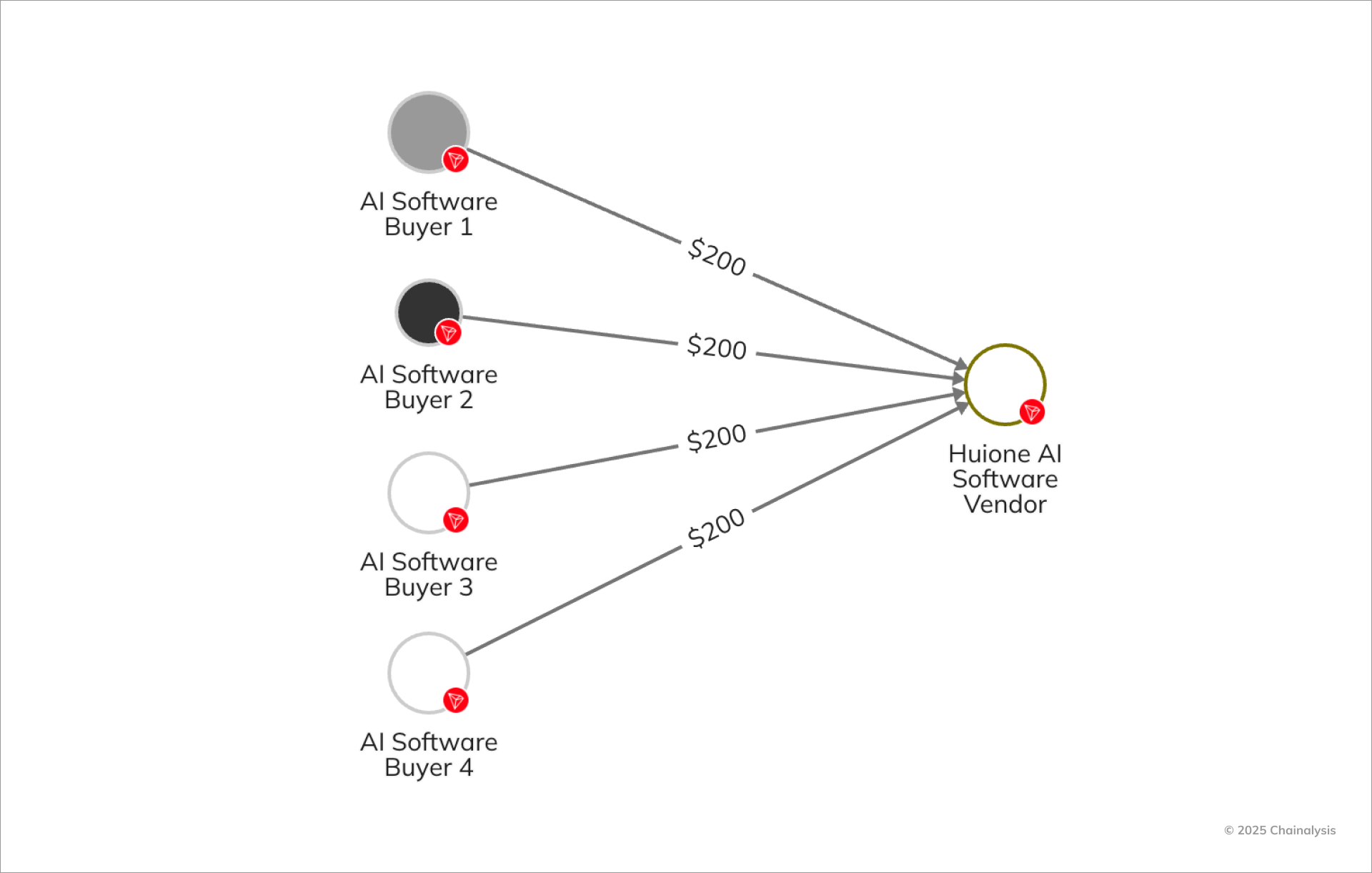

The Huione Guarantee platform hosts dozens of software vendors that provide generative AI technology to facilitate scams. As we see below, one AI vendor on Huione Guarantee advertises AI “face-changing services” for $200 worth of crypto.

