Transaction volumes show that stablecoins are currently the biggest use case for crypto assets. That makes June 30, 2024 a major milestone for crypto asset regulation in Europe — and potentially beyond — as the so-called “Stablecoins Regime” of the Markets in Crypto-Assets Regulation (MiCA) takes effect. This regulation requires issuers (and other persons) to have a MiCA license for publicly offering or trading asset-referenced tokens (ARTs) or e-money tokens (EMTs) within the European Union, without a transitional period.

MiCA represents a significant shift to a comprehensive regulatory framework including prudential and conduct requirements for both crypto asset issuers and crypto asset service providers (CASPs) within the EU. Previously, frameworks focused solely on anti-money laundering and counter-terrorist financing (AML/CFT). MiCA aims to unify the currently fragmented regulatory landscape by establishing harmonized rules, providing legal certainty, protecting consumers and investors, and supporting the integrity and stability of the European financial system while fostering innovation.

While the stablecoin regime comes into effect at the end of this month, the full regulatory framework for CASPs will become applicable six months later, on December 30, 2024. The European Banking Authority (EBA) and the European Securities and Markets Authority (ESMA) have undertaken extensive consultations on Regulatory Technical Standards (RTS), Implementing Technical Standards (ITS), and guidelines to assist firms to better understand regulatory expectations to comply with MiCA’s framework.

In this blog we specifically delve into MiCA’s stablecoin regime, including:

- On-chain data related to stablecoin usage and an overview of MiCA’s stablecoin regime (Part 1)

- The key differences between ARTs and EMTs, and what is required by issuers (Part 2)

- The remaining practical challenges and legal uncertainty of this regulatory framework (Part 3)

