Every year, we publish our estimates of illicit cryptocurrency activity to demonstrate the power of blockchains’ transparency – these kinds of estimates aren’t possible in traditional finance – and to teach investigators and compliance professionals about the latest trends in cryptocurrency-related crime that they need to know about. What could those estimates look like in a year like 2022? Last year was one of the most tumultuous in cryptocurrency history, with several large firms imploding, including Celsius, Three Arrows Capital, FTX, and others — some amid allegations of fraud.

Those allegations make this year’s Crypto Crime Report a bit tricky, as some feel that those businesses should be treated as criminal enterprises. Ultimately though, we don’t include their transaction volumes in our measures of illicit activity because our estimates are based solely on on-chain intelligence — we don’t account for instances where, for example, off-chain bookkeeping may have been fraudulent. Plus, the bankruptcy and criminal cases associated with these collapses are still ongoing, so for the time being, we’ll leave questions of criminality to the legal system.

The events of this year have made clear that although blockchains are inherently transparent, the industry has room for improvement in this respect. There are opportunities to connect off-chain data on liabilities with on-chain data to provide better visibility, and the transparency of all transactions on-chain in DeFi is a standard that all crypto services should strive to achieve. As more and more value is transferred to the blockchain, all potential risks will become transparent, and we will have more complete visibility.

For now though, we’ll continue to focus on illicit activity that can be measured on-chain. Let’s look at how the market tumult of 2022 affected cryptocurrency-based crime.

See endnote [1] for notes on this chart.

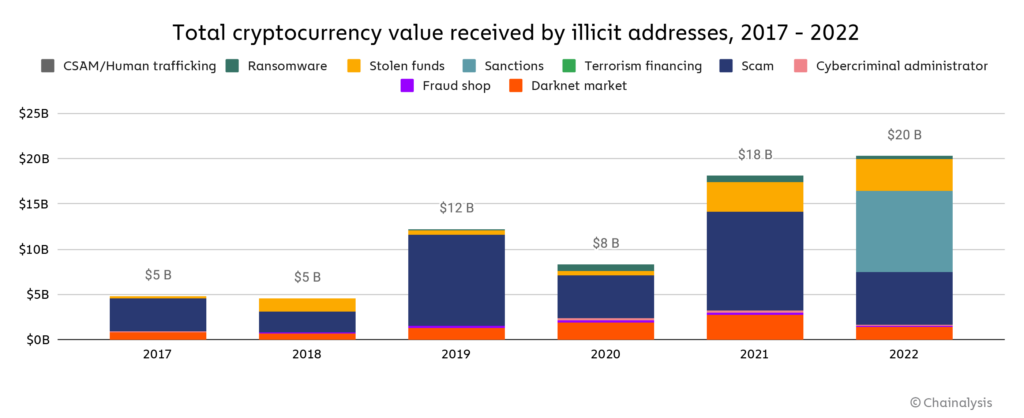

Despite the market downturn, illicit transaction volume rose for the second consecutive year, hitting an all-time high of $20.1 billion. We have to stress that this is a lower bound estimate — our measure of illicit transaction volume is sure to grow over time as we identify new addresses associated with illicit activity, and we have to keep in mind that this figure doesn’t capture proceeds from non-crypto native crime (e.g. conventional drug trafficking involving cryptocurrency as a mode of payment). For example, last year we published that we found $14 billion in illicit activity in 2021 — we’ve now raised that figure to $18 billion, mostly due to the discovery of new crypto scams.

It’s also worth keeping in mind that 44% of 2022’s illicit transaction volume came from activity associated with sanctioned entities, in a year when OFAC launched some of its most ambitious and difficult-to-enforce crypto sanctions yet. Crypto exchange Garantex, which accounted for the majority of sanctions-related transaction volume last year, is a great example. OFAC sanctioned Garantex in April 2022, but as a Russia-based business, the exchange has been able to continue operating with impunity. Transactions associated with Garantex or any other sanctioned crypto service represent, at the very least, substantial compliance risk for businesses that are subject to U.S. jurisdiction, including fines and potential criminal charges.

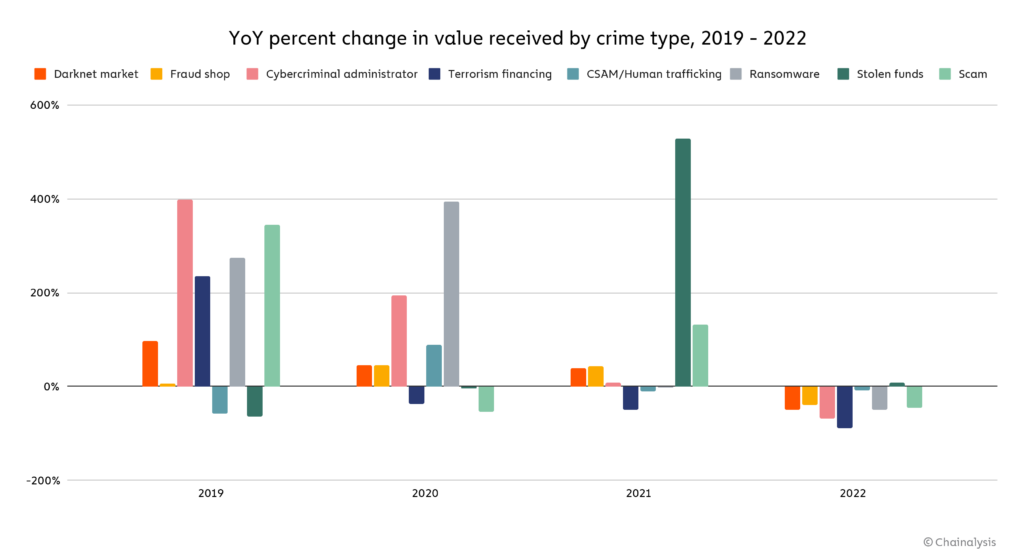

Note: Sanctions-related transaction volume rose 152,844% from 2021 to 2022 – we do not include that on the graph above due to the scale issues it would create.