On-chain analysis reveals multiple payments sent to the above AI software vendor were consistent with the purchase price, indicating the counterparties are likely AI software buyers and potential scammers. These buyers likely made these purchases after seeing the vendor’s advertisements on Huione Guarantee.

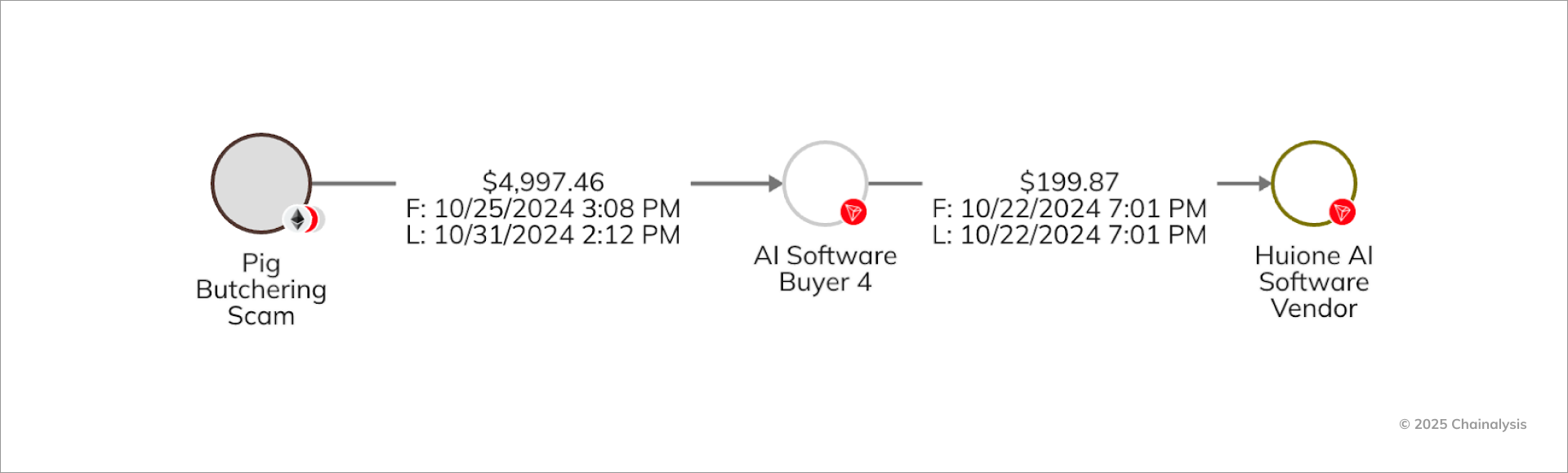

On-chain analysis, visualized below in Chainalysis Reactor, shows AI Software Buyer 4 first received pig butchering scam proceeds on October 25, three days after its AI software purchase on October 22, and another scam proceeds payment nine days later, on October 31. This narrow timeframe highlights how quickly scammers are likely leveraging Huione Guarantee’s technology vendors to execute their scams against their victims.