Part 1: What on-chain data tells us about stablecoins

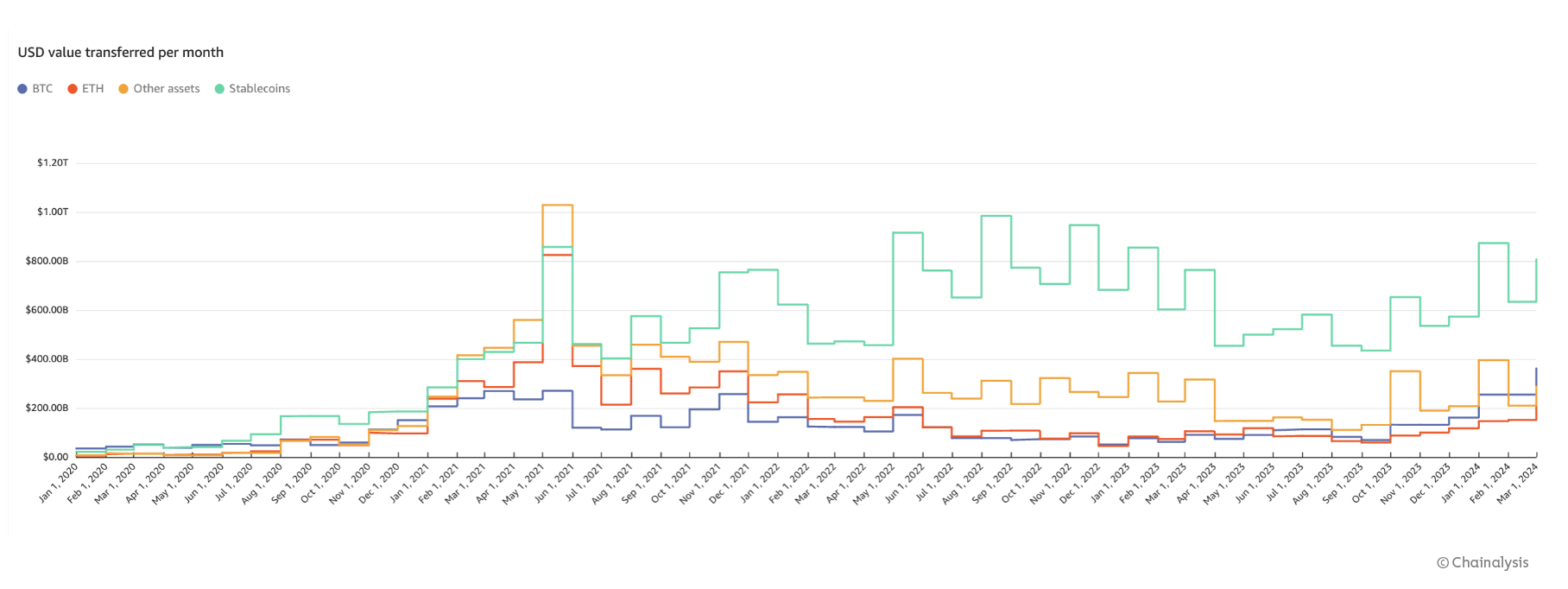

While Bitcoin accounts for roughly 50% of the total crypto asset market capitalization of approximately $2.2 trillion, it represents only a smaller portion of the overall transfer volume — about 10%. In 2023, the overall transaction volume on-chain reached $10 trillion, with stablecoins making up 60% of that volume (see Figure 1). This translates to a global, daily average of $17.4 billion transferred via stablecoins.

Chainalysis data further indicates that 1.5 million transfers are sent daily with stablecoins, with 91% of these transactions valued below $10,000. So, the biggest bulk of transactional volume is in lower denominations, suggesting a substantial retail usage of stablecoins.

