Stablecoins in the EU

Stablecoins are the single biggest crypto-asset use case currently in digital asset markets. Circle, the issuer of USDC and EUROC with its European headquarters in Paris, is the first — and currently only — MICA-licensed issuer of EMTs in Europe.

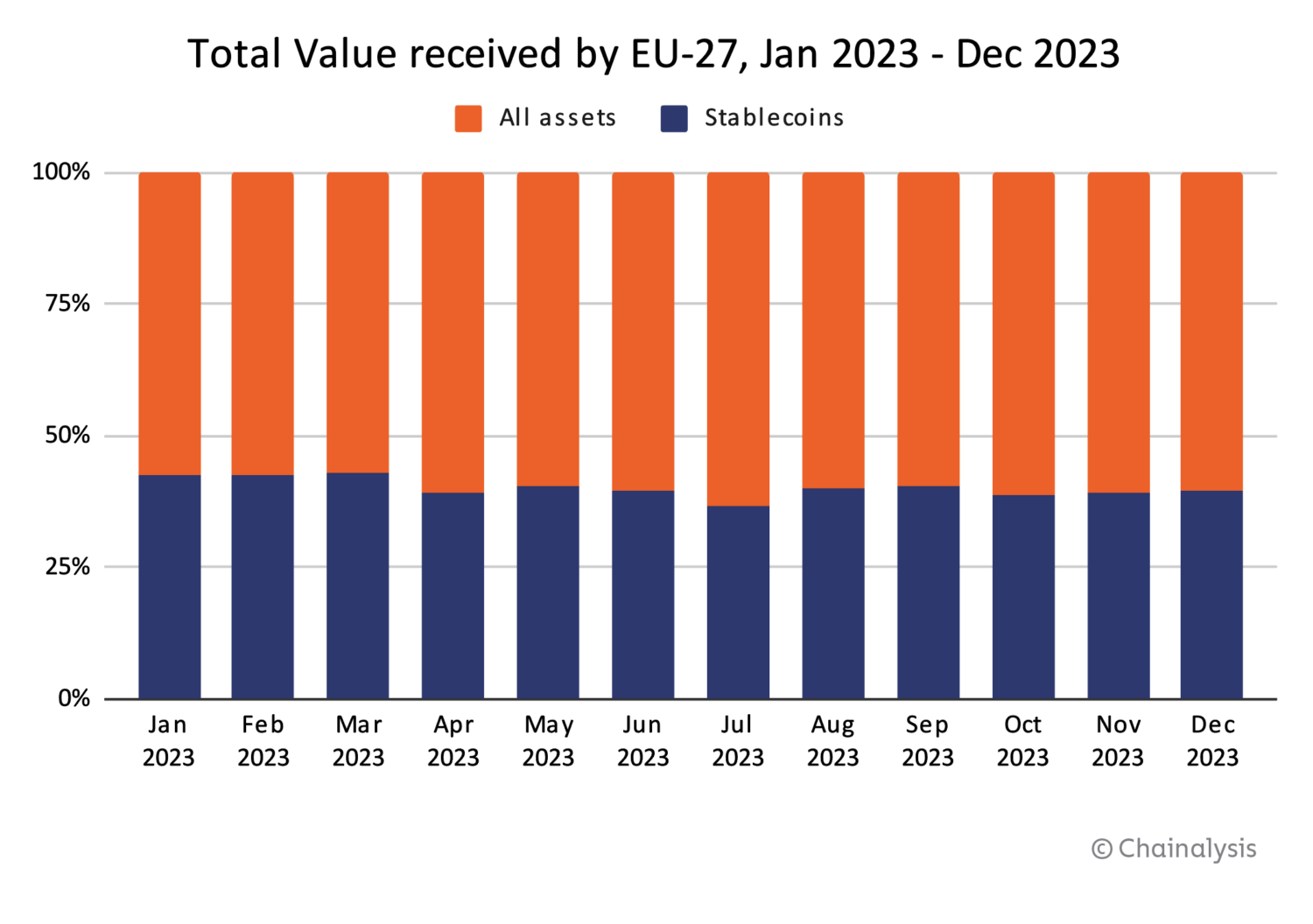