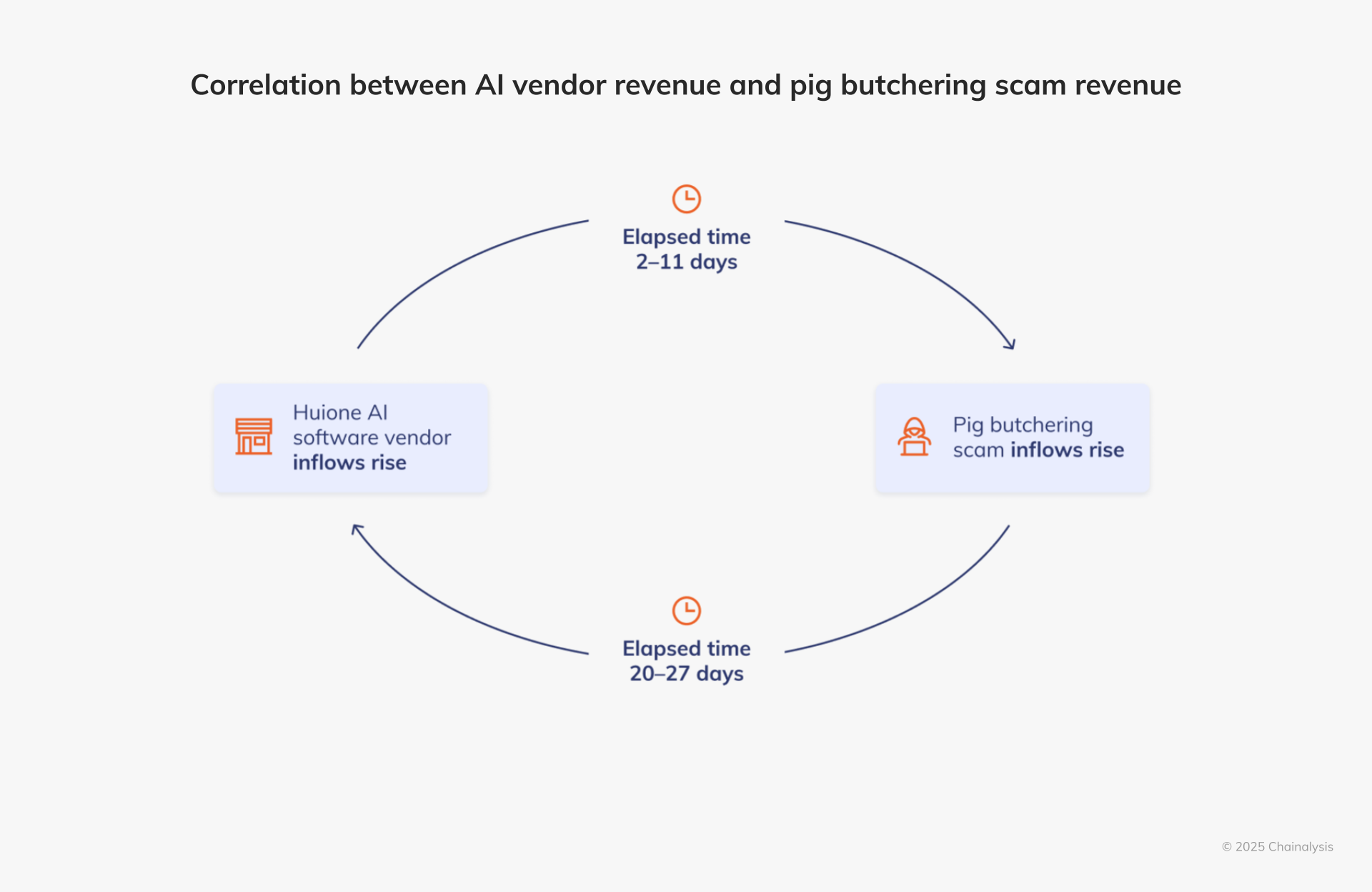

This example aligns with a cyclical pattern observed among Huione AI software vendors and five major pig butchering scams with on-chain exposure to Huoine Guarantee. When Huione AI software vendors see higher inflows, 2-11 days later, inflows rise for the pig butchering scams observed. Subsequently, 20-27 days after that increase, inflows to Huione AI software vendors rise; again, indicating that scammers are likely reinvesting scam proceeds into AI technology to execute new scams.

Last year, Huione launched a blockchain project called Xone, as well as its own USD-pegged stablecoin called “USDH”. Both entities are touted as unblockable and unrestricted by traditional regulatory agencies, likely to overcome asset seizure and freeze. Whether XOC or USDH will become Huione’s preferred means of trading remains to be seen. USDH is currently only available via Huione-affiliated websites, and according to an announcement in October 2024, the Huione Chain team is working with mainstream exchanges to allow the listing of USDH on trading platforms.

The interconnected nature of Huione vendors

A review of on-chain activity in the past year reveals the extent to which Huione vendors used each others’ services. The chart below shows the scale of this great degree of interconnectedness based on transfers within the Huione Guarantee platform.

