Want to see the full index ranking for all countries?

Get the 2024 Geography of Cryptocurrency Report

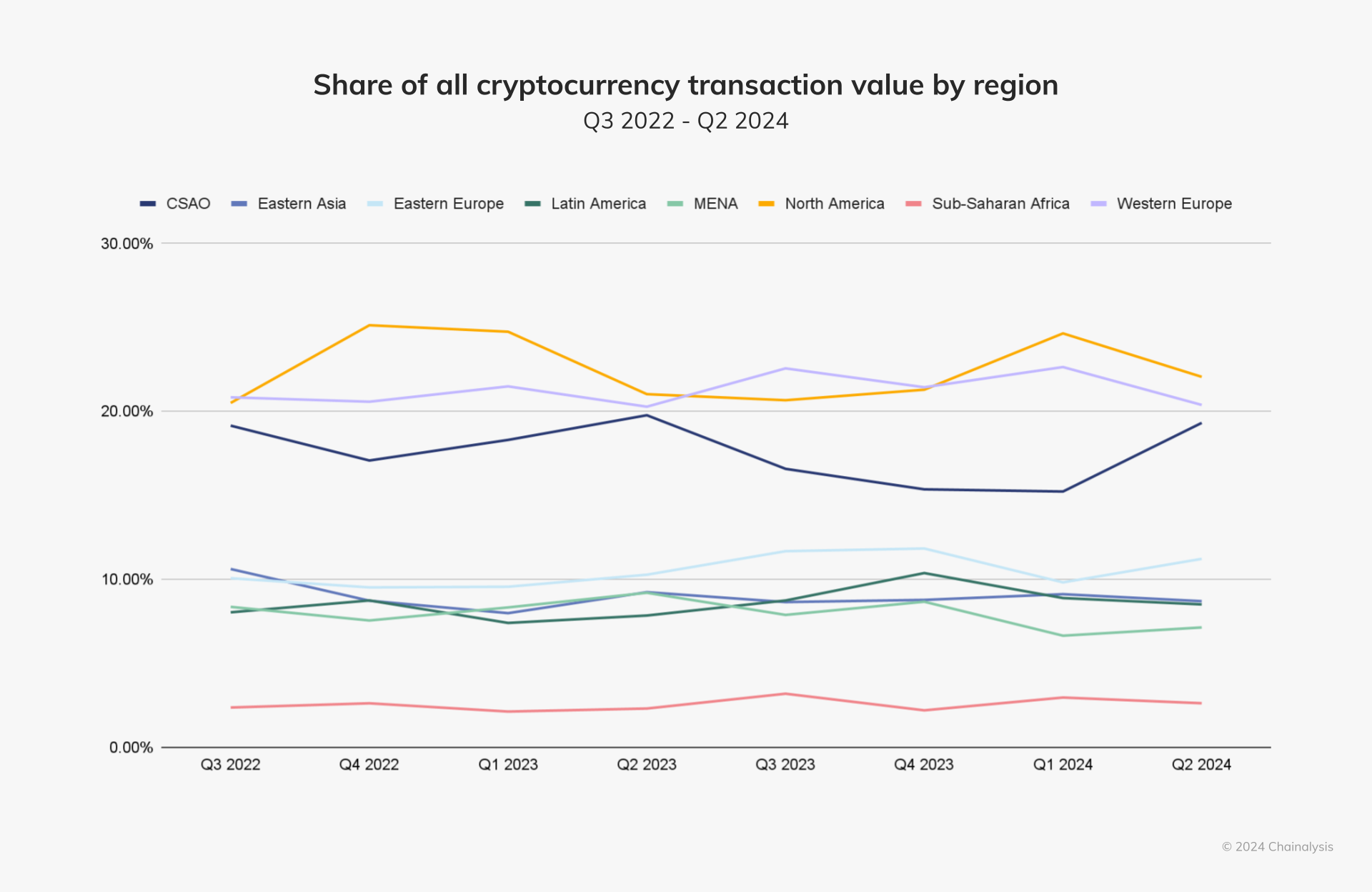

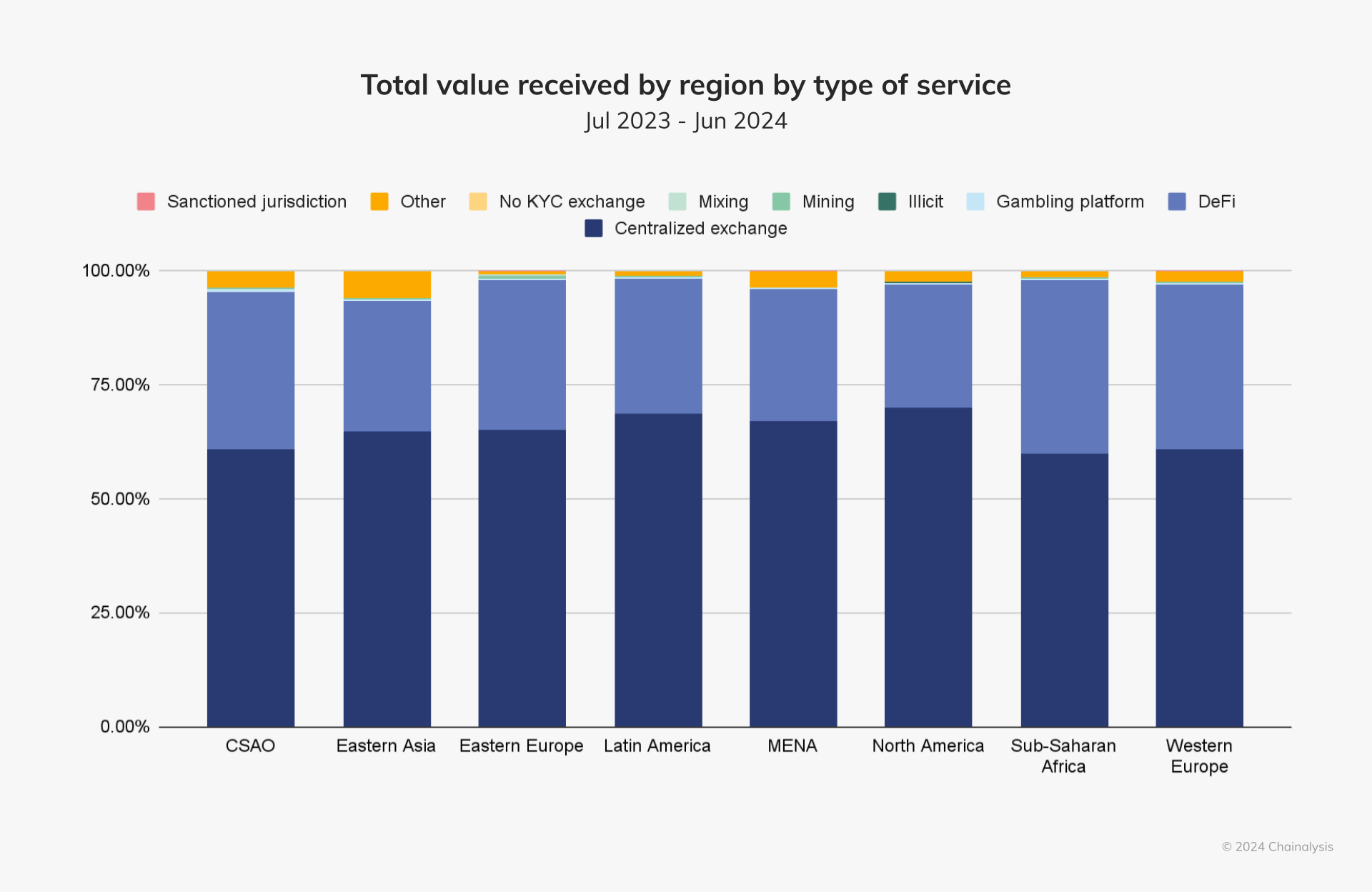

As the fourth largest cryptocurrency market, Eastern Europe received $499.14 billion in value on-chain between July 2023 and June 2024, or 11% of the total share of crypto received globally. Centralized exchanges (CEXes) received the most crypto in the region at nearly $324 billion, and DeFi activity grew significantly in the past year with $165.46 billion in crypto, a third of the region’s inflows.