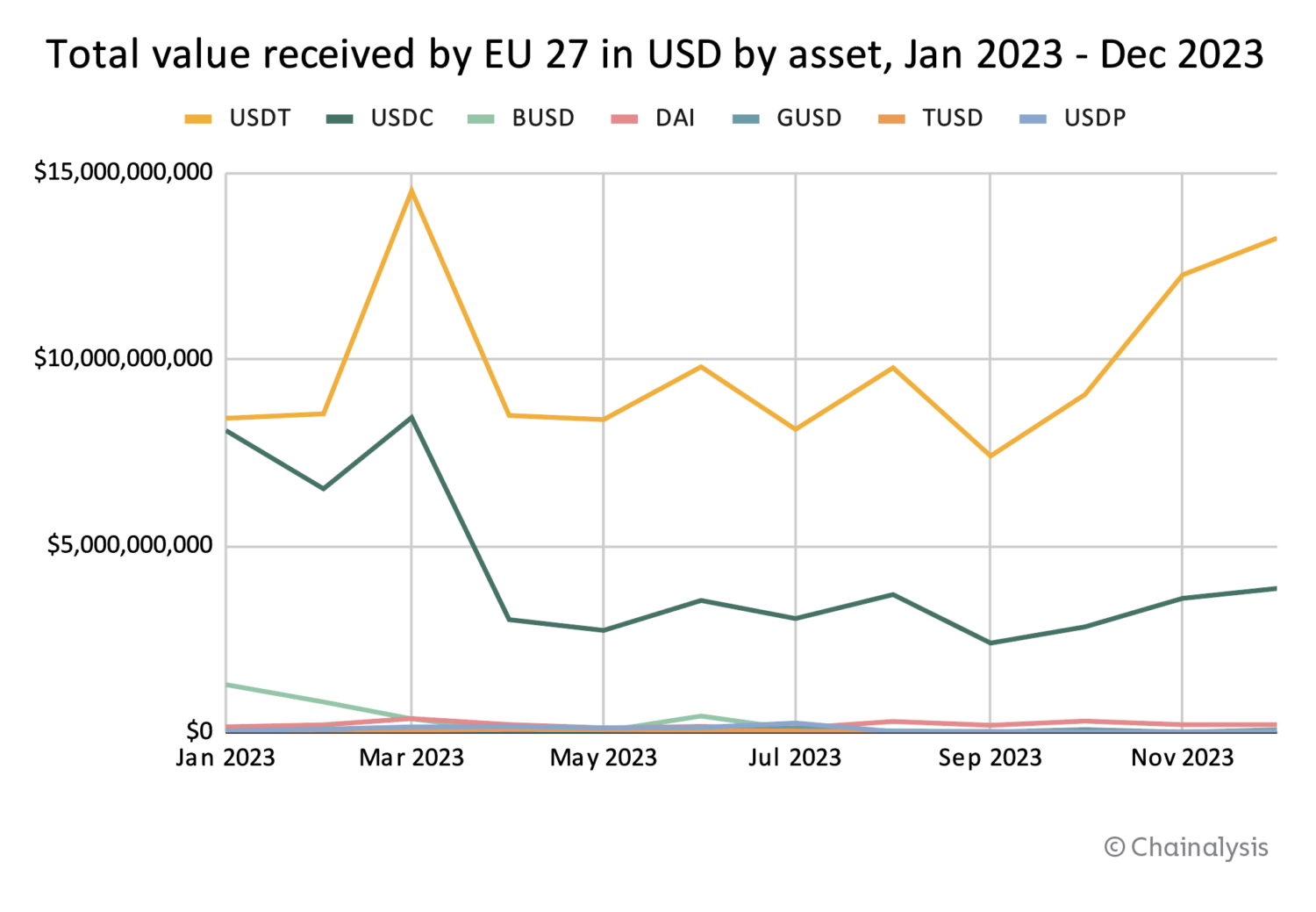

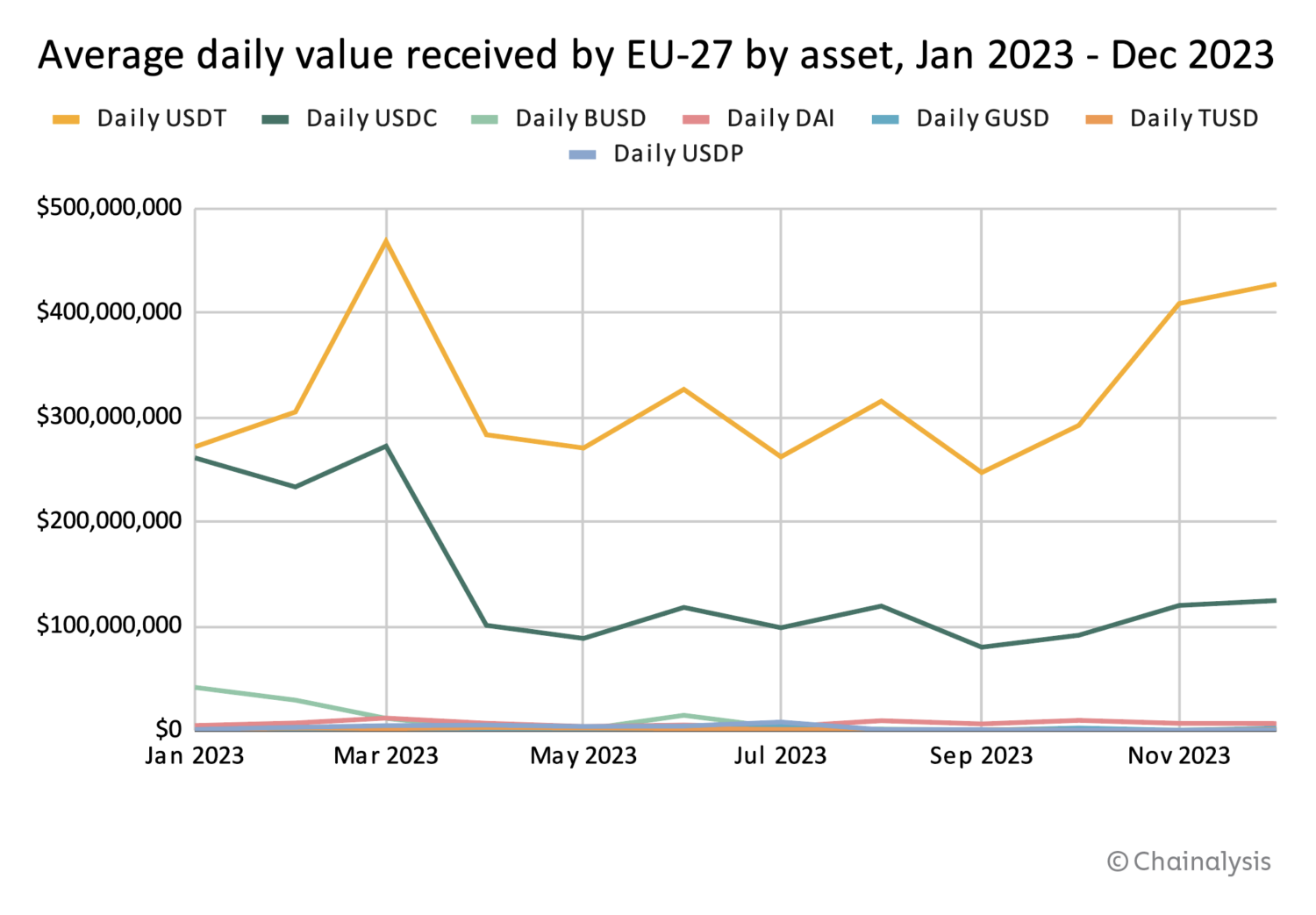

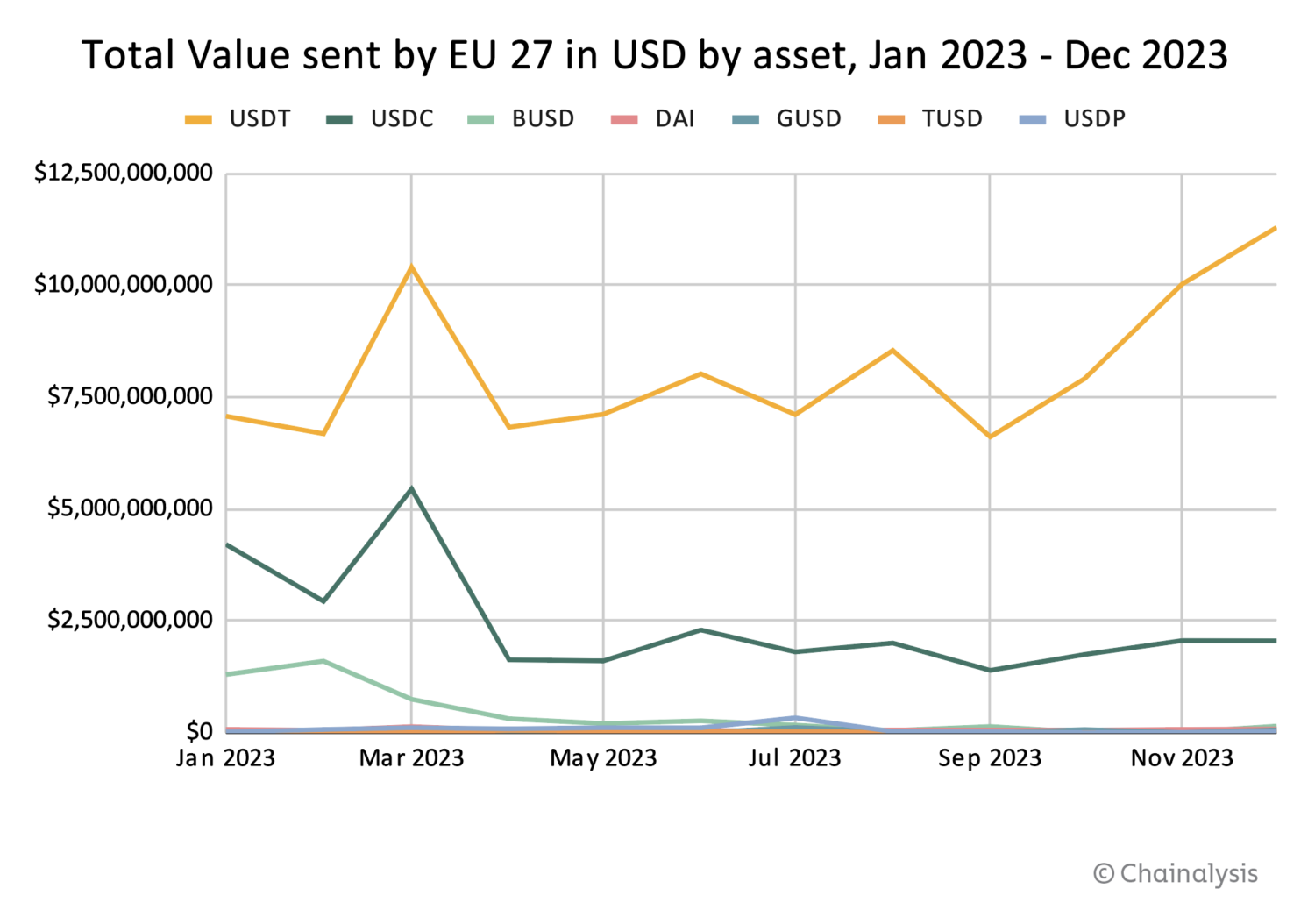

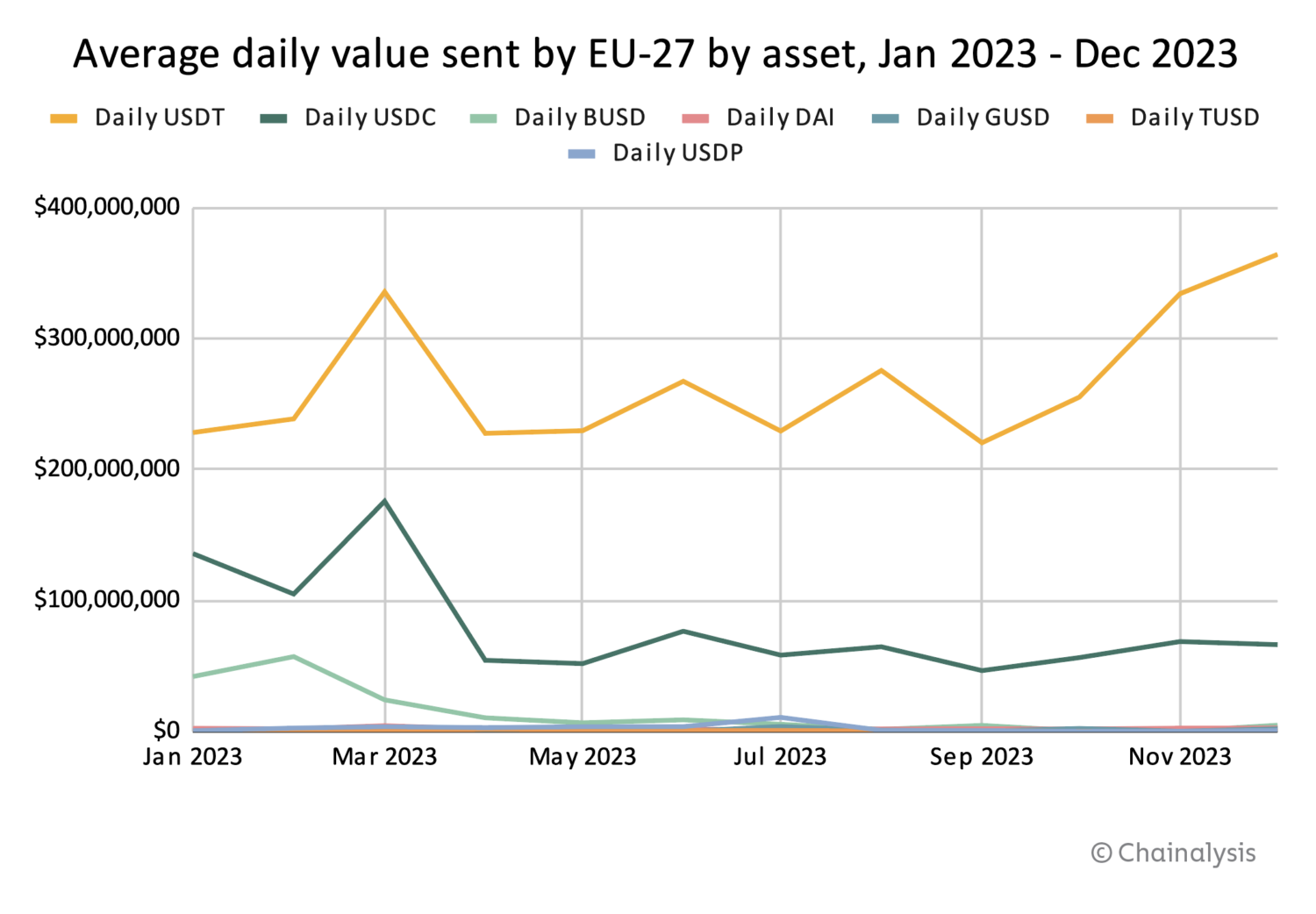

Figure 3 shows the USD value of on-chain stablecoin inflows to the EU in 2023. Figure 4 depicts the daily average USD value of stablecoin inflows to the EU in 2023.