When examining on-chain interactions in 2024 among vendors and scams on the Huione platform, the chord diagram above shows 2,345 transfers among scams, infrastructure providers, social media management services, AI service vendors, and data vendors. Given the larger width of the colored bands between infrastructure providers and social media management services, those two vendor types had the highest transaction activity in the group, sending funds mostly to each other, indicating frequent use of one another’s services. Scams had moderate transaction activity, paying primarily for social media management services, as did data vendors and AI service vendors, which had the lowest amount of transfers and interaction with the other entities.

Crypto ATMs: A risk vector for fraud payments

Crypto automatic teller machines (ATMs) (also known as Bitcoin ATMs or crypto kiosks) allow users to buy and sell cryptocurrency using an ATM, and have been around for over a decade. While crypto ATMs are used for legitimate purposes, they are also popular among scammers, and in the last few years, the FBI has received thousands of reports about cybercriminals using crypto ATMs to receive payouts for scams. To receive funds from their victims, scammers often impersonate tech and customer support personnel as well as government officials. In the tech scam scenario, the common tactic is urgency: the victim must act quickly to solve an imminent personal crisis by withdrawing cash from their bank and depositing it into a crypto ATM.

Since 2020, the Federal Trade Commission (FTC) has seen a tenfold increase in funds lost in the United States to scammers using crypto ATMs, according to reports from consumers. The FTC found that in just the first six months of 2024, these losses exceeded $65 million with a median reported loss of $10,000 per individual.

Crypto ATM scam case study

Last year, a target living in the Midwest fell prey to a tech support scam in which scammers extracted payment via Bitcoin ATM. The victim had purchased a new laptop compromised by malware. When the victim began using the computer, a malware-initiated popup explained that a virus had infected it, and included a number to call for assistance, which led to a scammer impersonating Microsoft tech support. Ultimately, the scammer convinced the victim that $15,000 was required to resolve the issue.