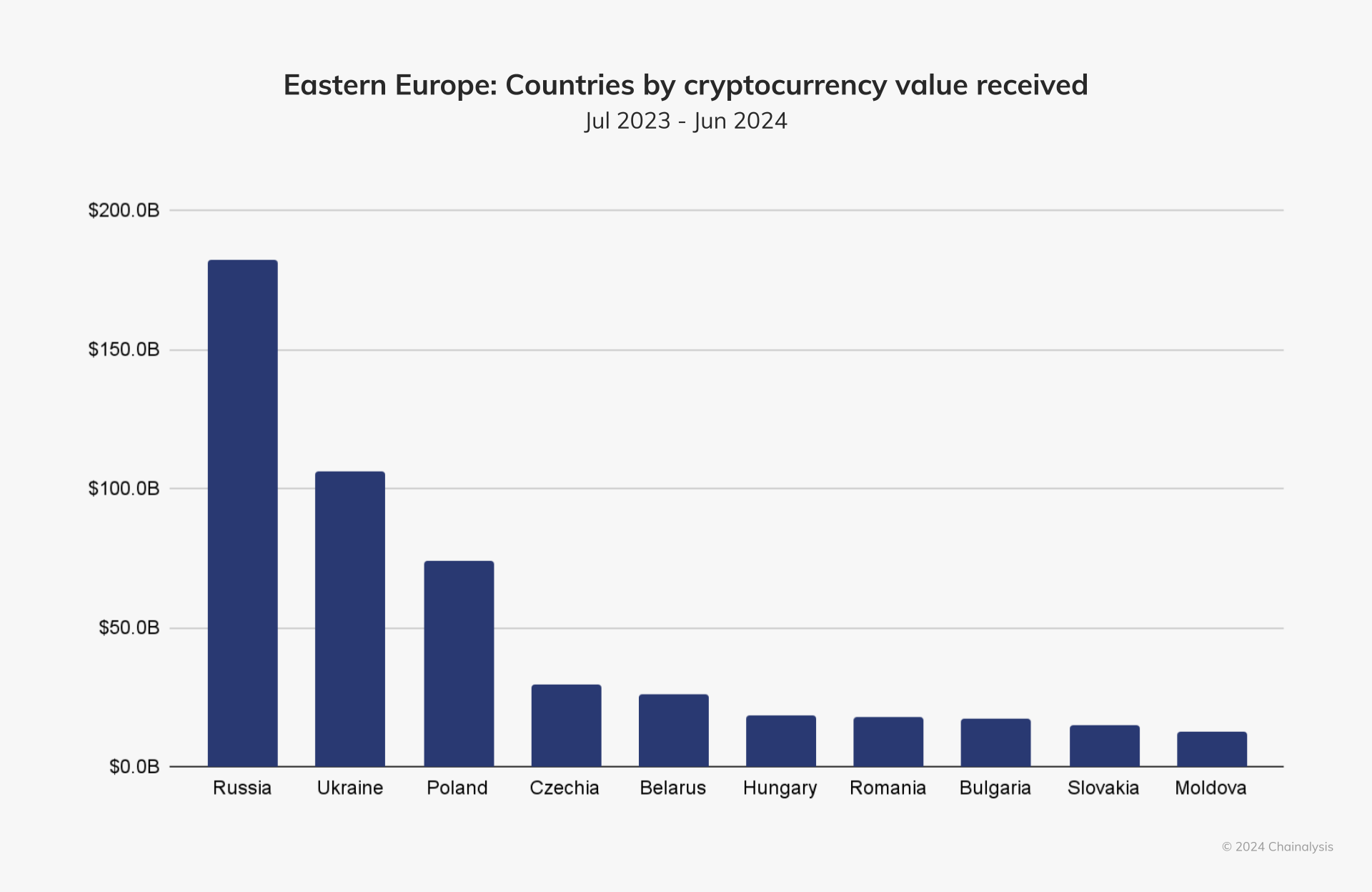

In this year’s global crypto adoption index, regional leaders Ukraine and Russia ranked 6th and 7th, respectively, with Russia advancing six places from last year’s ranking. That both countries’ crypto markets are thriving is remarkable given the ongoing war and intensifying international sanctions regime against Russia, which led Eastern Europe with $182.44 billion in crypto inflows as shown below. Ukraine followed, receiving $106.1 billion in crypto.