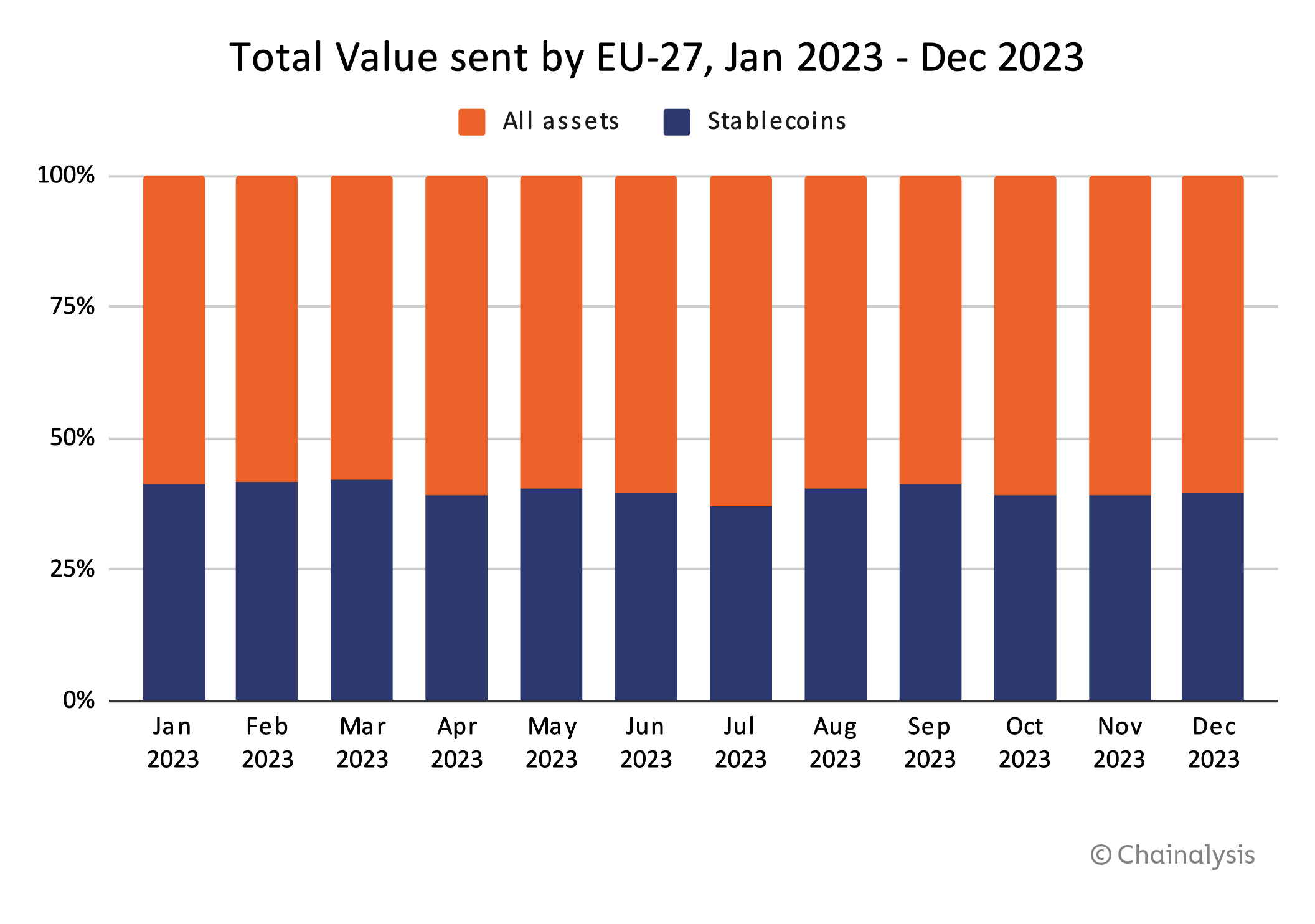

Figure 6 shows the USD value of on-chain stablecoin outflows from the EU in 2023 in total, and Figure 7 shows the USD value of stablecoin outflows from the EU in 2023 by asset. Figure 8 depicts the daily average USD value of stablecoin outflows from the EU in 2023.