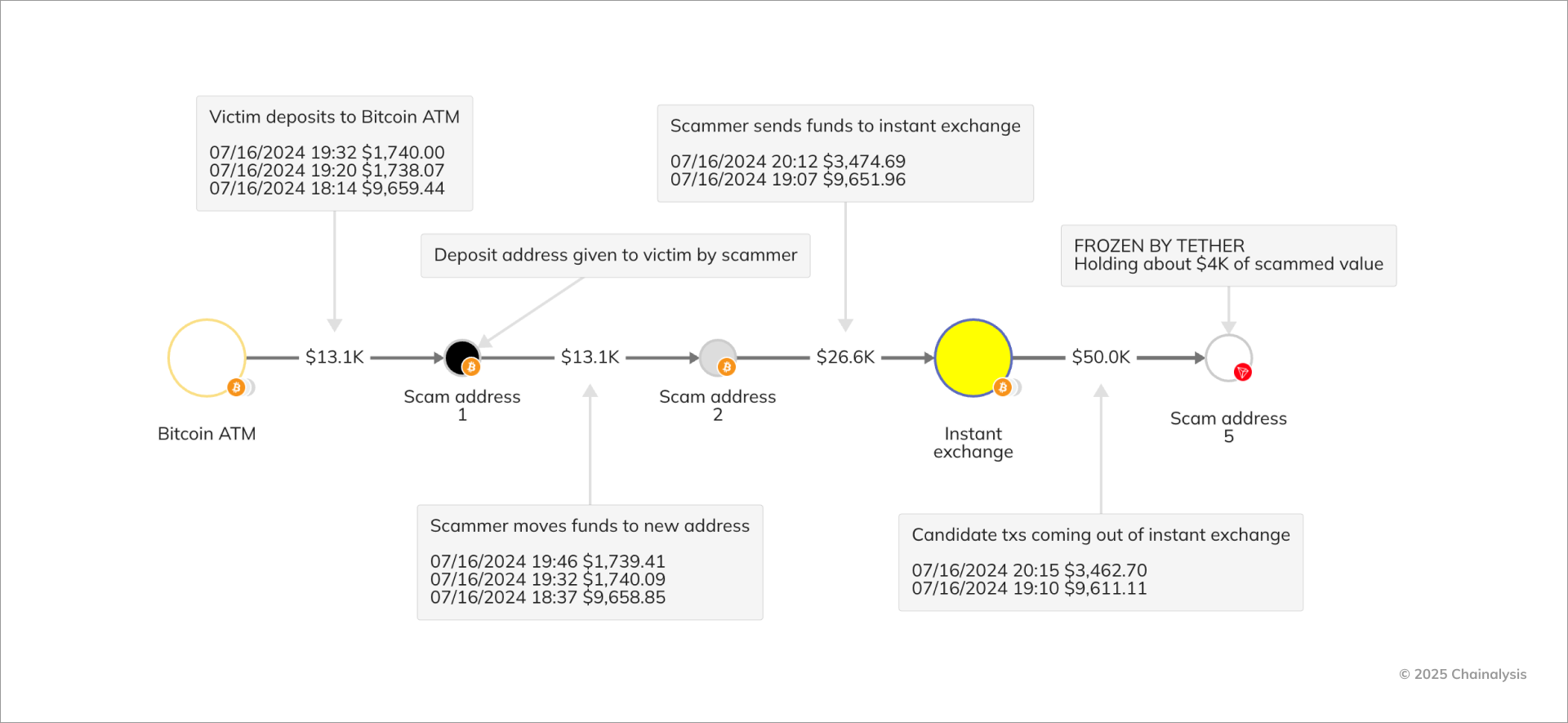

The Reactor graph below shows three deposits the victim made at three Bitcoin ATMs, as instructed by the scammer. After ATM fees, the $15,000 totaled roughly $13,000 on-chain. Upon reflection, before the transactions were even confirmed, the victim returned home and reported the situation to local authorities. Using Chainalysis, investigators found that the scammer sent $13,100 from the original deposit address (Scam address 1) to an intermediary address (Scam address 2) and then onward to an instant exchange where they converted the funds to USDT (Scam address 5).

The county sheriff’s department referred the case to state investigators and an FBI field office, and using the evidence gathered on-chain, brought the case to county court where the scammer was tried in absentia. After a guilty verdict was issued, authorities initiated the recovery process with Tether. When it comes to reporting crypto scams, time is of the essence, and the victim’s quick action helped positively influence the outcome of this case. It’s also key that law enforcement agencies have the knowledge and capabilities to investigate crypto crime.

Loss from crypto ATM scams

The FBI’s Internet Crime Complaint Center (IC3) urges U.S. citizens to report all cyber-enabled crime. Using this data, the agency investigates these crimes, observes criminal trends, attempts to mitigate loss for victims, and works to prevent future cybercrime.

IC3’s 2023 Elder Fraud Report disclosed that it had fielded over 15,000 scam complaints from people over 60, over 2,000 of which involved crypto ATMs. According to the report, “The use of cryptocurrency ATMs and kiosks has continued to increase as a payment mechanism, especially among Tech and Customer Support, Government Impersonation, and Confidence/Romance scams.”

The FBI’s 2023 Cryptocurrency Fraud Report also highlights the increasing prevalence of crypto ATM scams, reporting losses totaling $124.3 million that same year. And since 2020, 43% of crypto-related suspicious activity reports (SARs) have been tied to crypto ATMs, according to a 2024 report by the Financial Crimes Enforcement Network.

The push toward crypto ATM legislation

AARP, an organization dedicated to empowering people as they age, works to educate its audience about the risks of cryptocurrency scams and advocates for stronger consumer protections. Scams involving crypto ATMs are in the top 10 complaints the AARP Fraud Watch Network receives; on average, it fields three to four of these reports daily. Victim profiles transcend gender, and AARP often sees losses totaling in the tens of thousands of dollars or more. While the organization urges victims to submit their own reports via IC3 or local law enforcement, it also shares data with the FTC’s Consumer Sentinel Network, and has strong law enforcement partnerships.

AARP explained that asset recovery for victims of crypto ATM scams is challenging for a few reasons:

- Currently, no one is able to retrieve cash from a crypto ATM once a deposit is made, because transactions are irreversible.

- Business owners with crypto ATMs in their stores can be uneducated about the purpose of these machines, and powerless to help customers who need assistance.

- Police forces are generally not equipped to assist victims of crypto-related crimes, let alone those tied to crypto ATMs, because of a lack of training and resources.