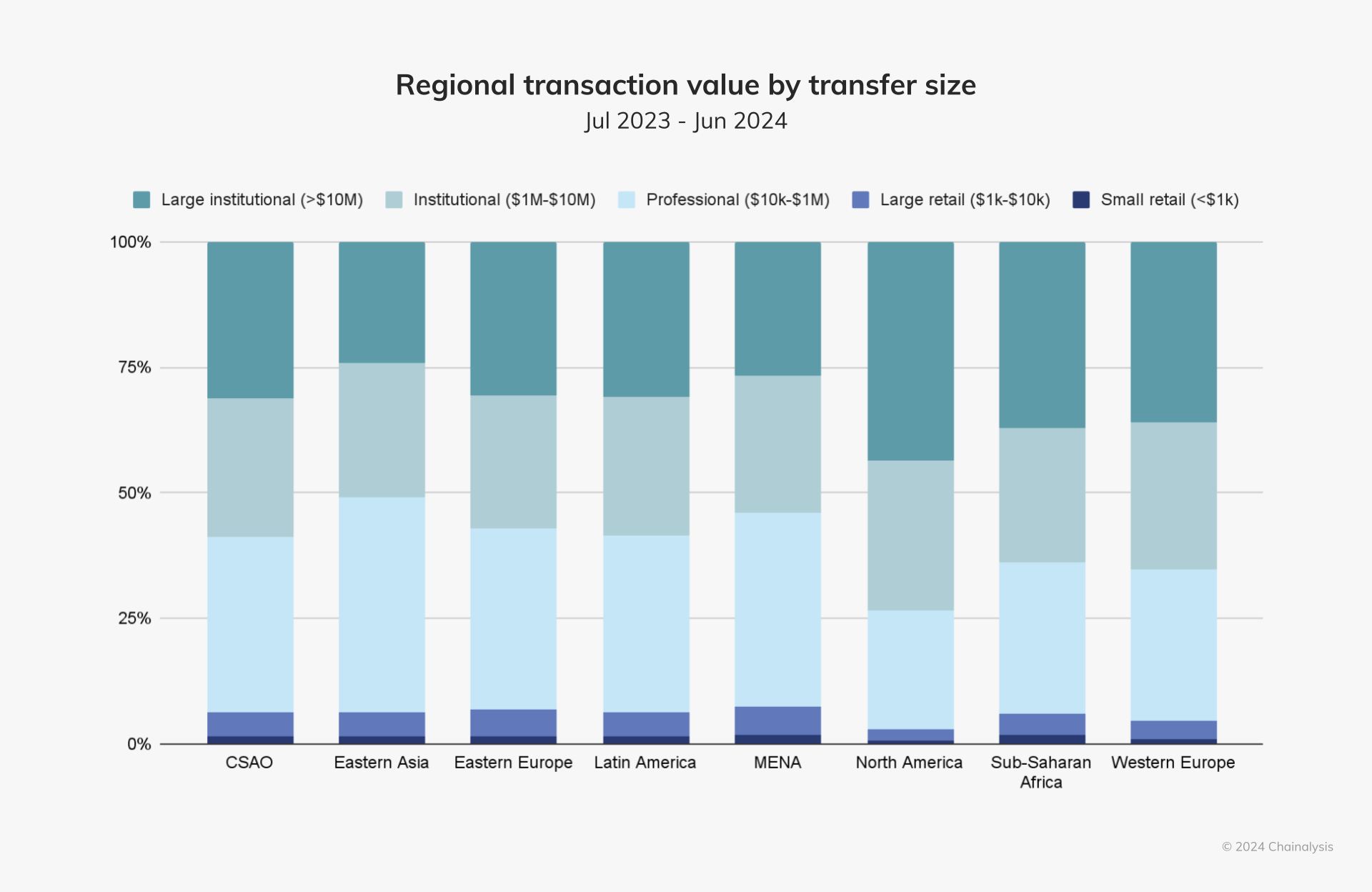

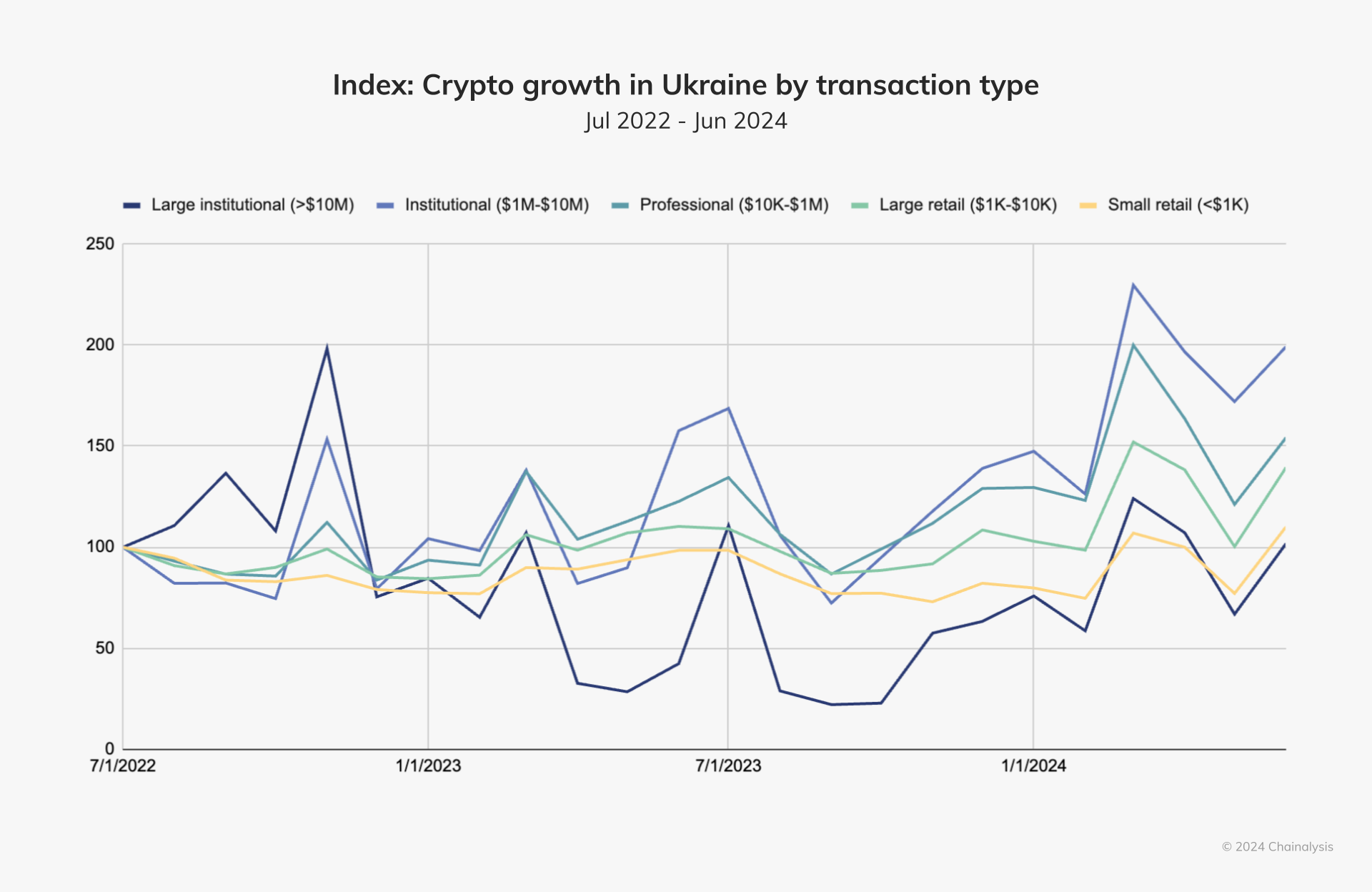

In Ukraine, institutional and professional transfers drove a large portion of its crypto market growth, a noteworthy development given the country’s evolving regulatory situation.

To gain regional perspective on this trend, we spoke with WhiteBIT, a crypto exchange with roots in Ukraine and currently headquartered in Lithuania, with a total of eight offices globally. Despite the war, WhiteBIT maintains a strong presence in the region, along with other CEXes, although some of them may have relocated operations to other Eastern European countries due to security concerns.

“Institutional and professional crypto transfers in Ukraine have surged as many seek financial stability amid the ongoing war, with cryptocurrencies viewed as a safer alternative,” the organization said. “This trend is influenced by global factors like market volatility, inflation, and war-related sanctions, alongside growing institutional interest in Bitcoin ETFs from firms such as BlackRock.”