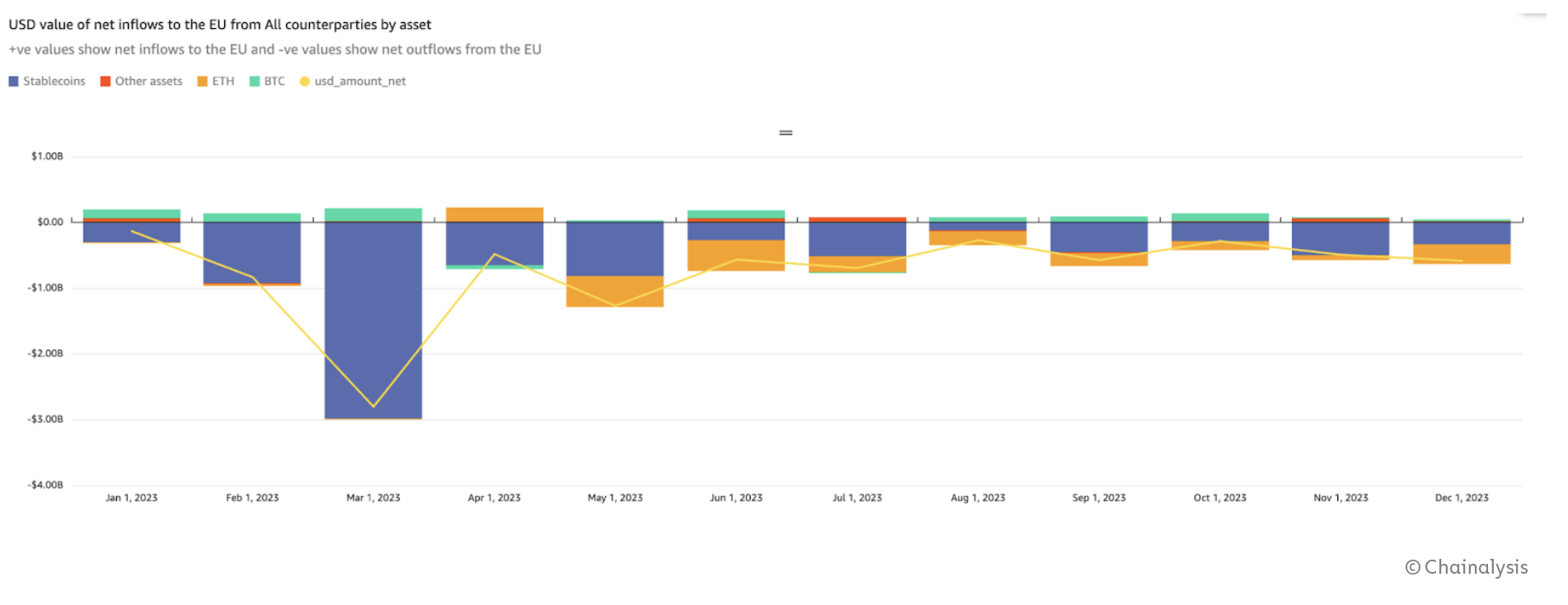

The 2023 USD value of net inflows and outflows of EU countries in Figure 9 shows that most value between the EU and other regions is transferred in stablecoins, with more stablecoins sent from the EU to other regions in 2023 than stablecoins received.