Transaction volumes fell across all of the other, more conventional categories of cryptocurrency-related crime, with the exception of stolen funds, which rose 7% year-over-year. The market downturn may be one reason for this. We’ve found in the past that crypto scams, for instance, take in less revenue during bear markets, likely because users are more pessimistic and less likely to believe a scam’s promises of high returns at times when asset prices are declining. In general, less money in crypto overall tends to correlate with less money associated with crypto crime.

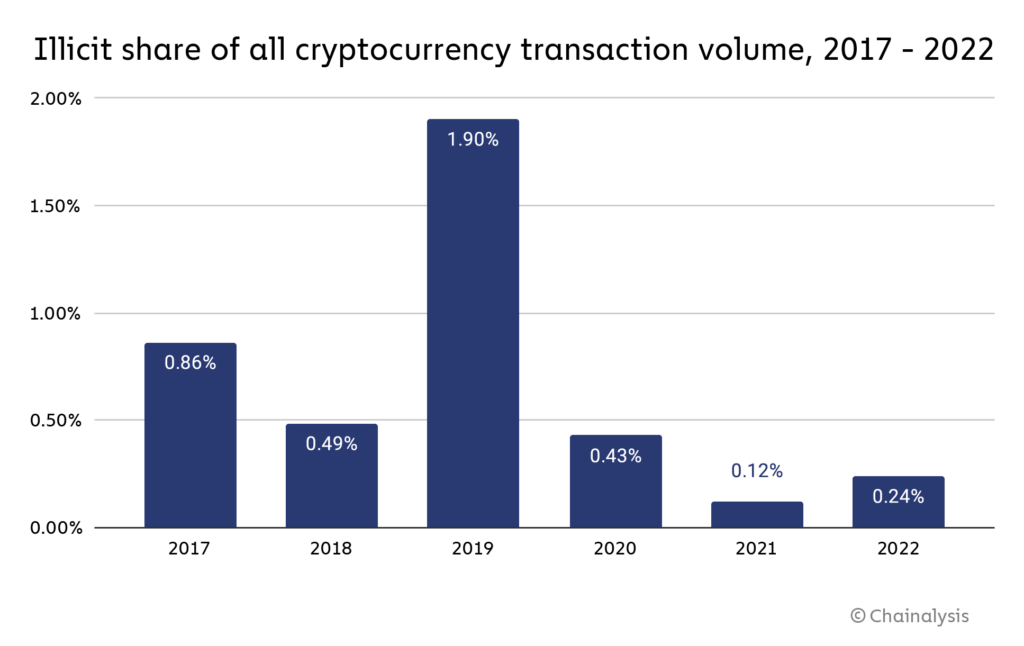

Overall, the share of all cryptocurrency activity associated with illicit activity has risen for the first time since 2019, from 0.12% in 2021 to 0.24% in 2022. [2]

This shouldn’t come as a huge surprise. As one might expect, total transaction volume fell with the onset of the bear market, and as we showed above, illicit transaction volume grew slightly. In fact, we first spotted this trend back in August, when we noted that legitimate transaction volumes were declining faster than illicit volumes.

Overall, illicit activity in cryptocurrency remains a small share of overall volume at less than 1%. It’s also worth keeping in mind that despite this year’s jump, crime as a share of all crypto activity is still trending downwards. Our full 2023 Crypto Crime Report will dig into the details of the criminal activity behind that 0.24%, as well as what our on-chain analysis reveals about the market failures of the last year.

Endnotes:

[1] Notes on our illicit transaction volume chart:

- These are lower bound estimates that will likely rise over time as additional illicit activity is discovered.

- This does not include off-chain criminal activity where proceeds may have been moved into crypto for laundering, though that activity can still be traced.

- This does not include volumes associated with centralized services that collapsed in 2022, some of which are facing charges of fraud, given lack of off-chain insights.

- Funds received by sanctioned entity Garantex accounts for much of 2022’s illicit volume. While most of that activity is likely Russian users using a Russian exchange, most compliance professionals treat this as illicit activity.

[2] For those keeping a close eye on our annual analyses, you may be surprised to find that our estimate for the illicit share of all cryptocurrency transaction volume for 2021 actually decreased from the number we published in last year’s report – 0.15% to 0.12%. Don’t these estimates usually increase over time, as mentioned above? In this case, our denominator – total volume analyzed – increased as we added mature support for additional blockchains.

This material is for informational purposes only, and is not intended to provide legal, tax, financial, or investment advice. Recipients should consult their own advisors before making these types of decisions. Chainalysis has no responsibility or liability for any decision made or any other acts or omissions in connection with Recipient’s use of this material.

Chainalysis does not guarantee or warrant the accuracy, completeness, timeliness, suitability or validity of the information in this report and will not be responsible for any claim attributable to errors, omissions, or other inaccuracies of any part of such material.