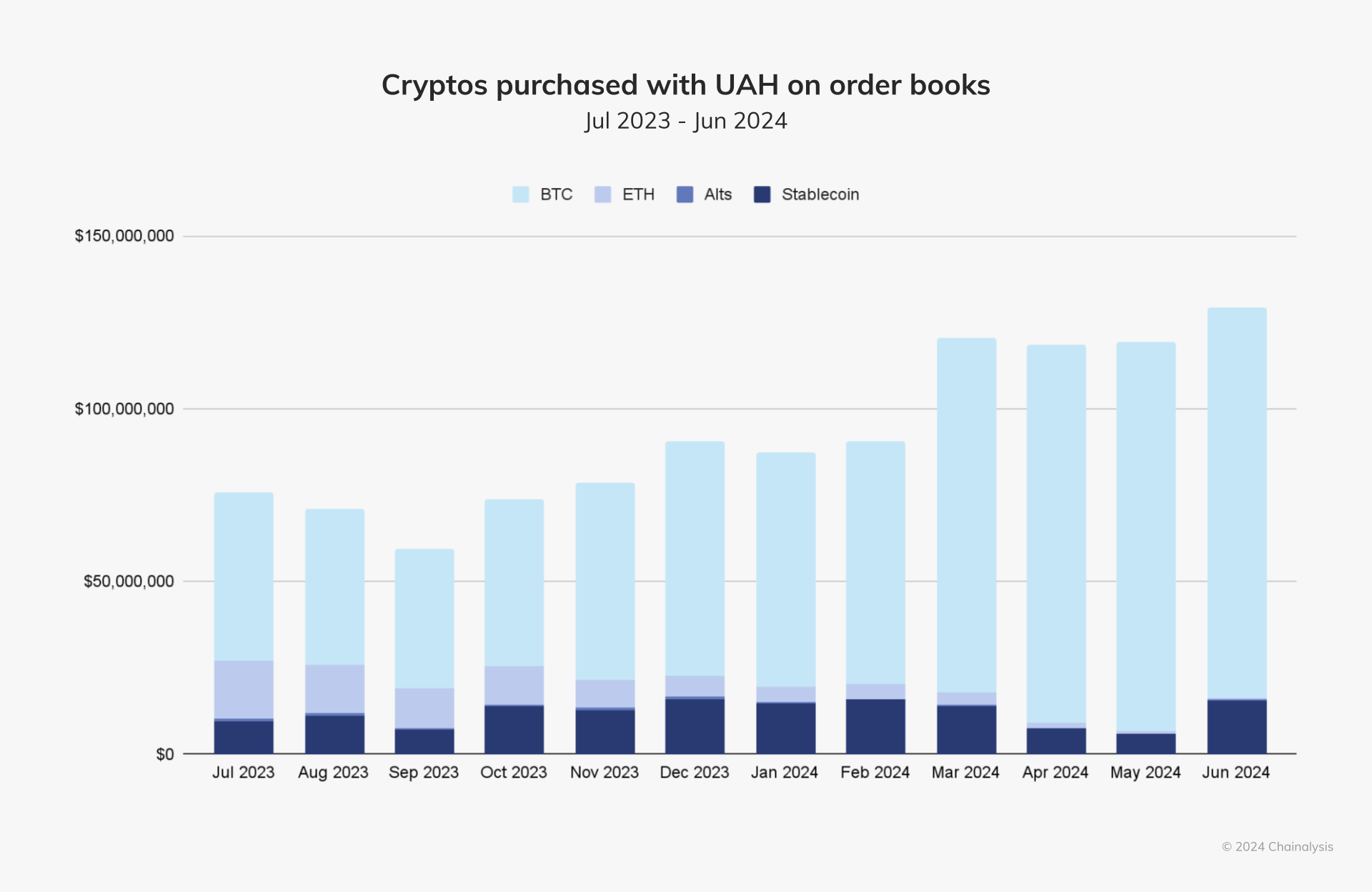

BTC purchases using Ukrainian hryvnia grow

A review of order book data — a list of buy and sell orders for an asset or security — shows that Bitcoin (BTC) purchases using the Ukrainian hryvnia (UAH) have grown in the past year, totaling $882.64 million.

This follows a peak in UAH inflation at 26.6% in December 2022, and a steady decline in inflation in Q1 2023. Because consumer purchasing behavior typically lags behind economic trends, Ukrainians may have been pursuing BTC as an alternative store of value to the UAH.

“Amid economic uncertainty, BTC is seen as a safer long-term investment compared to the volatile national currency,” WhiteBIT said. “BTC liquidity and security make it more attractive for both institutional and individual investors in Ukraine, who seek stability and long-term value preservation amid ongoing war and economic instability.”

Russia-based homegrown services grow in popularity

Russia continues to receive large volumes of cryptocurrency from domestic and foreign sources. Last year, we reported a growth in homegrown services in Russia, a trend that has remained steady this year. The index of growth for local services in Russia (below) examines the average share of web traffic — defined as a greater than a 50% share — to Russia-based services in the past two years. While visits to CEX websites have remained relatively flat, those to Russian-language no KYC exchange websites have risen, peaked mid-last year, and are now holding steady. This could be in part due to the expansive sanctions against major Russian financial institutions, driving Russian nationals to more broadly use these types of services, where they can on- and off-ramp fiat from their sanctioned Russian banks to crypto.