In addition to these challenges, the biggest problem AARP sees with crypto ATMs is the lack of friction around their deployment and usage. When crypto ATM vendors approach business owners about installing crypto ATMs at their locations, vendors not only promise the machine will increase traffic to the store, they assure owners they will not have to maintain the ATM.

When it comes time for consumers to use these machines, friction is nearly non-existent in that process, too. Crypto ATMs are often placed in the back corner of convenience, liquor, or vape stores, and have few of the protections or security of fiat currency ATMs — like cameras and daily transaction limits. Guidance about what the machines are for, and the risks associated with them, is also limited.

Amy Nofziger, AARP Fraud Watch Network’s director of victim support says, “There needs to be more transparency for business owners about what crypto ATM machines are used for and the risks they pose.”

Francoise Cleveland, government affairs director at AARP, agrees. One victim calling the Fraud Watch Network Helpline had so much cash to deposit that it took her two hours. Cleveland said, “On noticing her discomfort, rather than raising concern about what she was doing, employees offered her a chair so she could sit down while she finished making her deposit.” In another case, a victim who had fallen prey to a scam was robbed as he approached a crypto ATM to make a deposit. Cleveland also learned of a scammer who pretended to be the owner of a store in which a crypto ATM was located and compelled one of the store’s employees to withdraw $3,000 from the register and deposit it into the machine.

Clark Flynt-Barr, government affairs director, financial security at AARP says, “While education is important, we can’t educate our way out of this problem, but change is possible by putting regulation in place to protect consumers.” She says that while some crypto ATM providers have tiered compliance programs, others are not compliant with federal regulations and aren’t doing as much as they should to prevent victim loss. Flynt-Barr pointed to the example of Money Gram and Western Union, formerly preferred channels for criminal wire transfers, and how protections the U.S. government enacted to help consumers made a difference.

As AARP advocates for consumer protections around crypto ATMs, here are some measures the organization believes could mitigate crime in the US:

- Crypto kiosk operators could flag an address for investigation that has received funds from crypto ATMs several times in a few hours.

- Lawmakers could:

- Implement daily transaction limits, in particular for new customers, to limit the potential losses to fraud.

- Require that crypto ATM operators refund fees associated with fraudulent transactions.

- Require that all crypto ATMs include disclosures about how much fees cost, exchange rates, and warnings that criminals sometimes use the technology to facilitate scams.

- Introduce some of the controls around crypto ATMs that exist around ATMs

In September of 2024, the U.S. Senate Committee on the Judiciary sent a letter endorsed by seven senators to the 10 largest crypto kiosk providers, urging those companies to “to take immediate action to address troubling reports that your Bitcoin ATMs (BTMs) are contributing to widespread financial fraud against elderly Americans.”

Meanwhile, several states have been working to enact legislation to protect consumers from scams facilitated by crypto ATMs. States like California and Vermont passed daily transaction limits of $1,000. Many states are requiring that vendors register as money transmitters in the state, enacting fee regulations, and requiring written disclosure notices both for business owners where kiosks are installed, and any consumers using them. So far, the most restrictive legislation comes from New Jersey, proposing a statewide ban on crypto ATMs. Here’s a list of crypto ATM legislation that some states have passed:

States that have passed crypto ATM legislation

| State | Bill | Status |

|---|---|---|

| CA | Digital Financial Assets Law: Information for Kiosk Operators | Effective, 01/01/24 |

| CT | 5211: An act concerning virtual currency and money transmission | Passed, 01/06/24 |

| MN | New Minnesota crypto law goes into effect to protect consumers against fraud | Effective, 08/01/24 |

| VT | 110: An act relating to banking, insurance, and securities | Effective, 07/01/24 |

As for regulatory measures in Europe, Markets in Crypto-Assets Regulation (MiCA) went into effect last year and reinforces existing EU and national anti-money laundering (AML) laws. Ahead of MiCA’s rollout, last year, French regulators, including the French Financial Markets Authority (AMF) and the Paris inter-regional jurisdiction (JIRS), conducted search and seizure operations targeting unregistered crypto ATMs amid concerns they were being used for money laundering. French law dictates that these ATMs must be registered as digital asset service providers.