EMTs vs. ARTs

Common requirements for issuers of EMTs and ARTs

Both EMT and ART issuers under MiCA must submit a whitepaper to their regulators for approval, and they are responsible for its contents. The whitepaper content requirements are quite prescriptive, including detailed information on the issuer, the token (including rights and obligations attached to it), reserve asset management, operational mechanics and overall associated risks. It also must include specific disclaimers, and must be regularly updated where changes are likely to have significant influence on a token holder’s purchase decision.

Both types of issuers are further subject to prudential rules (such as initial capital and own funds requirements), governance requirements, recovery and redemption plans, and marketing regulations. Additionally and importantly from a business model perspective, there is a prohibition for both issuers and CASPs against granting interest on either EMTs or AMTs.

In terms of funds received for the issuance of tokens, issuers generally have to hold at least 30% of those funds as deposits in credit institutions.

However, although some of the regulatory requirements are similar, EMTs and ARTs are conceptually very distinct. EMTs essentially represent an evolution of already existing digital funds, i.e. e-money, whereas ARTs represent a novel means of exchange. Let’s look now at how they differ under MiCA.

EMTs

EMTs can only be issued by authorized e-money institutions (EMIs) and credit institutions (CIs). Issuers of EMTs shall issue tokens at par value and on the receipt of funds. Holders have a direct claim against the issuers for redemption at any time and at par value (without redemption fee charges). Non-EU currency-denominated EMTs have slightly different requirements under MiCA compared to EMTs denominated in an EU Member State’s currency — particularly regarding reporting requirements (see below).

MiCA defines EMTs as both a type of crypto asset and be e-money, which legally qualifies them as “funds” that can be used as a means of payment, just like cash — according to E-money Directive 2 (EMD 2) and the Payment Services Directive 2 (PSD 2). MiCA further states that Titles II and III of EMD 2 additionally apply to EMTs, and therefore essentially amends EMD 2 with EMTs. We explore this issue further below, as challenge 3.

ARTs

In contrast, ARTs are a novel form of instrument of exchange, subject only to MiCA. Crucially, they are not regarded as funds, so they can only be used as a means of exchange, not of payment. Holders of ARTs have a right of redemption at all times against the issuers in fiat equivalent to the market value of the assets referenced, or the actual delivery of that asset reference (i.e. not at par value). ART issuers have to clearly set out the redemption conditions and their reserve asset valuation methods.

In contrast to EMT issuers, ART issuers face additional requirements, including:

- Issuance reporting, including assistance from CASPs (see below)

- Issuance restrictions to prevent ARTs from becoming too widely adopted as a means of exchange, payment, and settlement of transactions (see below)

- Public disclosure requirements on their website regarding the amount of ARTs in circulation, and the value and composition of the reserve of assets

- Policies describing the stabilization mechanism

- Specific regime regarding their reserve of assets, including mandatory audits every six months (also relevant for significant EMTs)

Reporting on ARTs and non-EU currency denominated EMTs

For regulators and central banks to better understand market developments and mitigate risk — particularly to monetary policy transmission and monetary sovereignty through currency substitution effects — there are specific reporting requirements for issuers of ARTs and non-EU currency-denominated EMTs. According to MiCA and EBA’s final draft of their Regulatory Technical Standards (RTS) and Implementing Technical Standards (ITS), issuers whose issuance value exceeds EUR 100 million globally must report token activity to their regulator on a quarterly basis. This includes detailed information on the tokens’ underlying assets, on-chain and off-chain transaction volumes, and holder demographics (such as total number of holders and their country of residence). In order to allow the issuer to provide such information to their regulator, CASPs providing services related to these ARTs and EMTs must report necessary information — including off-chain activity — to the issuer for aggregation. Additionally, issuers must estimate the value and volume of on-chain transactions between non-CASP intermediated, personal wallets (also known as self-hosted or non-custodial wallets) on a “best-effort” basis. Blockchain analytics solutions like those from Chainalysis can support this by providing insights into transaction and holding patterns, and on-chain ownership changes.

According to MICA’s Article 22, ART issuers face the added challenge of identifying and reporting transactions “associated with uses of the ART as a means of exchange within a single currency area” (within the EU), a metric that requires nuanced analysis and interpretation of transactional behavior and its context. The EBA’s final draft RTS defines these “means of exchange” transactions in their Article 3 as those that are “used to pay for goods or services,” irrespective of whether the payment is made to a merchant or any other payee (i.e., when the token is used for settlement purposes.) This requirement has the potential to make the reporting process somewhat further complex and subjective.