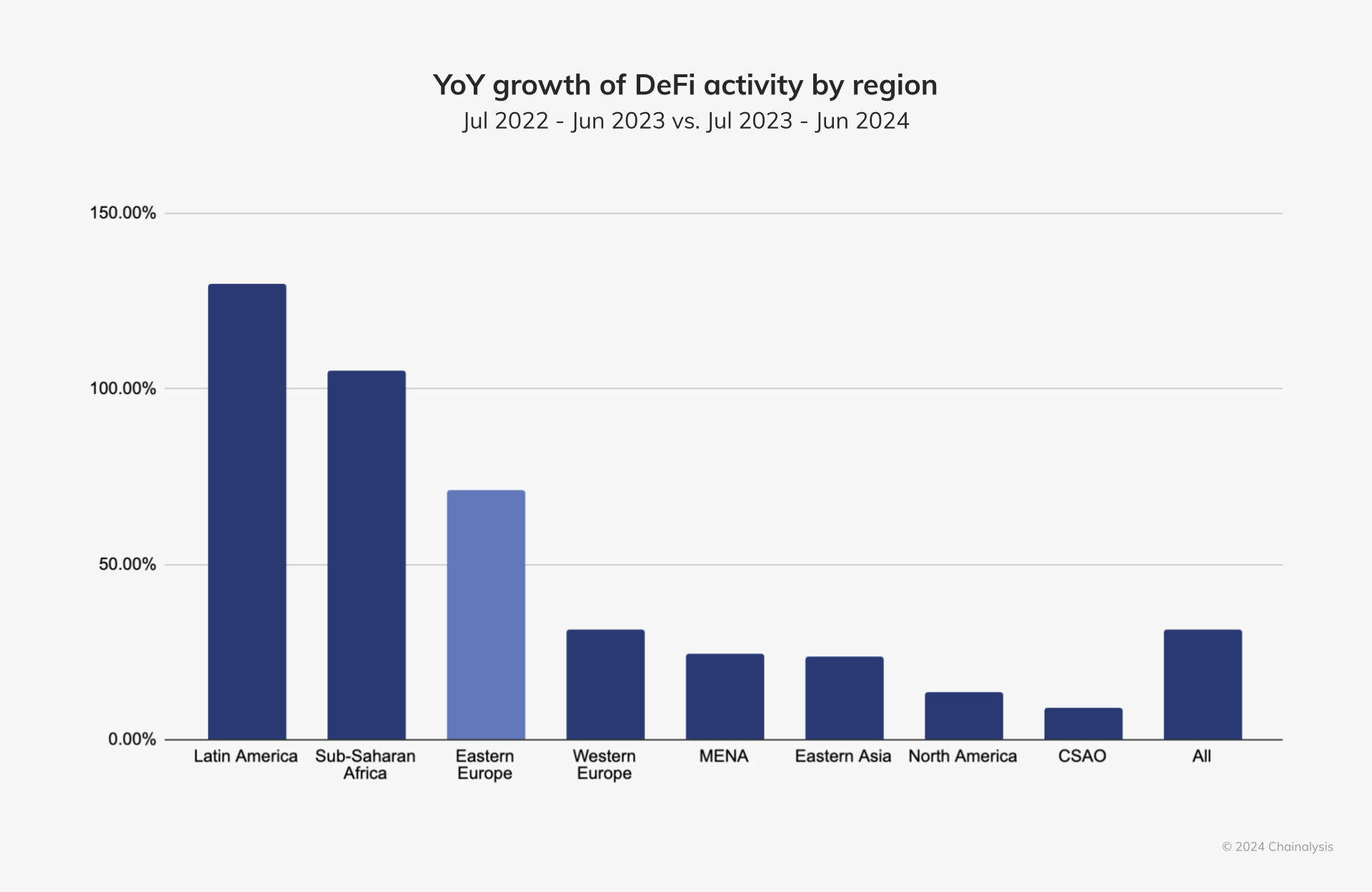

That reality aside, let’s discuss a potential positive growth indicator for Eastern Europe: a substantial increase in DeFi activity.