German authorities have also been cracking down on unregistered crypto ATMs. In August of 2024, Germany’s Federal Financial Supervisory Authority (BaFin) seized roughly €25 million from unregistered crypto ATMs across the country. Similarly, in September of 2024, the UK’s Financial Conduct Authority (FCA) charged an individual living in London for operating crypto ATMs without FCA registration. This operation was part of an ongoing effort by UK authorities to disrupt unregistered crypto ATMs, first announced in 2022.

In Türkiye, the Capital Markets Law was amended to include crypto assets in July 2024, which required that all crypto ATMs end operations within three months of the law coming into effect, i.e., by October 2024. It was further clarified that those that failed to comply would be shut down by the local authorities, with penalties for continued operations.

Across APAC, a number of regulators, such as in Singapore and Malaysia, have also taken steps to prohibit the operation of crypto ATMs. In Hong Kong, crypto ATMs would fall within the scope of the planned regulatory framework for OTC crypto businesses, which would include AML/CFT requirements. In Australia, the country which reportedly hosts the world’s third highest number of crypto ATMs, the Australian Transaction Reports and Analysis Centre (AUSTRAC) has announced plans to tighten monitoring of crypto ATM providers.

As broader cryptocurrency regulation evolves worldwide, the question of who should be liable when victims are scammed is increasingly entering the conversation. For instance, the UK introduced legislation requiring that crypto businesses compensate victims of APP fraud facilitated by these platforms. Other countries are requiring firms to take more responsibility for frauds such as hacks. The policy landscape may be shifting towards making stakeholders more accountable across all fronts.

In the absence of regulation and compliance, crypto ATMs remain a well-known risk vector for illicit activity. The good news is their transactions are also transparent and traceable.

Global enablement, collaboration, and regulation are keys to fraud prevention

The analysis of 2024’s crypto scams reveals a complex and evolving landscape. Platforms like Huione Guarantee enable the sophistication and professionalization of the scam ecosystem, and highlight the persistent and adaptive nature of these illicit activities. The potential of AI technology to exponentially scale crypto scams further adds to the challenges associated with combating these crimes.

Both fraud detection and compliance rely on granular, real-time data. Combining Alterya’s AI-powered fraud detection with the Chainalysis blockchain intelligence platform will enhance visibility into potential scam-related transactions, improving fraud prevention and enforcement capabilities. As scams continue to evolve, investigators need access to deeper intelligence, faster insights, and specialized expertise to detect and disrupt these emerging threats.

Efforts to combat scams must focus on both prevention and enforcement, requiring stronger investigative resources and greater enablement of government agencies and local authorities. Regulatory measures, such as those discussed for crypto ATMs, play a role in mitigating scam risk and protecting consumers. But effective disruption also requires collaboration between law enforcement, regulators, and the private sector.

A recent example is Operation Spincaster, a Chainalysis-led initiative that brings together public and private sector organizations to disrupt and prevent scams. Through our advanced blockchain tracing capabilities, data and targeted training, investigators identified and traced thousands of compromised wallets amounting to over $187 million in losses, demonstrating how a coordinated, intelligence-led ecosystem approach can disrupt scam infrastructure and support victims.

Combatting crypto scams at scale requires sustained efforts from government agencies, regulators and organizations. Chainalysis works alongside these organizations to build investigative capacity, enhance intelligence, and empower investigators with the technology needed to stay ahead of emerging threats.

As scammers continue to adapt, so must regulators and authorities to safeguard individuals and the broader financial system from these threats. Learn more about how Chainalysis supports leading organizations in the fight against crypto scams and other illicit blockchain activity worldwide.

End notes:

[1] These numbers include the platforms Huione Guarantee, Huione Pay, and all vendors advertising through Huione platforms.

This material is for informational purposes only, and is not intended to provide legal, tax, financial, or investment advice. Recipients should consult their own advisors before making these types of decisions. Chainalysis has no responsibility or liability for any decision made or any other acts or omissions in connection with the use of this material.

Chainalysis does not guarantee or warrant the accuracy, completeness, timeliness, suitability or validity of the information in this report and will not be responsible for any claim attributable to errors, omissions, or other inaccuracies of any part of such material.