The final draft RTS excludes this sub-reporting requirement regarding transactions involving personal wallets due to the challenges in establishing ownership changes and specifying geographical locations of those transactions (i.e. nexus to the EU). While blockchain analytics can assist by identifying transfers without ownership change to obfuscate origins of crypto-assets (including so-called peel chains), industry and regulators are continuing to discuss how to best tackle this metric in practice.

This reported data also assists regulators to make informed decisions on potential issuance limits and to assess and monitor “significance” of ARTs and EMTs.

Restrictions on issuance of ARTs and non-EU currency denominated EMTs

While there is no issuance restriction for EMTs denominated in an official EU currency, MiCA-licensed issuers of ARTs and non-EU currency-denominated EMTs, however, are required to stop issuing tokens once they surpass either a daily value of transactions associated to its uses as a means of exchange of EUR 200 million, or 1 million transactions (on a quarterly average basis) within a single currency area within the EU (i.e. the Euro or the Swedish Krona area). Based on the EBA’s final draft RTS, only transactions where both the payer and the payee are located in the same single currency area are to be reported, and hence will count toward this total. Also, transactions between personal wallets are excluded from this reporting requirement (see above).

Within 40 working days of reaching that threshold, issuers have to submit a plan for approval to their national regulator on how they ensure that the estimated quarterly averages stay below the above threshold.

Significant ARTs and EMTs

MiCA also distinguishes ARTs and EMTs where they are “significant,” given they are likely to present higher challenges for regulators in terms of financial stability, monetary policy transmission, and monetary sovereignty objectives. The EBA classifies a token as significant if it meets at least three criteria, including out of the following: more than 10 million holders, a value of issued tokens, market capitalization, or reserve assets over EUR 5 billion, more than 2.5 million daily transactions and EUR 500 million in daily transaction volume on average, the issuer’s activities on an international scale (including the use of the token for payments and remittances) and interconnectedness with the financial system (see also EBA’s Technical Advice on the last two categories).

The issuer, national regulator, and ECB can voice their opinions on a specific significance classification within 20 days of receiving the EBA’s draft decision. Once classified as significant, issuers are directly supervised by the EBA and subject to more stringent requirements, such as higher capital requirements, with at least 60% of reserve assets deposited at multiple credit institutions, and enhanced interoperability and liquidity management policies and tests.

New opportunities for ecosystem monitoring

Before the advent of global, permissionless networks, digital value transfer was confined to closed-loop systems, such as traditional e-money networks. ARTs and EMTs revolutionize these value transfer systems by offering tokens that operate on open systems allowing for more flexible usage, including integration into smart contracts and Web3 applications. Users can purchase these crypto-assets on secondary markets without necessarily a direct relationship with the issuer beyond the direct redemption right they will have towards MiCA-licensed issuers.

MiCA does nonetheless place certain emphasis on issuers to leverage on-chain analytics to understand the use of their tokens, including how they may be used for illicit activities. This sort of data can provide insights into holders, balances, and transactional behavior, offering a degree of transparency on the usage of particular tokens on an aggregate-basis, as well as at the transaction-level. This allows issuers to have a real-time view of active wallets holding their tokens, including holder behavior (i.e. exchange vs. personal wallets, duration of holdings), overall transaction volume across multiple blockchains, and alerts for transactions involving sanctioned entities or jurisdictions. This insight could allow issuers to take proportionate, risk-based measures where warranted.

Furthermore, ecosystem monitoring can also support national authorities as they gather a view on the jurisdictional flows of stablecoins, understand the national market size and its most important stakeholders.

This website contains links to third-party sites that are not under the control of Chainalysis, Inc. or its affiliates (collectively “Chainalysis”). Access to such information does not imply association with, endorsement of, approval of, or recommendation by Chainalysis of the site or its operators, and Chainalysis is not responsible for the products, services, or other content hosted therein.

This material is for informational purposes only, and is not intended to provide legal, tax, financial, or investment advice. Recipients should consult their own advisors before making these types of decisions. Chainalysis has no responsibility or liability for any decision made or any other acts or omissions in connection with Recipient’s use of this material.

Chainalysis does not guarantee or warrant the accuracy, completeness, timeliness, suitability or validity of the information in this report and will not be responsible for any claim attributable to errors, omissions, or other inaccuracies of any part of such material.