DeFi activity grew nearly 40% YoY in Eastern Europe

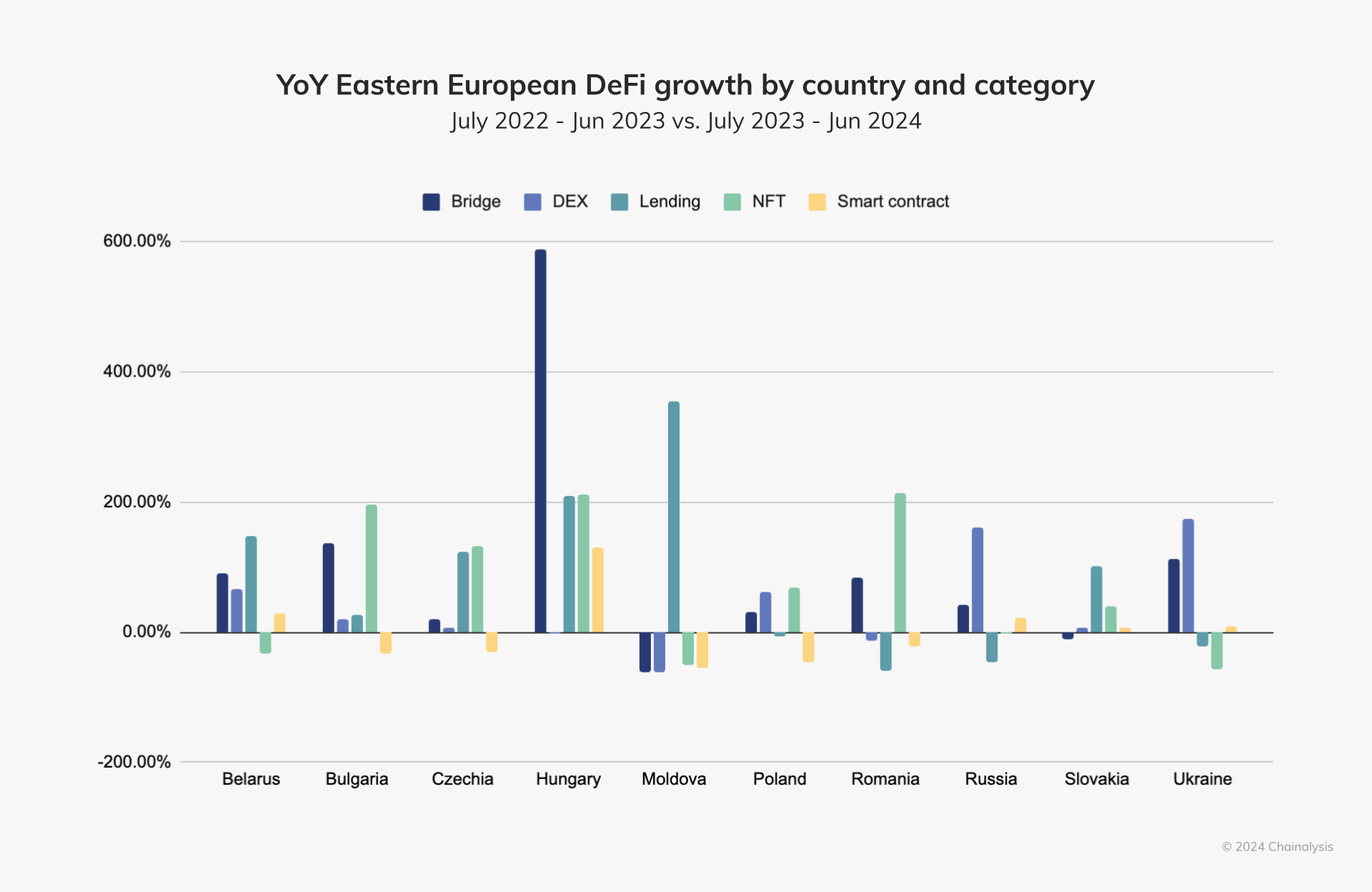

In the past year, DeFi activity accounted for over 33% of total crypto received for Eastern Europe. And when looking at YoY DeFi growth worldwide, Eastern Europe placed third globally, behind Latin America and Sub-Saharan Africa.

In Eastern Europe, decentralized exchanges (DEXes) saw by far the greatest increase in crypto inflows — particularly in Ukraine, Russia, Poland, and Belarus. Regionwide, DEXes received $148.68 billion in crypto. Crypto sent to DEXes in Ukraine and Russia grew by 160.23% and 173.88%, respectively, with Ukrainian DEXes receiving $34.9 billion and Russian DEXes, $58.4 billion. Several countries, such as Moldova, Hungary, and Czechia, also saw a rise in DeFi lending services, which received $11.29 billion in crypto.

While countries like Hungary and Moldova saw explosive growth in bridges and lending, given their relatively small markets, crypto inflows to those categories only accounted for a fractional share of the region’s total DeFi volume. For instance, Hungary’s nearly 600% increase in crypto sent through bridges amounted to $151 million in crypto. While not an insignificant sum, comparing Hungary’s bridge inflows to Ukraine’s — $897 million— puts the figure into regional context. NFT growth also surged in some countries, but accounted for a mere $6.9 million of Eastern Europe’s total DeFi inflows.

Token smart contracts (i.e., those that leverage ERC-20 tokens, as well as popular stablecoins, such as USDT and USDC) were not included in the above chart because all Eastern European countries experienced a notable decline in this category, mirroring a regional decrease in stablecoin volumes. Most other regions saw sustained growth in stablecoins, and WhiteBIT believes that regulatory uncertainty and geopolitical tensions could be contributing to Eastern Europe’s move away from stablecoins.

As for Ukraine’s decline in stablecoin usage, Anna Tutova, CEO at crypto news media group and PR-consulting agency, Coinstelegram, had this to say. “Many people in Ukraine buy crypto for investment purposes, so this may be the reason for the reduction in use of stablecoins. At the same time many people in Ukraine use stablecoins purely for P2P transactions, as money, a payment method and an easy tool for cross-border transfers and they may not use it for investments at all. Stablecoins are often used as a store of value in countries with volatile currencies, or as a way for financial inclusion for the unbanked population. In Ukraine and other Eastern European countries there is no need for that, as most of the population has bank accounts and local currencies are more or less stable. Of course, because of the war and generally over the years Ukrainian hryvnia lost its value significantly, but people tend to exchange their savings in hryvnia to dollars. Before December 2023 there were limits on buying foreign currency in Ukraine, but in December 2023 they were levied.”

Both institutional use and grassroots crypto adoption take hold in Ukraine and Russia