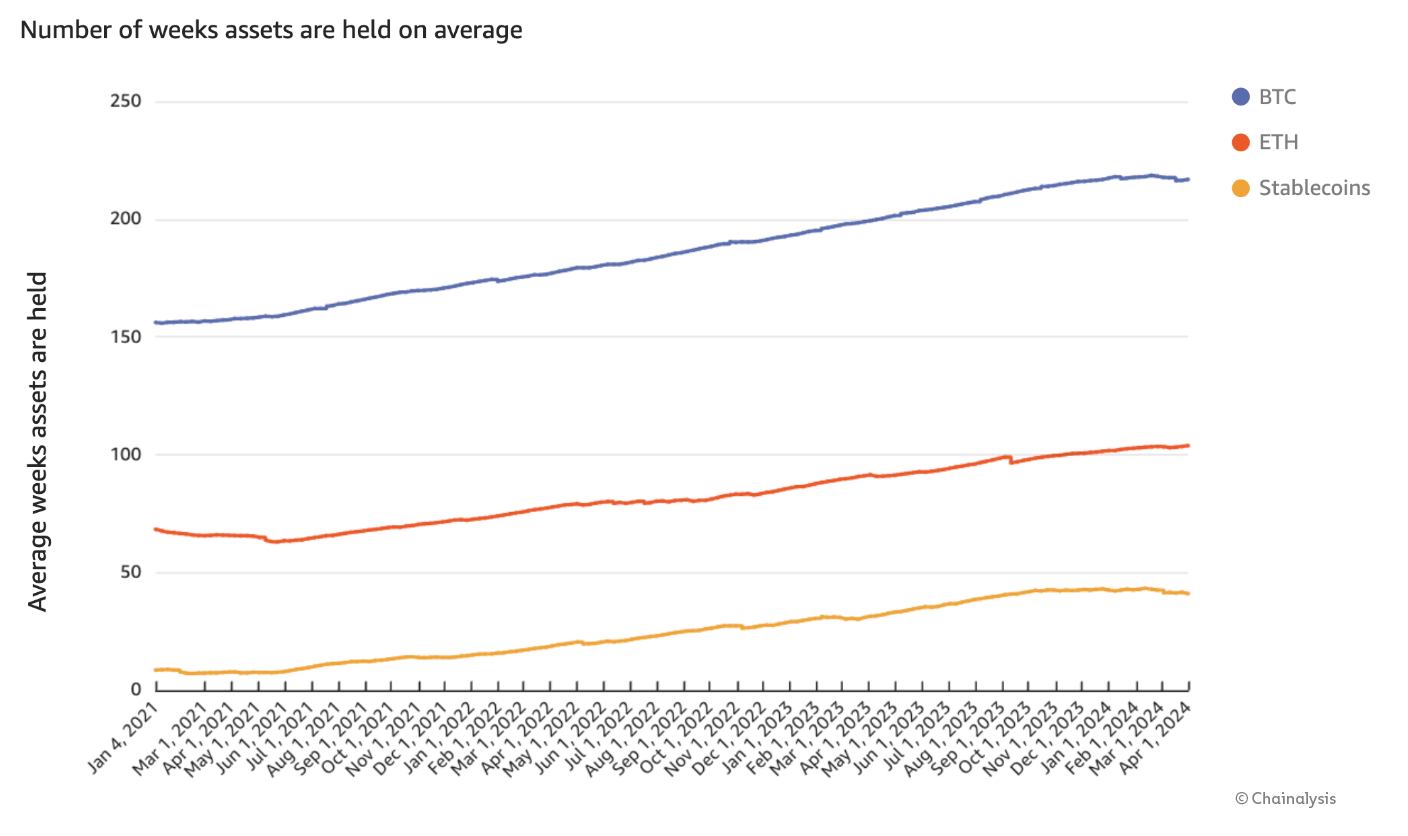

Additionally, stablecoins are now being held for increasingly longer periods at a receiving wallet address before they are transferred to another wallet address, around 40 weeks on average (see Figure 2). This is part of a more structural trend, as an increasing number of people holding crypto-assets do so for longer periods, expecting positive price movements. This trend is typically also more pronounced in bear markets, which see less trading activity. However, you can also observe in the right hand side of the chart the cyclical impact of the current bull market, with the average holding times slightly shortening already.

In our recent Policy Pulse Webinar we also discuss these trends with Dimitrios Psarakis and Philip Gradwell.

MiCA’s stablecoin regime

MiCA defines crypto assets and distinguishes between three types:

- asset-referenced tokens (ARTs),

- e-money tokens (EMTs), and

- other tokens that are neither ARTs nor EMTs.

The main difference between ARTs and EMTs is the underlying peg:

- ARTs under Title III are a type of crypto asset that is not an electronic money token and that purports to maintain a stable value by referencing another value (e.g. gold and crypto-assets) or right or a combination thereof, including one or more official currencies (e.g. a basket of currencies).

- EMTs under Title IV are a type of crypto asset that purports to maintain a stable value by referencing the value of one official currency.

The rules applying to EMTs and ARTs (referred to in this blog as “stablecoins” unless otherwise specified) take effect from June 30, 2024.

The third category of token under MiCA are “other tokens,” such as Bitcoin or Ether. The regulatory obligations for these “other tokens” will come into effect on December 30, 2024, alongside the regulatory framework for CASPs that offer one or more of the ten specific MiCA services.

With regard to so-called “algorithmic stablecoins,” which aim to maintain stable value by operating a system of demand and supply managed by an algorithm, these could fall within the definition of an ART or EMT, and therefore MiCA specifies that issuers of such tokens are required to follow the respective rules. If they do not fall within these definitions, issuers still have to follow the rules for “other tokens.”

Finally, it is worth noting that MiCA excludes from its scope tokens already subject to other regulatory frameworks, such as those representing financial instruments (e.g. shares, bonds and derivatives) governed by the EU’s Markets in Financial Instruments Directive (MiFID).

This website contains links to third-party sites that are not under the control of Chainalysis, Inc. or its affiliates (collectively “Chainalysis”). Access to such information does not imply association with, endorsement of, approval of, or recommendation by Chainalysis of the site or its operators, and Chainalysis is not responsible for the products, services, or other content hosted therein.

This material is for informational purposes only, and is not intended to provide legal, tax, financial, or investment advice. Recipients should consult their own advisors before making these types of decisions. Chainalysis has no responsibility or liability for any decision made or any other acts or omissions in connection with Recipient’s use of this material.

Chainalysis does not guarantee or warrant the accuracy, completeness, timeliness, suitability or validity of the information in this report and will not be responsible for any claim attributable to errors, omissions, or other inaccuracies of any part of such material.