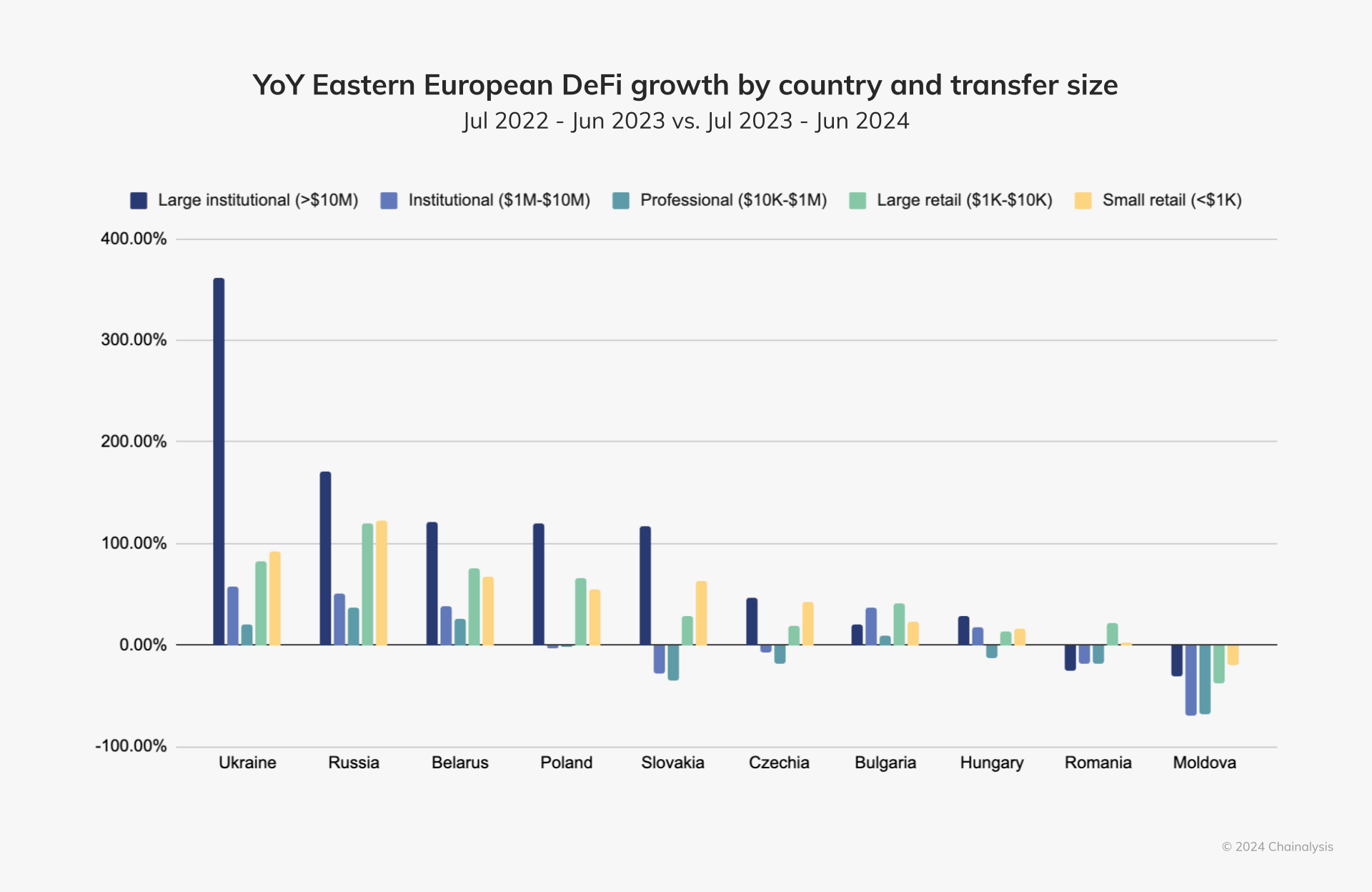

DeFi transaction sizes for the past year reveal two key trends, particularly among regional leaders, Ukraine and Russia. Ukraine saw a 361.49% increase in large institutional transactions (i.e., those greater than $10M), which drove most of its DeFi growth. Similarly, Russia, Belarus, Poland, and Slovakia saw the greatest DeFi growth with large institutional transfers.

Conversely, Ukraine had a significant increase in large retail transactions (those between $1K-10K) and small retail transactions (those less than $1K), which rose 82.29% and 91.99%, respectively. Small retail transactions typically indicate grassroots adoption, and given the region’s geopolitical instability and Ukraine’s recent recovery from inflation, these smaller transactions could demonstrate investors using crypto to bolster everyday purchasing power.

That this is happening with DeFi presents another consideration: while an increase in DeFi activity typically indicates that a crypto market is maturing, investors may also be turning to DeFi because it offers greater ease, speed, and control over one’s assets in transacting than operating through CEXes. When crypto users face regulatory uncertainty, they may choose the path of least resistance.

The future of crypto in Eastern Europe

This past summer, the EU began its rollout of Markets in Crypto-Assets Regulation (MiCA) with the applicability of its so-called stablecoin regime starting on June 30, 2024. On December 30, 2024, MiCA will be fully applicable to all crypto-asset service providers operating within the EU. By all indications, Ukraine is working towards adopting MiCA standards given its candidacy for EU membership.

“Embracing blockchain technology and integrating crypto-assets into a regulatory framework could be a major step forward for Ukraine’s efforts to support its economy, particularly during the ongoing war with Russia,” says Oleksandr Bornyakov, Deputy Minister of Digital Transformation of Ukraine on IT industry development. “A regulated crypto economy can generate tax revenue to the government, attract and retain startup talents, and position the country as a competitive player in the global digital economy. Well-designed crypto legislation will help move the crypto industry out of the so-called ‘gray area’ and into a legal framework, enhancing both legitimacy and trust in this emerging market.”

Responding to Western sanctions and fears of difficulty in trading with countries like China, the Russian government passed legislation in September to legalize crypto mining and to allow the use of crypto for international payments, following a years’ long crypto ban. Officials at the Central Bank of Russia and Russian lawmakers have explicitly singled out a strong desire to reduce reliance on the U.S. dollar to mitigate the effects of the sanctions that were put in place as a consequence of its invasion of Ukraine.

As for crypto’s future in Eastern Europe, WhiteBIT had this to say. “Given the rapid evolution of blockchain technology and the increasing focus on regulatory frameworks, we are confident that the crypto industry holds immense growth potential. Eastern Europe, as part of the global market, is emerging as a pivotal region for blockchain adoption. This is a time of opportunity, where embracing new regulations and technological advancements can become a catalyst for the development of digital assets across the region.”

A regulator in Ukraine shares this optimism. “From the perspective of promising areas for digital assets in Eastern Europe, we believe that Ukraine has the potential to become a key player, considering the high level of adoption and interest in cryptocurrencies,” said Yurii Boiko, Commissioner at Ukraine’s National Securities and Stock Market Commission. “We have a multi-million population with a high level of IT literacy, a continually expanding digitalization in the country, strong technological ecosystems, and a drive for innovation. Combined with a favorable regulatory environment, which we are actively working on establishing, this will enable Ukraine to become a future driver of the development and implementation of digital assets in the Eastern European region.”

We’ll continue monitoring trends to see how MiCA and other regulatory efforts affect Eastern European crypto adoption in the coming year.